Let us make in-depth study of the concept of corporate governance and social responsibility of business.

The Concept of Corporate Governance:

In the corporate governance we deal with the problem of producing best results for its shareholders by the corporate enterprise, while at the same time promoting the interests of other stakeholders such as employees, consumers and lenders.

When there is sole proprietorship form of business organisation, the sole owner manages a concern and, according to the standard economic theory, he will tend to maximise his profits or wealth.

For achieving this objective he will try to achieve efficiency in the use of resources to minimise costs for a given level of output. The market forces will compel him to produce goods or services for satisfying consumer wants. So in a sole proprietorship there is no clash of interests between persons.

ADVERTISEMENTS:

However, in a corporate business enterprise there is a separation of ownership from management, that is, shareholders of the firms from the board of directors and managers who conduct business and take various business decisions. In theory, shareholders control board of directors and top management and can change if they find they are not working in their best interests.

However, the reality is quite different. Shareholders are spread over a wide area, and they generally do not attend the general body meetings of the corporate company. As a result, they have no effective control over the working of board of directors and management of corporate enterprise.

This often causes clash of interests. Thus, while in theory the objective of board of directors and management is to maximise profits or shareholders value and wealth, but in practice this does not happen. The board of directors and top management in the context of separation of ownership may pursue their own interests by pursuing, for example, very risky or imprudent projects and misappropriate funds raised from investors and use them in promoting their own interests. Ishkander and Chamlou in a World Bank study of the problem writes,

“The interests of those who have effective control over a firm can differ from the interests of those who supply the firm with external finance. The problem commonly known as a principal-agent problem grows out of the separation of ownership and control and corporate outsiders and insiders”.

ADVERTISEMENTS:

Similarly, Mr. Justice Arijit Pasayat in his speech at 5th LAWASLA. Business Law Conference, New Delhi, states, “When ownership is separated from control, the manager’s self-interest may lead to the misuse of corporate assets, for example, through the pursuit of overly risky or imprudent projects. Corporate financier (whether they are individuals or pension funds, mutual funds, banks and other financial institutions, or even government) need assurances that their investment will be protected from misappropriation and used as intended for the agreed corporate objective. These assurances are at the heart of what effective corporate governance is all about”.

The objective in a corporate, as stated above, is the maximisation of shareholders value subject to the protection of interests of other stakeholders. Committee on Corporate governance set up by SEBI and headed by Kumar Manglam Birla righty states that the objective of corporate governance is the “enhancement of long-term shareholders ‘value while at the same time protecting the interests of other stakeholders.”

To achieve the objectives of the protection of investment of individuals from misappropriation of funds by management of a corporate enterprise and maximisations of long-term shareholders’ value, it is required that practices of good corporate governance, namely, transparency in the transactions of corporate with stakeholders, accountability and responsibility for the decisions taken, keeping of accurate accounts and fairness in treatment should be adopted if the objective of the corporate is to be attained.

The corporate governance is affected by the relationship among various participants in the governance system. The shareholders, especially those who can hold bulk of shares and are in controlling position can influence corporate behaviour, institutional investors (such as banks, mutual funds) are increasingly having a larger say in corporate governance of some companies. Creditors also demand an important role in the corporate governance and employees can also play an important role in contributing to the good performance of the corporation and realisation of its long-term objective.

ADVERTISEMENTS:

It is worth mentioning that the focus of good corporate governance is on the voluntary adoption of ethical code of conduct in business decision-making and financial transactions in a corporate enterprise for its long-term success and performance, while the government can establish the overall legal framework.

The board of directors and top management is central to the concept of corporate governance and it is their accountability and transparency in the dealings with shareholders and other stakeholders that underlie good corporate governance.

The practices of good corporate governance are expressed as ethical code of conduct and are mainly self-regulated and not imposed by laws or legislation. Of course, as mentioned above, the government can establish overall institutional and legal framework so that corporate enterprises do not indulge in patently corrupts practices and fleece shareholders and customers.

Corporate Social Responsibility (CSR) Under the Amended Companies Bill 2011

An important provision of the new Companies Bill 2011 is that it requires the profit-making corporate companies to spend 2 per cent of their average net profits during preceding three years on social responsibility activities if they have net profit of Rs. 5 crore or more or net worth more than Rs. 500 crore or turnover of 1000 crore in a year.

The expenditure on CSR activities has to be spent only in the local areas. This spending on CSR activities on is not mandatory, but in case of non-compliance to spend 2% of average profits of preceding three years on CSR activities in local areas the company’s board will have to explain why spending on CSR activities has fallen short in a particular year.

This provision for corporate companies to spend 2% of their net profit on CSR activities is a landmark measure to make the Indian corporate companies to spend adequate amount on CSR activities. The performance of Indian companies in case of CSR has been pathetic as they have failed in their role of being a good corporate citizen. They are found to be doing more of lip service rather than actual initiatives in and around the areas of their operations.

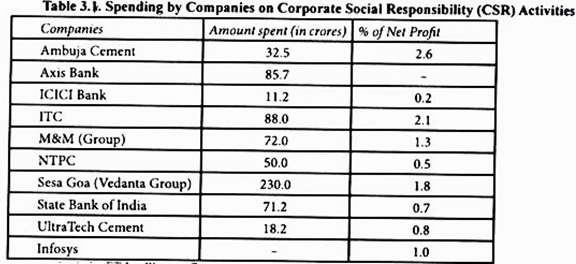

Estimates made by ET Intelligence group reveal that the bulk of CSR expenditure – nearly 5000 crore will be spent by the Nifty 50 Index of Bombay Stock Exchange. So far record of Indian companies for spending social responsibility activities is dismal. Only 2 companies Ambuja Cement, ITC companies, currently spend 2% of their net profits on CSR. Even noted companies Infosys spend only 1% of its net profit on CSR activities. Spending on CSR activities by some companies in year 2010-11 is shown in Table 3.1.

In our view spending on CSR activities by companies is spending for a social cause and they will benefit immensely from it goodwill for it that will be generated because of engaging with the community around their areas of operations. To ensure the compliance by the companies to spend 2 % of their average profit in three preceding years requires the government to watch their required spending on CSR activities prescribed in the new amended Companies Act, 2011.