Indian financial markets are sub-divided broadly into money markets (that deal in short-term funds) and capital markets (that deal in long-term funds).

Structurally, money market comprises both organised and unorganised sectors.

Unorganised sector is normally made up of indigenous money lenders and bankers who do not follow formal lines of business.

Their businesses are informal and thus independent of the Reserve Bank of India or banks for any fund support. This sector is shrinking but, during the period of economic reforms launched after 1991, the activities of these institutions have become a matter of serious concern and anxiety.

ADVERTISEMENTS:

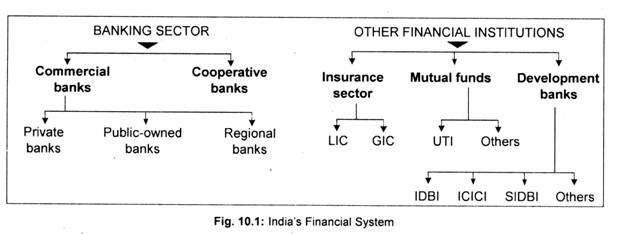

The organised component of money market consists of the RBI, commercial banks and cooperative banks. The RBI is the head of the financial institutions as well as the monetary authority of the country. In the diagram, we have not shown anything about the RBI.

The second most important component of the organised money market is the commercial banks. The first commercial bank in this country—Bank of Bengal—was set up in 1806 in Kolkata. In addition to this Presidency Bank of Kolkata, two other Presidency Banks were established in 1840 in Mumbai and in 1843 in Chennai. Integrating these three commercial banks or Presidency Banks, the Imperial Bank of India was formed in 1921.

This Imperial Bank was nationalised in 1955 and then came to be known as the State Bank of India. Its seven subsidiary banks were nationalised in 1956. However, Indira Gandhi nationalised 14 commercial banks—having deposits of Rs. 50 crore and above—in 1969. Another 6 private banks were nationalised in 1980. At present, the number of public sector banks is 27.

ADVERTISEMENTS:

In terms of size and business, cooperative banks in India are rather tiny compared to commercial banks. It is a three-tier banking structure (i) with the State Cooperative Bank operating in each state as an apex bank, (ii) at the district level, the central cooperative hanks, and (iii) at the village level, the primary agricultural credit societies. However, long- term loans beyond five years are given by the Primary Cooperative Agricultural and Rural Development Banks (PCARDBs).

Although public sector commercial banks is the dominant banking sector, privately- owned banks are nonetheless important in the liberalised regime. Following the Narasimham Committee recommendations made in 1991 and in 1998, private banks are now being allowed to operate. In addition, there are some foreign banks operating in India with little or no restrictions now.

Finally, regional rural banks have been functioning since 1975 to meet the credit needs of the rural people. At present, the number of regional banks stands at 76.

The other side of the Fig. 10.1 deals with ‘other financial institutions’. The main three elements of other financial institutions are: (i) insurance sector, (ii) mutual funds, and (iii) development banks. The two notable insurance institutions are the Life Insurance Corporation of India and the General Insurance Corporation.

ADVERTISEMENTS:

The most prominent mutual funds institution is the Unit Trust of India. Finally, as the name suggests, development banks provide long-term capital to industries in a rather non-conventional way. At present, there are as many as 60 development banks in the country. The largest of them is the Industrial Development Bank of India (IDB1).

Finally, in the realm of industrial finance, there is an institution called capital market that provides long-term funds to both public and private sector units. Security market is the most important component of the capital market that deals in both corporate and government or gilt-edged securities. In India, the capital market has undergone a revolutionary change in recent years following the launching of the new economic policies in 1991.