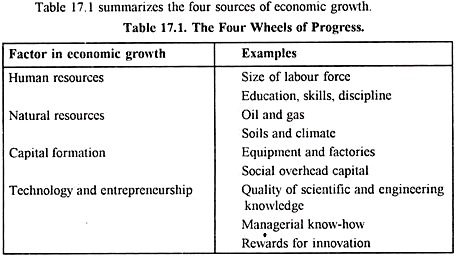

The following points highlight the four important sources of economic growth of a country. The sources are: 1. Human Resources 2. Natural Resources 3. Capital Formation 4. Technological Change and Innovation.

Source of Economic Growth # 1. Human Resources:

Labour inputs consist of quantities of workers and of the skills of the work force.

Many economists believe that the quality of labour inputs—the skills, knowledge, and discipline of the labour force—is the single most important element in economic growth.

A country might buy the most modern telecommunications devices, computers, electricity-generating equipment, and fighter aircraft. However, these capital goods can be effectively used and maintained only by skilled and trained workers.

ADVERTISEMENTS:

Improvements in literacy, health, and discipline, and most recently the ability to use computers, add greatly to the productivity of labour.

Source of Economic Growth # 2. Natural Resources:

The second classical factor of production is natural resources. The important resources here are arable land, oil and gas, forests, water, and mineral resources. Some high-income countries like Canada and Norway have grown primarily on the basis of their ample resource base, with large output in agriculture, fisheries, and forestry.

Similarly, the United States, with its temperate farmlands, is the world’s largest producer and exporter of grains. But the possession of natural resources is not necessary for economic success in the modern world. New York City prospers primarily on its high-density service industries.

Many countries that have virtually no natural resources, such as Japan, have thrived by concentrating on sectors that depend more on labour and capital than on indigenous resources. Indeed, tiny Hong Kong, with but a tiny fraction of the land area of resource-rich Russia, actually has a larger volume of international trade than does that giant country.

Source of Economic Growth # 3. Capital Formation:

ADVERTISEMENTS:

Recall that tangible capital includes structures like roads and power plants, equipment like trucks and computers, and stocks of inventories. The most dramatic stories in economic history often involve the accumulation of capital. In the nineteenth century, the transcontinental railroads of North America brought commerce to the American heartland, which had been living in isolation.

In this century, waves of investment in automobiles, roads, and power plants increased productivity and provided the infrastructure which created entire new industries. Many believe that computers and the information superhighway will do for the twenty-first century what railroads and highways did in earlier times.

Accumulating capital, as we have seen, requires a sacrifice of current consumption over many years. Countries that grow rapidly tend to invest heavily in new capital goods; in the most rapidly growing countries, 10 to 20 percent of output may go into net capital formation. By contrast, many economists believe that the low national savings rate in the United States—only 4 percent of output in 1996— poses a major economic problem for the country.

When we think of capital, we must not concentrate only on computers and factories. Many investments are undertaken only by governments and lay the framework for a thriving private sector. These investments are called social overhead capital and consist of the large-scale projects that precede trade and commerce. Roads, irrigation and water projects, and public-health measures are important examples.

ADVERTISEMENTS:

All these involve large investments that tend to be “indivisible,” or lumpy, and sometimes have increasing returns to scale. These projects generally involve external economies, or spillovers that private firms cannot capture, so the government must step in to ensure that these social overhead or infrastructure investments are effectively undertaken.

Source of Economic Growth # 4. Technological Change and Innovation:

In addition to the three classical factors discussed above, technological advance has been a vital fourth ingredient in the rapid growth of living standards. Historically, growth has definitely not been a process of simple replication, adding rows of steel mills or power plants next to each other.

Rather, a never-ending stream of inventions and technological advances led to a vast improvement in the production possibilities of Europe, North America, and Japan.

Technological change denotes changes in the processes of production or introduction of new products or services. Process inventions that have greatly increased productivity were the steam engine, the generation of electricity, the internal-combustion engine, the wide-body jet, the photocopier machine, and the fax machine. Fundamental product inventions include the telephone, the radio, the airplane, the phonograph, the television, and the VCR.

The most dramatic technological developments of the modern era are occurring in electronics and computers, where today’s tiny notebook computers can outperform the fastest computer of the 1960s. These inventions provide the most spectacular examples of technological change, but technological change is in fact a continuous process of small and large improvements, as witnessed by the fact that the United States issues over 100,000 new patents annually and that there are millions of other small refinements that are part of the routine progress of an economy. For the most part, technology advances in a quiet, unnoticed fashion as small improvements increase the quality of products or the quantity of output.

Occasionally, however, changes in technology create headlines and produce unforgettable visual images. During the war in the Persian Gulf in 1991, the world was stunned by the tremendous advantage that high-technology weapons—stealth aircraft, “smart” bombs, antimissile missiles—gave to the United States and its allies against an opponent armed with a technology that was but a few years behind. Civilian technological advances—computers, telecommunications, and other high-technology sectors—are less dramatic but contribute greatly to the increase in living standards of market economies.

Because of its importance in raising living standards, economists have long pondered how to encourage technological progress. Increasingly, it is becoming clear that technological change is not a mechanical procedure of simply finding better products and processes.

Instead, rapid innovation requires the fostering of an entrepreneurial spirit. Consider today’s U.S. computer industry, where even enthusiasts can hardly keep up with the stream of new hardware configurations and software packages.

Why did the entrepreneurial spirit thrive here and not in Russia, home to many of the great scientists, engineers, and mathematicians? One key reason is the combination of an open spirit of inquiry and the lure of free-market profits in Silicon Valley in comparison to the secrecy and deadening atmosphere of central planning in Moscow.

Economic growth inevitably rides on the four wheels of labour, natural resources, capital, and technology. But the wheels may differ greatly among countries, and some countries combine them more effectively than others.