This article will help you to learn about the difference between tariff and quotas.

Difference between Tariff and Quotas (With Diagram)

Governments of different countries have to intervene in the area of international trade for both economic and non-economic reasons.

Such intervention goes by the name ‘protection’. Protection means government policy of according protection to the domestic industries against foreign competition.

There are various instruments or methods of protection which aim at raising exports or reducing imports. Here we are concerned with those methods which restrict import.

ADVERTISEMENTS:

There are various methods of protection. Most important methods of protection are tariff and quotas. A tariff is a tax on imports. It is normally imposed by the government on the imports of a particular commodity. On the other hand, quota is a quantity limit. It restricts imports of commodities physically. It specifies the maximum amount that can be imported during a given time period.

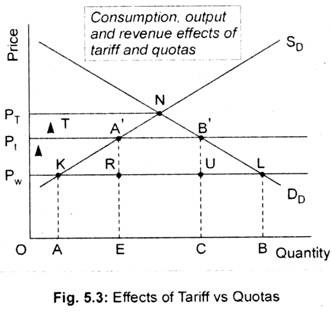

We can now make a comparison between tariff and quotas in terms of partial equilibrium or demand-supply approach. Fig. 5.3 illustrates the effect of tariff. The domestic supply curve is represented by SD while the demand curve is given by Dd.

These two curves intersect each other at point N. And the price that is determined is known as the autarkic price or pre-trade price (PT). If trade is free, the international price that would prevail is assumed to be PW. At the international price PW, a country produces OA but consumes OB and the country, therefore, imports AB.

1. Effects of Tariff:

Now, if a country imposes a tariff = t per unit on its import, immediately the price of the product will rise to Pt by the amount of tariff. This increase in price has the following effects. Since the tariff raises the price, consumers buy less. Now the consumption declines from OB to OC. This is called consumption effect of tariff. The second effect is the output effect or protective effect. Tariff raises domestic output from OA to OE, this is because higher price induces producers to produce more. The third effect is the import-reducing effect.

ADVERTISEMENTS:

As tariff is imposed or tariff rate is increased, import declines from AB to EC. The fourth effect is the revenue effect earned by the government. The government revenue is the volume of import multiplied by the tariff i.e., the area A’B’UR. It is a transfer from consumers to government. However, if a tariff equal to T were imposed price would have increased to PT. Consequently, imports would drop to zero. Such a situation is called prohibitive tariff.

2. Effects of Quota:

Quotas are similar to tariff. In fact, they can be represented by the same diagram. The main difference is that quotas restrict quantity while tariff works through prices. Thus, quota is a quantitative limit through imports.

If an import quota of EC (Fig. 5.3) amount is imposed then price would rise to Pt because the total supply (domestic output plus imports) equals total demand at that price. As a result of this quota, domestic production, consumption, and imports would be the same as those of the tariffs.

ADVERTISEMENTS:

Thus, the output effect, consumption effect and import restrictive effect of tariff and quotas are exactly the same. The only difference is the area of revenue. We have already seen that tariff raises revenue for the government while quotas generate no government revenue.

All the benefits of quotas go to the producers and to the lucky importers who manage to get the scarce and valuable import permits. In such a situation, quotas differ from tariff. However, if import licences are auctioned off to the importers then government would earn revenue from the auction. Under these circumstances, quotas and tariff are equivalent.

3. Advantages of Quotas:

(i) Foreign Exchange Implication:

The main advantage of a quota is that it keeps the volume of imports unchanged even when demand for imported articles increases. It is because quotas make the completely elastic (horizontal) import supply curve completely inelastic (vertical). But a tariff permits imports to rise when demand increases, particularly if the demand for imports becomes inelastic. Thus, quotas lead to greater foreign exchange saving compared to tariff (which may even lead to an increase in foreign exchange spending because imports may rise even after tariff).

(ii) Precise Outcome:

Another advantage of quotas is that its outcome is more certain and precise, while the outcome of tariff is uncertain and unclear. This is so because the volume of imports remains unchanged if a quota is imposed. But this is not so in case of a tariff.

(iii) Flexibility:

Finally, Ingo Walter argues that “quotas tend to be more flexible, more easily imposed, and more easily removed instruments of commercial policy than tariffs. Tariffs are often regarded as relatively permanent measures and rapidly built powerful vested interests which make them all the more difficult to remove.”

4. Disadvantages of Quotas:

(i) Corruption:

Quotas generate no revenue for the government. However, if the government auctions the right to import under a quota to the highest bidder only then quotas are similar to tariff. But quotas lead to corruption. Usually, officials charged with the allocation of import licences are likely to be exposed to bribery. Under this situation, tariff is preferable to quotas.

(ii) Monopoly Profit:

Secondly, quotas creates a monopoly profit for those with import licences. This means that consumer surplus is converted into monopoly profits. Thus, quotas are likely to lead to a greater loss of consumer welfare. If a tariff is imposed domestic price will be equal to import price plus tariff.

(iii) Monopoly Growth:

Thirdly, allied to this disadvantage of quotas another drawback is that quotas are much more restrictive in effect as it restricts competition. Thus, quotas may ultimately lead to concentration of monopoly power among the importers and exporters.

(iv) Distortion in Trade:

Finally, quotas have the tendency to distort international trade much more than tariffs since its effects are more vigorous and arbitrary.

ADVERTISEMENTS:

Thus, we will have to make a choice between tariff and quotas. A tariff is usually considered a less objectionable method of trade restriction than an equivalent quotas. A tariff permits imports to increase when demand increases and, consequently, the government is able to raise more revenue. In contrast, quotas are less obvious and more likely to remain in force for an indefinite period. For all these reasons, a tariff, while objectionable, is still preferable to quotas. WTO condemns quotas.