Responsibility accounting, also called ‘Responsibility Reporting’ is a system of responsibility reporting and control. Here, various income and expense reports are built on the lines of the organisation chart.

The focus is on specific units within the organisation that are responsible for the accomplishment of specific activities.It could be viewed as an accounting system designed to control costs by relating costs to executives responsible for their incurrence.

Responsibility accounting is not yet another branch of accounting like financial or cost accounting. It is only a control system of accounting and reporting. Under this system, the organisation structure is split into a number of sub- units. Each such sub-unit is placed in charge of a manager.

Contents

- Introduction to Responsibility Accounting

- Meaning of Responsibility Accounting

- Definition of Responsibility Accounting

- Objectives of Responsibility Accounting

- Assumptions Based on Operation of any Organization

- Extension of Budgetary System

- Difference between Cost Accounting and Responsibility Accounting

- Uses of Responsibility Accounting

- Responsibility Centres Classification

- Essential Requirements for the Success or Failure of a System of Responsibility Accounting

- Steps of Responsibility Accounting

- Fundamentals of Responsibility Accounting

- Conditions for the success of Responsibility Accounting

- Responsibility Reporting

- Levels of Reporting

- Guidelines for Reporting

- Difference between Feedback and Feed-Forward Controls

- Benefits of Responsibility Accounting

- Advantages of Responsibility Accounting

- Limitations of Responsibility Accounting

What is Responsibility Accounting: Meaning, Objectives, Assumptions, Requirements, Fundamentals, Responsibility Reporting, Difference, Advantages, Limitations, and More…

What is Responsibility Accounting – An Introduction

Responsibility accounting, also called ‘Responsibility Reporting’ is a system of responsibility reporting and control. Here, various income and expense reports are built on the lines of the organisation chart. The focus is on specific units within the organisation that are responsible for the accomplishment of specific activities.It could be viewed as an accounting system designed to control costs by relating costs to executives responsible for their incurrence.

ADVERTISEMENTS:

The concept emphasizes “personalisation of costs” by putting questions as to where the cost was incurred and who were responsible for it. The technique seeks to control costs at the starting point. Broadly speaking, responsibility accounting is designing the accounting system according to answerability of the manager.The accumulation, classification, measurement and reporting of financial data is so arranged that it promotes the fixing of precise responsibility on the concerned manager.

Charles T. Horngreen rightly says, “Responsibility accounting focuses on people and not on things. It is designed to present managers with information relating to their individual fields of responsibility”. The message is that since all items of income, operating costs, other expenses and capital expenditure are the responsibility of some manager, none should be left unassigned.

Responsibility accounting considers both historical and future costs. For some purposes, the activity of responsibility centres are expressed in historical amounts. For others, these are expressed in estimated future amounts.

Responsibility Accounting – Meaning

Responsibility accounting is not yet another branch of accounting like financial or cost accounting. It is only a control system of accounting and reporting.Under this system, the organisation structure is split into a number of sub- units. Each such sub-unit is placed in charge of a manager.

ADVERTISEMENTS:

He is, in fact, made responsible for the activities of the sub-unit under his control. Being a supplementary cost control device, responsibility accounting traces costs to these individual managers.Till recently, most cost accounting systems were designed to accumulate costs for product costing and inventory valuation.

As such, they emphasised general cost control. With the available controlling devices, a sincere attempt was made to ascertain and control both product costs and period costs.Cost accounting system was thus directed towards expenditure, and showed the actual costs and where money was spent. However, the system did not pinpoint the individual manager who spent money. As such, the system failed to fix individual responsibility for the money spent.

Responsibility accounting seeks to overcome this limitation. It shifts the emphasis from product costing to divisional performance measurement. The basic feature of responsibility accounting is that every manager is made responsible for the activities which are under his control. His actions are measured by the revenue results achieved by him.

ADVERTISEMENTS:

Accordingly, responsibility accounting may be defined as “a system designed to accumulate and report costs by individual levels of responsibility. Each supervisory area is charged only with the cost for which it is responsible and over which it has control.”

Responsibility Accounting – Definition

Responsibility Accounting deals with the basic premise that individual managers should be held responsible for their performance and the performance of their subordinates.

Horngren defines Responsibility accounting as – “a system of accounting that recognizes various responsibility centres throughout the organization and reflects the plans and actions of each of these centres by assigning particular revenues and costs to the one having the pertinent responsibility”.

This concept guides the accountants in the accumulation and reporting of operating results by areas of responsibility. The Responsibility accounting recognizes that each member of the organization, who has any control over cost or revenue, should be a separate responsibility centre, whose stewardship must be defined, measured and reported upward in the organization.

It may also be defined as a system of accounting which is tailored to an organization so that costs are accumulated and reported by the level of responsibility within the organization. Each responsibility centre in the organization is charged only with the costs for which it is responsible and over which it has control.Responsibility accounting works well for all types of decentralized operations irrespective of the basis of framing the divisions.

The divisions may be based on business functions, products, processes, customers or any other. The responsibility accounting system is a subset of the general accounting system. It is used to accumulate performance information by different divisions.Responsibility reporting has no or very little importance for a small organization, but as the firm grows, control and evaluation becomes more and more difficult.

Responsibility Accounting – 3 Main Objectives

The objectives of responsibility accounting are:

Objective # 1. Measurement of the Contribution of a Division:

The performance of a responsibility centre can be measured in terms of its efficiency (relationship of inputs to outputs) and effectiveness (relationship between output and the goals of the organization). A responsibility centre should be both efficient and effective.

ADVERTISEMENTS:

Objective # 2. Performance Evaluation of the Individual:

The responsibility accounting is used to measure the performance of the individuals working in an enterprise. This technique allows to measure the performance of an individual along with the performance of the division where he works.In many cases, a division might not have made a satisfactory contribution to the goals of the organization, but the manager may be judged to have discharged his responsibilities well.

In case of a global slowdown, may be the performance of the division has deteriorated but the manager may be rated as efficient in performing his duties by minimizing the impact of slow down on the profits of the enterprise.

Objective # 3. Goal Congruence:

ADVERTISEMENTS:

Divisional performance measurement should be designed in such a way that it motivates the people to achieve their individual goals though the achievement of the organizational goals. This goal congruence may be made possible by introducing a system of incentives.

Responsibility Accounting – Assumptions Based on Operations of Any Organization

Responsibility accounting is based on certain basic assumptions regarding the operations of any organization as follows:

1. That managers should be held responsible for the activities accruing in the area of the organization over which they exercise control.

2. That managers must try to attain the objectives defined for them and for their department.

ADVERTISEMENTS:

3. That managers should participate in establishing the goals against which their performance is measured.

4. Goals should be practically feasible with effective performance.

5. That there should be timely reporting and feedback of performance.

Some Other Assumptions are:

The responsibility accounting, which is tailored according to the requirements of a particular organization, makes the following important assumptions:

1. Each responsibility centre should be capable of being identified for which the managers should be held responsible.

ADVERTISEMENTS:

2. Managers are responsible only for those items over which they can exercise some control.

3. Managers should actively participate in the establishment of goals and budgets against which the performance is to be compared.

4. Performance reports should contain only significant information relating to each responsibility centre.

5. Responsibility managers should try to achieve the targets for their area of responsibility only.

Responsibility Accounting – Extension of Budgetary System

In some way, responsibility accounting is an extension of the budgetary system. It provides for the reporting of operating data and budget comparisons to the individuals and groups who have organisational responsibility. Responsibility accounting, measures plans by budgets, and actions by actual results of each responsibility centre.

If fully developed, it has a built-in budgetary system which perfectly fits the organisational chart. Budgeting provides the measuring stick by which the actual performance can be judged. Budgets, along with responsibility accounting provide systematic help to the managers if they interpret the feedback carefully.

Difference between Cost Accounting and Responsibility Accounting

Cost accounting was evolved with the main objective of ascertaining product cost. Incidentally, it also helped inventory valuation for purposes of balance sheet. With the passage of time, however, the emphasis was shifted from product costing to cost control. Cost finding was subordinated to cost control.Control is the process of ensuring that the activities of a concern are in conformity with its plans so that its objectives are achieved.

ADVERTISEMENTS:

A control system is a communications network that monitors the activities within the organisation. Such a system also provides the basis for corrective action. Effective control requires that corrective action is taken in order to make actual performance conform to planned performance.

It is, in this, context that we refer to responsibility accounting. Normally, control of day-to-day operations is in the hands of lower level managers. As such, in order to enable them to effectively control the day-to-day operations, it is necessary to provide them with information at frequent intervals. The information should enable them to compare the actual performance with budgeted performance.

Such information may not help them control past inefficiencies. However, it certainly facilitates isolation of such past inefficiencies and the reasons for the same. This, in turn, facilitates further action in preventing the recurrence of the same in future. The system that provides reports facilitating comparison of budgeted performance with the actual performance is known as responsibility accounting.

Thus, responsibility accounting is only an aspect of cost accounting. Its purpose is to facilitate control of day-to-day performance. In other words, one of the fundamental objectives of cost accounting, viz., and cost control is achieved through the system of responsibility accounting.

Responsibility Accounting – Top 6 Uses Listed

Responsibility accounting which focuses on responsibility centres is an important aid in the management control process. It has several uses and confers many benefits.

ADVERTISEMENTS:

These are listed below:

Use # (i) Performance Evaluation:

This is perhaps the biggest benefit. When a manager is held responsible for whatever he does, he becomes extra-vigilant. Responsibility accounting system provides the manager with information that helps in controlling operations and evaluating the performance of subordinates.

Use # (ii) Corrective Action:

If performance is unsatisfactory, the person responsible must be identified. It is only after identification of the erring subordinate that the corrective action can be taken. Under responsibility accounting, as areas of authority are clearly laid down, such corrective action becomes easier.

Use # (iii) High Morale and Efficiency:

ADVERTISEMENTS:

Once it is clear that rewards are linked to the performance, it acts as a great morale booster. Great disappointment will be caused if an operating foreman is evaluated on the decisions in which he was not a party.

Use # (iv) Delegating Authority:

Large business firms can hardly survive without proper delegation of authority. By its very nature, responsibility accounting makes it happen. Decentralisation of power is its key-point and, hence, delegation of authority follows.

Use # (v) Management by Objectives:

The heads of divisions and departments are assigned definite objectives before the commencement of the period. They are held answerable for the attainment of these targets. Shortfalls are punished and excesses rewarded. Such a system helps in establishing the principle of management by objectives (MBO).

Use # (vi) Motivation:

Responsibility accounting is the use of accounting information for planning and control. When the managers know that they are being evaluated, they are prompted to put their heart and soul in meeting the targets set for them. It acts as a great stimulus. As a matter of fact, responsibility accounting is based on the hypothesis of motivating executives to maximum performance.

Responsibility Centres Classification – Cost Centre, Profit Centre and Investment Centre

The responsibility accounting system is structured around the responsibility centres. The type of the responsibility centre used for measuring divisional performance depends upon the type of business situation. The performance report should measure appropriately the performance of the responsibility centre managers.

For example, if a manager is responsible for the costs of a department, and has no control over the revenues, the responsibility report should be limited to costs only and should net include profits.

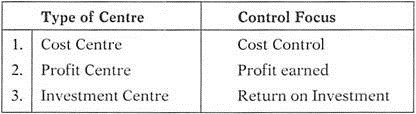

A responsibility centres may be classified as Cost, Profit or Investment Centre with the proper control focus as follows:

Classification # 1. Cost Centre:

A cost centre in an organization is a division in which a manager is held responsible for the costs incurred in that division. It is a responsibility centre that has control over the incurrence of cost only and has no control over the generation of revenue or use of investment funds. The cost centre is the most widely used form of responsibility centre because in most of the cases, divisions can be easily classified as cost centres.

In an organization, the entire marketing department, or a sales region or a sales manager may be defined as cost centre. Similarly, the customer service department provides services that generate and maintain profits.

Though it is an important element in the operations of the firm, yet it is difficult to measure the precise effect of this department on the profit of the firm. So, this department can be considered as a cost centre in terms of costs being incurred in its running.

One of the characteristics of a cost centre is that the cost controllable by the manager can be identified. It seems reasonable to expect cost centre managers to accept responsibility for the costs they or their subordinates control or incur. However, it is not always easy to identify costs with individual cost centres.

The issue of what costs should be charged to the cost centre is critical in evaluating cost centre manager. Control of a cost centre may be achieved through the budgeting process. Budgets are set and actual performance is compared to the budgeted figures.The cost centre managers are responsible for explaining variances from the budget.

It may be noted that cost centres do not provide a means of motivating the performance of the divisional managers other than through the process of requiring them to operate within the budgeted figures.Performance evaluation of a cost centre emphasizes efficiency measures to ensure that the operating results of a given period are achieved with the minimum possible cost.

The efficiency is evaluated from the performance reports that share the actual cost of operating the centre compared with the budgeted cost that represents an acceptable efficiency level. In divisional performance, financial responsibility extends beyond costs. Two such financial centres may be found in actual practice. These are Profit Centre and Investment Centre.

Classification # 2. Profit Centre:

A profit centre exists when revenues as well as costs can be identified with a particular division. As against a cost centre, a profit centre has control over both the costs and revenues. A profit centre is a segment of the business in which a manager is held responsible for expenses as well as revenues generated. It is something like a business unit within a business. Each profit centre has its objective as the maximization of profit and this is the objective of the firm also.

So, if all the profit centres maximize their profits, the profit of the firm will also be maximised. All business segments may not have features to be classified as profit centres. For example, the accounting departments do provide services to the firm but its effect on the revenues and profits is virtually impossible to be measured.

Following features should be present in the firm to have profit centres:

a. There must be at least two units for which separate measures of revenue and expenses are available.

b. The manager in control of each department should have considerable control over the costs and revenues of that department.

c. The profit of each division must be reported to top management on a regular basis and profit must be considered as a part of performance of that division.

Profit centres may also be called artificial centres because they mainly sell their output within the firm. The selling price involved in such sales is called transfer price. The use of an artificial profit centre provides an incentive to the manager responsible for its performance even though the results may not be the same as they would be with outside sales.

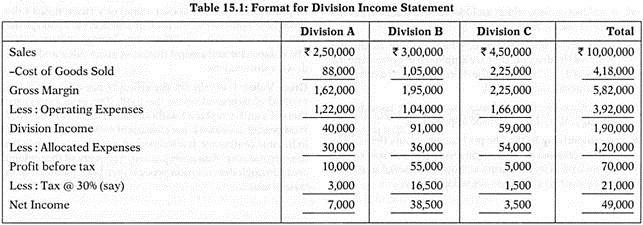

A profit measure such as division income or contribution may be used to evaluate the performance of a profit centre.

The calculation of profit for a profit centre is very similar to finding the profit of a firm. However, basic problem arises because there are some costs that are difficult to be identified with a profit centre but are common to several profit centres.

For example, benefits of corporate administration, research and development and centralised computer services are shared by all the departments of the firm.

If the allocations of these costs are made arbitrarily, then the resultant profit figures may not be all that relevant. Table 15.1 presents an Income Statement of a company in terms of different divisions or different profit centres.

In this example, the common expenses are allocated in the ratio of sales of different departments. All expenses specially identifiable with a division, together with the allocated expenses are considered to find out the net income of the division.

Classification # 3. Investment Centre:

An Investment centre in an organization is a responsibility centre which has control over the use of investment funds besides control over costs and revenue. When a division of a firm has control over investment in such areas such as plant and equipment, receivables, inventories, etc., then it is termed as an investment centre.

Investment centres Eire the divisions where the managers are responsible for the best combination of costs and revenues in relation to the capital employed in the division. Managers in the investment centres are held responsible for the return on the resources invested in division.

Total profit alone may not be a good measure of a division’s performance because typically profit is related to the amount of resources available to earn the profit. A division having more assets should earn more than a division having lesser assets.In an investment centre, the manager is held responsible for the return on resources used in the division.

In other words, he is accountable for the revenues, costs and operating assets with the goal of achieving a satisfactory return on investments. So, the emphasis shifts from the profit figure to a measure of rate of return (ROR).

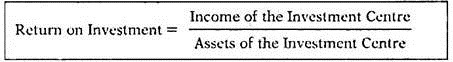

The rate of return for an investment centre may be calculated as follows:

For example, if a division has earned a profit of Rs 50,000 on the investments of Rs 2,50,000, then the rate of return for the division is 20%. The profit of the division is the key element in calculating the rate of return. The investment base of the division and the problem of isolating revenues and expenses are significant for rate of return.

As far as the investment base is concerned, there are different alternatives available:

(i) Total Gross Assets, which include all assets of a division. This will include the non-operating assets and investment also,

(ii) Total Net Assets, which include all assets less depreciation on these assets,

(iii) Total Net Assets Employed, which include all the net assets of the division that are employed in generating the net profit. As a result, the non-operating assets and investments are excluded,

(iv) Any other investment bases may also be used by top management, if it is deemed appropriate.

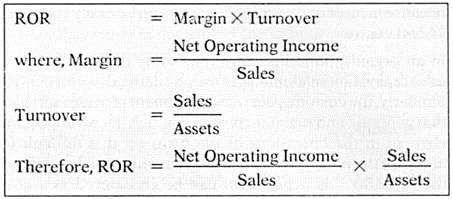

Factors underlying ROR:

The profitability of any firm or any division is a product of the margin (profit per unit sold or % of Profit) multiplied by the turnover (total number of units sold or total sales), this can be presented as follows:

The above explanation emphasizes the fact that ROR is actually a function of two variables i.e., the margin earned and the turnover of assets. While evaluating the performance, both the margin and the turnover should be considered. The tendency to consider only the margin and ignoring the turnover should be checked.

No doubt, margin earned is a valuable measure of performance. Standing alone, however, it overlooks one very crucial area of managers responsibility i.e., the control of investment in operating assets. Excessive funds tied up in operating assets can be justified only if commensurate earnings are there.

One of the real advantages of ROR criterion is that it forces the managers to control their investment in operating assets as well as to control expenses. The ROR measure blends together many aspects of the managers responsibilities into a single figure that can be compared against the return of other investment centres or other firms in the same competitive environment.

Net Operating Income and Operating Assets:

In the above ROR formula, the term Net Operating Income was used instead of Net Income. Net Operating Income is Earnings before Interest and Taxes i.e., EBIT. The reason for using EBIT is that the income figure used should be consistent with the base to which it is applied. The base in the turnover part of the formula is assets.

In order to maintain the consistency, the base assets should be only the operating assets and not the total assets. The term operating assets would include all current and fixed assets held for productive use in the division. Examples of assets that would not be included in operating assets would include factory building being rented out, financial investment or other non-trade investments.

A major consideration in the computation of ‘asset’ for the ROR formula is the valuation of depreciable assets. Should it be gross value (historical cost value) or written down value. Both these approaches are used in practice, even though they will obviously yield very different operating assets and ROR.

The reasons for and against the use of gross value and written down value may be:

Gross Value:

It eliminates the effect of age of asset and the method of depreciation on the ROR. The asset or any part thereof can be replaced without much effect on the ROR. However, gross value is not consistent with the figure of EBIT in Income Statement. It also involves double counting in that the original cost of an asset plus any recovery of that original cost (through depreciation process) are both included in the ‘assets’ base.

Written Down Value:

It is also known as net book value. The WDV is consistent with the fixed assets as reported in the balance sheet. It is also consistent with the net operating income concept. However, ROR over time will be affected because the assets base would go on declining as more and more depreciation is provided. Further, if there is a replacement of an asset, it would dramatically affect the ROR.

Residual Income as a Performance Measure:

The objective of an investment centre should be to maximize the rate of return on its investments. There is another approach to measure performance of an investment centre. This is known as Residual Income.

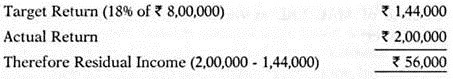

Quite often the management may set a minimum or target rate of return for the division. Any income in excess of the target return is known as Residual Income. For example, in the case of MAC Ltd., say CMA Ltd., has fixed a target ROR of 18% on TNA for MAC Ltd.

The Residual Income for MAC Ltd., may be found as follows:

The concept of Residual Income may highlight the absolute excess contribution by a division towards the total profit of the company.

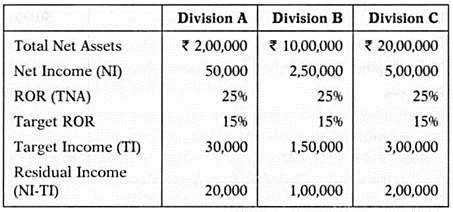

For example, a firm has 3 divisions, A, B and C whose positions with reference to Investment, Income and Residual Income are as follows:

The above figures highlight that though the ROR as well as target ROR for all the 3 divisions are same, yet the absolute contribution (Residual Income) of the 3 divisions are different. The Residual Income has a tendency to highlight the division that generates the higher monetary profit to the profit of the firm.

In the Residual Income approach, the performance of a divisional manager is assessed according to how larger or small the Residual Income is from year to year. The larger the Residual Income, the better is the performance rating received by the manager. So, the Residual Income may be regarded as a better measure of performance than ROR.

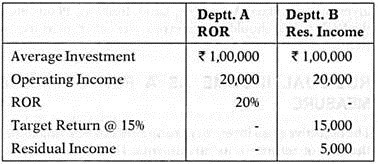

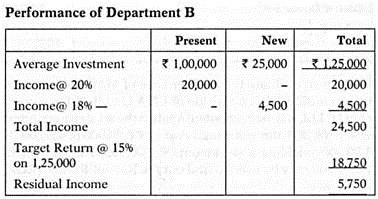

The Residual Income approach encourages managers to make profitable investments that would be rejected being measured by ROR formula. Say, Department A and B, both have an income of Rs 20,000 on the assets of Rs 1,00,000. So the ROR for both is 20%. In case, the performance of Deptt.

A is measured according to ROR criterion, while that of Deptt. B, is measured by Residual Income approach (target rate is 15%), their position can be presented as follows:

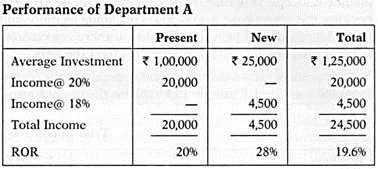

Suppose, both the Departments are presented with an opportunity to make an investment of Rs 25,000 in a project that is expected to earn 18%. The manager incharge of Deptt. A would not be enthusiastic about taking up this project. The reason being that if he takes up this project then his ROR which is 20% at present would be reduced after taking the project with ROR of 18%.

This can be shown as below:

The manager will, therefore, be not receptive for taking new project as the ROR will decline to 19.6%. He may tend to think and act along these lines, even though the opportunity he rejects might have benefited the firm as a whole.

However, the position of Deptt. B of which performance is being measured by Residual Income may be presented as follows:

It is apparent that the manager of Deptt. B may be anxious to accept the new project as the Residual Income of the Deptt., will increase from Rs 5,000 to Rs 5,750, hence a better performance. Any project that provides a return of more than 15% will be attractive, since it will add to the total residual income of the Department.

The fact that the overall ROR of the Deptt. B might be lower as a result of accepting this project is immaterial since the performance is being evaluated by Residual Income and not ROR.

Residual Income and Unequal Divisions:

One of the disadvantages of Residual Income as a performance measure is that it cannot be used to compare the performance of different divisions of different sizes, since by its very nature, the Residual Income approach creates a bias in favour of large divisions.

Improving the ROR:

For obvious reasons, every manager is inclined to show better and better performances. In case his performance is being measured by ROR, he can attempt for better performance by concentrating on one or more variables of the ROR formula.

In general, a manager can improve the ROR for the division in any of the following 3 ways:

a. By Increasing Sales:

A look at the ROR formula gives an impression that the sales figure is neutral as it appears in the denominator of the margin component and in the numerator of the turnover component and in the process gets cancelled. However, this is not so. Even if sales figure is cancelled out (mathematically), there is no denying the fact that ROR or the profitability is a factor of two variable i.e., margin and turnover.

Moreover, sales can affect either the margin or the turnover. For example, a firm may have some fixed expenses which remain constant as sales grow, thereby allowing a rapid increase in operating income and causing margin percentage to rise. Further, a change in sales can affect the turnover if sales either increase or decrease without a proportionate increase or decrease in operating assets.

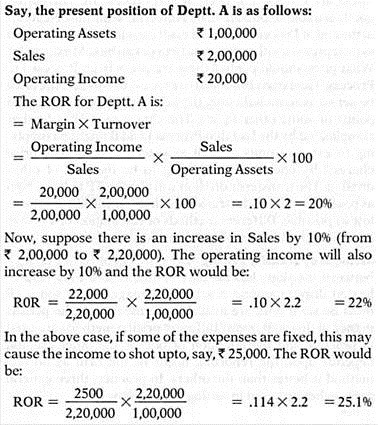

This can be analysed as follows:

In the first case, the ROR increased from 20% to 22% because of increase in turnover only. The margin % was fixed as all costs were assumed to be variable in nature. In the second case, where some of the costs were taken as fixed, the income level also increased. As a result, both the margin and the turnover increased and the increase in ROR was more pronounced from 20% to 25.1%.

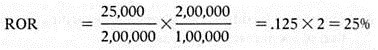

b. By Reduction in Expenses:

Whenever there is a pressure on ROR, on easy route oftenly suggested is to shed the ‘fat’ from the firm/division through a concerted effort to control the expenses. The discretionary fixed expenses come under scrutiny first, and various programmes are curtailed or eliminated in an effort to cut costs.

In the above example, (sales level Rs 2,00,000), the manager is able to reduce operating expenses from Rs 1,80,000 to Rs 1,75,000 and thereby increasing income from Rs 20,000 to Rs 25,000.

The sales level (Rs 2,00,000) and Assets level 1,00,000) remaining same, the ROR would be:

In this case, the ROR has increased from 20% to 25% because the margin has increased from 10% to 12.5% (as a result of decrease in costs).

c. Reduction in Assets:

Managers in practice may be sensitive and reluctant to reduce the expenses but may not be reluctant to the idea of reducing the level of operating assets unless it is affecting their operational efficiency. The ROR formula implies that excessive investment in assets will reduce the turnover and affect the ROR. Reduction in assets will help improving the turnover, on one hand, and will release the funds that can be used elsewhere in the firm, on the other.

In the above example, if the assets level is reduced from Rs 1,00,000 to Rs 80,000 only (Sales Rs 2,00,000 and Earnings Rs 20000), the ROR would be:

In this case, the margin has remained constant at 10%, but the ROR still has increased from 20% to 25% as a result of increase in turnover from 2 to 2.5. There may be a problem before a manager as to how the operating assets of the division may be reduced. One possible answer could be to attempt to pare out the obsolete and redundant inventory.

Another could be to speed up the collection of receivables; the funds so released can be used to pay short term creditors. As the level of investment, inventory and receivables is reduced, the asset turnover is increased and it results in greater ROR.

ROR and Allocated Expenses:

While calculating the ROR, a crucial and ticklish question may arise as to whether the allocated expenses should be considered for a division ROR or not.

The allocated expenses refer to the value of services rendered by the central organization to a division. These services have helped the division to earn the sales revenue and so these allocated expenses should be included in the calculation of ROR. However, on the other hand, it can be argued that these should not be included as the divisional manager has no control over these expenses.

However, care must be taken that arbitrary allocation is avoided in the ROR calculation. If arbitrary allocations are made, greater danger exists of creating a bias for or against a particular division. Expense allocation should be restricted to the cost of those services provided by the central organization that the division would have otherwise procured for itself.

The amount of expenses allocated to a division need not be more than the cost that the division would have incurred it had provided the services itself instead of availing from the central organization.ROR is easily quantifiable measure of performance and consequently is widely used. However, it is far from being a perfect tool.

Some of the shortcomings of the ROR may be noted as follows:

1. ROR tends to emphasize the short term performance only and ignores the long term profitability.

2. There may be difference of opinion regarding the definition of income or assets base.

3. ROR is basically dependent on accounting profit and is not consistent with the cashflow approach. Difference in accounting policies being followed by different firms make the RoR, an unreliable measure.

4. ROR may not be fully controllable by the divisional manager, as there may be some committed costs and therefore, it is difficult to distinguish between performance of a manager and performance of the division as an investment.

Essential Requirements for the Success or Failure of a System of Responsibility Accounting

The success or failure of a system of responsibility accounting depends upon the following essential requirements:

(i) Well-defined organisation structure,

(ii) Proper authority-relationships, i.e., superior-subordinate relationships,

(iii) Clear-cut goals and objectives of the organisation,

(iv) Responsibility centres,

(v) Communication net-work,

(vi) Frequent performance reports,

(vii) Isolation of inefficiencies and reasons for the same,

(viii) Corrective action,

(ix) Budgeting performance for future in the light of isolated inefficiencies.

Responsibility Accounting – Top 5 Steps

Following steps are included in the process of responsibility accounting:

Step # (1) Establishment of Responsibility Centres:

From the point of view of control first of all the activities of the business are divided into groups. Each working group becomes a responsibility centre. According to Robert N. Anthony, “A responsibility centre is simply an organisation unit headed by a responsible person.”

Responsible Centres are of three types:

(i) Cost or Expense Centre:

Cost or expense centre is that unit of the enterprise on which expenditure is incurred but its output cannot be measured in terms of money. For example- an office is a cost centre which involves expenditure on administrative activities but it cannot be said what income will result on these expenses.

(ii) Profit Centre:

Profit centre is that unit of the enterprise whose aim is determined in the form of profit. It is a unit whose success or failure is evaluated on the basis of profit by finding out the difference between income and expenditure. For example- a factory is a profit centre because the cost of goods produced therein and the difference in selling price indicates the amount of profit.

(iii) Investment Centre:

Investment centre is a unit of the enterprise where the manager is held responsible for the effective use of the assets of the department along with the income and expenditure of the department.

Step # (2) To Develop a System of Accounting:

In the second step of responsibility accounting a system of accounting is prepared under which the accounts of every responsibility centre can be prepared separately.

Step # (3) Determination of Goals:

In the third step of responsibility accounting the goals for all the departments are determined.

Step # (4) Determination of Controllable and Non-Controllable Costs:

After determining goals the costs of every department are divided into two parts –

(i) on which control is possible (controllable), and

(ii) on which control is not possible (non-controllable). Managers can be held responsible only in case of the first type.

Step # (5) To Take Necessary Action:

In the last step of responsibility accounting, a record of the actual progress of the department is maintained and deviations are sought to be found. Then the progress report is sent to the officers concerned and appropriate action is suggested after fixing responsibility.

Responsibility Accounting – Top 4 Fundamentals

Every system has a structure and the process, and so the responsibility accounting. Its structure centres round responsibility centres. The process consists of bifurcating costs into controllable and non-controllable groups, flexible budgeting and performance reporting.

All these four fundamentals of responsibility accounting are being discussed below:

Fundamental # (i) Establishing Responsibility Centres:

Responsibility accounting rests on functional activity for which each specific manager is responsible. Here, the first step, therefore, is the setting up of responsibility centres. The organisation has to be restructured in terms of areas of influence. In ascending (i.e., rising) order of responsibility, these are cost centres, revenue centres, profit centres, and investment centres.

Control can be exercised only through managers who are responsible for what the organisation does. It is based on the principle that a manager’s performance should be assessed only on the factors that are within his span of control.

Fundamental # (ii) Limits to Controllable Costs:

Once the responsibility centres have been established in a company, costs and revenues under the control of each therein need be indicated. In responsibility accounting, the basis of classifying costs is controllability—the capability of the manager of a responsibility centre to influence (i.e., increase or decrease) them.

As such, the costs are accumulated and reported in the two groups of controllable and noncontrollable costs- The former are those which can be changed by the head of the responsibility centre. He has the ability to alter the quantity or the price or both of an item by his managerial action. Uncontrollable costs, obviously, are the costs which cannot be increased or decreased within a given time span. Generally, costs of raw materials and direct labour are controllable, and fixed costs are non- controllable.

Fundamental # (iii) Flexible Budgeting:

Responsibility accounting starts with the assumption that budgets are flexible. They have to be prepared for several levels of activity, instead of one static level. When actual output has been obtained, a fresh budget is prepared thereof. Comparison of actual results is made against the budget targets freshly prepared, for that level.

It would be a weak analysis to use a budget based on a level of activity that differs from the actual level of activity. A performance budget is the flexible budget adjusted to the actual level attained. It would be recalled that flexible budget are prepared either by the mathematical function or formula method, or the multi-activity method.

Fundamental # (iv) Performance Reporting:

Each responsibility centre has to periodically report about its performance. A report has both financial and statistical parts. It shows income, expenses and capital expenditures. Statistics such as volume of production, cost per unit, and manpower data are also provided. These reports point out how actual results compare with the current budget. The purpose is to take timely and corrective action.

Performance reports could be monthly, weekly, or even daily depending on the size of the organisation and significance of the item. In addition, the report must be given to the manager while the information is still useful.

Further, once the performance reports are prepared, management need only consider the significant variances from the budget. This is called management by exception (MBE).

Conditions for the Success of Responsibility Accounting

Responsibility accounting, by itself, does not give any benefits. Its success is dependent on certain conditions.

These are:

i. Support of all levels of management.

ii. The system must be based on people’s responsibility, it is the people who incur costs and should be held accountable for each expenditure.

iii. Separation of costs into controllable and non-controllable categories.

iv. Restructuring the organisation along the decision-making lines of authority.

v. An organisation plan which establishes objectives and goals to be achieved.

vi. The delegation of authority and responsibility for cost incurrence through a system of policies and procedures.

vii. Motivation of individual by developing standards of performance together with incentives.

viii. Timely reporting and analysis of difference between goals and performance by means of a system of records and reports.

ix. A system of appraisal or internal auditing to ensure that unfavourable variances are clearly shown. Then, follow-up and corrective action to be applied.

Responsibility Reporting

The objective of responsibility accounting is to accumulate costs and revenue for each responsibility centre so that deviations from budgeted performance can be attributed to the individual manager in charge of that centre. A system of responsibility accounting postulates the existence of an effective system of communication.

As such, the system is implemented by issuing performance reports at frequent intervals.Responsibility reporting is the issuance of performance reports to managers of responsibility centres informing them of the deviations from the budget in respect of various items of expenses.

In the process of reporting, it is necessary to distinguish between controllable and uncontrollable costs. Normally, it is considered appropriate to charge an area of responsibility only those costs that are influenced by the manager of that centre.

Although it is difficult to distinguish between an item of cost that can be controlled and that which is not so amenable, it is absolutely necessary to make such a distinction for purpose of performance reporting.

Only then will it be possible to compare the budgeted with the actual costs, bring out the differences, analyse the causes, locate responsibility and take appropriate remedial action to prevent the recurrence of the same.

Responsibility Accounting – Levels of Reporting

The number of responsibility centres in an organisation depends upon the degree of delegation of authority. Deep down decentralisation has the effect of bringing into existence a number of smaller responsibility centres. A problem, therefore, that arises in the course of operating a system of responsibility accounting is that of determining the lowest levels of responsibility for purpose of responsibility reporting.

This problem arises in the context of decentralisation of authority. Greater the degree of decentralisation, the greater will be the number of responsibility centres. The greater the number of responsibility centres, the greater will be the cost of responsibility reporting.

Accordingly, a very small responsibility centre is not worth its existence from the point of view of reporting performance. In case this appears to be so, it may be considered necessary to combine small responsibility centres and treat several of them as a single unit. Reporting will then be this single unit considered as a department and responsibility centre.

Responsibility Accounting – Guidelines for Reporting

The essence of responsibility accounting is the issuance of performance reports at frequent intervals. The main purpose behind such reporting is to inform the responsibility centre managers of deviations of actual performance from the budgeted performance and to take corrective action for the future.Comparison of actual performance with the budgeted performance is, essentially, in terms of costs or expenses.

For this purpose, it is necessary to distinguish between controllable costs and uncontrollable costs. But, it is not always easy to decide which items of cost are controllable and which of them are uncontrollable. Controllability depends upon two factors, viz., level of management and time span involved.It is necessary to remember that when the organisation is viewed as a whole, there is nothing like uncontrollable costs.

All costs can be controlled. Similarly, the cost of any department can be reduced to zero by closing down that department.

Responsibility Accounting – Difference between Feedback and Feed-Forward Controls

In the context of responsibility accounting, it is necessary to distinguish between feedback and feed-forward controls. According to the definition given by the Official Terminology, feedback system of control is “the measurement of differences between planned output and actual outputs achieved, and the modification of subsequent action and/or plans to achieve future required results.”

Feedback control system is thus the process of monitoring output achieved against desired output and, in case of deviation, taking corrective action.

According to the Official Terminology, feed-forward control is “the forecasting of differences between actual and planned outcomes, and the implementation of action, before the event, to avoid such differences.”

In the case of feed-forward control system, instead of comparing actual output against desired output, forecasts are made of outputs expected at some future time. In case the forecast outputs are different from the desired outputs, action is taken to minimise the differences.

Thus, in the case of feed-forward control system, possible errors are anticipated and steps are taken to overcome or minimise them. This is in contrast with the feed-back control system in the case of which actual errors are identified after the event and corrective action is taken to prevent the recurrence of the same while implementing future actions.

Responsibility Accounting – Benefits

In particular, the benefits of responsibility accounting can be summarized as follows:

1. A big organization is subdivided into smaller units which are of manageable size.

2. Decisions are made at the level at which managers are aware of the problems facing them.

3. The morale of the managers will be higher because of their active participation in decision making.

5. Responsibility centres managers have an opportunity to gain valuable managerial skill that in turn provides the firm with a pool of potential top managers.

6. It provides increased job satisfaction and greater incentive for the managers to put for the their best efforts.

Responsibility Accounting Advantages – In an Enterprise

The introduction of responsibility accounting in an enterprise offers the following advantages:

1. Responsibility accounting makes it possible to measure the contribution of a particular segment in the overall goal of the organization.

2. Responsibility accounting allows measuring the performance of the individuals which may be necessary for the different human resource decisions such as promotions, transfers, and termination of the employees.

3. If the expected performance and the targets are carefully set, the responsibility accounting works as a strong motivator for the employees.

4. A well-defined responsibility centre makes it possible for the firm to delegate the authority and fix up the responsibility of the individuals which is a prerequisite for the cost control exercise.

Responsibility Accounting – Limitations

A system of responsibility accounting provides a built-in means of evaluating a manager’s performance. Timely reports of performance ensure prompt corrective action directed towards deviations from the budgeted performance.

In spite of these advantages, responsibility accounting suffers from the following limitations:

(i) It is difficult to establish a sound organisation structure with clearly defined authority and responsibility. This is so owing to the interdependent nature of many departments.

(ii) It is equally difficult to match the responsibility centres and the chart of accounts for collecting costs by such centres.

(iii) Individual interest may come into conflict with the interests of the organisation.

(iv) The system may not work well unless it has the support of the people who operate the system. Since the person who incurs costs is to be held responsible for each item of cost, he should willingly accept responsibility for deviations.

(v) The system does not take into consideration the reactions of those who are involved in it.