In this article we will discuss about the strategies of economic development – balanced and unbalanced growth.

A major problem for an LDC relates to the ‘balance’ that needs to be preserved between the different sectors of the economy, viz., agriculture, industry, services, foreign trade, etc. One cannot have agricultural development first and industrial development next.

In fact, the past two centuries development of agriculture and that of industry went hand in hand in the UK and the USA. Contrarily, the erstwhile USSR achieved a very high rate of growth even by neglecting agriculture and putting constant emphasis on heavy industry. However, irrespective of the strategy to be adopted, one cannot neglect agriculture-industry interdependence in any economy.

Let us now consider the labour-surplus economy like India. In such an economy there may occur transfer to labour from the primary to the secondary sector at low wages mainly due to the existence of surplus labour. Suppose, the wage (measured in industrial product) rises when the industrial sector expands relative to agriculture sector.

ADVERTISEMENTS:

This might have occurred if there were inadequate agricultural progress which, in turn, could lead to a rise in agricultural prices with a consequent rise in the wage-rate as measured in industrial product, and, hence, a slowing down of the rate of growth of the industrial sector. When the wage rate rises the amount of profits available for reinvestment in the next stage falls.

So, the absorption of labour which depends on industrial surplus (or wage fund) in the industrial sector declines. In absence of a wage rise, profits available for reinvestment in the industrial sphere would be higher as also the quantity of labour service hired. The point is that, unproductive agriculture may slow down the growth even of a potentially productive industrial sector.

The debate about agriculture versus industry in a part of the debate about balanced vs. unbalanced growth and is still going on unabated. The question that arises is whether an LDC should move forward simultaneously in all directions or whether it should focus attention and concentrate efforts on certain ‘key’ or leading sectors of economy. But the point is there is significant interdependence between among the different sectors of an economy.

Emphasising this interdependence balance growth theory suggests that a country must achieve advances simultaneously over a broad range of activities. An isolated effort is unlikely to bear fruit. This view was shared, among others, by R. Nurkse and P.N. Rosenstein-Rodan.

ADVERTISEMENTS:

Balanced growth theory refers to the minimum size of the investment programme required to start economic development. Or, it may refer to the path of economic development and the pattern of investment necessary to keep the different sectors of the economy in a balanced growth relation with each other.

The earlier version of the theory is to be found in P. N. Resenstein-Rodan’s writings. The central idea here is the need to overcome the smallness of the size of the market created by low per capita income and purchasing power of consumers in the LDCs.

He argues that a single factory, even when it uses more efficient methods of production than the handicraft industry, may fail when set up on its own because of the smallness of the market outlet for its output.

What is needed is the simultaneous setting up of a number of factories producing different consumer goods so that between them they create enough new employment and purchasing power to provide a sufficiently large market for each other.

ADVERTISEMENTS:

The modern version of the theory is nothing short of a attempts to introduce a comprehensive and integrated programme of industrialization, including within its framework, not only the consumers’ goods industries and social overhead investment but also capital goods industries.

The only thing left out there seems to be the agricultural sector. It is argued that in order to launch development successfully, it is necessary not only to enlarge the size of the market and obtain the ‘internal economies’ of large- scale production, but also to obtain the ‘external economies’ which arise from simultaneously setting up industries which are technically interdependent on each other; while these ‘technical complementaries’ do not normally exist between a horizontal group of consumers goods industries at the same stage of production, they are very important between a vertical group of industries at different stages of production; and since these external economies are particularly important in the capital goods industries which supply each other and the consumer goods industries with various inputs in the form of machinery and semi-processed intermediate goods, the capital goods sector should form an integral part of the balanced-growth programme.

This comprehensive version of the theory, therefore, tries to fulfill simultaneously three sets of balanced growth relation:

(a) The horizontal balance between different consumer goods industries determined by the pattern of expansion in consumers ‘demand;

(b) The balance between social overhead investment and the directly productive activities both in the consumer and the capital goods sectors;

(c) The vertical balance between the capital goods industries including the intermediate and the consumer goods industries, determined by the technical complementaries.

Logically, the fact that two industries A and B are complementary does not necessarily mean that they should be expanded simultaneously to reach the maximum possible expansion for both.

These points have been criticised by the opponents who reach exactly the opposite conclusion. For example, A. O. Hirschman, who presented the doctrine of unbalanced growth, has argued that for accelerating the pace of development in an LDC like India, it is advisable that imbalances are created in its economy in a conscious manner.

Uneven development of various sectors often generates pressures or creates conditions for rapid development. The situation in which some industries are more developed than others provides an inducement to grow to the not-so-developed industries. Hirschman has convincingly argued that there exist linkages among different industries — backward and forward.

ADVERTISEMENTS:

These provide a basis for concentrating on certain specific areas of the economy only. These provide a basis for concentrating on certain specific areas of the fronts, as one stage or sector of industry, the country will set up heavy demands for productive resources in the lagging parts.

The major criticism of the balanced growth doctrine is that, it fails to suggest measures that can be taken to overcome the fundamental obstacle to growth, viz., a shortage of productive resources. In fact, in the absence of sufficient resources, especially capital, entrepreneurs and decision makers, the balanced growth approach may not provide a sufficient stimulus to the spontaneous mobilisation of resources or the inducement to invest.

In this context Hirschman attempts to answer the following questions: given a limited amount of investible resources, and series of proposed important projects whose total cost exceeds the available resources, how will one select the projects that will make the greatest contribution of each project?

Prima facie, he distinguishes between two types of investment choices — substitution choices and postponement choices. Substitution choices are those that involve a decision as to whether project A or B should be undertaken (i.e., the two projects are mutually exclusives in this case). Postponement choices are those which involve a decision as to the sequence of projects A and B, i.e., which project should be given top priority and selected first.

ADVERTISEMENTS:

Hirschman’s main concern is with postponement choices and how they are made. He argues that some projects (which induce progress in other sectors) should be given top priority. The basic object to be entrepreneurial talent or business acumen.

In other words, the real scarcity is not the resources themselves but the means and the ability to bring them into play. He points out that “preference should be given to that sequence of projects which maximises induced decision making.”

Hirschman’s argument may be illustrated by considering the relation between social overhead capital (SOC) and directly productive activities (DPA). Where SOC precedes DPA, the strategy goes by the name “development via excess capacity”; where DPA precedes SOC, the strategy may be called ‘development via shortage’. Both sequences create inducement and pressures conducive to growth.

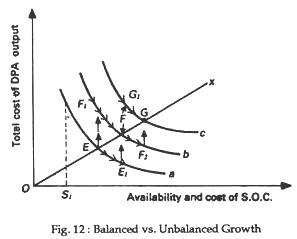

The choice problem is illustrated in Fig.12. The total cost of DPA output is measured on the horizontal axis. The curves a, b, c etc. show the cost of producing a specific full-capacity output of DPA from a fixed amount of investment in DPA as a function of the availability of SOC. Successive curves a, b, c, etc. represent different levels of DPA output from higher and higher level of investment in DPA.

ADVERTISEMENTS:

These curves are convex to the origin because as more and more SOC becomes available, DPA costs will continue to fall. But there is a minimum amount of SOC necessary for any level of DPA output (e.g., OS1 corresponding to curve a) and as SOC increases, its impact on the costs of DPA output becomes less and less.

Suppose, the objective of the economy is to obtain increasing outputs of DPA with the minimum use of resources employed in the DPA and SOC sectors. On each curve, a, b, c the point where the sum of the coordinates is the smallest represents the most desirable combination of the two. The line OX is the locus of all such points, and these represent the most efficient expansion path, or ‘balanced’ growth path, between SOC and DPA.

Now, let us consider a specific situation where ‘optimum’ amounts of SOC and DPA cannot be expanded simultaneously to keep in balance with one another. Now on what criterion is that postponement choice made? One possibility, according to Hirschman, is the sequence EF1 FF2 G where the initial expansionary step is taken by DPA. This sequence is called ‘development via shortages’. Hirschman has argued that preference should be given to that sequence of expansion which maximises ‘induced’ decision making.

Linkages:

Hirschman also developed the concepts of linkages as criteria for ‘induced decision-making’. Linkages refer to interdependencies between activities. He distinguished between ‘backward’ and ‘forward’ linkages. Backward linkages measure the proportion of an activity’s output that is purchased from other sectors.

ADVERTISEMENTS:

For example, the setting up of a steel mill will create demand for coal, iron ore and blast furnace. Forward linkages measure the proportion of an engineering factory is likely to supply nuts and bolts to the railways. So, the input-output relations must be studied first, and those sectors should be selected where the linkages are the thickest.

Hirschman suggests that “within the directly productive sector a useful development strategy would be to encourage those activities with the potentially highest combined linkages, because this will provide the greatest inducement and incentive to other activities to develop.”

However, there is lack of interdependence among sectors in LDCs. Production in the primary sector has very limited backward and forward linkages with other activities. Agriculture’s demand on other sectors is minimal.

In fact, only a small fraction of total agricultural output in LDCs is possessed domestically; most is exported. But, manufacturing activities possess greater linkages and strengthen the cumulative nature of development. This indeed is a powerful reason for industrialisation.