Reconciliation of Cost and Financial Accounts is the process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts.

There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting.

A reconciliation statement is a statement which is prepared to reconcile the profit as per cost accounts with the profit as per financial accounts by suitably treating the causes for the difference between the cost and financial profit.

Contents

- Introduction to Reconciliation of Cost and Financial Accounts

- Need and Objectives of Reconciliation of Cost and Financial Accounts

- Preparation of Reconciliation Statement of Cost and Financial Books

- Reasons for Disagreement between Cost and Financial Accounts

- Reasons for Difference in the Net Results Shown by Cost and Financial Accounts

- Preparation of Reconciliation Statement and Memorandum Reconciliation Account

- Procedure for Reconciliation

- Reasons for Difference in Profit Shown by Financial and Cost Accounts

- Integral Accounting System

- Advantages of Reconciliation of Cost and Financial Accounting

- Objective Type Questions and Answers

Reconciliation of Cost and Financial Accounts: Introduction, Need, Objectives, Reasons, Preparation of Reconciliation, Procedure Statement, Advantages, MCQ, Objective Type Questions/Answers and Examples

Reconciliation of Cost and Financial Accounts – Introduction

Reconciliation of Cost and Financial Accounts is the process to find all the reasons behind disagreement in profit which is calculated as per cost accounts and as per financial accounts. There are lots of items which are shown in the profit and loss account only when we make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when we calculate profit as per cost accounting.

ADVERTISEMENTS:

Suppose, we have taken the profit or loss as per financial accounts, we adjust it as per cost accounts. In the end of adjustments, we see same profit as per cost accounts. If we have taken profit as per cost account, we must adjust items as per financial accounts. For this purpose, we make reconciliation statement.

A reconciliation statement is a statement which is prepared to reconcile the profit as per cost accounts with the profit as per financial accounts by suitably treating the causes for the difference between the cost and financial profit.

Reconciliation of Cost and Financial Accounts – Need and Objectives

(i) To find out the difference existing in cost accounts and financial accounts.

ADVERTISEMENTS:

(ii) To ensure the mathematical accuracy and to have a check on both the cost and financial books.

(iii) To adhere to the convention of consistency where all the policies should be kept constant with regard to valuation of inventory or depreciation etc.

(iv) To help the management in taking decisions with regard to profitability of the concern.

(v) To help the management to take people internal control.

ADVERTISEMENTS:

(vi) To promote coordination between the two departments namely the costing departments and financial department.

(vii) To identify and detect the variation in profit caused by the difference in the books of cost and financial system.

(viii) To detect if any mistakes are made in recording the translations in both the books namely the cost or financial books of accounts.

Profit reconciliation is necessary to achieve the following two objectives:

1. To ascertain the reasons for the difference in the profits or losses in cost and financial books.

2. To check the arithmetic accuracy and reliability of cost and financial data.

Reconciliation of Cost and Financial Accounts – Preparation of Reconciliation Statement of Cost and Financial Books

When a manufacturing company opt integrated accounting system, there is no separate cost and financial accounts maintained. But where this accounting system is not followed, the need for reconciliation of cost book and financial book occurs there. Because the financial statement and costs statement shows different profit, it creates problem. This problem can be solved by preparing a Reconciliation statement of Cost and Financial books.

So, reconciliation between two sets of books is necessary due to the following reasons:

(a) To find out the reason of differences of profit or loss in both the books.

ADVERTISEMENTS:

(b) To make sure that the calculation, accuracy and reliability of cost and financial accounts in order to have a correct cost control.

(c) To standardised the policies regarding valuation of stock, depreciation of assets and overheads.

(d) To increase the internal control system over cost by comparing the cost allocation according to finance and cost.

(e) To coordinate in a better manner in activities of financial and cost department.

ADVERTISEMENTS:

(f) To identify the reasons for different result of accounts.

Reconciliation of Cost and Financial Accounts – Reasons for Disagreement between Cost and Financial Accounts

Disagreement between cost and financial accounts may arise due to the following reasons:

Reason # (a) Items included in Financial Accounts but not in Cost Accounts

There are certain items which are recovered in financial accounts and not in cost accounts.

ADVERTISEMENTS:

1. Purely Financial Charges

These includes:

(i) Dividend paid

(ii) Income Tax paid

(iii) Goodwill Writtenoff

(iv) Preliminary Expenses Writtenoff

ADVERTISEMENTS:

(v) Debenture interest

(vi) Provision for doubtful debts

(vii) Loss on sale of assets

(viii) Discount allowed

2. Purely Financial Incomes

These includes:

ADVERTISEMENTS:

(i) Interest Received

(ii) Dividend Received

(iii) Rent Received

(iv) Transfer Fees

(v) Profit on Sale of Assets

Reason # (b) Items include in cost accounts only

ADVERTISEMENTS:

These are certain items which are included in cost accounts but not in financial accounts. These items are:

(i) Notional Interest

(ii) Notional Rent.

Reason # (c) Under or over absorption of overheads in cost accounts

In cost accounts overheads are absorbed at predetermined rates which are based on past data. In financial accounts actual amount incurred is taken into account. Thus, under or over recovery of overheads in cost accounts leads to a difference in two accounts.

Reason # (d) Adoption of different base for stock valuation

ADVERTISEMENTS:

In cost accounts stocks finished goods are valued at cost by adopting FIFO, LIFO etc. But in the financial accounts stocks are valued either at cost or market price which is less. Thus, Over or under valuation of stock leads to a difference in two accounts.

Reason # (e) Base of Depreciation

The rates and methods of charging of depreciation may be different in two sets of accounts. For example, in financial accounts straight line method or written down value method whereas in cost accounts MHR or replacement value method may be used.

Reconciliation of Cost and Financial Accounts – Reasons for Difference in the Net Results Shown by Cost and Financial Accounts (With Examples)

Difference in the net results as shown by cost and financial accounts may arise due to the following reasons:

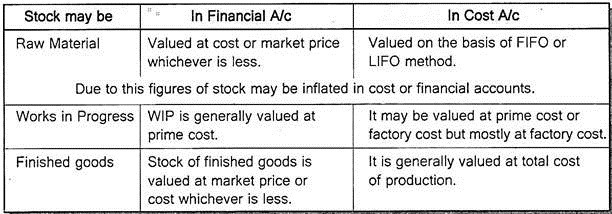

1. Basis of Inventory Valuation:

In financial accounts, the fundamental principle for the valuation of stock is cost or market price whichever is lower. But in cost accounts, the stock of material is valued on the basis of FIFO, LIFO, and Average Price etc.

Stock of work-in-process is valued on the basis of prime cost or prime cost plus proportionate factory overheads. The stock of finished goods is valued on the basis of total cost of production. Due to difference in the valuation of stock, the profits in two sets of books vary and call for reconciliation.

2. Recovery of Overheads:

In cost accounts, overheads are absorbed at an estimated or predetermined rate. In financial accounts, overheads actually incurred are recorded. The difference between overheads incurred and overheads absorbed is known as under or over-absorption of overheads.

This may be written off to Overheads Adjustment Account or transferred direct to Costing Profit and Loss Account. As a result, actual overheads shown in financial accounts will now agree with that finally charged in cost accounts. However, if this has not been done, there will be difference in the profits as per two sets of accounts.

3. Different Methods of Charging Depreciation:

The rates and methods of charging depreciation may vary in the two sets of accounts. In financial accounts, depreciation may be charged on diminishing balance to meet the requirements of income-tax rules. In cost accounts, depreciation may be charged on the basis of machine hours, units output etc. This will create a difference in the two profits.

4. Abnormal Losses and Savings:

In financial accounts, abnormal items are merged with their normal heading. Abnormal losses of material or labour, for example, will be added to the debit for material and wages. In cost accounts, on the other hand, abnormal wastages, losses and savings are kept outside the manufacturing costs. Losses due to obsolescence, shifting of a business to better site, overhauling of the plant etc. are not entered in cost accounts.

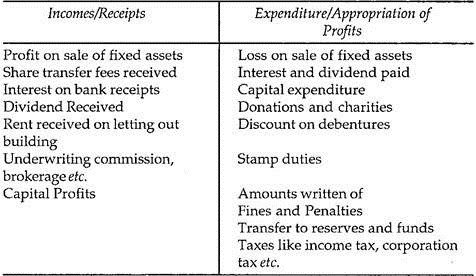

5. Items Appearing Only in Financial Accounts:

There are a number of items which are included only in financial accounts and not in cost accounts.

These items are classified into three categories as under:

i. Purely Financial Charges:

These are the expenses and losses which are shown only in financial accounts and do not form part of the production costs.

Examples are:

a. Losses of capital assets arising from sale, exchange or uninsured destruction.

b. Losses on the sale of investments, buildings etc.

c. Interest on bank loans and mortgages etc.

d. Fines and penalties.

e. Obsolescence loss.

f. Discount on bonds and debentures.

g. Expenses of company’s transfer office.

h. Damages payable by law.

ii. Purely Financial Incomes:

These are the incomes and gains which are shown only in financial accounts and do not form part of the production costs.

Examples are:

a. Interest received on bank deposits.

b. Rent receivable.

c. Interest, dividend etc. received on investments.

d. Profit on the sale of fixed assets.

e. Transfer fee received.

iii. Appropriation of Profits:

These represent the appropriation or distribution of profits.

Examples are:

a. Income-tax

b. Dividends paid

c. Transfer to reserves and sinking funds

d. Charitable donations.

e. Excessive depreciation due to change of method of depreciation.

f. Writing off goodwill, preliminary expenses, underwriting commission and capital issue expenses.

Items Appearing Only in Cost Accounts:

There are certain items which are included only in cost accounts.

Examples are:

1. Interest on own capital which is a notional or imputed cost if it is decided to include the item in the cost (even if interest is not paid).

2. Rent on self-owned factors or office building. It is also a notional cost like interest on capital, (even if rent is not paid).

Reconciliation of Cost and Financial Accounts – Preparation of Reconciliation Statement and Memorandum Reconciliation Account (With Format and Specimen)

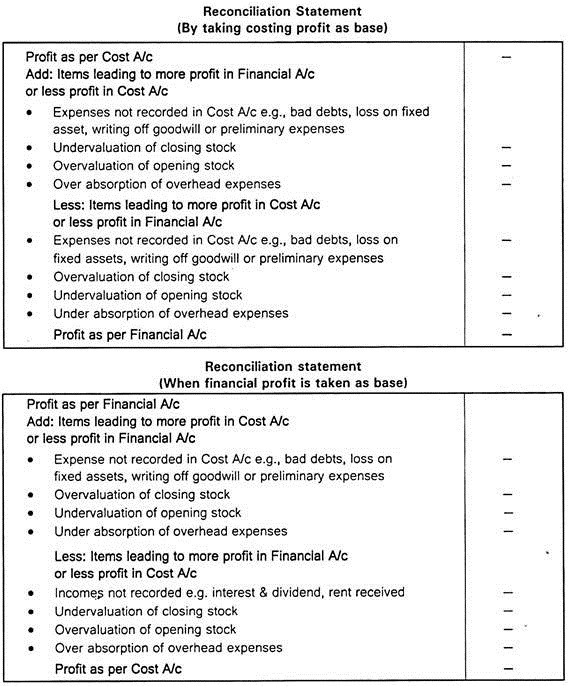

The reconciliation may be done by way of preparing a reconciliation statement or by preparing a memorandum reconciliation account, based on profit figures shown by cost accounts or financial accounts.

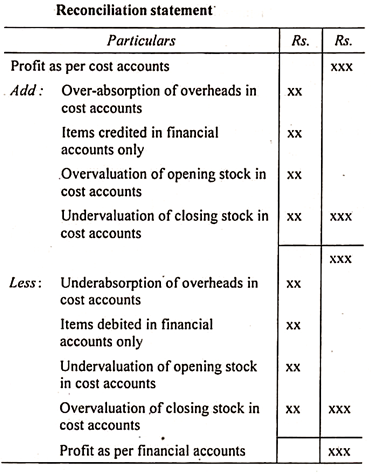

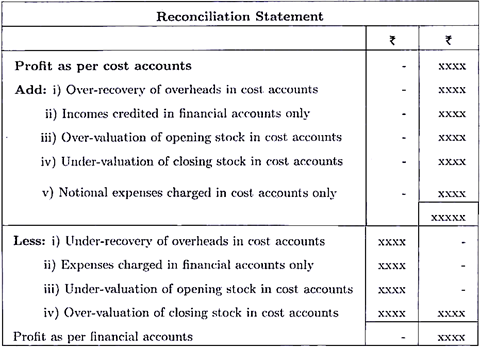

Preparation of Reconciliation Statement:

As the name indicates, the reconciliation statement is prepared in the form of a statement by taking the profit as shown by cost accounts or financial accounts as the starting point.

If the reconciliation statement is started with profit disclosed by cost accounts, the following items should be added to the profit as per cost accounts:

1. Over-recovery of overheads (factory overheads, administrative overheads, and selling and distribution overheads) in cost accounts or under-recovery of overheads in financial accounts.

2. Items of income credited in financial books only.

3. Overvaluation of opening stock (raw materials, work-in-progress and finished goods) in cost accounts.

4. Undervaluation of closing stock (raw materials, work-in-progress and finished goods) in cost accounts.

The following items should be subtracted from profit as per cost accounts:

1. Under-recovery of overheads (factory overheads, administration overheads, selling and distribution overheads) in cost accounts or over-recovery of overheads in financial accounts.

2. Items of expenses and losses debited in financial accounts only.

3. Undervaluation of opening stock (raw materials, work-in-progress and finished goods) in cost accounts.

4. Overvaluation of closing stock (raw materials, work-in-progress and finished goods) in cost accounts.

After making all the above additions and deductions in costing profit, the resultant figure will be the profit as per financial accounts. The above treatment of items will be reversed if profit as per financial accounts or loss as per cost accounts is taken as a starting point.

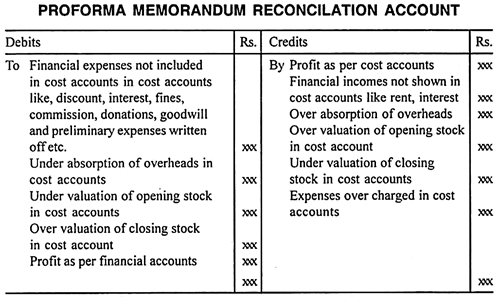

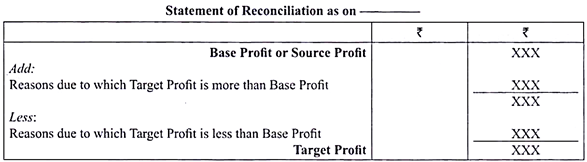

The proforma of a reconciliation statement is as follows:

Points to be Observed while Preparing Reconciliation Statement:

1. Keep the same principles of Bank Reconciliation Statement in mind.

2. Unless otherwise specifically given, direct materials, direct wages and direct expenses may be taken as ‘common’ for both sets of books. Similarly, the amount of sales is also assumed to be the same in both sets of books of accounts.

3. If the profit as per cost accounts is not given in the problem, then the cost sheet is to be prepared first and reconciliation is to be made.

4. While preparing the profit & loss account, the actual expenses incurred are to be taken into account, whereas in cost accounts, the absorption rate given for the overheads should be used. Hence, the terms ‘absorbed’ or ‘recovered’ are used in cost accounts. The term ‘incurred’ is generally used in financial accounts.

5. If information about number of units produced and sold is given in the problem, the value of closing stock of finished goods is to be ascertained on the basis of cost of production. The value of closing stock of finished goods given in profit & loss account should not be used in cost sheet.

If, on the other hand, no other details are available, the value of closing stock of finished goods given in profit & loss account can be used in the cost sheet. Similarly, opening stock of finished goods may be valued at the same rate as the closing stock, if no other information is given.

6. Interest and dividend – These two items can be treated either as income or expenses. If differences alone are given in the problem and debit or credit nature of these items is not mentioned, assumption can be made either way. However, when both profits are given, the treatment which leads to correct reconciliation can be adopted.

7. Variability of overheads – When overheads are budgeted on the basis of variability, the variable overhead is not affected as it is absorbed on the basis of output. But fixed overhead is proportionately undercharged or overcharged according to the actual output compared to the budgeted output.

8. When items of difference are not given Income given in the profit & loss account but not included in costing and also expenses and losses charged in profit & loss account but ignored in costing have to be taken into account specifically.

Other differences in overheads, valuation of opening and closing stock, etc. in both sets of books are to be considered. Based on the items of difference, reconciliation statement can be prepared.

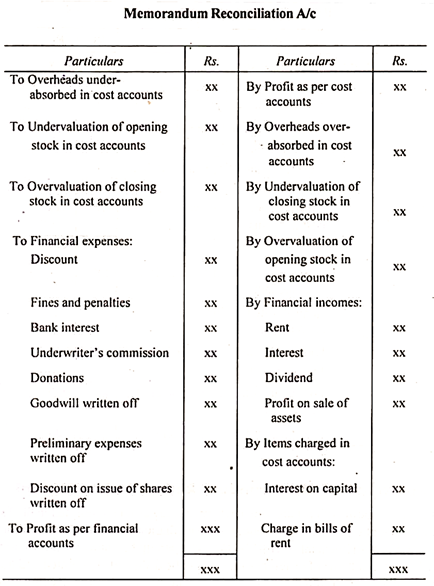

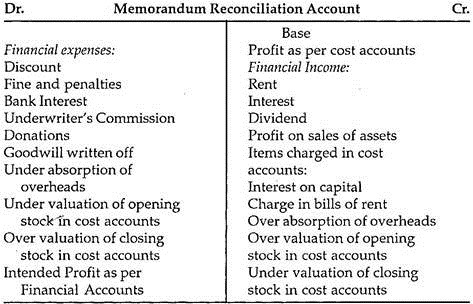

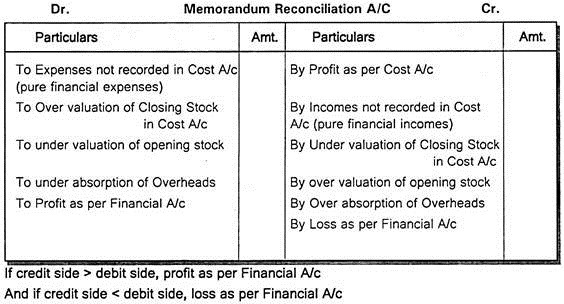

Preparation of Memorandum Reconciliation Account:

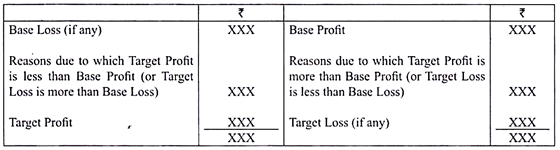

The reconciliation of cost and financial profits may also be presented in the form of an account styled as ‘Memorandum Reconciliation Account’. In this account, the base profit (financial or cost) is taken as opening balance and shown on the credit side. All items of difference required to be deducted are debited and those to be added are credited to this account.

The balance in this account is the resultant profit (financial or cost). In case of loss, base loss is shown on the debit side of the account and resultant loss is finally shown on the credit side of the account.

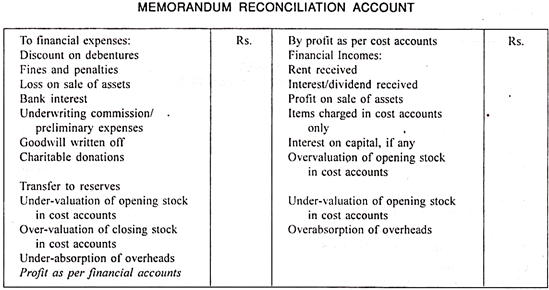

The specimen form of Memorandum Reconciliation Account is as follows:

Reconciliation of Cost and Financial Accounts – Procedure for Reconciliation

1. Start with profit shown by any one set of accounts (profit as per financial accounts or profit as per cost accounts). Let this profit be taken as a base (referred to as “base profit”).

2. All expenditures not taken into account in arriving at the base profit should be deducted from it.

3. All expenditures taken into account for arriving at the base profit but not considered for profit shown by other set should be added back to base profit.

4. The amount of expenditures undercharged in arriving at the base profit should be reduced from it.

5. All income taken into account for arriving at “base profit” but not considered for profit shown by other set should be reduced from it.

6. Amount of understated income for arriving at the base profit should be added back.

7. Amount of overstated income for arriving at the base profit should be reduced from it.

8. Income not taken into account for arriving at the base profit but considered for profit shown by other set should be added to base profit.

9. Consider in isolation with the factors, the effect of differences in valuation of opening stock on base profit. If base profit has been overstated due to difference in valuation of opening stock, it should be reduced. If base profit has been understated due to difference in valuation of opening stock, the amount of difference should be added to it.

10. Similarly consider in isolation with other factors, whether difference in valuation of closing stock has had the effect of overstating the base profit or understanding the base profit. Suitable adjustments should be made, so that base profit falls in line with the profit shown by other set of accounts.

The reconciliation of costing and financial profits can be attempted either –

(a) by preparing a reconciliation statement, or

(b) by preparing a memorandum reconciliation account.

Whichever method is followed, the end result remains the same. Profit shown by one set of accounts is reconciled with the profit shown by other set of accounts.

When reconciliation is attempted by preparing a reconciliation statement, profit shown by one set of accounts is taken as base profit and items of difference are either added to it or deducted from it to arrive at the figure of profit shown by other set of accounts.

When reconciliation is attempted through “Memorandum reconciliation account”, profit to be taken as base profit’ is shown like the opening balance of this account. All items of difference required to be deducted are debited to this account. The balancing figure of this account is the profit shown by other set accounts.

Reconciliation of Cost and Financial Accounts – Reasons for Difference in Profit Shown by Financial and Cost Accounts

The profit shown by financial accounts and cost accounts differ on account of the following reasons:

Reason # I. Items of Financial Nature not Recorded in Cost Accounts:

The following items are not recorded in cost accounts as they are of purely financial nature and consequently the profits differ as these items are recorded in the financial accounts.

Interest Received on Bank Deposits:

i. Dividend, interest received on investments.

ii. Rent received

Losses on Sale of Assets:

i. Bad debts written off, recovered

ii. Transfer fees received

iii. Interest on proprietor’s capital

iv. Fines and penalties payable

Compensation payable.

Reason # II. Items Charged to Profit and Loss Account but not Recorded in Cost Accounts:

The following items are found in financial accounts but not recorded in cost accounts:

i. Corporate taxes

ii. Appropriations out of profits, such as transfer of profits to reserves

iii. Certain payments like dividend, interest

Additional Provisions of Depreciation:

Certain amounts written off such as goodwill, patents, preliminary expenses, underwriting commission etc.

Reason # III. Items Peculiar in Cost Accounts:

The items described below are peculiar in cost accounts while their treatment in financial accounts is different. Hence there is a difference between the profits shown by both the systems.

i. Overheads:

In cost accounts, overheads are finally absorbed to the products by computing the predetermined rate of absorption. In such cases, there may be under / over absorption of overheads. This means that the overheads actually incurred will not tally with the overheads charged to the product.

In financial accounts overheads are always taken at an actual basis irrespective of under/over absorption of the same. In such cases the profits shown by both the systems will differ. However, if the under / over absorbed overheads are charged to the costing profit and loss account, the profits shown by financial accounts and cost accounts will not differ.

ii. Valuation of Closing Stock and Work-in-Progress:

The principle of valuation of closing stock in financial statements is cost price or market price whichever is less. However, in cost accounts, valuation of closing stock may be made on the basis of marginal costing where only the variable costs are taken into consideration while valuing the closing stock.

Thus, the closing stock valuation may differ. Work-in-Progress in cost accounts is often valued on the basis of prime cost and sometimes variable manufacturing overheads are added in the same.

On the other hand, in financial accounting, work-in-progress may be valued after taking into consideration administrative expenses also. Due to this difference in valuation, profits shown by cost accounts and financial accounts differ.

iii. Abnormal Losses and Gains:

In cost accounts, abnormal losses and gains are computed and transferred to the Costing Profit and Loss A/c. No such computation is made in the financial accounts. This results in difference between the profits shown by cost accounts and financial accounts.

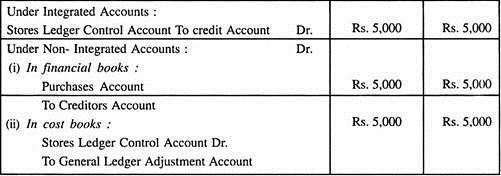

Reconciliation of Cost and Financial Accounts – Integral Accounting System (With Journal Entries)

Maintaining one set of accounts under an integral accounting system eliminates the necessity of operating cost ledger control account in financial ledger, and general ledger adjustment account in cost ledger.

It can be clear with the help of the following example:

One item of transaction is “Credit purchase of material of Rs. 5,000”.

Journal entries for this transaction will be as follows:

Integrated Accounting System is economical as there is no need of duplication for recording the transaction at two places. Thus, reconciliation can be avoided by adopting Integral or Integrated Accounts in the organization.

Reconciliation of Cost and Financial Accounts – 5 Main Advantages

The advantages of reconciliation are as follows:

(a) It helps to check the reliability of accounting procedure followed by both systems.

(b) It helps to short out the errors and mistakes, if any, taken place during book-keeping.

(c) It helps to identify the under absorption or over absorption of overheads.

(d) It helps to show the purely financial items which should not be included in cost book.

(e) It helps to identify the reasons due to which difference in profit is occurred.

Reconciliation of Cost and Financial Accounts – MCQs or Objective Type Questions and Answers

1. Which of the following items is included in cost accounts?

(a) Notional rent

(b) Rent receivable

(c) Transfer to general reserve

(d) None of the above

Ans. (a)

2. Which of the following items is not included in financial books?

(a) Interest on capital

(b) Notional rent

(c) Loss on sale of fixed assets

(d) Donations

Ans. (b)

3. Cost and financial accounts are reconciled under

(a) Integral system

(b) Cost control accounts system

(c) Under both (a) and (b)

(d) None of these

Ans. (b)

4. Which of the following items shall be added to costing profit to arrive at financial profit?

(a) Income tax paid

(b) Interest on debentures paid

(c) Rent receivable

(d) Under-absorption of works overheads

Ans. (c)

5. When costing profit is Rs.13,500 and a charge in lieu of rent is Rs.2,000, the financial profit should be

(a) Rs.13,500

(b)Rs.11,500

(c) Rs.15,500

(d) None of these

Ans. (c)

6. When costing loss is Rs.7,600 office overheads under-absorbed being Rs.800, the loss as per financial accounts should be

(a) Rs.7,600

(b) Rs.8,400

(c) Rs.6,800

(d) None of these

Ans. (b)

7. Profit as per financial books is Rs.76,000. What will be the profit as per costing books when selling and distribution expenses, actual as well as predetermined, are Rs.3,000?

(a) Rs.76,000

(b) Rs.73,000

(c) Rs.79,000

(d) None of these

Ans. (a)

Reconciliation of Cost and Financial Accounts: Reasons for Reconciliation, Procedure and Memorandum Reconciliation Account

Reconciliation of Cost and Financial Accounts – Introduction, Reasons for Reconciliation and Methods of Reconciliation

Where cost accounts and financial accounts are kept separately in any organisation, there are chances that both the books may show profit separately. The profits shown by costing books may not agree with the profits shown by financial Books. Therefore, it becomes necessary that the profit and loss shown by both cost accounts and financial accounts should tally to each other. For this purpose reconciliation of both the books are to be made.

Under non-integral system, the question of reconciliation of cost and financial accounts arises. But under the integral accounting system, cost and financial accounts are integrated to one set of books, and there seems to be no necessity to prepare and to reconcile the profits shown by cost as well as shown by financial accounting.

Reasons for Reconciliation:

The main reasons of reconciliation are as under:

(i) Arithmetic Accuracy – It helps in checking the arithmetic accuracy and reliability of the cost accounts.

(ii) Reasons for Difference – Reconciliation shows the reasons for difference in profit between cost and financial accounts.

Reasons for Disagreement in Profit or Loss A/C:

The main reasons of disagreements are discussed below:

(1) Items Shown Only in Cost Accounts:

There are certain items which are shown in cost accounts only and they are not shown in financial accounts.

They are as under:

(a) Interest on capital charged but not paid.

(b) Fully depreciated assets, still are used in the business.

(c) Own building is used and no rent is payable.

(2) Separate Base of Stock Valuation:

Stocks in cost accounts are valued on FIFO or LIFO or Average method, but the stock in financial accounts is valued on the principles of cost or market price, whichever is less. Thus these difference are there in the value of stock shown by the two sets of accounts books.

(3) Separate Base for Depreciation:

The rate and method of charging depreciation may differ in cost accounts and financial accounts. In cost account, machine hour rate, production unit method, may be used for charging depreciation, while in financial accounting straight line or Diminishing method may be used. It will bring a difference in the profit or loss figures.

(4) Under Absorption or over Absorption of Overheads:

In cost accounts overheads are recorded on percentage basis, while in financial accounting, actual expenses are recorded. This may give rise to difference between overheads observed in cost and actual overhead incurred. It will bring difference in profits shown by cost and financial accounting.

(5) Items Shown Only in Financial Accounts:

These items are classified into 3 categories as under:

(A) Purely Financial Items of Expenses:

It includes the following:

(i) Discount on debentures

(ii) Company expenses on transfer of office

(iii) Fines and penalties

(iv) Goodwill written off, Preliminary expenses written off

(v) Loss on sale of capital asset

(vi) Losses on investments

(vii) Interest on bank loans

(viii) Penalties and damages under law

(ix) Loss due to theft, pilferage etc.

(B) Purely Financial Income Items:

It includes the following:

(i) Rent Receivables

(ii) Interest received on bank deposits

(iii) Transfer fees received

(iv) Dividend and interest received on investments

(v) Profit on sale of capital asset.

(C) Appropriation of Profits:

It includes the following items:

(i) Transfer to reserve

(ii) Income tax, wealth tax

(iii) Dividend paid

(iv) Charitable donation

(v) Charity etc.

Methods of Reconciliation:

The following procedure is recommended for preparing a reconciliation statement:

(1) First of all find out the profits of difference between cost accounts and financial accounts

(2) Take Profit of cost accounts as base

(3) Add items overcharged of expenses in cost accounts

(4) Add items of incomes under recorded in cost accounts

(5) Deduct items of incomes over recorded in cost Accounts

(6) Add amount of over valuation of stock in cost accounts

(7) Deduct amount of under valuation of stock in cost accounts

(8) Add amount of under valuation of closing stock in cost Accounts

(9) Deduct amount of over valuation of closing stock in cost accounts

(10) After adding or deducting all the items, the resulting profits will be the profit or loss as per financial books

(11) If the starting point of profit in as per financial account, the above items will be reversed.

Memorandum Reconciliation Account:

This is an alternative method to Reconciliation statement. The profit of cost account is shown on the credit side. All items which are to be added are shown on credit side. All items which are to be deducted are shown on the debit side. The balance figure is known as profit as per financial accounts.

Reconciliation of Cost and Financial Accounts – With Specimen

The reconciliation statement is a memorandum reconciliation account to determine the items necessary to bring the balance of cost profit in agreement with the financial profit – Eric L. Kohler, in Dictionary for Accountants.

Once companies follow integrated accounts, there is no contradiction and no need for reconciliation. The financial profit is simply the cost profit as transferred from the Costing Profit and Loss Account. Contrarily, if a separate set of books is maintained for cost and financial accounts, it is rare that the profit figure of the two agrees.

Invariably, the profit shown by the financial accounts is different from that shown in the cost accounts. The difference is not because of errors in either system but due to different accounting requirements. It is important that they are periodically reconciled with each other, lest they should lose their credibility.

The need for reconciliation arises due to the following reasons:

1. To find out the reasons for the difference in the profit or loss in cost and financial accounts.

2. To ensure the mathematical accuracy and reliability of cost accounts in order to have cost ascertainment, cost control and to have a check on the financial accounts.

Reasons for the Difference:

These reasons can be broadly discussed under three headings:

1. Differing treatment of items;

2. Items appearing only in financial accounts; and

3. Items appearing only in cost accounts.

Let these points be explained a little:

1. Differing Treatment of Items:

The treatment accorded to certain items in financial accounts is significantly different from that in cost accounts.

Some of the examples are the following:

i. Basis of Inventory Valuation:

In financial books, as a matter of financial prudence, stocks are valued at cost or market price whichever is lower. But in cost books, the stock of material is valued on the basis of FIFO, LIFO, Average Price, etc. Work-in-process is valued on the basis of prime cost or prime cost plus proportionate factory overheads. The stock of finished goods is valued on the basis of total cost of production. With such a different approach in the two sets of books, it is likely that the profit figures are different.

ii. Recovery of Overheads:

In cost accounts, the recovery of overheads is always based on an estimate and, therefore, under or over recovery. It is generally charged as a percentage on materials, labour, prime cost, percentage on sales, etc. When overheads are charged at predetermined rates, the amount charged or recovered may not be equal to the amount actually incurred.

The difference between the amount incurred and the amount recovered is known as under or over-absorption of overheads. This may be written off to Overhead Adjustment Account or transferred direct to Costing Profit and Loss Account. As a result, the actual amount shown in the financial accounts will now agree with that finally charged in the cost accounts.

However, if this has been carried forward as a balance in the next year, there will be difference in the profits as per the two sets of accounts. Moreover, certain overheads such as selling and distribution might have been ignored in cost accounts.

iii. Depreciation:

The rates and methods of depreciation may be different in cost and financial accounts. In financial accounts, depreciation is charged mainly on the basis of straight line or diminishing balance. But in cost accounts, the basis may be machine hours, units of output, etc. Financial accounts regard depreciation as period cost which varies with the lapse of time, whereas in cost accounts depreciation is regarded as variable expense. This will create difference in the two profits.

iv. Abnormal Losses and Savings:

In financial accounts, abnormal items are merged with their normal headings. Abnormal losses of material or labour for example, will be added to the debits for material and wages. In cost accounts, on the other hand, abnormal wastage, losses or savings are kept outside the manufacturing costs as something with which product costs should not be burdened. Losses as a result of obsolescence, shifting of business to a better site, overhauling of the plant etc. are not entered in the cost accounts.

2. Items Appearing Only in Financial Accounts:

Under this head, three kinds of items could be identified:

i. Purely Financial Charges:

These are the expenses and losses which stand debited only in Trading and Profit and Loss Account and do not form part of the production costs.

Examples are:

(a) Losses of capital assets, arising from sale, exchange or uninsured destruction.

(b) Losses on the sales of investments, building etc.

(c) Interest on bank loans, mortgages, debentures and other borrowed money, if interest on capital is ignored in cost accounts.

(d) Penalties payable for late completion of contracts.

(e) Damages payable by law.

(f) Losses due to scrapping of machinery before the expiry of its life i.e. obsolescence loss.

(g) Expenses of the company’s transfer office.

(h) Discounts on bonds, debentures etc.

ii. Purely Financial Incomes:

These are the incomes and gains which stand credited only in the Profit and Loss Account and are outside the scope of manufacture.

Examples are:

(a) Interest received on bank deposits

(b) Rent receivable

(c) Interest, dividends etc. received on investments.

(d) Profits made on the sale of fixed assets and capital expenditures charged specifically to revenue.

(e) Transfer fees received.

iii. Appropriations of Profit:

These represent the appropriations or distribution of profits.

Being charges against net profit, items like the following appear in the Profit and Loss Appropriation Account and not in cost accounts:

(a) Taxation

(b) Dividends paid

(c) Transfer to Debenture Redemption Fund or Sinking Fund for repayment of liabilities.

(d) Transfer to general reserve or any other reserve to strengthen the financial structure.

(e) Amounts written off as goodwill, preliminary expenses, underwriting commission, and expenses of capital issues.

(f) Charitable donations.

3. Items Appearing Only in the Cost Accounts:

There are some expenses which are included only in cost accounts.

Examples are:

(a) Notional interest—when management decides to charge interest on capital employed. Even if the interest is not paid, it will be included while calculating the cost,

(b) Notional rent—even if no rent is paid when a factory is being run in the premises owned, notional rent will be included in the cost books.

Procedure for Reconciliation:

To reconcile financial and cost profits, either a Reconciliation Statement or a Memorandum Reconciliation Account is prepared. There is no difference between these two except that the format is different.

When a reconciliation statement is prepared, the following steps have to be taken:

If the profit as per cost accounts is taken as the starting point, the following adjustments should be made in the costing profits-

a. Deduct – Purely financial charges appearing in financial accounts only.

b. Add – Purely financial incomes shown in financial books only.

c. Deduct – Appropriations of profit shown in financial accounts only.

d. Add – Over-absorption of overheads in cost accounts.

e. Less – Under-absorption of overheads in cost accounts.

f. Add – Depreciation overcharged in cost accounts.

g. Deduct – Depreciation undercharged in cost accounts.

h. Deduct – Under-valuation of opening stock in cost accounts.

i. Add – Over-valuation of opening stock in cost accounts.

j. Deduct – Over-valuation of closing stock in cost account.

k. Add – Under-valuation of closing stock in cost accounts.

After the above adjustments, the resultant figure will be profit as per financial accounts. If the profit shown by the financial accounts is taken as a starting point, the treatment as explained above will be reversed.

The format of a reconciliation statement is given below:

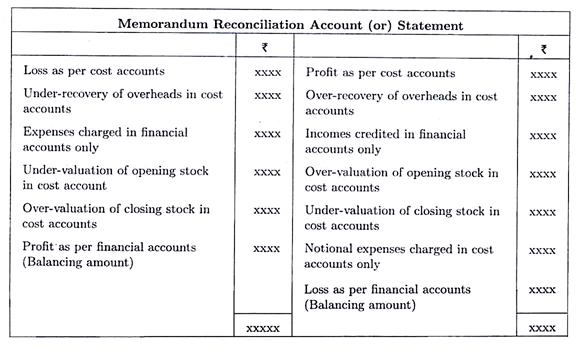

Memorandum Reconciliation Account:

This account is an alternative to reconciliation statement. This account with the usual debit and credit sides details the causes because of which the difference in the two profits has arisen.

A specimen form of memorandum reconciliation accounts is given below:

Reconciliation of Cost and Financial Accounts – Need for Reconciliation, Procedure for Reconciliation and Memorandum Reconciliation Account or Statement

In a non-integral accounting system, cost accounts and financial accounts are maintained separately. Though both accounts are maintained under double entry principles, the profits disclosed in cost accounts is not the same as disclosed by financial accounts. The principles followed for recording incomes and expenses between both the sets of accounts vary.

In financial accounts all incomes and all expenses are recorded on actual basis, but in cost accounts only those expenses relating to production, administration and selling and distribution activities are recorded and all incomes are omitted. Therefore it becomes necessary that these two sets of accounts should be reconciled.

Need for Reconciliation:

1. To find out the reasons for variance in profits in the two sets of accounts.

2. To check the accuracy of the information in cost accounting books. It ensures the reliability of cost informations recorded in cost accounting books.

When cost and financial accounts are kept under integral accounting system, there will be only one set of accounts. So there is no need for reconciling the two sets of accounting books.

The Reasons for Disagreement in Profits in Two Sets of Account Books:

The following are the various reason which result in disagreement in profits between the two sets of accounts:

1. Some expenses are recorded in financial books only and not in cost accounts:

They are:

i. Expenses of pure financial nature – They include interest paid on bank loans, mortgages, debentures, overdrafts, share and debenture issue expenses written off, discount on issue of shares and debenture discounts written off etc.

ii. Intangible assets written off – They include Preliminary expenses, goodwill, deferred revenue expenditures written off.

iii. Abnormal Loss – They include Loss by fire, accident, theft, natural calamities etc.

iv. Capital Loss – They include Loss on sale of fixed assets and investments.

v. Appropriations – They include Provisions for income tax, income tax paid, transfer to reserves, dividends paid, proposed dividend etc.

vi. Provisions – They include Provision for bad and doubtful debts, provision for discounts, etc.

vii. Others – Fines and penalties paid for infraction of law, presents, gifts, charity, donations, obsolescence loss, etc.

Effect on profit – Cost profit more and financial profit less.

2. Expenses appearing in cost accounts only and not in financial accounts:

They are called notional expenses or imputed costs.

They are:

i. Rent charged for own building

ii. Interest charged on own capital.

iii. Depreciation charged on fully depreciated assets.

iv. Salary for proprietor charged in cost accounts but not actually drawn.

Effect on profit – Cost profit less and financial profit more.

3. Some expenses appear in both account books but the amounts differ:

i. Over-recovery or over-absorption of overheads – In financial accounts expenses are shown on actual basis, but in cost accounts expenses are shown on some estimated basis which is called recovery or absorption of overheads. This may result in showing more or less expenses than the actual in cost account books. If expenses recovered in cost accounts are more, it is called over-recovery or over-absorption.

Effect on Profit – Cost profit less and financial profit more.

ii. Under-recovery or under-absorption of overheads – If expenses charged in cost accounts are less, it is called under-recovery or under-absorption of overheads.

Effect on Profit – Cost profit more and financial profit less.

4. Difference in valuation of stock:

There are different methods for valuation of stock such as FIFO, LIFO, average cost methods etc. cost accountant may follow any of the above methods for valuation of stock. But financial accountant will follow the policy of valuing the stock at cost price or market price whichever is lower. As a result the profits in two sets of account books differ.

i. Under-valuation of opening stock in cost accounts

Effect on profit – Cost profit more and financial profit less.

ii. Over valuation of opening stock in cost accounts

Effect on profit – Cost profit less and financial profit more.

iii. Under-valuation of closing stock in cost accounts

Effect on profit – Cost profit less and financial profit more.

iv. Over-valuation of closing stock in cost accounts

Effect on profit – Cost profit more and financial profit less.

5. Over or under-recovery of depreciation:

There are different methods for calculation and charging of depreciation. Cost accountant may follow one method and financial accountant may follow another method. This results in charging different amounts of depreciation in the two sets of account books.

i. Over recovery of depreciation

The depreciation charged in cost accounts will be more.

Effect on profit – Cost profit less and financial profit more.

ii. Under-recovery of depreciation

The depreciation charged in cost accounts will be less

Effect on profit – Cost profit more and financial profit less.

6. All incomes (except sales and scrap value of materials) are shown in financial accounts only and not in cost accounts:

They Include Interest, dividends, rent etc. received, discount received, commission earned, profit on sale of fixed assets and investments, transfer fees, difference in exchange (cr) etc.

Effect on Profit – Cost Profit less and financial profit more.

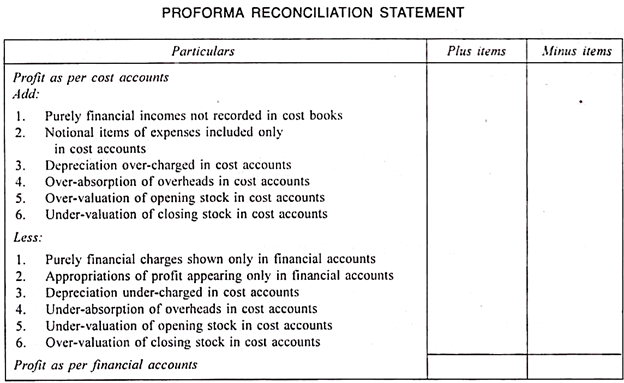

Procedure for Reconciliation:

Reconciliation statement commences with profit as per one set of account books. The transactions which result in difference in profits are either added or deducted from the given profit to find the profit as per the other set of account books.

The profit we take as starting point in reconciliation statement is usually called base profit or starting profit. The profit to be found is called opposite profit. Transactions causing difference in profits which have the effect of reducing base profit are to be added and those transactions causing difference in profits which have the effect of increasing the base profit is to be deducted.

Transactions which have the effect of reducing the opposite profit are to be deducted and those transactions which have the effect of increasing the opposite profit are to be added.

In case loss as per one set of account books is given reverse procedure is to be followed.

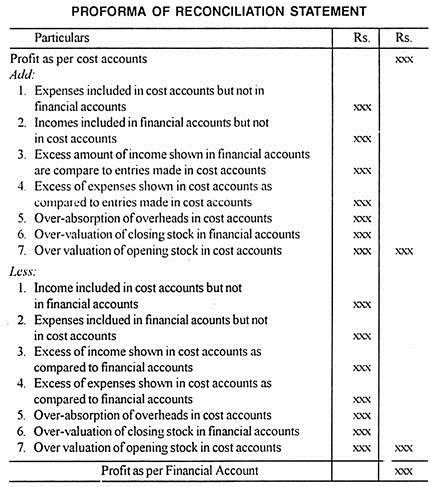

The following is the proforma of a “Reconciliation Statement”:

Note:

(i) When profit as per financial accounts is given, all items added above are to be deducted and all items deducted are to be added to find the profit as per cost accounts.

(ii) When the reconciliation statement is started with profit in one set of account books and the final answer is in minus amount, it is called loss as per other set of account books.

Memorandum Reconciliation Account or Statement:

If reconciliation statement is prepared in a ledger format, it is called Memorandum Reconciliation Account (or) Statement. Starting profit or base profit is taken on the credit side of the memorandum reconciliation account. All items to be added are shown on the credit side of the Memorandum Reconciliation account.

All items to be deducted are shown on the debit side. Since it is only a memorandum account the prefixes “To” on the debit side and “By” on the credit side need not be used.

The following is the proforma of a Memorandum Reconciliation Account:

Reconciliation of Cost and Financial Accounts – Need for Reconciliation, Reasons for Disagreement in Profit, Procedure and Memorandum Reconciliation Account

When cost and financial accounts are separately maintained by a concern in two different sets of books, the profit shown by cost accounts may not one for costing books and the other for financial books. The profit or loss shown by the cost books differ from profit or loss shown by financial accounting for a number of reasons. Therefore, it becomes necessary that profit and loss shown by the two sets of books should be reconciled.

This enables to test the reliability of cost accounts. In case it is not possible to reconcile the two sets of accounts, its reliability would be less. In the words of H. G. Wheldon, “No system is complete unless it is linked up with financial accounts, that results shown by both cost and financial accounts may be reconciled”.

However, under the integral accounts, since cost and financial accounts are integrated into one set of books, the problem of reconciliation does not arise.

Need for Reconciliation:

Due to some reasons the profit and loss shown by the cost and financial accounting differs from each other.

Let us understand the need that arises due to the difference between cost and financial accounts with the help of following reasons:

1. Reconciliation is necessary to ensure that no income or expenditure has been omitted or there is no under or over recovery of overheads.

2. Reconciliation is necessary to check the arithmetical accuracy of the results of both the sets of accounts.

3. It is necessary as it reveals the reasons for variation in results and facilitates internal control.

Reasons for Disagreement in Profit:

Difference in profit or loss between cost and financial accounts may arise due to the following reasons:

1. Items Included in One Set Accounts but not Included in the other Set:

There are certain items which are recorded in financial accounts but not in cost accounts and vice-versa.

2. Matters of Financial in Mature:

There are number of items which are financial in nature not included in cost accounts; they are centered in financial accounts. This will lead to a difference in profit or loss.

The following items appear in financial books, but not in cost books:

i. Purely Financial charges –

a. Loss on the sale of fixed assets

b. Discount on bond, debentures etc.

c. Losses on Investments

d. Stamp duties

e. Fines, penalties

f. Damage payable

g. Cash discount

ii. Purely financial incomes –

a. Interest received on bank balance

b. Rent receivable

c. Profit arising from sale of fixed assets.

d. Transfer fees received

e. Dividend and interest received on investments

iii. Apportionment of Profit –

a. Dividend paid

b. Transfer to reserves

c. Charitable donations

d. Income Tax

e. Amount written off for example goodwill, preliminary expenses, discount on debentures, expenses of capital issues etc.

f. Excess provision against depreciation.

3. Items Shown Only in Cost Accounts:

There are a few items which are included in cost accounts and not in financial accounts, they are –

i. Notional Rent

ii. Interest on capital employed in production but upon which no interest is paid.

4. Under – or – Over Absorption of Overheads:

In cost accounts over-head are recovered at a predetermined rate where as in financial accounts there are recorded at actual cost this may give rise to a difference between overheads absorbed in cost and actual overhead cost incurred. If overheads are not fully recovered the amount of overhead absorbed in cost accounts is less than the actual amount it results in under absorption. On the other hand if overheads recovered in cost accounts is more than actual amount it is called over absorption.

5. Different Basis of Stock Valuations:

In Cost accounts, stocks are valued according to the system adopted in stores accounts e.g. FIFO, LTFO etc. On the other hand, valuation of stock in financial accounts is invariably based on the principle of cost or market price, whichever is less. This result in some difference in profit or loss as shown by the two set of books.

6. Different Charges for Depreciation:

The rates and methods of charging depreciation may be different in cost and financial accounts. The financial accounts may follow straight line or diminishing balance method etc. Where as in cost accounts machine hour rate, production unit methods etc., may be adopted, this will also cause a difference in the profit / loss figure.

Procedure of Reconciliation:

The procedure is similar to Bank Reconciliation statement. It may be prepared in the form of a statement or in the form of a memorandum reconciliation account. If the profit or loss shown by the cost books does not tally with the figures of financial books, the reconciliation may be made with profit (or loss) shown by the cost books. The statement is prepared by making additions or deduction of the items included in one set of accounts and not in the other set.

When there is difference between profit and loss disclosed by cost and financial accounts, following steps have to be taken to prepare reconciliation statement:

1. Start with profits as per cost accounts.

2. Ascertain –

i. Items which are shown in financial accounting not in cost accounting

ii. Items which are shown in cost accounts only.

iii. Extent of difference between indirect expenses as shown in financial accounts and overheads recovered in cost accounts.

iv. The basis on which stocks of raw material work in progress and finished goods have been valued for balance sheet purposes and compare with cost accounts.

v. Other items which are shown in cost and financial accounts which differ in value.

3. Add –

i. Expenses included in cost accounts but not in financial accounts.

ii. Incomes included in financial accounts but not in cost accounts

iii. Excess amount of income shown in financial accounts as compared to entries made in cost accounts.

iv. Excess of expenses shown in cost accounts as compared to entries made in financial accounting.

v. Over-absorption of overheads in cost accounts.

vi. Over valuation of closing stock in financial accounts.

vii. Over valuation of opening stock in cost accounts.

4. Less –

i. Income included in cost accounts but not in financial account.

ii. Expenses included in financial accounts but not in cost accounts.

iii. Excess of income shown in cost accounts as compared to financial accounts.

iv. Excess of expenses shown in financial accounts as compared to cost accounts.

v. Under-absorption of overheads in cost accounts

vi. Under valuation of closing stock in financial accounts.

vii. Under valuation of opening stock in cost accounts.

5. After making the above adjustments the resulting figure shall be profit as per financial accounts.

Memorandum Reconciliation Account:

The reconciliation of profit or loss can be presented alternative in the form of an account. This alternate account is called memorandum reconciliation account, as it is prepared without forming a part of double entry system of book keeping. The amount of profit as per cost records is credited to the memorandum account.

The over recovered expenses in cost account and incomes credited in financial accounts but not in cost accounts are credited in this account. Similarly the under recovered expenses in cost accounts and expenses debited in financial accounts but not in cost accounts are debited in this account. The balancing figure is profit or loss of financial accounts.

The specimen of memorandum reconciliation account is shown below:

Reconciliation of Cost and Financial Accounts – Need for Reconciliation, Reasons for Variation and Procedure of Reconciliation

Need for Reconciliation:

In an enterprise where two sets of books, namely cost books and financial books, are being maintained, the profit shown by two sets of books will not generally agree with each other owing to certain reasons (like difference due to valuation of stock, recovery of overheads, charging of indirect expenses etc.,).

As a result, management is presented with two different profit figures, i.e., one based on financial data and the other on cost data. Reconciliation, basically, aims at finding out the reasons for the disagreement of the two profits. Besides it will also help checking the arithmetical accuracy of both books and thus facilitate internal control by highlighting the factors contributing to increase or decrease in profits.

Objectives:

Reconciliation, thus, has two objectives:

1. Finding out the reasons for the difference in the profit or loss in cost and financial books.

2. Checking the arithmetical accuracy and reliability of cost as well as financial data.

Reasons for Variation:

The reasons for the disagreement in the profit or loss shown by two sets of books may be classified into the following categories:

1. Items of Financial Nature:

There are a number of items which are included in financial account but not in cost accounts, as shown below:

2. Items Shown only in Cost Account:

There are certain items which are incurred in cost accounts but not in financial accounts. For example, national charges such as rent on owned building, interest on capital etc.

3. Under or Over-Absorption of Overheads:

In cost accounts overhead is recovered on a predetermined basis, i.e., percentage on prime cost, direct labour, wages, sales etc. In financial accounts the actual expenses (paid or due) are shown. Not unnaturally, the overheads so ‘recovered’ or charged may not exactly agree with the amount of overheads actually incurred during a particular period, creating differences in two accounts.

In case of under absorption of overheads (overheads recovered in cost books less than the actual overheads incurred), costing profit will be higher than the financial profit and in the case of over absorption the costing profit will be lower than financial profit.

4. Valuation of Stock:

In financial accounts stock is valued at cost or market price whichever is less. However, in cost accounts stock is valued at cost only. The adoption of two different methods of valuation of stocks in the two sets of books, often, creates differences in profit figures.

5. Other Reasons:

The methods in charging depreciation, the procedures adopted for charging abnormal gains or losses may also lead to differences in profit in financial and cost books.

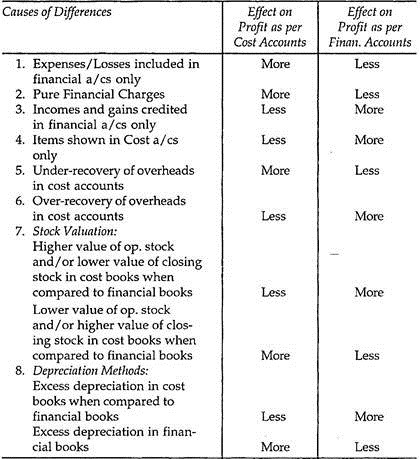

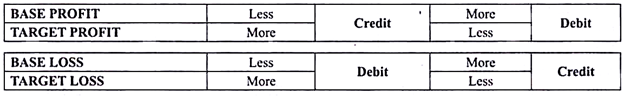

Effect of Various Items on Profit:

Now, let’s examine the effect of various items, discussed above on the profit figures revealed by cost accounts and financial accounts.

Procedure of Reconciliation:

The reconciliation may be attempted in the form of a statement or in the form of a Memorandum Reconciliation Account, based on Profit figure shown by cost accounts or financial accounts.

I. Profit as per Cost Accounts (Base Profit):

1. If Profit as per Cost Accounts is Taken as the Base:

Add:

(i) Over recovery of overheads in cost books, (ii) Items credited in financial books only, (iii) Higher value of opening stock in cost a/cs. (iv) Lower value of closing stock in cost a/cs.

Less:

(i) Under-recovery of overheads in cost books (ii) Items debited in financial accounts only (iii) Lower value of opening stock in cost a/cs (iv) Higher value of closing stock in cost a /cs.

II. Profit as per Financial Accounts:

1. If Profit as per Financial Accounts is Taken as the Base:

The reverse procedure has to be followed in this case. The items which are added in the above instance will be deducted now and the items deducted above shall be added back.

2. Memorandum Reconciliation Account:

Reconciliation may also be done by preparing a memorandum reconciliation account. The base profit is credited to this account. Items to be added are credited and those to be deducted are debited. The credit balance shown by this account is the intended profit.

The specimen form of memorandum reconciliation account is given below:

Reconciliation of Cost and Financial Accounts – Need for Reconciliation, Reasons for Difference in Profits, Method of Reconciliation and Memorandum Reconciliation Account

In a business where cost accounts and financial accounts are separately maintained, the profit/loss shown by Costing Profit and Loss Account may differ from that shown by Financial Profit and Loss Account. In such a case it becomes necessary that costing profit or loss is reconciled with that shown by financial accounts. Otherwise the two sets of accounts may provide conflicting information.

However, in integral accounting system, cost accounts and financial accounts are maintained in only one set of account books and only one Profit and Loss Account is prepared. In such a system, obviously there is no need for reconciliation between cost accounts and financial accounts.

Need for Reconciliation:

The need for reconciliation arises due to the following reasons:

1. To know the causes of differences – Reconciliation reveals the reasons for difference in profit or loss between cost accounts and financial accounts. Several items of income and expenses may have been recorded in financial accounts and not in cost accounts and vice versa.

2. To check arithmetic accuracy – Reconciliation also helps in a checking the arithmetic accuracy of cost accounts and financial accounts.

Reasons for Difference in Profits:

Difference between cost and financial accounts may arise due to the following reasons:

1. Items Shown only in Financial Accounts:

There are a number of items which appear in financial accounts and not in cost accounts. When reconciling the cost and financial accounts, any items under this category must be considered.

These items are classified into the following three categories:

i. Purely financial charges, e.g. –

a. Loss on the sale of fixed assets,

b. Interest on bank loans,

c. Discount on debentures,

d. Expenses of company’s transfer office,

e. Damages payable at law,

f. Fines and penalties,

g. Expenses on issue of shares/debentures,

h. Loss on investments, etc.

ii. Purely financial incomes, e.g. –

a. Profits arising from the sale of fixed assets ;

b. Rents receivable;

c. Dividends and interest received on investments;

d. Transfer fees received;

e. Interest received on bank deposits, etc.

iii. Appropriations of profit, e.g. –

a. Dividends paid on the share capital of the company;

b. Transfer to general reserve or any other fund of accumulated profits;

c. Amounts written off goodwill, preliminary expenses, discount on debentures, etc.

d. Charitable donations;

e. Income-tax etc.

2. Items Shown only in Cost Accounts:

There are certain items which are shown in cost accounts and not in financial accounts.

These items are:

i. Interest on capital employed but not actually paid

ii. Charge in lieu of rent when premises are owned.

3. Under or Over-Absorption of Overheads:

In costing, overheads are usually absorbed at an estimated or predetermined rate. In financial accounts, the actual amount incurred is taken into account. Therefore, there may arise a difference between the actual expenses and the predetermined overheads absorbed. In other words, overheads recovered at predetermined rates in costing may be more or less than the actual amount of overheads shown in financial books. This causes the difference between profit or loss as shown by the two sets of account books.

4. Different Bases of Stock Valuation:

Valuation of stock affects the amount of profit or loss. In costing books, stocks of materials, semi-finished and finished goods are valued at cost by using FIFO, LIFO methods, etc. But in financial accounts, stocks are usually valued at cost or market price, whichever is less. This will also lead to some difference in profit or loss as shown by costing and financial books.

5. Different Methods of Charging Depreciation:

The rates and methods of charging depreciation may be different in the two sets of account books. The financial accounts may be following straight line or diminishing balance method, etc., whereas in cost accounts machine-hour rate methods, production units method, etc., may be used. This will also cause difference in the profit figures of cost accounts and financial accounts.

Method of Reconciliation:

The cost and financial accounts are reconciled by preparing a Reconciliation Statement.

The following procedure is recommended for preparing a Reconciliation Statement:

1. Ascertain the points of difference between cost accounts and financial accounts.

2. Start with the profit as per cost accounts,

3. (i) Regarding items of expenses and losses –

Add – Items overcharged in cost accounts.

Deduct – Items undercharged in cost accounts.

For example, depreciation in cost accounts is Rs. 9,500 and that in financial accounts is Rs. 9,700. This will add to costing profit by Rs. 200. Then in order to reconcile, 200 will be deducted from costing profit.

(ii) Regarding items of incomes and gains –

Add – Items under-recorded or not recorded in cost accounts.

Deduct – Items over-recorded in cost accounts.

For example, interest on investments received amounting Rs. 2,500 is not recorded in cost accounts. This will have the effect of reducing profit as per cost books. Thus in order to reconcile, this amount of Rs. 2,500 for interest should be added in the costing profit.

(iii) Regarding valuation of stock –

a. Opening Stock – Add – Amount of over-valuation in cost accounts.

Deduct – Amount of under-valuation in cost accounts.

b. Closing Stock – Add – Amount of under-valuation in cost accounts.

Deduct – Amount of over-valuation in cost accounts.

4. After making all the above additions and deductions in costing profit, the resulting figure shall be the profit as per financial books.

5. The above treatment of items will be reversed when the starting point in the Reconciliation Statement is the profit as per financial accounts or loss as per cost accounts.

Memorandum Reconciliation Account:

This is an alternative to Reconciliation Statement. The only difference is that the information shown above in the proforma reconciliation statement is shown in the form of an account. The profit as per cost accounts is the starting point and is shown on the credit side of this account. All items which are ‘added’ to costing profit for reconciliation are also shown on the credit side. The items to be ‘deducted’ from costing profit for reconciliation are shown on the debit side. The balance figure is the profit as per financial accounts.

It is only a memorandum account and does not form part of the double entry books of accounts.

Reconciliation of Financial and Cost Accounts – Causes for Difference in Results as Per Financial and Cost Accounts, Memorandum Reconciliation Account and a Few Others

For any given period of time, usually, the results shown by Financial Statements and the Cost Statement will not be the same. It is essential to identify the reasons for the difference in results and reconcile the same. For ascertaining the Reasons of Difference in Profits or Losses shown by the two different Accounting Systems, a Statement of Reconciliation or a Memorandum Reconciliation Account is prepared.

Causes or Reasons for Difference in Results as Per Financial Accounts and Cost Accounts:

The following are the reasons or causes for the differences in results as per financial accounts and cost accounts:

1. Certain items are recorded only in Financial Accounts but not in Cost Accounts

2. Certain items are considered only in Cost Accounts but not recorded in Financial Accounts

3. Difference on account of Treatment for Overheads

4. Method of Depreciation

5. Method of Stock Valuation

These factors have been explained in detail as follows:

1. Items Recorded only in Financial Accounts, but not Considered in Cost Accounts:

i. Expenses and Losses:

Certain items of Expenses and Losses are recorded only in Financial Accounts, but not considered while preparing a Statement of Cost.

The following are some examples of expenses or Losses considered only in financial accounts:

(a) Interest on Loans (Mortgage Loans, Debentures, etc.)

(b) Cash Discount allowed

(c) Fines, Damages and Penalties paid for Contravention of Law

(d) Donations

(e) Expenses incurred for raising Capital

(f) Loss on Sale of Assets

(g) Loss on Sale of Investments

(h) Loss on account of damage or destruction of asset due to fire accident, theft, etc.

(i) Loss due to Scrapping of Machinery

(j) Preliminary Expenses written off

(k) Intangible Assets amortized or written off

ii. Incomes and Gains:

Certain items of Incomes and Gains are recorded only in Financial Accounts, but not considered while preparing a Statement of Cost.

The following are some of the examples of incomes or gains considered only in financial accounts:

(a) Interest on Bank Deposits

(b) Income from Investments

(c) Rental Income

(d) Transfer Fees received

(e) Profit on Sale of Assets

(f) Profit on Sale of Investments

(g) Interest on Loans advanced

(h) Cash Discount received

(i) Commission received

(j) Damages received

iii. Appropriation of Profits:

One of the uniqueness of Financial Accounting is providing for future by appropriating Profits and creating Reserves and Provisions. Such practice is not adopted in Cost Accounting.

Some examples of appropriations, which are found only in financial statements but not in cost statements, are:

(a) Provision for Tax

(b) Proposed Dividend

(c) Provision for Bad Debts

(d) Provision for Future Losses

(e) General Reserves

(f) Any other specific reserve like Dividend Equalisation Reserve, Redemption Reserve, etc.

2. Items Considered only in Cost Accounts, but not recorded in Financial Accounts:

Financial Accounting considers only actual expenses incurred (with the exception of Depreciation). However, in Cost Accounting, Notional Expenses (i.e., expenses, which are not incurred but are likely to be incurred) and Opportunity Cost (i.e., value of benefit loss of an alternative or course of action which is not adopted) are also recorded.

Some examples of items, which are considered only in, cost statement but not recorded in financial statements, are:

a. Notional Salary (i.e., Salary of Proprietor or Owner)

b. Notional Rent (i.e., Rent for building and premises owned by Owner)

c. Interest on Capital (even if the actual liability does not exist)

3. Treatment of Overheads:

In Financial Accounting, the Overheads are recorded on an actual basis. However, in Cost Accounting, Overheads are absorbed into Cost of Product or Service, based on certain relationships. For example, Factory Overheads are absorbed as a percentage of Direct Wages, Office Overheads are absorbed as a percentage of factory Cost, etc.

On account of this, the Overheads considered in Costing Books might be more or less than the actual amount incurred (i.e., over-absorbed or under-absorbed). This is one of the major reasons of difference in results shown by Financial Accounting and Cost Accounting.

4. Method of Depreciation:

The difference in Amount of Depreciation recorded in Financial Accounts and Cost Accounts is another Reason for Difference in results between the two systems. The difference in the Amount of Depreciation would be on account of the Method of Depreciation followed. In Financial Accounting, the method for calculating Depreciation is usually Straight Line Method or Written-Down Value Method, whereas in Cost Accounting, it is usually the Machine Hour Rate Method.

5. Method of Stock Valuation:

In Financial Accounting, Stocks are valued at Cost Price or Net Realisable Value, whichever is less. However, in Cost Accounting, the Stocks are valued at Cost Price. On account of the difference in Stock Valuation Policy, the results shown by Financial Statements and Cost Statements could be different.

Statement of Reconciliation:

A Statement of Reconciliation or Reconciliation Statement is a Statement prepared to present the reasons for difference in results under the two Accounting Systems, thereby enabling the accuracy of both the systems and transparency in recording of business transactions.

Format of Statement of Reconciliation:

Notes:

1. The Base Profit or Source Profit can be Profits of any set of Books of Accounts. When the Profit under only one Accounting System is given, it should be considered as Base Profit. For example, if only Profits as per Financial Statements are made available, they should be considered as Base Profits.

However, when the Profits under both Accounting Systems are provided, then any of the Profits can be the Base Profit and the other Profit must be considered as Target Profit. For example, if Profit under Financial Accounting is considered as Base Profit, then Profits under Cost Accounting will be Target Profit.

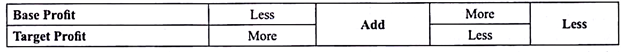

2. On account of any given reason, if the Target Profit is more than the Base Profit, the reason must be considered under items to be added (ADD). Similarly, on account of any given reason, if the Target Profit is less than the Base Profit, the reason must be considered items to be deducted (LESS).

So, the simple criterion for identifying the treatment for a reason of difference is given as follows:

On account of the given reason if the Base Profit is less and Target Profit is more = Add

On account of the given reason if the Base Profit is more and Target Profit is less = Less

3. Where the results under both the systems are Losses, then the same can be presented with negative sign (-) in the aforementioned format.

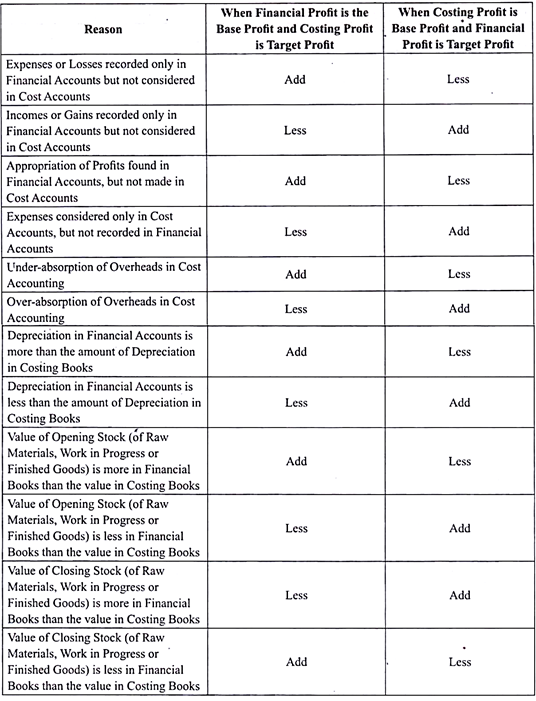

Treatment for Various Items of Difference in Statement of Reconciliation:

Memorandum Reconciliation Account:

Memorandum Reconciliation Account is an alternative to Statement of Reconciliation. It is prepared to present the reasons for difference in the results shown by Financial Statements and Cost Statements. The account is not a part of Double Entry System. Hence, it is called Memorandum Reconciliation Account.

Format of Memorandum Reconciliation Account:

Notes:

1. The Base Profit or Source Profit can be Profits of any set of Books of Accounts. When the Profit under only one Accounting System is given, it should be considered as Base Profit. For example, if only Profits as per Financial Statements are made available, they should be considered as Base Profits.

However, where the Profits under both Accounting Systems are provided, then any of the Profit can be the Base Profit and the other profit must be considered as Target Profit. For example, if Profits under Financial Accounting is considered as Base Profits, then Profits under Cost Accounting will be Target Profits.

2. On account of any given reason, if the Target Profit is more than Base Profit (or the Target Loss is less than Base Loss), the reason must be credited in the Memorandum Reconciliation Account. Similarly, on account of any given reason, if the Target Profit is less than the Base Profit (or the Target Loss is more than Base Loss), the reason must be debited in the Memorandum Reconciliation Account.

So, the simple criterion for identifying the treatment for a reason of difference is given as follows:

On account of the given reason if the Base Profit is less and Target Profit is more = Credit

On account of the given reason if the Base Profit is more and Target Profit is less = Debit

Reconciliation of Cost and Financial Accounts – With Proforma

There are two accounting system in origination relating to cost accounting & financial accounting:

(a) Integrated Accounting System – Integrated accounting implies a system of accounting where both cost & financial accounts are maintained in one set of books. The profits disclosed by these two records are same & there is no requirement to reconcile both records of accounts.

(b) Non-integrated Accounting System – In this system separate set of books for cost & financial transactions are maintained with different items & amounts. Thus the profit disclosed by cost account and financial account does not match with each other and the need for reconciliation of cost and financial account arises.

A reconciliation statement is prepared to reconcile the two different figures of profit revealed by two set of books by as pertaining the reasons for the difference but the aim of reconciliation is the only reconcile & not to rectify.

Need for Reconciliation (Purpose):

i. Reconciliation reveals the reason for difference in profit or loss shown by cost & financial accounts.

ii. It helps in testing the arithmetic accuracy of costing data makes it reliable.

iii. It promotes coordination and cooperation between cost & financial data.

iv. It helps in formulating policies related to overheads, depreciation & valuation of stock.

Reasons/causes for difference in profit as shown by cost & financial accounts:

1. Pure financial nature incomes and expenses/losses

2. Pure cost nature or notional items

3. Under or over absorption of overheads

4. Different methods of depreciation

5. Different basis of valuation of stock

6. Abnormal gains and losses

1. Pure Financial Nature Items:

(i) Incomes:

a. Profit on sale of fixed assets

b. Profit on sale of investment

c. Interest & divided received

d. Transfer fee, brokerage, commission received

e. Abnormal gain in production

(ii) Expenses and Losses:

a. Loss on sale of fixed assets

b. Loss on sale of investment

c. Preliminary expenses goodwill written off

d. Interest on loans & debentures

e. Loss by fire or theft bad debts

f. Abnormal wastage of material

g. Donation & subscriptions

(iii) Apportionment of profits:

a. Transfer to general reserve

b. Dividend paid

c. Income tax paid on profits

2. Pure Cost Nature Incomes (Notional Incomes):

i. Notional rent of the owned premises

ii. Notional salary of proprietor/owner manager

iii. Notional interest on capital employed.

3. Under or Over Absorption of Overheads: