Let us make an in-depth study of the Explanation of Business Cycles. After reading this article you will learn about: 1. The New Classical Explanation of Business Cycles 2. New Keynesian Explanation of Business Cycles.

The New Classical Explanation of Business Cycles:

Real business cycle models suggest that booms and slumps are equilibrium responses to the constraints faced by the optimising agents.

The new classical macroeconomics argues that business cycles occur essentially in a typical market clearing framework in response to real shocks, which include, inter alia, technology shocks and fiscal shock.

Moreover the new classical macroeconomics argues that anticipated monetary shock has no real effect on real variables. We also note that wages and prices are perfectly flexible, which ensure two classical results, viz., automatic full employment and long-term neutrality of money.

ADVERTISEMENTS:

Although most macroeconomists agree that monetary policy can affect unemployment and output, at least in the short run, the new classical economics, developed by Robert Lucas, Thomas Sargent and Robert Barro emphasises the role of flexible wages and prices, but it adds a new feature, called rational expectations, to explain short-term economic fluctuations or the emergence of business cycles.

New classical macroeconomic holds that (i) prices and wages are flexible and (ii) people use all available imformation in making decisions and form their expectations on the basis of it. Under the assumption, the government cannot ‘fool’ the people, because people are well-informed and have access to the same information as the government.

According to rational expectations, forecasts are unbiased and are based on all available information. This means that people make unbiased forecast. The key assumption in new classical macroeconomics is that because of rational expectations the government cannot deceive the people with systematic economic policies.

Assumptions:

ADVERTISEMENTS:

Rational expectations theory is based on three assumptions : (i) Individuals and business firms learn through experience to anticipate the consequences of changes in monetary and fiscal policies, (ii) They act instantaneously to protect their economic interests, (iii) All resource and product markets are purely competitive. This means that all markets clear automatically even in the absence of government intervention.

We may now turn to the implications of rational expectations in the context of business cycles. Here we present the new classical macroeconomic model developed by Robert Lucas and Thomas Sargent.

The Lucas-Sargent Market Clearing Model:

In this model all wages and prices are completely flexible with respect to expected changes in the general price level; that is, a rise in the expected price level results in an immediate and equal rise in wages and prices because workers try to keep their real wages from falling when they expect the price level to rise.

This view of how wages and prices are set indicates that a rise in the expected price level causes an immediate leftward shift in the aggregate supply (AS) curve, which leaves real wages unchanged and aggregate output at the natural rate (full-employment) level if expectations are realised.

ADVERTISEMENTS:

The model then suggests that anticipated policy has no effect on aggregate output and employment; only unanticipated policy has an effect.

The Effect of Unanticipated Monetary Shock:

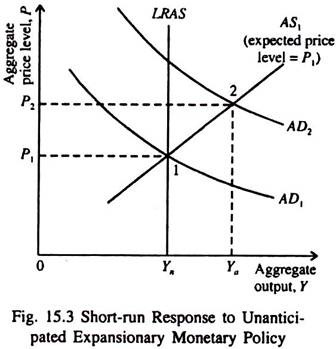

Let us now look at the short-run response to an unanticipated policy such as unexpected increase in the money supply. In Fig. 15.3 the AS curve is drawn for an expected price level P1. The initial aggregate demand curve AD1 intersects aggregate supply curve AS1 at point 1, where the realised price level is at the expected price level P1 and aggregate output is at the natural rate level Yn.

Since point 1 is also on the LRAS curve at the output level Yn, there is no tendency for the AS curve to shift. The economy remains in long-run equilibrium.

Now suppose the central bank feels that the unemployment rate is too high and so makes a large bond purchase that is unexpected by the public. The money supply increases and the AD curve shifts rightward to AD2. Since this shift is unexpected, the expected price level remains at P1 and the AS curve remains at AS1.

Equilibrium is now at point 2, the intersection of AD2 and AS1. Aggregate output increases above the natural rate level to Ya and the realised price level increases to P2. Thus in case of an unanticipated policy change money does not have a neutral effect on the economy.

Instead income fluctuation occurs due to monetary policy change. We may now examine the effect of an anticipated monetary shock in a market clearing rational expectations framework.

The Effect of an Anticipated Monetary Shock:

Lucas believes that people can anticipate government policies to fight inflation and recession, given their knowledge of policy, past experience and expectations about the future. Consequently they act on this anticipation, effectively nullifying the intended effects of those policies. What, then, should the government do? It should follow strict guidelines rather than try to use discretionary policy to stabilise the economy.

Let us imagine that the central bank decides to increase the rate of growth of the money supply in order to stimulate output and raise employment. According to rational expectations theory if the public expects that the central bank will make open market operations in order to lower unemployment because they have seen it done in the past, the expansionary policy will be anticipated.

ADVERTISEMENTS:

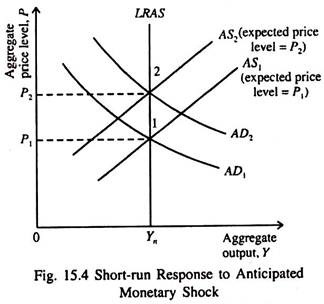

The outcome of such an anticipated monetary shock is illustrated in Fig. 15.4.

Since expectations are rational, workers and firms recognise that an expansionary policy will shifts the AD curve to the right from AD1 to AD2 and will expect the aggregate price level to rise to P2. Workers will demand higher wages so that their real earnings remain the same when the price level rises. So no extra labour is supplied and no extra output is produced.

The AS curve then shifts leftward to AS2 and intersects AD2 at point 2, an equilibrium point where aggregate output is at the natural rate level Yn and the price level has risen to P2.

ADVERTISEMENTS:

The rational expectations framework demonstrates that aggregate output does not increase as a result of anticipated expansionary policy and that the economy immediately moves to a point of long-run equilibrium (point 2) where aggregate output is at the natural rate level. This proves the classical neutrality of money, i.e., money has a neutral effect on real variables such as aggregate output and employment.

Decline in Aggregate Output due to Expansionary Monetary Policy:

An important feature of the rational expectations hypothesis is that an expansionary policy such as an increase in the rate of money growth can lead to decline in aggregate output if the public expects an even more expansionary policy than the one actually implemented.

There will be a surprise in the policy, but it will be negative and drive output down. Policy makers cannot be sure if their policies will work in the intended direction.

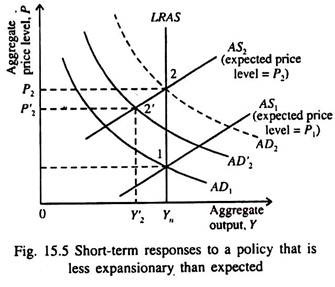

To see how an expansionary policy can lead to a decline in aggregate output we look at Fig. 15.5. Initially the economy is at point 1, the intersection of AD1 and AS1; output is Yn and the price level is P1. Now suppose the public expects the central bank to increase the money supply in order to shift the aggregate demand curve to AD2.

ADVERTISEMENTS:

As we saw in Fig. 15.3, the aggregate supply curve now shifts leftward to AS2 because the price level is expected to rise to P2.

Suppose that the expansionary policy of the central bank actually falls short of what was expected so that the aggregate demand curve shifts only to AD’2.The economy will move to point 2′, the intersection of the aggregate supply curve AS2 and the aggregate demand curve AD’2.

The result of the mistaken expectation is that output falls to Y’2, while the price level rises to P’2, rather than P2. An expansionary policy that is less expansionary than anticipated leads to an output movement directly opposite to that intended.

Implications for Policymakers:

The market clearing rational expectations framework implies that discretionary stabilisation policy cannot be effective and might have undesirable effects on the economy. The reason is that policy-makers cannot know the outcome of their decisions without knowing the public’s expectations regarding them.

Policymakers’ attempts to use discretionary policy might lead to unpredictable policy surprises, which, in turn, cause undesirable fluctuations around the natural rate level of aggregate output. To eliminate these undesirable fluctuations, the central bank and other policymaking agencies should abandon discretionary policy and generate as few policy surprises as possible.

ADVERTISEMENTS:

In short, in the market clearing rational expectations framework when any policy is anticipated, aggregate output remains at the natural rate level. Yet the rational expectations model allows aggregate output to fluctuate away from the natural rate level as a result of unanticipated movements in the aggregate demand curve. The prediction that follows from the rational expectations model is a striking one.

The Policy Ineffectiveness Theorem:

Anticipated policy has no effect on the business cycle only unanticipated policy matters.

This conclusion is called the policy ineffectiveness proposition because it implies that one anticipated policy is just like any other; it has no effect on output fluctuations. However, this proposition does not rule out output effects from policy changes. If the policy is a surprise (unanticipated) it will have an effect on output.

New Keynesian Explanation of Business Cycles:

The new classical macroeconomics offers a strong criticism of orthodox Keynesian macroeconomics on the ground that Keynesian macroeconomic models are primarily ad hoc in the sense that they are not based on economic agents’ optimisation programme. In other words, the orthodox Keynesian economics does not have explicit micro-foundation.

Moreover, rigidity in nominal variables including wage and price is merely assumed without any rigorous analytical foundation. This is precisely the challenge that new Keynesian macroeconomists responded to by offering specific micro-details of incomplete nominal adjustment.

The new Keynesian theories offer different explanation for wage-price stickiness. These theories include, among others, efficiency wage theory, small menu cost and aggregate demand externality and staggered price adjustment.

ADVERTISEMENTS:

Most Keynesians do not accept the RBCT. They believe that short-run fluctuations in output and employment represent deviations from the economy’s natural rate of unemployment — the rate which is consistent with absolute price level stability. Deviations from the natural rate occur due to the fact that wages and prices are slow to adjust to changing macroeconomic environment.

This inflexibility (stickiness) makes the short-run AS curve upward sloping rather than vertical. Consequently the economy experiences short-run output and employment fluctuations.

In Keynesian models unemployment is caused by due to rigidity of money wage caused by fixed-wage labour contracts and workers’ backward-looking price expectations. When aggregate commodity demand falls, the demand for labour also falls. But due to money wage rigidity it is not possible to maintain the initial employment level in the short run.

New Keynesians like N. G. Mankiw and David Romer have suggested additional explanations of involuntary unemployment and, in the process, attempted to improve the microeconomic foundations of the Keynesian systems. According to them wage and price rigidities arise mainly from the behaviour of optimising agents.

There are three causes of rigidities of price and wage:

1. Product market imperfection, i.e., the existence of monopolistic competition and oligopoly;

ADVERTISEMENTS:

2. Product price rigidity; and

3. Real rigidities — factors that make the real wage or firm’s relative price rigid in the face of changes in aggregate demand.

On the basis of these assumptions, three types of new Keynesian models have been developed, viz., (i) sticky price (menu cost) models, (ii) efficiency wage models and (iii) insider-outsider models.

These models may now be discussed one by one:

(i) Sticky Price (Menu Cost) Models:

There is a puzzling aspect of business cycle theories based on the assumption that wages are slow to adjust. Unemployment is a very serious problem because it creates large social costs. Changing a wage or a price is a relatively simple and apparently cheap matter.

The payroll has to be reorganised, or new price tag has to be put on. The puzzle is why these apparently small costs obstruct price adjustment so as to solve the unemployment problem.

ADVERTISEMENTS:

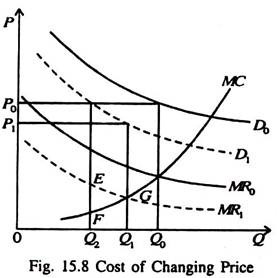

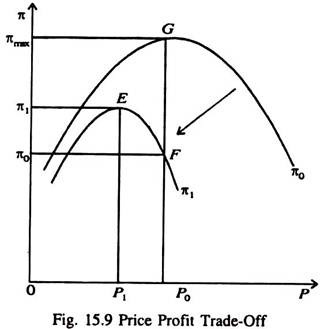

Small cost of changing prices can have large effect. When firms set prices optimally, they lose very little by meeting increases or decreases in demand by producing more or less without changing prices. Then if there is some small costs for the firm of changing its prices or wages, a small shift in demand will not trigger a price or wage change.

But if firms do not change prices in response to shifts in demand, then the economy exhibits price and/or wage rigidity. In fact, extremely small costs of changing prices can generate enough wage and price stickiness to give changes in the money stock substantial real effects.

Keynesian economists assumed money wage rigidity to explain unemployment. The product market was assumed to be perfectly competitive. So output and employment would adjust to changes in aggregate demand.

The new Keynesian sticky price model is based on the assumption that firms are imperfect competitors. So they face downward sloping demand curves for the products. Yet firms do not reduce prices when demand falls due to the existence of menu costs. Such costs refer to any type of cost that a firm is required to incur if it changes the prices of its products.

There are various costs of changing prices which may be explicit (such as the cost of printing new prices and bringing the information to the notice of the customers through advertising) or implicit such potential loss of customer goodwill or even initiation of a destractive price war in a recession (when all firms struggle to survive by cutting prices).

Consequently, output and employment fall when there is a fall in demand; the costs of changing prices prevent price adjustments.

Two reasons:

According to N. G. Mankiw, prices are sticky for two different but interrelated, reasons: (i) menu costs and (ii) aggregate demand externality.

(i) Menu costs:

Menu costs are costs of price adjustment. New, prices (menus) are to be printed in catalogues and announced through trade journals, magazines, and television programmes, and so on. Because of menu costs firms adjust prices at periodic intervals, rather than every now and then. Due to discrete rather than continuous prices, price adjustment fails to occur instantaneously — as Leon Walras had postulated in his general equilibrium analysis.

Whether menu costs can explain the short-run price stickiness is debatable. Critics of menu costs point out that since such costs are very small, they cannot explain such big events as economy-wise recessions. Supporters of menu cost argue that ‘smallness’ does not mean ‘inconsequential’. Such costs may be small for the individual firm, but they can have widespread ramifications, or large effects on the whole economy.

(ii) Aggregate demand externality:

According to the supporters of the menu-cost hypothesis prices adjust slowly because there are externalities to price adjustment: price cut by a single firm is beneficial to various other firms in the economy. The lowering of price by a firm implies marginally lowering the average price level.

A fall in the price level increases what Don Patinkin calls real money balances. This, by shifting the LM curve to the right, increases GDP.

As the economy gradually moves into the expansionary phase of the business cycle the demand for the products of all firms increases automatically. This is known as aggregate-demand externality, i.e., the macroeconomic effect of one firm’s price adjustment on the demand for all other firms’ products.

In the presence of this aggregate-demand externality, small menu costs can make prices sticky, which, in its turn, can impose huge costs on society. When a firm plans to cut its present price (which is considered to be high), it takes into consideration both the cost and benefit of price adjustment (such as higher sales and profits).

Yet due to the aggregate-demand externality, the benefit to society of the price cut would exceed that of the firm.

An individual firm ignores this externality when making its own pricing decisions. This is why it may decide not to bear the menu costs and cut its price even though price cut is beneficial from the society’s point of view. Thus, sticky prices may be optimal for those firms which set prices, even though they are not desirable from the point of view of the economy as a whole.

Recessions as Coordination Failure:

An important prediction of the new Keynesian economists is that recessions are the result of coordination failure. In a period of low economic activity output is low, workers are unemployed, and factories remain idle. For instance, output and employment were much higher and everyone was better-off in the 1920s compared to those in the 1930s. This was due to better allocation of resources.

If society as a whole fails to reach an economically feasible and universally desirable outcome, then its cause is not low demand or high prices, but lack of coordination of strategic activities such as wage fixation and price setting. Resources will be inefficiently allocated and recessions will occur (i.e., society will move inside the PPC) if some members of society fail to coordinate in some way.

Coordination problems arise due to lack of Synchronised behaviour on the part of economic agents. To be made specific, those who set wages and prices often fail to anticipate similar actions on the part of others. Coordination problem can be avoided to some extent through proper anticipation of the actions of rival firms.

For instance trade, union leaders negotiating wages are concerned about the wage increases other unions will be able to achieve. Firms setting pricing have to keep a close watch on the prices other firms will charge.

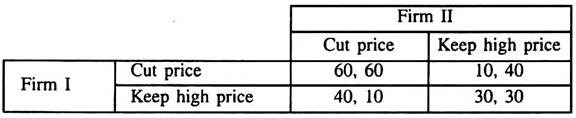

If we make a few assumptions we can show that recession is the outcome of coordination failure. Suppose there are two firms. Now money supply falls. Each firm has to decide whether or not to cut the price. Each firm is a profit-maximiser. But its profit depends not only on its own pricing decisions but also on the decisions of its rivals. The pay-off matrix of the two firms is presented in Table 15.1.

Table. 15.1 The Pay off Matrix of Two Firms

This an example of multiple equilibria. If both firms choose to maintain previous high price, then both will end up making low profit (30, 30). But each firm would hesitate to cut price as none is sure of the action that will be taken by its only rival. If a firm’s rival prefers to stick to the original price then the firm cutting price will earn even lower profit (10). Hence recessions occur because of coordination failure.

Prices can be sticky because people expect them to be so. Yet stickiness is against every firm’s best interest.

In the real world it is often difficult to achieve coordination since the number of firms setting prices is large. Prices can be sticky simply because people expect them to be sticky, even though stickiness is in the interest of nobody.

This statement may apparently appear to be subversive even though it contains an element of truth. In short, coordination failure occurs because the price (market) system often fails to serve as a communication device.

(ii) Staggered Price and Wage Adjustment:

Adjustment of wages and prices, throughout the economy is staggered, i.e., not everyone in the economy sets new wages and prices simultaneously. Staggering makes overall wages and price level adjust slowly, even when individual wages and prices change frequently.

Suppose first that price setting is synchronised. Every firm adjusts its prices on the first day of every month. Now suppose on the tenth day of the month money supply rises and thus aggregate demand. Till the tenth day of that month to the first day of the next month prices remain unchanged.

Therefore output rises in response to rise in demand. On the first day of the next month all the firms will end up raising prices in response to the rise in demand — resulting in a boom.

Now assume price setting is staggered. Half of the firms set their prices on the 1st of each month and the rest on the 15th. If the money supply rises on the 10th day of the month, then half of the firms can raise prices on the 15th. However, these firms will probably not raise price — fearing that the prices changed by other firms will reduce demand for their products.

Now, the firms who are scheduled to change their prices on the 1st of the next month will not change their prices (only a few a might) fearing that a change in relative price will reduce the demand for their product. Hence the aggregate price level will change slowly. Thus, staggering makes prices stidky.

Staggering also affects wage determination. Suppose there has been a fall in money supply. Hence, aggregate demand falls. To maintain full employment, nominal wage must fall to full extent (equi-proportionate). Each worker can take a cut in his nominal wage if all other wages fall equi-proportionately.

However, he will be reluctant to be the first one to accept a price cut as that will reduce his relative wage. Since setting of wage is staggered, this reluctance makes wages sluggish.

In a decentralised economy every wages and salaries are not synchronised. A firm which thought that a relative wage increase was appropriate for its workers would not know what other wages were. Hence it could not achieve that relative increase.

Staggered wage-setting provides information to firms and workers about wages and prices elsewhere. Non-synchronised wage and price setting thus seems desirable in a decentralised economy.

Moreover, staggered wage-setting adds some stability to wages. Without staggering, all wages and prices would go up in each period. There would be no base for setting each wage. Tremendous variability would be introduced in the price system. In such an unstable environment economic agents will not be able to take correct decisions.

In short, workers normally have wage adjustments infrequently, about once per year, or even more than one year. These adjustments are staggered over time. Since the wage is rarely changed within the year, the wage setting process creates wage stickiness.

Wages are set for long period because collective bargaining, threats of strikes or careful reviews of worker performance make adjusting the wage costly.

Since all unions and firms do not set new wages and prices at the same time, we find staggering of wage and price adjustment in the economy. Due to lack of synchronisation of the activities of different unions and firms staggering occurs, i.e., individual wages and prices change frequently even though the overall level of wages and prices adjust slowly and gradually (or show sluggishness).

The reason for this is that every firm prefers to wait and watch the actions of others. No firm wishes to take the lead, i.e., to be the first to announce a substantial price increase.

There is staggering in the labour market, too. This affects wage determination. If, for instance, the money supply falls aggregate demand will fall. This, in its turn, requires a proportionate fall in nominal wages to ensure full employment.

If all wage rates fall proportionately, each-worker would willingly accept a lower nominal wage. But each worker is reluctant 40 be the first to accept a wage cut because this means a temporary fall in his real wage.

Since the setting of wages is staggered, the reluctance of each worker to reduce his wage first makes the overall level of wages slow to respond to changes in AD. Alternatively stated, the staggered setting of individual wages makes the overall level of wages sticky.

Recent developments in the theory of short-run economic fluctuations make one thing clear at least — economic fluctuations are beyond the comprehensive power of most economists till date. Two main questions remain unanswered: (i) Are business cycles caused by the stickiness of wages and prices? (ii) Does money matter, or does monetary policy affect real variables?

The answers to these questions will determine the role of economic policy. The new Keynesian theories, based on the belief that wages and prices are sticky, suggest that monetary and fiscal policies should be used to stabilise the economy.

Since price rigidity is a form of market imperfection, it is the task of the government of a country to affect the economic well-being of the society as a whole by making an optimal correction of market failure.

By contrast the RBCT suggests that the government can exert very little, if any, influence on the economy and even if it could stabilise the economy, it should not attempt to do so. The upswings and downswings of the economy are the natural responses of the economy to changing technological possibilities.

Since this theory does not make any reference to market imperfection, the ‘invisible hand’ of the market is relied upon to ensure an optimal allocation of resources.

In short, while RBCT shows an undue reliance on intertemporal optimisation and forward- looking behaviour, the new Keynesian theory stresses the importance of sticky prices and other market imperfections.

(iii) Hysterisis, Recession and Natural Rate of Unemployment:

Fluctuations in AD affect output and employment only in the short run. In the long run, economy returns to the level of output, employment and unemployment described by the classical model.

This hypothesis has been a challenge, demanding that through a number of mechanisms, recessions might leave permanent scars on the economy by altering the natural rate of unemployment.

Hysterisis describes the long-lasting influence of history on natural rate of output and employment. Recession might have the permanent effect in the following ways.

A person who has lost job during recession may lose his skill during the period of unemployment. Hence, when the recession ends it might be difficult for him to find a new job easily and quickly.

A long period of unemployment might reduce a individual’s desire to find a job. So he falls in the category of discouraged worker, who has given up any job-finding activity.

Those who lose jobs, may also lose their influence on the wage-setting process. Unemployed workers may lose their status as union members, i.e., some insiders become outsiders in the wage-setting process. If the smaller group of insiders cares more about high real wage and less about employment, then the recession may permanently push real wages above equilibrium level and raise the magnitude of wait unemployment. Hysterisis suggests that recessions are more costly than the natural-rate hypothesis would suggest.

(iv) Efficiency Wages and Involuntary Unemployment:

Efficiency wage models suggest that the productivity of labour depends directly on the real wage paid to workers. The real wage is set to maximise the efficiency units of labour per rupee of expenditure, not just to clear the labour market.

Efficiency wage theory argues that wages are not cut because doing so reduces a firm’s profits. However, efficiency wage theory permits real wage rigidity and involuntary unemployment. These points may now be discussed.

Let us define an index of worker efficiency, or productivity (e) such that

e = f(w/P)…(9)

Workers’ efficiency varies directly with real wage. So the aggregate production function is

Y = F[K, eL] …(10)

Output (Y) depends both on the amount of capital (K) and on the amount of labour input, measured in efficiency units. The number of efficiency units of labour equals the number of physical units (L), measured in man-hours per period, for example, multiplied by the index of efficiency (e). Output increases either when more units of labour are hired (L increases) or when the efficiency of the existing labour force improves (e increases if w/P is raised).

In terms of the aggregate production function (10) the goal of the firm is to set the real wage so that the cost of an efficiency unit of labour is minimised, or to maximise the number of efficiency units of labour bought with each rupee of the wage bill.

This goal is achieved by increasing the real wage to the point where the elasticity of the efficiency index [f(w/ P)] with respect to (w/P) is 1. The condition that determines the optimal level of the real wage, called the efficiency wage (w/P)*, is

Many firms deliberately set real wage above the market-clearing level on efficiency grounds and in the process create involuntary unemployment.

The Rationale of Efficient Wage Theory:

Three reasons for the payment of efficiency wage are:

1. The shirking model:

By setting the real wage above the prevailing market level (i.e., a worker’s true opportunity cost), a firm gives a worker an incentive not to cheat, i.e., work less or deliberately work slowly. If he does so he runs the risk of being fired and he knows that it would be difficult to get another job at this wage.

If firms can monitor job performance to some extent and incur some cost in doing it, such a high-wage strategy may pay good dividends in terms of efficiency gain (higher labour productivity or lower labour cost) and higher profitability.

2. Turnover cost model:

By paying a wage which is higher than the prevailing one, firms can reduce quit rate and save turnover costs (i.e., cost of selection, recruitment, and training). The high wage also allows firms to achieve another objective, viz., human resource development, i.e., development of a more experienced, and, therefore, more productive, work force,

3. Gift exchange model:

Wages higher than the customary level boost the morale of firms’ workers and induce them to put forth more effort. Since employers voluntarily pay above market wage to workers (which is a form of gift) they reciprocate by imposing discipline on themselves, i.e., putting extra effort and, in the process, gaining efficiency.

However, if efficiency wage rates (i.e., real wage rates above the market-clearing levels) are set in a large number of sectors, substantial involuntary unemployment may result. If labour productivity increases, less workers will be required in each firm and the demand for labour will fall short of supply.

Workers will continue to seek high-paying jobs and prefer to remain unemployed when demand for labour is low rather than accept any low-paying jobs that may come along the line.

In efficiency models the real wage is fixed on efficiency grounds to meet condition (3). Such models can explain involuntary unemployment caused by real rigidity.

However, rigidity of real wage is not enough to explain such unemployment, which is also caused by menu costs. If prices are inflexible downward due to menu costs, then firms will have to keep money wage fixed in order to keep the real wage at the efficiency level.

If, in such a situation, aggregate demand falls, involuntary unemployment is bound to result due to a fall in output. Thus the real wage rigidity as also nominal rigidity and the menu costs together explain involuntary unemployment.

4. Insider-outsider model:

The term ‘hysteresis’, as noted earlier, is used to refer to the property that, when a variable is shocked away from an initial value, it shows no tendency to return even when the shock is over.

An interesting explanation for hysteresis in the unemployment process is the insider- outsider model. This model, like the sticky price models, is based on the assumption of imperfect competition.

According to this model, insiders (e.g., workers in unionised firms or industries) are the only group that affects the real wage bargain. Outsiders (e.g., the unemployed) seek jobs but cannot bargain for higher real wage. They cannot exert downward pressure on real wages because they are irrelevant to the wage-bargaining process.

In fact, the insiders are assumed to use their bargaining power to push the real wage above the market-clearing level, resulting in an unemployed group of outsiders. During recessions when workers are laid off insiders become outsiders.

So a sort of unemployment trap occurs. Once the recession is over and most workers go back to work, there are fewer insiders, the real wage rises and unemployment persists. The model explains the persistence of high unemployment due to fixed money wage contracts or backward-looking price expectations.

In fact, the real source of wage rigidity is captured by the efficiency wage theory. The theory explains real rigidities by stressing that firms pay wages above the market-clearing levels for reducing shirking on the jobs and minimising costs of production.

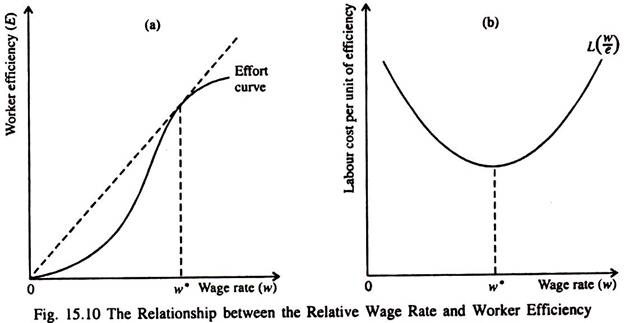

As Fig. 15.10(a) shows worker efficiency increases faster than the real wage up to point w* and more slowly thereafter. Consequently labour cost per unit of efficiency reaches its maximum at w* in Fig. 15.10(b). The value of w* is called the efficiency wage. So firms have no incentive to cut wages since this would actually increase their wage bill per unit of output.

The efficiency wage model explains why firms resist cutting their wages in response to a decline in demand. Recessions occur due to low demand and high price, caused by sticky prices of materials and sticky wages.

The Real Sources of Business Cycles:

The failure of MC to fall instantly and fully in response to nominal demand reflects a coordination failure. MC would drop if all workers and firms cut wages and prices together by the same percentage as nominal demand. But each is afraid to act first, since it would lose out if other workers and firms fail to act also.

Long-term labour contracts are an important source of sticky MC faced by business firms. Like monopolistic firms, firms and workers that are entering into long-term contracts impose a cost on society.

Wages negotiated under labour contracts are not completely rigid or fixed. Rather the change occurs when new contracts are signed.

However, all contracts do not expire at the same time. So in reality we find overlapping staggered contracts. With such contracts, wages adjust slowly and with a long lag, making marginal costs sticky for many firms. Much of the economy’s adjustment to shifts in AD takes the form of business cycles in output and employment.

Policy Implications:

New Keynesian economics suggests — in contrast to some new classical theories — that recessions do not represent the efficient functioning of markets. The elements of new Keynesian economics, such as menu costs, staggered prices, coordination failures, and efficiency wages, represent substantial departures from the assumptions of classical economics, which provide the intellectual basis for economists’ usual justification of laissezfaire. In new Keynesian theories recessions are caused by some economy-wide market failure.

Thus, new Keynesian economics provides a rationale for government intervention in the economy, such as countercyclical monetary or fiscal policy. In other words the visible hand of the government has to supplement the invisible hand of the market to stimulate and stabilise the economy.

Just as the central bank is the lender of the last resort the government is the employer of the last resort. Thus the government has to spend more, even by money creation, to increase total desired expenditure. This will have job-creating and income-creating effect.