Let us make an in-depth study of the transactions at disequilibrium prices.

The equilibrium price is also called the market clearing price. But the market price is the one that actually prevails at any point of time.

The equilibrium price does not rise or fall unless there is a change in the demand and supply schedules shown in Table 9.2. But there may be a continuous change in the actual market price.

Thus, the actual price may go above the equilibrium price of Rs. 1.80 in our example. In this case there will be excess supply or surplus. Producers will be willing to offer a larger quantity for sale than consumers are willing to buy. On the other hand, if actual price goes below the equilibrium value, there will be shortage or excess demand. Consumers will be willing to buy more than what producers are willing to sell.

ADVERTISEMENTS:

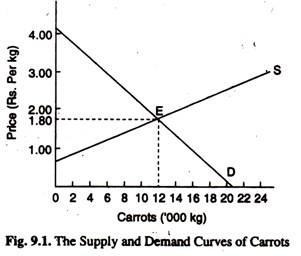

By looking at Fig. 9.1 and Table 9.2, it is clear that when the actual price is Rs. 3.00 per kg, the quantity demanded is 6,000 kg but the quantity supplied is 24,000 kg. This implies that at this price the supply curve lies to the right of the demand curve.

In the opposite situation, where market price (say, Re. 1.00) is below the equilibrium price, (Rs. 1.80) there is excess demand, i.e., the quantity demanded (14,000 kg) exceeds the quantity supplied (8,000 kg). In this case, the demand curve lies to the right of the supply curve. This is what is observed at all market prices below the equilibrium level.

Thus, we have referred to the following two points:

1. The equilibrium price is the one at which the demand and supply curves intersect. At this price the quantity demanded is exactly equal to the quantity supplied and the market is cleared.

ADVERTISEMENTS:

2. When the quantity demanded exceeds the quantity supplied, there is excess demand. This is observed at all prices below the equilibrium one. When the quantity supplied exceeds the quantity demanded, there is excess supply. This is observed at all prices above the equilibrium one.

The Operation of the Market Forces:

We may now consider certain forces which will be acting on the market price when it differs from the equilibrium price. When there is excess demand, consumers will not be able to buy all they wish to buy. The quantity offered for sale is just not sufficient to fulfill their desire (or meet their need). On the other hand, when there is excess supply, suppliers will be unable to sell what they wish to sell. The quantity demanded is just not sufficient to fulfill their desire.

In such disequilibrium situations, i.e., in cases of excess demand or excess supply, therefore, some people are unable to do what they would like to do. So some action on the part of buyers and sellers is inevitable. This action is known as the working of market forces.

Excess Demand (Shortage):

If the market price is below the equilibrium price, there is excess demand. So the unsatisfied buyers will be ready to pay a higher price. Therefore, market price will rise. In fact, in a situation of excess demand, we see two types of responses. On the one hand, some buyers, who are unable to buy as much as they like, offer higher prices in an attempt to obtain more of the limited quantity of the commodity that is available.

ADVERTISEMENTS:

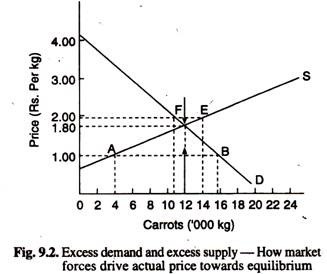

On the other hand, suppliers, finding it easy to sell their output at high prices, start charging higher prices for the quantities that they have produced. Thus market forces—the response of producers to the competition among the unsatisfied buyers of goods—put upward pressure on price. This is indicated by the (upward-pointing) arrow in Fig. 9.2. The arrow indicates that whenever the actual price goes below the equilibrium level, there is excess demand. This excess demand creates upward pressure on price and the actual price ultimately reaches the equilibrium level.

Excess Supply (Surplus):

If, on the other hand, the market price is below the equilibrium level, there will be excess supply. For example, when price is Rs. 2 per kg, the quantity supplied is 14,000 kg but quantity demanded is only 11,000 kg. Thus there is a surplus or excess supply of 3,000 kg. This creates downward pressure on price. Market price will now tend to fall. Suppliers now find it difficult to sell all of their output at this price. So they are charging lower prices for what they want to sell.

Consumers observe that there is excess supply of carrots in the market. So they respond to this situation by offering lower prices. As a result of both these pressures, coming from sellers and buyers, the market price tends to fall. This downward pressure on price is indicated by the (downward-pointing) arrow in Fig. 9.2. Thus, when actual price goes above the equilibrium level, there is downward pressure on it.

Summary of the Main Points:

From the theory of market price determination presented here it is clear why price in the market for carrots tends towards equilibrium at the point of intersection between the supply and demand curves. All other prices are called disequilibrium prices. Transactions at these prices create the problems of excess supply or excess demand. If the actual price is above the equilibrium level, market forces tend to push the price down.

As a consequence excess supply disappears. On the contrary, at prices below equilibrium market forces tend to raise price. As a result the excess demand is eliminated. Only when market price is at its equilibrium value, the market is exactly cleared, leaving neither a deficit (shortage or excess demand) nor a surplus (glut or excess supply) at the end.

In other words, only at the equilibrium price consumers want to buy exactly what the producers want to sell. There is no unsatisfied buyer; there is no unsatisfied seller either. The equilibrium price may, therefore, be called the market clearing price.

ADVERTISEMENTS:

The equilibrium price is also the price which remains unchanged for some time. The reason is simple. It is the price at which there are no market forces—brought about by excess demand or excess supply—to cause the price to change.