The Adaptive Inflation Inertia!

Subject-Matter of Adaptive Expectations and Inflation Inertia:

The Modern view is that people form their expectations of inflation on the basis of actual inflation that occurred in recent past.

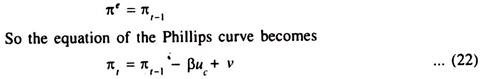

This assumption is known as adaptive expectations. If, for instance, people expected this year’s prices to rise at the same rate as they did last year, then this year’s expected inflation (πe) will be the same as last year’s actual inflation (πt-1).

This equation states that this year’s inflation depends on last year’s inflation, cyclical unemployment and a supply shock. Thus interpreted, the natural rate of unemployment which is consistent with price level stability is called the Non-Accelerating Inflation Rate of Unemployment (NAIRU).

Inflation Inertia:

ADVERTISEMENTS:

The term πt-1 in the above equation implies that inflation has inertia. This means that if unemployment is at un and if there are no supply shocks, the continued rise in price keeps its own momentum intact like a self-fulfilling prophesy in the sense that it neither speeds up nor slows down.

Inflation inertia arises because past inflation influences expectations of future inflation, as also because these expectations influence the wages and prices that people set. Money loses its value simply because we have inflation. We have inflation because we expect inflation and we expect inflation because we experienced it in the past.

Inertial inflation occurs due to upward shifts of both AS and AD curves. We know that the position of the AS curve depends on the expected price level. Thus, if prices have been rising fast, people will expect the same trend to continue — in which case the SRAS curve will continue to shift upward over time.

ADVERTISEMENTS:

The process will come to a halt only if an adverse exogenous change — such as a recession or a supply shock, changes inflation and thereby changes inflationary expectations.

A persistent increase in aggregate money supply will cause the AD curve to shift to the right to confirm the expectations of inflation. If the central bank suddenly halted monetary expansion, aggregate demand would stabilise and the upward shift in AS would cause an inflationary recession (i.e., a situation of high price and low demand).

But there is, of course, an offsetting consideration. The high unemployment in recessionary downturn would reduce inflation and expected inflation. As a result, inflation inertia would subside, i.e., inflation would be self-destroying in nature.

In modern industrial economies like the USA, inflation is highly inertial. That is, it will persist at the same rate until some economic events cause it to change. Other names sometimes used to describe this concept are the core, underlying, or expected inflation rate. In truth, the rate of inflation that is expected and built into contracts and informal arrangements is the inertial rate of inflation.

ADVERTISEMENTS:

Inertial inflation can persist for a long time — as long as people expect the inflation rate to remain unchanged. In such a situation; inflation is built into the system. But economic history amply demonstrates that inflation does not remain undisturbed for long.

The actual rate of inflation may move above or below the inertial rate due to adverse and favourable shocks — such as changes in aggregate demand, oil price hike, crop failure, exchange rate fluctuations, productivity changes and a host of other factors. The major kinds of shock are demand-pull and cost-push.

At a given time, the economy has an ongoing rate of inflation to which people’s expectations have adopted. This built-in inertial inflation rate tends to persist until a shock causes it to move up or down.

Demand-Pull and Cost-Push Inflation:

There is no single source of inflation. After all, inflation indicates ill-health of the economy. Like illness, inflation can occur for many reasons. Some inflation comes from the demand side and others from the supply side. But the truth is that modern inflations develop an internal momentum. And it is very difficult to stop them once they are underway.

From the Phillips curve equation we can identify two forces behind the change in the rate of inflation.

Firstly, low cyclical unemployment (uc) pushes the inflation rate up. This type of inflation is called demand-pull inflation. Such inflation occurs due to high aggregate demand. The converse is also true. High uc keeps the inflation rate down. The parameter p measures inflation elasticity of cyclical unemployment.

Secondly, an adverse supply shock implies a positive value of v and causes the rate of inflation to accelerate. Such inflation — which occurred all over the world in the 1970s mainly due to rise in the price of oil — is called cost-push inflation.

Such inflation occurs from the supply side due to rise in costs of production. A favourable supply shock — such as a major technological breakthrough — makes v negative and causes the rate of inflation to fall.