This article will help you to learn about the difference between full-employment budget surplus and budget surplus.

Difference between Full-Employment Budget Surplus and Budget Surplus

Budget Surplus:

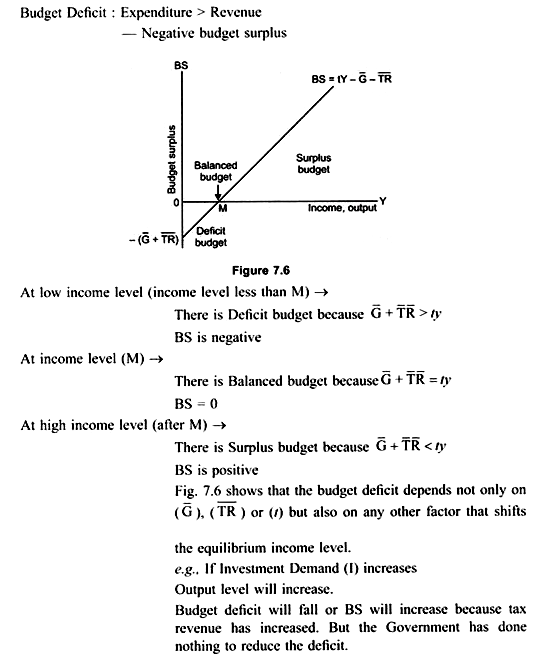

Budget Surplus (BS) is the excess of the Government’s revenue (taxes) over its total expenditure, which consists of purchase of goods and services and transfer payments.

BS is a function of level of income, for a given, government expenditure, transfer payments and income tax.

Effect of Fiscal policy, that is, ∆G and ∆TA on the Budget Surplus:

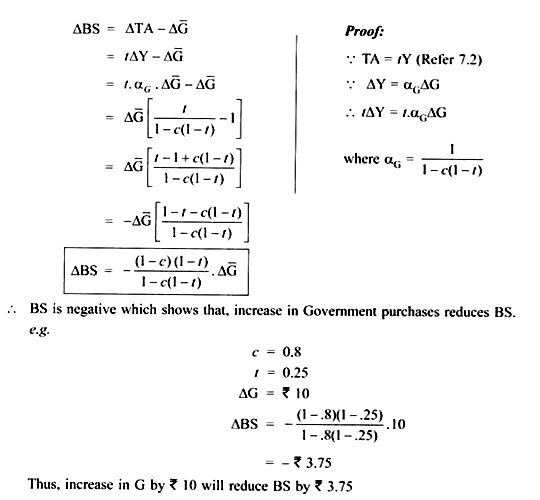

(i) If Government purchases increase:

BS will be reduce. This is because, due to increase in Government purchases by ∆G, income will increase. This increase in income ∆Y = αG . ∆G Since, a fraction of this increase in income is collected in the form of taxes, therefore, tax revenue will increase by tαG . ∆G.

(ii) When tax rate increases

ADVERTISEMENTS:

This will lead to increase in the BS

Thus, increase in taxes with government expenditure constant will not lead to decrease in BS

(iii) When ∆G = ∆TA (Balanced budget multiplier)

ADVERTISEMENTS:

BS will be unchanged.

Limitation of Budget Surplus:

If budget surplus is used to measure the effects of Fiscal Policy, then the BS can change if there is a change in the Autonomous private spending.

Full-Employment Budget Surplus:

Cyclically adjusted surplus (or deficit)/

high-employment surplus/

standardized budget surplus/

structural surplus.

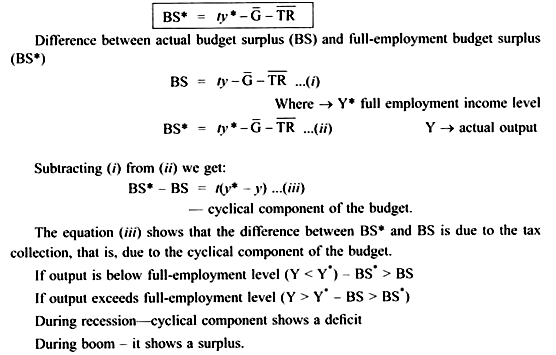

It is the BS at full-employment level of income. The full-employment budget surplus (BS*) shows the budget-surplus (BS) at the full-employment level of income (Y*)

According to Dornbusch and Fischer:

ADVERTISEMENTS:

1. Full-employment level means an unemployment rate of about 5 to 5.5%. This rate will differ depending on the assumptions made about the economy at full employment.

2. High-employment surplus is not a perfect measure of fiscal policy because fiscal policy involves a number of variables like the tax rate, transfers and Government purchases.