Budgetary control is a system whereby the budgets are used as a means of planning and controlling costs. Budgeting lays down as to what is to be attained and how it is to be attained while control ensures that the objectives are realised and actual results do not deviate from the planned course more than necessary.

CIMA has defined budgetary control as “the establishment of budgets relating to the responsibilities of executives to the requirement of a policy, and the continuous comparison of actual with budgeted results either to secure by individual action the objective of that policy or to provide a basis for its revision”.

Contents

- Introduction to Budget and Budgetary Control

- Definitions of Budget

- Definitions of Budgetary Control

- Features of Budgetary Control

- Features of a Budget

- Elements and Characteristics of a Budget

- Objectives of a Budget

- Objectives of Budgetary Control

- Techniques of Budgetary Control

- Classifications of Budgets

- Types of Budget

- Preliminaries to be Taken into Account for Effective Cost Control

- Essentials of Budgetary Control

- Functions of Budgetary Control System

- Budget Reports

- Responsibility Accounting

- Performance Budgeting

- Zero Base Budgeting

- Performance Report, Analysis of Budget Variations and Budget Follow-up

- Control Ratios

- Revisions of Budget

- Difference between Forecast and Budget

- Distinction between Flexible Budgeting and Zero Budgeting

- Difference between Flexible Budget and Fixed Budget

- Difference between Traditional Budgeting and Zero Base Budgeting

- Differences between Standard Costing and Budgetary Control

- Advantages of a Budget

- Advantages of Budgetary Control

- Limitations of Budgetary Control

- Problems of Budgetary Control

- Dangers in Budgeting

- Multiple Choice Questions and Answers

What is Budgetary Control: Definitions, Features, Objectives, Types, Preliminaries, Functions, Differences, Advantages, Limitations, MCQ and More…

Introduction to Budget and Budgetary Control

Budgets are one of the most important aspects of any system – be it domestic life, a corporate house or a nation. At home, we often make yearly, monthly, weekly or even daily budgets that would influence our expenses and savings. Budget of any organisation will tell you about it’s growth and expansion plans.

ADVERTISEMENTS:

Union Government Budget not only allocates resources for various programmes that decide our nation’s progress, it even affects you and me, as it determines the rate of income tax and other taxes which will affect everybody directly or indirectly.

At personal level, almost everybody make budgets for future plannings. Most people, rich or poor, make estimates of their income and plan expenditure for food, education, entertainment, savings, housing, clothing and so on. As a result of this exercise, people restrict their spendings to some predetermined, allowable amount. Knowingly or unknowingly most of us go through a budgeting process.

Budget of a business firm serve much the same purpose as the budget prepared by an individual. The business budgets are, however, prepared in detail and involve more work unlike personal budgets. Success of a business does not come by accident. That is why all commercial and service organisations need budgeting.

A budget is a formal expression of the management’s plans for the future and how these plans are to be accomplished. The act of preparing a budget is called Budgeting. An organisation may attain certain degree of success without budget, but it cannot reach that height that could have been reached with a well coordinated budgeting system.

ADVERTISEMENTS:

Modern business world is full of competition, uncertainty and exposed to different types of risks. This complexity of managerial problems has led to the development of various managerial tools, techniques and procedures useful for the management in managing the business successfully. Budgeting is the most common, useful and widely used standard device of planning and control.

The budgetary control has now become an essential tool of the management for controlling costs and maximising profit. Costs can be reduced, wastage can be prevented and proper relationship between costs and incomes can be established only when the various factors of production are combined in profitable way.

The resources of a business can be effectively utilised by efficient conduct of its operations. This requires careful working out of proper plans in advance, coordination and control of activities on the part of management.

A proper planning and control are essential for an efficient management. A good number of tools and devices are available. Of all these, the most important device used is budget. Cost accounting aims not only at cost ascertainment, but also greatly at cost control and cost reduction. Thus the management aims at the proper and maximum utilisation of resources available.

ADVERTISEMENTS:

It is possible when there is a pre-planning. Modern management aims that all types of operations should be predetermined in advance, so that the cost can be controlled at every step. The more important point is that the actual programme is compared with the pre-planned programme and the variances are analysed and investigated. All are familiar with the idea of budget, at every walk of life—state, firm, business etc.

Definitions of Budget

CIMA has defined budget as – “a plan quantified in monetary terms prepared and approved prior to a defined period of time usually showing planned income to be generated and/or expenditure to be incurred during that period and the capital to be employed to attain a given objective.”

A budget may be expressed in monetary as well as non-monetary terms, e.g., units of time, units of products, no. of employees, etc. A budget relates to a definite future period and is prepared in advance of the period during which it will operate. The purpose of the budget is to implement the policies formulated by the management to achieve a specified objective.

A budget is a detailed plan of operations for some specific future period. Many of us are familiar with the term ‘Budget’.

For instance, if we want to have a holiday trip to Kashmir, we are to estimate the cost of travelling, boarding, lodging etc. so as to have sufficient amount for the trip. On return from the trip, we may like to compare the actual amount spent with the estimated or budgeted figures. Similarly we can know the importance of budgets even from the household management.

The word ‘budget’ is derived from a French term “Bougette” which denotes a leather pouch in which funds are appropriated for meeting anticipated expenses. The same meaning applies to the business management.

A budget is a numerical statement expressing the plans, policies and goals of the enterprise for a definite period in the future. It is a plan laying down the targets to be achieved within a specified period. It is a final and approved share of a forecast. When forecasts are approved by the management as a tentative plan for the future they become budget.

The following are some of the important definitions:

1. “Budget is an estimate of future needs arranged according to an orderly basis, covering some or all of the activities of an enterprise for definite period of time”. —George R. Terry

ADVERTISEMENTS:

2. “A Budget is a comprehensive and coordinated plan, expressed in financial terms, for the operations and resources of an enterprise for some specific period in the future.” —James

3. “A budget is a predetermined statement of management policy during a given period which provides a standard for comparison with the results actually achieved.” —Brown and Howard

4. “A financial and/or quantitative statement, prepared prior to a defined period of time, of the policy to be pursued during that period for the purpose of a given objective.” —ICMA, England

Budgetary Control – Some More Definitions

Budgetary control is a system whereby the budgets are used as a means of planning and controlling costs. Budgeting lays down as to what is to be attained and how it is to be attained while control ensures that the objectives are realised and actual results do not deviate from the planned course more than necessary.

ADVERTISEMENTS:

According to J.L. Brown and L.R. Howard – “Budgetary control system is a system of controlling costs which includes the preparation of budgets, coordinating the departments and establishing responsibilities, comparing actual performance with the budgeted and acting upon results to achieve maximum profitability.”

According to J. Batty-“Budgetary Control is a system which uses budgets as a means of planning and controlling all aspects of producing and/or selling commodities or services.”

From these definitions, it is clear that budgetary control operates through different budgets. It aims at laying down a policy, coordinating the different activities of the business and exercising necessary control so that the individual targets set by different budgets can be achieved.

The targets set up under the system are such that they can be directly compared with the actual performances, and the difference, if any, can be traced to an individual who is responsible for the same. This building up of a sense of responsibility in accounting is the main feature of budgetary control.

ADVERTISEMENTS:

CIMA has defined budgetary control as “the establishment of budgets relating to the responsibilities of executives to the requirement of a policy, and the continuous comparison of actual with budgeted results either to secure by individual action the objective of that policy or to provide a basis for its revision”.

Budgeting is the whole process of planning, implementing and operating budgets.

Budgetary Control – Main Features

The main features of budgetary control are:

(i) Establishing budgets for each functional area e.g., sales, production, purchase, etc., the policies and various activities which might be adopted for achieving them.

(ii) Recording actual performance of each functional area.

(iii) Analysing the reasons of variances and identifying the persons responsible.

ADVERTISEMENTS:

A budget may be expressed in relation to:

(a) Time – Short-term and Long-term Budget;

(b) Behaviour – Fixed and Flexible Budget; and

(c) Functions – Sales Budget, Production Budget, Cash Budget, etc.

Some of the other features are:

(i) Targets/Objectives –

ADVERTISEMENTS:

To determine the targets / objectives to be achieved during the budget period, and the policy or policies that might be adopted for the achievement of these objectives.

(ii) Activities –

To determine the various activities that should be undertaken for achieving the objectives.

(iii) Plan for each activity –

To draw a plan or a scheme of operation for each class of activity in physical as well as monetary terms for the full budget period and its parts. The budgets prepared for various departments/ activities are consolidated to prepare a master budget consisting of the budgeted profit and loss account and the balance sheet.

(iv) Comparison / ascertain causes –

ADVERTISEMENTS:

To lay a system of comparison of actual performance of each person, section or department with the relevant budget and to ascertain the causes for the variations / discrepancies, if any.

(v) Remedial action –

To ensure that corrective action is taken where the plan is not being achieved and, if that be not possible, the plan will be revised.

In brief, budgetary control system assists the management in the allocation of responsibility, authority and planning for the future. It facilitates the analysis of the variation between budgeted targets and actual performance.

The budgetary control system develops a proper basis of measurement or standards for evaluating the efficiency of operations. It enjoys equal prominence in both non-profit and profit seeking organisations.

For effectiveness of budgetary control, an organisation should also have standard costing system in operation. The whole organisation should be so integrated that all lines of authority and responsibility are laid, allocated and defined.

ADVERTISEMENTS:

This is essential since the system of budgetary control assumes a separation of various functions and a division of responsibilities. It presupposes that the organisation shall be so planned that everyone, from the managing director down to the shop foreman, will have his duties properly defined.

Features of a Budget

A budget is a blueprint for management action. It is a vital tool for carrying out effective short-term planning and control in firms.

The following are the features of a budget:

(a) One Year Duration –

Generally, budgets are prepared annually. However, for seasonal business, such as – fruit canning, ice-cream, apparels, etc., there may be biannual budgets – a slack season budget and a peak season budget.

(b) Estimation of Business Unit’s Profit Potential –

It shows how much profit or loss a business unit is expected to make and thereby reveals its profit potential.

(c) Appraisal of Performance –

At the end of a specified period, actual performance is compared with the budget and deviations are ascertained. These deviations which are known as variances are analysed by causes and responsibility centres.

(d) Monetary Terms –

The figures in the budget are expressed in monetary terms. However, the monetary figures are supported by nonmonetary information, namely units purchased, units manufactured, units sold, etc.

(e) Alteration of Approved Budget Under Specified Conditions –

After the budget has been approved by the top management, the same cannot be altered except under specified conditions.

(f) Review and Approval by a Higher Authority –

The budget proposal which is prepared by the budgetee is reviewed and approved by an authority same or lower than the budgetee.

(g) Managerial Commitment –

The budget is essentially a commitment made by the manager of responsibility centres. They agree to shoulder responsibility for the purpose of achieving the budgeted objectives.

Elements and Characteristics of a Budget

The following are the basic elements of a budget:

i. Budget is a comprehensive plan of what the enterprise endeavors to achieve.

ii. It provides yardsticks and measures for the purpose of comparison.

Characteristics:

The following are the main characteristics of a budget:

i. A budget is prepared for a definite future period of time (Budget period).

ii. It is prepared in advance and is based in future plan of action.

iii. It is a statement prepared in monetary value or physical units or both.

iv. It is approved by the management before its implementation.

v. It is prepared for implementation of policy formulated by the management and achievement of objectives.

5 Main Objectives of Budget

The main objectives of budget are as follows:

1. One important objective of budget is planning. The existence of a budget forces managers to think for future, trying to anticipate possible problems and their solutions.

2. Another objective of budget is coordination. Without coordination the departmental heads may follow courses which are beneficial for their departments, but may not be beneficial for the organisation as a whole.

For example, the purchase manager could be interested in buying materials in large quantity for availing good discount. However, holding of large quantity of materials in stock will increase the loss of materials and ultimately the organisation may suffer.

3. Another objective of budget is to provide motivational impetus. The budget can be a useful device for motivating managers to perform in line with the objectives of the organisation.

4. Budget is a good device for communicating plans to various managers. With the help of budget, top management communicates its expectations to lower level management so that the goals of the organisation are achieved.

5. Budget is most widely known as a device for control. Control is exercised by comparing the actual cost or expenditure with the budgeted cost. Failure to meet expectations as shown by the budget, points immediately to the need for some corrective actions.

Budgetary Control Objectives – Planning, Coordination, Control, Optimum Employment of Capital, and Responsibility Accounting

The objectives of budgetary control system are usually summarised under five heads:

1. Planning,

2. Coordination,

3. Control,

4. Optimum employment of capital, and

5. Responsibility accounting.

Objective # 1. Planning:

A budget is nothing but a plan. Budgeting involves drawing up detailed plans relating to different functions like production, sales, raw material requirements, labour requirements, research programmes, etc. When plans are made in advance, many problems are anticipated long before they arise and solutions can be sought through careful study.

Objective # 2. Coordination:

Coordination is the process whereby different sections of a business work towards achievement of the common goal. Budgets provide a means of coordination for the business as a whole. While making budgets, various factors like production, sales, etc., are balanced and coordinated.

Objective # 3. Control:

Control is the action necessary to ensure that planned objectives are being achieved. Budgetary control makes control possible by comparing the actual performance against planned performance and taking action on the basis of variations between the two.

Objective # 4. Optimum employment of capital –

The resources required for achieving the firm’s objectives are estimated and are made available.

Objective # 5. Responsibility accounting –

Each individual is entrusted with well-defined responsibilities and they are made accountable.

Budgetary Control – Techniques

The technique of budgetary control involves the following:

i. Establishment of a budget for each activity or section of the organisation.

ii. Establishment of budgets for each function like sales, production, purchase, etc.

ii. Measurement of actual performance.

iii. Comparison of actual performance with budgeted performance to find out variations, if any.

iv. Ascertainment of the reasons for such variations and taking suitable remedial action.

Broadly speaking, budgetary control is a system of achieving the firm’s objectives with minimum possible cost. Like standard costing, budgetary control also provides a powerful tool to the management for efficient performance of its functions.

Classification of Budgets – On the Basis of Functions, Nature of Transactions, Activity Levels, Miscellaneous and Cash Budget

Budgets may be classified into 5 types on the basis of:

A. Functions involved.

B. Nature of transactions.

C. Activity levels.

D. Miscellaneous Budgets, and

E. Cash Budget.

Classification # A. Functional Budgets:

1. Sales budget.

2. Production Budget.

3. Direct Materials Budget-

(a) Consumption budget; and

(b) Purchase Budget.

4. Direct Labour Budget-

(a) Labour hours requirement;

(b) Availability;

(c) Manpower budget; and

(d) Labour cost budget.

5. Overheads Budget-

(a) Manufacturing;

(b) Administration;

(c) Selling; and

(d) Distribution

6. Plant utilisation Budget-

(a) Machine hours requirement;

(b) Availability;

(c) Purchase of additional equipment;

(d) Disposal of surplus equipment.

7. Production Cost Budget.

Classification # B. Nature of Transactions:

There are two nature of transactions:

1. Operating Budget, i.e., revenue budget.

(a) Programme Budget

(b) Responsibility Budget

2. Capital Budget.

1. Operating Budget:

It shows the planned operations for the future period and includes all the functional budgets. It includes production cost budget, budgeted profit and loss statement and budgeted balance sheet.

(a) Programme Budget:

Separate budgets are set for each plan of the concern.

(b) Responsibility Budget:

Budgets are set for operation by a department or by an executive responsible for it. In this system, executives are responsible not only for control of costs but also for achieving the goals of their departments.

They have to submit various reports to the management indicating the large variances keeping the principles of Management by Exception (MBE) and Management by Objectives (MBO) in the mind.

2. Capital Budget:

It relates to capital expenditure and budgeted investment in fixed assets. It is also related to the capital structure, liquidity, loan capital and overdraft facilities. It includes working capital budget also.

Classification # C. Activity Levels:

1. Fixed Budget.

2. Flexible Budgets.

Classification # D. Miscellaneous Budgets:

1. R and D Budget.

2. Advertising Cost Budget.

3. Maintenance Costs Budget.

Classification # E. Cash Budget:

Annual Cash Budget is first prepared incorporating capital receipt, revenue income, capital expenses, revenue expenses, repayments of loan and receipt of loan etc., and then it is divided into monthly cash budgets.

Budgetary Control – Types of Budget

Type # 1. Fixed Budget:

A fixed budget is a budget which is used unaltered during the budget period. It is prepared for a particular activity level and it does not change with actual activity level being higher or lower than budgeted activity level. In other words, this budget does not highlight the ‘activity variance’, i.e., the change accountable for actual activity level being different from budgeted activity level.

A budget may be prepared for, say, 1,00,000 units. Actual activity level may be say, 1,20,000 units. If it is a fixed budget, then absolute differences of budgeted figures and actual figures will be found out without any type of adjustment for change in level of activity. A fixed budget may roughly meet the needs of profit planning, but it is almost completely inadequate as a cost control technique.

Following are the disadvantages of fixed budget:

i. It is misleading. A poor performance may remain undetected and a good performance may go unrealised.

ii. It is inadequate for control purposes.

iii. It violates logic. Based on logic, comparison should be made between two things with a like base. When fixed budget is used, budgeted costs at budgeted activity are compared with actual costs at actual activity, i.e., two things with two different bases are compared.

There is no criterion to immediately highlight good or bad performance. Still, some companies defend the use of fixed budget maintaining that their operation is very stable and the variation in activity is so slight that activity changes will have little effect on either budget or actual cost.

This may be true in exceptional cases, but in general this is difficult to believe. For this reason fixed budget have got only theoretical relevance.

Type # 2. Flexible Budget:

“A flexible budget is a budget which, by recognising different cost behaviour patterns, is designed to change as volume of output changes” — CIMA.

It is designed to furnish budgeted cost at any level of activity actually attained. Flexible budget is also known as variable or sliding scale budget. The main characteristic of flexible budget is that it shows the expenditure appropriate to various levels of output.

If the volume changes, the expenditure appropriate to it can be established from the flexible budget for comparison with actual expenditure as a means of control. The flexible budget provides a logical comparison of budget allowances with actual cost, i.e., a comparison with a like basis. When flexible budget is prepared, actual cost at actual activity is compared with budgeted cost at actual activity, i.e., two things to a like base.

Flexible budgeting helps both in profit planning and operating cost control. When flexible budget is prepared, budgeted cost allowances are adjusted according to actual activity of the operation. Actual activity usually varies from budgeted activity and consequently budgeted cost allowances are adjusted according to actual level of operations. With flexible budget, it is possible to establish budgeted cost for any range of activity.

For preparation of flexible budget, items of costs have to be analysed individually to determine how different items of costs behave to changes in volume. Therefore, in depth cost analysis and cost identification is required for preparation of flexible budget. This cost analysis and cost identification will involve categorising the expenses as fixed, variable and semi-variable. Fixed items of expenditure will be the same for all level of activity.

For items of variable expenditure, rate per unit of activity is determined and based on this relationship variable expenses for any levels of activity can be found out. Extra efforts are made in analysing semi-variable items of expenditure in fixed and variable elements. Actually a flexible budget constitutes a series of fixed budgets, i.e., one fixed budget for each level of activity.

Budget Cost Allowance/Flexed Budget:

“CIMA defines it as the budgeted cost ascribed to the level of activity achieved in a budget centre in a control period. It comprises variable costs in direct proportion to volume achieved and fixed costs as a proportion of the annual budget.”

Method of Graphic Presentation:

Another method of preparing flexible budget is the graphic method. Under this method, an estimate is made of fixed and variable expenses at various levels of activity. The figures, thus, derived are plotted on a graph paper to get the curves for these levels. It is very easy to find budget cost allowance for a particular level through this method.

Difference between Flexible Budgets and Fixed Budgets:

The basic and vital difference between fixed budgets and flexible budgets should be thoroughly understood:

Under fixed budgets, budgeted cost as per budgeted activity is compared with actual cost as per actual activity.

Under flexible budgets, budgeted cost as per actual activity is compared with actual cost as per actual activity.

This point constitutes the most vital difference between flexible budgets and fixed budgets.

Type # 3. Basic Budgets:

These budgets are made for use unaltered over a long period of time. These budgets are not updated, as the conditions change. Revisions of pay scales or changes in price of material will not lead to changes in these budgets.

The main shortcoming of these budgets is that changed conditions give rise to variances, which obscure operating variances. These budgets are not very good for control purposes.

Type # 4. Current Budgets:

These budgets are established for use over a short period of time and are related to current conditions. These budgets dominantly highlight operating variances. Variances purely due to changed conditions are reduced to the minimum. These budgets can be referred to as effective control devices.

Type # 5. Appropriation Budgets:

These budgets set out a limit for a particular type of expenditure like capital budgeting, advertising and research. Budgeted amount becomes the maximum limit that can be spent for a given item of expenditure.

These budgets are used when effectiveness of expenditure is difficult to measure. Government budgets are mostly appropriation budgets. In business and industry capital expenditure budgets are only this type of budgets.

Type # 6. Capital Expenditure Budgets:

It is a plan for proposed outlay on fixed assets like land, building and plant and machinery. These budgets are long-term budgets. Proper care should be taken to bring about harmony between capital expenditure budget and operational budgets.

Type # 7. Departmental/Functional Budgets:

CIMA defines it as a budget of income and/or expenditure applicable to a particular function. A function may refer to a department or a process.

Functional budgets frequently include –

(i) production cost budget (based on a forecast of production and plant utilisation;

(ii) marketing cost budget, sales budget;

(iii) personnel budget;

(iv) purchasing budget;

(v) research and development budget.”

Type # 8. Rolling/Continuous Budgets:

According to CIMA it can be defined as a budget continuously updated by adding a further period, say a month or quarter and deducting the earliest period. Beneficial where future costs and/or activities cannot be forecast reliable. For preparation of these budgets, budgeting is a continuous process.

As the month or a quarter passes, forecast for that period is dropped and a forecast for a further month or quarter is added in such a way that always a twelve month forecast is available. These budgets prove to be very costly, but operational variances are considerably reduced by use of these budgets.

Type # 9. Performance Budgets:

It is an adjusted budget prepared after operations to compare actual results with cost, that should have been incurred at actual level attained.

Type # 10. Line Item Budget (Govt.):

The listing of cost by subject, such as salaries, stationery and advertising.

Type # 11. Operating Budget:

Budget of the profit and loss account and its supporting schedules.

Type # 12. Summary Budgets:

A summary budget summarises all functional budgets.

The end products of summary budgets are –

(i) the budgeted profit and loss; and

(ii) the budgeted balance sheet.

Type # 13. Master Budget:

The summary budget is reviewed, readjusted and re-budgeted till a satisfactory budget is drafted. This budget is then accepted by top management and only after receiving acceptance of top management it is called a Master Budget. Master budget is a summary budget, which has been formally accepted by top management. Compromise may be necessary before a summary budget becomes a Master Budget.

Type # 14. Zero-Base/Priority-Base Budgeting:

A method of budgeting whereby all activities are-re-evaluated each time a budget is set. Discrete Levels of each activity are valued and a combination chosen to match funds available.

Budgetary Control – Preliminaries to be Taken into Account for Effective Cost Control

For the purpose of effective cost control, the system of budgetary control should take into account the following preliminaries –

1. Creation of Budget Centres:

An organisation is broken down into a number of budget centres to facilitate the control of planned activities. A budget centre refers to a department or other location to which income or expenses may be attached and of which the responsibility is borne by an individual.

The Institute of Cost and Management Accountants defines a budget centre as “a section of the organisation of an undertaking defined for the purposes of budgetary control.” For each budget centre, a separate budget is prepared.

2. Introduction of Suitable Accounting Records:

The preparation of various budgets for the purpose of budgetary control, requires the provision of adequate accounting records. As such, it is necessary that accounting system should be able to provide the required information in an analytical form.

For this purpose, a chart of accounts corresponding with the budget centres should be maintained.

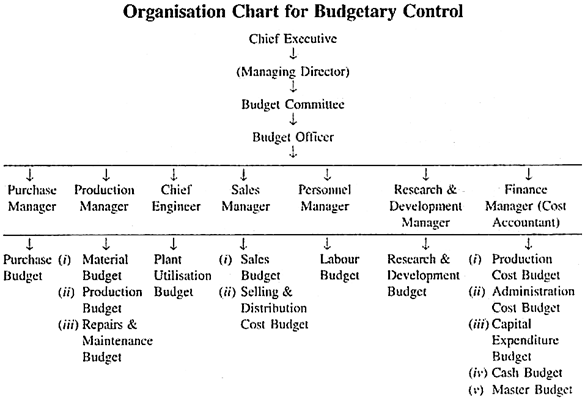

3. Preparation of Organisation Chart:

There should be a well-defined organisation chart for budgetary control. This organisation chart shows the functional responsibilities of each executive and assists him in ascertaining his position in the organisation and his relationship with other executives.

The design of the organisation chart shall depend upon the nature and size of the organisation but a simple organisation chart may be given as follows –

4. Setting Up of a Budget Committee:

In small concerns, the preparation of the budget is usually the responsibility of Accountant or Cost Accountant. In large concerns, the preparation of the budget is entrusted to a Budget Committee which is headed by the Chief Executive of the organisation.

The budget committee is composed of the representatives of various departments e.g., Sales, Production, Purchases and Works Engineering etc. The responsibility for operating the system of budgetary control is undertaken by the Budget Officer who is a senior member of the Accounting Department.

The main functions of a Budget Committee are:

(a) To receive and scrutinise different budget estimates;

(b) To decide detailed policy to be followed;

(c) To suggest revision of functional budgets, where necessary;

(d) To approve budgets; and

(e) To receive and to deal with budget and comparison statement and to recommend action to be taken under the circumstances.

5. Preparation of a Budget Manual:

In large undertakings, generally, a Budget Manual is prepared which guides the Budget Officer and various departmental heads.

Budget manual is a document which contains:

(a) Standard instructions for compilation of budgets.

(b) Specific responsibilities and limits of each executive concerned with the budget.

(c) Method of compilation of the various schedules and coordinating with related figures of some other schedule.

6. Fixation of the Budget Period:

Budget period is defined as the period for which a budget is prepared and employed. There is no specific rule governing the selection of the budget period but it should neither be too long nor too short.

In case budget period is too short, it will be very difficult to compare it with the actual performances. If it is too long, the budgets may not conform with actual conditions and therefore, the comparison of two unlike figures will not serve any purpose. The budget period is determined by the nature of the budget to be prepared.

7. Determination of the Key Factors:

In the preparation of the budgets, it is necessary to consider the key factor/factors. A key factor is also known as ‘Limiting Factor’ or ‘Principal Budget Factor.’ Key factor refers to any factor or reason which limits the production or sales.

The influence of the key factor must be assessed first in order to ensure that functional budgets are reasonably capable of fulfilment.

The following is a list of principal key factors and their causes which will influence the target of the business concern:

(A) Material:

(i) General shortage of Raw Materials

(ii) Seasonal shortage

(iii) Restrictions on imports

(iv) Restriction of quota or licence.

(B) Labour:

(i) Overall shortage of workers

(ii) Shortage of particular type of skilled workers

(C) Plant:

(i) Shortage of plant and machinery

(ii) Shortage of capital/funds

(iii) Shortage of space/accommodation for plant

(iv) Bottlenecks in different processes.

(D) Sales:

(i) Consumer Resistance

(ii) Inadequate Advertising

(iii) Shortage of sales force

(iv) Dumping by a foreign country

(E) Management:

(i) Lack of capital

(ii) Lack of technical knowledge

(iii) Shortage of experienced managers.

In most of the business concerns, sales is the most important key factor. If a limiting factor cannot be avoided by any means, then all the functional budgets will have to be built around that factor.

8. Determination of Level of Activity:

For the purpose of planning production and controlling costs, it is necessary to establish the normal level of activity of the business concern. Normal level of activity is the level of activity at which the business concern is expected to operate under the present conditions.

The budget estimates should also provide for necessary allowance to the made in the budget figures and suggest what the figure should have been with the level of activity actually attained.

9. Budget Officer or Budget Controller:

A ‘Budget Officer’ or ‘Budget Controller’ is appointed to link up the various operations to bring them together and to coordinate their efforts in the matter of the preparation of budgets. Budget Officer is more or less the Secretary to the Budget Committee.

But it should be remembered that Budget Controller does not control the preparation of budgets. He is an advisor and he does not issue instructions.

His principal duties are:

(i) To render assistance in the preparation of various budgets and their coordination and compilation into the Master Budget.

(ii) To compile information about actual performance on a continuous basis, comparing it against the budgeted figures, ascertaining cause of variances and preparing reports based thereon and sending them to appropriate executive.

(iii) To bring to the notice of the management the need for revision of budgets.

(iv) To compile information of all types for the purpose of efficient preparation of budgets.

Budgetary Control – Top 11 Essentials for the Implementation of Budgetary Control System

Successful implementation of a budgetary control system depends upon the following essentials:

(a) Support by Top Management:

Budgeting alters the method, working, habits of personnel and their inter-relationship. As such, there is bound to be some resistance to change. Further, budgets should be prepared and implemented by all managerial personnel.

Hence, budgeting should have the full support and cooperation of every member of the management team. However, the impetus and direction should come from the top. The wholehearted support of top management is bound to ensure the active support of the line managers also.

(b) Formal Organisation:

The existence of a formal and sound organisation structure is of an absolute necessity for an effective system of budgetary control. Organisation structure, together with its pictorial representation, viz., organisation chart, clearly lay down the authority relationship of the managerial personnel and other executives. Every member of the organisation knows clearly the scope of his authority and responsibility.

(c) Budget Centers:

Establishment of budget centers is yet another essential of effective budgetary control system. The CIMA Official Terminology defines a budget center as “a section of an entity for which control may be exercised and budgets prepared.”

For budgetary control purposes, the entire organisation will be split into number departments, area or functions, known as ‘centers’ and budgets will be prepared for each such center.

(d) Clear-Cut Objectives and Reasonably Attainable Goals:

Enterprise objectives representing goals should be clear and unambiguous. They should be equally realistic and capable of achievement. If goals are too high to be attained, the purpose of budgeting is defeated. The administration of budgets is also rendered useless.

On the other hand, if the goals are so low that they can be attained very easily, there will be no incentive to special effort since such goals will not be a real challenge.

(e) Preparation by Responsible Executives:

Every executive responsible for the implementation of budgets should be given an opportunity to take part in the preparation of budgets. In other words, a budget should be ‘participative’ or ‘bottom-up’ budget rather than top-down or ‘imposed’ budget.

‘A budgeting system in which all budget holders are given the opportunity to participate in setting their own budgets” is, according to the CIMA Official Terminology, known as ‘participative budgeting.’

(f) Budget Committee:

The work of preparing a budget manual should be entrusted to a Budget Committee. The manual should specify the steps to be taken to prepare budgets. It is also the duty of the Budget Committee to lay down the form in which budgets should be prepared.

The work of scrutinising the budgets as well as approving of the same should be the work of this Committee.

(g) Comprehensive Budgeting:

Budgeting should not be partial, covering one or two business functions only. It should cover all the functions. Further, budgeting should not be a temporary phenomenon. Once budgeting work is taken up, it should be made a permanent feature.

(h) Adequate Accounting System:

Historical data form the basis for the budget estimates. As such, those who are involved in the preparation of estimates depend heavily on the accounting department. Further, figures in respect of actual costs and revenue are periodically compared with those of the budgeted figures.

Budget procedures should, therefore, be developed in such a way that they employ the same Classification of accounts in respect of revenue and expenses as those of the accounting department.

If classifications are not similar, comparison would be meaningless. It is also necessary that the budgetary plan should follow the organisation chart and accounts should be classified in terms of authority and responsibility to facilitate the introduction of a system of responsibility accounting.

(i) Periodic Reporting:

Budgetary control to be effective, there is the need to have a prompt and timely communication and reporting system. Periodic comparison of the actual performance with the budgeted standards may reveal variances. These variances should be reported by those responsible for execution, to their superiors. In turn, they should get instructions for correction of deviations.

(j) Budget Education:

Successful implementation of budgets depends, to a very large extent, upon the interest evinced by the supervisory personnel. The best way of making them actively interested in the budgetary control programme is to impart to them a continued budget education, by briefing them on the objectives, potentials and techniques of budgeting.

It is also necessary for the budget director to come into close contact with the supervisory personnel. He should discuss with them problems pertaining to budgets and welcome suggestions from them for improving budget procedures.

(k) Knowledge of Uses and Limitations of Budgeting:

Persons in the organisation responsible for budgeting and budget implementation should understand clearly the usefulness and limitations of budgeting. No one should entertain the feeling that budgets are imposed on the personnel and that he should participate mechanically in the preparation and implementation regardless of whether he likes it or not.

He should be made to appreciate the need for budgeting, knowing at the same time, and the limitations of budgetary control.

Top 8 Functions of Budgetary Control System

Non-budgetary control devices support the successful functioning of the budgetary control system.

These include the following:

Function # 1. Statistical Data:

The performance of the departments need to be captured and presented in terms of tables, charts and graphs from time to time for periodic assessment and review.

Function # 2. Special Reports and Analysis:

Analytical reports and industry trends and patterns need to be prepared in advance to provide a direction and guidance with the help of industry experts and specialists engaged for the specific task.

Function # 3. Break-Even Analysis:

This analysis shows the impact of changes in costs; volume of production and sales on profit. Also, it shows how much minimum volume is to be produced to cover the expenses and prevent losses. This is also called profit planning and control tool.

Function # 4. Internal Auditing:

The purpose of Internal audit is to verify whether the financial transactions are properly reported, accounted for and reflected in the financial statements or not. Internal auditing is carried out by company’s internal auditors to assess whether the accounts are properly maintained by the company.

The purpose of internal audit is to keep all accounts ready for external audit. Any type of irregularity or violation of accounting norms and standards are reported internally and these are addressed before the external audit commences. In other words, internal audit sets the tone and context for external audit.

Function # 5. Time-Event Network Analysis:

To ensure that the projects are completed without any cost or time over runs, network analysis is deployed. Network analysis has two parts – Programme Evaluation and Review Technique (PERT) and Critical Path Method.

Here the projects are analysed in terms of activities and events, identification of critical path, probability of completing the project within scheduled time, determination of cost slope and crashing the project so that the projects are completed within the schedules with optimum expenditure.

Function # 6. Standard Costing and Variance Analysis:

Standard costing is a process of formulating material standards, labour standards and overheads standards and verifying whether the actual expenses are within the given standard are not. Where there is difference between the actual and standard expenses, it is called variance. The manager’s job is to ensure that the variances are reduced to minimum

Function # 7. Ratio Analysis:

Ratio analysis shows the relationship between two factors. Ratio analysis is a financial analysis tool used to examine whether the liquidity, solvency and profitability of the enterprise are within the acceptable standards or not.

Function # 8. Personal Observation:

Managers need to spend time by going around the departments, speaking to the employees so that they can get first-hand information about what is happening around. By going around the departments, senior managers may come across many issues which cannot be put on paper but critical in nature can be sorted out on time.

Budget Reports (With Reasons)

Preparation of functional budgets is the planning function. Their implementation is, however, the controlling function. As such, mere preparation of budgets does not serve any useful purpose. They should be implemented, i.e., put into practical use. In the course of doing it, it is equally necessary to compare the actual performance with the budgeted performance.

At the commencement of the budget period, each manager will receive a copy of the budget relating to his business segment. Acting within his scope of authority, every departmental manager proceeds with the work of implementation of budget relating to his sphere of activity.

If, in the course of implementation, it is found that everything proceeds exactly according to what is laid down in the budget, no deviation is said to occur. The result revealed by the financial statements will coincide with that projected by the master budget.

However, there may be deviations or discrepancies between the actual performance and budgeted performance. These deviations are of vital interest to management. The best way of bringing these deviations to the knowledge of management is through budget reports. In order that the budget programme may serve management as a control device, systematic plan of performance evaluation and reporting should be established.

Daily, weekly or monthly reports should be prepared by the cost office and sent to management. These reports should show comparison between the budgeted cost and actual cost as well as deviations, if any.

Management is interested in the deviations for the following reasons:

(i) To know if there is any error in budgeting due to wrong assumptions, carelessness, etc.

(ii) To take remedial action, and

(iii) To revise the budgets, if necessary.

The budget reports should be prepared in such a way that they locate the responsibility of a department or an executive for the deviations. While reporting, attention of management should be drawn to controllable costs.

A budget report is essentially a control report. As such, its utility is lost if it is not sent in time to the authorities responsible for control. However, the frequency of reports depends entirely upon the nature of duties of the executive using the report.

Control reports will, usually, be in the form of tabulated statements, although sometimes, the necessary information may be conveyed in the form of diagrams and charts. Every report should have a distinct heading and it should mention the period covered. The names of persons preparing the reports as well as those receiving the same should be mentioned. The report should be clear and concise.

While reporting, the attention of management should be drawn only to the exceptions and not to those events and transactions which have proceeded as planned. In other words, the guiding principle, ‘management by exception’ should be followed while making budget reports.

Budgetary Control – Responsibility Accounting (With Concept)

Responsibility accounting is the method of accounting in which costs are identified with persons assigned to their control rather than with products of functions. In this system division of units of an organization under specified authority of a person are developed as a responsibility centre and evaluated individually for their performance.

The Concept:

A responsibility centre is a subunit of the organization whose manager is responsible for a specified set of activities.

A responsibility centre may be a cost centre, a profit centre, or an investment centre. The manager of a cost centre is responsible for keeping costs within targets established by the budget. A profit centre manager is responsible for achieving the target profit. An investment centre manager is responsible for achieving the target ROI or EVA.

A responsibility accounting system measures the operating results of responsibility centres. It facilitates the delegation of authority. Under this system of control the performances of managers, who are not expected to seek routine guidance from their superiors in decision-making, are evaluated by comparing actual results with budget targets, standards, etc. Thus, this system provides autonomy without diluting controls. It motivates managers to achieve high performance.

Performance Budgeting (With Steps)

It is a new approach to budgeting which lays emphasis on work done or services rendered. It focuses attention on the physical aspects of achievement. In this new approach, there is not only a financial plan but also a work plan in terms of work done or end products produced or services rendered. Performance budget tries to give a broader view as a programme of action rather than an instrument for obtaining funds.

It states that performance evaluation should not be simply based on the spending limit rather than on the cost/output relationship. It is a more effective management control relating costs to results. A precise definition of work to be done and a careful estimate of what that work will cost is made. It marks the integration of input with the outputs of a development programme.

Performance budgeting is essentially a process which involves the following steps:

i. An activity is classified in terms of functions, programmes and activities.

ii. There is a measurement of financial and physical activities.

iii. The progress report of performance is made to management at periodical intervals.

iv. It needs restructuring of the accounting system.

Therefore, performance budgeting is one which looks to obtain the physical measures of work effort and results by establishing a relationship between financial and physical content of the programme.

They are useful not only for the business organizations but also to the government and non-profit making organizations, if the organizations’ focus is towards spending resources than obtaining results. With the introduction of input output concept, an appropriation budget tries to establish fixed amount which can be applied to achieve the objectives of the organization.

Zero Base Budgeting (ZBB) – Meaning, Concept, Areas, Process, Questions, Steps, Advantages and Limitations

Zero Base Budgeting was developed to overcome the limitations of ‘Traditional’ Budgeting. At the time of preparing a ‘Traditional Budget’, the last year’s figures are taken as – ‘Base’ and a percentage is added for inflation and making adjustment for any unusual factors or incremental changes.

Zero Base Budgeting (ZBB) starts from the position of zero previous expenditure and managers are required to justify all budgeted expenditures. The base line is zero rather than the previous year’s budget. It takes the view that every item of expenditure incurred in any activity should be re-evaluated and re-assessed and fixed. Actual figures of the last year are virtually ignored.

Concept of Zero-Base Budgeting:

The concept of zero-base budgeting is of recent origin and was originally developed by Peter A. Pyhr in Texas Instruments of U.S.A. and later on introduced by Ex-President Jimmy Carter of U.S.A., then Governor of the State of Georgia, as a means of controlling state expenditure.

Peter A. Pyhrr has defined zero-base budgeting as “an operating planning and budgeting process, which requires each manager to justify his entire budget request in detail from scratch (hence zero base) and shifts the burden of proof to each manager to justify why he should spend any money at all.”

The ‘zero-base’ refers to a “nil budget’ as the starting point. As an activity is budgeted, costs are objectively budgeted. It starts with the premise that the budget for the next period is ‘zero’ so long as the demand for a function, process, project or activity is not justified.

The assumption is that without such justification no spending will be allowed. Each manager is responsible to justify why the money should be spent at all and to explain in detail as to what would happen if the proposed activity is not carried out and no money is spent.

Thus, each manager or functional head in the organisation, is required to make cost-benefit-analysis of each of the activities or projects under his control and for which he is responsible. Hence, ‘Zero- base Budgeting’ is a resource planning and redeployment process rather than a cost reduction control.

Areas where Zero-Base Budgeting is Applicable:

Zero-base Budgeting is more suitably applicable to discretionary cost areas. These costs may have no relation to volume or activity and generally arise as a result of management policies. Where standards are determinable, those costs associated with the inputs should be controlled through the use of standard costing.

On the other hand, if output as a function of input cannot be specified. Zero-base Budgeting may be more suitably applied. Thus, service or support- type activities are more suitable for Z.B.B.

Process of Zero-Base Budgeting or Steps Involved in Zero-Base Budgeting:

The process of zero-base budgeting involves the following steps:

(i) Identification of ‘Decision units.’

(ii) Preparation and development of decision packages.

(iii) Ranking of priority.

(iv) Approval and Funding.

(i) Identification of Decision Unit –

A decision unit refers to a tangible activity or group of activities for which a single manager has the responsibility for successful performance. Thus, decision unit is a programme or a project or a segment of the organisation for which separate budgets are to be prepared.

(ii) Preparation of Decision Packages –

Preparation of decision packages is a set of documents which identify and describe activities of the unit in such a way that the management can evaluate and rank them against others competing for resources (limited) and decide whether to approve or disapprove.

(iii) Ranking of Priority –

The third step involved in Z.B.B. is the ranking of proposed alternatives included in decision packages for various decision units or of various decision packages for the same decision unit.

(iv) Funding –

Funding involves the allocation of available resources of the organisation to various decision units keeping in mind the alternative which has been selected and approved through ranking process.

Some basic questions may need to be answered by each manager, such as:

(i) What is the need for this particular activity?

(ii) How much will it contribute towards achieving the objectives of the organisation?

(iii) How much expenditure will be needed?

(iv) Is there a more cost-effective way of carrying it out?

ZBB is popular with Not-for-Profit organisations, local authorities and government departments. Manufacturing organisations use ZBB for service and support activities.

Steps in Implementing ZBB:

The following steps are generally followed for implementing the ZBB:

Step 1 – Managers identify ‘decision units’, a unit may be a department, an area of activity (e.g., marketing), etc.

Step 2 – ‘Decision packages’ are developed based on ‘decision unit’. Decision packages are evaluated using cost benefit analysis.

Step 3 – Decision packages are ranked based on cost benefit analysis. Uneconomical decision packages are excluded.

Step 4 – Budget resources are allocated according to the ranking.

Advantages of Zero Base Budgeting:

1. It helps to allocate scarce resources of the organisation in a more efficient and equitable manner.

2. It reduces the wasteful expenditure by eliminating inefficient operations.

3. The managers are forced to take budgeting more seriously.

4. It helps to identify activities that do not contribute towards organisational objectives.

5. It challenges the status quo and encourages a questioning approach to activities and expenditure.

6. It requires considerable documentation. It provides an in-depth appraisal of an organisation’s activities.

Limitations of Zero Base Budgeting:

1. It is too time consuming and too costly for small organisations.

2. In a manufacturing organisation scope of implementing ZBB is very limited.

3. Wrong cost benefit analysis may hamper the future growth of the organisation. For example, cutting of present advertisement costs may affect future sales.

4. Conflict between departments may affect the overall profitability of the organisation.

Budgetary Control – Performance Report, Analysis of Budget Variations and Budget Follow-up

Performance Report:

The real advantages of budgetary control will materialise when budget preparation is followed by a feed-back system. Reporting through well designed performance report is an integral part of budgetary control.

A performance report is a document that periodically communicates to achieved, exceeded or not achieved. A performance report will give the management an insight into the operational inefficiencies.

There should be a separate performance report for each budget centre Performance report should be regularly made to the required level of management. For designing a reporting system for an organisation, magnitude and multitude of its activities in relation to organizational structure will form major considerations. For each company a suitable system should be developed to conform to its requirements.

Analysis of Budget Variations:

A comparison of actual results with budgeted results is an important facet of control. It is vital for the management to know the underlying causes of significant variations, because causes rather than the results provide the basis for appropriate corrective action.

Following points should attract special attention in evaluating and investigating the variances to determine the underlying causes:

i. The variations should not be significant. Both favourable and unfavourable variations should be investigated, if they are significant.

ii. It should be ensured that variation is not due to reporting error or clerical error.

iii. It should be noted whether variation was due to special managerial decision in order to improve efficiency or meet certain exigencies.

iv. It should be possible to explain whether the variance is controllable or uncontrollable.

v. The maximum attention should be focused towards the variations for which precise underlying causes are not known. These variations are of primary concern to the management and should be carefully investigated.

Budget Follow-Up:

The final phase is budget follow-up. Budget follow-up is the action taken to see that budgets are properly used and that they cause the initiation of steps for improvement.

Thus, it is the control phase of budgeting and utilises the budget performance reports to achieve the results desired, it should be noted that budget follow-up is the most difficult of all areas of budgeting. The operating manager must accept the parts that budget officer has to play.

At the same time budget officer should be sensitive to manager’s problems as well. If budget follow-up work is done properly, it will offer not a threat but still another service to operating managers.

Following steps are involved in budget follow-up:

1. Distribution of budget report.

2. Making variance analysis.

3. Reporting on variance analysis.

4. Action on variance analysis findings.

5. The total follow-up job, which primarily consists of –

i. Providing data and impetus were needed,

ii. Detecting areas of cost improvement, and

iii. Identifying the need for more staff support.

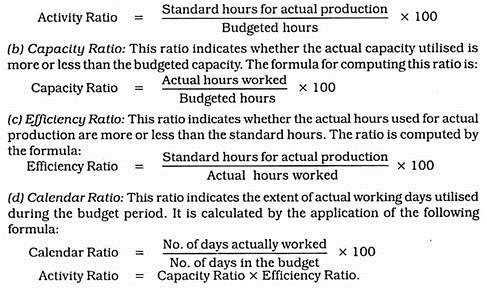

Budgetary Control – Control Ratios (With Formula)

Control is the process of ensuring that the activities of an organisation conform to its plans and its objectives are achieved. According to Peter Drucker, controls are different from control. The former are a means to an and the end is control.

The function of control is concerned with satisfying oneself that the actual work proceeds according to that which is budgeted.

A control system is a communication network. It monitors activities within the organisation. At the same time, it provides the basis for corrective action. Control ratios are a means of providing information about the extent of deviations of actual performance from the budgeted performance. Deviations may be favourable or unfavourable.

A ratio which is 100% or more is said to be favourable and anything less than 100% is said to be unfavourable.

The various control ratios useful to management are:

Budgetary Control – Revisions of Budget

Revisions of budget, as originally established at the start of the budget period, are needed primarily for following two reasons:

1. Human errors.

2. Changes in operating conditions.

Budget revisions should be, as far as possible, a joint effort by the operating managers and the budgeting staff. A budget is never originally prepared perfectly. Things will be missed and errors will be made. The likelihood of errors will increase with increase in the size of organisation.

As the errors are detected during the year, they must be corrected. The major errors that markedly affected the budget plan should be approved by top management. Such revisions are very embarrassing in nature.

The more common and, thus, more troublesome, budgeting problems are those caused by changes in operating conditions. Such changes, often, require budget revision either upward or downward in the sales forecast or the cost allowance.

Major revisions to budgets can be discussed under the following headings:

1. Downward Revision to Sales Forecast:

There are unfortunate hard times when a company must revise its income projections downward in the light of developing economic recession.

2. Downward Revision to Cost Allowances:

Downward revisions to budgeted costs can be required by many types of changes in operating conditions. Each revision has to be evaluated and acted upon on its own individual merits and conditions.

3. Upward Revisions to Sales Forecasts:

If a realistic original sales forecast has been made, there should be no need to make upward revision to sales forecast, even though the sales are well above the level originally projected. This is a happy situation and the higher- than-expected income can be identified as the cause of larger than ever expected favourable variance in income.

If favourable income variances are a recurring phenomenon, senior operating management must go deep to get to the reality. Recurring favourable income variances, particularity if they are substantial in size, should not be tolerated by top management. A management expects a better original forecasting of sales by its executives.

4. Upward Revisions to Cost Allowances:

All upward revisions to cost allowances must be approved by higher levels of management. The procedure to revise the upward cost allowance may be laid down in budget manual. It should be noted that budgets are not handcuffs. They are not fixed in concrete structure. They are a plan and plan can be changed, as new and better opportunities arise.

They should never be allowed to delay the start of progressive action. For this reason, upward budget cost allowance can be allowed, if laid down procedure has been followed and compelling reasons are existing. It is very necessary to understand the situation.

Difference between Forecast and Budget

Preparation of budgets, i.e., the work of budgeting, is a planning function. Planning deals with futurity of present decisions. Consequently, managers make predictions about the future based on past data and current happening. Such predictions or probable events are known as ‘forecasts’.

A forecast is thus, a prerequisite to planning. Planning is done on the basis of a forecast. A forecast is “an estimate of what will happen in the future.” The CIMA Official Terminology defines the term ‘forecast’ as “a prediction of future events and their quantification for planning purposes.”

Being a prerequisite to planning, a forecast results in planning. Planning, in turn, results in budgeting.

Regardless of this inter-relationship, a forecast differs from a budget in the following respects:

(i) A budget is a blueprint for a projected plan of action of a definite period of time. A forecast is only an assessment of probable future events.

(ii) A forecast relates to probable events. A budget, on the other hand, is based on the implications of forecast. It relates to planned events.

(iii) A budget lays down a target. A forecast does not lay down any target in the form of commitment.

(iv) A forecast merely takes note of the future events. A budget aims at controlling and shaping them.

(v) A budget may be prepared for the business as a whole. It may cover all the organisational activities. Alternatively, it may be for a particular function or segment of the business. A forecast usually covers a specific business function.

(vi) A budget is both a planning and controlling device. Being a statement of future events, a forecast is not at all a means of control.

(vii) Forecasting function ends with the assessment of probable future events. Budgeting, however, starts where forecasting ends.

Distinction between Flexible Budgeting and Zero Budgeting

The distinction between flexible budgeting and zero budgeting are as follows:

Flexible Budgeting:

1. A flexible budget is a budget which is designed to change in accordance with the level of activity attained.

2. It recognises the difference between fixed and variable costs. Semi-variable overheads and segregated into fixed and variable elements. Only variable costs will undergo change while fixed costs remain unaltered.

3. The approach is incremental in nature in the sense that the previous year’s actuals plus some addition will be converted into the current year budget.

4. Each manager is required to justify the additional amount of budget.

5. Flexible Budgeting applies mainly to the production area. A series of budgets are prepared one for each of a number of alternative production levels.

Zero- Base Budgeting (ZBB):

1. ZBB makes significant departure from the traditional budgeting mainly in approach rather than in basic planning and control philosophy.

2. It requires each manager to re-evaluate all the programmes and activities of his department and justify his entire budget.

3. Each manager has to build up his budget from the grass root. ZBB starts with the assumption that zero will spent on each activity.

4. He has to justify the entire amount of his budget. ZBB forces the managers to constantly evaluate the costs and benefits of all the programmes under his control.

5. ZBB is generally applied to the service areas such as personnel, R and D, etc.

Difference between Flexible Budget and Fixed Budget

Flexible Budget:

1. A flexible budget is “a budget which is designed to change in accordance with the level of activity attained”. (CIMA definition).

2. It has different budgeted costs for different levels of activity. That is, under this method, a series of budgets would be prepared at varying levels of activity, e.g., 70%, 80%, 90% and 100% capacity.

3. It is most suited for variable costs.

4. It provides a meaningful basis for comparison and control.

5. The great advantage of flexible budgeting is that variance analysis will enable the management to take appropriate action.

6. It helps in fixation or price.

7. Forecasting of result is easy.

Fixed Budget:

1. Fixed Budget is one that remains unchanged, whatever the actual level of capacity is.

2. It does not provide for any change in expenditure arising out of changes in the level of activity.

3. It is most suited for fixed costs.

4. It is simple to prepare but reporting to management is less meaningful. It has only a limited application and is ineffective as a tool for cost control. That is, while comparing the actual cost with a fixed budget the difference cannot be properly explained.

5. It does not consider the variances due to change in the volume.

6. Fixation of prices becomes difficult if the budgeted and actual activity varies.

7. Forecasting of results is difficult.

Difference between Traditional Budgeting and Zero Base Budgeting

1. Traditional budgeting is accounting-oriented. Main stress happens to be on previous level of expenditure. Zero base budgeting makes a decision-oriented approach. It is very rational in nature and requires all programmes, old and new, to compete for scarce resources.

2. In traditional budgeting, first reference is made to past level of spending and then demand is made for inflation and new programmes. In Zero-base budgeting a decision unit is broken into understandable decision packages, which are ranked according to importance to enable top management to focus attention only on decision packages, which enjoy priority to others.

3. In traditional budgeting, some managers deliberately inflate their budget requests so that after the cuts they still get what they want. In zero base budgeting, a rational analysis of budget proposals is attempted.

The managers, who unnecessarily try to inflate the budget requests, are likely to be caught and exposed. Management accords its approval only to a carefully devised result-oriented package.

4. In traditional budgeting, it is for top management to decide why a particular amount should be spent on a particular decision unit. In zero base budgeting, this responsibility is shifted from top management to the manager of decision unit.

5. Traditional budgeting is not as clear and as responsive as zero base budgeting is.

6. Traditional budgeting makes a routine approach. Zero base budgeting makes a very straightforward approach and immediately spotlights the decision packages enjoying priority over others.

Difference between Standard Costing and Budgetary Control

The following are the difference between standard costing and budgetary control:

Difference # Standard Costing:

1. Standards are based on technical assessments and engineering data.

2. Standards are mainly for production expenses, i.e., elements of cost.

3. Standard cost is projection of cost accounts.

4. Standards are minimum targets which are to be attained.

5. Standards are pointers to further improvements.

6. Standard costs are planned under specific assumed conditions of Production performance.

7. Standards are expressed per unit of production.

8. Detailed analysis is needed in case of variances whether they are favourable or unfavourable.

9. Variances are accounted for in the books.

10. It is a costing technique.

11. It is for each product.

12. It shows how cost should behave.

13. It is for manufacturing activities.

14. It aids in cost reduction.

Difference # Budgetary Control:

1. Budgets are based on past actuals adjusted to future trends.

2. Budgets are compiled for sales, production, expenses, profit, capital expenditure and cash. Budgets including both income and expenditure.

3. Budgets are projections of financial accounts.

4. Budgets are the maximum limits of expenses above which expenditure should not be incurred.

5. Budgets are indices, adherence to which keeps a business out of problems.

6. Budgets are expected costs used for forecasting profits.

7. Budget are expressed in totals of amounts.

8. No further analysis is required if costs are within the budget.

9. Variance Analysis is only a statistical data. It is a financial measure of target and achievement.

11. It is for each department.

12. It shows only expected costs and actuals.

13. It is for departments and organisation as a whole.

14. It helps cost control.

Main Advantages of a Budget

The following are the main advantages of a budget:

1. It provides an advance estimate of revenues and expenses.

2. It forces management to make an early study of their problems.

3. It helps to develop at all levels of management the habit of timely, careful and adequate consideration of all factors before reaching important decisions.

4. It compels all members of management to participate in the establishment of goals of the organisation.

5. It provides a way of communicating the plans of the management throughout the organisation.

6. It forces all managers to think about the future and chalk out plan for future.

7. It pinpoints the extent and lack of efficiency in the organisation.

8. It compels different departmental managers to make plans in harmony with the plans of other departments.

9. It forces managers to put down in black and white what is necessary for achieving the desired results.

10. It helps to allocate resources of the organisation for the most economical use.

11. Periodical review of a budget will help to check the progress of the target to be achieved.

12. It provides a platform for evaluating subsequent performance.

13. It can help managers to identify the current and other potential bottlenecks in operations. Managers can take timely action to ease any bottleneck.

14. It is a motivating device for young managers.

Budgetary Control – Advantages

The advantages of budgetary control are as follows:

1. Budgetary control aims at maximisation of profits through careful planning and control.

2. Budgeting provides a planned approach to business affairs. This eliminates the element of uncertainty and prevents the company from being caught napping.

3. It coordinates the activities of various departments and functions of the business.

4. It increases production efficiency, eliminates waste and controls the costs.

5. The responsibility of each individual in the organisation is fixed in advance. Each one is aware of its task and is fully conscious as to the best way by which it is to be performed.

6. A budget motivates employees to attain the given goals.

7. It directs capital expenditure on the most profitable channels.

8. Deviations from budgets point out weak spots and inefficiencies so that corrective action can be taken.

9. It compels management to plan for the most economical use of materials, men and machines.

10. It instills into all levels of management the habit of timely and careful thinking.

11. The budget of cash receipts and cash expenditure ensures availability of sufficient working capital for the efficient operation of the business.

12. Budgetary control system creates necessary conditions for the introduction of a standard costing system.

Some of the other advantages of budgetary control system explained:

The main advantages of budgetary control system may be given as follows:

1. Helps in Planning:

Continuous use of the budgetary control system enhances the ability and power of the management to foresee or think ahead. It enables them to forecast future operational problems and difficulties and to arrange for suitable or corrective actions well in advance.

It certainly brings an improvement in planning process and it becomes more clear, precise and effective. To quote Charles T. Horngren, budgetary control “helps managers to focus on operating and financial problems early enough for effective planning and action.”

2. Encourages Cost Consciousness:

Under budgetary control system, the establishment of budgets, fixation of responsibility and communication of the targets to be achieved by various executives, make every executive and worker cost conscious. The cost consciousness leads to the elimination of the causes of inefficiency and reduction in cost.

3. Leads to Economy in Operations: