This article will help you to learn about the difference between short period and long period.

Difference between Short Period and Long Period

We often draw a distinction between the short run and the long run. We do not define the short run with respect to any calendar period (one year, one month, one week, etc.). Rather the short run is the period during which some factors remain fixed and others are variable. But, in the long run all factors—including the size of the plant or factory—are variable.

This is why in the long run—that is, in the period long enough for the influence of all factors to be felt—all costs are variable. Moreover, in the long run, a firm can choose its best plant sizes and its lowest-envelope curve. What is or is not a ‘long’ period or ‘short’ period depends upon circumstances such as the introduction of a revolutionary technical change in the method and the costs of manufacture.

The short run refers to a period of time short enough so that the amounts of at least one or more of the factors of production used by the firm cannot be changed. In a barber shop it takes little time, perhaps a week, to install another chair and find another barber to increase the production of haircuts. For a barber shop, therefore, the short run may be as little as a week.

ADVERTISEMENTS:

It may also take only a week or two to lease some space and get started in many small businesses. TISCO (or PAL), on the other hand, needs considerably more time to add another rolling mill or more blast furnaces and hire a workforce to run them. The short run for TISCO may be months or even years. Obviously, the actual length of time of the short run will depend on the kind of firm and industry we are talking about.

By the long run we mean a period of time long enough so that the amounts of all factors of production used by the firm can be changed. For a barber shop the long run may be any time period longer than a week or two. For TISCO it may be any time period longer than two or three years. The difference between the behaviour of the firm’s costs in the short run and the long run is very significant in the analysis of the firm.

If economic profit exists in a perfectly competitive industry, we can expect additional resources to flow into that industry. It is important to keep in mind the fact that the existence of economic profit (P—AC) implies that all resources are being compensated according to their opportunity cost, and some (perhaps the entrepreneurial factor) have an excess return.

This above normal return serves as incentive for new firms to enter the industry or existing ones to expand production. (In this type of market all firms produce a homogeneous product, there is completely free mobility of resources, and there is perfect knowledge — i.e., no industry secrets).

ADVERTISEMENTS:

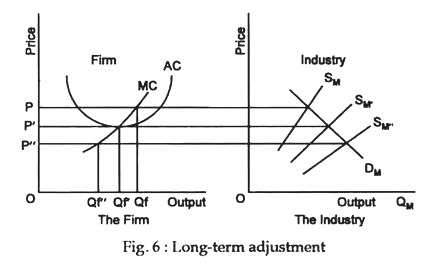

The adjustment process is illustrated in Figure 6. The right hand portion of that figure shows an initial set of market conditions (DM and SM) that determine the price P. At this price the firm, depicted in the left hand part of the figure, earns a positive economic profit by producing of units.

This profit acts as the stimulus for new resources to enter the industry which shifts the market supply curve to SM. This, in its turn, lowers the market price to P. The firm, faced with this lower price, produces Qf’ units and has a zero economic profit. We can generalise to say that if the market price P is greater than the zero profit price P, new resources will enter the industry until a zero-profit equilibrium is reached.

If too many new resources flow into this industry such that the market supply curve shifts to SM‘ or if SM” represents an initial condition, we can expect some firms to leave the industry. With market supply at SM“, the price will be P” at which firms are faced with economic losses. In such a case, some firms will be forced out of the industry until the market supply curve shifts to S’M and zero-profit long-run equilibrium price is established at P’.

ADVERTISEMENTS:

Although we have discussed the long-run equilibrium of a competitive industry in terms of new firms entering or existing firms leaving the industry, the adjustments may also take place, in part or in whole, by expansion or contraction of existing firms. When this happens, the average cost curve for the firm may not be static as is assumed in the short run.

Regardless of the adjustment process the result is that, for the long-run perfectly competitive industry, P=MR=SRAC=SRMC=LRAC=LRMC. Thus, for perfectly competitive industries, firms will be led by natural economic forces to produce the optimum level of production in plants of the optimum size.

Conclusion:

Barring certain types of market failure, we can now reach three important conclusions about perfect competition:

(i) First, since products are produced at the lowest possible cost (minimum average cost), we can say that perfect competition leads to technologically efficient production.

(ii) Second, excess returns (economic profit) will be eliminated as price is driven to the level equal to minimum average cost.

(iii) Finally, the perfectly competitive market leads to an efficient allocation of resources because price will also equal marginal costs. These results have had, and are likely to continue to have, important influence on a wide variety of public policies aimed at promoting competition.