The balance of payments account of a nation follows the procedure known as double-entry book-keeping. Each international transaction is recorded twice, once on the credit side and once on the debit side, of an equal amount. It is done because every transaction has two sides. Suppose a country exports goods worth Rs. 100 crore.

This item will be included on the credit side (+) of the merchandise account as it will entitle a country to receive payment from the foreigners. But at the same time, this amount is treated as a short term capital debit (-) because it represents a short term capital outflow from the exporting country.

In the balance sheet of a typical business firm, the credit entries are shown on the right side and debit entries on the left side. In case of balance of payments accounting, however, the practice is opposite- credits are shown on the left side and debits on the right side.

In order to understand the structure of balance of payments account, we first of all consider the accounting procedure followed in the United States of America.

ADVERTISEMENTS:

The United States Balance of Payments Account consists of three accounts:

(i) The current account,

(ii) The capital account, and

(iii) The account of financing of deficit or surplus.

ADVERTISEMENTS:

(i) The Current Account:

This section of the balance of payments accounts records all current transactions which involve either the export or import of goods and services. The goods exported are termed as ‘visible’ exports. The services performed for the people of other countries, on the other hand, are called as the ‘invisible’ exports. These include shipping, banking and insurance, expenditure on diplomatic services, tourist expenditure, interests, profits and dividends from overseas investment and private transfers, e.g., remittances from relatives abroad.

The exports and imports of visible and invisible items enter into the income and product accounts of every nation. The total exports (X) of a nation in money terms represent the value of the national product that is demanded by the rest of the world.

Total imports (M), on the other hand, represent the part of the national product spent on the purchase of goods and services from the rest of the world. The difference between the value of goods exported and imported is termed as the balance of trade.

ADVERTISEMENTS:

When the receipts and payments on account of invisible items are included in it, we have the balance on goods and services or the balance on current account. The excess of X over M represents a surplus on current balance, and if M exceeds X, there is a deficit on balance on current account. The importance of this surplus or deficit, especially when looked at over a number of years, is that it indicates how a country is doing in its day-today dealings—whether it is spending less or more than it is currently earning.

(ii) The Capital Account:

The capital account, according to Peterson, represents in a sense, the financial counterpart of transactions involving currently produced goods and services which constitute a part of the current account. The nature of the capital account can be discerned more clearly, if we ignore for a moment the role of monetary gold in the settlement of international balances.

Assuming that a country has an excess of exports (X) over imports (M) in the current income period, it implies that the country concerned has larger claims against the rest of the world.

An import surplus, on the opposite, will mean that the foreign residents have larger claims against the domestic economy. If a country maintains an export surplus, the settlement of it can be effected in a number of ways. The foreigners may borrow funds from the residents of the domestic economy upto an amount considered sufficient for settling the export surplus.

These borrowings will represent a net increase in the foreign claims on internationally held assets of the residents of the domestic economy. Alternatively, the export surplus may be financed by the foreign residents by drawing down balances which they may hold in the banks of the domestic economy.

This means a net decrease in the liabilities which the domestic residents owe to the foreign residents. The capital account thus, includes all transactions involving the lending or borrowings of capital of both short and long maturities and basically reflects the net change during the accounting period in the financial claims and liabilities of domestic citizens, business firms or financial institutions vis-a-vis the rest of the world.

(iii) The Account of Financing of Surplus or Deficit:

The deficit on current account, apart from the short or long term capital movements, may be adjusted through the transactions involving the sale of gold. Since gold is universally accepted by the nations in the settlement of balances, the gold selling to exporting countries can obtain the necessary amount of foreign exchange for discharging their foreign liabilities. The deficit may also be covered by the domestic economy either by drawing on the reserves, or by borrowing from the I.M.F. or other sources abroad.

ADVERTISEMENTS:

The balance of payments accounts also include the item, “Errors and Omissions”. Since a larger number of items in the balance of payments account are estimated from the incomplete data, these may be subject to errors of an uncertain magnitude.

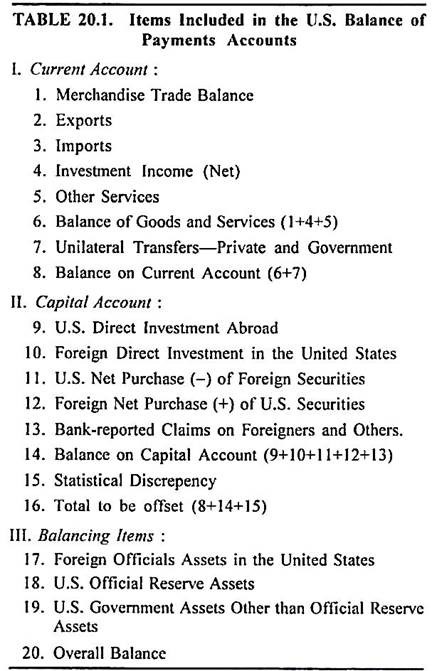

The different components of the balance of payments account can be shown through Table 20.1 which mention the heads and subheads of the balance of payments accounts in the United States of America.

The structure of balance of payments accounts in India consists of:

ADVERTISEMENTS:

(i) Trade Balance,

(ii) Current Account,

(iii) Capital Account, and

(iv) Account of Financing.

ADVERTISEMENTS:

(i) Trade Balance or Balance of Trade:

This account includes the imports and exports of visible items during a given year.

(ii) Current Account:

The current account includes trade balance, net non-monetary gold movements and the net of invisible exports and imports. The invisible exports and imports are concerned with net receipts or payments due to foreign travel, transportation, insurance, investments income, net government receipts and payments not included elsewhere and transfer payments both official and private.

(iii) Capital Account:

The capital account in Indian balance of payments account includes the net private non-banking short term and long term capital receipts or payments, net banking receipts or payments excluding those of R.B.I, and net miscellaneous government receipts or payments.

ADVERTISEMENTS:

(iv) Account of Financing:

The surplus or deficit on account of current account, capital account and errors or omissions is financed or bridged up through external assistance (loans), gross drawing from the IMF, allocation of SDRs and increase (-) or decline (+) in reserves.

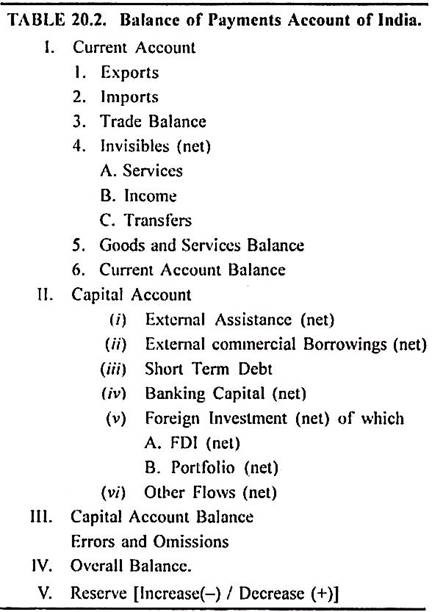

The different components of balance of payments account of India can be shown through Table 20.2.