In this article we will discuss about the Revealed Preference Theory (RPT) put forth by prof. Samuelson.

The Concept of Revealed Preference:

Prof. Samuelson has invented an alternative approach to the theory of consumer behaviour which, in principle, does not require the consumer to supply any information about himself.

If his tastes do not change, this theory, known as the Revealed Preference Theory (RPT), permits us to find out all we need to know just by observing his market behaviour, by seeing what he buys at different prices, assuming that his acquisitions and buying experiences do not change his preference patterns or his purchase desires.

Given enough such information, it is even theoretically possible to reconstruct the consumer’s indifference map.

ADVERTISEMENTS:

Samuelson’s RPT is based on a rather simple idea. A consumer will decide to buy some particular combination of items either because he likes it more than the other combinations that are available to him or because it happens to be cheap. Let us suppose, we observe that of two collections of goods offered for sale, the consumer chooses to buy A, but not B.

We are then not in a position to conclude that he prefers A to B, for it is also possible that he buys A, because A is the cheaper collection, and he actually would have been happier if he got B. But price information may be able to remove this uncertainty.

If their price tags tell us that A is not cheaper than B (or, B is no-more expensive than A), then there is only one plausible explanation of the consumer’s choice—he bought A because he liked it better.

More generally, if a consumer buys some collection of goods, A, rather than any of the alternative collections B, C and D and if it turns out that none of the latter collections is more expensive than A, then we say that A has been revealed preferred to the combinations B, C and D or that B, C and D have been revealed inferior to A.

Therefore, if the consumer buys the combination E1 (x1, y1)of the goods X and Y and does not buy the combination E2(x2, y2) at the prices (p1x, p1y,) of the goods, then we would be able to say that he prefers combination E1 to combination E2, if we obtain

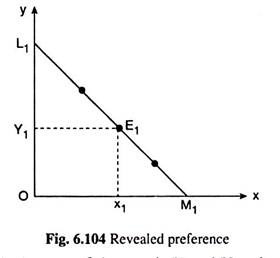

The complete set of combinations of the goods X and Y to which a particular combination is revealed preferred can be found with the aid of the consumer’s price line. Let us suppose that the consumer’s budget line is L1M1 in Fig. 6.104 and he is observed to purchase the combination E1 (x1, y1) that lies on this line.

Now, since the costs of all the combinations that lie on the budget line are the same as that of E1 and since the costs of all the combinations that lie below and to the left of the budget line are lower than that of E1 we may say that E1 is revealed preferred to all the combinations lying on or below the consumer’s budget line.

ADVERTISEMENTS:

Again, since the costs of the combinations that lie above and to the right of the budget line are higher than that of E1 we cannot say that the consumer prefers E1 to these combinations when he is observed to buy E1, because here E1 is the cheaper combination.

We have to note here the difference between “preference” and “revealed preference”. Combination A is “preferred” to B implies that the consumer ranks A ahead of B.

But A is “revealed preferred to B” means A is chosen when B is affordable (no-more-expensive). In our model of consumer behaviour, we generally assume that people are choosing the best combination they can afford that the choices they make are preferred to the choices that they could have made. That is, if (x1 y1) is directly revealed preferred to (x2, y2), then (x1, y1) is, in fact, preferred to (x2, y2).

Let us now state the RP principle more formally:

Let us suppose, the consumer is buying the combination (x1, y1) at the price set (p’x, P’y) let us also suppose that another combination is (x2, y2), such that p’x1 + p’yy1 ≥ p’xx2 + p’yy2. Now, if the consumer buys the most preferred combination subject to his budget constraint, then we will say the combination (x1, y1) is strictly preferred to combination (x2, y2).

The Assumptions:

With the help of the simple principle of RP, we may build up a powerful theory of consumer demand. The assumptions that we shall make here are:

(i) The consumer buys and uses only two goods (X and Y). The quantities x and y of these goods are continuous variables.

(ii) Both these goods are of MIB (more-is-better) type. This assumption is also known as the assumption of monotonicity. This assumption implies that the ICs of the consumer are negatively sloped.

(iii) The consumer’s preferences are strictly convex. This assumption implies that the ICs of the consumer would be convex to the origin, which again implies that there would be obtained only one point (the point of tangency) on the budget line of the consumer that would be chosen by him over all other affordable combinations.

ADVERTISEMENTS:

This assumption is very important. On the basis of this assumption, we shall obtain a one- to-one relation between the consumer’s price-income situation or budget line and his equilibrium choice—for any particular budget line of the consumer, there would be obtained one and only one equilibrium combination of goods and for any combination to be an equilibrium one, there would be obtained one and only one budget line.

(iv) The fourth assumption of the RP theory is known as the weak axiom of RP (WARP). Here we assume that if the consumer chooses the combination E1(x1, y1) over another affordable combination E2(x2, y2) in a particular price-income situation, then under no circumstances would he choose E2 over E1 if E1 is affordable.

In other words, if a combination E1 is revealed preferred to E2, then, under no circumstances, E2 can be revealed preferred to E1.

(v) The fifth assumption of the RP theory is known as the strong axiom of RP (SARP). According to this assumption, if the consumer, under different price-income situations, reveals the combination E1 as preferred to E2, E2 to E3,…, Ek-1 to Ek, then E1 would be revealed preferred to Ek and Ek would never (under no price-income situation) be revealed preferred to E1.

Revealed Preference—Direct and Indirect:

ADVERTISEMENTS:

If RP is confined to only two combinations of goods, E1 and E2, and if, in a particular price- income situation, E1 (x1,y1) is revealed preferred to combination E2 (x2, y2), then it is said that E1 is directly revealed preferred to E2.

But if preferences are considered for more than two combinations and if preferences are established by way of transitivity of RP, then it is a case of indirectly revealed preference. For example, if E1 is revealed preferred to E2,…, Ek-1 to Ek, then by SARP, we say E1 is indirectly revealed preferred to Ek.

Violation of the WARP:

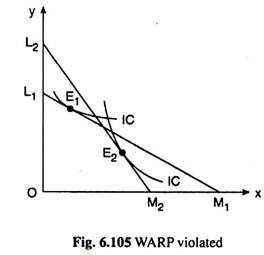

Let us consider Fig. 6.105. Here let us suppose that, under the price income situation represented by the budget line L1M1, the consumer purchases the combination E1 (x1, y1) and he reveals combination E1 (x1 y1) as preferred to E2 (x2, y2).

For here he chooses E1 over the affordable combination E2. Again, let us suppose that when the budget line of the consumer changes from L1M1 to L2M2, the consumer buys the combination E2 (x2, y2), although he could have obtained the affordable combination E1 (x1, y1), i.e., under L2M2, E2 is revealed preferred to E1.

ADVERTISEMENTS:

What we have seen here is that under the budget line, L1M1, the combination E1 is revealed preferred to E2 and under a different budget line L2M2, E2 is revealed preferred to E1. Obviously, the consumer here violates the WARP.

The reason for this violation may be that the consumer here does not attempt to obtain the most preferred combination subject to his budget constraint; or, it may be that his taste or some other element in his economic environment has changed which should have remained unchanged by our assumptions.

Now, whatever may be the reason for the violation of WARP, this violation is not consistent with the model of consumer behaviour that we are discussing.

The model assumes that the consumer wants to maximise his level of satisfaction and, that is why, when he chooses a particular combination, say, E1 subject to his budget, that must be the most ‘preferred’ to all other affordable combinations, and none of these ‘other’ combinations can be ‘preferred’ to E1 under a different budget. WARP puts emphasis on this simple but important point. We may give the formal statement of WARP in the following way.

ADVERTISEMENTS:

If a particular combination E1 (x1 y1) is directly revealed by the consumer as preferred to a different combination E2 (x2, y2), then E2 would never be revealed by the consumer as preferred to E1.

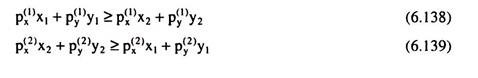

In other words, if the consumer is observed to purchase E1 (x1, y1) at the price set (px(1), py(1)) and E2 (x2 , y2) at the price set (px(1), py(2)), then if (6.138) below holds, then (6.139) must never hold:

As we have seen, WARP has been violated in Fig. 6.105, when the consumer buys combination E1 on L1M1 and E2 on L2M2. Here the preference ordering of the consumer breaks down. It may be verified in Fig. 6.105 that the IC tangent to L1M1 at E1 and the IC tangent to L2M2 at E2 cannot be non-intersecting in this case.

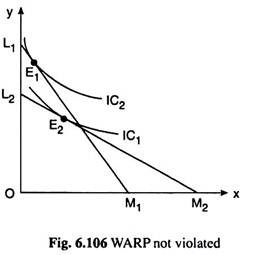

In Fig. 6.106, on the other hand, let us suppose, the consumer buys the combination E1 on L1M1 and the combination E2 on L2M2. Here when he buys E1 he chooses E1 over the affordable combination E2, i.e., E1 is revealed preferred to E2. But when he buys E2, he chooses E2 over an unaffordable E1, i.e., E2 is not revealed preferred to E1.

Therefore, here, WARP is not violated, and so, here the preference ordering of the consumer does not break down. It may be seen in Fig. 6.106 that the IC tangent to L1M1 at E1 and the IC tangent to L2M2 at E2 would be non- intersecting.

Significance of the SARP:

ADVERTISEMENTS:

Let us now discuss the significance of the strong axiom of revealed preference (SARP). According to this axiom, if the consumer reveals a combination E1 (x1, y1) as preferred to another combination E2 (x2, y2) and if E2 (x2, y2) is revealed preferred to E3 (x3, y3) then E, would always be revealed preferred to E3.

This may be called the transitivity of revealed preferences. Now, if the consumer is a utility-maximising one, then the transitivity of revealed preferences would lead to transitivity of preferences—if E1 is preferred to E2 and E2 to E3, then E1 would be preferred to E3.

But this is necessary to ensure that the ICs are non-intersecting and the non-interesting ICs are necessary for arriving at the utility-maximising solution. It is evident that if any of the WARP and SARP is violated, then utility-maximisation cannot be achieved by the consumer.

Revealed Preference Theory and the Slutsky Theorem:

Let us now see how the RPT can be used to prove the Slutsky Theorem which states that if the income effect (IE) for a commodity is ignored, then its demand curve must have a negative slope. To explain this, we shall take the help of Fig. 6.107.

In this figure, let E1 (x1, y1) represent the combination of goods that the consumer initially purchases when his budget line is L1M1. We want to show here that a ceteris paribus fall in the price of good X from L1M1 will increase the purchase of the good if we ignore the income effect, i.e., if we consider only the substitution effect (SE).

ADVERTISEMENTS:

Let us suppose that the imaginary budget line for Slutsky-SE is L2M2. This line will be flatter than L1M1, since the price of X has fallen, ceteris paribus, and this line (L2M2) will pass through the combination E, so that, as per the Slutsky condition, the consumer might be able to buy the initial combination, if he liked, under the changed circumstances.

Let us now see, because of the SE, the point the consumer may select on the imaginary budget line L2M2 (if it is to be different from E), would be a point like E2 to the right of the point E1. To prove that this must be so, we have to note that selection of any point on L2M2 such as E3 which lies to the left of E1, is ruled out by WARP.

This is because, initially, E1 has been revealed preferred to E3, since E3 lies below L1M1. But if E3 were chosen when the price line was L2M2, it (E3) is revealed preferred to E1 since E1 is no-more-expensive than E3 (for they both lie on the same budget line L2M2). In that case, we obtain that E1 is revealed preferred to E3, and vice versa, which violates WARP.

Thus no point on L2M2 which, like E3, lies to the left of E1, can be chosen. On the other hand, if the consumer chooses a point like E2 on L2M2 to the right of E1, then there is no harm to the weak axiom, because when he purchases E2, E2 is revealed preferred to the no-more-expensive combination E1 but, initially, when he purchased E1 (on L1M1) and not a point like E2, he did this, because E1 was cheaper than these points.

From the analysis, it is clear that the SE of a fall in the price of X will generally increase the demand for the relatively cheaper commodity X at a point like E2 to the right of E1. Thus, the Slutsky theorem is deduced from the revealed preference approach.

We have seen that if the price of X falls, ceteris paribus, and if the income effect of this price fall is ignored, then the SE would increase the demand for X, i.e., the demand curve for X would be negatively sloped, and the law of demand is obtained.

From Revealed Preference to Preference:

ADVERTISEMENTS:

The principle of revealed preference (RP) is rather simple, but at the same time it is very powerful. Supported by the assumptions we have made, the RPT enables us to obtain the consumer’s preference pattern or indifference curves (ICs) from his revealed preferences.

No introspective data are required from the consumer to achieve this task. If we know the price- income situation of the consumer as represented by his budget line and his point of revealed preference on the line, we would be able to derive his IC that passes through this point. The process of obtaining the IC is described below.

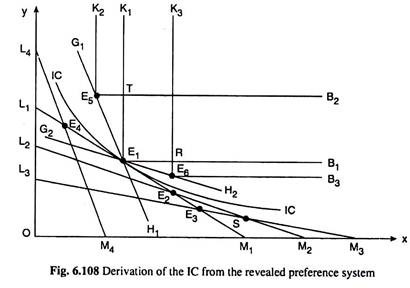

Let us suppose that the budget line of the consumer is L1M1 in Fig. 6.108 and the combination of the goods that the consumer is observed to purchase, is E1 (x1, y1). As we know, the consumer here prefers the point E, directly to all other points on the budget line or in the area OL1M1. For, in spite of all these points being within his budget, he purchases E1. “All these points” are considered to be “worse” than E1.

On the other hand, the costs of all the combinations lying to the right of the budget line L1M1 are more than that of the point E1, or, E1 is cheaper than these points. Apparently, the consumer chooses E1 over these points because they are more expensive, and we cannot say anything about the ‘revealed’ preference of E1 to any of these points.

That is why, the area in the commodity space to the right of L1M1 is known as the area of ignorance. We shall see, however, with the help of the assumptions of the RPT, that some of the points in the area of ignorance are directly or indirectly preferred or inferior to E1 and some of the points are indifferent with E1.

These latter points that are indifferent with E1 give us the indifference curve (IC) passing through E1, Let us now see how we can derive this curve.

At the very first, let us consider the area K1E1B1. The commodity combinations (except E1) belonging to this area are directly preferable to the consumer to E1 , since all these combinations have more of either one or both of the goods than the point E1. These combinations may be called the “better” combinations.

So far we have obtained that the consumer directly prefers E1 to the points to the left of the budget line L1M1, i.e., those lying in the area OL1M1 and he directly prefers the points lying in the area K1E1B1 to E1. Therefore, his IC through the point E1 if it is obtained, would be spread in the space between these two areas, and it would touch the line L1M1 and the area K1E1B1 at the point E1.

Let us now consider the points in the area of ignorance lying above the line L1M1 and outside the area K1E1B1. At first, we shall try to identify the points that the consumer prefers less to E1—these points may be called the “worse” points. In order to do this, let us consider any point E2 lying on L1M1 to the right of E1.

Let us suppose that the consumer is observed to purchase E2 when his budget line is L2M2. He, therefore, reveals the point E2 as preferred to the points to the left of the budget line L2M2. Since E1 has already been revealed preferred to E2, the consumer prefers E1 to all these points lying in the area OL2M2.

Since a portion of this area, viz., □OL2E2M1 belongs to the area OL1M1, here the net increase in the area of “worse” points is obtained to be □E2M1M2. The consumer prefers E1 indirectly to the points of this area through the combination E2—he prefers E1 to E2 and E2 to these points.

We may again increase the area of “worse” points to the right of E1 by considering any other point E3 lying on the line L1M1 to the right of E2. Let as suppose that the consumer purchases E3 when the budget line is L3M3. That is, he reveals the point E3 as preferred to the points lying in the area OL3M3.

Again, since E1 has already been revealed preferred to E3, he may be said to prefer E1 to these points in the area OL3M3. Here the net increase in the area of points worse than E1 has been □SM2M3. The consumer prefers E1 indirectly (through the point E3) to the points in □SM2M3.

So far we have seen how we may lessen the area of ignorance by considering the points on the budget line L1M1 to the right of E1. We may also do this job by considering points on L1M1 to the left of E1. Let us suppose, E4 is any point on L1M1 to the left of E1 and the consumer is observed to purchase E4 when his budget line is L4M4.

The point E4, therefore, is revealed preferred to the points lying in the area OL4M4. But the point E1 has already been revealed preferred to point E4 and so the consumer prefers E1 to these points. Here, if we leave out the common portion of areas OL1M1 and OL4M4, we obtain that the consumer indirectly prefers E1 to the points of □E4L1L4.

Therefore, now we have been able to reduce the area of ignorance by □E4L1L4. We may, in this way, go on reducing the area of ignorance by considering more points on L1M1 lying to the left of the point E1.

So far we have reduced the area of ignorance by increasing the area of “worse” combinations. We may now see how we may increase the area of “better” combinations outside the area K1E1B1 and thereby reduce further the area of ignorance. Let us suppose that the consumer is observed to purchases the point E5 when his budget line is G1E1H1.

Here the consumer will prefer all the points in the area K2E5B2 to the point E5, since these points have more of either one or both the goods. Also it is now revealed that the consumer prefers E5 to E1, for he chooses E5 over the affordable E1. Therefore, what we obtain here is that the points lying in the area K2E5B2 are “better” than the point E1.

Here, if we leave out the portion of □K2E5B2 which is in common with □K1E1B1, we find that there has been a net increase in the area of “better” points and net decrease in the area of ignorance—this net increase is represented by the area lying in between the lines K2E5, K1T and E5T.

Again, because of our assumptions of convex preference and MIB, the consumer will prefer the points in □E1E5T to E1. Therefore, this area is also added to the area of “better” combinations and the area of ignorance is reduced accordingly. We may go on increasing the area of “better” combinations in this way. For example, the consumer is observed to purchase the point E6 on the budget line G2 E1 H2.

Here we would find that the area of the “better” points gets an increase by the area in between the lines RB1 RE6 andE6B3 plus the area E1E6R. Therefore, these areas are also added to the area of “better” combinations and the area of ignorance is reduced accordingly.

In Fig. 6.108, we have seen that on the basis of the idea of revealed preference and with the help of the assumptions made, we may go on increasing the area of the combinations that are “worse” than a particular combination E1 from below and we may also go on increasing the area of the combinations that are “better” than E1 from above.

In the limit, the area between these two areas would get reduced to a border line curve of indifference. By applying the advanced methods of calculus and also intuitively, we may obtain that this indifference curve of the consumer would pass through the point E1, would lie in between the two paths like K2E5E1E6B3 and L4E4E,E2SM3 and would be convex to the origin.

We have seen how we may obtain a consumer’s IC through any particular combination E1. Applying the same process, we may obtain his IC through any other point in the commodity space, i.e., we would obtain his indifference map.

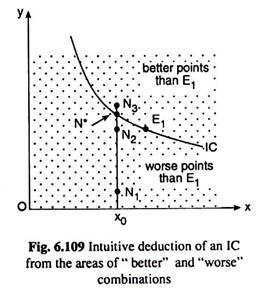

Let us now see with the help of Fig. 6.109, how we may conclude intuitively that the borderline between the areas of “better” and “worse” combinations than any point E1 is an IC through that point.

In Fig. 6.109, we have represented that the areas of better and worse combinations than E1 have been made to advance towards each other and in the limit the gap between them looks like an IC, and actually, it would be an IC, passing through E1 We can understand this in the following way.

Let us move vertically from one point to another in the commodity space of Fig. 6.109 starting from any point like N, (x°, y1) of the area of worse combinations. As we move upwards vertically, the quantity of good X remains the same at x0 and that of good Y increases, and ultimately, very near the border of the “worse” area we shall arrive at a point like N2 (x°, y2).

Let us suppose, if we still move upwards slightly beyond N2, we shall arrive at a point N3 (x°, y3) in the area of “better” combinations. Now we may easily understand intuitively that there lies a point N* (x0, y*), y2 < y* < y3, in the infinitesimally small vertical gap between the points N2 and N3 which is neither worse nor better than E1 but which is indifferent with E1.

Therefore, if we join the points E1 and the points like N* by a curve we would obtain the required IC through E1.

Indifference Curve, Revealed Preference and Cost of Living Index:

Let us first consider two price index formulas. One is Laspeyre’s formula and the other is Paasche’s formula. Laspeyre’s price index number is the ratio of two aggregates—aggregate of current year prices at base year quantities and that of base year prices at base year quantities. Let us suppose that an individual purchases two goods.

The base year and current year prices of the goods are p01, p02 and pt1, pt2. Also the base year and current year quantities of the goods purchased by the consumer are q01, q02 and qt1, qt2. Then Laspeyre’s price index would be

Here the base year quantities of the goods have been taken as weights of their prices. L gives us the price index in the current year if the base year price index is 1. For example, if L = 1.5, then we obtain that current year price index is 1.5 when the base year price index is 1, i.e., the prices in the current year are 50 per cent more than those in the base year.

Laspeyer’s price index may be interpreted in another way. The numerator of the right hand side of (6.140) gives us the cost of the base year basket of goods (q01 , q02) at the current year prices (pt1, pt2), and the denominator gives us the cost of buying the same basket of goods at the base year prices (p01, p02).

Looking in this way, L = 1.5 gives us that the cost of buying the base year basket of goods has increased by 50 per cent in the current year over the base year. That is, the Laspeyre’s price index number L may also be considered as the Laspeyre’s cost of living index number.

Let us now come to Paasche’s price index number which is the ratio of the aggregate of current year prices at current year quantities and that of the base year prices at current year quantities. Therefore, we obtain Paasche’s price index number as

Here the current year quantities of the goods have been taken as the weights of their prices. Just like the Laspeyre’s price index number, Paasche’s price index number may also be considered as the Paasche’s cost of living index number. It gives us the percentage increase in the cost of buying the current year basket of goods in the current year over the base year.

Let us now come to the total expenditure of the consumer in the base year and in the current year. In the base year his total expenditure is, say, E0, and he purchases the quantities q01 and q02 at prices p01 and p02. Therefore, his budget line in the base year is

E0 = p01q01 +p02q02 (6.142)

Similarly, in the current year his total expenditure is, say, Et, and he purchases the quantities qtI and qt2 at the prices pt1 and pt2. Therefore, his budget line in the current year is

Et = pt1qt1 + pt2qt2 (6.143)

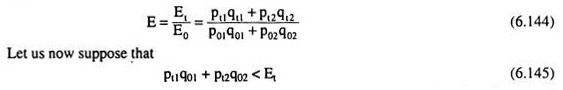

Since it is assumed that expenditure equals income, Et/E0 gives us the index of change in the consumer’s income in the current year over the base year. That is, the index of money income change is

This means that the cost of the base year basket at current year prices is less than the current year expenditure. In other words, in the current year, the consumer might purchase the base year basket, if he so desired, but he chose not to buy this basket. This means that he prefers the current year basket to the base year basket, i.e., he is better off in the current year than in the base year.

Dividing both sides of inequality (6.145) by E0, we get

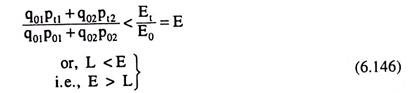

Therefore, (6.145) implying (6.146) gives us the condition for the consumer to be better off in the current period over the base period. Let us now consider the following case:

This means that the cost of the current year bundle at the base year prices is less than the base year expenditure. This implies that the consumer might have bought the current year basket in the base year, but he chose not to buy this basket.

Thus, he preferred the base year basket and was better off in the base period over the current period. In other words, he is worse off in the current year than in the base year. Dividing both sides of (6.147) by Et we have

Therefore, (6.147) implying (6.148) gives us the condition for the consumer to be better off in the base period or, worse off in the current period.

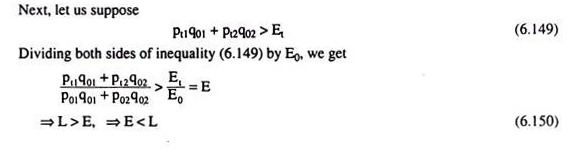

From (6.149) implying (6.150), we obtain that the cost of the base year basket at current year prices is greater than the current year expenditure. Therefore, the base year basket is not available to the consumer in the current year.

That is, he purchases the current year basket not because he prefers it to the base year basket, but because it is cheaper. Therefore, we cannot say that the consumer is better off in the current year over the base year.

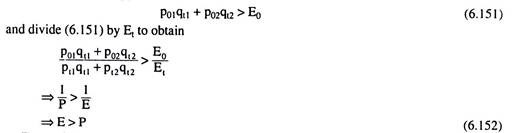

Similarly, if we suppose:

From (6.151) implying (6.152), we obtain that the cost of current year basket in the base year is greater than the base year income. Therefore, the consumer buys the base year basket in the base year not because he prefers it, but because it is cheaper than the current year basket. Therefore, here we cannot say that he is better off in the base year over the current year, or, worse off in the current year over the base year.

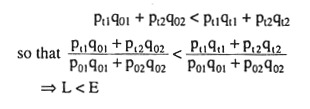

What we have obtained above is that if E > L as given by condition (6.146), the consumer is better off in the current year over the base year. On the other hand, if E < P as given by (6.148), the consumer is better off in the base year than in the current year.

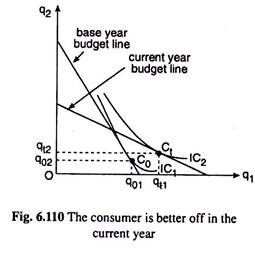

We may use the indifference curves of the consumer to illustrate these points. Fig. 6.110 illustrates the first case, i.e., the consumer is better off in the current year than in the base year.

Here, in the current year, the consumer buys at the point Ct on the current year budget line and he buys in the base year at the point C0 on the base year budget line. It is seen in Fig. 6.110 that Ct lies on the higher IC, viz., IC2, and C0 lies on the lower IC, viz., IC1.

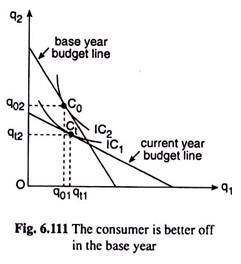

Similarly, Fig. 6.111 illustrates the second case, i.e., the consumer is better off in the base year than in the current year. It is seen in this Fig. that C0 lying on the base year budget line, is placed on a higher IC, viz., IC2, and Ct lying on the current year budget line, is placed on a lower IC, viz., IC1.

From the above analysis, especially from the inequalities (6.146), (6.148), (6.150) and (6.152), we may distinguish between four cases:

(i) E is greater than both L and P (E > L, E > P). Here by (6.146), i.e., E > L, the consumer is better off in the current year over the base year. On the other hand, by (6.152), i.e., E > P, the standard of living does not fall in the current year. Hence, the individual is definitely better off in the current period.

(ii) E is less than both P and L (E < P, E < L). Here it follows from (6.148) that if E < P, the consumer would be better off in the base year, and it follows from (6.150) that if E < L, the consumer would not be better off in the current period. Again, we obtain an unequivocal answer that if E < P and E < L, then the consumer would be better off in the base period, i.e., his standard of living falls in the current period from what it was in the base period.

(iii) L > E > P. If L > E, or, E < L, then by (6.150), it cannot be said whether the consumer would be better off or worse off in the current period over the base period, and if E > P, then by (6.152), we cannot say that he would be better off in the base year. Consequently, in this case, no definite conclusion can be drawn in respect of improvement or deterioration in the standard of living of the consumer between the two periods.

(iv) P > E > L. If P> E, or, E < P, then by (6.148) the consumer’s standard of living falls in the current period, since he prefers the base year basket to the current year one, and if E > L, then by (6.146), the consumer’s standard of living increases in the current year, since he prefers the current year basket to that of the base year.

Therefore, in this case also we cannot draw any definite conclusion regarding a change in the consumer’s welfare, and this is the situation where the weak axiom of the revealed preference theory has been violated.

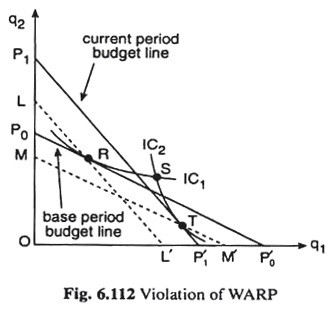

This situation is illustrated in Fig. 6.112. Here the base period budget line is P0P’0 and the current period budget line is P1P’1. Let us suppose that the consumer chose R (q01, q02) on IC1 when the budget line was P0P0‘and T (qt1, qt2) on IC2 when the budget line was P1P1‘. Since LL’ lies below P1P1‘ and is parallel to it and since R is on LL’ and T is on P1P1‘, it must be true that expenditure at R at (pt1, pt2) must be less than that at T at (pt1, pt2), i.e., we would have

Also, since the point T (qt1, qt2) is on MM’ which is parallel to p0p0 but lies below it, T has the same prices as p0p0’ but has less expenditure than the point R (q01, q02) which lies on P0P0’, i.e., we have

Thus, we have P > E > L. But in this case, there is inconsistency. This is also obvious from Fig. 6.112. The consumer could have purchased T in the base period, since T lies below the base period budget line p0p0’, but he actually chose R, implying that he prefers R to T.

But in the current period, he could have had R, since R lies below the current period budget line P1P1‘, but he chose T, implying that he prefers T to R.

This is inconsistent if his tastes remain unchanged between the base period and the current period, and the weak axiom of revealed preference is not complied with. This inconsistency is also reflected in the fact that the ICs through R and T, viz., IC1 and IC2, have not been obtained to be non-intersecting—they have intersected at the point S.

We have seen, therefore, that it is sometimes possible to determine whether the consumer’s standard of living has increased or decreased by means of index number comparisons. However, there may be situations where we cannot arrive at any definite conclusions or where the results may be contradictory.

Example 1:

When two commodity baskets are purchased by the consumer at two different points in time, explain how price weighted quantity indices may be used to verify the weak axiom of revealed preference.

Solution:

We have to explain how price-weighted quantity indices may be used to verify the weak axiom of revealed preference. Let us suppose that in the base period ‘0’, a consumer is observed to purchase the combination q0 (q01, q02) of two goods Q1 and Q2 at the price set p0 (p01, p02) and in the current period ‘t’ he is observed to purchase the combination qt (qt1, qt2) of the goods at the price set pt (pt1 , pt2).

Therefore, the costs of purchasing the combination q0 at the price set p0 and pt are

Again, the costs of purchasing the combination qt at the price set p0 and pt are

In the base period, the consumer purchases the quantity set q0 at the price set p0. If he happens to prefer q0 to qt, then by definition, the cost of the quantity set q02 must be less than, or, (at most) equal to that of purchasing q0 at p0, i.e.,

Since the left-hand side of (5) is, by definition, the Laspeyre’s base year price weighted quantity index (L), we obtain the condition for q0 at p0 to be preferred by the consumer to q0 at p0 as

L ≤100 (6)

Again, in the current period, the consumer is observed to purchase the combination qt at price pt. However, if the weak axiom of revealed preference is to be satisfied then he must not prefer qt at pt to q0 at pt. Therefore, we may conclude that he purchases q in the current period because it is cheaper than q0, i.e.,

Since the left-hand side of (7) is by definition the Paasche’s current year price weighted quantity index (P), we obtain the condition for pt at qt to be cheaper than p0 at qt as

P < 100 (8)

(6) and (8) give us that the weak axiom of revealed preference would be satisfied if the Laspeyre’s and Passche’s quantity indices both are less than 100. Of course, L may be at most 100. Here 100 is the base period index numbers for both the formulas.

Example 2:

A consumer is observed to purchase x1 = 20, x2 = 10 at the prices p1 = 2 and p2 = 6. He is also observed to purchase x1 = 18 and x2 = 4 at the prices p1 = 3 and p2 = 5. Is his behaviour consistent with the weak axiom of revealed preference?

Solution:

From the given data, we obtain:

(i) The cost of the combination (x1= 20, x2 = 10) at the prices (p1 = 2, p2 = 6) is

E1 = 20×2 + 10×6 = 100

(ii) The cost of (x1 = 18, x2 = 4) at the prices (p1 = 2, p2 = 6) is

E2= 18×2 + 4×6 = 60

(iii) The cost of (x1 = 18, x2 = 4) at the prices (p1 = 3, p2 = 5) is

E3 = 18×3 + 4×5 = 74

(iv) The cost of (x, = 20, x2 = 10) at the prices (p1 = 3, p2 = 5) is

E4 = 20×3 + 10×5= 110

From above, it is obtained that the consumer buys the first set of goods, (20, 10), not because it is cheaper than the second set but because he prefers it to the second set, since the cost of the former, E1 = 100, is greater than the cost of the latter, i.e., E2 = 60.

However, when he purchases the second set, not the first one, at the prices (p1 = 3, p2 = 5), he does this because it is cheaper than the first set, not because he prefers this set to the first set, since the cost of the second set, i.e., E3 = 74, is less than that of the first set, i.e., E4 = 110.

Therefore, the consumer’s behaviour is consistent with the weak axiom of revealed preference.

Convexity and Concavity:

Convex and Concave Functions:

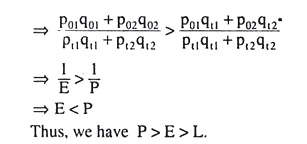

Let us refer to Fig. 6.113. A function f (x) represented by the curve ABCDE, is convex over the interval (a, b) if we have

In Fig. 6.113, point S has divided the line segment BD in the ratio 1 – λ: λ. Therefore, the x and y coordinates of point S are

OT = λx1, +(1 -λ)x2

and ST = λf(x1) + (1 -λ)f(x2)

The function f(x) is said to be strictly convex over the interval (a, b) if strict inequality holds in (6.153) for all 0 < λ < 1.

Let us again refer to Fig. 6.113. A function f(x), now represented by the curve FBGDH is concave over the interval (a, b) if we have

f [λx1 + (1 -λ)x2] ≥ λf(x1) + (1 – λ)f(x2) (6.154)

and the function is strictly concave if strict inequality holds in (6.154) for 0 < λ < 1.

Quasi-convex and Quasi-Concave Functions:

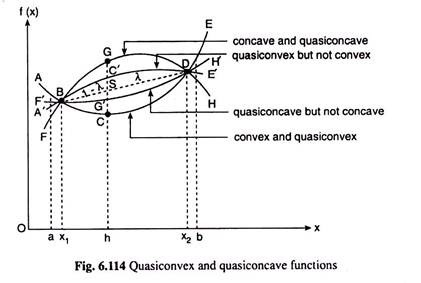

By definition, a function f(x) is quasi-convex over the interval (a, b) if we have

f [λx1 + (1 -λ)x2] ≤ max [f(x1), f(x2)] (6.155)

for all x1 and x2 in the interval and all 0 ≤ λ ≤ 1. The function f(x) is strictly quasi-convex if strict inequality holds in (6.155) for 0 < λ < 1.

In Fig. 6.114, the curve A’BC’DE’ represents, by definition, a quasi-convex function over the interval (a, b).

Let us now come to quasi-concavity. A function f(x) is quasi-concave over an interval (a, b) if we have

f[λx1 + (1 – 1)x2] ≥ min [f(x1), f(x2)] (6.156)

for all x1 and x2 in the interval (a, b) and for all 0 ≤ λ ≤ 1. The function is strictly quasi-concave if strict inequality holds in (6.156) for 0 < λ < 1. In Fig. 6.114, the curve F’BG’DH’ represents, by definition, a quasi-concave function over the interval (a, b).

At the end of our discussion of convex and concave curves, let us note that, as per the definitions, a convex function is also quasi-convex for the former also satisfies (6.155), but a quasi-convex function cannot be a convex function for it does not satisfy (6.153). Similarly, a concave function is also quasi-concave for it satisfies also (6.156), but a quasi-concave function cannot be concave for it does not satisfy (6.154).

Geometrical Illustrations:

From our discussions above we obtain the following with illustrations in Fig. 6.113:

(i) The curve, ABCDE, representing a function, f (x), is convex over a certain interval (a, b) if the line segment, BD, joining any two points, B and D, on the function in the said interval lies on or above the curve; and if the line segment lies throughout above the curve, it is said that the function is strictly convex.

(ii) On the other hand, a function f(x), viz., FGDH, is concave over a certain interval (a, b) if the line segment joining any two points, B and D, on the function in the said interval lies on or below the curve; and if the line segment lies throughout below the curve, it is said that the function is strictly concave.

We also obtain the following with illustrations in Fig. 6.114.

(iii) A function f(x), viz., A’BC’DE’, is quasi-convex over a certain range between x = a and x = b, if at any x = h in the range, we have f(h) ≤ max [f(a), f(b)], and if the strict inequality holds, the function is said to be strictly quasi-convex.

It may be noted that a convex function is also quasi-convex, but a quasi-convex function cannot be convex, for some quasi-convex functions, like A’BC’DE’, may lie above the line segment joining the points on the function at x = x1 and x = x2, which a convex function cannot.

(iv) Lastly, a function f(x), like F’BG’DH’, is quasi-concave over a certain range between x = x1 and x = x2, if at any x = h in the range, we have f(h) ≥ min [f(x1), f(x2)]; and if the strict inequality holds, the function is said to be strictly quasi-concave. It may be noted here that a concave function is also quasi-concave.

But a quasi-concave function cannot be concave, for some quasi-concave functions, like F’BG’DH’, may lie below the line segment joining the points on the function at x = x1 and x = x2, which a concave function cannot.

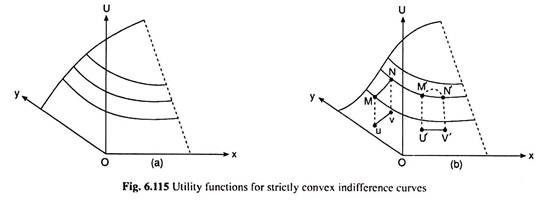

Utility Function for Strictly Convex Indifference Curves:

Our question here is what types of utility function will produce strictly convex indifference curves (ICs) and thus satisfy the second-order condition. Two functions that may be accepted as such utility functions have been shown in Fig. 6.115. Part (a) of the Fig. 6.115 gives us a smooth strictly concave function.

Because of the assumption of positive marginal utilities, we have only shown the ascending portion of the dome-shaped surface. When this surface is cut with a plane parallel to the xy-plane, we obtain for each such cut a curve which will become a strictly convex downward sloping IC with respect to the xy-plane.

Strict concavity in a smooth utility function is, therefore, sufficient to fulfill the second-order condition (SOC) for utility-maximisation. However, if we examine part (b) of Fig. 6.115, it would be evident that strict concavity is not necessary for the SOC. This is because the strictly convex ICs can also be obtained from the utility function given in part (b) of the figure, which is not strictly concave—in fact, not even concave.

The function in Fig. 6.115 is generally shaped like a bell. Of course, we have shown here only the ascending portion of the bell. The surface of this function is called strictly quasi-concave.

The geometric property of this function is that, for any pair of distinct points u and v in its domain, if the line segment uv (which is assumed to lie entirely in the domain) gives rise to the arc MN on the surface, and if M is lower than or equal in height to N, then all the points on arc MN other than M and N must be higher than M.

[Algebraically, a function f is said to be strictly quasi-concave if, for any two distinct points in its domain like u and v, and for all values of λ, 0 < λ < 1, we would have:

The quasi-concavity of the function in Fig. 6.115 may be verified by examining such arcs as MN (N higher than M) and M’N’ (M’ and N’ being of equal height). We have to note here that in the case of arc M’N’, it is the dotted arch that lies directly above the line segment u V, not the solid curve, which possesses the property of a quasi-concave function.

The interesting thing, however, is that the strictly concave function in Fig. 6.115(a) is also strictly quasi-concave.

From what we have obtained, we may conclude that only a smooth, increasing, strictly quasi-concave utility function would generate strictly convex ICs. Such a function may have convex as well as concave portions, as shown in Fig. 6.115(b) so that the marginal utilities may be either increasing or diminishing.

From this it follows that strict convexity of ICs does not imply diminishing MUs. However, if we accept the stronger assumption of a strictly concave utility function, then we may have the features of both diminishing MU and strictly convex ICs at the same time.