The following points highlight the top two methods of creating credits through deposits. The methods are: 1. Primary or Passive Deposits 2. Derivative or Active Deposits.

Method # 1. Primary or Passive Deposits:

The banks create passive deposits when they open deposit accounts in the name of the customers who bring cash or cheques to be credited to their accounts.

From economists point of view such types of deposits are known as passive or primary deposits.

Out of these deposits the banks make loans and advances to their customers.

ADVERTISEMENTS:

But these primary or passive deposits out of these deposits the banks make loans and advances to their customers. But these primary or passive deposits do not make any net addition to the money which is in the vaults. In-fact these deposits merely convert currency money into deposit money.

Therefore, creation of these primary or passive deposits does not mean creation of money in the sense as written above. But these primary deposits provide funds out of which the bank makes loans and advances to the customers.

The bank knows by business experience that all these primary deposits are not going to be withdrawn by the depositors at the same time or one time. Only a small portion of these deposits may be withdrawn by the depositors at any one particular time, so the bank after keeping a small percentage of these deposits in cash, uses the balances for making loans and advances to the customers.

In this connection the normal norm of a commercial bank is that it keeps in reserve only 10% of its deposit to meet the demand of customers and invests 90% in giving loans and advances, it means it utilizes 90% in credit creation.

Method # 2. Derivative or Active Deposits:

ADVERTISEMENTS:

Derivative or active deposits are created by the bank by opening a deposit account in the name of the person concerned who contacts bank to borrow money. Then the bank plays an active role in the creation of such deposits. This type of dealings is known as an active deposits.

The above written facts can be explained in a better manner by the following example:

Suppose, the bank allows a loan of Rs. 1,00,000 to its customer against any collateral security. What the bank will do is that it will open an account in the name of the person who has been granted loan. The bank will credit Rs. 1, 00,000 in it. The bank will not pay Rs. 1,00,000 in cash to the borrower.

The borrower may either withdraw from his account the entire amount immediately or he may withdraw small amount of money time to time according to his need and to his requirements and the balance amounts are granted as loans to other persons who require it. Here, it shall be noted that by making a loan, the bank has, at the same time has created a new deposit in its book.

ADVERTISEMENTS:

This type of dealings has been called by an economists as—”Every loan creates a deposit or loans are the children of deposits and deposits are the children of loans.” This deposit is also called an active deposit because it has been created actively by the bank. Some economists called it “derivative deposit” because it has been derived directly from the loan transaction of the bank.

Further, the active deposits are also created by the bank when it purchases securities or other forms of assets from the public. For example—When the bank buys government securities or debentures of private firms, it makes the payment to the sellers of these assets by opening a deposit account in their names.

The bank may also create deposits when it purchases bills of exchange by opening a deposit account in the name of the seller. The proceeds of the exchange bills are credited or transferred to the account of the seller.

This process of credit expansion can be shown as under:

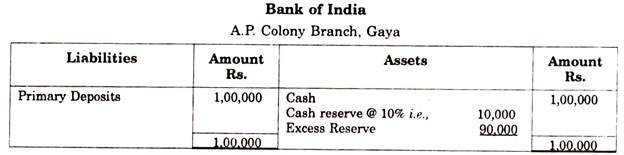

Suppose that the maximum cash reserve ratio is maintained by the commercial banks is 10% and a person deposits Rs. 1,00,000 in the Bank of India, A.R Colony Branch.

The balance sheet of the bank will show as follows:

As the bank is maintaining 10% of the cash reserve as minimum balance, therefore the bank will keep Rs. 10,000 as cash reserve requirement and will create derivative deposit to the extent of Rs. 90,000 because this figure represents the excess reserves with the bank. This excess reserve fund which is with the bank may be used as giving loans and advances to its customers.

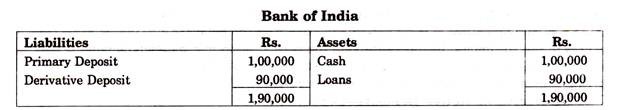

Then the balance sheet will appear as under:

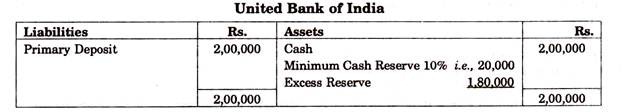

Next, suppose, the borrower Mr. Rahul Kumar in the repayment of some business outstanding gives the cheque of Rs. 2,00,000 to Mr. Shanker Lai who has a deposit account in the United Bank of India. The United Bank receives Rs. 2,00,000 as primary deposit. This will increase the liability of the United Bank by Rs. 2,00,000.

The Balance Sheet of the United Bank will be as under:

By seeing the above Balance Sheet, it is clear that the deposit liabilities of the bank have increased by Rs. 2,00,000. There is also an equivalent increase in the cash reserve of Rs. 2,00,000. After keeping the Reserve of 10% cash, the bank balance now will be Rs, 1,80,000. Now, the bank is in a position to expand its lending activity to the extent of its excess reserves of Rs. 1,80,000.

ADVERTISEMENTS:

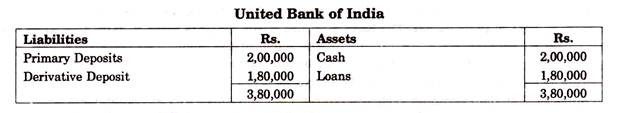

If the bank expands its loans and advances to Rs. 1,80,000, new Balance Sheet will be as under: