Everything you need to know about the types of budgets. Budget is a financial statement that provides detailed information about the revenue and expenditure of a particular year.

However, there is no single rule or pro forma available to prepare budget, as in case of balance sheet and profit and loss account. You should note that different organizations follow different rules and methods to prepare their budgets.

Some of the types of budgets are:-

1. Fixed Budget 2. Flexible Budget 3. Functional Budget/Operating Budget 4. Long-Term Budget 5. Short-Term Budget 6. Basic Budget 7. Current Budget 8. Master Budget

ADVERTISEMENTS:

9. Zero Based Budgeting (ZBB) 10. Performance Budget 11. Sales Budget 12. Production Budget 13. Direct Materials Budget 14. Direct Labour Budget 15. Factory Overheads Budget 16. Financial Budget

17. Administrative Expenses Budget 18. Selling and Distribution Expenses Budget 19. Capital Expenditure Budget 20. Production Cost Budget 21. Purchase Budget 22. Labour Budget 23. Cash Budget 24. Incremental Budget 25. Rolling Budget.

Types of Budget in Accounting: Fixed Budget, Flexible Budget, Functional Budget, Long-Term Budget, Short-Term Budget and a Few Others

Types of Budgets – Fixed Budget, Flexible Budget and Functional Budget

1. Fixed Budget:

According to CIMA, London – “A fixed budget is a budget designed to remain unchanged irrespective of the level of activity actually attained.” Thus, a budget which is prepared on the basis of standard or fixed level of activity is known as fixed budget.

Fixed budget is based on the assumption that there will be no change in the level of activity. This budget is more useful for a short period of time when level of activity is not expected to change. Practically, this budget is of less use and has limited applications in controlling cost.

2. Flexible Budget:

ADVERTISEMENTS:

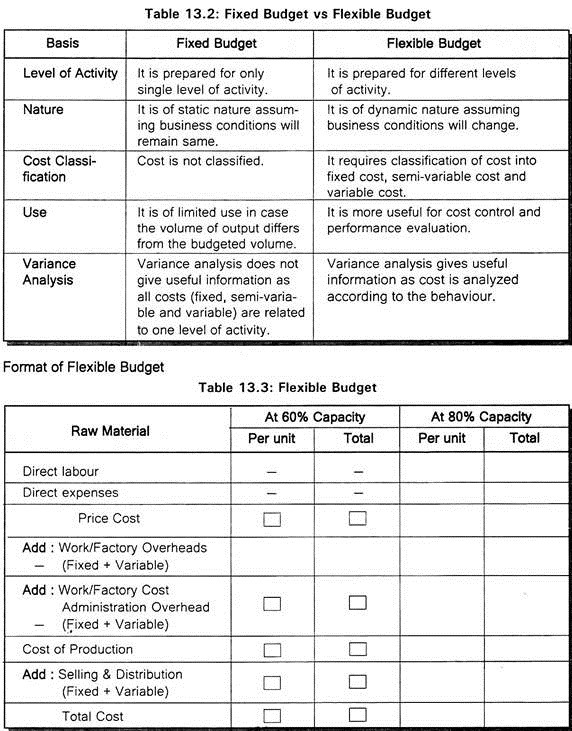

According to CIMA, London- “A flexible budget is a budget designed to change with the level of activity actually attained.” The other names used for flexible budget are variable budget and sliding scale budget. In flexible budget, budgeted figures can be changed according to the level of activity. E.g. – Budget was prepared for 60% production capacity but in actual 50% or 70% production capacity was used.

The budgeted figures are changed according to these production levels. Furthermore, flexible budget recognizes the behavior of cost into variables, semi variable and fixed cost. It is more realistic and practically used for cost control purpose.

3. Functional Budget/Operating Budget:

Functional budget is the budget which relates to a specific function of the business, e.g., sales budget, production budget. These budgets are prepared for each function and they contribute to the master budget. The number of functional budget depends upon the size and nature of the business.

ADVERTISEMENTS:

The production budget is prepared for making a plan of production e.g., quantity of production, cost of production, type of products, plant capacity, operating cycle, availability of inputs, make or buy policy etc., during the budgeted period. The production manager is responsible for the preparation of production budget and executing it. Production budget is generally based on sales budget.

ii. Sales Budget:

The sales budget is a statement of planned sales in quantity and value both. In sales budget, sale is forecasted during the budget period. The sales manager is responsible for preparation of this budget.

This budget is prepared for every purchase item to be purchased in each department. The purchase manager is entrusted with the responsibility of making this budget. This budget enables the purchase department to make bulk purchases.

Production cost budget is prepared to show the cost of production for the units of budgeted production. It is also known as manufacturing cost or work cost budget and includes cost of material, cost of labour, cost of direct expenses and factory overheads.

ADVERTISEMENTS:

Budget includes estimation of indirect labor cost, indirect material cost and indirect expenses.

b. Administrative Overheads Budget:

This budget is prepared for control of all administrative staff expenses. E.g., Managing Director’s salary, office rent, staff salaries, printing and stationery, postage, telephone charges etc. These expenses are generally fixed in nature. This budget is prepared with the help of past experience and anticipated changes. Administrative Overheads Budget is prepared and executed by administration manager.

ADVERTISEMENTS:

c. Selling and Distribution Budget:

In this budget all expenses relating to the selling and distribution of various products are estimated for the budget period. This budget is closely related sales budget. Selling and distribution overheads are divided into fixed and variable according to the volume of sales. These expenses are rent of sales office, salary of sales staff, bad debts, delivery expenses, salesman’s commission.

vi. Capital Expenditure Budget:

In this budget, estimates are made for the purchase of capital assets or fixed assets during the period of budget, e.g., land and building, plant and equipments etc.

ADVERTISEMENTS:

vii. Plant Utilisation Budget:

This budget is prepared to know the plant facility required for production. The purpose of this budget is to decide the (requirement) of each process on plant, cost of machines, overtime working, expanding the production, utilization of surplus capacity.

viii. Research and Developmental Cost Budget:

Generally in every business, research and development costs are to be incurred so as to avoid the product to become outdated. Besides this, expanding business also need research and development.

ix. Cash Budget (Financial Budget):

The cash budget is the most important as it controls the cash. It is a detailed statement of cash receipts, cash payments and cash balance for the budgeted period. Cash Budget coordinates-and controls the financial aspects of business. This budget is prepared after the preparation of all other functional budgets. This budget is prepared by the chief accountant of the firm.

Types of Budgets – Long-Term Budget, Short-Term Budget, Basic Budget, Current Budget, Functional Budgets, Master Budget, Fixed Budgets, Flexible Budget and a Few Others

ADVERTISEMENTS:

1. Long-Term Budget:

Long-term budgets are prepared for a period exceeding one year. They are only forward looking plans. They act as a guidelines for preparing short term budgets. Long-term budgets are not meant for immediate implementation.

2. Short-Term Budget:

A budget prepared for a period less than a year is called short-term budget. Short term budgets are prepared for actual implementation and it has a practical value.

3. Basic Budget:

Essentially it is a long-term budget. The conditions and assumptions for preparing budgets should remain unaltered for a long period. Basic budgets are like long-term budget act as a guidelines for preparing short-term budgets.

ADVERTISEMENTS:

4. Current Budget:

A budget prepared for a short time is called a current budget. It is meant for actual implementation. Conditions prevailing at the present are the basis for preparing these budgets.

5. Functional Budgets:

Functional budgets are the budgets prepared for various activities of a firm.

6. Master Budget:

Master budget is a summary of all functional budgets. It gives an overall view of the firm’s plan of action for the budget period. In a master budget a summary of functional budgets are incorporated. Master budget takes two forms – a budgeted profit and loss account and budgeted balance sheet. In the budgeted profit and loss account all cost and revenues of all functional budgets are shown in summary form. It reveals the forecasted profit or loss for the budget period. In budgeted balance sheet all assets and liabilities are shown.

ADVERTISEMENTS:

7. Fixed Budgets:

Fixed budget is prepared for a specific level of activity forecasted. It is prepared on the assumption that actual activity will not vary from budgeted activity level. If the actual activity is different from the budgeted activity, the fixed budget becomes useless. In the fixed budget no provision is made for its modification to suit the actual level of activity. Fixed budget becomes impracticable when future conditions change. It does not help the management in exercising control over the firm’s activities.

8. Flexible Budget:

Flexible budget is also called variable budget. In a flexible budget provisions are made to modify the budgeted cost and revenue for any level of activity of the firm’s operations. So a flexible budget prepared for one level of activity can be altered for any level of activity. For the purpose of preparing flexible budget the costs are classified as variable, semi- variable and fixed costs.

Variable cost will vary in direct proportion to the level of activity. Fixed cost remains same for all activity levels. Semi-variable cost changes but less than proportionately to change in activity level. So detailed estimate is made for determining semi-variable cost for different levels of activities.

9. Zero Based Budgeting (ZBB):

ADVERTISEMENTS:

ZBB was introduced by Peter A. Phyrr in Texas Instruments Incorporation, USA in the year 1969-70. Jimmy Carter applied ZBB techniques in government budgeting in the State of Georgia during 70’s when he was the Governor of this State. He introduced ZBB technique at national level during 80’s when he became the president of USA.

ZBB differs from traditional budgeting in selecting the projects or activities for inclusion in the budgets. In traditional budgeting ongoing projects or activities are automatically included in the budget for the next year with adjustment for inflation. Additionally new activities and projects are added in the budgets. But in ZBB continuing projects or activities from the past are not automatically included in the current budget.

The new budgets are prepared afresh from the start (scratch or zero base, hence ZBB). Each project or activity is to be justified of its necessity for its inclusion in the budget. No past activity is included the current budgets unless there is justification for its inclusion. It is an effective tool of planning and control of activities and costs during the budget period.

10. Performance Budgeting:

Performance budgeting establishes a link between the amount of costs incurred and the output achieved. Under performance budgeting objectives are established for each function or programme. A person in charge of a function or programme is made responsible for achieving the objectives within the budgeted expenditure. Usually objectives to be obtained are fixed in physical terms (say, number of units to be produced or number of units to be sold).

Under traditional budgeting expenditure to be incurred is given prominence rather than objectives to be achieved in physical terms. Importance is given for controlling the cost within budgeted level in the traditional budgeting. Less importance is given for achieving the objectives.

In performance budgeting responsibility accounting is made possible.

Types of Budgets – Sales Budget, Production Budget, Direct Materials Budget, Direct Labour Budget, Factory Overheads Budget, Financial Budget and a Few Others

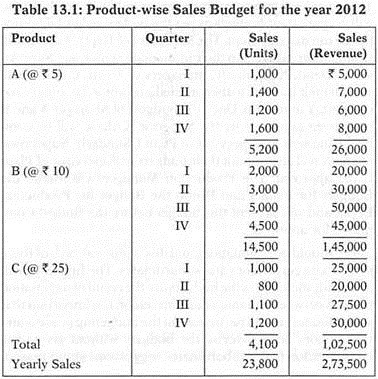

Type # 1. Sales Budget:

The most important element and the starting point of the operating budgets is the sales budget.

The sales budget constitutes the foundation upon which the entire budget programme of the firm is developed. In turn, the sales budget is based on the sales forecast for the budget period. So, the realistic sales forecast for the budget period is the starting point for the sales budget and also for the operating budgets for that period. The sales forecast involves estimation of the units sales and the sales revenue for each product line and for each sub- period.

Different statistical techniques such as scatter diagrams, extrapolation, trend line, etc. are available for this purpose. The sales manager should select an appropriate technique for sales forecasting depending upon the data available, prevalent situation and conditions regarding demand etc. For example, if the demand for the product is highly elastic, then a change in selling price may cause a more than proportional change in the demand and sales forecast must reflect this.

Moreover, several assumptions need to be made for a reliable sales forecast. These assumptions may be related to consumer’s demand, competitor’s price variations, government policies, number of sales personnel required to service the estimated sales, the appropriate level of advertisement and promotional expenditures, tax structure and the changes therein, excise duties, custom duties etc.

The sales unit forecast should then be compared with the production capacity of the firm to find out whether estimated sales units are within the capacity of the firm or not. If the sales forecast is in excess of plant capacity, then either the sales forecast be adjusted downward or additional plant capacity be planned by sub-contracting, job work, assignment or installing a new plant, etc. The manager must ensure a consensus between the sales forecast and the production capacity.

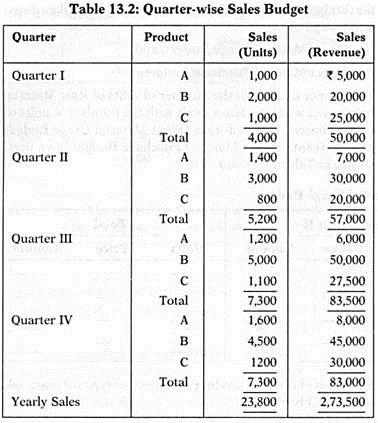

Within a time horizon of a year, sales budget may be prepared quarter-wise or month-wise. A typical sales budget may look like as given in Tables 13.1 and 13.2.

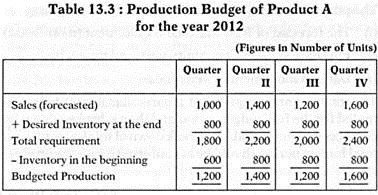

Type # 2. Production Budget:

The production budget is concerned with different phases of production and distribution of goods produced or services rendered. This budget is an estimate of the number of units that must be produced during the budget period. Impliedly, this budget uses the sales budget as a base from which the finance manager makes the projection of minimum production to help meeting the sales targets. The minimum inventory level of the finished goods to be maintained by the firm is also considered.

Therefore, in order to prepare the production budget, the figures of sales budget and the desired inventory level are required. The aim of the production budget is to make available sufficient quantity of goods and services as and when required by the sales or marketing department. Like sales budget, the production budget should also be prepared for each sub-period of the overall budget period.

The production budget is prepared in such a way that it keeps an optimal balance between sales, inventory, production schedule, production capacity and contingencies such as labour unrest, power failure, economic disturbances etc. For example, if the sales budget shows a sharp increase in a particular month or quarter, then the production budget must call for increased production in the preceding month or quarter to meet the sale forecast.

The production budget may also notify the need for setting up of additional production capacity or arrangement for job work at an appropriate time. A typical production budget in coordination with the sales budget (Tables 13.1 and 13.2) may look like as given in Table 13.3.

Note:

The desired level of inventory of product A has been increased from 600 units to 800 units for the year 2012.

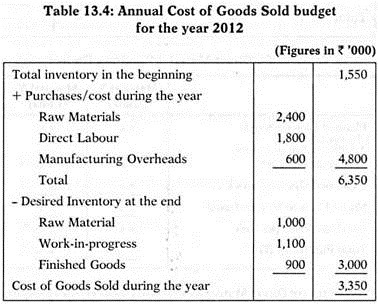

The production budget in turn helps preparation of Cost of Goods Sold budget, Raw Material budget, Direct and Manufacturing Expenses budget, Direct Labour Expenses budget, etc. A typical Cost of Goods Sold budget has been given in Table 13.4.

The Production budget and the Cost of Goods Sold budget need to be coordinated with – (i) the Purchase budget, which specifies the other materials besides the raw materials needed in the production, (ii) the Maintenance budget, which specifies the required maintenance costs, (iii) the Plant Utilization budget, which specifies the estimation of plant capacity to meet the budgeted production during the budget period.

Type # 3. Direct Materials Budget:

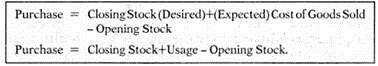

Materials used in the manufacturing process may be classified as Direct Material and Indirect Material. The budget for the usage of Indirect Material is included in the Overhead Budgets. The budget for the Direct Material may be prepared separately. The Direct Material Budget specifies the budgeted quantities of each raw material required for the budgeted production.

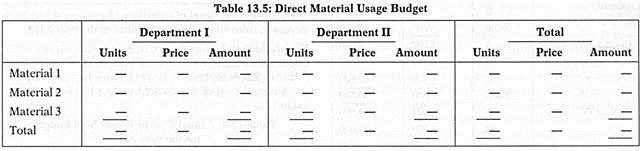

The requirement (purchase) of material may be found as follows:

The preparation of Direct Material Budget may require:

(i) The forecast of Raw Material requirement (month-wise)

(ii) Purchase schedule – quantity-wise and time-wise.

(iii) Date on movement of inventories.

The total quantity required of a particular item is first estimated for the full budget period and then is broken down by component time period. The break-down of total quantity and total budget period should be in conformity with the production budget.

The Direct Material Budget may be broken down into two parts:

1. Direct Material Usage Budget, and

2. Direct Material Purchase Budget.

The former deals with the number of units of Raw Material being used while the latter deals with the number of units to be purchased. The Proforma Direct Material Usage Budget and Proforma Direct Material Purchase Budget have been shown in Tables 13.5 and 13.6.

Preparation of Direct Material Purchase Budget is the responsibility of the Purchase Manager since he is required to procure necessary units to meet the production needs. The objective of this budget is to purchase these materials at right time at the planned purchase price.

In case, the material consumption rate can be standardized, both the Materials Budgets can be prepared easily and exactly. The Purchase department should proceed to procure these units in the most profitable way (i.e., best quality at the least cost).

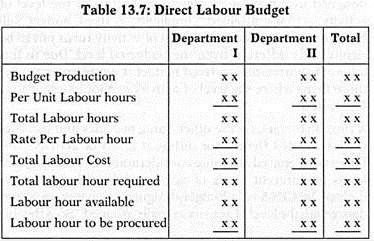

Type # 4. Direct Labour Budget:

Direct Labour Budget deals with the requirement of labour for the budgeted production. The budget may incorporate the details in terms of Direct labour hours required, price per hour and total direct labour cost. The preparation of Direct Labour Budget is the responsibility of respective departmental heads. They will prepare estimates of department’s labour requirement to meet the planned production. Where different grades of labour exist, these should also be specified in the budget.

Like the Direct Material Budget, the Direct Labour Budget can also be prepared in two parts i.e.:

(i) Direct Labour Requirement Budget, and

(ii) Direct Labour Procurement Budget.

The former deals with the total labour required and its cost for the planned production while the latter deals with the additional labour force required. The Direct Labour Budget ensures that the required labour force of different grades and skills will be available to the production department at the right time. The Proforma Direct Labour Budget has been presented in Table 13.7.

Type # 5. Manufacturing Expenses or Factory Overheads Budget:

The Manufacturing or Factory overheads refer to total of all indirect expenses such as indirect labour, indirect material expenses and indirect general expenses.

These total expenses can further be sub-divided into:

i. Fixed overheads

ii. Semi-variable overheads, and

iii. Variable overheads.

It may be noted that Fixed Overheads are those which do not vary with a change in output or level of activity and hence can be accurately estimated to a greater extent. The Semi- variable overheads are those which are partly fixed and partly variable. The variable overheads are those which are fixed per unit of output and hence total variable overheads vary with the level of activity.

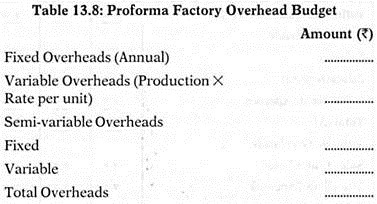

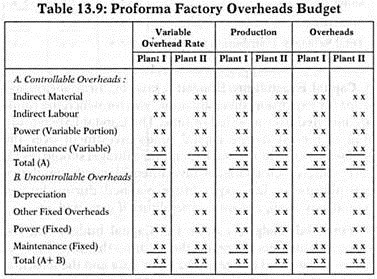

The preparation of Factory Overheads Budget is the responsibility of the respective departmental managers. The total of overheads budget will depend on the behaviour of the costs of individual item and the level of production. The overheads may also be analysed according to whether they are controllable or non-controllable for the purpose of cost control. Proforma for Factory Overheads are given in Tables 13.8 and 13.9.

Type # 6. Administrative Expenses Budget:

Administrative expenses are those expenses which are incurred on the administrative personnel of the firm. These people may be related to formulation of policies, controlling the operations and overall directing the organization. These expenses will not include any expense incurred for sales function, production function, or such related areas.

Generally, the Administrative expenses are of fixed nature and do not vary with the change in level of activity. In order to prepare the Administrative Expense Budget, an in-depth analysis of the administrative needs of the firm is very necessary. The total administrative expense budget for the entire firm can be prepared by adding up the departmental administrative expenses.

Type # 7. Selling and Distribution Expenses Budget:

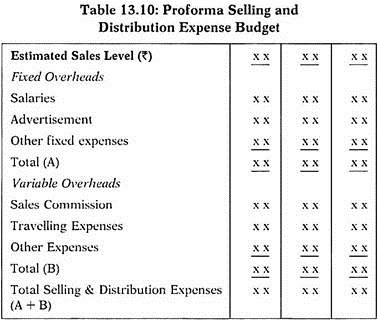

The selling and distribution expenses are salaries and commission payable to sales force, transportation, freight charges, expenses of inventory control and warehouse expenses etc. In a broader sense, the selling and distribution expense may also include the advertisement and delivery expenses. This budget may be prepared product wise or region wise. There must be coordination of sales expenses with the sales budget.

The preparation of Selling and Distribution Expenses Budget is the responsibility of the Sales and Distribution department. For this purpose, an in-depth analysis of the market situation, market segmentation, competition, etc. must be taken. These expenses may also be analysed from the point of view of fixed and variable expenses. A Proforma Selling and Distribution Expense Budget has been presented in Table 13.10.

Type # 8. Capital Expenditure Budget:

A growing firm always has plans for expansion, diversification, etc., for which the funds are invested over a period of time. The Capital Expenditure Budget represents the capital funds investment over the budget period. The Capital Expenditure Budget should reveal several facts such as Original Investment planned, cumulative expenditure so far, expenditure planned during budget period, any change in total expenditure if expected, etc.

Type # 9. Financial Budgets:

After the Capital budget and the Operating budgets are ready, there comes the turn of preparation of financial budgets. The basic data and the information for the preparation of financial budgets are primarily provided by the Capital budgets and Operating budgets. The finance manager combines these budgets with all other budgets to estimate the firm’s funds flow, profitability and financial positions over a given period.

The financial budget are prepared to represent the financial implications of different budgets i.e., to represent the resultant cash flows and changes in the overall financial position of the firm. Two important aspects of the financial planning process are the cash planning and the profit planning.

The cash planning is done by preparing the Cash budget and profit planning is done by preparing the Projected Financial Statements. The financial budgets are based upon the accounting structure and hence are uniform in format and approach.

Types of Budgets – Sales Budget, Production Budget, Production Cost Budget, Purchase Budget, Labour Budget, Cash Budget, Master Budget and Other Types

1. Sales Budget:

Sales Budget is one of the important Functional Budgets. This is considered as an important one as all other Functional Budgets such as Purchase Budget, Production Budget, Personnel Budget, etc., are affected by this Budget (viz., Sales Budget). Sales Budget is primarily concerned with the forecasting of what the company can expect to sell during the Budget Period. This expected sale is usually expressed in terms of both the physical units and the monetary value.

However, the Sales Budget is usually prepared for each product, sales territory, etc. Sometimes, a company may also prepare customer-wise (if the number is very less and if the customers are institutional customers) and/or salesman-wise Sales Budgets. However, while preparing the Sales Budget, the sales manager shall consider a number of relevant and influencing factors.

After considering the above and a number of other factors, a Sales Budget is prepared. This Budget may be prepared on the basis of either the products (if the company is a multi-product concern) or the sales territories (if it is selling its product/s in more than one territory) or the salesmen or the customers or the time factor (such as – monthly, weekly, quarterly or six-monthly budgets) or a combination of two or more of these variables.

2. Production Budget:

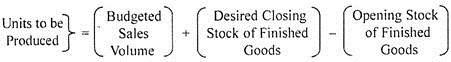

After the preparation of Sales Budget, Production Budget is prepared. Production Budget shows the number of units of each of the products of the company that must be produced during the Budget Period to meet the demand for the products and to keep the units of finished goods at the desired level at the end of the Budget Period. In order to find out the number of units to be produced, it is necessary to take into account the opening and closing stocks of finished goods and the sales volume.

Because,

It is, therefore, said that the Production Budget is essentially a Sales Budget adjusted for changes in inventory levels.

3. Production Cost Budget:

After the preparation of Production Budget, this Budget (i.e., Production Cost Budget) is prepared. Because, only when the company knows the number of units to be produced, it can determine the production cost. Production Cost Budget shows the cost of the production determined in the Production Budget. That means, it shows the amount of expenditure expected to be incurred to produce the units estimated in the Production Budget.

It is very well known that the production cost (also known as manufacturing cost or works cost) includes the cost of direct materials, direct labour cost and factory overhead expenses (also known as works-on-cost). Factory overhead expenses are classified into variable and fixed, and they are usually shown separately.

4. Purchase Budget (Raw Material):

Once the Production Budget is prepared, it is necessary to determine the different inputs required to carry out the production activities. One such input factor is the raw material. The Purchase Budget shows the number of units of materials (usually, only direct materials as the indirect materials are considered while preparing the Overheads Budget) to be purchased during the Budget Period.

It may also incorporate the monetary value of the units of materials to be purchased for producing the goods and services as per its Production Budget. In the case of a company which purchases finished goods for resale, Purchase Budget of the company will include the information about the number of units of finished goods to be purchased during the Budget Period. However, the objective of this budget is to see that the required raw materials are available for production as and when they are required by the production department/s.

5. Labour Budget:

This Budget shows the number of employees and/or the number of labour hours (skilled, semiskilled and unskilled for both production, administration, and selling and distribution) required to produce and/or sell the budgeted output, and/or budgeted sales.

While preparing this Budget, it is necessary to consider the budgeted output and sales, capital expenditure programmes, research and development activities, etc. This Budget may also incorporate the monetary value. Therefore, appropriate remuneration rates are to be used. These rates should include the provision for possible changes in the rates due to new wage agreement, enhance in the admissible allowances, etc.

In addition to the Budgets discussed above, a number of other Functional Budgets, as presented below, are also prepared:

i. Production Overhead Expenses Budget – It shows the amount of production overhead expenses expected to be incurred to produce the budget output.

ii. Administrative Overhead Expenses Budget – It shows the probable expenses pertaining to top managerial and supervisory functions.

iii. Selling and Distribution Overhead Expenses Budget – It presents the information in detail about the probable expenditure to be incurred to promote the sale of goods and services, and for distribution.

iv. Plant Utilization Budget – This Budget estimates the number of machine hours (or in any other convenient form) required for producing the budgeted output as set out in the Production Budget.

v. Research and Development Cost Budget – This Budget presents the details about the limits within which the research and development activities are to be carried out during the Budget Period.

vi. Capital Expenditure Budget – It shows the details about the future capital expenditure programmes which the company intends to undertake in future. Further, it presents information about the probable capital to be employed on the projects during the Budget Period. This Budget is normally prepared for a long period.

6. Cash Budget:

Cash Budget forecasts both the inflow and outflow of cash during the Budget Period. Since the business functions and transactions cause the flow of cash, this Budget is prepared after the preparation of all the Functional Budgets. This Budget is necessary as the company wants to know the sources from which cash is expected to flow into the company and also the activities for which this cash is required. Because, cash is required for the purpose of meeting its current cash obligations.

As is known, if a company fails to meet its cash requirements, it will impair its reputation. Anyhow, it is prepared on the basis of detailed estimates of both cash receipts and cash disbursements. Further, time-lag in credit transactions is also taken into consideration while preparing the Cash Budget.

Though this Budget is prepared for the Budget Period, normally companies prefer to split the Budget Period so that Weekly, Monthly and Quarterly Cash Budgets can be prepared. This is necessary for controlling purposes. Three important methods are available for preparing the Cash Budgets.

They are:

i. Receipts and Payments Method,

ii. Adjusted Profit and Loss Account Method, and

iii. Balance Sheet Method.

i. Receipts and Payments Method:

Under this method, Cash Budget is prepared on the basis of all cash receipts (from different sources) and all cash payments (to different parties and purposes) that are expected to take place during the period. Therefore, cash requirements of all the Functional Budgets are considered. All expected cash receipts are added to the opening balance of cash and from this aggregate, all expected cash payments are subtracted to arrive at the balance of cash at the end of the Budget Period.

Since this method considers only the anticipated cash receipts and payments, it is implied that all accruals and adjustments are not considered for preparing the Cash Budget. That means, advance payments and receipts are taken into consideration for the purpose of preparing the Cash Budget irrespective of whether these cash flows pertain to the current year or not. Further, the expenses incurred but not paid and the incomes earned but not received are excluded from the Cash Budget.

Special attention shall be given to the time lag in credit transactions – the credit allowed to customers, the credit allowed by the suppliers, delay in the payment of wages, salary, interest, and other expenses are the factors which shall be taken into consideration to determine the timing of receipts and payments.

ii. Adjusted Profit and Loss Account Method:

This method of preparing the Cash Budget is similar to the preparation of Cash Flow Statement.

Further, the following shall be added to the opening balance of cash:

(i) Decrease in Current Assets except cash. Because, the reduction in the Current Assets represents their sale and therefore, the sale causes the inflow of cash i.e., cash receipts, and

(ii) Increase in Current Liabilities. This represents the additional loans raised. Therefore, it causes the inflow of cash.

d. From the aggregate of the above (i.e., a + b + c above), capital expenditure (such as – acquisition of Fixed Assets), capital redemption (e.g., redemption of Redeemable Preference Shares, Debentures, etc.,), repayment of long-term loans, increase in Current Assets except cash (because, it represents the acquisition of Current Assets resulting in cash outflow) and reduction in Current Liabilities (as it represents the discharge of the Current Liability) shall be subtracted as they involve the cash outflow.

e. The balance [i.e., (aggregate of first three) – (fourth item)] represents the closing balance of Cash.

iii. Balance Sheet Method:

Under this method, a Budgeted Balance Sheet is prepared for the Budget Period incorporating all the items of liabilities, capital and assets except cash. The balancing figure in the Budgeted Balance Sheet represents the Cash and Bank Balance or the Bank Overdraft depending upon whether the capital and liabilities side exceeds the assets side or vice versa.

7. Master Budget:

A budget which is prepared incorporating the summary of all the Functional Budgets is called Master Budget. It normally comprises of Budgeted Profit and Loss Account, and Budgeted Balance Sheet. The Budget Committee prepares these Budgeted Profit and Loss Account, and Budgeted Balance Sheet on the basis of the Functional Budgets.

Once this Master Budget is prepared and approved by the Budget Committee and/or by the Board of Directors, then it is considered as the target to be achieved and accomplished by the company during the Budget Period.

8. Fixed Budgets:

A Budget prepared for a particular level of activity is called Fixed Budget. According to CIMA, London, a fixed budget is a budget which is designed to remain unchanged irrespective of the level of activity actually attained. It presents the cost details for a specific level of activity. Consequently, budgeted costs for budgeted level of activity are compared with the actual costs for actual level of activity.

Therefore, Fixed Budget is not going to highlight the cost variances due to the difference in the levels of activity. Because, they can serve as yardsticks only when the company’s actual level of activity corresponds to the budgeted level of activity. That means, it is useful only when there is no difference between the budgeted and actual levels of activity. This budget does not consider the variances in costs and other performance indicators on account of changes of the level of activity.

Hence, this type of budget is useful for the industries wherein the demand pattern is more or less stable and where the budget period is comparatively short. However, this type of Budget is not of much use to the management as no adjustment is made to the costs for the difference in the activity levels.

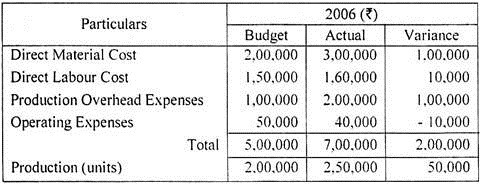

Few details presented below clarify this point:

From the above, one can come to a conclusion that the company has incurred Rs.2,00,000 more expenses than budgeted. It is due to both the inefficiency and also due to the increase in the volume of output by 50,000 units from 2,00,000 units to 2,50,000 units. However, the Fixed Budget makes no such distinction. Therefore, it is of less use to the managerial personnel.

9. Flexible Budget:

A Budget prepared for a range of activities rather than for a single level of activity is called Flexible Budget. It is capable of furnishing the budgeted cost at any level of activity. Hence, CIMA, London defined Flexible Budget as a budget designed to change in accordance with the level of activity actually attained. It recognizes the behaviour of costs and classifies them into variable, fixed and semi-variable.

On the basis of this, the Budget is designed to change (i.e., flex) in relation to the level of activity attained. Therefore, it is possible to compute and compare the budgeted costs for actual level of activity attained with the actual costs incurred. In order to prepare the Flexible Budgets, tabular method is normally used.

Under Tabular Approach, Flexible Budget is prepared in the form of a table. This table provides columns for different levels of activity, and the expenses are computed and recorded against the corresponding activity levels. Hence, a number of budgets are prepared for different levels of activity. However, it may be noted here that all the budgets are included in one budget providing one column for each level of activity. The expenses are normally recorded under the heads variable, fixed and semi-variable.

Variable cost items are presented in the budget under the head ‘variable costs’ as per the level of activity/output. On the other hand, the fixed cost items, which normally do not change irrespective of the levels of activity, are shown at the same amount in the budget under the head ‘fixed costs’. Sale revenue is also determined for different levels of sales and shown in the budget.

Even the semi-variable costs are determined taking into account the variable and fixed portions, and shown in the budget either under a separate head or under variable costs and/or fixed costs.

Another method used for preparing the Flexible Budgets is based on the budget for normal level of activity. This Budget estimates the different cost items at that level. Each item of variable cost is then expressed for one unit of output. In the same way, variable portion of each item of semi-variable costs is also expressed per unit of output. Based on the unit variable costs, total variable costs are determined at different levels of output.

Because, total variable cost represents the product of output and the unit variable cost. Since the fixed costs (including the fixed portion of semi-variable costs) are expected to be constant for different levels of activity, they do not pose any difficulty. Because, the same amount is considered for different levels of output. Using these details, Flexible Budgets are prepared for different levels of activity.

Types of Budgets: 7 Types: Performance Budget, Fixed Budget, Flexible Budgets, Incremental Budget, Rolling Budget and Cash Budget

Budget can be divided into various types:

Type # 1. Performance Budget:

Performance budget lists all the activities carried out in the organization along with their outcomes. It includes a set of performance targets that must be met at a given level of expenses. In an organization, the top-level management reserves the right to approve, modify, disapprove, and revise the performance budget.

The top management takes the decision to approve the proposed budget after taking into consideration the profitability of various activities, projects, and operations. Performance budget is prepared after taking into account various budgets formulated by different departments.

Now, let us discuss each constituent of performance budget in detail in the following points:

i. Sales Budget:

Involves the assessment of past sales, general business conditions, plant capacity, seasonal fluctuations, availability of stock, and market research by the marketing manager.

ii. Production Budget:

Helps in analyzing the availability of finished goods required by the sales department. Production budget manages and controls the overall production activities of an organization. It can also be termed as operating budget, which is prepared to forecast the current expenses of an organization and the anticipated sources of funds. It focuses on ensuring the adequate amount of funds required for paying salaries, interest, and depreciation charges.

iii. Cash Budget:

Indicates the need of funds by taking into account cash and credit sales and payments given to creditors.

iv. Selling and Distribution Cost Budget:

Forecasts the cost to be incurred on selling and distribution during a period of time. This budget is prepared by the marketing manager after considering direct selling, sales office, distribution, and advertising expenses.

v. Purchase Budget:

Provides information regarding purchases during the budgeted period. It is prepared by considering opening and closing stocks, work in progress, and the maximum and minimum level of inventory to be maintained by an organization. Purchase budget helps in reducing the cost of production as it minimizes unnecessary purchase by planning in advance.

vi. Research and Development Budget:

Helps in forecasting the cost to be incurred on research and development during the budgeted period. It is prepared by considering the existing and potential market of the product. The promotion of the new product and demand in the market are also considered while formulating research and development budget.

vii. Plant Utilization Budget:

Forecasts the production capacity of the plant for the future production. It considers the cost of purchasing a new plant during the budget period. In addition, the plant utilization budget considers cost of utilization of machine per hour. It also considers that whether the plant is operating more or less than its optimum capacity.

viii. Capital Expenditure Budget:

Forecasts the cost to be incurred in purchasing assets for an organization. It is prepared by considering the king-term and short-term requirement of assets. Capital expenditure budget also forecasts the need of asset replacement, delays in purchasing new assets, and alternative means to satisfy the production requirement.

Type # 2. Fixed Budget:

In fixed budget, funds required to complete various targets in the budgeted period are rigidly fixed. It is usually prepared for a short period of time as it does not consider variations that may occur in the long run. Financial Business Decisions, there are two types of cost, such as fixed cost and variable cost. Fixed cost remains unchanged irrespective of production levels; whereas, variable cost keeps on changing with the level of production.

Therefore, an organization having low percentage of variable cost in the total cost of production can make fixed budget as it does not affect the working of the organization. On other hand, an organization having high percentage of variable cost in the total cost of production cannot rely on fixed budget. For example- an aluminum manufacturing organization requires more of sophisticated machinery and less of labors.

The purchase of sophisticated machinery is a part of fixed cost; whereas, the wages of labors are a part of variable cost. In the organization, the contribution of fixed cost in the total cost of the organization is more as compared to variable cost. In such a situation, the organization can prepare fixed budget.

The advantages of fixed budget are as follows:

i. Needs less time and money for preparing as there are no or less changes in different situations

ii. Avoids complexities as it is made on an assumption that all types of cost are fixed

iii. Facilitates better comparison between different periods as it remains unchanged

The disadvantages of fixed budget are as follows:

i. Works on unrealistic assumptions, such as market situation and economic condition would not change

ii. Provides no useful information as fixed budget does not consider variable cost while calculating profit

iii. Makes it difficult to take into considerations the impact of inflation on cost of production

Type # 3. Flexible Budget:

Flexible budget refers to a budget that can be changed with changes in the different activity levels of the organization. It is the type of budget in which both the fixed and variable costs are considered. It is prepared in such a manner that the budget cost for different level of output can be determined easily and compared with actual cost to find the gap between the two. While preparing flexible budget, it is necessary to consider variation in variable cost at different levels of output.

A different budget is prepared for a different level of activities. For example- the organization prepares flexible budget at production as well as distribution level.

The advantages of flexible budget are as follows:

i. Controls the cost of production as variable cost for different production level is considered

ii. Maintains a greater level of accuracy by considering different situations, such as recession and inflation

iii. Compares the actual performance with the budgeted targets to find the gap between the two

iv. Helps in making financial plans and forecasts about future fund requirement

The disadvantages of flexible budget are as follows:

i. Requires more time in preparation as segregating fixed and variable costs is a difficult task

ii. Increases complexities as different budgets are prepared for different levels of output

Type # 4. Incremental Budget:

Incremental budget is the type of budget in which extra amount is added to the previous budget every year. It is prepared by keeping actual performance of preceding year as a base. In incremental budget, funds are allocated to different activities in the pattern similar to the preceding year. For example- an organization allocates Rs.1 lac to various activities in the current year. It would increase the amount of Rs.1 lac in the next year’s budget.

In incremental budget, funds allocated to each activity increase in every budget without doing any analysis. Incremental budget is criticized for ignoring changes in business, economy, and fiscal and monetary policies.

The advantages of incremental budget are as follows:

i. Covers the increase in cost by allocating more funds in each activity as compared to previous year.

ii. Helps in maintaining consistency in business operations as funds are always sufficient and do not get affected by inflation rate.

iii. Simplifies the process of framing and analyzing the budget.

iv. Allocates separate amount of funds for each and every department of an organization. Therefore, there are fewer chances of clashes between different departments.

v. Evaluates the effect of changes in cost on a regular basis.

The disadvantages of incremental budget are as follows:

i. Assumes that the cost of each and every activity is increased at a constant rate

ii. Increases the cost of production in every new budget

iii. Encourages more spending habit even if it is not required. This happens because the funds for different activities are increased without any cost analysis.

iv. Gives no priority to any particular activity even when it is required

Type # 5. Rolling Budget:

Rolling budget refers to a budget, which is prepared by making changes in a given budget at a fixed interval of time. The changes may be added monthly, quarterly, half yearly, or annually. In simple words, it is a kind of budget in which there is always a scope of amendments at any period of time. The rolling budget is prepared for a very short period of lime. It is very useful for industries that are facing swift changes and require forecasting for a short interval of time.

For example- in most of the cases, an IT organization faces swift changes due to frequent enhancements in technology. Rolling budget is also known as continuous budget as it never ends and the management keeps on incorporating changes in the same budget as per the organizational needs.

Type # 6. Cash Budget:

Cash budget is prepared by analyzing cash inflow and outflow of an organization. It is prepared to ensure the sound liquid position of an organization so that the organization can pay its short-term liabilities. It also helps the organization in avoiding situations in which there is idle cash or shortage of cash.

The cash budget is divided into four sections, which are given as follows:

i. Receipts Section – Maintains the records of the cash receipts obtained from customers and other sources

ii. Payment Section – Maintains the records of all the payments or expenditure incurred by the organization

iii. Cash Flow Section – Keeps the record of difference between cash inflow and outflow to determine surplus or shortage of cash

iv. Financing Section – Keeps the record of loans and payments to be made against them