Overheads are indirect Costs. Indirect Cost cannot be traced to any unit. These costs are incurred for a number of units and so cannot be identified with a cost unit. Indirect costs are those which cannot be allocated to any particular cost unit but is generally apportioned to or absorbed by cost units on a suitable basis. Overhead is also known as “on cost, burden or load”.

Overheads are any expenditure over and above the prime cost. Overheads may be defined as all indirect costs incurred for the production of goods or services. Overheads are also known in cost accounting terminology as ‘On Cost’, ‘Burden’, Indirect Expenses, etc.

Contents

- Introduction to Overheads

- Meaning of Overheads

- Definitions of Overheads

- Meaning of Accounting of Overheads

- Objectives of Costing for Overheads

- Features of Overhead Expenses

- Elements of Overhead

- Classifications of Overhead

- Importance of Overhead

- Collection of Overhead

- Codification of Overhead

- Allocation of Overhead

- Apportionment and Re- Apportionment of Overheads

- Distinction between Allocation and Apportionment

- Departmentalisation of Overheads

- Steps Involved in the Accounting of Production Overhead

- Methods of Segregating Fixed and Variable Overhead Elements

- Selling and Distribution Overheads

- Administration Overheads

- Manufacturing Overhead

- Primary and Secondary Distribution of Overhead

- Single Overhead Rate and Multiple Overhead Rates

- Types of Capacity Levels

- Absorption Overheads

- Under-Absorption and Over-Absorption

- Treatment of Certain Items

What is Overheads: Introduction, Meaning, Definitions, Factory Overhead, Expenses, Overhead Expenses, Features, Classification, Importance, Collection, Codification, Allocation, Steps, Treatment, Formula and Examples…

Overheads – Introduction

Overheads are indirect Costs. Indirect Cost cannot be traced to any unit. These costs are incurred for a number of units and so cannot be identified with a cost unit. Indirect costs are those which cannot be allocated to any particular cost unit but is generally apportioned to or absorbed by cost units on a suitable basis. Overhead is also known as “on cost, burden or load”.

ADVERTISEMENTS:

According to the terminology of Cost Accountancy, CIMA, London, overhead is defined as “the aggregate of indirect material cost, indirect wages and indirect expenses”.

In the words of Wheldon, overhead may be defined as “the cost of indirect materials, indirect labour and such other expenses including services that cannot conveniently be charged direct to specific cost units”.

Therefore, overhead includes:

1. Indirect costs, which cannot be, by their nature, traced to specific units of production.

ADVERTISEMENTS:

2. Direct costs, which are so small in amount that it is inexpedient to trace them to specific units of production.

Overhead = Indirect material + Indirect labour + Indirect expenses

Overheads – Meaning

Overheads are any expenditure over and above the prime cost. Overheads may be defined as all indirect costs incurred for the production of goods or services. Overheads are also known in cost accounting terminology as ‘On Cost’, ‘Burden’, Indirect Expenses, etc.

Indirect cost or overheads are those expenses which cannot be identified or related to a specific or particular product or service. These overheads are not ‘Allocated’ but are apportioned (divided) among various products or cost centres like rent, insurance, repairs, telephone charges, etc.

ADVERTISEMENTS:

As the production these days is involving capital intensive industries and on the mass scale with automatic machines and computerised system. All this has resulted into heavy expenditure on indirect cost which means increase in overheads. Overhead expenses these days are very significant in the total cost of production.

So these overhead needs careful analysis for cost calculation and control of cost. The overhead analysis, classification and apportionment to a cost centre plays a significant role in various types of managerial decision-making. Minimisation of overheads (control on wastage) is very important to keep a watch on the cost of production and production planning.

Overheads – Definitions

“Any cost of doing business other than a direct cost of an output of product or service”.

– Eric L. Kohler

“Overheads are cost of an which do not result solely from the existence of individual cost units”. – W. M. Harper

“Overhead represents the cost of indirect material, indirect labour and such other expenses including services as cannot conveniently be charged to a specific unit”.

According to CIMA, overhead costs are defined as, ‘the total cost of indirect materials, indirect labour and indirect expenses’. Thus all indirect costs like indirect materials, indirect labour and indirect expenses are called as ‘overheads’.

Meaning of Accounting of Overheads

Accounting of overheads means the method adopted by the organization to accurately include the overhead costs in the total production cost of the finished goods. Accounting of overheads is a much more complex matter than that of accounting of direct costs.

The main reason for this difficulty is that overheads are specific to any cost center or product but are incurred for the common benefit of several cost centers.

ADVERTISEMENTS:

Therefore each overhead has to be studied, analysed and distributed to several cost centers, departments to which the benefits of the overheads go. This gives rise to a search for a basis of distributing the overhead. This basis or ratio of distribution is not the same for different overheads or for different cost centers

Objectives of Costing for Overheads

The objectives of costing for overheads are:

1. For determining the actual cost of a product, overheads are to be charged indirectly to the product.

2. For identifying overheads with cost centres, or for the purpose of cost control, overheads have to be identified and charged to the final output.

6 Important Features of Overhead Expenses

ADVERTISEMENTS:

The features of overhead are as follows:

They are identified below:

1. Overhead Expenses are indirect costs.

2. They are common costs.

ADVERTISEMENTS:

3. They include both escapable and inescapable. Because, discontinuance of a Cost Centre or Cost Unit results in the avoidance of incurrence of certain items of Overhead Expenses.

Therefore, they are called escapable. Other Overhead Expenses (i.e., which cannot be avoided) are inescapable.

4. They comprise of both cash expenses (e.g., insurance, rent, etc.,) and book expenses (i.e., depreciation).

5. They consist of both production expenses and non-production expenses (i.e., administrative, and selling and distribution expenses).

6. They are both variable and fixed.

Overheads Elements – Indirect Material Cost, Indirect Labour Cost and Indirect Services Cost

The elements of overhead are discussed below:

ADVERTISEMENTS:

Element # 1. Indirect Material Cost:

Indirect material cost is that material cost which cannot be assigned to specific units of production. Indirect material cost is common to several units of production. A few examples for the same are consumable stores, lubricating oil, cotton waste and small tools for general use.

Sometimes indirect material cost includes direct material cost, which is so small or complex that direct tracing to specific units is inexpedient, for example, glue, thread, rivets and chalks etc.

Element # 2. Indirect Labour Cost:

Indirect labour cost is that portion of labour cost, which cannot be assigned to any specific units of production. Indirect labour cost is common to several units.

Salaries of foreman, supervisory staff and works manager, wages for maintenance workers, idle time, and workmen compensation are some of the examples of indirect labour cost, which like some direct material cost, are not assigned to the specific units of production for the sake of expediency.

ADVERTISEMENTS:

Employees’ social security charge and unemployment payroll taxes are the two examples that fall under this category.

Element # 3. Indirect Services Cost:

A few examples of indirect services are –

(i) repair and maintenance of plant and machinery,

(ii) factory rent,

(iii) expenses of keeping and handling of stores, and

ADVERTISEMENTS:

(iv) first aid expenses.

Overheads Classifications – According to Elements, Function, Variability and Controllability

Overheads may be classified on various basis such as:

1. According to Nature/element

2. According to Function or Functional classification

3. According to Variability

4. According to Controllability.

ADVERTISEMENTS:

1. According to Elements:

Overheads are divided into 3 categories:

i. Indirect material

ii. Indirect labour

iii. Indirect expenses

2. Functional Classification:

i. Production Overhead:

Production Overhead mean and include all indirect cost involved in the production process. It includes indirect material, indirect labour and other indirect expenses of the factory. Production overhead are also termed as factory overhead or works overhead etc.

The examples include Factory’s power & lighting, factory rent, depreciation on factory building, repairs & maintenance etc.

ii. Administrative Overhead:

All those costs which are of general natural and spent for administrative purposes will from part of administrative overhead. For example office staff salaries, manager salary, office stationary, rent of office building, insurances of office building etc.

It is to remember here that the purpose for which amount is spent will constitute the basis for its allocation. For instance if stationary is purchased for office use, it will be administrative overhead but if the stationary is used in factory, it will be part of production overhead.

Similarity lighting expenditure of office building is administrative overhead while lighting expenditure of factory building will be production overhead. Therefore, the place and the purpose of money spent is the key to know the category of overhead cost.

iii. Selling & Distribution Overhead:

Selling and distribution overhead include all indirect costs incurred to enhance and maintain sales level. For example – godown expenses, packing expenses, salesman’s salary & advertising, travelling expenditure etc.

3. According to Variability:

Overheads can be classified into three categories according to variability viz.:

i. Fixed overheads,

ii. Variable overheads and

iii. Semi-variable overheads.

These are explained below:

i. Fixed Overhead:

Costs are those cost which do not change because of change in the particular production level. It means the fixed overhead is independent of production process. Some examples are rent of building, salaries to staff, insurance of the building, manager’s salary etc.

It should be remembered here that concept of fixed cost is applicable only in the short run. All costs are variable in the long run.

ii. Variable Overhead:

This is the most confusing word. If we are talking about overhead, it has to be indirect cost and it is generally believed that all indirect cost are fixed cost. But this is not true. There are certain cost which are indirect costs but are variable in nature.

For instance, oil & lubricant expenditure of the machine. It is indirect cost because it cannot easily be identified with the product but variable in nature as the use of oil and lubricant depends on the level of production. Other examples are store, power, lighting expenditure, indirect labour etc.

iii. Semi-Variable Overhead:

Semi variable Overhead costs are those costs which do not vary in the same proportion as the level of production.

Example of semi variable cost are:

a. Depreciation of P & M

b. Inspection cost

c. Supervisors salaries

d. Repairs & maintenance

4. According to Controllability:

All those overhead cost which can be influenced by the decision of the management are called controllable overhead cost. Generally variable and semi variable cost are covered in this category.

Uncontrollable Overhead –

Those overhead costs which are not controllable at the discretion of the management are called uncontrollable overhead cost. Generally fixed overhead cost is covered in uncontrollable overhead e.g., rent of office, salaries of staff etc.

Advantages of Classifying the Cost into Fixed and Variable Component:

Variable cost are controllable costs, therefore total costs has to be divided into variable & fixed cost so that effective cost control is possible.

Segregation of cost into fixed & variable component helps in following ways:

(i) Cost Control and Decision Making:

Cost control can be exercised only if the cost is divided into fixed and variable cost as only variables cost can be controlled and reduced easily. Fixed costs are considered to be uncontrollable costs and therefore are left while taking decisions.

But is does not mean that all fixed costs are redundant. The fixed cost which is relevant in a particular decision making situation is known as controllable cost.

Therefore, costs are divided into relevant and irrelevant cost in decision making process. Relevant costs may include variable as well as fixed costs.

(ii) Budget Preparation:

Cost classification helps in budget preparation for various levels of production. Variable cost generally increases or decreases according to the level of production while fixes cost remains same. So, all semi fixed cost need to be divided into fixed & variable components so that a comparative budget can be prepared.

(iii) Helps in Marginal Costing:

Division of cost into fixed and variable component helps in marginal costing. In marginal costing, only variable costs are considered to calculate cost of production and valuation of closing/opening stocks.

Marginal costing also helps in fixation of the price in depressions or slowdown. Marginal costing also helps in various other decisions like make of buy, shut down, product mix etc.

(iv) Helps in Determining Overhead Absorption Rate:

Separation of cost into fixed and variable cost helps in determination of overhead rate separately for fixed and variable overhead cost without the use of predetermined overhead rate. The cost cannot be absorbed without the use of overhead absorption rate.

Overheads – Importance

In the past the term cost is used to mean only prime cost. Due to scientific inventions production is being carried on large scale. This necessitated the increased use of machines, mobilisation of large financial resources, employing professional managers for framing corporate policies and planning, transportation of materials and products, personnel management, marketing, adherence to various business laws, tax laws, labour laws etc.

This resulted in incurring of large indirect costs like plant maintenance, technical consultancy, legal advices, secretarial services, and marketing research. It forms a large part of total cost incurred in a firm. To ascertain the correct cost of production, it is necessary to establish a detailed system for collection and accounting for overheads.

Collection of Overheads from Various Sources

In cost accounting collection of the overheads from various sources is very important, so that these may be properly allocated, apportioned and codified.

The sources of these overheads can be:

(i) Purchase Journal and Invoices

(ii) Store requisitions

(iii) Wages Analysis Book

(iv) Cash book

(v) Journal

(vi) Different Reports and Registers.

Source # (i) Purchase Journal and Invoices –

Material are purchased for different requirements and for different production departments by the purchase department. These purchases are recorded in the purchase journals and material control accounts and the invoices for expenses are entered in the overhead control accounts.

Source # (ii) Store Requisitions –

Store requisitions prepared for the issue of indirect material like cotton waste, lubricants, brushes, soaps, etc., are useful in collecting overheads to be charged to the department to which issued.

Source # (iii) Wages Analysis Book –

The book provides information regarding indirect wages, overtime, bonus, etc. to be treated as overhead.

Source # (iv) Cash Book –

All those expenses which are paid in cash are recorded in cash book. So all those overheads which are paid in cash and which are not recorded anywhere else in the above said books can be collected from cash book.

Source # (v) Journal –

This book gives information about outstanding expenses and prepaid expenses along with other items of overheads like depreciation interest, notional rent etc.

Source # (vi) Different Reports and Registers –

Reports related to scrap, spoilage, wastage, idle time, idle production capacity and various registers like plant and machinery, repair and maintenance register etc. help to collect overheads.

Overheads Codification – Methods and Objects

When the collected overheads are grouped according to their class it is known as classification of overheads. Each group or class is given a code number to help in maintaining mechanised accounting and secrecy in the system. This code allotment procedure is known as codification.

Codification may be done by any of the following methods:

(i) Numbers

(ii) Alphabets

(iii) Combination of numbers and alphabets

(iv) Symbols.

Objects of Codification:

(i) To collect the overheads of similar nature into one group.

(ii) To help the allocation and apportionment of overheads to products, process, jobs or cost centres.

(iii) To help in planning and control of cost of products.

(iv) To make possible to prepare accounts by mechanised and computerised system.

(v) To make the accounting system more economical and useful through reducing the number of the ledgers and accounts.

Codification is associated with allotment of standing order, numbers to the different groups and items of overheads.

(i) Standing Order Number – The numbers provided to production overheads are known as standing order numbers.

(ii) Cost Accounts Number – The numbers provided to office overheads and selling and distribution overheads are known as cost accounts numbers.

The orders in which these numbers are allotted remain fixed. These are known as standing orders. These standing order numbers as adopted by an organisation are to be listed in a schedule or manual.

Methods of Codification:

(i) Numerical Numbers:

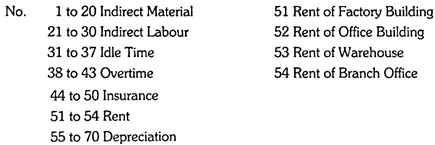

Under this method the various groups are allotted numerical numbers so that one group of overhead may represent one standing order number. As for example –

(ii) Alphabets:

Under this method alphabets are allotted to each overhead. These alphabets help in memory and identification of overheads. For example –

PO – Power

RE – Repair

DE – Depreciation

CA – Carriage

MA – Maintenance

(iii) Combination of Alphabets and Numerical:

Under this method both of the above methods are combined into one. Under this method alphabet stands for head of expenses and number shows further analysis of expenses. As for example –

RE1 = Repair to factory building

RE2 = Repair to office building

RE3 = Repair to warehouse

RE4 = Repair vehicle

RE5 = Repair to furniture

Again repair to furniture can be divided into further code number.

RE5.1 = Repair to factory furniture

RE5.2 — Repair to office furniture

RE5.3 = Repair to warehouse furniture and so on.

(iv) Symbols:

This method is used in those concerns which are working under mechanised system with punched card accounting. The nine digit punched card is divided into four parts.

00/000/00/00

The first part of two digits represents class of overhead, i.e., fixed or variable. The second part of three digits represents head of overhead (i.e., idle time, etc.), the third part of two digits signifies analysis of expenses (i.e., waiting for material). The fourth part of two digits represents the cost centre (i.e., assembly shop).

For example, symbol 10/120/01/07

Stands for 10 for variable cost, 120 for idle time, 01 for waiting of material, 07 for assembly shop.

Overheads – Allocation of Overheads (With Categories)

According to The Chartered Institute of Management Accountant, London, Terminology, allocation is defined as “the allotment of whole items of cost to cost centres or cost units”. Expenses which originate directly and completely in a department are identified with the foreman responsible for the supervision of that department.

Direct departmental overhead in production and service department can be categorised as under:

i. Supervision, indirect labour and overtime.

ii. Labour fringe benefits.

iii. Indirect material and factory supplies

iv. Repairs and maintenance

v. Equipment depreciation

Apportionment and Re- Apportionment of Overheads (With Illustration)

Apportionment of overheads is the process of distributing those items of overheads that cannot be allotted to a cost centre or department on an equitable basis. In other words, apportionment of overheads involves charging a share of the aggregate production overheads to various departments or cost centre.

Thus, apportionment will arise in respect of overheads common to more than one department or cost centre. For example, salary of general manager is to be apportioned to various departments on the basis of time devoted by him on several departments.

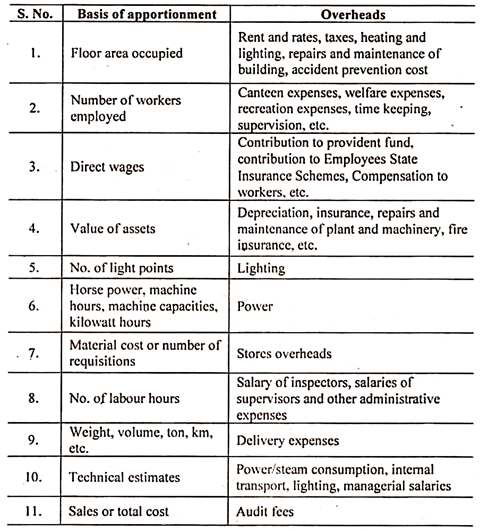

Basis of Apportionment of Overheads:

There is no hard and fast rule regarding the basis of apportioning overheads to various departments and cost centres. Nor is there any single basis for apportioning all the items. The basis to be used for apportionment shall be determined with reference to the nature of the particular item of overheads.

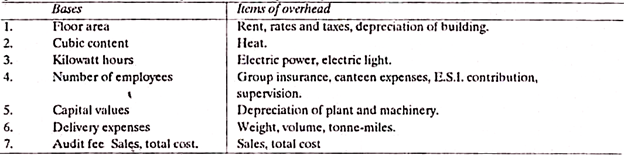

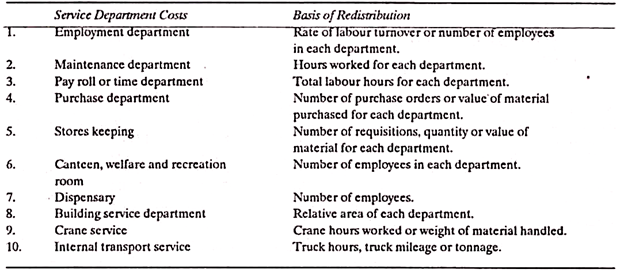

Some of the common basis of apportionment of different items of overheads are illustrated in the following table:

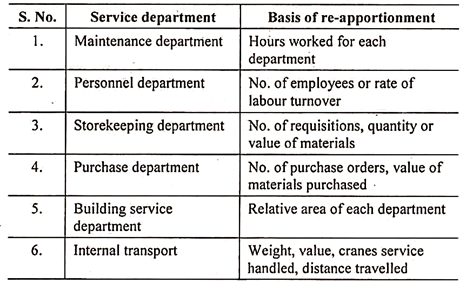

Re-Apportionment of Overheads or Secondary Distribution of Overheads:

After apportioning the overheads to production and service departments, the next step is to apportion the total overheads of service departments to production departments. As service departments are not involved in manufacturing products, it becomes necessary to apportion the overheads of the service departments to the production departments.

The process of redistributing the overheads of service departments to production departments is known as re-apportionment of overheads or secondary distribution of overheads.

Generally, the following bases are adopted for re-apportionment:

Methods of Re-Apportionment of Overheads:

The following three methods are generally used to re-distribute the overheads of service departments to production departments:

1. Direct re-distribution method

2. Step method

3. Reciprocal service method

1. Direct Re-Distribution Method:

Under this method, the service departments’ total overheads are directly re-distributed to production departments. This method does not take into account the service provided by one service department to another service department or to each other.

2. Step Method:

Under this method, the cost of most serviceable department, i.e. the department that renders service to the largest number of departments, is first apportioned to other service departments and production departments. Thereafter, the next service department is taken up for-re-distribution and later the next, and so on, until the costs of all the service departments are reapportioned.

The cost of the last service department is, of course, apportioned only to the production departments. This method is also known as step-ladder method because the tabulation of the distribution resembles a step ladder.

3. Reciprocal Service Method:

This method recognises the fact that each service department not only renders service to other service departments, but also receives the benefit or service from them. As such, this method aims at re-apportionment mutually on inter-departmental basis.

There are three methods for dealing with inter-service department transfers:

i. Repeated distribution method

ii. Simultaneous equation method

iii. Trial and error method

i. Repeated Distribution Method:

This method is also known as continuous allotment method or attrition method or iteration method. Under this method, the total overheads of all the departments as per primary distribution summary are put on one line.

Thereafter, the overheads of service department are apportioned in turn repeatedly to all the departments including other service departments on the basis of the percentage given.

The overheads of the service department, which has received the least service from other departments are distributed first. In this process of re-distribution, the service department whose overheads have been distributed to other departments will again receive a share of overheads of other departments.

The overheads so received will again be re-distributed to other departments. This process is repeated until the figures of overheads in each service department becomes negligible. This is a laborious method and therefore a computer can be used in the calculations.

ii. Simultaneous Equations Method:

This method involves the following steps:

(a) The amount of overheads for the two service departments is to be obtained by solving two simultaneous equations. Let x be the total overheads of the service department P and y be the total overheads of service department Q, then the equation will be-

x = Overheads of P Dept. + Percentage of Q Dept.

y = Overheads of Q Dept. + Percentage of P Dept.

(b) After getting the total overheads of service departments, they are to be re-apportioned to production departments on the basis of percentages given. This process involves only one step as compared to the previous method, which involves a number of repeated steps.

iii. Trial and Error Method:

Under this method, first of all, the overheads of the first service department are apportioned to other service departments at the given rate. Then, the overheads of the next service department are apportioned to the first and other service departments.

This process is repeated till the service department overheads are exhausted or becomes negligible.

Overheads – Distinction between Allocation and Apportionment

Allocation and apportionment represent two successive stages in the process of distributing factory indirect expenses. The purpose obviously is to determine unit product cost. Thus, the distinction between these two terms is largely conceptual rather than substantive.

The points of distinction are enumerated below:

(i) Direct vs. Indirect Identification:

If an item of factory overheads can be identified directly with a specific cost centre, it is allocated thereto. If such an identification with a particular cost centre is not possible, the item will have to be apportioned on some fair and equitable bases. That is the allocation ends with a cost centre, the process of apportionment is carried further down.

(ii) Whole vs. Part:

In allocation, the whole amount of factory overheads is charged to a cost centre whereas in apportionment only a part of the factory overheads is charged to the departments or division within a cost centre.

For example, if the factory itself is treated as one cost centre, the depreciation and maintenance of, factory building will be allocated to it. If the factory consists of two or more departments, the depreciation and maintenance cost will have to be apportioned on some reasonable basis.

Similarly, the salary of the supervisor will be allocated to a cost centre if he looks after the factory treated as a single cost centre. If it is a multi- department factory, his salary will be apportioned amongst all divisions and departments.

In brief, allocation is a direct process but apportionment is an indirect method for which equitable bases are to be selected.

Departmentalisation of Overheads (With Purposes)

In big organisations or factories, there exist a number of departments. Some departments are engaged in the process of production, while others are involved in rendering service to production departments. The former type of department is known as a production department and the latter is called a service department.

Whenever a factory incurs overheads, they will have to be charged on these two types of departments. The process of allocation and apportionment of overheads to various departments is termed as departmentalisation or primary distribution of overheads.

Proper allocation and apportionment of overheads serves the following purposes:

1. It helps in the ascertainment of cost with greater accuracy.

2. It helps in fixation of selling (transfer) prices of products.

3. It helps in control of costs by assigning and identifying costs with the particular department.

4. It helps in accurate forecasting and estimating.

5. It facilitates correct ascertainment of work-in-progress.

6 Steps Involved in the Accounting of Production Overhead

The objective of overhead accounting is to ascertain cost of production. The following steps are involved in the accounting of production overheads.

The following steps are involved in the accounting of production overhead:

Step-1 Departmentalisation.

Step-2 Collection and Classification of overhead.

Step-3 Allocation and apportionment of overheads.

Step-4 Distribution of overheads to production and service cost centres.

Step-5 Re-distribution of service cost centre expenses to the departments using the service till all expenses are distributed over production cost centres.

Step-6 Absorption of overheads by production units.

Departmentalisation is the complete division of the factory into production and service cost centers where expenses are incurred. All documents shall contain cost centers references for correct collection of cost.

Classification and Collection of overheads from various sources are listed below. These are stores acquisition, invoices, cash book, wages analysis, other registers and reports and journal entries.

Allocation is the process of identification of overheads with cost centres apportionment is defined as “the allotment of two or more cost centres of proportions of the common items of cost on the estimated basis of benefit received” (CIMA terminology) –

Distribution of overheads to production and service cost centres may either be primary distribution or secondary distribution.

The redistribution of service department cost can be done by one of the following three methods, when one service cost centres renders service to the other service cost centres.

(i) Direct Distribution Method.

(ii) Step Method.

(iii) Reciprocal Services Method.

Finally, absorption of overhead is the final step in overhead account. The object of absorption of overheads is to charge as an equitable proportion of the total factory overheads to each unit of production.

The total factory overheads are distributed to the production cost centres by allocating departmental expenses, by apportioning common costs along with service department expenses and by re-distributing service department cost to the production cost centres.

The rates may be a single or blanket rate for the entire factory or separate rates for each production departments or cost centres.

Allocation of Overheads

Allocation means the allotment of the entire items of cost to the cost centres or cost unit. The nature of expense can easily be identified and allocated to a cost centre.

For example, salary paid to the office staff is allocated to the administration department.

Apportionment of Overheads

Allotment of proportions of items of cost to cost centres or cost units are called apportionment. This is done in the case of those items of overhead which cannot be allocated to a particular department for example, light cannot be allocated to a department only since it is shared by all production department. It has to be proportionally allocated to the various departments on the basis of area.

Principles of Apportionment

1. Use or Service

The overhead should be apportioned on the basis of use received by a particular department. The greater the amount of service or use received by a department the grater the share of an item of overhead to be apportioned to that department.

2. Survey or Analysis

According to the existing conditions overheads are proportioned on the basis of survey for example a supervise two department X and Y giving 60% of his time in department X and 40% of his time in department Y.

His salary will be apportioned between the two departments in the ratio 60 : 40.

3. Ability to pay

Here the apportionment is made on the ability to pay. Thus, higher the revenue of a particular department, higher shall be proportionate charge for the services.

Top 6 Methods of Segregating Fixed and Variable Overhead Elements

The main problem to a cost accountant is to segregate the semi-variable overhead into fixed and variable elements.

Segregation of semi-variable overhead into fixed and variable elements can be done by adopting any of the following methods.

They are:

1. Comparison Method:

Under this method the quantity of output at two different levels is compared with corresponding amount of expense.

As we know that fixed overhead remains fixed, variable element of overhead is obtained by applying the following formula –

Variable cost per unit = Change in Amount of Expenses/Change in Quantity (output)

2. High and Low Points Method or Range Method:

Under this method, the amount of expense at the highest and lowest levels are compared and related to output attained at those levels. Since fixed overhead remains fixed, the change in the level of overhead must be due to its variable portion. Thus,

Variable cost per unit = Change in amount of Expenses/Change in Output (Units)

3. Equation Method:

Under this method, variable and fixed portions of overhead are ascertained by means of straight line equation. The straight line equation is –

Y = mx + C

Where,

Y = Total semi-variable cost

C = Fixed costs included in semi-variable costs

m = Variable cost per unit

x = Output or Number of units

4. Average Method:

Under this method segregation of fixed and variable elements is made by first taking the average of two selected groups and then applying the range method or equation method, as the case may be.

5. Graphical Method:

Under this method, the portions of variable and fixed overheads are ascertained by plotting the amounts of semi-variable or semi-fixed overheads incurred at various levels of activity on graph paper and drawing the ‘line of best fit.’ Under the graphical method, volume of output is drawn on horizontal-axis and semi-variable expenses on vertical-axis.

Expenses corresponding to each volume are plotted on the graph paper and a straight line, ‘the line of best fit’ is drawn through the points plotted. This straight line represents the ‘total cost line’. The point where the straight line intersects the vertical-axis is taken to be the amount of fixed expenses.

A parallel line from the intersection point to the horizontal- axis gives the ‘fixed cost line’. Thereafter, the ascertainment of variable cost can be made by means of comparison of fixed cost and total cost.

Graphical method is also known as Scatter graph Method. This method is fairly good but the results obtained will not be as accurate as under the least squares method.

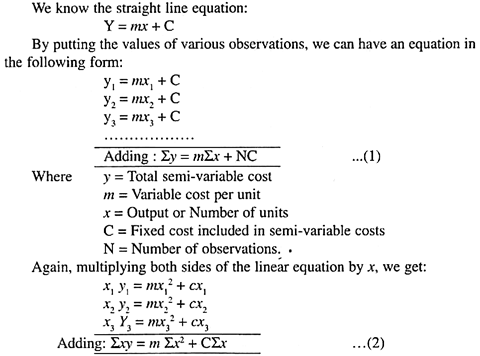

6. Least Squares Method:

Under this method, segregation of fixed and variable elements of semi-variable overhead is made by finding out a ‘line of best fit’ for a number of observations with the help of statistical methods.

With the help of equations (1) and (2), we can get the values of ‘m’ (variable cost per unit) and ‘C’ (fixed cost) and obtain the relationship.

Selling and Distribution Overheads (With Methods and Formula)

(i) Selling Overheads:

Selling Overheads is concerned with either maintaining the sales or to increase the sales to increase the profits or profitability. Selling overheads are also called as marketing expenses.

(ii) Distribution Overheads:

It is concerned with placing the goods from the place of production to the place of consumption. The newspaper printed in the printing house has no value until and unless it is transported the same morning to the place of readers.

So distribution cost creates the place utility in the goods produced or services provided. It is because of this electricity produced at Bhakra Dam is transported through electricity lines and transformers to the factories, homes, offices and other establishments and creates place utility.

Thus, all expenses related to sales or distribution like, advertisement, salesmen expenses, show room expenses, sample cost, packing transportation, warehousing are selling and distribution overheads.

Sometime it is difficult to create distinction between selling overheads and distribution overheads. As for example a salesman may carry on door to door campaign and the live demonstration of the goods and on the same time delivering the goods on the spot.

As in the case of Eureka Forbes. Here both the functions of sales and distribution are performed simultaneously.

The main method of absorbing selling and distribution overheads can be:

(a) Rate per Article –

Under this method, the selling and distribution overheads per unit are calculated and absorbed by multiplying this rate with the number of units sold.

(b) As a percentage of sales –

Under this method, the percentage of selling overheads on the sales is calculated for absorbing the selling overheads.

(c) As a percentage of factory cost –

Under this method, selling and distribution overhead are related to factory cost. The formula is –

Administration Overheads (With Accounting Treatment)

Administrative overheads are defined as “the sum of those costs of general management and of secretarial accounting and administrative services, which cannot be directly related to production, marketing, research or development functions of the enterprise”.

According to this definition, administrative overheads constitute the expenses incurred in connection with formulating the policy, directing the organisation and controlling the operations of an undertaking. These overheads have no direct relation with production, selling, distribution, research or development activity or function.

Examples of administrative overheads are— office, salaries, postages, telephone, stationery, audit fees, directors’ remuneration etc. These overheads are collected and classified in the same way as factory overheads.

The administration overheads of general office department, secretarial department, personnel department, etc. are directly allocated as they can be identified with specific departments. The other overheads are apportioned to various departments on some suitable basis.

Accounting Treatment:

There are three methods for the accounting of administration overheads.

They are as follows:

i. Transfer to Costing Profit and Loss Account:

Under this method, administration overheads are transferred to costing profit and loss account at the end of the accounting period. This method is based on the assumption that administration overheads are not directly connected with the production function of the organisation and therefore, should not be included in the cost of production.

ii. Apportionment of Production and Selling Functions:

In this method, it is assumed that administration overheads are incurred, both for production and also for selling and distribution.

Hence, administration overheads should be apportioned on some equitable basis between manufacturing activity and selling and distribution activity and included in the cost of production and of sales.

iii. Addition as a Separate Item of Cost:

In this method, administration overheads are treated as a separate function and the same is shown in the cost sheet as a separate item of the cost of finished products sold. In such a case, administration overheads are mostly absorbed as a percentage of works cost.

The rate is computed as under:

The administration overheads may also be absorbed on the basis of number of units produced, sales value, etc.

Manufacturing Overhead – Collection and Distribution of Overhead

Manufacturing overhead represents all costs incurred in the factory over and above direct material cost and direct labour cost. In other words, it is the aggregate of factory indirect material cost, factory indirect labour cost and cost of factory indirect services.

Examples of these costs are – consumable stores, lubricating oil, factory rent, repairs and maintenance of plant and machinery, depreciation of plant and machinery used in the factory, depreciation of factory building, etc.

Collection of Overhead:

Separate Standing Order Numbers are used for collection of different items of manufacturing overhead.

It is primarily collected from the following sources:

1. Stores Requisitions:

The indirect materials are requisitioned from stores through material requisition slips showing related standing order number and the department using the indirect materials. The total indirect materials drawn from store are debited to Manufacturing Overhead Control Account and credited to Stores Ledger Control Account.

2. Time Cards or Wages Analysis Sheet:

Indirect wages payable are booked against each standing order number and for each department on the oasis of time cards or job cards. These are summarised monthly in Wages Analysis Sheet. The total of indirect factory wages obtained from this sheet is debited to Factory Overhead Control Account and credited to Wages Control Account.

3. Cash Book:

If petty expenses are frequently incurred, cash book should be scrutinised to collect these expenses according to standing order numbers department-wise. The expenses, thus, collected from cash book are debited to any of the accounts suitably, i.e.-

(a) Store Ledger Control Account

(b) Wages Control Account, and

(c) Cost Ledger Control Account.

4. Subsidiary Records:

There are many items of expenditure which do not involve current cash outlay. A provision is required to be made in cost accounts in anticipation of cash outlay to be made in future. Items of this type are – depreciation, notional rent, notional interest, delayed electricity, telephone and other bills, etc.

These items are recorded in subsidiary records like plant ledger or general ledger. A thorough scrutiny of these subsidiary records helps to collect the amount to be debited to factory overhead account.

Distribution of Overhead:

The relationship between items of overhead and their object cannot always be seen clearly. This difficulty makes the exercise of distribution of overhead a complex problem for a cost accountant.

There are following three aspects of this problem of distribution of overhead:

1. Distribution of overhead among production departments and service departments, i.e., primary distribution.

2. Distribution of cost of service departments among production departments, i.e., absorption of overhead.

3. Absorption of production departments’ overheads by units produced.

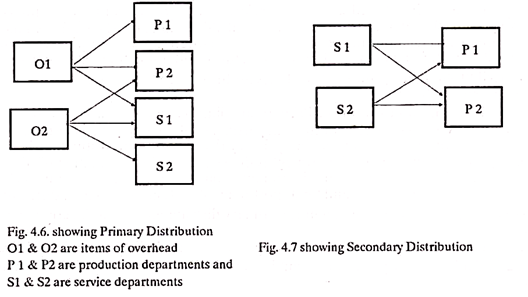

The charts given below describe the three aspects of distribution of overhead:

(Fig. 4.6 shows that items of overhead are distributed in production departments and service departments disregarding their distinction) Fig. 4.7 shows that under secondary distribution/cost of service departments is distributed among production departments.

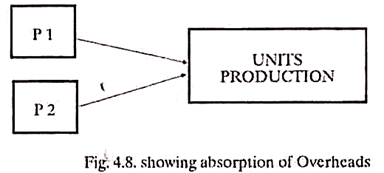

This figure shows that absorption of overhead involves distributing overhead of production departments in units produced.

Primary and Secondary Distribution of Overhead

Primary distribution involves allocation or apportionment of different items of overhead to all departments of factory. This is also known as departmentalisation of overhead. In making primary distribution, the distinction between production department and service department is disregarded.

The distribution of different items of overhead in different departments is attempted on some logical and reasonable basis.

Following points should be kept in mind for apportionment of items for primary distribution:

(i) Basis adopted for apportionment for primary distribution should be equitable and practicable.

(ii) Charges should be made to different departments in relation to benefits received.

(iii) Method adopted for primary distribution should not be very much time consuming and costly.

Following bases are most commonly used for apportioning items of overhead among production and service departments for primary distribution:

For the purpose of primary distribution, a departmental distribution summary is prepared. An example will indicate how allocation and apportionment of expenses are done and finally the total overhead of each department is obtained in the form of Departmental Distribution Summary.

Secondary Distribution:

The products do not pass through service departments, but service departments do benefit the manufacture of products. It is, therefore, logical that product cost should bear an equitable share of the cost of service departments. Based on this logic, the second step in the distribution of overhead is to apportion the cost originally assigned to service departments among the production departments.

This step is taken to collect overhead by production departments only. The process of redistributing the cost of service departments among production departments is known as secondary distribution.

The distinction of production departments and service departments dominates secondary distribution, while this distinction is disregarded in primary distribution.

Criteria for Secondary Distribution:

Following basis are available for determining the basis for apportionment of cost of service departments among production department:

(i) Services Received.

(ii) Analysis of Survey or Survey of existing conditions.

(iii) The ability to pay basis.

(iv) Efficiency or Incentive Method.

(v) General use indices.

Common Bases for Secondary Distribution:

Following is the representative list of bases, which are frequently used for apportionment of cost of service departments among production departments:

Single Overhead Rate and Multiple Overhead Rates (with Formula)

Single Overhead Rate:

Single overhead rate computed for the entire factory is known as Blanket Rate.

Blanket rate is used in small factories where only one product is manufactured or where all the products pass through all the departments and the overhead cost is uniform in all the departments. Why? It is easy to calculate and requires less cost in calculation of factory overhead absorption rate.

Multiple Overhead Rates:

It is a calculation of different overhead rates for different products or separate rates for each production department, service department and cost centre. Further, there are separate rates for fixed overheads and variable overheads also.

Overheads – Types of Capacity Levels

It may be recalled that in the computation of overhead absorption rate, various basis e.g. production units, labour hours, direct wages, machine hours may be used. Each of these bases will represent different figures at different capacity levels. In case of actual overhead rate i.e. actual overheads/actual base, there is no problem with respect to selection of capacity level.

But when a predetermined rate is used, a decision has to be taken as to the most suitable level of capacity to be adopted. The overhead rate and consequently the amount of over or under-absorbed overheads will vary depending upon the adoption of a particular capacity.

The various types of capacity levels are:

Type # 1. Maximum Capacity:

A factory is said to be operating at maximum capacity when it is able to sell all the goods that it can product. But it is very difficult to utilize maximum capacity as some allowance for repair and maintenance and other causes will have to be made.

Type # 2. Normal Capacity:

This is the long-term average of the capacity based on sales expectancy. In other words, the concept of normal capacity is based on the average utilization of plant capacity over a long period. An overhead rate based on normal capacity does not fluctuate much because the long term average levels out highs and lows that occur in a business.

Type # 3. Practical Capacity:

It represents the maximum level of activity at which a plant or machinery can realistically operate with full efficiency. It makes necessary allowances for time lost due to unavoidable factors like plant repairs and maintenance, setting-up time, holidays etc.

Type # 4. Ideal Capacity:

It is the capacity specified or prescribed by the manufacturer and is attainable under ideal conditions. It is also known as installed capacity or rated capacity.

Type # 5. Excess Capacity:

It is that part of plant capacity which is in excess of operating capacity. It is the difference between ideal capacity and operating capacity. Excess capacity may be created by operating extra shift on overtime.

Type # 6. Idle Capacity:

It is that part of machine or plant capacity that cannot be effectively utilised in production. The idle capacity may arise due to lack of demand; non-availability of material, skilled labour; absenteeism; shortage of power, fuel or supplies; seasonal nature of product and unbalanced production.

Thus, idle capacity is the productive capacity lost through idle time. Idle capacity should be distinguished from excess capacity. Excess capacity is the retention of larger production capacity than expected usable capacity. Idle capacity is generally temporary in nature.

Type # 7. Capacity Costs:

The idle capacity costs are mostly fixed charges which remain unabsorbed or unrecovered due to under-utilisation of plant and service capacity. This is a loss to the enterprise and as such idle capacity should be reduced to the minimum.

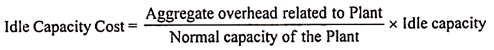

Idle capacity cost may be ascertained by using the following formula:

Treatment of Idle Capacity Costs:

Idle capacity costs can be treated in cost accounting in the following ways:

(i) If the idle capacity cost is due to unavoidable reasons such as repairs, maintenance, changeover of jobs, initial set-up, etc., a supplementary overhead rate may be charged.

(ii) If the idle capacity is caused due to avoidable reasons such as lack of management, faulty planning, power failure or lack of foresightedness, the cost of idle capacity should be charged to costing profit and loss account.

(iii) If the idle capacity cost is the result of seasonal factors, i.e., fall in the demand of a product, then the idle capacity cost should be charged in cost of production by inflating overhead rate.

Absorption of Overheads (With Methods and Formula)

As soon as the service department’s overheads are re-distributed to production departments, the total overheads of production departments should be charged on the number of units produced in those departments. The process of charging the overheads from cost centres to cost units is known as absorption of overheads.

In other words, the recovery of overheads by the finished goods from various production departments are known as absorption of overheads. The main purpose of overheads absorption is to assign an equitable proportion of the total factory overheads to each unit of production.

Methods of Absorption of Overheads:

The important methods used in absorption of factory overheads are discussed below:

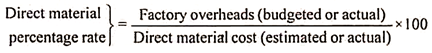

1. Direct Material Cost Method:

Under this method, factory overheads are absorbed on the basis of cost of direct materials. The overheads absorption rate is expressed as a percentage of direct material cost.

It is calculated as under-

This method can be adopted for assembly line, process type and chemical industries where the volume of output and the time of operation of a plant or department bear a direct and proportionate relationship to the materials consumed.

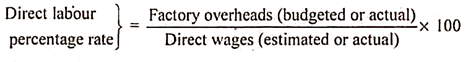

2. Direct Labour Cost (or Direct Wages) Method:

Under this method, the overheads to be absorbed are divided by direct labour cost and the quotient is expressed in the form of percentage.

The overhead rate is obtained by using the following formula:

This method can be safely applied in cases where:

i. The incidence of overheads are not heavy.

ii. The workers in the department are more or less of the same efficiency.

iii. The rates of wages are uniform.

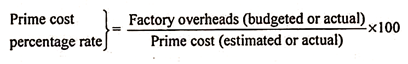

3. Prime Cost Percentage Method:

Under this method, overheads absorption is made on the basis of prime cost. It assumes that both materials and labour give rise to overheads and, therefore, both should be taken into consideration.

The overhead rate is expressed as a percentage of the prime cost and can be obtained by using the following formula:

4. Direct Labour Hour Method:

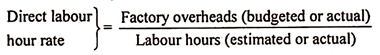

Under this method, the labour hours spent against each job or product in a particular department are added together and a labour hour rate is arrived at through dividing the total overheads of the department by the total direct labour hours.

The formula for computing the direct labour hour rate for a period is as follows:

5. Machine Hour Rate Method:

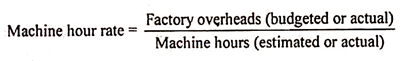

In a manufacturing environment where automatic and semi-automatic capital intensive machinery are used, machine hour rate method is applied in absorption of overheads. The term ‘machine hour rate’ indicates the cost or expenses incurred in running a machine for one hour.

It is on the basis of this rate that a charge is made to the jobs for the overheads depending upon the number of hours for which a machine has worked on that job. The machine hour rate is obtained by dividing the amount of factory overheads concerning a machine by the number of machine hours. Thus-

Under-Absorption and Over-Absorption of Overheads (With Reasons and Accounting Treatment)

Overheads to the cost of production may be absorbed on the basis of the actual or on the basis of estimated or pre-determined basis. If actual rate is applied then there is no question of under or over absorption of overheads.

But in case of predetermined rate, it may result into either under-absorption or over- absorption. If the amount of overhead (on the basis of predetermined rate) absorbed is less than the actual overhead incurred, it is a case of under-absorption (short absorption).

It represents the amount by which the absorbed overheads fall short of the actual amount of overhead incurred. If the amount absorbed is more than the expenditure incurred actually it is over-absorption of overheads.

Over-absorption will inflate the cost. It means over-absorption (means the excess of overheads absorbed over the actual amount of overhead incurred.)

(1) Under absorption – Where the amount absorbed is less than the actual amount of overheads incurred is known as under absorption.

Under-absorption = Actual Overheads – Absorbed Overheads

(2) Over-absorption – Where the amount absorbed is more than the amount of overhead actually incurred it is a case of over-absorption of overheads.

Over-absorption = Absorbed Overheads – Actual Overheads

Reasons for Under-Absorption or Over-Absorption of Overheads:

(i) Error in estimating overheads.

(ii) Error in estimating the level of production.

(iii) Error in estimating the machine hour or labour hours to be worked.

(iv) Seasonal variation in the overhead expenses from period to period.

(v) Unanticipated changes in the method or techniques of production.

(vi) Unforeseen changes in the production capacity.

(vii) Under or over-utilisation of productive capacity.

Treatment of under absorption or over absorption of overheads may be disposed off in any of the following manners:

Accounting Treatment of Under-Absorbed or Over-Absorbed Overheads:

A. Transfer to Costing Profit and Loss Account;

B. Carry forward to Next Year;

C. Use of Supplementary Overhead Rate

A. Transfer to Costing Profit and Loss Account:

Under this method the amount of under-absorbed or over-absorbed overheads is written off by transferring to costing profit and loss account.

The main problem in this method is that the value of stock is distorted. Under-absorption or over absorption will also give false figure of profit or loss of the organisation by the same amount for the period. Journal entry to be passed in case of under absorption –

Costing Profit and Loss A/c …Dr.

To Factory Overhead Control A/c

In case of over-absorption –

Factory Overhead Control A/c …Dr.

To Costing Profit and Loss A/c

This method of transfer to Profit and Loss Account should be used in the following cases:

(a) When the amount of under/over absorbed overhead is small.

(b) When the under or over absorbed overheads take place due to abnormal circumstances like strikes, lock out, breakdown etc.

B. Carry Forward to Next Year:

Under this method the amount of under/over absorbed overheads at the end of the year is first transferred to ‘Overhead Reserve A/c’ or ‘Overhead Suspense A/c’ and then carried forward to the next year accounts in the hope that the same will be automatically counterbalanced in future periods.

This method may be used in the following circumstances:

(i) When the normal business cycle extends more than one year and overheads rates are calculated for long period.

(ii) When in the beginning the production is low due to new start of business or new project and is expected to improve in the later year.

C. Use of Supplementary Overhead Rate:

If the product is still unsold then this method can be used very easily. This method should be used where the under or over absorbed overheads are quite large. Under this method supplementary rate of overhead is used to adjust the amount of under or over absorption.

This rate is calculated as follows:

Under absorption is adjusted by using a plus-supplementary rate since the amount is to be added.

Over absorption is adjusted by using a minus-supplementary rate since the amount is to be deducted.

Overheads – Treatment of Certain Items (with Formulas)

I. Depreciation:

Depreciation is the diminution in the value of a fixed asset due to use and/or lapse of time. It is the result of two factors; usage of the asset and lapse of time. If the usage of the asset is more extensive (e.g., working shift work, overtime etc.) the rate of depreciation would be greater.

The more the use to which an asset is put, the greater will be the depreciation. On the other hand, with the lapse of time an asset continues to depreciate even if it is not in active service.

In cost accounts, depreciation of an asset is charged to cost of sales on the following grounds:

1. It represents a charge for the use of capital resources.

2. After the expiry of the life of the asset, the asset becomes useless and the full value has to be written off. This is against business practice. If depreciation is provided, sufficient funds are made available to replace the asset. The cost of the asset has to be recovered from the cost sales.

3. If depreciation is not accounted for, dividends are likely to be paid out of capital.

4. When an asset is put to use, the value of the asset falls which is equivalent to an item of expenditure. If it is not taken into consideration, it would be difficult to arrive at correct profit.

Methods of Calculating Depreciation

1. Straight Line Method:

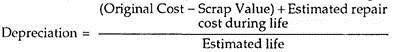

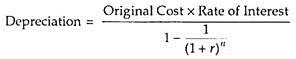

In this method, the cost of acquisition plus the installation expenses of an asset minus the scrap value is spread over the estimated life of the asset to determine the annual charge. It is, thus, a method of providing depreciation by means of equal periodic charges over the assumed life of an asset.

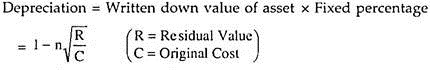

2. Reducing Balance Method:

It is a method of providing for depreciation by means of periodic charges calculated as a constant proportion of the balance of the value of the asset after deducting the amounts previously provided. In this method, the rate of depreciation is the same throughout, but depreciation is calculated on the balance of the asset remaining after charging depreciation each year,

3. Production Unit Method:

In this method, depreciation is charged at a rate per unit of production by dividing the cost of the estimated number of units to be produced during the life of the asset.

4. Production Hour Method:

This is a method of providing for depreciation by means of a fixed rate per hour of production calculated by dividing the value of the asset by the estimated number of working hours of its life.

5. Repair Provision Method:

This is a method of providing for aggregate of depreciation and maintenance cost by means of periodic charges, each of which is a constant proportion of the aggregate of the cost of the assets depreciated and the expected maintenance cost during its life.

6. Annuity Method:

In this method a provision is made for the interest which the business would have earned if the amount of the asset has been invested elsewhere. So the asset account is debited with the amount of interest at a fixed rate each year, but the amount of depreciation to be charged each year is calculated with the help of annuity tables.

The amount of depreciation remains the same every year and is charged like the straight line method.

7. Sinking Fund Method:

In this method, the amount of depreciation is invested every year in some securities. Interest received thereon is again invested so as to raise sufficient money to purchase a new asset, when the asset becomes useless.

This method, thus, not only provides for depreciation but also accounts for the replacement of the asset.

The amount of depreciation under this method is lower than the annuity method and the total depreciation charged is less than the original cost of an asset.

8. Endowment Policy Method:

In this method an insurance policy is taken out for the amount needed to replace the asset. The depreciation charge is the annual premium fixed by the insurance company on the policy. This method is, therefore, similar in effect to the sinking fund method.

Depreciation = The premium charged by the insurance company.

9. Revaluation Method:

This method is usually applied to rapidly depreciating assets such as loose tools, livestock, patents etc. In this method the value of the asset is revalued at the end of the year and compared with value of the asset at the beginning of the year.

The difference between the two is treated as depreciation.

Depreciation = Previous Asset Value – Present Asset Value.

10. Sum of the Digits Method:

This method is suitable for depreciation of those assets which drop in value immediately after purchase e.g., motor vehicles.

This is the method of providing for depreciation by means of differing periodic rates computed according to the following formula:

If ‘n’ is the estimated life of the asset, the rate is calculated each period as a function in which the denominator is always the sum of the series 1,2,3……. n and the numerator for the first period is n, for the second n – 1, and so on.

Rates of Depreciation:

The rates of depreciation may be worked out as –

(1) a single rate for each asset,

(2) a composite rate for a number of assets,

(3) a group rate for a number of assets of identical type and characteristics, and

(4) an accelerated rate.

(1) Single Rate –

Here depreciation is calculated for every machine separately with reference to the estimated life on an asset.

(2) Composite Rate –

It is a depreciation rate which is calculated by dividing the aggregate of the individual depreciation charges in any one period of all assets concerned, by the aggregate of the costs of those assets.

(3) Group Rate –

This is similar to the composite rate except that the assets which form the group should of identical type having similar physical features.

(4) Accelerated Rate –

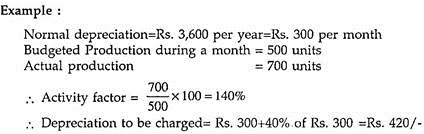

When an asset normally working on a single shift is worked for double shift, the asset depreciates much more and therefore extra depreciation must be provided for the additional charge.

To obviate this the depreciation rate is suitably increased e.g., for double shift working, the depreciation rate is doubled. The ‘activity factor’ is normally used to calculate the accelerated rate.

II. Obsolescence:

Obsolescence is the loss in the value of an asset due to its supersession at an earlier date than was foreseen. It may arise due to a number of reasons such as change in the product, change in the method of manufacture, invention of an improved model of machine etc.

Treatment:

(1) If obsolescence can be foreseen the loss in value should be covered by additional provision of depreciation,

(2) Where obsolescence cannot be foreseen and depreciation is charged in the ordinary course at normal rate, the loss on the asset owing to obsolescence should be written off to Costing Profit and Loss Account

(i) in one lump sum or

(ii) in a number of instalments over a period less than the remaining life of the asset replaced or

(iii) in instalments over the remaining periods of the life on the asset replaced.

III. Interest on Capital:

Interest on capital may be on

(1) borrowed capital or

(2) owned capital. While accountants generally agree that the amount of interest paid should be included in cost, the controversy on the point whether or not the interest not paid (on owned capital) should be included in costs.

The arguments for and against inclusion of national interest are given below:

For:

1. Interest is a reward of capital as wages are the reward of labour.

2. Interest on borrowed capital is included in costs. Likewise interest on owned capital must be incurred.

3. It makes costs comparable.

4. Interest is the reward for time, and hence it is to be included in costs to account for the time element, specially when capital is locked up for long periods of time e.g., timber held for maturing. In such a case, true cost can be ascertained only when interest on capital involved is included.

5. The results of replacing hand labour by expensive machinery cannot be gauged accurately unless interest on capital is included.

Against:

1. The reward for capital is covered by profits.

2. Cost accounts should take into account actual expenditure only. There should be no room for national interest, which is not paid. Comparison of costs including interest can also be done by maintaining separate statements; it does not necessarily require inclusion of interest on capital in costs.

For the purpose of computing interest it is difficult to find out the exact capital employed. Also, it is difficult to arrive at the fair rate of interest.

3. Interest on capital complicates cost accounts. It is a matter of pure finance. Moreover, it is in anticipation of profit and therefore cannot be a part of cost. More importantly, interest on capital inflates the inventory values unnecessarily, upsetting the profit calculations.

IV. Rent:

Like interest on capital, rent is also a debatable item of overheads. The rent paid is an item of fixed overheads and is apportioned to manufacturing, administrative, selling and distribution overheads in a suitable way.

As regards rent not paid by a concern when the company is housed in its own premises, the majority of cost accountants are of the opinion that it should be included in cost accounts because –

(1) Rent is more akin to depreciation charge and, therefore, should not receive differential treatment.

(2) It makes costs comparable.

(3) If the same premises were let out, rent would have been charged and included in cost accounts.

(4) The amount in lieu of rent can be calculated easily on the basis of municipal valuation of the land and buildings.

V. Royalty:

Royalty is payable for the right to make use of a patent process or component in the course of manufacture and is a direct charge to production. It is, therefore, included in prime cost. If royalty is payable on the basis of number of units sold, then it is included in selling overheads.

VI. Repairs and Maintenance:

If the expenditure is on account of normal maintenance and minor repairs, it is an overhead item. If the expenditure is incurred for plant and machinery/factory building, it is included in factory overheads. Repairs undertaken by outside agencies are paid for and included in factory overheads.

Where the repairs and maintenance expenditure is heavy and is intended to increase the earning capacity of the capital asset, the expenditure should be capitalised or treated as a deferred revenue expenditure.

VII. Treatment of Other Items:

1. Research & Development – Include in factory/administrative/ selling overheads based on the field of research.

2. Advertising Expenditure – If incurred for a specific product, treat the same as selling overhead and recover from the product. If incurred for a number of products apportion suitably.

3. Transport Charges – Expenses on purchases included in raw material cost. Carriage outwards is an item of selling overheads.

4. Fuel and Power – Included in factory overheads, whether generated internally or obtained through an outside agency.

5. Dismantling of Plant – The cost of dismantling added to the cost of the asset. The cost can be set off against the sales of the dismantled asset.

6. Material Losses & Wastage –

(i) Loss in Transit – Recovered from suppliers, insurance company or from transporters. If losses are recoverable, treated as overhead. If amount is heavy, written off to Costing P & L A/c.

(ii) Loss during storage – Normal loss due to pilferage, evaporation shrinkage, theft, fire, mismanagement—treated as a factory overhead. Abnormal loss written off to Costing P & L A/c.

(iii) Loss during manufacturing – Normal wastage charged to job and abnormal wastage charged to Costing P & L A/c.

(iv) Loss in handling/carriage – Costs incurred in carriage of material are included in the cost of material. If loss pertains to a number of materials then treated as production overhead.

7. Leave Wages – May be debited to factory overhead account. Where leave is granted to a worker (who is not otherwise entitled) wages paid for the period be treated as abnormal payments, debited to costing profit and loss account.

8. Annual Bonus – To be treated as part of cost of production, because payment of bonus is a legal requirement in India.

Where bonus is paid voluntarily, it should be charged to Costing P & L A/c.

9. Cost of Patterns & Dies – If prepared for a specific job, treated as direct charge.

If they are meant for production in general, treated as items of factory overhead.

10. Fringe Benefits – Treated as part of departmental overheads. Sometimes, treated as a part of direct wages through a supplementary rate.

11. Medical Expenses – Distributed to all departments on the basis of number of employees working in each department.

12. Canteen Expenses – If canteens are run on no-profit-no- loss basis, the amounts spent or received are excluded from cost accounts. Where they are run based on subsidies provided by management, the subsidy is to be treated as an item of overhead.

13. Training Expenses – Treated as items of production overhead. Where training expenses pertain to selling, distribution or administrative divisions, they are charged to selling/distribution administration overheads.

14. Fines Collected from Workers – To be credited to Fine Fund and used for welfare activities. Not to be included in cost accounts.

15. Township Maintenance costs – Part of welfare expenditure to be charged to different departments on the basis of number of employees in each department.

16. Catalogues and Price Lists – The cost of printing the catalogues and price lists should be debited to a suspense account and charged evenly over the period during which they are actually used.

17. Bad Debts – Bad Debts up to a reasonable limit (normal in nature) should be included in selling overheads. If the amount is somewhat abnormal then written off from Costing P & L A/c.

18. Exhibition Expenses – Part of Selling Overheads. If the exhibitions are held regularly and the benefits of expenditure incurred in one year would accrue to other years as well, treat the expenditure as deferred revenue expenditure.

19. Packaging Expenses – Primary packing is a part of production overhead. Packing meant for transportation or delivering of goods is part of distribution overhead. Packing meant to attract customers is part of selling overhead. Cash discount.

20. Discounts – Excluded from cost accounts. Trade discount deducted from purchases or sales as the case may be.

21. Subscriptions – Subscriptions to welfare agencies, trade journals treated as part of production overhead. Subscriptions and donations which do not offer benefit to workers should be excluded from cost accounts.

22. After Sale Service Costs – Treated as a selling overhead item and charged to different products on the basis of sales made.