Let us make an in-depth study of the controversy regarding MNCs.

External dependence of poor LDCs arises because the bulk of FDI is done by the MNCs/ TNCs.

There is a controversy regarding the definition of MNCs. Usually, MNCs are defined as firms that enjoy management rights and controls in at least two countries.

Others say that the number of such firms that control assets in at least six countries is to be called MNCs. What is important is that only enterprises that undertake at least one FDI project in which it enjoys management rights and control are to be called the MNC.

FDI is an investment involving:

(i) green-field investment—the creation of new production facility abroad; and

(ii) the mergers and acquisitions of controlling interest in an already existing foreign company through the purchase of shares and stocks.

It may be noted that such controlling right depends on the volume of share of equity of a foreign business and that too varies from country to country. Foreign affiliates can be minority-owned (10 to 50 p.c. of equity capital), majority-owned (between 50 p.c. and less than 100 p.c.), and wholly-owned (100 p.c.) affiliates.

ADVERTISEMENTS:

United Nations prefers the term transnational corporations (TNCs) to MNCs since a firm’s business operations from a single home country are extended beyond national frontiers.

On the basis of this definition, the United Nations Conference on Trade and Development (UNCTAD) estimated that in 2002 there were about 64,000 MNC firms as against 50,000 in 2000 with more than 8, 70,000 affiliates. Enterprises like General Motors, Wal-Mart, Exxon-Mobil, Mitsubishi, and Siemens belong to the 200 largest MNCs which account for over half of the global industrial output. All these corporations maintain headquarters in North America, Europe, Japan, and South Korea.

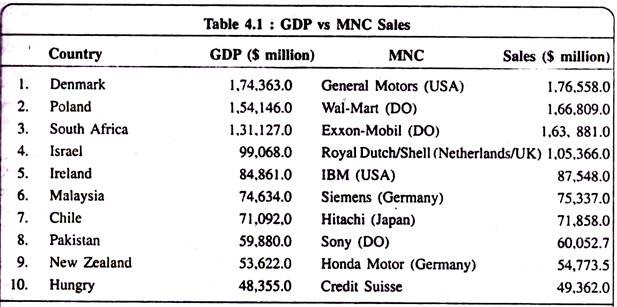

One of the largest MNCs— Royal Dutch Shell of Netherland—has subsidiaries in 116 countries. In terms of sales, the largest MNC is General Motors, in 2000, sales figure of General Motors exceeded Denmark’s GDP figure of that year. Table 4.1 compares the strength of MNCs, measured in terms of sales and the country’s GDP.

As far as power and influence of MNCs over production and export of agricultural commodities produced in LDCs is concerned, only 3 US-based MNC firms control more than one-half of global banana trade, 5 European companies control 90 p.c. of tea sold in the developed countries. Anyway, total FDI flows that constituted nearly $ 150 billion in 2002 shot up to $ 334 billion in 2005 to developing countries. Out of this total FDI, 10 countries of South America and South-East Asia received as high as 80 p.c. of such investment.

ADVERTISEMENTS:

We conclude this section in the words of M. B. Steger:

“No doubt, the growing power of TNCs has profoundly altered the structure and functioning of the international economy. These giant firms and their global strategies have become major determinants of trade flows, the location of industries, and other economic activities around the world. As a consequence, TNCs have become extremely important players that influence the economic, political, and social welfare of many nations.”