Read this article to learn about the meaning, working, importance, leakages in the working and criticism of multiplier Keynesian.

Meaning and the Development:

The concept of ‘Multiplier’ occupies an important place in Keynesian theory of income, output and employment. It is an important tool of income propagation and business cycle analysis.

According to Keynes, employment depends upon effective demand, which in turn, depends upon consumption and investment (Y = C + I). Consumption function, as we have known, is stable in the short-run and MPC is less than unity.

Therefore, all the increases in income do not go to increase consumption to the extent of increment in income, with the result, that a gap comes to exist between the income (output) produced and consumed which must be made up by investment. Keynes believed that the initial increment in investment increases the final income by many times. To this relationship between an initial increase in investment and the final increase in aggregate income. Keynes gave the name of ‘Investment Multiplier’, also called ‘Income Multiplier’ by others.

ADVERTISEMENTS:

The idea that a change in effective demand has multiplier effects on income and employment appeared in economic theory around the turn of the century. The theory of inflation developed by Wick-sell in his book ‘Interest and Prices’ is a multiplier theory, even if it is not clearly stated in such terms. N. Johannsen developed a lucid multiplier theorem—using the term—for the deflationary case in his theory of economic depressions, first published in 1903 and later reformulated in 1913.

According to Johannsen this “principle rests on the fact that those individuals whose incomes are reduced through the savings process in turn reduce their expenditure and thus further reduce total demand.” More recently a detailed analysis of the multiplier process was given by R.F. Kahn. In his article Kahn gave a precise exposition of the same concepts but applied them to an expansionary process. However, the theory of multiplier became one of the focal points of discussion only when J.M. Keynes made it an integral part of his ‘General Theory’.

The idea of multiplier originated as an explanation of the favourable effects of investment on total employment but it has become part and parcel of Keynesian theory of income and employment. Keynes adopted the notion of multiplier, an idea borrowed from R.F. Kahn, for income analysis. R.F. Kahn had through multiplier, traced the effect of an increase in investment on employment.

Keynes converted this into an income multiplier designed to show the relationship of a small increase in investment to final increase in income. The multiplier mechanism suggested that heavy spending—by government, business or consumers—would have a salutary impact on the national income.

ADVERTISEMENTS:

It is very closely connected with the concept of the marginal propensity to consume and is considered as one of Keynes’ path breaking contributions. As a matter of fact, Keynes’ investment multiplier is a modification of Kahn’s employment multiplier’. Multiplier is the ratio of the final change in income to the initial change in investment.

In other words, it is the ratio expressing the quantitative relationship between the final increase in national income and the increase in investment which induces the rise in income. Arithmetically, this relationship is expressed as ∆Y = K. ∆I, where ∆ (delta) stands for increases or changes, Y for national income, K for Multiplier and I for investment. Therefore, we get

K = ∆Y/∆I, i.e., K (multiplier) is equal to the ratio of the increase in income to the increase in investment, which is responsible for the rise in income.

Thus, if investment in the economy increases by Rs. 1 crore and the national income rises by Rs. 3 crore, then the multiplier is 3. All this happens because whenever an investment is made in the economy, the effect is to increase total income not only by the amount of original investment but by a multiple of it.

ADVERTISEMENTS:

The reason is that the investment not only expands the income in the industries where the investment is originally made but also in other industries whose products are demanded by men employed in investment industries. It may, however, be noted that the value of multiplier is, in fact, determined by the marginal propensity to consume. The multiplier is large or small according as the marginal propensity to consume is large or small.

Theoretically, the values of the multiplier can change; all the way, from one to infinity. It can never be one because consumption always increases when income increases (i.e., MPC is never zero). Further, multiplier can never be equal to infinity if Keynes’ assumption of the MPC being less than unity is valid. Actual value of the multiplier varies from 2 to 4, according to the different estimates made from time to time.

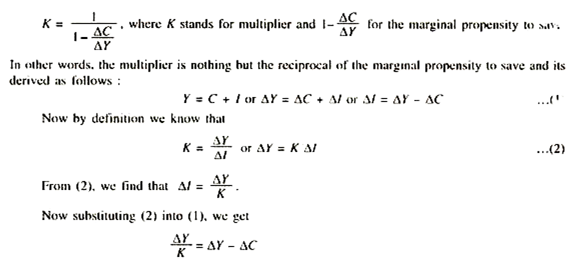

The general formula for the multiplier is:

Working Of the Multiplier:

Multiplier is the mechanism through which income gets propagated as a result of original investment. How a new investment brings about a multiple increase in income by increasing consumption is clear from the following example. This example gives us what may be described as a ‘motion picture’ of income propagation under certain assumptions.

Assuming the marginal propensity to consume as ½, let us assume further that there is an investment of Rs. 20 crore in public works. The MPC being ½ K (multiplier) will be 2[1/1-½=2] An investment of Rs. 20 crore will increase the total income by Rs. 40 crore. When an original investment of Rs. 20 crore is made, half of it will be spent on consumption by the income recipients (because MPC = ½?, Rs. 10 crore out of Rs. 20 crore will be spent on consumption in the first round).

In the second round, income shall increase by Rs. 10 crore. In the third round, income shall expand by Rs. 5 crore, in the fourth by Rs. 2.5 crore, in the fifth by Rs. 1.25 crore, and so on, till it has increased to Rs. 40 crore, i.e., 2 times the original investment. Thus, we note there is an infinite geometric series of the descending variety, viz., Rs. 20 cr. + Rs. 10 cr. + Rs. 5 cr. + Rs. 2.5 cr. + Rs. 1.25 cr…………….. and so on adding up to Rs. 40 crore. We see that the multiplier is equal to the ratio of the increase in income to the increase in investment, i.e., Rs. 40cr/20cr = 2 . Therefore, the multiplier is 2.

ADVERTISEMENTS:

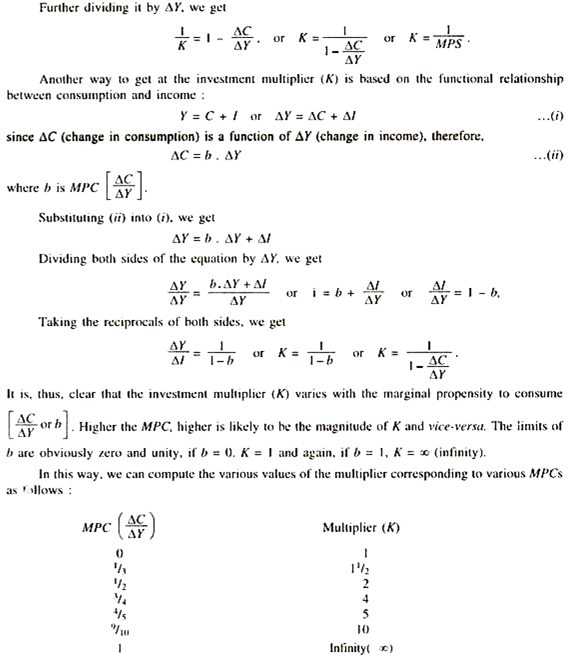

It may, however, be noted that the whole process of income C, expansion is spread over time as the income does not increase to Rs. 40 crore all at once. Keynes, however, did not give much importance to time lags involved in the process of income generation. The simultaneous multiplier effects of investment on 50 income are shown in Fig. 14.1.

In this figure, CC consumption curve is drawn according to the MPC being ½ (0.5 at all income levels).

E1Y1 gives us the equilibrium level of income.

ADVERTISEMENTS:

For one reason or the other, investment rises from C + I to C + I + I’. The new curve C + I + I’ intersects the 45° line at E2.

E2Y2 gives us the new level of income atY2. It is greater than the old level of income (Y1) by Y1Y2.

This is twice the difference between C + I and C + I + I’ curves. Thus, assuming MPC of 1/2 and, therefore, the multiplier being 2, the original increase in investment leads to double the increase in income Y1Y2.

Reverse Operation of the Multiplier:

Multiplier is a double-edged weapon. It works in the backward direction as much as in the forward direction. The process of income propagation through multiplier does not work in the forward direction only. It is quite possible that it may work in the reverse direction depending upon the direction of the initial change in investment. Suppose, investment decreases by Rs. 20 crore, there will be a net reduction in income to the extent of Rs. 40 crore, (MPC = 1/2 and K = 2). The higher the MPC, the greater the value of the multiplier and greater the cumulative decline in income. In other words, a community with a high propensity to save is affected less by the reverse operation of the multiplier than the one with a low propensity to save.

ADVERTISEMENTS:

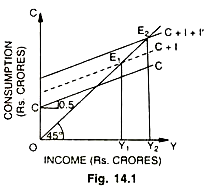

A high multiplier would cause greater jerks and shocking decline of income whenever the investment falls. But there is one ray of hope—the MPC being less than one, multiplier is not infinity. Just as consumers do not spend the full increment of income on consumption, similarly, they do not curtail expenditure of consumption by the full extent of the decrement of income. The reverse operation of multiplier is shown in Fig. 14.2.

In this figure, the S curve (drawn according to the MPS being ½) is interested by the I curve to give us the equilibrium level of income Y1 at E1 Y1. When investment declines from I to K the income also declines from Y1 to Y2 and a new equilibrium E2Y2 is obtained. The incomes decreases by Y1 Y2 i.e., being double the decline in investment. Fig. 14.2

Logical Multiplier:

The multiplier as enunciated above is Keynesian multiplier, logical or tautological or simultaneous multiplier. It is so called because it assumes no time lag between the initial change in autonomous investment and ultimate change in income. In other words, it assumes that the change in all the three or basic variables is simultaneous, that is, investment, consumption and income—all change at the same time. Changes in them constitute the core of the multiplier process. Thus, Keynes’ discussion of the multiplier runs mainly in terms of the “logical theory of the multiplier which holds good simultaneously without time lag at all moments of time”.

This logical theory of the multiplier as given by Keynes has been criticized on many grounds, specially, its assumption of instantaneous responses in consumption to changes in investment outlays. In actual practice, however, things do take time to happen. There is always an expenditure lag between income and consumption. Sometime interval must elapse before the consumers spend their incomes on the purchase of goods and services.

They take time to adjust their consumption to the new incomes. The logical theory does not explain the path which the change in income follows as it moves from the old initial equilibrium to the new and final equilibrium position. Hence, this static multiplier theory of Keynes has been replaced by a dynamic multiplier theory which takes into account the time lags.

ADVERTISEMENTS:

The main limitations and qualifications of static or logical multiplier are discussed below:

Multiplier Assumptions:

Yet another great limitation and qualification arises from the assumptions of multiplier on which Keynes’ theory is based.

These are:

(i) That there is no change in the marginal propensity to consume during the adjustment process, which remains more or less constant.

(ii) That there is no induced investment (i.e., accelerator is not operating).

(iii) That the new higher level of investment is maintained long enough for the completion of the adjustment process.

ADVERTISEMENTS:

(iv) That the output of consumer goods is responsive to effective demand for these.

(v) That there is complete absence of government activity like taxation or expenditure.

(vi) That there is no time lag between the receipt of income and its expenditure.

(vii) That there is a closed economy.

Importance of Multiplier:

The introduction of multiplier analysis in income theory is one of Keynes’ path-breaking contributions, in as much as it has not only enriched economic analysis but also profoundly affected economic policies. “It is true that Lord Keynes did not discover the multiplier, that honour belongs to Mr. R.F. Kahn. But he gave it the role, it plays today, by transforming it from an instrument for the analysis of ‘road-building’ into one for the analysis of ‘income building’. From his own and subsequent work, we now have a theory, or at least its sound beginning, of income generation and propagation, which has magnificent sweep and simplicity. It set a fresh wind blowing through the structure of economic thought”.

From the foregoing qualifications and limitations it should never be concluded that the concept of multiplier is of little use. Despite the structures, multiplier has been of great importance both to economic theory and policy. Firstly, it established the immense importance of investment as the major dynamic element in the economy. Not only did it indicate the direct creation of employment, it also revealed that income was generated throughout the system like a stone causing ripples in a lake.

ADVERTISEMENTS:

On the side of practical economic policy it is of the utmost importance because the case for public investment has all the more been strengthened by the introduction of this concept; it tells us that a small increment in investment leads to a large increase in investment and employment. A knowledge of multiplier is of vital importance during the course of business-cycle studies and for its accurate forecasting and control. Further, it is a useful analytical tool for following suitable employment policies. Thus, we find that the theory of multiplier has brought almost a virtual revolution in the thinking of economists and policy-makers alike. With the use of this concept, the approach has radically changed from ‘no intervention’ to the growth of the public sector in practically all the countries of the world.

Leakages in The Working Of Multiplier:

We have learnt about the timeless and instantaneous multiplier. But in actual practice the working of the multiplier is affected by a large number of considerations. We see that the whole of the increment in income is not spent on consumption nor is it entirely saved. Therefore, the value of the multiplier is neither one nor-infinity. This is because there are several leakages from the income-stream as a result of which the process of income propagation is slowed down.

Important leakages are as follows:

1. Saving:

Saving constitutes an important leakage to the process of income propagation. If the whole of the increment in income was to be spent on consumption (i.e., if MPC is one) then, ‘once- for-all’ increase in investment would go on creating additional consumption so that the full employment would ensure. This is not the case in actual practice, because a part of the increased income is not spent on consumption but saved and ‘peters out’ of the income stream, thereby limiting the value of the multiplier. In fact, the whole of saving forms a sort of leakage arid higher the propensity to save, the lower is the value of multiplier. Further, for various reasons these savings constitute an important leakage.

2. Debt Cancellation:

It has been observed that part of the income received by the people in the economy may be used for paying off old debts to the banks and individuals, who may, in turn, fail to spend. As such, the consumption is not stimulated and the value of the multiplier is thereby reduced.

3. Imports:

If there is an excess of imports over exports, part of the increased income as a result of increased investment will go to increase income in the foreign countries at least in the short period. It is argued that in the long period, the increased income in the foreign countries will go to increase the demand for exports and thus will have beneficial effects on the income of the country importing goods. But this may or may not be the case, as it presupposes free trade. In this way imports and the money spent on the imported goods constitute an important leakage.

4. Price Inflation:

ADVERTISEMENTS:

Price inflation constitutes another important leakage from the income stream of an economy. As long as there is unemployment of resources and factors of production, increase in investment will have expansionary effects. But once that full employment or near full employment of the resources has been attained, increase in investment will go to raise prices and the cost of the factors of production, because at this level the factors of production become scarce and a competition ensues between the consumer goods industries and investment goods industries for securing the scarce resources even at higher prices. Thus, as a result of price inflation a major part of the increased income is dissipated instead of promoting consumption, income and employment.

5. Hoarding:

Hoarding or the tendency of the people to hold idle cash balances forms another leakage. If the people have high liquidity preference and a tendency to keep idle cash balances they will diminish the expenditure on consumption in the economy, thereby restricting the value of the multiplier.

6. Purchase of Stocks and Securities:

Sometimes, people purchase old stocks and securities with the newly created income and do not spend it on increased consumption. Some of them purchase new insurance policies. Thus, this type of financial investment severely restricts the value of the multiplier, as the increased incomes, instead of being spent on consumption, are spent on nominal (not real) investments.

All these factors constitute potential leakage from the income stream resulting from an expansion of new investment. This new income under such circumstances, does not give rise to secondary consumption expenditures. It is, therefore, highly desirable that to have the desired results of multiplier, these leakages should be plugged. To the extent these leakages from the income stream can be controlled, the original increase in investment will have greater multiplier effects.

Criticism:

Criticism is leveled on the ground that Keynes’ theory of multiplier rests on the simple assumption of increases in consumption as a result of increases in income and, further, on the MPC being less than one. Actual studies show that the relationship between income and consumption is not so simple as presumed by Keynes, nor is consumption the function of income alone. Multiplier depends upon a large number of limitations and qualifications like the availability of consumer goods, maintenance of investment, direction of investment, multiplier period, and takes no account of the effect of induced consumption on investment, besides completely overlooking the time-element.

Keynes’ logical theory of the multiplier takes into consideration the effects of increases in consumption as a result of increases in income, but it takes no account of the effects of increases in consumption on investment (induced investment). On this ground alone, the theory has been severely criticized by D.H. Robertson, R.M, Goodwin and A.P. Lerner.

These writers rightly grudge the undue importance and attention given to the multiplier, which they feel, in a way, is too bad; “since the concept, often seems like nothing but a cheap jack way of getting something for nothing and appears to carry with it a spurious numerical accuracy.” Prof. A.G. Hart has insisted, no doubt correctly, that the multiplier concept is a useless ‘fifth wheel’. It adds nothing to the ideas or result already implied in the use of consumption function. Haberler with some justice, accused Keynes of dealing in tautology when he discussed the multiplier—that is of defining something as necessarily true, and then proclaiming as discovery the ‘truth’ of the relationship made inevitable by definition.

Prof. Hazlitt has also criticized the concept of multiplier rather bitterly. He calls it ‘strange concept’, ‘a myth, much ado about noting’. He asks, “What reason is there to suppose that there is such a thing as the multiplier”? He doubted if there could be any precise or mechanical relationship between social income, consumption, investment and extent of employment. He called it a worthless toy made familiar by monetary cranks. According to Prof Hutt, “the conventional multiplier apparatus is rubbish and that it should be expunged from the text books”.

Thus, the main points of criticism against the concept of multiplier as given by Keynes are that:

(i) It assumes as instantaneous relationship between income, consumption and investment—it is a timeless phenomenon.

(ii) It is of static nature which is unsuited to the changing process of the dynamic world, it fails to reckon the influence of time lags and its results are obtained only under static conditions,

(iii) It ignores the influence of induced consumption on induced investment, i.e., there is a relationship between the demand for capital goods and the demand for consumption goods, i.e., the demand for capital goods is a ‘derived demand’,

(iv) Further, its sole emphasis on consumption is also not proper. It would be more realistic to speak of a ‘marginal propensity to spend’ rather than to consume,

(v) Again, Haberler feels that this multiplier theory is an un-verified hypothesis because Keynes offers no adequate proof except a number of vague observations,

(vi) Prof. L.R. Klein has pointed out that empirical studies in respect of the behaviours of aggregate consumption in relation to aggregate income, show that actual trends in spending have a much more complicated relationship which may be non-linear and the assumption of linear relation between aggregate consumption and aggregate income is open to question.

(vii) Again, consumption is not the function of income alone and the marginal propensity to consume is not constant as was assumed by Keynes as the basis of multiplier.

Nevertheless, the multiplier idea has been widely used as a way of summarising the workings of the Keynesian model, and a whole body of literature has grown up which employs this terminology. A strong defence has been put up by writers like Harrod, Hansen and Samuelson who have tried to deal with the criticism and made the whole analysis dynamic. In the words of S.E. Harris, we may sum up the position as follows: “On the discussion of the multiplier, many economists have gone on fishing expeditions, but though they had many bites they did not catch any large fish. Indeed, they have added much to Keynes’ relatively simple and unverified presentation”.