Labour cost refers to the amount of money paid to the people who are engaged in the production of goods. In manufacturing businesses, often management will break down labour cost into direct cost and indirect cost.

The nature of labour whether it is direct or indirect depends upon the contribution of labour towards production. If they are directly engaged in production activities, the labour is termed as direct labour and if indirectly engaged then indirect labour.

Labour cost includes various types of expenses incurred on workers. These may be monetary payments made to workers directly such as basic wages, dearness allowance, bonus etc., deferred monetary benefits such as employer’s contribution to provident fund, gratuity, pension, etc., and fringe benefits such as employer’s contribution to Employees’ State Insurance scheme, subsidised food, subsidised housing, leave travel concession, medical and holiday home facilities, libraries and Other Welfare measures. In relation to the job or the product, labour cost may be direct or indirect.

Contents

- Introduction to Labour Cost Control

- Meaning of Labour Cost Control

- Factors for Labour Cost Control

- Importance of Labour Cost Control

- Types of Labour Cost Control

- Labour Variance Types

- Techniques of Labour Cost Control

- Important Departments of Labour Cost Control

- Time Keeping

- Time Booking

- Reconciliation between Time Booked and Time Kept

- Functions of Payroll Department

- Labour Turnover

- Essential Features of a Successful Remuneration Payment Plan

- Ideal Wage System

- Idle Time

- Overtime

- Allowances

- Incentives

- Incentive Wage Payment Systems

- Incentives Schemes to Indirect Workers

- Holiday Pay and Leave with Pay

- Fringe Benefits

- Merit Rating

- Time and Motion Study

- Efficiency Rating

- Out Workers and Casual Workers

- Learning Curve

- Group Bonus Schemes

- Labour Productivity

Labour Cost Control: Introduction, Meaning, Factors,Types, Importance, Techniques, Labour Turnover, Idle Time, Departments, Incentives, Fringe Benefits and More…

Labour Cost Control – Introduction

Employees of any organization, as its precious wealth and backbone, play an important role in its developmental and productive activities. The development and progress of the organization, to a greater extent, are influenced by the effective and systematic utilization of available human resources. In the same analogy, if this resource is not utilized properly, it is sure that its manufacturing and marketing activities are bound to be retarded.

ADVERTISEMENTS:

In other words, it is the human resource which is capable of either annihilating an organization which otherwise is doing well or putting an organization on an even keel which otherwise is on the way to extinction. It is these factors which necessitate to lay emphasis on the labour related aspects such as recruitment, training, placement, payment of wages and incentives, etc.

Labour cost is another important element of total cost of any organization and it works out to 40 to 60% of total cost in most of the corporate undertakings. By keeping these labour costs at the minimum level, it is possible to lower the total labour cost, conversion cost, production cost and the cost of sales which enables the company to offer its products to the customers at a comparatively lower prices which in turn ensures higher demand for the products.

As a result, the company is in a position to earn a higher amount of profit. On the other hand, if the labour costs are not controlled properly, it will have an adverse impact on both the cost economies and profit.

ADVERTISEMENTS:

Minimization of labour cost through control does not necessarily mean paying less to the employees. It means obtaining maximum work from the employees by providing them all the facilities – both monetary and non-monetary.

Because, an employee who is satisfied with his employer’s remuneration, work environment, fringe benefits, etc., is able to devote his full attention to the overall welfare of the company.

This analysis clearly brings the point to the fore that systematic utilization of the labour force is a necessity. The companies must, therefore, try to accomplish this objective by proper planning and implementation of its policies, programmes, etc., starting from recruitment.

Labour Cost Control – Meaning

Labour cost refers to the amount of money paid to the people who are engaged in the production of goods. In manufacturing businesses, often management will break down labour cost into direct cost and indirect cost.

ADVERTISEMENTS:

The nature of labour whether it is direct or indirect depends upon the contribution of labour towards production. If they are directly engaged in production activities, the labour is termed as direct labour and if indirectly engaged then indirect labour.

Labour cost includes various types of expenses incurred on workers. These may be monetary payments made to workers directly such as basic wages, dearness allowance, bonus etc., deferred monetary benefits such as employer’s contribution to provident fund, gratuity, pension, etc., and fringe benefits such as employer’s contribution to Employees’ State Insurance scheme, subsidised food, subsidised housing, leave travel concession, medical and holiday home facilities, libraries and Other Welfare measures. In relation to the job or the product, labour cost may be direct or indirect.

5 Factors for Labour Cost Control – Production Planning, Setting up of Standards, Use of Labour Budgets, Study of the Effectiveness of Wage-Policy and Labour Performance Reports

The factors for labour cost control are discussed below:

Factor # 1. Production Planning:

The production is to be planned in a way as to have the maximum and rational utilization of labour. The product and process engineering, programming, routing and direction constitute the production planning.

Factor # 2. Setting up of Standards:

Standards are set up with the help of work study, time study and motion study, for production operations. The standard cost of labour so set is compared to the actual labour cost and the reasons for variations, if any, are studied minutely.

Factor # 3. Use of Labour Budgets:

Labour budget is prepared on the basis of production budget. The number and type of workers needed for the production are provided for along with the cost of labour in the labour budget. This budget is a plan for labour cost and is prepared on the basis of the past data considering the future prospects.

ADVERTISEMENTS:

Factor # 4. Study of the Effectiveness of Wage-Policy:

The point for study and control of cost is how far the remuneration paid on the basis of incentive plan matches with increased production.

Factor # 5. Labour Performance Reports:

The labour utilization and labour efficiency reports received periodically from the departments are helpful in the managerial control on labour and exercise labour cost control.

Importance of Labour Cost Control

ADVERTISEMENTS:

Like material cost, labour cost also constitutes a significant portion of total production cost. Now-a-days when wage rates are increasing and labour cost is tending to become more and more fixed, particularly in large manufacturing organisations, strict control over labour cost has assumed great significance in order to control the overall cost of production and the cost of operating a unit.

However, high wages to the workers do not necessarily mean high labour cost. In fact payment of high wages to workers is aimed to achieve more than proportionate increase in their output resulting in lower per unit labour cost.

Some other importance of labour cost control given in points:

1. As Labour is a human being, it symbolizes human contribution to a firm’s production.

ADVERTISEMENTS:

2. Accounting and control over labour cost necessitates correct time keeping.

3. Proper control on the recruitment of labour is needed for the accounting and control of labour cost.

4. Labour cost is a committed cost because of the existing labour laws which give considerable protection to them.

5. Cost per unit of a product is influenced in a major way by labour cost.

6. In the case of some industries there is a shortage of skilled labour and hence it is necessary to make their effective utilization.

Labour Cost Control – Types: Direct and Indirect Labour Cost

Type # 1. Direct Labour Cost:

ADVERTISEMENTS:

Direct labour cost refers to that portion of prime cost in a factory that is spent on workers who were directly involved in production or manufacture of goods in the factory. The cost of direct labour may also be defined as the amount that is paid to labourers for each unit they have produced or for each hour they have spent on production.

Direct labour cost can be identified and allocated to the specific job process or product. The examples of direct labour costs are the payments made to the workers engaged in making furniture in factories, printing newspapers in the printing press, binder in a binding shop, and tailor in a tailoring shop.

Type # 2. Indirect Labour Cost:

Indirect labour cost refers to the amount paid to those workers who are not directly engaged in the production of goods. The indirect labour cost cannot be identified and allocated to a particular cost centre or cost unit.

Generally indirect labour costs are apportioned on an equitable basis. For example maintenance personnel, supervisors, sweepers, managers etc., all are indirect labour cost. Though, they also help in the production of goods but indirectly.

The amount of money paid to them cannot be given on the basis of units produced. It is incurred for the benefits of a number of cost centers for example a manager is responsible for many factory shops. It forms part of the overhead costs.

Labour Cost Control – Labour Variance Types (With Formulas)

The types of labour variance are:

ADVERTISEMENTS:

Type # i. Labour Cost Variance:

Labour cost variance represents the difference between the standard labour cost and the actual labour cost. According to ICMA terminology labour cost variance is defined as the difference between standard direct labour costs and in the actual direct labour cost incurred for the production achieved.

If the actual labour cost is less than the standard labour cost, the variance is favourable whereas the actual labour cost is higher than the standard labour cost, the variance is said to be adverse.

The formula for labour cost variance is as follows:

Labour Cost Variance = (Standard Time x Standard Rate) – (Actual Time x Actual rate)

ADVERTISEMENTS:

In short = LCV = (ST x SR) – (AT x AR)

Type # ii. Labour Rate Variance:

It is the difference between the standard rates in the actual rate which is multiplied by the actual time. According to ICMA, labour rate variance is defined as “the difference between the standard and the actual direct labour rate per hour for total hour work.” If the actual rate is less than the standard rate, the variance is said to be favourable whereas if the actual is higher the standard rate, the variance is adverse.

The formula for labour rate variance is as follows:

Labour Rate Variance = (Standard Rate – Actual Rate) x Actual Time.

In short – LRV = (SR – AR) AT

ADVERTISEMENTS:

Type # iii. Labour Efficiency Variance:

It is the difference between the standard time and the actual time which is multiplied by the standard rate. As per ICMA terminology labour efficiency variance is defined as “the difference between the standard hours for actual production achieved and the hours actually worked, valued at the standard labour rate.

When the work is finished in less than the standard time, the variance is favourable where as if more time is taken to complete the job, the variance is adverse which reveals inefficiency.”

The formula for labour efficiency variance is as follows:

Labour Efficiency Variance = (Standard Time – Actual Time) x Standard Rate.

In short – (LEV) = (ST – AT) SR

Type # iv. Labour Mix Variance:

This variance is similar to material mix variance. It rises only when more than one grade of workers are employed and the composition of the actual grade of workers differ from those specified.

The formula for labour mix variance is as follows:

Labour Mix Variance = (Revised Standard time – Actual Time) x Standard rate.

In short- (LMV) = (RST – AT) SR.

Type # v. Labour Revised Efficiency Variance:

It is also known as sub variance of labour efficiency variance. It arises due to increase in idle time and labour mix variance. This is a residue of labour efficiency variance left after idle time and mixed variance.

The formula for labour revised efficiency variance is as follows:

Labour Revised Efficiency Variance = (Std hours for actual output – Revised std hours) x Std Rate

In short – LREV = (SH – RSH) SR

Type # vi. Labour Idle Time Variance:

Idle time occurs when there is a difference between the time for which workers are paid and the actual time spent by the workers on job. In other words it represents the portion of labour efficiency variance which is due to abnormal idle time like strike, machinery breakdown, power failure etc. It is a loss of time and is always un-favourable. Usually it should be charged to idle time variance accounts.

The formula for labour idle time variance is as follows:

Labour Idle Time Variance = (Idle hours x Standard Rate)

In short – LITV = (IH x SR)

Top 8 Techniques of Labour Cost Control

Control of labour cost is a significant influence on the growth, profitability and cost of production. Labour cost may become unduly high due to inefficiency of labour, ineffective supervision, ideal time, unusual overtime work etc. Therefore, the primary objectives of the management is to efficiently utilize the labour as economically as possible.

Techniques of Labour Cost Control:

In order to achieve the effective utilization of manpower resources, the management has to apply a proper system of labour cost control. The labour cost control may be determined on the basis of establishment of standard of efficiency and comparison of actuals with standards.

The management applies various techniques for the effective control of labour costs as under:

(1) Scientific method of production planning.

(2) Use of labour budgets.

(3) Establishment of labour standards.

(4) Proper system of labour performance report.

(5) Effective system of job evaluation and job analysis.

(6) Devise a proper system of control over ideal time and unusual overtime work.

(7) Establish a fair and equitable remuneration system.

(8) Effective cost accounting system.

Labour Cost Control – Important Departments: Personal, Engineering, Time Keeping, Payroll and Cost Accounting Department

The following are the important departments for control over labour costs:

They are:

1. Personal Department

This department is basically concerned with the selection of workers, placing them after necessary training to the jobs for which they are suitable.

2. Engineering Department

This department is mainly concerned with preparing the plans Job specification, job analysis, time and motion studies, safe working conditions and supervision of the production process.

3. Time Keeping Department

This department is concerned with recording of workers attendance and calculation of wages for the purpose of analysis and apportionment of labour cost.

4. Payroll Department

The responsibility of the payroll department is calculation of wages payable to employees. The functions performed by payroll department includes maintenance of wage record of each worker, verifying the time shown by the time card, calculate the amount payable to each worker, compute the deductions required for tax purposes, provident fund etc., and to send payrolls to cash department for payment of wages and cost accounting department for making entries.

5. Cost Accounting Department

This department is concerned with the accounting of all labour costs. In other words it accumulates and classifies all the cost data relating to labour and prepares the cost reports for the use of management in order to exercise necessary control.

Labour Cost Control – Time Keeping: Meaning, Objectives and Methods

Meaning of Time Keeping:

Time keeping means, recording the attendance of workers in the factory. Every factory has an opening and a closing time, a lunch interval and weekly holidays. These timings are fixed according to the provisions of the Factories Act and are to be observed by all concerned. A proper attendance record for workers on outdoor/site duty is also essential.

Objectives of Time Keeping:

Time keeping serves two main purposes:

(i) Preparation of Payroll

The payroll department will prepare wage bills on the basis of information provided by the time keeping department.

(ii) Computation of Cost

The costing department will compute labour cost of different jobs, departments or cost centres on the basis of information provided by the time keeping department.

In fact, the costing department would also require information about labour hours spent on jobs and idle time. This is done by time booking explained later.

Methods of Time Keeping:

The following are important methods of time keeping:

1. Handwritten Registers (Popularly Called Attendance Register):

In this system, each worker has to sign against his name in a register upon arrival and departure, noting down the time in and the time out. Preparation of monthly pay-rolls and payment of overtime work are made on the basis of attendance register. The register system is very popular, particularly in small factories and organisations.

However, it is a method which is considerably abused by the workers. Moreover, in this system, delays may occur when each worker has to sign his name in turn. Due to these drawbacks, the use of handwritten registers is generally avoided in modern organisations and factories.

2. Token or Disc Method:

In this method, every worker is allotted a metal token or disc on which his token number is printed or engraved. Every day in the morning, these tokens are hung up in a serial order on a board placed at the gate. Every worker who enters the factory premises on time, takes his token and hangs it on another board called the in-board or puts it in a box kept for the purpose.

The tokens on the in-board are removed from the gate after normal entry time on the basis of these tokens. A separate late in-board or box indicating the extent of the late arrival is put at the gate for those who come late. These late in-boards/boxes are removed at regular intervals for the purpose of attendance. After recording attendance, these tokens are again rearranged on the board.

The procedure is repeated for recording the departure time including overtime and also for recording the attendance of those who leave the factory premises during lunch time or on short leave. This method is considered an improvement over the handwritten register method of attendance.

3. Clock Cards:

In this, a card is allotted to each worker. Attendance time of workers is recorded in this card for the week or even for the month. The card also contains space for the amount of wages payable. For recording his arrival and departure time, the worker inserts the card into the time-recording clock.

The moment the card is inserted, the arrival/departure time is entered in the card. This is an effective system of recording time with little chance for the worker to tamper with the time. However, in the absence of suitable checks, a worker may act as a proxy for his absentee friends.

Two other types of time recorders, viz., dial recorders and key recorders are also available. In these recorders, cards are not used but time is printed on a roll of paper placed inside the machine.

Labour Cost Control – Time Booking: Meaning, Objectives and Methods

Meaning of Time Booking:

Time booking means the recording of time of each worker spent on various jobs during his period of attendance in the factory.

Objectives of Time Booking:

The following are the objectives of time booking:

1. To ascertain the labour hours spent on work and the idle labour hours.

2. To ascertain labour cost of various products or jobs.

3. To calculate the amount of wages and bonus payable under the wage incentive scheme.

4. To compute and determine overhead rates and absorption of overheads under the labour and machine hour method.

5. To evaluate the performance of labour by comparing actual time booked with standard or budgeted time.

Methods of Time Booking:

A number of methods are used to know the quantum of time spent on a job, operation or process.

The following are important methods of time booking:

(i) Daily and Weekly Time Sheets:

In smaller factories, a handwritten timesheet is filled daily or weekly by the worker. It shows the name and ticket number of the worker, description of work, quantity produced and the time when work was started and finished.

Time sheets are simple and easy to understand. The foreman can easily verify how much work each worker has performed. These sheets are also suitable for booking time when a worker has to work in different departments.

The main disadvantage of time sheets, especially weekly time sheets, is that the workers may attempt to fill their time sheets for two or three days together. Besides, such sheets may not be very reliable if strict supervision is absent.

Time sheets also involve a lot of paperwork. As such, they can be used with advantage in small organisations where the number of workers and jobs handled by them are few.

(ii) Job Card:

In this method of time booking, a job card or a job ticket is issued to each worker specifying his job. The worker records his time by hand or through the time recording clock on the job card as he starts the work. When he completes his work, he again writes or punches the time on the card.

A job card thus provides information about the nature of work done, the labour time spent thereon and its cost. Job card also enable the management to keep a close check on the time spent by a worker on each job carried out during the day. The total duty time of a worker should tally with the time shown in the job card.

If it does not, then the time for which a worker remained idle should be recorded in the idle time card with reasons to account for his full day’s attendance time in the factory. Job cards can be gainfully used for workers on outdoor duties.

The main disadvantage of a job card is that where the workers also enter their overtime, there is a tendency to overstate the time. Further, where a job takes a long time, it may be several weeks before the job card reaches the costing department. In such a situation, it is practically impossible to reconcile the time booked in the card with the time recorded for attendance.

(iii) Labour Cost Card:

In this card, the total labour time of all the workers spent on a particular job/order on different activities is recorded. This card travels with the job. In place of preparing separate job cards for each worker, only one card is prepared and is passed on to the next worker for carrying out the next operation after completion of the previous operation.

Each worker records the time spent by him on a particular operation assigned to him. When priced, this card can give the information about the total labour cost of the job at one place. It facilitates cost analysis.

Labour Cost Control – Reconciliation between Time Booked and Time Kept

For ensuring proper control over labour it is necessary to match the time kept at the gate with the time booked. This reconciliation implies ascertaining that the time spent by a worker in the factory is equal to his time at work plus recorded idle time. Idle time is the time when the worker does no work and remains idle.

The reasons for idle time are numerous such as waiting for materials, tools, orders, failure of power supply, breakdown of machinery, accidents etc. Idle time, so that every minute spent by a worker may be correctly accounted for. It helps in taking steps to reduce the idle time. It ensures a proper reconciliation between the time booked and time kept.

Labour Cost Control – 6 Main Functions of Payroll Department

The payroll department is responsible for making payment of wages or salary to each employee.

The main functions of this department are as follows:

(i) To keep wage records of each worker.

(ii) To verify the time shown in the daily time card of each employee.

(iii) To calculate the wages earned by the employees.

(iv) To prepare the summary of deductions from the gross income of each worker such as Income Tax, Provident Fund etc.

(v) To make payment of wages or salaries to each employee.

(vi) To maintain a permanent pay-roll record for each employee.

Labour Cost Control – Labour Turnover: Causes, Measurement, Effects, Reduction and Cost

Labour turnover denotes the percentage change in the labour force of an organisation. The ratio of the replaced workers to the total number of workers is the Labour Turnover Ratio. High percentage of labour turnover denotes that labour is not stable. A high turnover is a costly affair and must be avoided.

Causes of Labour Turnover:

The workers leave the factory due to following reasons:

i. Personal Causes;

ii. Unavoidable Causes;

iii. Avoidable Causes.

i. Personal Causes:

Labourers may leave the organisation on personal grounds, e.g. –

(a) Death

(b) Ill health

(c) Dislike for the job

(d) Marriage of Woman Workers

(e) Retirement due to old age

(f) Family responsibilities and domestic troubles.

ii. Unavoidable Causes:

These causes are:

(a) Workers may be discharged due to insubordination or incompetence;

(b) Workers may be discharged due to lack of attention to duty;

(c) Workers may be discharged due to immoral character;

(d) Workers may be discharged due to accidents.

iii. Avoidable Causes:

These causes are:

(a) Lack of job security

(b) Lack of proper training facilities

(c) Lack of promotion opportunities

(d) Lack of accommodation and medical facilities.

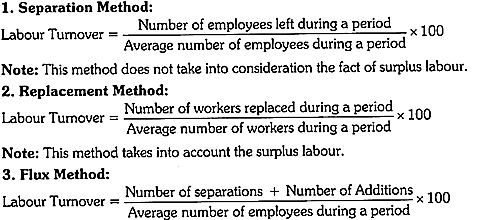

Measurement of Labour Turnover:

The I.C.M.A., London recommends the replacement method. Moreover, replacement method can be taken to be the most reliable method and it will also give correct labour turnover when the factory is expanding.

Effects of Labour Turnover:

The labour turnover below the over is always detrimental to the organisation.

So, it is always better to keep the normal rate is low turnover and the turnover in excess of normal rate is high turnover. A high labour turnover low.

A high labour turnover has an adverse effect on the cost of production which is due to following reasons:

i. Change in labour force interrupts production and production goes down.

ii. New workers take time to become efficient and this results in increasing the cost of production.

iii. The costs of selection and training of new workers would further increase the cost.

iv. The new workers cannot handle the tools and machines efficiently. Due to faulty handling of new workers, breakdown of tools and machines may occur very often.

v. The rate of accidents may increase. Consequently, the cost of production increases.

Reduction of Labour Turnover:

The following steps must be taken to reduce the labour turnover:

i. Distinction between efficient and inefficient workers should be made by introducing an incentive wage rate system. The system should be such that the efficient workers may be paid more as compared to inefficient workers.

ii. Good working conditions should be provided to the workers.

iii. Non-monetary benefits, i.e., fringe benefits should be introduced in the organisation.

Cost of Labour Turnover:

There are two types of costs of labour turnover:

(i) Preventive Costs

(ii) Replacement Costs

(i) Preventive Costs:

These are the costs which are incurred to provide such facilities to the workers to keep them satisfied so that they may not leave the organisation.

These costs include:

(a) Cost of providing welfare services

(b) Cost of providing medical and housing facilities to the workers

(c) Cost of providing good working conditions

(d) Cost of providing safety measures

(e) Miscellaneous schemes and benefits such as pension, gratuity, bonus, provident fund scheme etc.

(ii) Replacement Costs:

These are costs which are incurred to recruit new workers and these costs are associated with replacement of workers.

For example:

(a) Cost of recruitment, selection and training of new workers

(b) Cost of inefficiency of new workers

(c) Cost of frequent accidents

(d) Cost of breakage of tools and machines

(e) Loss of profit due to loss of production

(f) Cost of excessive spoilage.

Labour Cost Control – Essential Features of a Successful Remuneration Payment Plan

The term ‘remuneration’ means all monetary earnings of employees and it includes hourly wages, piece work wages and other financial incentives. Every system of remuneration should be designed in such a manner so as to encourage the individual worker to do his best. A good remuneration system will attract the best employee from the market. It will also reduce labour turnover to a great extent.

Essential Features of a Successful Wages / Remuneration Payment Plan:

The following are the essential features of a successful system of wages/remuneration:

1. The remuneration system should be satisfactory from the view point of employees and employer.

2. The scheme should be accepted by the employees and its union.

3. The scheme should stabilize the labour turnover.

4. The scheme shall aim at improving the morale of the employees.

5. There should be some provision for flexibility to permit necessary changes in future.

6. The cost of administration and operation should be minimum.

7. It should be at par with the industry to attract and retain talented people.

8. There should be a provision for incentive plans.

9. The wages should be related to the efforts put in by the employees.

10. It should encourage the efficient workers to earn more and reduce the overall cost per unit.

Labour Cost Control – Ideal Wage System: Objectives, Principles and Essentials

Objectives of an Ideal Wage System:

An ideal wage system is required to achieve the following objectives:

(1) The wage system should establish a fair and equitable remuneration.

(2) A sound wage system helps to attract qualified and efficient workers by ensuring an adequate payment.

(3) It assists to improve the motivation and morale of employees which in turn lead to higher productivity.

(4) It enables effective control of labour cost.

(5) An Ideal wage system helps to improve union-management relations. It should reduce grievances arising out of wage inequities.

(6) It should facilitate job sequences and lines of promotion wherever applicable.

(7) An ideal system seeks to project the image of a progressive employer and to comply with legal requirements relating to wages and salaries.

Principles of an Ideal Wage System:

The following principles should be adopted for an ideal wage system:

1. Differences in pay should be based on differences in job requirements.

2. Follow the principle of equal pay for equal work.

3. The scheme should be based on work study, and the work contents of various jobs should be stabilized.

4. Recognize individual differences in ability and contributions.

5. The scheme should not be very costly in operation.

6. The scheme should be flexible.

7. The scheme should encourage productivity.

8. The scheme should not undermine cooperation amongst the workers.

9. The scheme should be sufficient to ensure for the worker and his family reasonable standard of living.

Essentials of an Ideal Wage System:

1. It should be just and fair to both employer and the employee.

2. It should have a standard task and generous return.

3. It should be unrestricted as to the amount of earning.

4. It should be reasonable apart from being simple.

5. It should recognize the efficiency of a worker.

6. It should be flexible to meet the changes in the labour market.

7. It should help in building team spirit and cordial relations among the employees.

8. It should have the employees support and should meet the minimum needs of an employee.

Labour Cost Control – Idle Time: Causes, Segregation and Treatment

Losses due to idleness of workers occur even in most carefully managed plants. Certain losses due to idleness of workers are unavoidable. Excessive idle time is a problem that should attract the attention of management immediately.

It is the duty of cost analyst to analyse the idle time cost in two categories, i.e., controllable and uncontrollable. On the basis of this information, he must attempt to interpret the costs and fix responsibilities.

Causes of Idle Time:

a. Production Causes:

These causes can be further divided into two categories, i.e., internal causes and external causes.

Following are the main production causes that may result in idle time:

(a) No power.

(b) Machine breakdown.

(c) Waiting for work.

(a) No power

When idle time occurs due to non-availability of power supply, payment is made to workers. Power losses are sometimes so heavy that some concerns maintain alternative power sources. The cost of idle time due to lack of power supply is borne by good units produced.

(b) Machine breakdown

Labour idle time cost due to machine breakdown is borne by good units of production.

(c) Waiting for work

Idle time may occur due to lack of work.

This may be the result of factors such as –

(i) poor planning by production department,

(ii) poor planning by foreman,

(iii) lack of material.

b. Administrative Causes:

Sometimes, labour idle time is the result of administrative decisions. For example, in some cases skilled labour is used. The management is often unwilling to dismiss such labour during periods of depression, because the cost of rehiring may be more than the cost of maintaining the present skilled force.

Idle time may also occur, when labour force is planned considering the future growth and skilled labour is scarcely available.

c. Economic Causes:

Idle time may also occur due to following causes:

(a) Seasonal

Sometimes production cannot be evenly distributed throughout the year because the product demand is seasonal, e.g., ice-cream, furs, etc. In these cases, the cost of carrying inventory may be too high and, therefore, result in idle time. Sometimes, it is possible to use the labour force for complementary business but it is not always possible.

(b) Cyclical

Cyclical fluctuations are similar to seasonal fluctuations but they exert the influence for a longer period. The management has limited control over idle time due to cyclical fluctuations. For example, it is difficult to control uneven demand of products.

(c) Industrial reasons

Idle time may also occur due to shifts in demand, population movement, changes in the means of transport, etc. Idle time may also occur due to strikes and lockouts.

Segregation and Accumulation of Idle Time Cost:

The management tries to eliminate idle time but it is always not possible and, therefore, best efforts should be made to minimise the idle time. Since idle time is caused by a number of different factors, it is necessary to determine which factor is causing the idleness in a particular case.

Once this is known, suitable managerial action can be taken to reduce the idle time. Each labour card should show the time spent on different operations and the idle time.

A separate standing order number should be maintained for idle time so that the executive’s attention is invited to the idle time factor and the department responsible for it. If idle time is due to abnormal conditions which are beyond the control of management, the idle time cost should not form part of the cost of production. It should be debited directly to the profit and loss account.

A strike, lockout, storm, flood are the examples of abnormal conditions. For best results, idle time reports should be periodically prepared and detailed analysis of these reports should be undertaken to fix the responsibility.

Treatment of Idle Time:

The following two practices are often used for treatment of idle time:

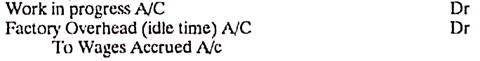

a. Charge to Factory Overhead:

If the idle time is of such a nature that it cannot be avoided and the magnitude of idle time is normal, it forms part of overhead according to the nature of business activities. For effective control, each type of idle time should be booked to separate standing order numbers.

Idle time will, thus, conspicuously appear as part of the overhead to attract the attention of management for necessary remedial measures. Following entry may be passed to record normal idle time.

b. Debit to the Profit and Loss Account:

If the idle time is abnormal, its payment cannot be regarded as part of cost of manufacture. Payment of idle time of abnormal nature is charged directly to the costing profit and loss account. Its cost will render the figures relating to two periods uncomparable.

Abnormal idle time arises in the following situations:

(a) Strikes.

(b) Lockouts.

(c) Fire.

(d) Failure of power supply.

(e) Breakdown of machinery due to inefficiency of work engineers.

(f) Bottlenecks in production.

Labour Cost Control – Overtime: Meaning, Treatment, Reasons, Control, Disadvantages and Steps

Meaning of Overtime:

Overtime refers to the time spent by a worker in doing a job beyond his normal hours of work. According to the Factories Act, 1984, every worker is required to work not more than 9 hours a day or 48 hours in any week. If, due to the urgency of the work, a worker is required to work for more than 9 hours a day or more than 48 hours in a week, excess time over 9 hours on any day or excess time over 48 hours in a week, is to be paid to the worker at a higher rate, generally at double the normal wage rate.

The excess rate over normal wage rate is called overtime premium and the work done beyond normal working hours is known as overtime work.

Treatment of Overtime Premium in Cost Accounting:

The payment for overtime involves two elements,

(i) normal wages for overtime and

(ii) overtime premium.

The normal wages are treated as direct labour cost and charged to concerned job as direct labour cost. But the treatment of overtime premium depends on the circumstances which cause overtime working.

Some of the reasons for overtime working and treatment of over-time premium in cost accounts are given below:

Reasons for Overtime Working:

1. Overtime work is the result of management policy of under-staffing.

2. Overtime work is done occasionally to meet temporary extra demands or peak seasonal demand.

3. Overtime work is done at the request of a customer.

4. Overtime work has been necessitated by abnormal circumstances such as earthquake, flood, fire etc.

5. Overtime work has been necessitated due to delay/fault on the part of other departments in the organisation.

Treatment of Overtime Premium in Cost Accounts:

1. The overtime premium payment should be added to normal wages and basic wage rate should be determined after taking into consideration overtime premium. All jobs done in the factory will be charged at an inflated wage rate.

2. The overtime premium should be charged to factory overheads.

3. The overtime premium should be charged to the particular job and recovered from the concerned customer.

4. The overtime premium should be charged to the cost of profit and loss account.

5. The overtime premium should be debited to the department which caused delay or is at fault.

The payment of overtime premium to indirect factory workers should be charged to factory overheads. Similarly, the overtime work done by the staff of the administrative, selling and distribution department should be debited to administrative overheads and selling and distribution overheads respectively.

Control of Overtime Work:

Since the overtime working involves payment of wages at a higher rate, generally at double the normal wage rates, it is essential to exercise effective control over labour and to see that overtime work is done only when it is unavoidable.

Beside obvious higher cost of overtime work, it also has the following other disadvantages:

1. Due to late hours working, productivity and efficiency of labour is reduced.

2. Continuous long hours of work cause fatigue and have adverse effects on the health of workers which in turn may result in defective and below standard output.

3. If overtime work is not possible for all the workers equitably, it causes discontentment among the workers.

4. Unrestricted overtime work converts certain workers into habitual overtime workers and they avoid working during normal working hours.

5. Other resources such as plant, machinery, are unduly burdened and the cost of electricity, supervision, etc., goes up.

6. Overall production cost, labour cost as well as factory overhead, is increased.

In view of the above, it is essential that overtime working, if not eliminated, should be reduced.

The following steps may help in this regard:

1. Overtime working should be allowed only when it is unavoidable.

2. A competent authority should sanction overtime work after proper assessment and before the start of the overtime working.

3. Proper monitoring of work during normal hours is necessary to avoid slackness.

4. Proper evaluation/measurement of work done during overtime is necessary to ensure a satisfactory level of efficiency/productivity.

5. Separate computation and recording of overtime cost should be made and reported to the management for comparison and control purposes.

6. If overtime working tends to become a permanent feature, steps should be taken to recruit additional work force to complete the work during normal working hours, provided it is cheaper.

7. Possibility of shift-working, installing additional machines, sub-contracting, etc., should be explored after proper cost-benefit analyses.

8. During normal working hours, proper production planning and control should be ensured for efficient utilisation of man and machinery.

Labour Cost Control – Allowances (With Example)

In addition to basic pay, workers/employees are also paid some money by way of various allowance such as dearness allowance (DA) to compensate for increase in cost of living, city compensatory allowance (CCA) to compensate for the high cost of living in big cities, house rent allowance (HRA) to compensate for not providing residential accommodation, etc. A worker’s normal gross earnings include basic pay and all the above allowances.

All such allowances which form part of gross wages should be considered in computing the wage rate of direct and indirect workers. But all such allowances which are paid in special circumstances and not uniformly payable to all workers may not be included in computing the wage rate.

For example, overtime allowance is paid only to those workers who work overtime, i.e., beyond the normal duty hours. Therefore, while computing the wage rate, overtime allowance will be treated separately depending on the situation.

Labour Cost Control – Incentives: Indirect Monetary Incentives and Indirect Non-Monetary Incentives (With Advantages, Disadvantages and Examples)

The schemes are not related to the performance of the individual or group workers directly. Workers get additional remuneration based on the prosperity of the company, e.g., a share in the company, better amenities, perquisites, etc.

It includes:

(i) Indirect monetary incentives, and

(ii) Indirect non-monetary incentives.

(i) Indirect Monetary Incentives:

Indirect monetary incentives again include the following:

(a) Profit-Sharing, and

(b) Co-partnership.

(a) Profit-Sharing:

It is an agreement between the employers and the workers which provides additional payment in cash to the workers over and above their normal wages and incentives out of the profits earned by the undertaking during the year, as a profit bonus based on an agreed percentage.

According to the Payment of Bonus Act, 1965, the minimum and maximum bonus payable are 8.33% and 20% respectively up to a certain wage limit.

The minimum bonus is to be paid, even if there is no profit. Besides profit bonus, there are other schemes where a certain portion of the profit is invested by the employer, and the workers share some benefit at the time of retirement.

The scheme recognises the fact that each worker jointly and severally contributes towards the profit earned by the undertaking.

The advantages of this scheme are as follows:

i. It develops a sense of partnership and as such workers try to increase productivity.

ii. Workers feel that the company is their own which indirectly reduces labour unrest, labour turnover, etc.

iii. Workers work wholeheartedly for the company and utilise machines and materials properly.

iv. Workers treat themselves as one group and as such group incentives are shared by them.

The disadvantages of the scheme are given below:

i. Since there is a time-gap between the services rendered and payment of the share of profit, it cannot be regarded as an incentive for higher efficiency.

ii. Besides hard work and efficiency of workers, profit is influenced by external factors like managerial efficiency, business policy, trade cycle, accounting decision, etc. All these create confusion, distrust, misunderstanding, etc., amongst the workers who are not participating in the policy decisions.

iii. Since the share of profit is assured, workers do not put in their best efforts.

iv. The scheme does not differentiate between efficient and inefficient workers.

v. Individual efficiency and efforts are not adequately rewarded as bonus is shared by group. Moreover, additional earnings in this scheme are comparatively small.

vi. Workers share profits in good years but do not share losses incurred in other years.

vii. The basis of apportionment of profit sometimes presents difficulties.

viii.The trade unions do not favour this scheme as it may create disunity in the ranks of working classes.

(b) Co-Partnership or Co-Ownership:

Under the scheme, employees get an opportunity to participate in the capital of the business as well as the part of profits that accrue to their share of ownership. Participation in the capital may be achieved by various means, e.g., allowing loans to employees and enabling them to buy company’s shares, or giving “employees’ shares” to them through some scheme.

Shares held by employees may or may not have voting rights. The scheme creates a sense of belonging and partnership, encourages workers to handle costly machines and materials more carefully and contribute effectively towards growth of the company. The scheme increases morale of the employees, reduces labour turnover and weakens worker’s loyalty to trade unions.

(ii) Indirect Non-Monetary Incentives:

Such incentives include those benefits which do not form part of the worker’s pay-packets but the provision of which by the employer serves as stimulants to workers to improve their productivity and efficiency. Such benefits may be provided free or subsidised and are related to working conditions and welfare purposes.

Few examples of such benefits are:

i. Canteen — free or subsidised meals/tiffins.

ii. Medical/Hospitalisation benefits for employees and his family.

iii. Education and training facilities to the employees and their children.

iv. Fair price shop — subsidised,

v. Benevolent funds, co-operatives, subsidies to sick, etc.

vi. Pensions, Superannuation benefits, etc.

vii. General Welfare — Sports, recreational facilities, transport and housing facilities, holiday homes, long service awards, etc.

The range of such incentives is very wide. The objectives of such incentives are to keep the workers happy, contented and in better health for increasing productivity. The incentives make condition of employment more attractive, encourage loyalty, minimise absenteeism and labour turnover.

Labour Cost Control – 6 Important Incentive Wage Payment Systems

A very important characteristic of a good wage payment system is that it should be mutually beneficial to the employer and the employee. The employer should be able to control cost and workers to increase their earnings.

The control of labour cost, however, does not mean paying less to workers. It means improving the productivity of labour and thereby reducing per unit cost of labour in relation to output. All incentive wage payment systems aim at achieving these objectives.

The six important incentive wage payment systems are briefly discussed below:

1. Taylor’s Differential Piece Rate System:

Taylor, the father of scientific management, advocated strongly for maximizing output. He emphasized that low production causes total cost of production to rise and higher production causes cost of production to fall.

Therefore, Taylor supported quick production. On the basis of time and motion study, he fixed standard time for producing one unit of output, and two-piece rates, one lower and the other higher.

The lower rate is 80% of the normal rate and the higher rate 120% of the normal rate. In other words, the higher rate is 150% of the lower rate.

A worker achieving the standard or producing more than the standard output in a given time (at efficiency level of 100% or above) is paid wages on the basis of the higher rate as per unit of output. Those who fail to achieve the standard (below 100% efficiency level) are paid at the lower rate.

Due to the existence of two rates, the system is known as a differential piece rate system. In this system no minimum wages are guaranteed. From the point of view of the workers, it is disadvantageous.

A worker whose work tails just short of the standard would lose very heavily. Taylor’s philosophy, that work ought to be done by the most efficient worker and not by others, puts workers under fear that in case they fail to reach the standard, they may be dismissed someday.

2. Merrick’s Multiple Piece Rate System:

This system is a modification of the Taylor system. In this system three-piece rates, depending on the efficiency level of the worker are used. The basic (ordinary) piece rate is applied to those workers who produce below 83% of the standard output. In cases where the performance level is 83% to less than 100% of standard output, 110% of the ordinary piece rate is applied. For workers whose performance is at 100% efficiency or above, 120% of the ordinary piece rate is used.

Under the Merrick system, there is no sudden rise in wages from one level of output to another and the loss for inefficiency is relatively lighter. However, like the Taylor system, minimum wages are not guaranteed in this system also.

3. Gantt Task and Bonus System:

It is a combination of time wages, piece rate and bonus using the principle of differential piece rates. In this system a definite task (target output) is set to be completed within the standard time allowed. If the output of a worker is below target output, he is paid guaranteed time wages.

If a worker is able to complete the task within the standard time, he gets a bonus in addition to his guaranteed minimum time wages. The bonus is a fixed percentage of time wages. If a worker completes the task in less than the standard time, he is paid a high piece rate for the whole output. The high piece rate takes care of bonus also.

Wages payable to workers under this plan are calculated as under:

Output:

(i) Output below standard (target task)

(ii) Output at standard

(iii) Output above standard

Payment:

(i) Guaranteed time rate

(ii) Time wages plus 20% (usually) bonus of time wages.

(iii) High piece rate on worker’s whole output.

The high piece rate is so fixed as to ensure a bonus of 20% of the time rate.

4. Emerson’s Efficiency Plan:

In this system, minimum time wages are guaranteed. But beyond a certain efficiency level, bonus in addition to minimum day wages is given. Emerson chose certain arbitrary points in order to spread incentive at both low task and high task levels. A standard output is fixed as representing 100% efficiency. Up to 66-2/3% efficiency level, workers are paid the guaranteed time wages.

Beyond 66-2/3% efficiency, they are paid a bonus at a stated ratio or percentage of time wages in addition to their time wages. Emerson used about 32 bonus percentages for efficiency beyond 66-2/3%. The bonus starts from 0.01% above 66-2/3% efficiency, and increases up to 20% at 100% efficiency. Thereafter, the bonus is 20% plus 1% of the basic wages for each 1% increase in efficiency. This system encourages beginners to work hard.

Scheme of bonus in brief is as under:

Up to 66-2/3% efficiency – no bonus

Above 66-2/3% to 100% efficiency- Bonus varying between 0.01% and 20%

Above 100% efficiency – 1% for each 1% efficiency in addition to 20%.

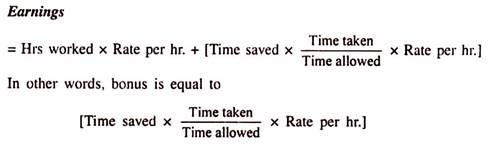

5. Halsey Premium Bonus Plan:

E.A. Halsey, an American engineer, introduced this plan in 1891. Under this plan, if a worker is able to complete the job before the standard time allowed he is given a bonus for the time saved; the most prevalent percentage is, however, 50 and the plan is, therefore, also known as the 50:50 bonus plan.

The earnings of a worker may be computed by the following formula:

Earnings:

= (Hours worked x Rate per hr.) + ½ (Time saved) x (Rate per hr.)

In other words, the bonus is equal to 50% of the wages for time saved.

6. Rowan Premium Bonus Plan:

David Rowan of Glasgow introduced this plan in 1901. In this plan, the bonus is paid at time rate for the proportion of the time taken, which the time saved, bears to the time allowed.

The total earnings of a worker under this plan may be computed as under:

Labour Cost Control – Incentive Schemes for Indirect Workers: Reasons, Examples and Distinction

Introduction of an incentive scheme for indirect workers like supervisors, machine maintenance staff, stores staff, canteen staff, internal transport, etc. is difficult as their performance cannot be measured directly.

Still it is essential to provide incentive to them due to the following reasons:

i. To promote team spirit, morale and healthy atmosphere of work.

ii. To eliminate labour unrest and reduce labour turnover.

iii. To maintain efficiency of important services, e.g., material handling, store keeping, repairs and maintenance of plant and machinery, etc.

iv. To reduce cost by improving overall efficiency.

Bonus may be paid to indirect workers on any of the following bases:

i. When indirect workers are working with a group of direct workers, bonus is paid to them on the basis of the output of direct workers with whom they are attached, e.g., maintenance workers attached to a particular department. Where a standard can be established, e.g., for inspection, material handling, regular repair, etc., bonus is paid based on such standard.

ii. When indirect workers render general services, e.g., sweepers, maintenance workers, canteen workers, stores, time office, dispensary, office staff, etc., bonus may be paid on the basis of the output of the department or the factory as a whole.

iii. On the basis of job evaluation and merit rating of indirect workers.

iv. On the basis of enhanced day rate or any other arbitrary basis which includes an element of bonus.

Incentives should be paid every week or month and it should be related to results, which should be displayed.

Examples of Some Incentive Schemes to Indirect Workers:

i. Bonus to foreman and supervisors

Bonus is paid based on output of the department, improvement in quality of the product, savings of expenditure or time, reduction of labour turnover, reduction of scrap and waste, etc.

ii. Bonus to repairs and maintenance staff (for routine and repetitive maintenance)

A group bonus may be established based on reduction on the number of complaints or reduction of breakdown, etc. Efficiency percentage is evaluated for payment of bonus.

iii. Bonus to stores staff

Bonus is paid based on the value of materials handled or number of requisitions.

Distinction between ‘Incentive to indirect workers’ and ‘Indirect incentive to direct workers’

Indirect Incentive to Indirect Workers:

1. It is paid to indirect workers.

2. It provides monetary inducements to workmen not directly involved in production.

3. It inculcates a spirit of team-work and goodwill amongst direct and indirect workmen.

4. It is not possible to fix time standards and is related to efficiency of support services.

5. Nature – Monetary amount.

6. It is treated in cost accounts as manufacturing overheads.

Indirect Incentive to Direct Workers:

1. It is paid to direct workers.

2. It provides non-monetary or psychological incentives to direct workmen to improve productivity and promote a sense of belonging amongst workmen.

3. It creates a sense of participation in management resulting in high quality and efficiency.

4. Direct incentives are provided on the basis of time standard but indirect incentives induce confidence, sincerity etc.

5. Nature – Provision of canteens, recreation facilities, suggestion awards and bonus schemes, accident prevention schemes, etc.

6. It is grouped as fringe benefits or welfare expenses and treated as manufacturing/administration/selling and distribution overheads depending on their identification with the respective cost centres.

Labour Cost Control – Holiday Pay and Leave with Pay

i. Holiday pay

There are various holidays in addition to the weekly holiday of Sunday for which workers are generally paid like Holi, Diwali, 15th August. The wages paid for these days are indirect expenses. They are charged as overhead cost in the cost accounts.

ii. Leave with Pay

Workers are also certified for a specified number of leaves for which they are paid for such as casual leave, medical leave and earned leaves. The wages paid in respect of leaves are also indirect cost and charged be as overhead cost in the cost accounts. The number of leaves entitled during a year may be different in different organisations depending upon management policies.

Labour Cost Control – Fringe Benefits: Meaning, Problem and Methods of Accounting

Meaning of Fringe Benefits:

Fringe benefits are services and financial compensation given to employees but not directly related to employees’ performance. Fringe items involve added labour cost to the employer but are not direct wage payments to employees.

Fringe benefits include the following:

a. Payments for awards and bonus.

b. Payments for time not worked.

c. Payments for employees’ security.

d. Payment for employees’ services.

Some of the benefits falling under each head are given below:

a. Non-Productive Awards and Bonus:

(a) Anniversary awards.

(b) Safety awards.

(c) Attendance bonus

(d) Service bonus.

b. Payment for Time not Worked:

(a) Down time pay

(b) Lay-off pay.

(c) Paid sick leave.

(d) Holidays paid but not worked.

c. Payment for Employees’ Security:

(a) Contribution for group insurance scheme

(b) Contribution to workmen’s compensation.

(c) Pension

(d) Contribution to provident fund.

d. Pay of Employee Services:

(a) Subsidised canteen services.

(b) Subsidised housing.

(c) Hospital facilities

(d) Subsidised bus facilities.

Problem of Fringe Benefits:

In many ways, the problem of fringe benefits is similar to the problem of Wages and salaries. In both the problems, the basic issue to the employer is one of labour cost. The employer must decide in both cases the level of wage cost in his organisation.

Fringe benefits are less tangible and more difficult to quantify. In spite of this, fringe benefits cost should form part of wages. Actually such benefits contribute more to the employees’ income as fringe benefits are normally not subject to income tax.

Methods of Accounting of Fringe Benefits:

There are three methods of accounting of fringe benefits:

a. Treatment as manufacturing overheads,

b. Treated as a separate class of overheads,

c. Part of basic wages of the employees.

The use of the first method (treating these costs like other manufacturing cost items) has the advantage of simplicity, but the disadvantage of hiding these costs under the maze of other manufacturing overhead items. If a rate other than direct labour cost is used for allocation of fringe benefit cost, it may distort product cost.

Treating fringe benefits cost as a separate class of overheads requires additional efforts but will result in more accurate costing of products and services.

Treating fringe benefits cost as additions to the basic wage is the most accurate method of charging these costs to production. This method correctly charges to production the cost of keeping employees including fringe benefits costs.

Labour Cost Control – Merit Rating: Meaning, Factors, Advantages and Limitations

Meaning of Merit Rating:

Merit rating is the appraisal of the performance of individual employees on the job. This appraisal is done periodically by the supervisor of the employee. Merit rating is different from job evaluation in the sense that in merit rating, individual merit of an employee is ascertained whereas in job evaluation the relative worth of various jobs in terms of their characteristics is determined.

Merit rating requires keeping performance records of each employee and assessing these performances against some set standards. The objective of merit rating is to reward an employee suitably on the basis of his merit. It is more useful in case of indirect workers whose work cannot be quantified.

Factors in Merit Rating:

The following are important factors which are considered while rating the merit of an employee:

- Quantity of work done

- Initiative

- Sense of responsibility

- Reliability and integrity

- Knowledge, general awareness, skill, experience and attitude for work.

- Conduct and discipline

- Sense of judgement

- Attendance and punctuality

- Dependability

- Tidiness of workplace

- Ability to follow instructions and adaptability

- Cooperation and attitude toward fellow workers

- Extraordinary personal characteristics.

Every factor is assigned some points. The merit-rater grants points to each worker for every factor. The relative merit rating of all the employees is determined, on the total points scored by an employee. Various incentives, advance increments, promotions, etc., may be granted on the basis of merit rating.

Advantages of Merit Rating:

1. Merit rating helps the management in placing the right man in the right job. The work of the personnel department is facilitated with regard to placement, training, transfer, and promotion, etc.

2. Merit rating provides the basis of granting incentives and out of turn promotions to employees. This in turn improves productivity of workers and stimulates competition among them for better performance.

3. By pointing out workers’ deficiencies, they get an opportunity to improve their performance. At the same time, the strong points and special abilities of workers are brought to light.

4. Linking of rewards to merits removes disparities among workers, improves labour relations and reduces dissatisfaction and labour turnover.

5. Merit rating compensates for inadequate work-study, particularly where precise measurement of work is difficult or impossible.

Limitations (Short-Comings) of Merit Rating:

1. Merit rating has an element of subjectivity. It is possible that two officers may rate the same worker differently. This may cause discontentment among workers.

2. Past rating records of an employee may influence the judgement of the present rater. This may vitiate the fairness and value of merit rating.

3. It may not always be possible to reward all workers on the basis of their merit rating, particularly where the quota system is followed. This may not provide adequate motivation for workers to improve their performance.

4. The rater may not be competent and adequately trained to do the job of merit rating; he might be assessing the performance of employees only by virtue of his official position.

Labour Cost Control – Time and Motion Study (With Advantages)

Ever increasing competition has forced firms to produce their products at the lowest possible costs. To achieve this, the management is always on the lookout for effective and cheaper ways of doing work. Time and motion study (work study) has played a significant role in controlling and reducing labour cost.

Time study is concerned with the determination of the standard time required to do work contents of an activity or job. It systematically analyses, records and synthesizes the time required to perform a motion or a series of motions.

Motion study is a systematic attempt to simplify the work process and eliminate unnecessary work in any field of activity. It has given very favourable results by increasing output with less effort and fatigue on the part of workers. It has also increased productivity and wages of workers and, at the same time, reduced per unit cost of production due to the more effective utilization of labour.

Time and motion study is concerned with:

(i) The time a worker takes in doing the job, and

(ii) How a worker does his work- the motions he uses in completing a given job or task.

Time study is the study of the time taken by a worker to complete a job. It systematically records, analyses and synthesizes the time required to perform a motion or a series of motions.

Motion study is the study of motions, and how to eliminate ineffective and wasteful motions. It attempts to select, invent and substitute nonproductive and wasteful motions with effective motions. Its ultimate aim is to find a simpler, easier and better way of performing a job. To achieve this, a detailed study is made of all the motions, materials, tools and equipment used in performing a job.

Time and motion study taken together is concerned with methods improvement. F.W. Taylor and Frank and Lillian Gilbreth have made a notable contribution to the growth and application of methods improvement. Many of the principles and procedures developed by them are being effectively used by industry.

By using time and motion Study, job performance can be made easier, simpler, quicker and less fatiguing. Productivity of labour can be enhanced with the help of time study; incentive wage plans can be set up to pay wages for additional work, simultaneously increasing production, it is possible to find normalized time (Actual time spent on job x Performance rating) and set standard time to perform work.

Advantages of Time and Motion Study:

In brief, the following advantages can be derived from time and motion study:

1. Equitable determination and assignment of work load to workers.

2. More effective production scheduling and planning.

3. Workers’ wages can be brought to a level consistent with their work.

4. Workers morale is raised and they feel more satisfied.

5. More rational evaluation of workers is possible.

6. Cost can be ascertained easily.

7. Group bonus schemes can be easily implemented since the efficiency of work groups can be calculated.

8. Wage incentive plans can be introduced in the organization.

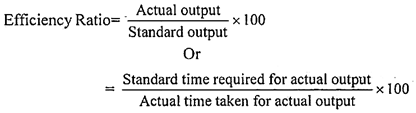

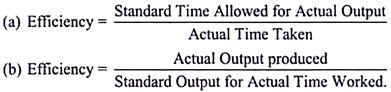

Labour Cost Control – Efficiency Rating: Meaning, Procedures, Formulae, Use and Ways

Efficiency Rating Meaning:

Efficiency rating refers to the measuring of labour productivity of a worker. Productivity means the yield obtained from any process or product by employing one or more production factors. Labour productivity is usually calculated as an index number, the ratio of output – input.

This index indicates efficiency and effectiveness in the use of resources, man, material and machines, etc. In the case of labour, productivity of a worker is measured by comparing a worker’s actual output with the standard output expected of him in a given time period or standard hours required for the actual output and the actual time taken for the actual output.

Efficiency Rating Procedures:

The efficiency rating of a worker may involve the following procedures:

(i) Laying down standard output expected of a worker in a given time period or determining the standard time required to do the given task.

(ii) Measuring the actual output of each worker in the given time or actual time taken by the worker to accomplish the assigned task.

(iii) Calculating the percentage efficiency ratio of each worker by any of the following formulae –

Use and Interpretation of Efficiency Ratio:

The efficiency ratio is gainfully used in measuring the performance of a worker. The efficiency of a worker is said to be increased if in the same hours more output can be obtained or the same output can be produced in less number of hours.

Ways to Increase Efficiency Rating:

Labour efficiency rating can be increased in the following ways:

i. By employing workers who possess requisite skill to do the job.

ii. By placing the right man in the job.

iii. By imparting necessary/proper training to new workers and conducting orientation training programmes for the existing workers.

iv. By avoiding a situation of surplus labour or shortage of labour.

v. By conducting work study (time and motion study) or performing a job in the best possible manner with minimum efforts.

vi. By fixing proper wage rates.

vii.By simplification and standardisation of work.

Labour Cost Control – Out Workers and Casual Workers

Out-Workers:

In some trades, for example, knitwear and in manufacturing lamp shades, certain of the work is performed by workers in their own houses. In such cases, time records are not required as the workers are paid according to their work they complete and the time spent on the work is of little interest to the employer.

However, it is imperative that rigid control be exercised over the out-workers in the following matters:

1. The issue of materials and the reconciliation of materials drawn from the store with the output.

2. The inspection of output within the time stipulated to ensure an even flow of production and the fulfilment of order and contracts.

3. The delivery of output within the time stipulated to ensure an even flow of production and the fulfilment of orders and contracts.

The wages of out-workers will usually be at a higher rate than those paid to piece workers engaged in the factory, as some compensation must be given for using their own premises, lighting, tools etc.

Out-workers should not be confused with outside workers, who are employees working outside the factory on building sites or moving from place to place on small installations or repair work.

Time records for such workers must be maintained so that workers may not waste the time. Where a large number of workers are engaged upon a site for a long period, time recording clerks should be installed to record the time of direct workers.

A particular type of time card is used for outworkers known as ‘Outwork Time Card’.

Casual Workers:

Casual workers and badli workers are employed either to handle urgent extra work, or to fill up casual vacancies arising out of the temporary absence of regular workers. Such workers are engaged on a daily basis. Wages are paid to them at the end of the day’s work, and charged as direct or indirect labour cost depending on their identifiability with specific jobs, work orders, or department.

When casual workers are employed on a job or work-order, they are given job cards. On the completion of the day’s work, the foreman initials these cards. Wages are paid on presentation of these cards. When they are employed as indirect labour, time cards are issued to them, which the foreman initials authorising payment of wages due at the day rate or hourly rate.

Casual workers employed by contractors at site are given time cards and the foreman in charge makes the necessary payment out of an imprest cash which he holds. Sometimes a clerk from the main office of the employer visits the site and makes payment to the workers. This provides a check on the foreman as regards the number he employs and their amount which is required to be paid.

Labour Cost Control – Learning Curve

It is pure commonsense that as a worker becomes familiar with a task through repetition, he becomes more proficient. As he gains experience, the average time to manufacture a unit will decrease.

He takes less time and makes fewer mistakes. Even otherwise, efforts are constantly made to upgrade the skills of the employees and enhance their efficiency through education and motivation.

After analyzing mass of data during World War II, aircraft manufacturers in the U.S.A. found that the rate of improvement is so regular that it can be reduced to a formula. Labour hours can also be predicted with a high degree of accuracy from the learning curve. Producers in other fields also have experienced the same regularity in the pattern of workers’ ability to learn a new task.

The premise is that labour hours decrease in a definite pattern as labour operations are repeated. The pattern which has been derived from statistical studies can be stated as follows-

Each time cumulative quantities are doubled, the cumulative average hours per unit will be reduced by some constant percentage, ranging between 10 and 40 per cent. The curve is usually described by its complement.

If the rate of reduction is 20 percent, the curve is referred to as an 80 percent learning curve, a 10 per cent reduction is titled a 90 percent curve. The increased productivity resulting from learning a new task can be plotted on a graph. This is exactly the learning curve. This curve dips very sharply at first and then levels off, a straight line when the learning phase has been completed.

The learning curve is a valuable management tool in both planning and cost control. In planning, it can be used in a number of ways- preparing cost estimates in competitive bidding on new contracts, determining budget allowances for labour and labour related costs.

Labour Cost Control – Group Bonus Schemes: Meaning, Conditions, Advantages, Disadvantages and Important Group Bonus Schemes

When a bonus is paid collectively to a group of workers, it is called ‘Group Bonus Scheme’. It is computed on the total production of a group of interdependent workers and distributed among them on some agreed basis.

Such schemes are suitable for mass production or assembly type of work, e.g., radio, television, scooter, etc. where a team of workers is engaged in various operations. The intention is to create a collective interest in the work.

Group Bonus scheme can be effectively used under the following conditions:

i. Where it is not possible to measure individual performance.

ii. Where the group is not very large.

iii. Where the workers forming a group have almost equal skill and efficiency.

iv. When incentive is to be provided to indirect workers.

v. Where output depends on the collective effort of a group of workers.

vi. Where management wants to promote team spirit.

The advantages of Group Bonus scheme are as follows:

i. It requires less clerical work as it involves recording of the output of the group and not of individual workers.

ii. It creates a team spirit among the workers.

iii. It reduces supervision and absenteeism of workers.

iv. Indirect workers may be included under the scheme.

The disadvantages of the scheme are as follows:

i. Efficient workers are not rewarded properly, as inefficient workers share bonus equally with efficient workers.

ii. It is difficult to fix the amount of bonus and the basis of distribution among individual workers in the group.

iii. It is difficult to get workers acceptance of the scheme, especially when workers in the group are of widely varying skills and efficiencies.

iv. The amount paid as a bonus to individual workers of the group is generally small and hence it does not give adequate motivation.

v. There is no direct relationship between individual effort and output.

Important group bonus schemes are:

(a) Priestman’s Production Bonus;

(b) Rucker Plan;

(c) Scanlon Plan; and

(d) Towne Gain Sharing Plan.

(a) Priestman’s Production Bonus:

The scheme was first used by M/s Priestman Bros. Ltd., of Hull in 1917. In this scheme, a standard is fixed every month or week for the entire work in terms or units or points.