Let us make an in-depth study of the subjective factors affecting consumption function.

The subjective factors affecting propensity to consume consist of those psychological motives, which induce individuals to increase their consumption or to refrain from spending.

These motives affect both individual and corporate savings.

These psychological factors which make the individual save more are: precaution, foresight, family affection, old age security, improvement, enterprise, pride etc. In considering the subjective factors affecting propensity to consume, Keynes depicted greater realism than the earlier economists.

ADVERTISEMENTS:

Classical economists unduly oversimplified the psychological background to any decision to save, representing it merely as a choice between present and future consumption. Keynes, on the other hand, considered decision to consume or save as more than a choice between the present and the future consumption. He held that an individual who saves is often motivated by the above feelings. One would like to have sizeable bank balance to be able to walk with one’s head high, to leave a fortune to one’s heirs, to meet unforeseen contingencies or merely to satisfy one’s instincts of miserliness.

Keynes does not think that all the subjective motives impel one to reduce consumption. The corresponding motives which induce one to spend more on consumption are: enjoyment, better standard of living, recreation, generosity, miscalculation, extravagance and ostentations. The desire for ostentations and self-display usually leads to higher expenditure. A generous man may give away all his wealth to satisfy his instinct of recognition. An extravagant man may waste his money on picnics and recreation.

Similarly, there are motives like liquidity, initiative, enterprise improvement in techniques of production and financial prudence which induce governments, business companies and corporations to curtail consumption and increase saving. Enterprise implies the desire to do big things or to expand business; liquidity implies the desire to face emergencies; financial prudence calls for adequate financial provision against depreciation and the ability to discharge debts.

Initiative implies the desire to take lead in matters of successful management. The relative strength and importance of these factors however, depend upon the institutional and social set-up. A change in these subjective factors is not easy in the short period and as such consumption function becomes stable in the short-run.

ADVERTISEMENTS:

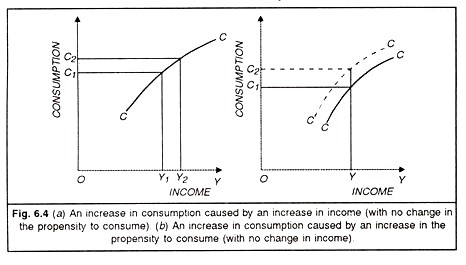

Fortunately, short-run changes in these subjective factors affecting propensity to consume are not likely to take place. As Keynes has remarked, these subjective consumption habits depend largely on “those psychological characteristics of human nature and those social practices and institutions which, though not unalterable, are unlikely to undergo a material change over a short period of time except in abnormal or revolutionary circumstances.” A knowledge of the objective factors which cause shifts in consumption function becomes important.