The following points highlight the four major economic effects of taxation. The effects are: 1. A redistribution of income 2. A raising of prices 3. A reduction of incentive 4. A reduction of enterprise.

Effect # 1. A Redistribution of Income:

This effect is felt most in developing countries. A proportional tax will not affect the distribution of income, but both progressive and regressive taxes will cause a change in income distribution. With progressive taxes, the post-tax distribution of income is more equal than the pre-tax distribution, whereas with regressive taxes the post- tax distribution is more unequal than the pre-tax distribution.

Effect # 2. A Raising of Prices:

The imposition of or increasing the rates of indirect taxes will cause the prices of the taxed goods to rise. Increases in indirect taxes, therefore, have implications for a government’s policy in relation to inflation. Such increases can have adverse effects on the rate of inflation not only directly, via increased prices, but also indirectly, via increased wage demands made by workers due to rise in their cost of living.

Effect # 3. A Reduction of Incentive:

It may be argued that increased taxation can have a disincentive effect on workers. They may feel that it is not worth taking on extra responsibility or putting in more hours because so much of their extra income would be taken in taxation.

ADVERTISEMENTS:

However, it may be argued that workers may want to maintain their present standard of living or may have heavy financial commitments so that if income tax was increased, they would work for longer hours to make up for the income lost in tax.

There are, therefore, conflicting views on the effect of incentives. It would seem logical that there must be a discentive effect at some point but it is not clear at what level of taxation that point is reached.

Effect # 4. A Reduction of Enterprise:

Entrepreneurs undertake investment in anticipation of increasing profit. Investment projects may be risky so the expectation of large profits is an important incentive. If, however, profits are heavily taxed, the entrepreneurs may feel that it is not worth taking such risks and so they will be far more cautious in their attitudes. Such caution may lead to reduced progress and efficiency with a consequent deterioration in the ability of domestic producers to complete with foreign rivals. Incidence of Taxation

The incidence of a tax is on the person who actually pays it. In the case of indirect taxes, however, the incidence may be on the buyer or the seller or it may be divided in any proportion between them depending on the elasticity of demand for the commodity on which the tax has been imposed. The effect of a commodity tax is to create a gap between demand price and supply price.

ADVERTISEMENTS:

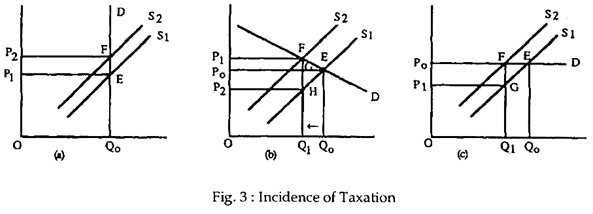

If demand is fairly inelastic, the tax will fall mainly on the buyer. If, however, the demand for the commodity is perfectly elastic the seller will have to reduce his price by the full amount of tax, so that its incidence will be entirely on the seller. If demand is fairly elastic, the tax will fall more heavily on the seller. Compare the diagrams in Fig. 3.

Here S1 is the supply curve, OP1 the price before the tax is imposed and S2 the supply curve and OP2 the price after tax imposition. In case a, where demand is perfectly inelastic, the tax falls entirely on the buyer; in case b, where demand is moderately elastic, the tax falls partly on the buyer and partly on the seller, but rather more heavily on the seller, in case c, where demand is perfectly elastic, the tax falls entirely on the seller.

In Fig. 3, the original equilibrium price is Rs.5 while the quantity is 2,000 units. If, following the imposition of the tax, price rises by the full amount of the tax from Rs.5 to Rs.6 per unit, then the quantity demanded would fall and there would be excess of supply over demand.

ADVERTISEMENTS:

This would cause the price to fall until it reaches the equilibrium point, where the new supply curve cuts the demand curve. In the diagram, the new equilibrium price is Rs.5.80. This is the price that will be paid by customers while, when the tax of Re.1 per unit is deducted, the producers will receive a unit price of Rs.4.80.

Thus, in this example, the tax has the effect of raising the price paid by consumers by Re.0.80 and lowering the price received by producers by Re.0.20. So, in general, “as long as the demand curve slopes downwards and the supply curve slopes upwards, the imposition of a tax will raise the price paid by consumers and lower the price received by the producers in both cases by an amount less than the amount of the tax.”