From the logic of weak ordering (along with the additional hypothesis) and the theory of direct consistency test based upon it.

Prof. Hicks proceeds to deduce all major propositions of the theory of consumer’s demand.

Hicks first derives theory of demand for a single commodity, that is, for the behavior of a consumer confronted with a market in which the price of no more than one good is liable to change.

The primary task in a theory of demand is to derive the law of demand, that is, “the principle that the demand curve for a commodity is downward sloping”. As in indifference curve approach the technique adopted by Hicks in Revision of Demand Theory to derive the law of demand is that of dividing the effect of a price change into two parts: income effect and substitution effect.

ADVERTISEMENTS:

In the present work, the substitution effect is deduced by Hicks from the consistency theory while the income effect, according to him, is based upon empirical evidence. He points out that there is a good deal of empirical evidence about the effects of ‘pure’ changes in income.

“It follows that in strictness the law of demand is a hybrid; it has one leg resting on theory and the other on observation. But, in this particular instance, the double support happens to be quite exceptionally strong. Let us now consider how the law of demand is derived by dividing the effects of a price change into substitution effect and income effect. The real task is to separate out the substitution effect.

The substitution effect can be separated by means of two methods:

(1) The method of the compensating variation, and

ADVERTISEMENTS:

(2) The method of the cost difference.

How the substitution effect is separated from the income effect by these two methods and how the law of demand is derived is explained below.

Deriving Law of Demand by the Method of Compensating Variation:

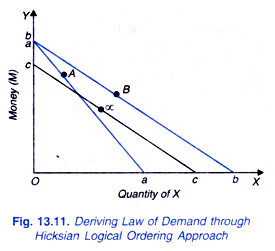

Let us consider the demand for a commodity X which is measured on the X-axis in Fig. 13.11. As before the composite commodity M (i.e., money) is measured on the Y-axis. Given a certain price of the good and income of the consumer, the opportunity line (i.e., price income line) aa is drawn. Now suppose that in this initial price-income situation the consumer chooses the combination A on aa.

ADVERTISEMENTS:

Suppose that the price of good X falls, money income remaining unchanged. As a result, the opportunity line will be bb starting from the same point on the vertical axis as the line aa but will be lying outside aa. The consumer will now choose a position on bb in this new situation. It follows from the consistency theory that so long as some amount of X is consumed any position on line bb must be preferred to A.

In other works, whether the chosen position B on bb lies to the left of or to the right of or exactly above A, it will be preferred to A. This is because A lies within the triangle bob. But, as Hicks says, “this is all we learn from consistency theory when it is applied to these two positions. It is perfectly consistent for there to be a rise, or fall, or no change in the consumption of X between A and B”.

Now the question is where the position B on bb will lie, that is, whether it will lie to the right of A, or to the left of A or exactly above it. The position B lying to the right of A means that the demanded of good X rises as a result of fall in its price, and the position B lying to the left of A means that the amount demanded of good X falls with the fall in its price, and further the position B lying exactly vertically above A means the amount demanded of the good X remains the same with the fall in price.

Thus, the question is whether the amount demanded of good X rises or falls or remains unchanged with a fall in its price. The answer to this question, as a whole, cannot be deduced from the consistency theory.Asexplained above, it is perfectly consistent for there to be a rise or a fall or no change in the amount demanded of a good as a result of the fall in its price.

However, if the fall in price of good X is accompanied by an appropriate reduction in consumer’s income, then it can be shown from the consistency theory that the amount demanded of good X must rise or remain the same; it cannot fall. When the income of the consumer is reduced by an appropriate amount along with a fall in price of X, the remaining effect of the change in price on the demand of the good will be due to the relative fall in price of good X.

The effect on the demand for a commodity due to only the relative change in its price is called substitution effect. It follows, therefore, that it can be shown from the consistency theory that due to substitution effect of the fall in price of good X the consumption of X must rise or remain the same; it cannot diminish. The rest of the effect of the change in price is the income effect. In which direction the income effect of the fall in price works cannot be proved with the aid of consistency theory. Our knowledge about income effect is based upon observation.

It follows from above that in order to show the influence of substitution effect on the demand for a commodity we have to construct an intermediate position and making suitable reduction in income along with a fall in price of X.

The movement from A on aa to B on bb as a result of the change in price represents the price effect. In order to separate out the substitution effect, income is reduced by compensating variation, that is, income is reduced by such an amount that gain in the real income accruing to the consumer due to the fall in price of good X is wiped out.

ADVERTISEMENTS:

In other words, income of the consumer is reduced by so much amount that in the intermediate position a he chooses at the new lower price but with lower income is indifferent to the position A. “On this interpretation, the substitution effect measures the effect of the change in relative prices, with real income constant’, the income effect measures the effect of the changes in real income.”

If the intermediate position can be obtained by the method of compensation variation, it is easy to show from the consistency theory that in what direction the substitution effect works. As the price of good X is the same in the intermediate position as indicated by the line bb, the price opportunity line cc on which the intermediate position a lies must be parallel to bb. Since the consumer is indifferent between the positions A and α, the opportunity line cc must intersect the line aa.

This is because if cc were to lie wholly outside aa, α would be shown to be preferred to A; and if it were to lie wholly inside aa, A would be shown to be preferred to a. Similarly, if A and α are to be indifferent, both A and a cannot lie to the left or to the right of the cross of the lines on which they lie. Further, if the two positions A and a lie within the cross, or one at the cross and the other within the cross, inconsistency of choice will be involved.

Thus, the only alternatives left are:

ADVERTISEMENTS:

(i) Both positions A and a lie outside the cross.

(ii) From position A and a, one lies at the cross and the other outside the cross.

(iii) Both positions A and a lie at the cross.

The above three are the only possible cases if the A and a are to be indifferent and if the consumer’s choice is to be consistent. In any of these cases it should be noted that either the consumption of X increases or remains the same. It, therefore, follows that if the fall in the price of good X is accompanied by the reduction in income by the compensating variation, the quantity demanded of good X will increase or at least will remain the same. In other words, as a result of substitution effect the quantity demanded of good X whose price falls will increase or at least will remain the same.

ADVERTISEMENTS:

In Fig. 13.11 when the income is reduced by the compensating variation, the new opportunity line cc intersects the opportunity line aa below the point A. On the opportunity line cc, the consumer actually chooses the position α which lies outside the cross. (It should be noted that the intermediate position a cannot lie to the left of the cross on the line cc, since in that case the consumer cannot be indifferent between a and A). The movement from A to a represents the substitution effect and results in the increase in quantity demanded of X. This is one part of the price effect.

Let the money income which was taken away from the consumer by the amount of compensating variation be now restored to him. With this rise in income whether the consumer will buy more of good X or less than at a cannot be proved with the aid of consistency theory or any other theoretical rule.

But from the empirical evidence we know that in case of most of the goods, the consumption of a good increases with the rise in income. “There is no theoretical rule which tells us that rise in income must ‘tend to increase’ the consumption of X but it is safe to conclude from the empirical evidence that it will do so in most cases, that the cases in which it does not do so may fairly be regarded as exceptional.”

Thus, when consumer is at position a and his income is raised by the amount which was previously withdrawn from him (so that he is once again on the opportunity line bb), he will further increase his consumption of good X. In other words, he will buy more of good X than at position a when his income is increased so that he faces the opportunity line bb. That is why the chosen position B on bb lies to the right of a, showing that the consumption of good X increases between a and B. The movement from a to B represents the income effect.

It follows from above that quantity demanded of a good increases with the fall in its price due to substitution effect and income effect. Thus the basic law of demand, namely, that the demand curve is downward sloping has been proved.

Deriving Law of Demands by Cost- Differences Method:

ADVERTISEMENTS:

While the method of compensating variation is perfectly valid and is very useful in dividing the price change into two parts which have ‘special economic significance’, the alternative method of cost difference is more convenient for the purpose of deriving the law of demand. The cost-difference method which was evolved by Samuelson has also been adopted by Hicks.

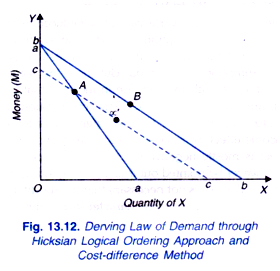

The cost-difference method and how the law of demand is established with its aid is illustrated in the Fig. 13.12. As before, the composite commodity, money (M) is measured on the Y-axis and the commodity X whose demand is under consideration is measured on the X-axis, aa is the initial opportunity line and point A on it represents the actually selected position.

Now, suppose the price of good X falls, money income of the consumer remaining the same. As a result of this, the opportunity line now takes up the position bb. Under the cost-difference method, the fall in price of good X is accompanied by the reduction in income of the consumer by such an amount which will leave the Quantity of X “consumer just able to purchase the original combination A. In other words, income is reduced by the difference between the cost consumption of X (that is, in position A) at the old price and at the new price. In terms of Fig. 13.12 this means that income is reduced by such an amount that the intermediate opportunity line cc passes through point A. (In Fig. 13.12 the cost difference = ca or cb).

Now the question is where the intermediate position on the opportunity line cc will lie. The two opportunity lines are aa and cc and one of the two positions now lies at the cross of the two lines, so that the possible cases in which consistency tests have to be applied are few. The intermediate position α’ lies to the right of A and (ii) that a’ and A coincide. In case (i) the consumption of X will increase between A and α’ and in case (ii) the consumption of X will remain the same. The movement from A to α’ represents the substitution effect. It follows from above that as a result of substitution effect, the consumption of X must rise or remain the same; it cannot diminish.

Now, if the income taken away from the consumer is given back to him, he will further increase the consumption of X, if the increase in income is known to raise the consumption of X. Thus the point B will lie to right of α’ showing the increase in consumption of X between α’ and B as a result of the income effect.

ADVERTISEMENTS:

It is clear from above that the choice of an intermediate position through the cost-difference method provides an alternative method of dividing the effect of a price change into income effect and substitution effect. Although the intermediate positions in the two methods are not exactly the same, the parts into which they break up the price effect have substantially similar properties.

By whichever method we divide the price effect it remains true that as a result of the substitution effect the consumption of good whose price falls must rise or remain the same; it cannot diminish. This conclusion about the direction in which the substitution effect operates follows from the consistency theory.

Hicks admits the superiority of cost-difference method over the compensating variation method for the purpose of deriving the law of demand. Commenting on them, he remarks, “The difference between the two methods is solely a matter of the magnitude of the rise in income, which leads to the income effect; and on this point the method of cost difference has a distinct advantage. For while the magnitude of the compensating variation is quite a problem… the magnitude of the cost-difference raises no problem at all.