In this article we will discuss about how money creation helps in financing development.

The government normally finances its expenditure through receipts from taxes, both direct and indirect. When government expenditure increases and it finds it difficult to raise more resources from taxation, it resorts to borrowing from the public or printing money to finance its expenditure. Increase in rates of income and other tax not only adversely affects incentives to work more, save and invest more but also promotes tax evasion. Further, as Laffer curve concept shows, increase in rate of a tax beyond a point causes revenue from taxes to decline.

Thus, there are limits to increasing revenue from taxes to finance the increased expenditure of the government. As a result, when government finds it difficult to raise adequate resources to finance its increased development expenditure fully through normal taxes, it faces a resource constraint resulting in budget deficit which in recent years is often called fiscal deficit. Thus government budget constraint refers to the limit placed on the government expenditure by the extent it can raise resources through taxation, borrowing from the market (i.e., through sale of its bonds) and using printed money. The government has to make a choice between the magnitude of borrowing from the market and the magnitude of using printed money to finance its budget deficit.

The general form of government budget equation is –

ADVERTISEMENTS:

G = T + ∆B + ∆M … (1)

where G stands for government expenditure (including subsidies and interest payments on past debt), T is tax revenue, ∆B is the new borrowing from the market (through sale of bonds or securities) and ∆M is the new printed money issued to finance government expenditure. According to the budget constraint equation (1), government expenditure in a year can be financed by tax revenue (T), new borrowing (∆B) by the government from the market (both within and outside the country) through sale of its bonds, and by creating new high powered money (∆M). The government budget constraint can be rewritten as-

G – T = ∆B + ∆M … (2)

Where, G – T represents fiscal deficit that must be financed by new borrowing (∆B) by the government through sale of bonds and through creation of new high powered money (∆M).

ADVERTISEMENTS:

The fiscal deficit can be financed by the government either by printing money by the government or by borrowing through sale of bonds to the public (which includes banks, insurance companies, mutual funds and other financial institutions). Thus, it is through sale of bonds that the government borrows from the market which adds to the government debt. The government has to pay interest annually on its debt and has also to pay back the principal sum borrowed at the maturity of bonds or securities.

Besides, borrowing by the government leads to the rise in interest rate which crowds out private investment. On the other hand, if government finances its budget deficit by using printed money, it can lead to inflation. Thus, due to budget constraint the government has to make a difficult choice between borrowing from the market and using printed money to finance its budget deficit. Financing through the use of printed money is also called money financing.

Before explaining how creation of new money can be used for financing investment or budget deficit by the government to accelerate economic growth, we will explain broadly the Keynesian and quantity theory approaches to prior savings, investment and inflation. Both these approaches suggest that subject to some limits created money can be used to finance development.

Prior Savings, Inflation and Investment:

The prior savings approach is based on classical economics which emphasizes that prior saving determines investment. They were against any deliberate policy of inflationary financing through creation of new money to finance government development expenditure as they thought inflation had bad consequences for the economy.

ADVERTISEMENTS:

It may be noted here that there is a quantity theory approach which explains the role of government in increasing its development expenditure by generating inflation through creating new money for financing its increased expenditure. In this quantity theory approach, through inflation, government succeeds in raising forced saving.

Thus, financing development expenditure through printing of new money and resultant inflation has been called financing through inflation tax. It is noteworthy that according to the quantity theory approach, the financing of development expenditure through creating new money inevitably leads to inflation which enables the government to obtain the required forced saving or inflation tax.

The Keynesian Approach:

The Keynesian approach also departs from ‘prior savings approach’ to financing of investment expenditure and considers that it is investment that determines saving and not the other way round. According to this it happens in two ways. When resources are unemployed due to deficiency of aggregate demand, the increase in investment by the government through creating new money will cause fuller utilisation of resources and thereby increase in output and income.

At higher levels of income, given the propensity to save, more will be saved. Thus, as opposed to prior savings approach, it is increase in investment that has generated larger savings for its funding. The second way in which the Keynesian approach explains the higher investment causing larger savings is that when there prevails full employment increase in investment causes income redistribution from the wage-earning workers with lower propensity to save to the profit earners with higher propensity to save as a result of inflation and thus cause larger saving.

Therefore in the Keynesian model, investment is not constrained by prior savings but by inflation rate acceptable to the workers. Consumption is reduced through cut in real wages as a result of income redistribution through the medium of inflation. Thus, Thirlwall writes, “At full employment, inflation is the inevitable result of the Keynesian approach to development. In contrast to classical and neoclassical theory, Keynesian theory specifies independent saving and investment functions and allows price changes in response to excess demand in the goods market to raise saving by redistributing income. Inflation is the means by which resources are redistributed between consumption and investment. In Keynesian model, investment is not constrained by saving but the inflation rate willing to be tolerated by wage earners who have had their real wages cut.”

As in the developing countries in the normal times there does not exist underutilization of productive capacity in the consumer goods industries due to deficiency of aggregate demand, the situation is similar to that of full employment of the Keynesian theory. In such a situation, both the Keynesian and quantity theory approaches to financing of development involve inflation. It is through the means of inflation that resources are released from consumption to be used for investment. In this respect both these approaches differ from the prior savings approach which involves no inflation.

Explaining the importance of difference of the Keynesian and quantity theory approach from prior savings approach, Thirlwall writes, “In the prior savings approach the resources released for investment come from voluntary and involuntary savings and no inflation is involved. In the Keynesian and quantity theory approaches the resources are partly released through the process of inflation by income redistribution from classes with low propensity to save to those with higher propensities to save, and by inflation as a ‘tax’ on money.”

How New Money is Created:

ADVERTISEMENTS:

Before explaining how creation of new money is used by government for financing investment for promoting development of the economy, it will be useful to explain how new money is created. When government’s investment expenditure increases and it cannot be fully financed by tax revenue, the government’s budget becomes deficit. This budget deficit or what is these days called fiscal deficit has to be somehow financed.

There are two possible links between budget deficit and growth of money supply. First, the budgetary deficit that is financed by borrowing by the government from the market reduces the supply of lendable resources for the private sector in the short run; this causes market interest rate to rise. Higher market interest leads to decline in private investment. In this way, budget deficit financed by borrowing crowds out private investment. If the Central Bank is following the policy of targeting interest rate, then to prevent the interest rate from rising it will increase the money supply. To do so the Central Bank will buy a part of the securities or bonds issued by the government. This is generally called accommodating the deficit.

Note that in some countries, such as the USA, the Central Bank, i.e., Federal Reserve enjoys independence from the government. Therefore, it can decide independently whether to buy a part of the bonds or securities floated by the government. The Central Bank prints money notes against these government securities or bonds held by it as an asset. In this way, budget deficit leads to the growth of money and possibly causes inflation. The second way by which the budget deficit leads to growth in money stock is the deliberate policy of the government of financing the budget deficit through the use of printing high powered money by virtue of its sovereign right of creating money.

In this method, the government itself may print new money or in some countries by the Central Bank as in India where the Central Bank is a nationalised bank without having any independence from the government. In India the Central government when it wants to finance the budget deficit through printed money just issues its securities or bonds and the Reserve Bank prints new money notes and credits them in government account which the government can use for spending to finance the deficit.

ADVERTISEMENTS:

Thus when Central Bank on its own buys government bonds or securities to accommodate the budget deficit so that its crowding-out effect on private investment does not take place, there is growth of money stock in the economy. Alternatively, when the government follows a deliberate policy of printing high powered money to finance its fiscal deficit it leads to growth in money supply in the economy. When money stock grows at a greater rate than the increase in output, it may lead to inflation. Thus risk of inflation acts as a constraint on printing money to finance budget deficit.

Financing of Development through Money Creation:

The government can finance its deficit and meet its increased expenditure by printing high powered money. The revenue raised through printing of money is also called seignior age. When government finances its budget deficit through printing money, money supply in the economy increases. There are two views regarding the effect of increase in money supply on inflation.

According to the Keynesian view, when money supply is increased in times of depression when both productive capacity and labour are lying idle or unemployed due to deficiency of aggregate demand, price level is not likely to rise much and the effect of increase in money supply is to raise output or income. The increase in real income, given the rate of taxation, will bring about increase in revenue from taxation, which will tend to reduce budget deficit in the short run. However, if the economy is operating at or near full employment, printing money to finance the deficit will cause inflation.

Printing money to raise revenue for financing the budget deficit that has arisen as a result of increase in government’s investment expenditure without being matched by extra taxation to raise revenue causes inflation which is like an inflation tax. This is because the government is able to get resources through printed money which causes inflation and reduces the real value of the holdings of money by the public.

ADVERTISEMENTS:

Let us first explain the Keynesian model with a fixed price level when the economy is in recession due to demand deficiency and a lot of unemployment of resources prevails. The tax function can be written as –

T = t(Y)

Where, t is the rate of tax and Y is real income and T is the total tax revenue. If G is government expenditure, then budget deficit (BD) is given by-

BD = G- t(Y)…. (1)

If G – t(Y) = 0, budget deficit will be zero and therefore the budget will be a balanced one.

If G – t (Y)> 0, there will be budget deficit.

ADVERTISEMENTS:

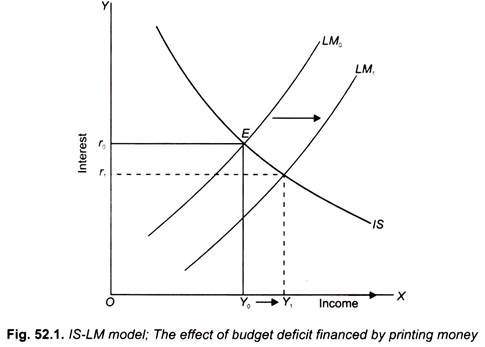

If the government finances its deficit through money creation, then the short-run macro equilibrium in simple IS – LM model is shown in Fig. 52.1 where IS and LM curves of the economy intersect at Point E and determine equilibrium income Y0 and equilibrium interest rate r0.

Suppose in this equilibrium the government has a budget deficit so that G – t(Y) > 0. Further, government finances this budget deficit through creating high powered money. As a result, money supply in the economy increases and LM curve shifts to the right to the new position LM1. With this, as will be seen from the figure, level of equilibrium income increases to Y1 and rate of interest falls to r1. Since we are assuming an economy with a depression, when unutilised productive capacity exists due to deficiency of aggregate demand, increase in demand brought about by expansion in money supply will not cause any rise in price level.

In the above model of an economy representing the period of recession price level remains unchanged as more money is created to finance budget deficit. In an important contribution, Fischer and Easterly explain the condition for non-inflationary printing of money.

They write, “The amount of revenue that the government can expect to obtain from the printing of money is determined by the demand for base or high powered money in the economy, the real rate of growth of the economy and the elasticity of demand for real balances with respect to inflation and income.” Further, assuming income elasticity of demand equal to unity and currency to GNP ratio equal to 0.13, they conclude that “for every one percentage point that GNP increases, the government can obtain 0.13 percentage points of GNP in revenue through the printing of money that just meets the increased demand for real balances. With an annual economic growth rate of 6.5 per cent of GNP the government should be able to obtain nearly 0.9 per cent of GNP for financing the budget deficit through the non-inflationary printing of money, increasing the high powered money stock at an annual rate of 6.5 per cent”. If rate of growth of money exceeds this given a stable demand function for currency, inflation will be the result.

Printed Money and the Inflation Tax:

ADVERTISEMENTS:

It follows from above that if the economy is operating at full-employment level of GNP or if growth rate of money due to persistent budget deficits over time is in excess of rate of growth of GNP, inflation will come about. It has been pointed out by some economists that inflationary financing through the creation of high powered money is an alternative to explicit taxation. Though in most of the industrialised economies (including the United States) the creation of high-powered money or inflationary financing of budget deficits is only a minor source of revenue, in other countries (including India), the creation of high powered money has been a significant source of raising revenue to finance government expenditure.

Before March 1997, in India the creation of new money to finance the budget deficit was called ‘deficit financing,’ which has been a significant source of revenue for the Central Government in the sixties, seventies and eighties of the last century. Though, as explained above, it is not entirely correct that financing government expenditure through creation of high powered money necessarily leads to inflation, in the quantity theory approach every creation of high-powered money has been called inflationary.

Why the creation of high powered money that causes inflation is called inflation tax and is an alternative to explicit taxation as a source of financing government expenditure? When government uses printed money to finance its deficit year after year, it uses it to pay for the goods and services it buys. Thus in this process the government gets the resources to buy goods and services and as a result, money balances with the people increase, a part of which they will save and the rest they will spend on goods and services. However, due to inflation real value of money balances held by the people decreases.

That is, with their given money balances, people can buy fewer goods and services due to inflation. Thus, when the government finances its budget deficit through creation of new high powered money and in the process causes inflation, the purchasing power of old money balances held by the public falls. Hence, inflation caused by creation of new money is like a tax on holding money.

Though, apparently people do not pay inflation tax, but since their old money balances can buy fewer goods and services due to inflation, they in fact bear the burden of inflation in terms of decline in their purchasing power. To conclude in the words of Dornbusch and Fischer, “Inflation acts just like a tax because people are forced to spend less than their income and pay the difference to the government. The government thus can spend more resources and the public less just as if the government had raised taxes to finance extra spending. When the government finances its deficit by issuing new printed money which the public adds to its holdings of nominal balances to maintain the real value of money balances constant, we say the government is financing itself through the inflation tax.”

We can even estimate the revenue rose through inflation tax as –

ADVERTISEMENTS:

Inflation tax revenue = Inflation tax X real monetary base

Note that monetary base is the amount of the high powered money. It may be mentioned that in the 1980s the inflation rate due to excess creation of high powered money in the Latin American countries was very high and therefore the revenue raised through inflation tax was very high. In fact, some Latin American countries experienced hyperinflation. Thus, during 1983-1988 average annual inflation rate in Argentina was 359 per cent, in Bolivia 1,797 per cent, Brazil 341 per cent, Mexico 87 per cent and Peru 382 per cent.

Inflation Tax Revenue:

In the Latin American countries, the governments raised large revenues due to high inflation rates caused by creation of large amount of printed money due to budget deficits year after year. From the above equation, it is evident that inflation tax revenue of the government depends on the inflation revenue obtained by the government will also be zero. As the inflation rate rises, the revenue obtained by the government through inflation tax increases.

But as the inflation rate rises, the people tend to reduce their holdings of the real money balances as the purchasing power of money holdings declines. As a result, as the inflation rate rises the public holds less currency and banks hold less excess reserves with them. With this the real money balances with the public and banks decline so much that inflation tax revenue collected by the government declines after a point.

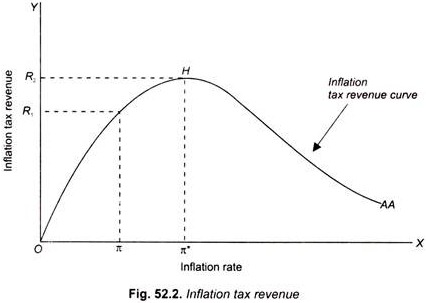

The change in the tax revenue received by the government as the inflation rate rises is shown by AA curve in Fig. 52.2. Initially, in the economy there is no budget deficit and therefore no printing of money, inflation rate is zero, inflation tax revenue received by the government is also zero and the economy’s situation lies at the point of origin. Now suppose the government reduces taxes, keeping its expenditure constant, budget deficit emerges which is financed by printing high powered money and suppose the resulting inflation rate is π at which the government collects tax revenue equal to OR1.But as the inflation rate further rises as a result of increase in printed money, the tax revenue collected increases until inflation rate π* is reached.

ADVERTISEMENTS:

At inflation rate π* brought about by a certain amount of increase in printed money, the tax revenue collected by the government is OR2. Beyond this growth in printed money and rise in inflation rate greater than π*, tax revenue collected declines because real money balances with the public and banks decline, as explained above. Thus OR2 is the maximum of tax revenue raised by the government through inflation tax and the corresponding inflation rate is π*.

In the developed industrialised countries where the real money base is relatively small, the government collects a small amount of inflation tax revenue. For example, in the United States where money base is only about 6 per cent of GDP the government raises revenue through inflation tax equal to only 0.3 per cent of GDP corresponding to 5 per cent rate of inflation. However, some developing countries such as Argentina, Brazil, Mexico, and Peru have collected 3.5 per cent to 5.2 per cent of their GDP as inflation tax revenue. But for this they had to pay a heavy price in terms of a very high rate of inflation.

Dornbusch, Fischer and Startz comment, “In countries in which the banking system is less developed and in which people hold large amounts of currency, the government obtains more revenue from inflation and is more likely to give much weight to the revenue aspects of inflation in setting policy. Under conditions of high inflation in which the conventional tax system breaks down, the inflation tax revenue may be the government’s last resort to keep paying its bills. But whenever the inflation tax is used on a large scale, inflation invariably becomes extreme.”

Evaluation of Inflation Tax Revenue:

The above view of inflation tax revenue is based on the assumption that every increase in printed money causes inflation. In our view this is not correct. When the economy is working much below its full production capacity due to deficiency of aggregate demand as it happens at times of recession or depression, then more printed money can be created by the government to finance its projects. The increase in demand resulting from this will help in fuller utilisation of idle production capacity and will also generate employment for unemployed labour.

This will not lead to inflation as output of goods and services will increase in this case to meet the increased demand. This case was analyzed by J.M. Keynes who advocated for the adoption of budget deficit to overcome depression and financing it through printed money without causing inflation. It is only when there exists full employment in the economy that financing government expenditure through printed money causes inflation.

Similarly, in developing countries like India where growth in GDP is taking place annually and also the economy is getting increasingly monetised, the demand for money is increasing. Therefore, since GDP is growing and the economy is getting monetised, the reasonable increase in money supply to meet the increase in demand for it will not generate inflation.

Besides, in developing countries like India a huge amount of natural and human resources are lying unutilised or underutilised, investment expenditure by creating a reasonable amount of new money to finance it for utilising these underutilised resources will lead to the increase in productive capacity of the economy and is therefore less likely to cause much inflation.

Further, if newly created money is used to invest in quick-yielding projects such as small irrigation works, anti-soil erosion projects, the danger of inflation will not be much there. Besides, if under the development plans, efforts are made to help the farmers to increase agricultural production, especially of food-grains, by providing them with HYV seeds, fertilizers and irrigation facilities in time and in adequate quantities, then the supply of agricultural goods will increase to match the reasonable amount of newly created money. To the extent we are able to increase agricultural production we can safely use created money without generating much inflation.

Since the income elasticity of demand for food-grains is very high in the developing countries like India, the incomes generated by government investment expenditure are mostly directed to the purchase of food-grains. Therefore, if we increase the production of food-grains and other essential consumer goods, a reasonable increase in created money will not cause much inflation.

It is worth repeating that danger of increase in newly created money generating inflationary pressures depends on the quality of government expenditure. If newly created money is used for productive investment expenditure, or what is called capital expenditure, it will lead to the expansion in productive capacity which will increase the supply of output of goods in the future which will bring down the inflation rate in the long run. However, if newly created money is used to finance subsidies or current revenue deficit of the government, it is likely to cause inflation.

It follows from above that within limits, the increase in created money can play a useful role in financing productive investment expenditure of the government. It is inflationary only if safe limit is crossed. Thus, to a reasonable extent depending on the quality of public expenditure, new money can be used to finance development in developing countries. However, in India, prior to 1991 the excessive use of newly printed money which was then called deficit financing for financing of various Five Year Plans, was made and therefore it led to high inflation rate in the Indian economy.

Therefore, under the Stabilisation and Structural Adjust Reforms since 1991, IMF and World Bank laid the condition of upper limit of fiscal deficit of 3% of GDP. It is up to this 3% of GDP the government could borrow from the market and use creation of new money. However, this could not be achieved in actual practice due to global financial crisis of 2008 and therefore new road map for achieving 3 per cent target has been planned.

In our above analysis of quantity theory approach to development, by ensuring forced saving’ of trotting inflation as a tax inflation has been treated as beneficial. The present author does not agree with this viewpoint of inflation as beneficial. In fact it is now widely recognised that, far from encouraging savings and generating higher rate of economic growth, inflation slows down the rate of capital accumulation. There are several reasons responsible for this.

First, when due to rapid inflation value of money is declining; people will not like to keep money with them and will, therefore, be eager to spend it before its value goes down heavily. This raises their consumption demand and therefore lowers their saving. Besides, people find that the rapid inflation will erode the real value of their savings. This discourages them to save. Thus, inflation or rapid rise in prices serves as a disincentive to save. Further, as a consequence of the rise in prices, a relatively greater part of the income of the people is spent on consumption to maintain their level of living and therefore little is left to be saved. Thus, not only does inflation reduce the willingness to save, it also slashes their ability to save.

Secondly, inflation or rising prices lead to unproductive form of investment in gold, jewellery, real estate, construction of houses etc. These unproductive forms of wealth do not add to the productive capacity of the economy and are quite useless from the viewpoint of economic growth. Thus, inflation may lead to more investment but much of this is of unproductive type. In this way, economic surplus is frittered away in unproductive investment.

Thirdly, a highly undesirable consequence of inflation, especially in developing countries, is that it accentuates the problem of poverty in these countries. It is often said inflation is enemy number one of the poor people. Due to rising prices poor people are not able to meet their basic needs and maintain minimum subsistence level of consumption. Thus inflation sends many people to live below the poverty line with the result that the number of people living below the poverty line increases.

Besides, due to inflation, consumption of a large number of poor people is reduced much below what may be regarded as productive consumption, that is, essential consumption required to maintain health, and productive efficiency. In India, rapid inflation in recent years is as much responsible for the mounting number of people below the poverty line as the lack of employment opportunities.

Fourthly, inflation adversely affects balance of payments and thereby hampers economic growth, especially in the developing countries. When prices of domestic goods rise due to inflation, they cannot compete abroad and as a consequence exports of a country are discouraged. On the other hand, when domestic prices rise relatively to prices of foreign goods, imports of foreign goods increase. Thus, falling exports and rising imports create disequilibrium in the balance of payments which may, in the long run, result in a foreign exchange crisis. The shortage of foreign exchange prevents the country to import even essential materials and capital goods needed for industrial growth of the economy. The Indian experience during 1988-92 when foreign exchange reserves declined to abysmally low level and created an economic crisis in the country, shows the validity of this argument.

There is no agreement among economists whether or not moderate or mild inflation encourages saving and therefore ensures higher rate of capital accumulation and economic growth. However, there is complete unanimity that a very rapid inflation or what is often called hyperinflation discourages saving and hinders economic growth. However, barring the special case of hyperinflation, whether or not saving is encouraged by inflation depends on whether there exists wage lag.

While there is sufficient evidence in the industrialised countries such as the U.S.A., Great Britain, France etc., about the existence of wage lag in the period before World War II, in the period after this there is no solid evidence of it. In the present, wages quickly catch up with the rising prices. Indeed, there is evidence in some developed countries that the share of profits in national income has declined and that of wages has gone up during the post-World War II period. Therefore, “To the extent that rate of long-run economic growth depends on the rate of capital accumulation, a major basis for the conclusion that inflation promotes rapid economic growth is undermined given that wages no longer lag during inflation as they apparently did in time of past.”

However, it may be noted that in the developing countries like India labour is mostly unorganised and trade unions of labour are not strong and further there is a lack of information which causes wages lagging behind prices during periods of inflation. This itself will cause greater proportion of national income going to profits and other business incomes which should ensure higher saving rate.

However, in India, businessmen are prone to make unproductive investment in speculative activities, gold, jewellery, real estate and palatial houses whose prices rise rapidly during periods of inflation. Such kind of investment is not only counter-productive and anti-growth but is repugnant to social justice as it further accentuates inequalities in the distribution of income and wealth.

It follows from above that rising prices as a goal of monetary policy are full of disastrous consequences for the economy and the people and therefore cannot be recommended as a desirable goal for the economic policy. Rising prices often get out of hand and hyperinflation might set in which will shake the confidence of the people in the monetary and fiscal system of the country.