Let us learn about the Short Run Cost Analysis of a Firm.

A firm’s cost of production will depend on the inputs it uses. Further, use or employment of an input depends on the length of time. In other words, cost of production will vary depending on the production period. Production may be conducted on a short run or on a long rim basis. In view of this, inputs employed by a firm may be fixed and variable.

Short run is that period of time over which at least one input is held fixed. In the short run, the firm cannot change its fixed input to expand output. Only by varying variable inputs can a firm change its volume of output. Thus, in the short run, total cost (TC) is divided into two broad components: total fixed cost (TFC) and total variable cost (TVC).

Thus TC = TFC + TVC where TFC = PK K̅ = rK̅ and TVC = PL.L = w.L. Here we have put bar sign over K since it is assumed to be fixed (in the short run).

ADVERTISEMENTS:

Total Fixed Cost (TFC):

A firm in the short run uses both fixed inputs and variable inputs. Costs that arise due to the use of fixed inputs are called fixed costs or overhead costs or unavoidable costs. It is the cost of the firm’s fixed inputs. Whether a firm produces or not it will have to incur fixed cost.

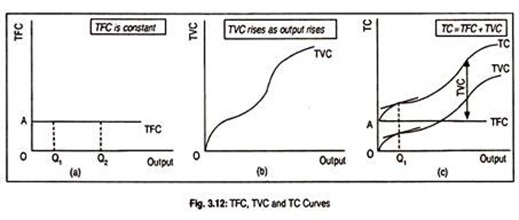

Thus, fixed cost is independent of the level of output. Whatever be the level of output (even if zero), fixed costs do not change. Thus fixed costs are sunk costs. This is shown in Fig. 3.12(a) where TFC curve has been drawn parallel to the horizontal axis on which we measure output. It is clear from the figure that the firm incurs a total fixed cost of OA, whether it produces or not.

Fixed costs or supplementary costs or overhead costs are:

ADVERTISEMENTS:

(i) Expenses for municipal rent on land,

(ii) Salaries of top officers

(iii) Interest on borrowed funds,

(iv) Depreciation of machine, and

ADVERTISEMENTS:

(v) Capital cost of computer, etc. Fixed costs are sometimes called indirect costs or overhead costs.

Total Variable Cost (TVC):

Costs that arise due to the use of variable factors are called variable costs or direct costs or prime costs. It is the cost of the firm’s variable inputs. If the firm does not produce, it need not use variable inputs. Thus, when no output is produced, variable cost is zero.

But, if the firm wants to produce, it will have to increase the usage of variable inputs. Thus more output means employment of more variable inputs and more variable cost. Thus, variable cost rises in response to an increase in output.

Total variable cost curve has been drawn in Fig. 3.12(b) where the TVC curve starts from the origin showing that TVC is zero when no output is produced. As soon as output rises, the TVC curve has, broadly, an inverse shape due to the operation of the law of variable proportions. That is why initially at a low level of output TVC rises less than the rise in output. Later on, TVC rises more than the rise in output.

Total variable costs include costs of:

(i) Raw materials

(ii) Wages of daily wage-earners

(iii) Transport cost

ADVERTISEMENTS:

(iv) Cost of packaging

(v) Electricity and other energy-related costs

(vi) Tariff

Total Cost (TC):

ADVERTISEMENTS:

Total cost is the sum total of fixed and variable costs. TC curve has been drawn in Fig. 3.12(c). TC curve in the short run starts from that point wherefrom the TFC curve starts. This means that total cost includes only fixed cost when output is zero.

But, as output rises, TC rises, since variable costs come into operation. That is why the TC curve takes the shape of the TVC curve. At any output level, the vertical distance between TC and TFC measures TVC. Alternatively, by adding TFC and TVC, one obtains TC.

The Cost Schedule:

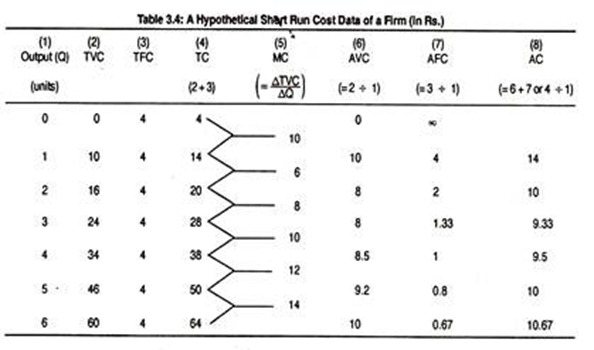

Total cost and its different variables are shown in a hypothetical Table 3.4. Consider a firm that uses both fixed and variable inputs to produce good X. Production is assumed to be subject to the law of diminishing returns. Table 3.4 illustrates various short run cost concepts for different levels of output of a commodity.

ADVERTISEMENTS:

Before explaining this table, we must know the meaning of different cost concepts. Table 3.4 suggests that, as output rises, TVC continuously rises but TFC remains unchanged at all levels of output. Columns (2) and (3) show the behaviour of TVC and TFC. By adding columns (2) and (3), we obtain the column of TC shown in column (4).

Marginal cost is the additional cost resulting from the change in output. This is illustrated in column (5). Column (5) tells us that MC initially falls and then rises as output rises. AVC is the variable cost per unit of output. AVC, like MC, initially declines and thereafter rises as output rises. Column (6) describes the behaviour of AVC. Column (7) illustrates AFC—the fixed cost per unit of output.

It gradually declines as output rises. AC schedule at different levels of output has been calculated in column (8). AC is the total cost per unit of output. It declines first and then rises.