The following points highlight the two approaches of Measuring National Income. The two Approaches are: 1. Income Approach 2. Expenditure Approach.

Measuring National Income # 1. Income Approach:

From Fig. 2.2 we know that the income derived from land, labour, capital, and entrepreneurial services are rent, wages and salaries, interest and profits, respectively.

Thus the income approach to measuring GDP involves adding up these various types of factor incomes.

We may now briefly discuss these factor incomes.

1. Wages, Salaries and other Labour Incomes:

ADVERTISEMENTS:

Wages and salaries are paid to numerous workers employed in the private and public sectors of the economy. Other labour incomes include provident fund, pension or insurance contributions that employers make on behalf of their employees.

2. Corporate Profits before Taxes:

This income category includes three items corporate income taxes, dividends paid out to shareholders, and retained earnings (undistributed profits). Dividend represents payment to those who provide equity (risk) capital.

3. Interest and other Investment Income:

This income category includes interest payments made by private businesses to individuals who provided debt capital. Interest paid by the government is not included because it is not payment for current goods and services.

The interest on internal public debt, for example, is treated as a transfer payment and is, therefore, excluded from this income category. Other types of investment income include profits from public sector units (such as the Coal India Ltd., the NTC or the SAIL) as also returns such as royalties paid to authors and artists.

4. Accrued Net Income from Agriculture:

ADVERTISEMENTS:

Income from agriculture includes: (i) total revenue for the sale of agricultural products, (ii) the total value of agricultural products not sold but consumed on the farm, (iii) the value of the change in inventories of farm output to arrive at net farm income.

We subtract all expenses incurred in operating agricultural farms and the depreciation of the real capital stock (machinery, equipment, and buildings) of the farms during the year.

5. Net Income of Non-Farm Unincorporated Business:

This category, also known as proprietors’ income, includes: (i) income of proprietorships, partnerships, self-employed persons, and (ii) any type of income other than corporate income and income derived from agriculture. Rent is included here as the income of landowners.

6. Inventory valuation adjustment:

During any period, the value of inventories (i.e., stocks of finished goods and raw materials) may change because of price changes. We know that the objective of NI accounting is to measure current production. Therefore, windfall profits resulting from stock appreciation are to be excluded; In other words, appropriate adjustment is to be made for windfall profits resulting from valuing inventories at higher prices.

ADVERTISEMENTS:

Role of Unplanned Changes in Inventory in Maintaining Basic GNP Identity:

One problem which arises while measuring national income from the output side is change in stock. Business firms and other producing units hold two types of stock or inventory, vi2., inventories of finished goods (unplanned or unintended) and inventories of raw materials and semi-finished goods (planned or desired). Finished goods inventory is held because production and sales do not always coincide.

Inventories of raw materials are held just to ensure uninterrupted production. Inventories of raw materials are held deliberately but inventories of finished goods are held due to a compelled necessity rather than as a deliberate act of choice. However, there is need to make inventory adjustment while estimating the national income of a country from the output side.

Let us suppose a bakery hires workers to produce bread, pays them wages but then fails to sell the bread. The effect of the above transactions on GDP depends on what happens to the unsold bread.

We may now consider three possibilities:

(i) No sale of bread:

Let us first suppose that the bread gets stale. So no revenue can be earned by selling it when it becomes inedible even after a few hours or a few days. In this case, the firm has made some wage payments but its profits are reduced exactly by the amount of wage payment. The reason is that it has not received any revenue by selling the bread. The total expenditure in the economy also remains unchanged because no bread has been purchased by any consumer.

So there is no increase in total income. In this case the additional wage gets reflected in negative profit, i.e., loss:

Total output (income) + wage payment = Total output – profit (loss).

ADVERTISEMENTS:

So, in this case, GDP remains the same because the transaction affects neither expenditure nor income.

(ii) Sale of bread:

Now let us suppose this additional bread is stocked for future sale. In this case we find a different type of transaction. It seems as if the owners of the firm have themselves purchased the bread for stock holding. So the firm’s profit is not reduced by the additional wage it has paid.

Since the additional wage payment raises total income and stock holding generates spending on inventory by the firm itself the total expenditure in the economy rises in this case. So the GDP of the country under consideration increases.

ADVERTISEMENTS:

(iii) Transactions in second-hand goods:

When the firm sells bread from its existing stock, say, after a few days, it is just like a used good. Consumers now spend their money on bread but there is negative investment by the firm (called disinvestment) due to running down of inventories.

This negative spending by the firm offsets the positive spending by consumers. So the sale out of inventory does not affect GDP.

Usual Practice:

ADVERTISEMENTS:

The usual practice is that when a firm increases its inventory of goods this inventory investment is counted as expenditure by the owners of the firm. Clearly then production for inventory increases GDP just as production for final sale does. A sale out of inventory, however, involves a dual transaction. It is a combination of positive spending (purchase) and negative spending (inventory disinvestment).

So it does not influence GDP. This treatment of inventories ensures that the economy’s current production of goods and services gets fully reflected in its GDP.

Net Domestic Income at Factor Cost:

If we add up all the above categories of income and make the appropriate adjustments, we arrive at a final figure called net domestic income (NDI) at factor cost. This aggregate is essentially the sum-total of incomes earned by the owners of the factors of production.

Two points:

Two related points may be noted in this context:

ADVERTISEMENTS:

(i) NDI is a net figure (i.e., net of depreciation).

(ii) NDI is measured (evaluated) at factor cost.

If we ignore the adjustments for inventory valuation, the NDI at factor cost may be expressed as:

NDI = W + Pr + i + R + A

where W = wages and other types of labour income

Pr = corporate profits before tax

ADVERTISEMENTS:

i = interest and other types of investment income

R = net income of unincorporated business (including rent); and

A = net income from agriculture.

Indirect Taxes less Subsidies:

Indirect taxes like excise duty, sales tax and import duty are a part of the cost of production of firms and raise the prices of saleable goods and services (such as 5% tax on telephone bills and insurance premia). The Government of India gives certain production and consumption subsidies (as on milk and articles such as sugar or wheat sold through ration shops).

Subsidies are negative taxes. They cause market prices to be lower than they would otherwise be. They must, therefore, be subtracted from factor cost in order to find out market prices. By adding indirect business taxes to factor costs and subtracting subsidies, we obtain market prices. We use the symbol Tib to denote net indirect business taxes, i.e., indirect taxes less subsidies.

ADVERTISEMENTS:

Capital Consumption Allowances (Depreciation):

Capital goods wear out through use and have to be replaced. During any given year, the plants and equipment used to produce the national output lose value due to wear and tear. This loss of value in the economy’s capital stock is called depreciation or capital consumption allowance.

Therefore, it measures the value of the capital consumed during the year. By including capital consumption allowances, we convert our net figure to a gross figure. We use the symbol D to denote capital consumption allowance.

Statistical Discrepancy:

The two approaches to measuring GDP do not always produce exactly the same result. The difference between the results obtained from using the income and the expenditure approaches to GDP is due to statistical error (called rounding-up error).

If there is no such discrepancy, then GDP from the income side may be expressed as:

ADVERTISEMENTS:

GDP = W + Pr + I + R + A + Tib + D

Synopsis for Learning:

1. Two Measures of GDP:

GDP can be measured either by the income approach or by the expenditure approach, (a) The income approach measures the total income of those involved in production, (b) The expenditure approach measures the total amount spent on the total output.

2. NDI at factor cost:

Net domestic income at factor cost is the total income earned by the factors of production.

Measuring National Income Approach # 2. Expenditure Approach:

If an economy produced only wheat, we could find out the total amount of money spent in buying wheat. Similarly, by finding out the total expenditure on the economy’s output of goods and services, we arrive at the market value of total output — GDP.

The various categories of expenditure are:

1. Personal Expenditure on Consumer Goods and Services:

This is the largest component of total spending in any economy. It only includes household expenditure on different types of consumer goods and services, including durable goods. Household expenditure on purchase of houses or flats is also included in this type of expenditure. The reason is that such immovable properties generate a flow of utility every year just as a motor car does.

2. Business Fixed Capital:

There are three items in this expenditure category residential and non-residential construction (expenditure on staff-quarters and office buildings) and machinery and equipment (which include tools and various types of machines that are purchased by businesses).

Even if the owner occupies a house or a flat, it is still considered as investment and not as consumption. The reason is simple. The owner could rent it out and earn a return.

3. Business Inventories:

Business inventories are included in total expenditure of a country because the firms that own them buy them. Note that it is the value of the physical change in inventories that is recorded in the national accounts.

If a firm starts the year with an inventory of 5000 cars, and end the year with 55,00 cars, then the difference of 500 cars must have been produced during the year, and must, therefore, be added to the year’s total output. In the same way, a fall in inventory this year implies that sales exceeds this year’s output. Thus, increases in inventories are added to while decreases are subtracted from business inventories.

4. Government Current Expenditure on Goods and Services:

This expenditure category includes purchases of currently produced goods and services by the Central, State and local governments. Purchases of dresses, medicines, food, educational services, police services, and health and defence spending are all included in the category because they represent expenditure on currently produced goods and services.

5. Government Investment:

This expenditure category includes fixed capital and inventories. An example of fixed capital investment by the government is the construction of a dam. Inventories are stocks of finished and semi-finished goods. They are, of course, not sold in the market. But they are treated as if the government buys them.

Total investment or gross capital formation consists of government and business inventories in fixed capital and inventories. Changes in these inventories affect their total output of goods and services.

6. Export of Goods and Services:

A certain portion of India’s domestic production is bought by foreigners. Expenditure by foreigners on goods and services produced in India are referred to as exports of goods and services. Export (X) is the difference between domestic production of a commodity (Q) and its domestic consumption (C): X = Q – C is positive if Q > C.

Clearly the value of exports (X) must be included in a country’s GDP.

7. Imports of Goods and Services:

Just as foreign countries purchase a certain portion of total output, India buys some portion of goods and services from foreign countries. Purchases of goods and services from foreign countries constitute imports in which case domestic consumption is equal to domestic production plus imports (M):

C = Q + M. Here C > Q if M > 0

GDP is a measure of the value of the goods and services produced in India. Since expenditures on imports do not represent expenditures on domestic output they must be deducted from GDP calculations. Inclusion of imports would overstate the value of our total output.

The difference between total exports and imports is called net exports (X – M) and is included in GDP.

Statistical Discrepancy:

This is actually the balancing item in income and expenditure accounts. The two measures of NI differ due to this discrepancy.

Total Domestic Expenditure and Total Final Expenditure:

We can summaries the national income from expenditure side as follows:

NI=C + I + G + X-M

where C = consumption, I = business investment

G = government expenditure (net of transfer)

X = export and

AT= import.

Here C + I + G is called total domestic expenditure and if we add this to net export (X- M) we arrive at total final expenditure which is another name of NI from the expenditure side.

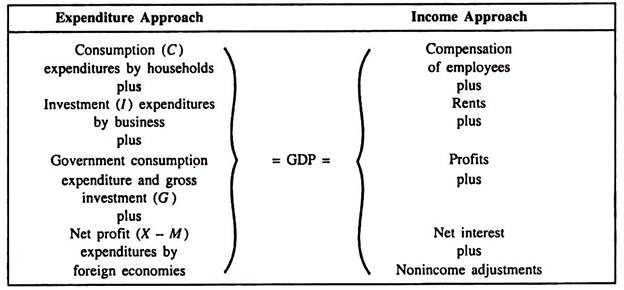

Table 2.2 presents the conceptual framework of the expenditure and income approaches to computing GDP.

Table 2.2 Expenditure and Income Approaches to GDP:

Gross and Net Values:

GDP = C + I + G (X-M)

where I is gross investment and NDP = C + In + G + (X-M)

where In is net investment.

The difference between the two values — gross and net — is due to a single item, called depreciation (D). Thus,

Gross investment = net investment + D.

or, Net investment = G – I – D

Similarly, GDP = NNP + D

or, NDP = GDP – D