Let us make an in-depth study of the relationship between time and demand in economics.

Time also exerts some influence on demand. Most consumers are to some extent creatures of habit.

So, if we are not accustomed to buying a commodity a price fall may not have much effect on our spending behaviour. If the price fall continues for a long time people may gradually consider the merit of the commodity in relation to that of other goods.

Take, for example, the case of ball-point pens. Some years ago one ball-point pen used to cost double that of a fountain pen. Today, two ordinary ball pens cost about Rs. 10. This is roughly the price of an ordinary ink pen. When the price of ball-point pens fell initially most people in India did not even consider it as an alternative to ink pen. The price has, however, remained low for long. As a result the demand for ball-point pens has grown. But this change has occurred gradually over a number of years.

ADVERTISEMENTS:

There is another reason why demand responds very slowly to price changes. Most people are not always as price conscious as they should be. They fail to realize that changes in relative prices have occurred. They realize it only if such a change lasts for long. People realize this only when they have to live with inflation of the present day type.

During inflation all prices do not rise or fall at the same time; they do not rise or fall at the same rate either. So changes in relative prices do occur. For example, in India, bus fare has increased by 50-70% or so during the last ten years. But the prices of land, houses or food articles have increased several times.

Those who have realized it have invested their surplus money in real estate, instead of putting it in commercial banks as saving or fixed deposits. In general, a fall in the relative price of a commodity leads to an increase in the quantity demanded of the same and vice versa (provided people can realize that such a change has occurred or is occurring).

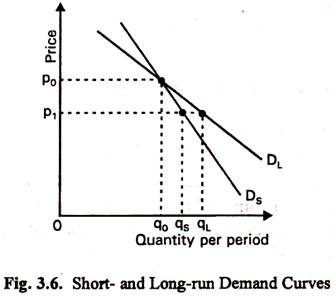

Thus, in general, the longer the period under consideration, the greater the response of the quantity demanded of a commodity to a change in its own price or a change in its price in relation to the prices of related goods. This point is illustrated in Fig. 3.6. Here we see two demand curves for a hypothetical commodity, say Z. The short-run demand curve is Ds and the long-run demand curve is D1.

In the short run a fall in price from p0 to p1 leads to an increase in quantity demanded from q0 to q1 In the long-run the same price change leads to a much longer change in quantity (from q0 to q1). In the long-run people get sufficient time to adjust their habits and find out close substitute items. As a result they can make full adjustment to price change. So their response to price change is noteworthy.