A major development debate from the 1940s to the 1960s concerned balanced growth versus unbalanced growth. Some of the debate was semantic, as the meaning of balance can vary from the abrupt requirement that all sectors grow simultaneously and at the same rate to the more simple plea that same attention be given to all major sectors—industry, agriculture and services.

In contrast, A. O. Hirschman develops the idea of unbalanced investment to complement existing imbalances. A broad choice of development strategy is between Ragnar Nurkse’s theory of balanced growth (BG) and A. O. Hirschman’s theory of unbalanced growth (UG). The doctrine of BG is based on the economic rationale for a ‘big push’.

By contrast, UG is based on the hypothesis that a ‘big push’ or a ‘critical minimum effort’ is not feasible. So the best way to stimulate development in LDCs is to deliberately create an imbalance. The issue is yet to be resolved. So, there are two opposite issues on development strategy.

The origin of the idea of balanced growth can be traced back to the 200-year old Say’s Law of Markets (1803)- Every increase in production, if distributed in the correct proportion among the factors of production on the basis of their respective contributions to society’s output, creates its own demand. Say made an insightful analysis that all productive activity creates demand along with supply.

ADVERTISEMENTS:

J. S. Mill added (1848) that while production creates specific supplies, and investment creates specific productive capacities, the income they generate creates general demand, which, then, is distributed over many goods.

This hypothesis has an important implication. If the structure of additional productive capacities is to match the structure of additional demand, investment would have to proceed simultaneously in the various sectors of the economy and industries in the same proportions in which the consumers decide to allow the expenditure of their additional income among the outputs of those sectors and industries.

This implies a faster growth of sectors and industries which produce goods having high income elasticities of demand and a simultaneous but slower growth of industries producing goods having low income elasticities of demand. This is the essence of balanced growth.

Different Interpretations of the Term ‘Balanced Growth’:

The synchronized application of capital to a wide range of different industries is called balanced growth by its advocates. The term BG is used in different senses. Paul Rosenstein Rodan, one of the original proponents of the doctrine, had in mind the scale of investment necessary to overcome indivisibilities on both the supply and the demand sides of the development process.

ADVERTISEMENTS:

Indivisibilities on the supply side refers to the ‘lumpiness’ of capital (especially social overhead capital) and the fact that only investment in a large number of activities simultaneously can exploit the various external economies of scale.

Indivisibilities on the demand side refer to the limitations imposed by the size of the market on the profitability, and thus economic feasibility, of various productive activities in the private sector. Thus, the doctrine of BG was originally interpreted as the large-scale expansion of economic activities to overcome divergences between private and social return.

Nurkse (1953) had extended the doctrine to refer to the path of economic development and the pattern of investment necessary to keep the different sectors of the economy in balance, so that lack of development in one sector does not act as an obstacle to development of others.

Nurkse considers this strategy the only way of escaping from the vicious circle of poverty. Of course, it is not necessary for output in all sectors to grow at the same rate, but,-rather in accordance with the income elasticity of demand for products, so that supply equals demand at the micro-level.

ADVERTISEMENTS:

This implies equilibrium in the market for each commodity as also absence of shortages and bottlenecks of any type. He does not consider the expansion of exports promising, because the price elasticity of demand for the LDCs’ predominantly primary exports is less than one, thus reducing export earning with increased volume, other things being equal.

Horizontal vs. Vertical Balance:

BG, therefore, has both horizontal and vertical aspects. On the one hand it recognises indivisibilities in supply and complementarities of demand. On the other hand it highlights the importance of achieving balance between such sectors as agriculture and industry, between the consumer goods industries and the capital goods industries, and between social overhead capital (SOC) and directly productive activities (DPA).

Two Versions of Balanced Growth:

Thus, there are two versions of the doctrine of BG. One refers to the path of development and the pattern of investment necessary to ensure smooth functioning of the economy. The other refers to the scale of investment necessary to overcome indivisibilities in the production process on both sides of the market. Nurkse’s exposition of BG embraces both versions of the doctrine, while Rosenstein-Rodan concentrates on the necessity for a ‘big-push’ to overcome the existence of indivisibilities.

On the demand side, the division of labour is limited by the size of the market and if the market is limited, certain activities may not be economically viable. So, several activities are to be set up simultaneously so that each can provide a market for the others’ products. In addition, activities that are not profitable, when considered in isolation, will become so when considered in the context of a large-scale development programme.

For this it is necessary that industrial enterprises are of a certain minimum size so that they can operate profitably. On the supply side, the argument for a ‘big push’ is inseparably linked up with the existence of external economies of scale.

In the context of development economics, the external economies refer mainly to the impact of a large investment programme on the cost and profit functions of the participating firms. In the presence of external economies, in either sense, the social return of an activity will exceed the private return.

The only way to eliminate this divergence is to make each activity part of an overall programme of investment expansion. Industries or enterprises which are unprofitable, when considered in isolation, become economically viable when considered as part of a comprehensive plan for industrial expansion embracing several activities.

No doubt, certain investments have to be of a minimum size to be economically feasible. It may be uneconomical to build roads, highways, buildings, railways and power plants if the current level of demand for transport services and power is low due to the backward nature of the economy.

ADVERTISEMENTS:

This type of SOC should be built on a large scale in order to achieve long-run economy in the use of resources only when different industries are set up simultaneously and the demand for SOC increases.

Intersectoral Balance:

The second version of the theory of BG stresses the necessity of balance among different sectors of the economy. The objective is to prevent development of bottlenecks in some sectors, which may act as an obstacle to development and excess capacity in others which may be wasteful. For example, a shortage of raw jute or raw cotton will hinder the development of the jute or the cotton textile industries.

Similarly, a shortage of steel may hinder the development of the automobile industry or even the engineering industry. This is why Nurkse (1953) and Arthur Lewis (1954) placed particular emphasis on achieving balance between the agricultural and the industrial sectors of LDCs.

ADVERTISEMENTS:

Two main reasons explain how the two sectors mutually exist and stimulate each other:

1. A balance between the agricultural and consumer goods sectors is necessary to give incentives to the farmers to improve productivity so as to expand their marketable surplus. If the consumer-goods sectors do not develop, the demand for agricultural goods will not increase much.

2. For increasing agricultural productivity there is need for capital goods such as tractors pump sets, etc. This requires a balance between agriculture and capital goods producing industries. Moreover, without good roads, farmers cannot sell their products in open markets at fair prices. So, there is need to provide adequate SOC in the form of roads, highways, buildings, etc.

The doctrine of BG stresses on the balance between agriculture and industry for three other reasons:

ADVERTISEMENTS:

3. Agricultural output can provide a basis for the development of agro-based local industries.

4. The industrial sector depends on the agricultural sector for food.

5. In the absence of increasing exports, the agricultural sector has to rely on the industrial sector for absorbing a major portion of its products.

Criticisms of the Doctrine of Balanced Growth:

1. Shortages of Resources:

The main criticism of the doctrine of BG is that it fails to tackle, perhaps, the most serious obstacle to development of LDC, viz, a shortage of resources of all kinds. The truth is that if LDCs do possess the resources for a ‘big push’ they ought not to be described as LDCs in the first place.

No one can deny the importance of a large-scale investment programme and the expansion of complementary activities. But in the absence of adequate resources, especially, capital, entrepreneurs and decision-makers, the adoption of the policy of BG may not provide a sufficient stimulus to the spontaneous mobilisation of resources or the inducement to invest.

ADVERTISEMENTS:

2. BG on a Global Scale:

The doctrine of BG calls for inward-looking development policies- investment in productive capacities to match the expansion of domestic demand. It then conflicts with the theory of comparative advantage, which says that rather than producing everything at home, each country does better through specialisation in the production of goods in which it is relatively efficient and by importing other goods in which it is relatively inefficient.

3. Economies of Scale:

The doctrine of BG also conflicts with the arguments for exploiting economies of scale. Whenever a country’s domestic market for a particular good is too small to absorb the minimum output that is economical to produce it is cheaper for it either to import that good from high-volume low-cost producers abroad, or to produce it at home on a large enough scale to render its cost competitive in world markets and export the surplus. This means that growth would have to be balanced, not on a national but on a global scale. This view has been expressed by T. Scitovsky.

The most influential advocate of BG was of course, Nurkse, who put the following argument:

The case of international specialisation is as strong as ever. But, if development through increased exports to the advanced countries is retarded or blocked, there arises a possible need for promoting increases in output that are diversified in accordance with domestic income elasticities of demand so as to provide markets for each other locally.

ADVERTISEMENTS:

No doubt there was widespread agreement on the desirability of matching the structure of output to the structure of domestic demand. But there was widespread disagreement (in the late 1950s) as to the best way to achieve that goal. Nurkse and his followers believed that, in poor countries, the market, left to itself, perpetuates poverty, because to escape from it would require investment in increasing productivity.

This is impeded not only by the low saving of the poor but even more by the lack of profit incentive to build high-productivity plants when the already existing local market for their output is too small.

As a means of escaping from that vicious circle, Nurkse advocated the BG doctrine. BG can be achieved in two ways. First, careful planning of investment can overcome the lack of private incentive. Alternatively, indicative planning can provide enough additional incentive, especially when aided by tariff protection, tax concessions or cheap credit.

Unbalanced Growth:

A. O. Hirschman and his followers showed more faith in market forces but stressed the virtual impossibility of BG in the narrow sense of the simultaneous establishment of many industries all at a time. He pointed out that most poor countries lack the resources for investing in more than one or very few modern projects at any given time and, therefore, can aim at BG only in the long run, through a sequential process of building first one, then another plant, with each step correcting the worst imbalance in order to approach a more balanced structure gradually. He called that process ‘unbalanced growth’-and argued that market forces are likely to aid it, because imbalances create shortages, whose impact on prices render their relief or elimination more profitable.

The Main Thesis:

Hirschman’s main thesis is that, given a limited amount of investment resources and a series of proposed investment projects whose total cost exceeds the value of available resources, we have to identify the projects that will make the maximum contribution to development relative to their cost.

Substitution Choice vs. Postponement Choice:

ADVERTISEMENTS:

According to Hirschman, in any development strategy there are two types of investment choices, viz., substitution choice and postponement choice. The former involves a decision as to whether to undertake projects or project B.

The latter involves a decision as to the sequence of projects A and B – i.e., which should precede the other. His main thesis is the question of priority which has to be resolved by making a comparative appraisal of the strength with which progress in one area induces progress in another.

The stress is on economizing the use of scarce resources through proper decision-making so as to achieve both effectiveness (choosing the project) and efficiency (completing the same at the lowest cost in terms of resources consumed).

In Hirschman’s’ view, the real scarcity in LDCs is not the physical, human, and man-made resources such as labour and capital but the means and ability to make the best possible utilisation of them. The scarcest resource in LDCs is the decision-making input or entrepreneurial ability. So, preference has to be accorded to that sequence of projects which maximises ‘induced decision-making’.

Choice between SOC and DPA:

Hirschman’s argument can be illustrated by examining the relation between social overhead capital (SOC) and directly productive activities (DPA). In this context he refers to two alternatives: development via excess capacity and development via shortages.

ADVERTISEMENTS:

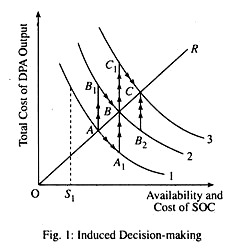

The former refers to a case in which SOC precedes DPA. The latter refers to the case in which the opposite thing happens – DPA precedes SOC. Both sequences create inducements and pressures conducive to development.’ The point is illustrated in Fig 1. We start with substitution choice.

1. Substitution Choice:

Here, we measure the total cost of DPA output on the vertical axis and the cost and availability of SOC on the horizontal axis. Curves 1, 2 and 3 show that cost of producing the maximum capacity output of DPA, from a given amount of investment, as a function of the availability of SOC.

The three curves indicate different levels of DPA output from successively higher investment. The curves are negatively sloped and convex to the origin because DPA costs decrease as the availability of SOC increases. However, a minimum amount of SOC is necessary to produce a positive DPA output (e.g., 05], corresponding to curve 1). However, as SOC increases the cost of DPA output falls no doubt but not proportionately.

Let us suppose the objective of an economy is to increase the output DPA with a minimum amount of resources devoted to both DPA and SOC. On each curve, 1, 2 and 3, the point where the sum of the coordinates is the smallest represents the most desirable combination of DPA and SOC. The line OR connects the optimal points on the different curves and thus represents the most ‘efficient’ expansion path, or ‘balanced’ growth path, between SOC and DPA.

2. Postponement Choice:

If, for some reason, ‘optimal’ amounts of SOC and DPA cannot be expanded simultaneously to maintain balance between the two, postponement choice is the only alternative course of action. One such action is to follow the sequence AA1BB2C, where the critical expansionary step is always taken by SOC.

This sequence is development via excess capacity. The other (opposite) possibility is the sequence AB1BC1C where the initial expansionary step is taken by DPA. This sequence is ‘development via shortages’. In Hirschman’s view, preference should be given to the sequence of expansion that maximises ‘induced decision-making.’

It is not possible to choose between the two sequences on an a priori basis. If SOC is expanded, existing DPA becomes less costly. This encourages expansion of DPA. If DPA is expanded first, cost will rise but pressures will be created for SOC facilities to be expanded. The sequence chosen must depend on the relative strength of entrepreneurial motivations on the one hand, and the response of planners to the growing demand for SOC on the other.

While a certain minimum amount of SOC is a prerequisite to the establishment of DPA, development via excess capacity, argues Hirschman, is permissible, but not the best possible choice for an LDC and to strive for balance is equally dangerous because there will be no incentive to induced investment (or decision-making). But development via shortages will put pressure for making further investment and, hence, the most ‘efficient’ sequence, as far as ‘induced decision-making’ is concerned, is that where DPA precedes SOC.

Hirschman strongly believes that the objective of development planning has to be to obtain increasing outputs of DPA at minimum cost in terms of resources devoted to both DPA and SOC, and that the cost of producing any given output of DPA will be higher the greater is the shortage of SOC facilities.

[There is no guarantee that the SOC will be simultaneously provided once DPA have been set up. Moreover, indivisibilities with respect to SOC may be so large that private investors are not induced to supply anything at any price. Reliance would then be on the government which has a comparative advantage in creating SOC facilities rather than participating in DPA.]

Backward and Forward Linkages:

Hirschman applied the criterion of ‘induced decision-making’ to the choice and sequence of projects within the DPA. Here, inducements originate from interdependence among activities, called linkage effects. These are of the two types—backward and forward. Backward linkages measure the proportion of an activity’s output that represents purchases from other domestic activities.

Industries with backward linkages use inputs from other industries. Automobile manufacturers, for example, uses the products of machinery and metal processing plants, which, in turn, use large amounts of steel. Building an automobile manufacturing plant, therefore, will create a demand for machinery and steel.

Initially, this demand may be met by imports, but eventually local entrepreneurs will see that they have a ready market for domestically made machinery and steel, and this demand stimulates them to set up such plants. Planners interested in accelerating growth, therefore, will emphasise industries with strong backward linkages because these industries will stimulate production in the largest number of additional sectors.

Both forward and backward linkages set up pressures that lead to the creation of new industries, which, in turn, create additional pressures, and so on. These pressures can take the form of new profit opportunities for private entrepreneurs, or pressures can build through the political process and force governments to act.

Private investors, for example, might decide to build factories in a given location without, at the same time, providing adequate housing facilities for the inflow of new workers or roads with which to supply the factories and transport their outputs. In such cases, government planners might be forced to product public houses and construct roads.

Forward linkages measure the proportion of an activity’s output that is used as an input into other industries. In other words, forward linkages occur in industries producing goods that then become inputs into other industries. Rather than start with automobiles, planners might prefer to start at the other end by setting up a steel mill.

Seeing that they had a ready domestic supply of steel, entrepreneurs might be stimulated to set up factories to use this steel. By using Leontief- type input-output tables it is possible to rank activities according to the magnitude of their combined linkage effects.

Unbalanced-growth advocates such as Hirschman, however, did not content themselves with simply pointing out an escape from the dilemma posed by balanced-growth proponents. Hirschman developed the unbalanced-growth idea to give a general interpretation of how development ought to achieved.

In fact, the central concept in Hirschman’s theory is that of linkages. Industries are linked to other industries in ways that can be taken into account in deciding on a development strategy. According to Hirschman within the DPA, the most appropriate development strategy is to encourage those activities with the potentially strongest combined linkages.

In other words, investment should be concentrated on those sectors in which the input-output relationship is the thickest or the linkage effects are the strongest. The reason is that this will provide the maximum inducement and incentive to other activities to develop. A close look reveals that there is no logical contradiction between the two strategies of economic development.

While, on the surface, the balanced and unbalanced-growth arguments appear to be fundamentally inconsistent with each other, when stated in less extreme forms, they can be seen as opposite sides of the same coin. In truth, there is no single pattern of industrialisation that all countries must follow. On the other hand, quantitative analysis shows that some patterns are broadly similar among large groups of countries.

While countries with large amounts of foreign trade can follow an unbalanced growth strategy for some time, a country cannot pick any industry or group of industries it desires and then concentrate exclusively on those industries throughout the country’s development; it cannot, in effect, follow an extreme form of an unbalanced growth strategy. The very concept of linkages suggests that extreme imbalances of this sort will set up pressures that force a country back towards a more balanced path.

Thus, the ultimate objective is a degree of balance in the development programme. But, planners have a choice between attempting to maintain balance throughout the development process or first creating imbalances with the knowledge that linkage pressures eventually will force them back toward the balance.

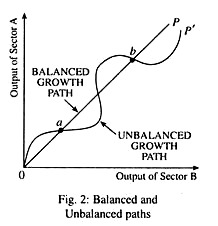

In terms of Fig. 2, the issue is whether to follow the steady balanced- growth path, represented by a “straight” line OP, or the unbalanced-growth path, represented by a curved line OP’. The straight line is shorter, but, under certain conditions, a country might get to any given point faster by following the curved line.

As T. Scitovsky has put it:

“Hirschman’s unbalanced growth is the distribution over time of individual investment projects whose cumulative long-run aim and effect is still to balance and keep in balance the structure of domestic productive capacities and outputs.”

Suitability of the Strategy of Balanced Growth:

In spite of its various shortcomings, the doctrine of BG became the fashionable doctrine of both economists and policy-makers in the post-Second World War (1939-1945) period. The policy-makers of LDCs were influenced by it while drawing up development plans to coordinate various investment programmes. But they paid more lip service than serious attention to the doctrine of both.

The most fashionable policy was import-substituting industrialisation, all too often centred on most highly automated and, therefore, most prestigious industries. In consequence, the growth of many LDCs not only remained unbalanced but became unbalanced in the wrong direction—in favour of sectors with the country’s greatest comparative disadvantage.

Industry was favoured while agriculture was neglected. Automobiles, T.V. sets, large kitchen appliances and heavy industries such as petrochemicals and engineering were favoured to the neglect of the simple manufactures and processed food on which most of the newly generated income of the emerging urban working classes was spent.

The unbalanced nature of such development manifested itself in the chronic underutilization of the new modern plants side by side with excess demand for food with its two adverse consequences—increasing imports and inflationary pressures. The disappointing record of import-substituting development in many LDCs led to a gradual shift towards export-led growth which was equally unbalanced but in favour of industries with a comparative advantage.

Export-led growth, therefore, was much more successful, especially as long as it was stimulated by expanding multilateral trade. Thus, balanced growth continues to remain more of a theoretical doctrine than a tried practical policy.