The following points highlight the five main phases of business cycle.

The phases are: 1. Depression 2. Recovery or Revival 3. Prosperity or Full Employment 4. Boom or Overfull Employment 5. Recession.

Business Cycle Phase # 1. Depression:

This constitutes the first stage of a business cycle. It is a protracted period in which business activity in the country is far below the normal.

It is characterised by a sharp reduction of production, mass unemployment, low employment, falling prices, falling profits, low wages, contraction of credit, a high rate of business failures and an atmosphere of all-round permission and despair.

ADVERTISEMENTS:

A decline in output or production is accompanied by a reduction in the volume of employment. All construction activities come to a more or less complete stand still during a depression.

The consumer goods industries such as food clothing etc., are not so much affected by unemployment as the basic capital goods industries. The prices of manufactured goods fall to low levels. Since the costs are “sticky” and do not fall as rapidly as prices, the manufacturers suffer huge financial losses. Many of these firms have to close down on account of accumulated losses.

The fall in prices distorts the relative price structure. The prices of agricultural commodities and raw materials fall to greater extent than the prices of finished manufactured goods. The agriculturists are hit more than the manufacturing classes.

For example:

ADVERTISEMENTS:

The two longest depressions are U. S. depression of 1873—1879 (65 months) and 1929-1935 (44 months).

Business Cycle Phase # 2. Recovery or Revival:

It implies increase in business activity after the lowest point of the depression has been reached. During this phase, there is slight improvement in economic activity to start with. The entrepreneurs begin to feel that the economic situation was not so bad as it was in the preceding stage. This leads to further improvement in business activity.

The industrial production picks up slowly and gradually. The volume of employment has steadily increases. There is a slow but sure rise in prices accompanied by a small rise in profits. The wages also rise, though they do not rise in the same proportion in which the prices rise.

Attracted by rising profits new investments take place in capital goods industries. The Banks expand credit. The business inventories also start rising slowly. The possimism and despair of the preceding period is replaced by an atmosphere of all-round cautious hope.

ADVERTISEMENTS:

The recovery continues until business activity reaches approximately the same level that it had achieved before the decline set in. The rate of recovery, it has been found is generally related directly to that of the preceding depression. The recovery could be initiated by new innovations government expenditure, changes in production techniques, investment in new regions, exploitation of new sources of energy etc.

Business Cycle Phase # 3. Prosperity or Full Employment:

This stage is characterised by increased production, high capital investment in basic industries, expansion of bank credit, high prices, high profits, a high rate of formation of new business enterprises and full employment. There is a general enterprises and full employment. There is a general feeling of optimism among businessmen and industrialists.

For example:

The longest sustained period of prosperity occurred in the U.S.A. between 1923 and 1929 with some minor interruptions in 1924.

Business Cycle Phase # 4. Boom or Over-All Employment:

It is the stage of rapid expansion in business activity to new high marks resulting in high stocks and commodity prices, high profits and over full employment. The prosperity phase of the business cycle does not end up with a stable state of full employment; it leads to the emergence of boom.

The continuance of investment even after the stage of full employment results in a sharp inflationary rise of prices. This causes undue optimism among businessmen and industrialists who made additional investments in the various branches of the economy.

This puts additional pressure on the factors of production which are already fully employed, causing a sharp rise in their prices. Soon a situation develops in which the number of jobs exceeds the number of workers available in the market. Such a situation is known as overfull employment.

Profits touch a new height, attracted by the rising profits, the businessmen and industrialists further increase their capital investments. Prices rise sky high. There is an atmosphere of over-optimism all round. The cost calculations of the businessmen and the industrialists are completely upset. Some new hastily set up firms collapse. A boom as it is said is inevitably followed by a bust.

Business Cycle Phase # 5. Recession:

It should be remembered that recession brings cumulative effect in the market. Once a recession starts it goes on gathering momentum and finally assumes the shape of depression. In this period the feeling of over optimism of the earlier period is replaced now by over pessimism characterised by fear and hesitation on the part of the businessmen.

ADVERTISEMENTS:

The failure of some businesses creates panic among businessmen. The banks also got panicky and begin to withdraw loans from business enterprises. More business enterprises fail. Prices collapse and confidence is rudely shaken.

Building construction slows down and unemployment appears in basic capital expenditures. Unemployment leads to fall in income, expenditure, prices and profits. For example—In 1957-58 the recession in U.S.A. was a severe one.

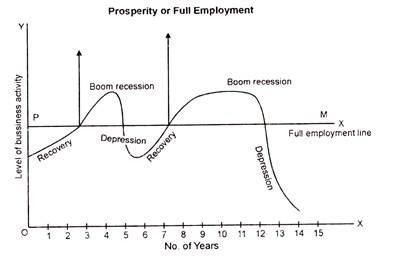

The various phases of the business cycle can be illustrated by the alongside diagram:

ADVERTISEMENTS:

In this diagram, PM is the full employment line. Above this line we have two stages of business cycle—a boom is the upswing and a recession is the down swing. Below this line, again we have two stages of the business cycle-recovery in the up-swing and depression in the down swing.

The business cycle as shown in the diagram passes through five stages. It starts with depression to be followed by recovery, prosperity, boom, recession and ultimately ends up again with depression.

These are the five phases or stage of a typical business cycle. It does not however, imply that every business cycle passes through these five stages in the same order. It is possible that the recovery stage may be followed by the recession stage without the business cycle entering into the prosperity and boom stages, as it actually happened in the U.S.A. in 1937.

Similarly, we cannot say anything definite about the ‘duration’ or ‘length’ of the various stages of the business cycle. It is possible that the depression phase is a prolonged one to be followed by quick recovery.

ADVERTISEMENTS:

It is also possible that the depression is a short-one but is followed by prolonged recovery. The ‘Through’ is the lowest point of business activity or the lowest point of the business cycle. Coming after a period of depression and before the period of recovery the ‘Trough’ is usually of a short interval lasting only a mouth or two.