Get the answer of: Can Banks Create Credit?

Commercial banks perform a number of functions in modern times.

These are as follows:

1. Commercial banks collect the savings of the community. These are provided as loans to the various sectors of the economy.

ADVERTISEMENTS:

2. Banks make loans and investment. Bank lend money to traders, industrialists and other persons for various purposes. Nowadays, consumption credit is also given. Banks invest money on shares and debentures of companies and on Government promissory notes.

3. Commercial banks, however, can give loans in excess of the money deposited with them. So, they can create money.

4. Commercial banks perform many other functions. For example, they keep valuables in safe custody; act as agents of their customers in the purchase and sale of shares, debentures, G.P. Notes, etc., and for the payment of insurance premiums, bills, etc., act as executors and trustees of wills; and exchange currencies of different countries for one another.

Three main functions performed by commercial banks are:

ADVERTISEMENTS:

(1) Safeguarding money,

(2) Transferring money, and

(3) Creating money.

However, in most countries the commercial banks are concerned mainly with making and receiving payments, receiving deposits and making short-term loans to private individuals, companies and other organisations.

ADVERTISEMENTS:

The banks increasingly provide a number of other policies to their customers: trustee and executor facilities, the supply of foreign exchange, the purchase and sale of securities, insurance, credit transfer, personal loan, and credit card facilities. The banks also over the years diversified into other financial houses and the merchant banks, e.g., venture or risk capital and the management of unit trusts.

A study of transactions taking place across a bank counter reveals an important fact: the value of money being deposited far exceeds the amount of cash (notes and coins) being withdrawn. Nowadays, cash transactions are a relatively small proportion of total transactions.

This is called ‘Liquidity Ratio. Suppose, the ratio is in the region of 10%. This means that for Rs.100 deposited, only Rs.10 is likely to be demanded in the form of cash. The rest will be transferred using cheques and credit cards and these transactions do not involve any ‘real’ money changing hands: they simply involve adjusting the balances held in savings and current accounts.

This liquidity ratio enables banks to be profitable, because it enables them to lend money to borrowers at a rate of interest. The lower the liquidity ratio, the greater the ability of banks to lend, and to increase the supply of money. It is sometimes said that every loan creates a deposit.

It is well-known fact that depositors do not withdraw the whole of their money at a time. If a bank has a total deposit of, say, Rs.1 crore, only about 10% of it will be withdrawn on a particular day. In the meantime other deposits will come.

Hence, the bank can provide for all withdrawals if it keeps about 10% of the total deposits in the form of cash. The remainder of the deposits will not be withdrawn and can be lent out to others. The percentage of deposits which a bank keeps in the form of cash to ensure safety is called the cash-reserve ratio or ‘liquidity ratio’.

Let us suppose that a bank, called the A Bank, receives a cash deposit of Rs. 1,000. Following the usual banking practice the A Bank will keep 10% of the money (i.e., Rs.100) in hand and lend out the remainder (Rs.900). The money lent out will in due course reach some other bank or banks. Let us suppose that the whole of it goes to Q Bank.

This bank will now keep 10% of Rs.900 (i.e., Rs.90) in hand and lend out the remainder (Rs.810). This money (Rs.810) will now be deposited in some other bank, which is, let us suppose, the C Bank will thereupon keep 10% of Rs.810 (i.e., Rs.81) in hand and lend out the remainder (Rs.729). The loans and deposits will go on until the final deposit becomes too small.

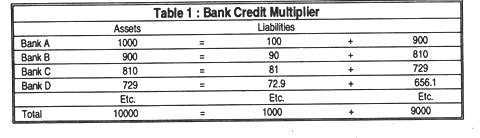

The process is illustrated in Table 1.

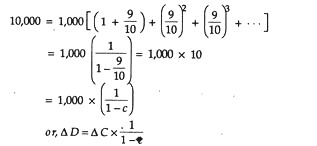

Total deposits (ΔD), in the banking system, arising out of the initial cash deposit (ΔC) of 1,000, amount to Rs.1, 000 + Rs.900 + Rs.810 + Rs.729 +………. up to Rs.0.

where 1/1 – c is bank credit multiplier (BCM). The formula for an infinite geometric progression is 1 + c + c2 +…….. cn = 1/1 – c as long as c < l. Hence, c stands for cash deposits. Here c + r = 1, where r is liquidity ratio. Or BCM =1/1 – c = 1/r. In other words, the relationship between the LR and the bank credit multiplier is reciprocal. So, if the LR is 10%, or 1/10, then BCM= 10.

This means that a deposit of Re.1 can create liabilities of Rs.10, of which Rs. 9 are loans, Re.1 is cash. The process of credit creation comes to a halt when the last increase in deposit is too small to generate a fresh loan.

ADVERTISEMENTS:

It will be found that the series of deposits shown above add up to Rs.10, 000 which is ten times the original deposit. The process described above takes place in the banking system as a whole. A particular bank in the system cannot, when it receives a cash deposit of say, Rs.1, 000 lend ten times this amount of Rs.10, 000.

It can only lend Rs.900 which is the part of the deposit that is expected to be left un-withdrawn by the customer. But in the banking system as a whole there will eventually arise deposits amounting to Rs.10, 000. Table 1 shows that which each individual bank lends less than the cash it receives, the bank system as a whole lends more than it has in cash.

An initial deposit of Rs.1, 000 has created liabilities of Rs.10, 000 of which Rs.1, 000 of liquid assets (cash and Rs.9, 000 of ‘promises to repay’ contracts to repay loans, which are less liquid). To quote P. A. Samuelson, “The banking system as a whole can do what each small bank cannot do; it can expand its loans and investments many times the new reserves of cash created for it, even though each small bank is lending out only a fraction of its deposits.”

It may be noted that most banks can reduce their liquidity ratios because they have other assets in reserve, such as government bonds, stocks and shares, and buildings, which could be ‘liquidated’ in an emergency.

Limits to the Process:

ADVERTISEMENTS:

Although the banks as a whole can cause a multiple expansion of credit, there are certain limitations on their power.

The following are some important limitations:

1. Cash Reserve Ratio:

Every bank must keep a certain amount of cash as reserve. The supply of cash or legal tender money is not unlimited. The government and the central bank determine the quantity of legal tender money available in the country.

The banks’ power of creating credit is limited by this quantity. So, to the extent that the central bank increases the legal reserve ratios of commercial banks, the power of the banking system to create money will be correspondingly reduced.

2. The Central Bank’s Monetary Policy:

ADVERTISEMENTS:

The central bank can also create difficulties and restrict their powers through its different methods of credit control, such as the bank rate policy, open market operations, variable reserve ratio, etc.

3. Monetary Habits of the People:

The monetary habits of the people constitute a limiting factor. If the people do not put money in deposit in the banks but keep their cash with themselves in a liquid form bank deposits cannot grow and banks cannot create money.

This occurs when the public s transactions demand for cash increases. In other words, the habits of the people regarding the holding of cash by them at hands (i.e., liquidity preference) also affect the credit creation. If the people desire to hold a large amount of cash balances at hands, the amount of credit creation will be naturally smaller.

4. Total Amount of Cash in the Country:

The power of the banks to create credit depends on the total amount of cash available in the country. Unless a large amount of cash is available for reserve, it would not be possible for them to create more money.

ADVERTISEMENTS:

5. Dearth of Adequate Number of Borrowers and of Proper Securities:

Banks create credit by lending. But, if the banks do not find a good number of borrowers, as usually found during depression, banks would not be able to create credit on a large scale. Similarly, if the borrowers cannot furnish proper securities for taking loans, the power of banks to create credit will be reduced. Again, when the banks do not find a sufficient number of securities for purchase (the second method of deposit creation), they would not be able to create more credit through the purchase of securities.

6. Leakages in the Process of Credit Creation:

Some leakages may appear in the chain of credit creation when some individuals who receive cheques do not deposit the proceeds in a bank but withdraw it for spending or for hoarding. In such cases a portion of deposits will go out of the banking system and hence the credit creation will be smaller.

7. Possible Excess Reserves by Banks:

The credit creation becomes smaller when a bank keeps an excess reserve above the legally required reserves (i.e., above 10% as per our illustration).

ADVERTISEMENTS:

Conclusion:

Samuelson remarks, there is nothing automatic about deposit creation, which depends on various factors like the banking habits of the people, the state of business and economic conditions of the country, cash reserve ratio, availability of securities and others.