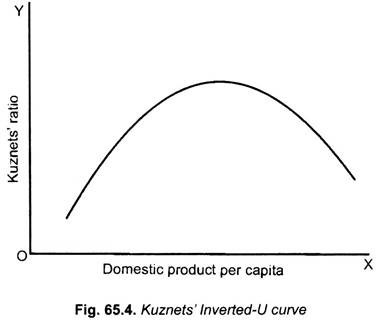

Simon Kuznets put forward the hypothesis that relationship between per capita national income and the degree of inequality in income distribution may be of the form of inverted-U. Due to limitations of data he used an inequality measure of the ratio of income share of the richest 20 per cent of the population to the bottom 60 per cent of the population known as Kuznets’ ratio.

According to the Kuznets’ Inverted U-hypothesis, as per capita national income of a country increases, in the initial stages of growth, inequality in income distribution rises and after reaching the highest degree in the intermediate level the income inequality falls. This is shown in Fig. 65.4 where as a country develops and its per capita income rises, the degree of income inequality initially rises and after reaching the maximum level, it falls as GDP per capita increases further.

As time series data of the transition of the poor underdeveloped countries from underdeveloped stage to the developed stage was not available, he used the data of cross section of countries including both developed and developing countries. In his 1955 study he calculated the Kuznets’ ratios and found that the developing countries tend to have a higher degree of inequality whereas the rich developed countries tend to have a lower degree of inequality.

Later in his 1963 study Kuznets provided further evidence of his inverted U-hypothesis regarding the relationship between inequality and economic growth. In this study he included eighteen countries, as in the earlier study, he included in this sample both the developed and developing countries. From this later study he concluded that the share of upper income groups in the rich developed countries was significantly lower than their counterparts in the developing countries. This means income inequalities were higher in developing countries compared to those in the developed countries.

ADVERTISEMENTS:

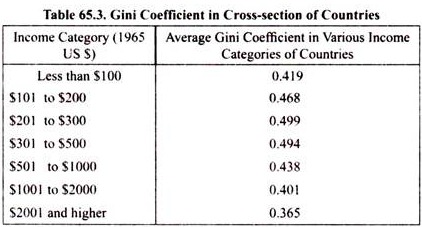

Other economists have also carried out studies to test Kuznets’ inverted U-hypothesis. Due to the non-availability of income distribution data of an individual country over time as it grows over time from an underdeveloped stage, like Kuznets, others have also generally used cross-section data of countries with a mixture of developed and developing countries to test Kuznets’ inverted U-hypothesis regarding the relationship between changes in income inequality and economic growth, one such cross-section study with data of forty six countries classified into different income categories according to the per capita GDP in 1965 in US dollars was made by Paukert using Gini Coefficient as a measure of inequality. Paukert’s analysis of cross-section of countries also confirmed the inverted U-hypothesis of Kuznets and his findings are given in Table 65.3.

As will be seen from Table 65.3 in less than $100 per capita GDP category countries, Gini Coefficient is 0.419 and as we go to the next category of countries with per capita GDP between $ 101 and $200, Gini Coefficient rises to 0.468 and in still higher categories of per capita GDP between $201 and 300 inequality as measured by Gini Coefficient rises to 0.499.

However, beyond this in still high income categories of countries, the value of Gini Coefficient goes on falling and in the highest income category of countries with per capital GDP $2001 and above, Gini Coefficient falls to 0.365. This is in accordance with Kuznets’ inverted U-hypothesis regarding changes in income inequality as economic growth occurs.

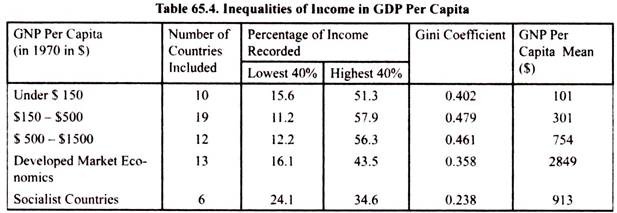

Kuznets inverted U-hypothesis seems to hold well in later years, at least upto the year 1970. Montek Singh Ahluwalia used income distribution data of cross-section of countries and made estimates for the countries in near about the year 1970. Results of his study are given in Table 65.4.

From the above table inequality can be judged by any three measures, namely, share of bottom 40% of population in GNP, share of top 40% of population in GNP and Gini Coefficients in different income categories countries. It is worth mentioning that in 6th column of Table 65.4 GNP per capita indicates the level of development of the economy. Using any of the three inequality measures it is found that the inequality first rises, then falls as per capita GNP increases as Kuznets’ inverted U-hypothesis suggested. Changes in Gini ratio reveals that as average GNP per capita of countries increased from $101 to $301 Gini Coefficient increases from 0.402 to 0.479 and in countries with per capita GNP of $ 754 Gini Coefficient falls to 0.461 and then at mean GNP per capita of $ 2849, Gini Coefficient falls to 0.358.

Similarly, the share of bottom 40% of population in GNP indicates that it first falls and then rises again showing that inequality first rises and then falls. In accordance with this the share of highest 40 per cent in GNP first rises and then it falls.

ADVERTISEMENTS:

An interesting fact is revealed by the last row of Table 65.4 which gives the data of 6 socialist countries around the year 1970. This reveals that degree of income inequality as per all the three inequality measures in them was much less compared to market capitalist countries. This is because in erstwhile socialist countries private ownership of tangible physical assets was generally abolished and therefore inequalities of income that arise mainly due to highly skewed distribution of assets and property did not exist in these socialist countries at that time. Even wage differentials in these countries were found to be less.

East Asian Countries and Kuznets’ Inverted U- Hypothesis:

It is worth mentioning that development experience in East Asian countries does not conform to the inverted-U hypothesis of Kuznets. In East Asian countries such as Japan, South Korea, Taiwan, Thailand, Indonesia and Malaysia, contrary to Kuznets’ inverted U -hypothesis, in the initial stages growth was not associated with increase in inequality. Instead, the increase in national income was widely shared among its population and millions were lifted out of poverty.

For example, in Malaysia and Thailand the incidence of poverty declined from about 50 per cent in 1960s to less than 20 per cent by the end of the 20th century. Though the policies pursued by the various East Asian countries differed a lot, but the common features of these countries were, high rates of investment in physical and human capital, rapid growth of agricultural productivity and declining fertility. All these were conducive to economic growth with decline inequality in income distribution.

Explanation of Kuznets’ Inverted U- Hypothesis:

Leaving aside the case of East Asian countries where Kuznets’ Inverted-U hypothesis regarding changes in inequality as a result of economic growth does not apply to a number of other countries, both the developed and developing countries, Kuznets’ inverted U-hypothesis seems to apply well. What explanations have been offered for this inverted U- hypothesis. It is Arthur Lewis’s famous model of ‘Economic Development with Unlimited Supply of Labour’ that was put forward to explain the development process in a dual developing economy has also found to be highly useful to explain Kuznets’ inverted U- hypothesis regarding the relation between economic growth and changes in income distribution over time.

It may be noted that Lewis’s development model like those of Ricardo and Marx was based on the assumption that the unlimited amount of labour was available for employment in modern industrial sector at a fixed real wage rate which was unlike the neoclassical economists who assumed that labour was a scarce factor of production to be bid away from alternative uses and therefore was not available in unlimited quantity for being employed for the growth of modern industrial sector.

Lewis’s labour-surplus model suggests that as economic growth takes place with withdrawal of surplus labour from low-productivity agriculture to the high-productivity modern industrial sector, income inequality will first increase and then after a point tends to decrease. This is therefore consistent with Kuznets’ inverted U-hypotheses. In Lewis’s labour-surplus model there are two reasons for increase in income inequality in the initial phase of economic development.

First, the share of profits or surplus of the capitalist’s (who in the Lewis’s version of the model may be either private capitalists or government running State-owned enterprises) increases as the modern industrial sector expands. The second reason for increase in income inequality in the early stages of economic growth is that in the beginning of urban industrialisation, wages in the modern industrial sector, according to Lewis, are 30 per cent higher in real terms compared to the subsistence wage level in the traditional agricultural sector. This tends to increase the overall income inequality in the economy.

ADVERTISEMENTS:

However, according to Lewis’s model, this tendency toward increasing inequalities is finally reversed as growth proceeds further and when all surplus labour has been fully withdrawn from subsistence sector and absorbed in the modern sector. This is because when all surplus labour is productively absorbed in the modern sector, labour becomes scarce and as demand for labour by the modern sector further increases, the increment in wages are needed to bid away workers from the marginal uses.

Thus, it is eventually rise in general wage level in Lewis’s model that causes decline in income inequality and also leads to the elimination of poverty. Thus commenting on changes in income inequality as economic growth takes place in Lewis’s model Debraj Ray writes, “It should be quite clear that economic development viewed in this way cannot be evenly spread across the entire population at any one point in time. Initially only a few people got access to the progressive or modern sector. This view also suggests that the developed countries that have completed the transition from ‘old’ to the ‘new’ sectors should exhibit less inequality than the developing countries that are in the middle of transition process where individuals are in both sectors. The argument suggests that change is first uneven and then compensatory.”

The second factor that causes increase in income inequalities as a result of economic growth is that technological progress initially benefits relatively few industries that employ a relatively small number of workers. Thus technological progress in the developing countries initially can benefit only a fraction of the industrial economy benefiting only a small number of workers employed in the industrial sector.

The modern capital-intensive farming is less applicable to the agriculture of the developing countries that have a large number of workers in the rural sector who are poor. The small and marginal farmers do not have access to bank credit to buy and use modern inputs such as fertilizers, high-yielding varieties (HYV) of seeds, pesticides, modern tools which are important inputs for adoption of green revolution technology. That is why, in the initial stages of the green revolution in India only rich farmers and landlords were mainly able to get benefits.

ADVERTISEMENTS:

There is another way in which the technological progress can lead to the increase in inequality in developing countries. This is because superior technology is biased against unskilled labour and can be used only by the trained skilled manpower. However, in developing countries initially only unskilled labour is in surplus and needs to be productively employed and their larger supply tends to lower wage rate and this tends to increase inequality in income distribution in the initial stages of growth. To quote Debraj again, “The skill differentials are ultimately compensated by the growing educational status of the labour force but this is a slower process. When it does occur, inequality tends to decline.”

Lastly, without the bias of technological progress and without the dual economy structure industrialisation itself also leads to the large profits accruing to the capitalist class which owns financial resources and entrepreneurial ability seize the opportunities of making profits from industrial growth that causes increase in income inequalities. However, it has been a general view among the economists that benefits of growth will ultimately trickle down to the poor working class in the form of more employment and higher wages, especially when the labour is organised into trade unions.

But, as emphasized by Prof. Debraj Ray, in many developing countries labour is initially in surplus so that wages do not rise right away and laws that protect labour are either absent or difficult to implement. However, it has been a general belief among economists that with the passage of time, rise in wages will ultimately eat into profits and lower the share of profits. This will therefore eventually bring about greater equality in income distribution. It was therefore claimed that inequality in the present- day developed countries was less as compared to developing countries.

Conclusion:

ADVERTISEMENTS:

Kuznets’ inverted U – hypothesis suggests that in the growth process inequality first rises and then decline. The various factors and arguments have been advanced in favour of inverted U-hypotheses. However, as pointed out above, in case of East Asian countries such as Japan, South Korea, Taiwan, Thailand, Singapore where, contrary to Kuznets’ inverted U-hypothesis, economic growth has resulted in the reduction in income inequality.

This is because the effect of economic growth on income distribution has been influenced by economic policies pursued in these countries. For example, in countries of South Korea, Japan, Taiwan and other East Asian countries there had been redistribution of land and also other interventions by government in influencing economic activities that growth process worked to lower inequality in income distribution.

In our view, there is no single path of growth which first increases inequality and then decreases it and much depends on the character of growth and policies followed by the governments of countries in the growth process. Many factors and policies influence growth and income distribution and the view that each country must travel through the inverted U- hypothesis is quite unwarranted.