In what follows we shall explain how taxation can be used to mobilise resources for economic development.

Capital formation is an important determinant of economic growth. For accelerating the rate of capital formation, saving and investment rate in the economy has to be stepped up. For this purpose, savings have to be mobilised and channeled into productive investment. Due to the severe limitations of alternative ways of mobilising resources for economic growth such as government borrowing and money financing, the role of taxation in performing this task assumes greater importance.

Fiscal policy, if properly designed, is an efficient and equitable way of mobilising resources for augmenting public investment. Through it not only collective public savings can be raised for financing public investment but also at the same time private savings and investment can be encouraged. In fact, taxation may be the most effective means of increasing the total volume of saving and investment in developing countries where the propensity to consume is normally high. Further, the fiscal policy can be so devised that not only the objective of rapid capital accumulation or growth, but also other objectives of economic policy such as equitable distribution of income and wealth, price stability and promotion of employment opportunities can be achieved.

Taxation is an important instrument of fiscal policy which can be used for mobilising resources for capital formation in the public sector. To raise ratio of savings to national income and thereby raise resources for development, it is necessary that marginal saving rate be kept higher than the average saving rate. By imposition of direct progressive taxes on income and profits and higher rates of indirect taxes such as excise duties and sales tax on luxury goods for which income elasticity of demand is higher, the marginal saving rate can be made higher than the average saving rate.

ADVERTISEMENTS:

This will cause a continuous increase in the saving rate of the economy. An important merit of taxation is that it is not only a good instrument of resource mobilisation for development but it also cuts down demand for consumer goods and thereby helps in checking inflation. Whereas direct taxes on income, profits and wealth reduce the disposable incomes of the people and thereby tend to reduce aggregate demand in the economy, indirect taxes directly discourage the consumption of the goods on which they are levied by raising their prices.

Direct Taxes and Mobilisation of Resources:

Now the question arises what should be the taxation structure of a developing economy which will mobilise the potential economic surplus to the maximum, that is, what kinds of taxes be levied, how much progressive should be their rates and what should be the exemptions and concessions in various taxes. This is, however, a highly controversial issue. It has been suggested that an appropriate tax which would mobilise resources or mop up economic surplus is the progressive income tax.

In India and other developing countries income has been regarded as a good base for direct taxation. And the imposition of highly progressive income tax not only mops up relatively greater amount of resources but also tends to reduce inequalities of income. However, a progressive income tax with high marginal rates of taxes adversely affects private saving and investment and also raises the propensity to evade the tax. In view of this, two proposals have been put forward to make the income tax both as an effective instrument of resource mobilisation for the public sector and of providing incentives to save and invest.

First, Prof. Kaldor of Cambridge University, who in 1956 was invited by the Government of India to suggest reforms in the Indian tax system for mobilising resources for development, suggested that whereas the marginal rate of income tax be reduced to, say, 45 to 50 per cent, expenditure tax be levied to discourage the people belonging to upper income brackets from dissipating their income in conspicuous consumption.

ADVERTISEMENTS:

According to him, this will also reduce the tendency to evade income tax on the one hand and promote private savings on the other. The second proposal to reform the income tax put forward by others is that whereas marginal rates of income tax may be kept high but some exemptions for approved forms of saving and investment be allowed to the individuals. This will channel individual savings along desired lines and at the same time mobilise resources for development.

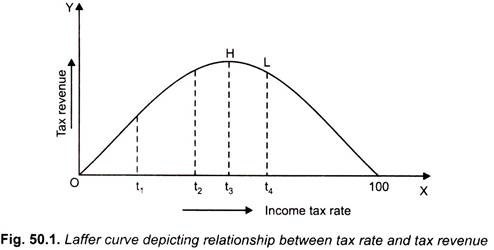

Recently supply-side economics has pointed out that increase in income tax rate beyond a point will lead to the reduction in tax revenue. In this connection, the concept of Laffer curve has been suggested. Thus, according to a Laffer curve concept put forward by an American economist, Arthur Laffer, raising income tax rate beyond a point will yield lower tax revenue. This is because higher income tax rates adversely affect incentives to work, save and invest and are therefore counterproductive. Thus higher income tax rates beyond a certain point causes reduction in supply of labour and capital and lead to lower national income and tax revenue.

A Laffer curve is shown in Fig. 50.1 where along the X-axis income tax rate is measured and along the Y-axis tax revenue is measured. It will be seen from this figure that as rate of income tax is increased, in the beginning tax revenue rises but after the tax rate t3 further increases in tax rate yields lower tax revenue. At tax rate t3, tax revenue t3 H is maximum. Empirical studies have found that tax rate in the range of 30 to 35 percentage is optimal from the viewpoint of maximum tax revenue.

Apart from the income tax on individuals and companies, the imposition of other direct taxes such as capital gains tax, wealth tax, gift tax, and estate duty is also needed to mobilise sufficient resources for capital formation. Unlike income tax, these capital taxes do not have any adverse effect on incentives to save and invest.

ADVERTISEMENTS:

They are also important instruments of reducing inequalities of income and wealth. Because of these advantages, Professor Kaldor in his report on taxation reforms in India recommended the imposition of these capital taxes and this recommendation was accepted and the annual wealth tax and gift tax were levied in 1957 with estate duty having been already introduced in 1954.

Agricultural Taxation and Resource Mobilisation:

A good part of national income in India and other developing countries originates in the agricultural sector which has substantial economic surplus which can be tapped for capital formation. This economic surplus mainly goes to rich farmers, landlords, merchants and other intermediaries and, in the absence of suitable taxation on agriculture, is used for conspicuous consumption and for investing in unproductive activities such as buying gold, jewellery, real estate. Thus, according to Professor Kaldor, “the taxation of agriculture by one means or another has a critical role to play in the acceleration of economic development.” Further, owing to economic growth in general and agricultural development in particular income of the agricultural class and therefore economic surplus enormously increases and therefore needs to be mopped up for further development.

Besides, the agricultural sector has to be taxed not only because it has a potential surplus but also to achieve maximum utilisation of land through devising a system of land taxation which would penalise poor use of good land. In this regard, a progressive land tax “the effective rates of taxation of which vary with the total value of landholdings of the family unit” may be suitable one. Besides this, progressive agricultural income tax with appropriate exemption may be levied to tap resources from affluent sections of the agricultural sector.

It may be noted that as compared to the non-agricultural sector, agricultural sector in India and other developing countries is quite under-taxed. Land revenue which was at one time the greatest source of revenue for government has now become an insignificant yielder of revenue. In the context of India, Agricultural Taxation Committee under the chairmanship of Dr. K.N. Raj recommended Agricultural Holdings Tax (AHT) which was to be imposed at a progressive rate on the rateable value of an agricultural holding of Rs 5000 and above.

It was expected to yield annually Rs 200 crores. However, Agricultural Holdings Tax was found to be difficult to assess and administer. In our view, a graded surcharge on the existing land revenue will be far easier to assess and administer and make land revenue a more elastic source of revenue. However, it may be noted that in India agricultural taxation is a State subject and there is lack of political will on the part of the State Governments to raise the level of land taxation in a country. But if sufficient resources are to be mobilised for development, the level of agricultural taxation has to be raised.

Merits of Direct Taxes for Resource Mobilisation:

As seen above, as an instrument of resource mobilisation for development direct taxes enjoy several advantages:

ADVERTISEMENTS:

1. They raise resources in a non-inflationary way. Indeed, they tend to check inflation by curtailing consumption demand.

2. They help to reduce inequalities of income and wealth.

3. They discourage conspicuous and non-essential consumption and thereby enlarge economic surplus. But the direct taxation of agricultural and non-agricultural sectors has its own limits. In India there is a great potential for raising resources through direct taxes. At present about 4 crore people out of 125 crore population pay income tax. As economic growth takes place incomes of the people increase and as a result their taxable capacity also increases.

There is a considerable evasion of income tax and corporation tax in India. If this evasion is checked more resources can be raised. Yield from other direct taxes such as wealth tax, gift tax is quite meagre due to very small coverage, low rates and considerable evasion of them. Therefore, more revenue from these taxes can also be obtained by making suitable reforms in them.

ADVERTISEMENTS:

How much tax revenue in developing countries can be raised depends on two factors:

(1) taxable capacity of the country and

(2) tax effort made by the country.

The tax efforts mean the policy measures are taken by the government to raise revenue so that taxable capacity is fully used.

ADVERTISEMENTS:

The taxable capacity of an economy depends on the level of its per capita income the distribution of income among the people. The higher the per capita income and greater the inequalities in income distribution, the larger will be the taxable capacity of the country. Besides, taxable capacity depends on the degree of urbanisation and the size of the industrial sector, the importance of foreign trade in the economy of the country.

The tax effort depends on the fiscal measures such as income tax, capital gains tax, wealth tax, gift tax, estate duty taken by a country to raise tax revenue. The data regarding tax revenue collected by the government in developing countries on an average are around 20 per cent of GDP as against 31 to 37 per cent of GDP in the developed countries. It is worth mentioning that India lags far behind in regard to tax efforts made as tax revenue as a percentage of GDP is equal to 10 per cent only.

In the developing countries the scope for increasing tax revenues is very limited because a large proportion of the population earns a very low income and falls outside the purview of the tax system. Besides, many exemptions and rebates given by the government in the direct taxes lower the tax base and the collection of tax revenue. In developing countries, less than 30 per cent of population is subject to income tax as compared to 70 per cent of population in the developed countries.

Therefore, there is a good deal of scope for raising tax revenue through undertaking reforms. An important object of tax system in the developing countries is to promote saving so that capital formation is accelerated. The high marginal tax rates often discourage work effort and also to the extent that high marginal tax rates fall on those groups having high marginal propensity to save, the saving rate may fall as marginal tax rate is increased. Besides, several exemptions in personal income tax given by the government are misused by the persons to evade and avoid income tax and wealth tax.

Likewise, corporate income tax which is a tax on profits of corporate companies is full of several exemptions and rebates given apparently for promoting social objectives are misused by the corporates to illegally reduce their tax liability. For example, in India though corporate income tax rate was 33 per cent including surcharges, then according to the estimate of the Finance Ministry actually on an average the companies actually pay only 20 per cent tax on their profits or income.

This is because of various exemptions in the corporate tax system. Even then in his budget for 2015- 16, the new Finance Minister, Mr. Arun Jaitly has reduced the corporate tax rate to 25 per cent in a phased manner subject to withdrawal of some exemptions. In our view, this will further reduce the actual income tax rate paid by the companies.

ADVERTISEMENTS:

This reduction in corporate income tax rate has been done to woo foreign investors to make investment in India. In our view, this is quite inequitable and unjust as individuals have to pay marginal income tax rate of 33 per cent (including surcharge) on their earned income of more than 10 lakh per annum, the corporates have to pay only 25 per cent. This shows that far from making tax system equitable and buoyant the government is making it more inequitable. Wages and salary earners are being discriminated against vis-a-vis the owners of property and capital. The equity demands that the tax system for both individuals and companies should be such as discourages luxury consumption and makes it difficult to evade and avoid taxes. This will also cause savings to increase.

Besides, the tax reforms are needed for effective taxation of wealth as the ownership of wealth bestows the owners with an inherent taxable capacity regardless of the income it yields. Strangely, instead of making it more effective by plugging its loopholes the Finance Minister in the budget for 2015-16 has abolished the wealth tax and has instead levied 2 per cent surcharge on income of above rupees two crores per annum. Due to large scale evasion of income tax, this move will not serve the end of justice and equity in taxation.

A.P. Thirlwall, a renowned development economist, has suggested the following four tax reforms in developing countries:

1. That overall income (including capital gains) be aggregated and taxed in the same way at a progressive rate but not exceeding a maximum marginal rate of, say, 50 per cent. Marginal rates above this level may not discourage incentive but may also be counter-productive by encouraging evasion and avoidance.

2. The institution of progressive personal expenditure tax levied on rich individuals who reach the maximum marginal rate of income tax.

3. The institution of wealth tax.

ADVERTISEMENTS:

4. The institution of a gift tax.

However, the above proposals of tax reforms are exactly those recommended N. Kaldor in case of India.

Role of Indirect Taxes in Resource Mobilisation:

As a result of limitations of direct taxes, developing countries have resorted to extensive use of indirect taxes. In India, almost all commodities have been brought within the net of indirect taxes such as excise duties and sales tax. Besides, there are customs duties (i.e., taxes on imports and exports). Indirect taxation is an important source of development funds in a developing country. In the last six decades of planned development, revenue from several indirect taxes has been rising as a percentage of total revenue as well as of national income. It has been found that indirect taxes are better suited to the conditions obtaining in developing countries for reducing current consumption and mobilising resources for development.

This is because in such countries quite a large proportion of national income tends to be diverted to current consumption instead of being saved and productively invested. The average propensity to consume in such countries is much higher than is the case in advanced countries. Indirect taxes which reduce consumption must thus play a more important part.

They will raise the rate of savings which are so essential for economic growth. High rates of taxes on commodities with a high income elasticity of demand are quite effective in siphoning a substantial proportion of increase in output into the resources of the public sector needed for development financing and a stiff rate of commodity taxes on luxury articles tends to introduce an element of progressiveness in an otherwise predominantly regressive tax structure in developing countries.

But in order to make sure that the resources raised through commodity taxes are adequate, it will be necessary to extend their coverage to include some articles of mass consumption. In the poor countries, it is not possible to exempt entirely goods of general and necessary consumption, because they are the only goods that provide a base broad enough to assure an adequate amount of resources.

ADVERTISEMENTS:

The rates of two important indirect taxes, namely, excise duties and customs duties which yielded increasingly greater revenue for government before 1991 had to be reduced under economic reforms initiated since 1991. To promote free trade customs duties had to be reduced as a part of agreement under WTO. Excise duty had to be reduced so that domestic industries could compete with imports from abroad after the adoption of liberal foreign trade policy.

However, to compensate for the loss in revenue due to reduction in customs duties and excise duty, new service tax (which is an indirect tax) has been imposed. Service tax which now covers more than 100 services has become a good source of tax revenue. In the financial years 2012-13 and 2013-14 service tax yielded Rs 132,601 and Rs 154,630 crores respectively. Besides, in the States sales tax has been replaced by value added tax (VAT) which is also yielding more revenue.

Limitations:

But there are some limitations of raising resources through indirect taxes. First, they lead to cost-push inflation. The burden of indirect taxes is passed on to the consumers in the form of higher prices charged from them. In India excise duties on sugar, cloth, kerosene oil, petrol etc., have raised the prices and have contributed a good deal to cost-push inflation witnessed in last several years. Secondly, levying of customs duties on imports of capital goods, raw materials used for industrial production have accelerated cost-push inflation in the Indian economy.

Thirdly, imposition of customs duties on imports of goods also protects inefficiency in domestic industries. This also contributes to high-cost production and promotes inefficiency. Lastly, indirect taxes are regressive in nature; both the rich and poor have to pay the same rate on the taxed commodities. The regressive character of indirect taxes has been attempted to be reduced by imposing higher rates of excise and customs duties on luxury items and smaller rates of duties on goods of mass consumption. However, the need for mobilising greater resources has forced the Finance Ministers to levy higher indirect taxes even on articles of mass consumption.

Reforms in the Indirect Tax System- Goods and Services Tax (GST):

An important reform in the indirect tax system is the introduction of goods and service tax (GST). GST will replace all multistage sales or value added taxes such as CENVAT and service tax levied by the Centre and the sales tax, value added tax (VAT), entertainment tax, luxury tax levied by the States. This is the comprehensive tax on goods and services. The introduction of GST will not only simplify the indirect tax system in the country but will also yield more revenue for the government. The significant reason of complexity of the present indirect tax system is related to the existence of various exemptions and multiple rates of CENVAT on various commodities and different rates of sales tax or VAT levied by the States. Since GST is a tax on consumption, it will promote saving. Besides, it will reduce the incidence of evasion.

ADVERTISEMENTS:

The starting base of Central excise duty or CENVAT is narrow and is further eroded by a variety of area-specific and conditional and unconditional exemptions. Therefore, the introduction of comprehensive single GST would be appropriate for deepening indirect tax system in India.

It has been decided that rate of GST will be 16%. Therefore, imposition of GST will lead to lowering of prices of goods. This is because a good with 8% excise duty and 12 per cent VAT will face a total tax rate of 20%. Under single GST it will fall to 16% given that rate of GST is fixed at 16%.

It has now been decided that GST will apply from April 2016. It is now widely recognised that GST will be a major milestone for indirect tax reform in India. By replacing all existing indirect taxes, the GST will create a national market as it will eliminate the cascading effects of multiple layers of taxation all over the country and facilitate movements of goods and services across State borders. Besides, it will align taxation of imports and exports correctly. This will improve the competitiveness of production and exports from India. The single GST will also improve tax collection as it will end the long-standing distortions of differential treatment of manufacturing goods and services and uniform removal of exemptions.