In this article we will discuss about:- 1. Meaning of Demand 2. Types of Demand 3. Determinants.

Meaning of Demand:

The demand for a commodity is its quantity which consumers are able and willing to buy at various prices during a given period of time. So, for a commodity to have demand, the consumer must possess willingness to buy it, the ability or means to buy it, and it must be related to per unit of time i.e. per day, per week, per month or per year.

According to Prof. Bober, “By demand we mean the various quantities of a given commodity or service which consumers would buy in one market in a given period of time at various prices or at various incomes or at various prices of related goods.”

Types of Demand Functions:

The demand function is an algebraic expression of the relationship between demand for a commodity and its various determinants that affect this quantity.

ADVERTISEMENTS:

There are two types of demand functions:

(i) Individual Demand Function:

An individual’s demand function refers to the quantities of a commodity demanded at various prices, given his income, prices of related goods and tastes.

It is expressed as:

ADVERTISEMENTS:

D = f(P)

(ii) Market Demand Function:

An individual demand function is the basis of demand theory. But it is the market demand function that is main interest to managers. It refers to the total demand for a good or service of all the buyers taken together.

The market demand function may be expressed mathematically thus:

ADVERTISEMENTS:

Dx = f(Px, Py, M, T, A, U)

Where

Dx = Quantity demanded for commodity x

f = functional relation

Px = Price of commodity x

Pr = Prices of related commodities i.e. substitutes and complementaries

M = The money income of the consumer

T = The taste of the consumer

A = The advertisement effect

ADVERTISEMENTS:

U = Unknown variables

By demand function, economists mean the entire functional relationship. This means the whole range of price quantity relationship and not just the quantity demanded at a given price per unit of time. The demand function expressed above is really just a listing of variables that affect the demand.

The demand function must be made explicit and clear for use in managerial decision making. The industry must have reasonably good knowledge and information about its demand function to formulate effective long run planning decisions and short run operating decisions.

The basic assumption in demand schedule and demand curve has been the relationship between price and quantity of a commodity signifying a change in price to bring a change in quantity demanded with all other variables assumed constant and unchanged.

ADVERTISEMENTS:

In demand function this assumption is relaxed and it is held emphatically that besides change in price there are other variables which influence the demand for a particular commodity.

Classical economists were aware of the fact that the price is not the only factor which determines sales but that other factors, too, have an important effect on them. These other factors are the income of the consumer, their tastes, habits, preferences, etc. When these factors influence the demand the demand is said to shift.

But their price-demand relationship is not as important to the management as the shift in demand, which constitutes the demand function. Shifting of demand curve renders the demand analysis difficult.

Therefore, demand function makes use of mathematical formulation to arrive at correct results. Recently more sophisticated methods have been developed for the study like simultaneous equation and mathematical programming which helps in arriving at precise results.

Types of Demand:

ADVERTISEMENTS:

Managerial decisions require the knowledge of various types of demand.

We explain below a few important types:

1. Demand for Consumers’ Goods and Producers’ Goods:

Consumers’ goods are those final goods which directly satisfy the wants of consumers. Such goods are bread, milk, pen, clothes, furniture, etc. Producers’ goods are those goods which help in the production of other goods that satisfy the wants of the consumers directly or indirectly, such as machines, plants, agricultural and industrial raw material, etc.

The demand for consumers’ goods is known as direct or autonomous demand. The demand for producers’ goods is derived demand because they are demanded not for final consumption but for the production of other goods.

Joel Dean gives the following reasons of the demand for producers’ goods:

(1) Buyers are professionals, and hence more expert, price-wise and sensitive to substitutes.

ADVERTISEMENTS:

(2) Their motives are purely economic: products are bought, not for themselves alone, but for their profit prospects.

(3) Demand, being derived from consumption demand, fluctuates differently and generally more violently.

The distinction between consumers’ goods and producers’ goods is based on the uses to which these goods are put. There are many goods such as electricity, coal, etc. which are used both as consumers’ goods and producers’ goods. Still, this distinction is useful for the appropriate demand analysis.

2. Demand for Perishable and Durable Goods:

Consumers’ and producer’s goods have been classified further into perishable and durable goods. In economics, perishable goods are the goods which are used up in a single act of consumption while durable goods are the goods which can be used time and again for a considerable period of time. In other words, perishable goods are consumed automatically while only services of durable goods are consumed. Thus, perishable goods include all types of services, foodstuffs, raw materials, etc.

On the other hand, durable goods consist of buildings, machines, furniture’s, etc. This distinction has great importance because in the demand analysis durable goods create more complex problems than nondurable goods.

Non-durable goods are often sold to meet the current demand which is based on existing conditions. On the other hand, the sale of durable goods increases the stock of available goods whose services are consumed over a period of time.

ADVERTISEMENTS:

The demand for perishable goods is more elastic while the demand for non-durable goods is less elastic in the short-run and their demand tends to be more elastic in the long run.

According to J. Dean, the demand for durable goods is more unstable in relation to the business conditions. Postponement, replacement, storage and expansions are inter-related problems which are included in the determination of demand for durable goods.

3. Derived and Autonomous Demand:

When the demand for a particular product is dependent upon the demand for some other goods, it is called derived demand. In many cases, derived demand of a product is due to its being a component part of the parent product. For example, demand for cement is dependent upon the demand for houses. The inputs or commodities demanded for further production have derived demand.

The demand for raw materials, machines, etc. do not fulfill any direct consumption need of the buyer but they are needed for the production of goods having direct demand. Therefore, they fall in the category of derived demand. If demand for final product increases, the derived demand for related product also increases. If demand for the former falls, the demand for the latter also decreases.

On the other hand, when demand for a particular product is independent of the demand for other products, such a demand is called autonomous demand. The demand for consumer goods is autonomous. It is the one where a commodity is demanded because it is needed for direct consumption. For example, T.V., furniture, etc.

To distinguish between derived demand and autonomous demand is not an easy job. There is a thin line of demarcation between the two. In fact, mostly demand is derived demand. For example, even the demand for a car by a household is derived from the demand for transport service. Thus, the distinction between the two is rather arbitrary and a matter of degree.

ADVERTISEMENTS:

Derived demand is generally less price elastic that the autonomous demand. In the case of derived demand, the impact of price on demand gets diluted by other components in production whose prices are sticky.

4. Industry and Company Demand:

Industry demand refers to the total demand for the products of a particular industry, that is, the total demand for paper in the country. On the other hand, company demand denotes the demand for the products of a particular company (firm), that is, the demand for paper produced by Bellarpur Paper Mills.

Industry demand covers the demand of all firms producing similar products which are close substitutes to each other irrespective of differences in trade names, such as Close-up, Colgate, Pepsodent, etc.

Industry demand is less price elastic than company demand. However, the structure of the market decides the degree of price-demand relationship of the company demand:

(i) In the case of perfect competition the degree of substitutability being perfect, the company demand for the product tends to be perfectly elastic.

(ii) In monopoly market, there is only one firm and the firm is itself an industry. In such a case, the company demand curve is the same as that of the industry demand curve.

ADVERTISEMENTS:

(iii) In homogeneous oligopoly, business is highly transferable among rivals. The company demand curve remains uncertain because it depends upon what its rivals do. Usually, the sellers charge the same price to stay in the market.

(iv) In differentiated oligopoly, the company demand is less closely related to the industry demand. Sellers try to differentiate their products from each other. Hence, the price competition is lower than the homogeneous oligopoly market.

(v) If there is monopolistic competition, the company demand curve is more price elastic than the industry demand curve.

5. Short-Run Demand and Long-Run Demand:

In the case of perishable commodities such as vegetables, fruit, milk, etc., the change in quantity demanded to a change in price occurs quickly. For such commodities, there is a single demand curve with the usual negative slope. But in the case of durable commodities such as equipment’s, machines, clothes, and others, a change in price will not have its ultimate effect on the quantity demanded until the existing stock of the commodity is adjusted which may take a long time.

A short-run demand curve shows the change in quantity demanded to a change in price, given the existing stock of the durable commodity and the supplies of its substitutes. On the other hand, the long-run demand curve shows the change in quantity demanded to a change in price after all adjustments have been made in the long-run.

According to Joel Dean, “Short-run demand refers to existing demand with its immediate reaction to price changes, income fluctuation, etc., whereas long-run demand is that which will ultimately exist as a result of the changes in pricing, promotion or product improvement, after enough time is allowed to let the market adjust itself to the new situation.”

6. Joint Demand and Composite Demand:

When two or more goods are jointly demanded at the same time to satisfy a single want it is called joint or complementary demand.

Joint demand refers to the relationship between two or more commodities or services when they are demanded together. There is joint demand for cars and petrol, pens and ink, tea and sugar, etc. Jointly demanded goods are complementary.

A rise in the price of one leads to a fall in the demand for the other and vice-versa. For example, a rise in the price of cars will bring a fall in their demand together with the demand for petrol and lower its price, if the supply of petrol remains unchanged.

On the contrary, a fall in the price of cars, as a result of a fall in the cost of production of cars, will increase their demand, and therefore increase the demand for petrol and raise its price, if available supplies of petrol are unchanged. A commodity is said to have composite demand when it can be put to several alternative uses.

This is not only peculiar to commodities like leather, steel, coal, paper, etc., but also to factors of production like land, labour and capital. For example, coal is demanded by railways, by factories, by households, etc.

There is competition among the different uses of a commodity in composite demand. Hence, each use of the commodity is the rival of the other uses. So it is also called rival demand. Any change in the demand for a commodity by a user will affect the supply of the other users which will change their prices.

An Individual’s Demand Schedule and Curve:

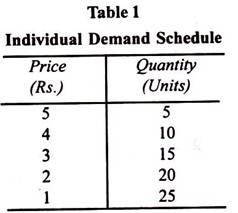

An individual consumer’s demand refers to the quantities of a commodity demanded by him at various prices, other things remaining equal (y, pr and t). An individual’s demand for commodity is shown on the demand schedule and on the demand curve. A demand schedule is a list of prices and quantities and its graphic representation is a demand curve.

The demand schedule reveals that when the price is Rs 5, the quantity demanded is 5 units. If the price happens to be Rs 4, the quantity demanded is 10 units, and ultimately the price being Re.1, 25 units are demanded. In Figure 1. DD1 is the demand curve drawn on the basis of the above demand schedule.

The dotted points P,Q,R,S and T show the various price-quantity combinations. Marshall Call them “demand points”. The first combination is represented by the first dot and the remaining price-quantity combinations move to the right towards D1.

The Market Demand Schedule and Curve:

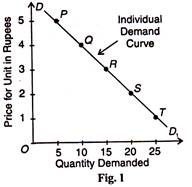

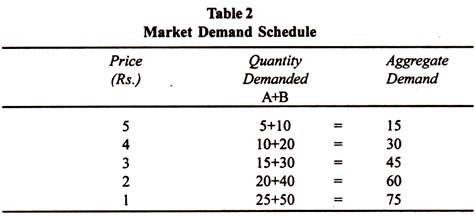

In a market, there is not one consumer but many consumers of a commodity. The market demand of a commodity is depicted on a demand schedule and a demand curve. They show the sum total of various quantities demanded by all the individuals at various prices. Suppose there are two individuals A and B in a market who purchase the commodity. The demand schedule for the commodity is depicted in Table 2.

The Table represents the market demand of orange at various prices. It is arrived at by adding the demand of consumers A and B.

When the price is very high, Rs 5 per unit, the market demand for orange is 15 units. As the price falls, the demand increases. When the price is the lowest, Re. 1 per unit, the market demand is 75 units.

From Table 2 we draw the market demand curve in Figure 2. DM is the market demand curve which is the horizontal summation of the two individual demand curves DA + DB. The market demand for a commodity depends on all factors that determine an individual’s demand.

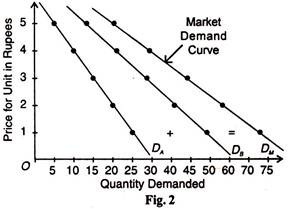

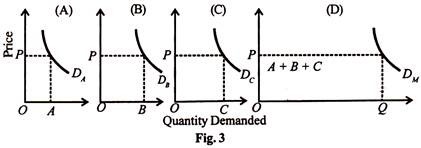

But a better way of drawing a market demand curve is to add together sideways (lateral summation) of all the individual demand curves. In this case, the different quantities demanded by consumers at one price are represented on each individual demand curve and then a lateral summation is done, as shown in Figure 3.

Suppose there are three individuals A, B and C in a market who buy OA, OB and OC quantities of the commodity at the price OP, as shown in Panels (A), (B) and (C) respectively in Figure 3. In the market, OQ quantity will be bought which is made up by adding together the quantities OA, OB and OC. The market demand curve, DM is obtained by the lateral summation of the individual demand curves DA, DB and DC in panel (D).

Determinants of Demand:

The demand for the product is mainly the attitude of consumers towards the product. The attitude of consumers gives rise to actions in buying different products at different prices. The demand for a product is determined by different factors. The main demand determinants are price, income, price of related goods and advertising. Therefore, demand is a multivariate relationship, i.e., it is determined by many factors simultaneously.

(A) Determinants of Individual Demand:

Let us discuss the variables which influence the individual demand.

1. Price of the Commodity:

This is the basic factor influencing the demand. There is a close relationship between the quantity demanded and the price of the product. Normally a larger quantity is demanded at a lower price that at a higher price. There is inverse relationship between the price and quantity demanded. This is called the law of demand.

2. Income of the Consumer:

The income of the consumer is another important variable which influences demand. The ability to buy a commodity depends upon the income of the consumer. When the income of the consumers increases, they buy more and when income falls they buy less. A rich consumer demands more and more goods because his purchasing power is high.

3. Tastes and Preferences:

The demand for a product depends upon tastes and preferences of the consumers. If the consumers develop taste for a commodity they buy whatever may be the price. A favourable change in consumer preference will cause the demand to increase. Likewise an unfavourable change in consumer preferences will cause the demand to decrease.

4. Prices of Related Goods:

The related goods are generally substitutes and complementary goods. The demand for a product is also influenced by the prices of substitutes and complements. When a want can be satisfied by’ alternative similar goods they are called substitutes, such as coffee and tea. Whenever the price of one good and the demand for another are inversely related then the goods are said to be complementary, such as car and petrol.

5. Advertisement and Sales Propaganda:

In modern times, the preferences of consumers can be altered by advertisement and sales propaganda. Advertisement helps in increasing demand by informing the potential consumers about the availability of the product, by showing the superiority of the product, and by influencing consumer choice against the rival products. The demand for products like detergents and cosmetics is mainly caused by advertisement.

6. Consumer’s Expectation:

A consumer’s expectation about the future changes in price and income may also affect his demand. If a consumer expects a rise in prices he may buy large quantities of that particular commodity. Similarly, if he expects its prices to fall in future, he will tend to buy less at present. Similarly, expectation of rising income may induce him to increase his current consumption.

(B) Determinants of Market Demand:

Market demand for a product refers to the total demand of all the buyers taken together. How much quantity the consumers in general would buy at a given period of time constitutes the total market demand for the product.

The following factors affect the market demand pattern of a commodity:

1. Price of the Product:

The law of demand states that if other things remain the same when price falls, demand increases and vice-versa.

2. Standard of Living and Spending Habits:

When people are accustomed to high standard of living their spending on comforts and luxuries also increase, that automatically increase the demand.

3. Distribution of Income Pattern:

If the distribution pattern of income is fair and equal the market demand for essential items tends to be greater.

4. The Scale of Preferences:

The market demand for a product is also affected by the scale of preference of buyers. If there is a shift in consumers’ preference from x to y, the demand for tends to increase.

5. The Growth of Population:

The growth of population is also another important factor that affects the market demand. With the increase in population, people naturally demand more goods for their survival.

6. Social Customs and Ceremonies:

Social customs and ceremonies are usually celebrated collectively. They involve extra expenditure on certain items and thereby increase the demand.

7. Future Expectation:

People are not sure about their future, because future is uncertain. If the consumers expect a rise in prices of products, they buy more at present and preserve the same for the future, thereby the market demand would be affected.

8. Tax Rate:

The tax rate also affects the demand. High tax rate would generally mean a low demand for the goods. At certain times the government restricts the consumption of a commodity and use the tax as a weapon. A highly taxed commodity will have a lower demand.

9. Inventions and Innovations:

Inventions and innovations introduce new goods in the market. The consumers will have a strong tendency to purchase the new product. The preference over the new goods adversely affects the demand for the existing goods in the market.

10. Weather Conditions:

Seasonal factors also affect the demand. The demand for certain items purely depends on climatic and weather conditions. For example, the growing demand for cold drinks during the summer season and the demand for sweaters during the winter season.

11. Availability of Credit:

The purchasing power is influenced by the availability of credit. If there is availability of cheap credit, the consumers try to spend more on consumer durables thereby the demand for certain products increase.

12. Pattern of Saving:

Demand is also influenced by the pattern of saving. If people begin to save more, their demand will decrease. It means the disposable income will be less to purchase the goods and services. On the contrary, if saving is less their demand will increase.

13. Demonstration Effect:

Demonstration effect helps to increase human wants. In underdeveloped countries, there is a desire in the minds of the people to imitate other people for conspicuous consumption and that is why they are not able to save. This change in the saving habits of the people is due to “contact effect”. The demonstration effect has a positive effect on the demand for comforts and luxury goods.

14. Circulation of Money:

An expansion or a contraction in the quantity of money will affect demand. When more money circulates among the people, more of a thing is demanded by the people because they have more purchasing power, and vice versa.