Multinational corporations are those large firms which are incorporated in one country but which own, control or manage production and distribution facilities in several countries. Therefore, these multinational corporations are also known as transnational corporations. They transact business in a large number of countries and often operate in diversified business activities. The movements of private foreign capital take place through the medium of these multinational corporations. Thus multinational corporations are important source of foreign direct investment (FDI).

Besides, it is through multinational corporations that modern high technology is transferred to the developing countries. The important question about multinational corporations is why they exist. The multinational corporations exist because they are highly efficient. Their efficiencies in production and distribution of goods and services arise from internalising certain activities rather than contracting them out to other firms. Managing a firm involves which production and distribution activities it will perform itself and which activities it will contract out to other firms and individuals.

In addition to this basic issue, a big firm may decide to set up and operate business units in other countries to benefit from advantages of location. For examples, it has been found that giant American and European firms set up production units to explore and refine oil in Middle East countries because oil is found there. Similarly, to take advantages of lower labour costs, and not strict environmental standards, multinational corporate firms set up production units in developing countries.

Alternative Methods of Foreign Investment by Multinational Companies:

In order to increase their profitability many giant firms find it necessary to go in for horizontal and vertical integration. For this purpose, they find it profitable to set up their production or distribution units outside their home country. The firms that sell abroad the products produced in the home country or the products produced abroad to sell in the home country must decide how to manage and control their assets in other countries. In this regard, there are three methods of foreign investment by multinational firms among which they have to choose which mode of control over their assets they adopt.

ADVERTISEMENTS:

There are four main modes of foreign investment:

1. Agreement with Local Firms for Sale of MNCs Products:

A multinational firm can enter into an agreement with local firms for exporting the product produced by it in the home country to them for sale in their countries. In this case, a multinational firm allows the foreign firms to sell its product in the foreign markets and control all aspects of sale operations.

2. Setting Up of Subsidiaries:

ADVERTISEMENTS:

The second mode for investment abroad by a multinational firm is to set up a wholly owned subsidiary to operate in the foreign country. In this case, a multinational firm has complete control over its business operations ranging from the production of its product or service to its sale to the ultimate use or consumers. A subsidiary of a multinational corporation in a particular country is set up under the Companies Act of that country. Such subsidiary firm benefits from the managerial skills, financial resources, and international reputation of their parent company. However, it enjoys some independence from the parent company.

3. Branches of Multinational Corporation:

Instead of establishing its subsidiaries, multinational corporations can set up their branches in other countries. Being branches they are not legally independent business unit but are linked with their parent company.

4. Foreign Collaboration or Joint Ventures:

ADVERTISEMENTS:

The multinational corporations set up joint ventures with foreign firms to either produce its product jointly with local companies of foreign countries for sale of the product in the foreign markets. A multinational firm may set up its business operation in collaboration with foreign local firms to obtain raw materials not available in the home country. More often, to reduce its overall production costs multinational companies set up joint ventures with local foreign firms to manufacture inputs or sub-components in foreign markets to produce the final product in the home country.

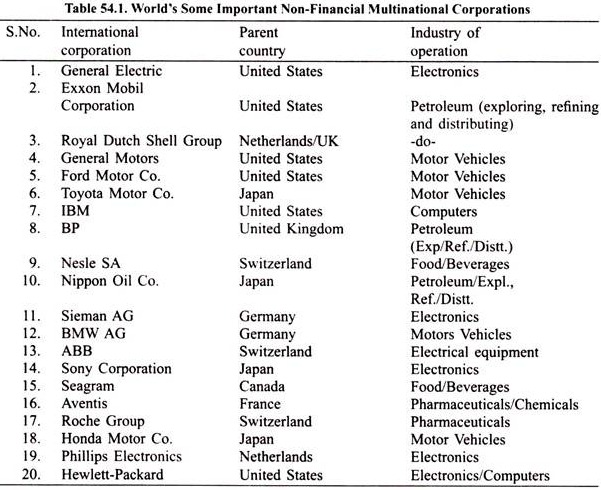

Some of the world’s largest multinational corporations are given below:

Role of Multinational Corporations in the India Economy:

Prior to 1991, multinational companies did not play much role in the Indian economy. In the pre-reform period the Indian economy was dominated by public enterprises. To prevent concentration of economic power the Industrial Policy 1956 did not allow the private firms to grow in size beyond a point. By definition multinational companies are quite big and operate in several countries. While multinational companies played a significant role in the promotion of growth and trade in South- East Asian countries they did not play much role in the Indian economy where import-substitution development strategy was followed.

Since 1991 with the adoption of industrial policy of liberalisation and privatisation role of private foreign capital has been recognised as important for rapid growth of the Indian economy. Since source of bulk of foreign capital and investment are multinational corporations, they have been allowed to operate in the Indian economy subject to some regulations.

The following are the important reasons for this change in policy towards multinational companies in the post-reform period:

1. Promotion of Foreign Investment:

In the recent years, external assistance to developing countries has been declining. This is because the donor developed countries have not been willing to part with a larger proportion of their GDP as assistance to developing countries. MNCs can bridge the gap between the requirements of foreign capital for increasing foreign investment in India. The liberalised foreign investment pursued since 1991 allows MNCs to make investment in India subject to different ceilings fixed for different industries or projects.

ADVERTISEMENTS:

However, in some industries 100 per cent export-oriented units (EOUs) can be set up. It may be noted, like domestic investment, foreign investment has also a multiplier effect on income and employment in a country. For example, the effect of Suzuki firm’s investment in Maruti Udyog manufacturing cars is not confined to income and employment for the workers and employees of Maruti Udyog but goes beyond that. Many workers are employed in dealer firms who sell Maruti cars. Moreover, many intermediate goods are supplied by Indian suppliers to Maruti Udyog and for this many workers are employed by them to manufacture various parts and components used in Maruti cars. Thus their incomes also go up by investment by a Japanese multinational in Maruti Udyog Limited in India.

2. Non-Debt Creating Capital Inflows:

In pre-reform period in India when foreign direct investment by MNCs was discouraged, we relied heavily on external commercial borrowing (ECB) which was of debt-creating capital inflows. This raised the burden of external debt and debt service payments reached the alarming figure of 35 per cent of our current account receipts. This created doubts about our ability to fulfill our debt obligations and there was a flight of capital from India and this resulted in balance of payments crisis in 1991.

ADVERTISEMENTS:

As direct foreign investment by multinational corporations represents non-debt creating capital inflows we can avoid the liability of debt-servicing payments. Moreover, the advantage of investment by MNCs lies in the fact that servicing of non-debt capital begins only when the MNC firm reaches the stage of making profits to repatriate. Thus, MNCs can play an important role in reducing stress and strains on India’s balance of payments (BOP).

3. Technology Transfer:

Another important role of multinational corporations is that they transfer high sophisticated technology to developing countries which are essential for raising productivity of working class and enable them to start new productive ventures requiring high technology. Whenever, multinational firms set up their subsidiary production units or joint-venture units, they not only import new equipment and machinery embodying new technology but also skills and technical know-how to use the new equipment and machinery.

As a result, the Indian workers and engineers come to know of new superior technology and the way to use it. In India, the corporate sector spends only few resources on Research and Development (R&D). It is the giant multinational corporate firms (MNCs) which spend a lot on the development of new technologies which can greatly benefit the developing countries by transferring the new technology developed by them. Therefore, MNCs can play an important role in the technological up-gradation of the Indian economy.

ADVERTISEMENTS:

4. Promotion of Exports:

With extensive links all over the world and producing products efficiently and therefore with lower costs multinationals can play a significant role in promoting exports of a country in which they invest. For example, the rapid expansion in China’s exports in recent years is due to the large investment made by multinationals in various fields of Chinese industry. Historically in India, multinationals made large investment in plantations whose products they exported. In recent years, Japanese automobile company Suzuki made a large investment in Maruti Udyog with a joint collaboration with Government of India. Maruti cars are not only being sold in the Indian domestic market but are exported in a large number to the foreign countries.

As a matter of fact, until recently, when giving permission to a multinational firm for investment in India, government granted the permission subject to the condition that the concerned multinational company would export the product so as-to earn foreign exchange for India. However, in case of Pepsi, a famous cold drink multinational company, while for getting a product license in 1961 to produce Pepsi Cola in India it agreed to export a certain proportion of its product, but later it expressed its inability to do so. Instead, it ultimately agreed to export things other than what it produced such as tea.

5. Investment in Infrastructure:

With a large command over financial resources and their superior ability to raise resources both globally and inside India it is said that multinational corporations could invest in infrastructure such as power projects, modernisation of airports and ports, telecommunication. The investment in infrastructure will give a boost to industrial growth and help in creating income and employment in the Indian economy. The external economies generated by investment in infrastructure by MNCs will therefore crowd in investment by the indigenous private sector and will therefore stimulate economic growth.

In view of above, even Common Minimum Programme of the UPA government provided that foreign direct investment (FDI) would be encouraged and actively sought, especially in areas of (a) infrastructure, (b) high technology, (c) exports and (d) where domestic assets and employment are created on a significant scale.

A Critique of Multinational Corporations:

ADVERTISEMENTS:

In recent years, foreign direct investment through multinational corporations has vastly increased in India and other developing countries. This vast increase in investment by multinational corporations in recent years is prompted by factors – (1) the liberalisation of industrial policy giving greater role to the private sector, (2) opening up of the economy and liberalisation of foreign trade and capital inflows. In this economic environment multinational corporations which are in search for global profits are induced to make investment in developing countries.

As explained above, foreign direct investment by multinational firms bring many benefits to the recipient countries but there are many potential dangers and disadvantages from the viewpoint of economic growth and employment generation. Therefore, role of multinational corporations in India and other developing countries has been criticised on several grounds.

Following are the criticisms, leveled against multinational corporations:

1. Capturing Markets:

First, it is alleged that multinational corporations invest their capital and locate their manufacturing units on their own or in collaboration with local firms in order to sell their products and capture the domestic markets of the countries where they invest and operate. With their vast resources and competitive strength, they can weed out their competitive firms. For example, in India if corporate multinational firms are allowed to sell or produce the products presently produced by small and medium enterprises, the latter would not be able to compete and therefore would be thrown out of business. This will lead to reduction in employment opportunities in the country.

2. Use of Capital-Intensive Techniques:

ADVERTISEMENTS:

It has been seen that increasing capital intensity in modern manufacturing sector is responsible for slow growth of employment opportunities in India’s industrial sector. These capital-intensive techniques may be imported by large domestic firms but presently they are being increasingly used by multinational corporations which bring their technology when they invest in India. Emphasising this factor, Thirlwall rightly writes, “In this case the technology may be inappropriate not because there is not a spectrum of technology or inappropriate selection is made but because the technology available is circumscribed by the global profit maximising motives of multinational companies investing in the less-developed country concerned.”

3. Encouragement to Inessential Consumption:

The investment by multinational companies leads to overall increase in investment in India but it is alleged that they encourage conspicuous consumption in the economy. These companies cater to the wants of the already well-to-do people. For example, in India very expensive cars (such as City Honda, Hyundai’s Accent, Mercedes, Audi, etc.), the air conditioners, costly laptops, washing machines, expensive fridges, and Plasma TVs are being produced/sold by multinational companies. Such goods are quite inappropriate for a poor country like India. Besides, their consumption has a demonstration effect on the consumption of others. This tends to raise the propensity to consume and adversely affects the increase in savings of the country.

4. Import of Obsolete Technology:

Another criticism of MNCs is based on the ground that they import obsolete machines and technology. Some of the imported technologies are inappropriate to the conditions of Indian economy. It is alleged that India has been made a dumping ground for obsolete technology. Moreover, the multinational corporations do not undertake Research and Development (R&D) in India to promote local technologies suited to the Indian factor-endowment conditions. Instead, they concentrate R&D activity at their headquarters.

5. Setting up Environment-Polluting Industries:

ADVERTISEMENTS:

It has been found that investment by multinational corporations in developing countries such as India is usually made for capturing domestic markets rather than for export promotion. Moreover, in order to evade strict environment control measures in their home countries they set up polluting industrial units in India. A classic example of this is a highly polluting chemical plant set up in Bhopal resulting in gas tragedy when thousands of people were either killed or made handicapped due to severe ailments. With the tightening of environmental measures in such countries, there is a tendency among the MNCs to locate the polluting industries in the poor countries, where environmental legislation is non-existent or is not properly implemented, as exemplified in the Bhopal gas tragedy.

6. Volatility in Exchange Rate:

Another major consequence of liberalised foreign investment by multinational corporations is its impact on the foreign exchange rate of the host country. Foreign capital inflows affect the foreign exchange rate of the Indian rupee. A large capital inflow through foreign investment brings about increase in the supply of foreign exchange, say, of US dollars. With demand for foreign exchange being given, increase in supply of foreign exchange will lead to the appreciation of exchange rate of rupee. This appreciation of the Indian rupee will discourage exports and encourage imports causing deficit in balance of trade. For example, in India in the fiscal years 2004-05 and 2005-06, there were large capital inflows by FII (giant financial multinationals) in the Indian economy to take advantage of higher interest rates here and cause further boom in the Indian capital market.

On the other hand, when interest rates rise in the parent countries of these multinationals or rates of return from capital markets go up or when there is loss of confidence in the host country about its capacity to make payments of its debt as happened in case of South-East Asia in the late nineties, there is large outflow of capital by multinational companies resulting in the crisis and huge depreciation of their exchange rate. Thus, capital inflows and outflows by multinationals have been responsible for large volatility of exchange rate.

Then there is the question of repatriation of profits by the multinationals. Though a part of profit is reinvested by the multinational companies in the host country, a large amount of profits is remitted to their own parent countries. This has a potential disadvantage for the developing countries, especially when they are facing foreign exchange problem. Commenting on this Thirlwall writes FDI has the potential disadvantage even when compared with loan finance, that there may be outflow of profits that lasts much longer.

Transfer Pricing and Evasion of Local Taxes:

ADVERTISEMENTS:

Multinational corporations are usually vertically integrated. The production of a commodity by a multinational firm comprises various phases in its production; the components used in the production of a final commodity may be produced in its parent country or in its affiliates in other countries. Transfer pricing refers to the prices a vertically integrated multinational firm charges for its components or parts used for the production of the final commodity, say in India.

These prices of components or parts are not real prices as determined by demand for and supply of them. They are arbitrarily fixed by the companies so that they have to pay less tax in India. They artificially inflate the transfer prices for intermediate products (i.e., components) produced in their parent country or their overseas affiliates so as to show lower profits earned in India. As a result, they succeed in evading corporate income tax.

Conclusion:

We have seen above foreign investment by multinational companies have both advantages and disadvantages. Therefore, they need regulation and should be permitted in selected sectors and also subject to a cap on their investment in particular fields. If objective of economic growth with stability and social justice is to be achieved, there should not be complete open door policy for them.

It is true that multinational corporations take risk in making investment in India, they bring capital and foreign exchange which are non-debt creating, they generally promote technology and can help in raising exports. But they must be regulated so that they serve these goals. They should be allowed to invest in infrastructure, high-technology areas, and in industries whose products they can export and if they help in generating net employment opportunities. We agree with Colman and Nixon who write –

“Transnational corporations cannot be directly blamed for lack of development (or the direction development is taking) within less developed countries. Their prime objective is global profit maximisation and their actions are aimed at achieving that objective, not developing the host less developed country. If the technology and products that they introduce are inappropriate, if their actions exacerbate regional and social inequalities, if they weaken the balance of payments position, in the last resort it is up to the government of less developed country to pursue policies which will eliminate the causes of these problems.”