The below mentioned article provides a close view on the Joan Robinson’s model of growth.

Subject Matter:

Mrs. Joan Robinson has given her model of growth in her classic book.

‘The Accumulation of Capital’ in 1956. Joan Robinson’s model clearly takes the problem of population growth in a developing economy and analyses the influence of population on the role of capital accumulation and growth of output.

In words of Prof. Mathew, The relation between distribution and growth in this model arises partly from the mutual interdependence of the rate of profit and the pace of capital accumulation and partly from the effect of distribution of income on the proportion of income saved.

ADVERTISEMENTS:

The two fundamental propositions of the model are as under:

1. The capital formation depends on the manner of distribution of income.

2. The rate at which labour is utilized depends upon the supply of capital and that of labour.

Assumptions:

1. Labour and capital are the only productive factors. It implies that the national output is the result of combined efforts of these two factors of production.

ADVERTISEMENTS:

2. The economy is assumed to be closed i.e., there is no foreign trade.

3. Total wage bill is the product of real wage rate and number of workers.

4. Total income is divided between capital and labour as these are the two factors of production.

5. The production is not affected by the technological changes i.e. there is no progress in technology.

ADVERTISEMENTS:

6. Total profit is the product of profit rate and amount of capital invested.

7. There is constancy in price level.

8. Wage earners spend all of their wage income on consumption, while profit takers save and invest all of their profit income.

9. Capital and labour are combined in a fixed proportion for a given output.

10. The national income is the sum of wage bill and total profits.

11. There is no scarcity of labour and entrepreneurs can employ as much labour as they wish.

12. Entrepreneurs consume nothing but save and invest their entire income for capital formation. If they have no profits, there is no accumulation and if they do not accumulate, they have no profits.

Open Model:

In an open economy, the conditions for the steady growth and conditions for rising rate of capital accumulation will be discussed. According to Mrs. Joan Robinson, national income is the sum of the total wage bill and total profit. Total wage bill is the real wage multiplied by the number of workers and total profits are equal to profit rate multiplied by the amount of capital.

This relationship can be expressed as under:

ADVERTISEMENTS:

PY = WN + πPK

Where P — Average Price level.

Y— Net national income.

W — Net money wage rate.

ADVERTISEMENTS:

N— Amount of labour employed.

K— Amount of capital invested.

π — Rate of profit.

To convert the expression into real terms, divide both sides of equation by p (average price level), we get

ADVERTISEMENTS:

ADVERTISEMENTS:

Where ρ Y/N i. e Labour/ Productivity, W/P real wage rate

ADVERTISEMENTS:

θ = K/N i.e., Capital Labour Ratio

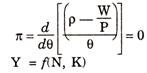

The above equation indicates that the profit rate is a function of labour productivity (p) and real wage rate (W/P) and capital labour ratio (8). In other words, the profit rate is shown as capable of varying directly with the rate of net return to capital and inversely with the coefficient of capital intensity. The necessary condition for maximization is that the first derivative must be zero.

ADVERTISEMENTS:

Keynesian income expenditure analysis shows that the net national real income (Y) is the sum of real consumption expenditure (C) and real net investment which can be expressed as;

Y = C + I

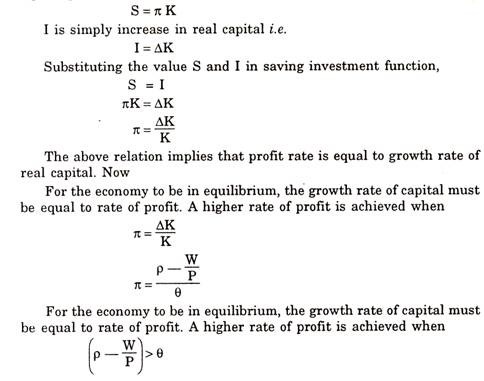

Now we know that labour spends its entire income and saves nothing. The profit earning class makes saving in the form of profit. According to Mrs. Robinson, savings must be equal to total profits. Thus, savings in a given period are equal to capital investment multiplied by rate of profit.

ADVERTISEMENTS:

The above equation illustrates that the rate of growth of capital is capable of increasing if the net returns to capital rise in greater proportion than the capital-labour ratio and vice-versa. In other words, lower rate of profit always affects the supply of capital adversely which in turn widens the gap between supply of capital and labour. The main feature of the model is that the rate of growth of capital is dependent on profit rate.

Closed Model:

In a closed economy, the concepts of Golden age and Platinum age are to be discussed. In simple words, Golden age is a situation of smooth steady growth with full employment arising out of the equality of the ‘Desired’ and ‘Possible’ rates of accumulation and has been designated by Mrs. Joan Robinson as the Golden age equilibrium.

However, if an increase in labour supply is not accompanied by proportionate increase in the capital supply, then it will cause unemployment in the economy. To achieve full employment of labour the growth rate of population must be equal to growth rate of capital i.e.

∆N/N = ∆K/K

When the rate of growth of labour and capital are equal to each other, then there is full utilisation of capital in the economy. Such a switch on is called Golden age. The existence of Golden age is the indicator of full employment level.

The concept of Golden age implies that there must be equality in actual, warranted and natural growth rates.

In short, in Mrs. Robinson Joan’s words, when technical progress is neutral and proceeding steady, without any change in the time pattern of production, the competitive mechanism works freely, population grows (if at all) at a steady rate and accumulation goes on fast enough to supply productive capacity for all available labour, the rate of profit tends to be constant and the level of real wages rises with output per head.

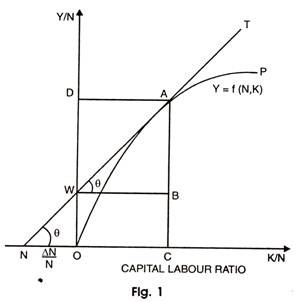

Then there are no internal contradictions in the system, we may describe these conditions as a Golden age (thus indicating that it represents a mythical state of affairs not likely to obtain in any actual economy). This is explained with the help of a diagram 1.

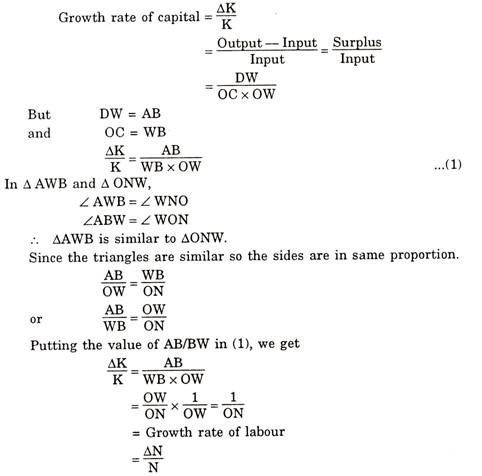

In the figure 1, capital labour ratio is illustrated along positive direction of X-axis and wage rate of labour on Y-axis and the growth rate of labour on negative side of X-axis. The production function is represented by OP. Each point on this curve shows the proportion in which capital and labour are combined to produce a particular level of output.

Tangent NT touches the curve OP at A and intersects Y-axis at W. At point A capital labour ratio is OC, the productivity of labour is OD and out of which OW is the wage rate. The surplus DW is rate of return to capital.

The point A shows the position of equilibrium because the slope of tangent NT and the slope of production curve OP is the same. It can also be said that at A, the growth rate of capital ∆K/K is equal to growth rate of labour ∆N/N.

State of Disequilibrium:

The economy will possess any equilibrium mechanism if and when it diverges from Golden age equilibrium for some reason.

There are two possibilities of divergence:

(i) ∆N/N˃ ∆K/K

(ii) ∆K/K ˃ ∆K/ A

1. The first possibility (i.e., ∆N/N ˃ ∆K/ K) shows that the growth rate of population is greater than growth rate of capital. This type of situation occurs in underdeveloped countries. Mrs. Robinson is of the view that it is the ‘profit wage relation’ which pushes the economy back on the path of Golden age. The excess of labour supply would depress the money wage rate and if the prices remain constant, the real wages would fall.

This fall in real wages would increase the level of profit, which in turn would stimulate the growth of capital. The increase in the growth rate is unable to fulfil the labour supply of population. When the parity between the two growth rates are restored, then the economy would be on Golden age.

On the other hand, if real wages do not fall because of subsistence wage floor or if the general price level does not fall in same proportion as money wage rate, it would be difficult to restore the position of Golden age and it will lead to under employment.

2. The second possibility comes out as the economy is in the disequilibrium and can be expressed as ∆N/N ˂ ∆K/K Under the situation, the growth rate of population is less as compared to growth rate of capital. This type of situation occurs in developed countries. The possibility of advanced countries returning to the path of Golden age equilibrium is greater than that of underdeveloped economies.

This is due to the fact that developed countries can move to higher production curve through the technological improvement. The higher production curve will lead to higher capital labour ratio. Thus, the equality between growth rate of capital and growth rate of labour is a pre-requisite for achieving the Golden age.

Types of Golden Age:

Mrs. Joan Robinson in her book ‘Essays in the Theory of Economic Growth’ gives various types of Golden age as discussed below:

1. A Limping Golden Age:

In this age, the steady rate of accumulation of capital takes place below full employment or the growth rate of capital stock is less than the growth of labour force. The limping Golden age can be well compared with the concept of underemployment equilibrium as it arises due to the deficiency of capital as given by Lord Keynes. The limp in Golden age may be of various degrees.

The intensity of limp depends upon fall or rise in employability and the labour force. The limp is said to be severe if the actual growth of output is less than the required rate of output per head. The continuous decline in the level of employment is an indicator of severity of limp which, in turn, may lead to the problem of inflation and unemployment.

On the other hand, when the limp is of moderate degree, the actual level of output would be rising faster than required rate of output per head i.e. if the employment increases faster than labour force, the economy would be heading towards full employment.

2. A Restrained Golden Age:

It is the situation where actual growth rate of capital is lower than the desired growth rate. This is due to the operation of certain bottlenecks as of high rate of interest and rationing of credit. During this period, firms cannot maintain the high rate of growth despite the technical progress in the economy. Mrs. Joan Robinson coined it Restrained Golden Age.

This situation is impossible. In her own words, with a stock of plant appropriate to the desired rate of accumulation which exceeds the rate of growth of population and full employment already attained, the desired rate of accumulation cannot be realised because the rate of growth of output per head (even with the stimulus of scarcity of labour) is not sufficient to make it possible.

Therefore, in a Restrained Golden age, proportion of unemployment is rising due to insufficient rate of accumulation, standard of workers falls unless real wage for employed workers is not rising sufficiently or opportunities for self employment are not sufficiently favoured.

The desired rate of accumulation cannot be realized due to the fact that when the firm desires to employ more labour than the existing labour force, this results in rise in money wages and price which further giving rise to the demand for credit to finance production. Thus, it pushes up the rate of investment to such a point at which investment is checked.

On the other side, the demand for labour is prevented from exceeding the available supply. If growth rate is kept down with a reserved unemployed force, the system could be said to be in a state of equilibrium. Thus, any relaxation of credit would encourage to increase the stock and employment of more and more workers which means the invitation to inflation which is quite uncontrollable.

Thus, financial control restrained by Golden Age cannot possess short period stability. In the case of scarcity of labour, firms may refrain from bidding up wage rates and attracting labourers from outside. In this situation, firms cannot get desired rate of profit.

It may also happen that they may continue to build up the production capacity in a hope of getting workers but productivity capacity remains under utilized. This under utilization may reduce the rate of profit on capital. Thus, short-period stability cannot prevail.

This makes clear that with the availability of capital and labour, it would be difficult to achieve the desired rate of growth due to the existence of market imperfections which act as a major constraint in the economy.

3. A Bastard Golden Age:

Prof. R.F. Kahn, originally used the term ‘Bastard Golden Age’. It is the age where unemployment prevails but real wages remain rigid downwards. As a result, the rate of accumulation cannot increase in the absence of technical progress. Therefore, the Bastard Golden Age implies that stock of capital equipment does not grow faster because of inflation barrier.

This barrier puts a limit to the growth rate of capital accumulation which leads to unemployment. The unemployment will continue till the wage rate does not fall below a particular level. Hence, a situation in which the rate of capital accumulation is low due to the threat of rising money wages an account of rise in prices, may be called as Bastard Golden Age.

A Bastard Golden Age may be of two types—High level and Low level.

A high level bastard age is one which steps in at a fairly high level of real wages when organised labour stalls the efforts to reduce the real wage rate.

In such a situation, the rate of accumulation is limited by the inflation barrier. A low level bastard age steps in when the real wage rate is at the minimum level. The minimum standard of life sets a limit to the rate of accumulation. The Bastard Golden Age exists in those countries where there is a large surplus of labour.

Types of Platinum Age:

In the platinum age, the growth rate of output and employment are given from outside and technical advance is zero. Thus, in platinum age, the development parameters are considered to be rigid. The steady growth cannot occur in initial stages due to rigidity of development parameters.

Various types of platinum ages are discussed below:

1. Bastard Platinum Age:

The Bastard Platinum Age resembles to Bastard Golden age. This is a situation when the rate of accumulation is increasing and real wages remain constant even in the face of technical progress. Therefore, acceleration of accumulation takes place without inflation.

This type of situation occurs in underdeveloped countries where the available capital is inadequate to provide employment to unemployed force. In other words, it implies that manpower exceeds the material power.

For making proper utilization of manpower, the underdeveloped countries should adopt appropriate development strategy. This age lies at the heart of the development strategy of the underdeveloped economies. It is, therefore, necessary for underdeveloped countries to pay more attention to this type of growth.

2. Galloping Platinum Age:

It reflects the case of an economy experiencing a rising rate of profit and rising capital intensity of production but unemployment still prevails. In this age, the rate of capital accumulation accelerates rapidly from low level to high level. The rate of profit rises as the real wage rate falls.

As a result, less mechanised methods of production are chosen at each round of investment to increase the employment at a faster rate. It is also known as Forward platinum age.

3. Creeping Platinum Age:

This age begins with full employment situation where the rates of accumulation and profit are very high and techniques of low capital intensity are being installed. The consequent fall in the rate of profit will bring down the desired rate of accumulation.

As the rate of profit falls, more mechanised techniques will be chosen at each round of investment. This process will continue until the rate of accumulation comes down approximately equals the rate of growth of labour force.

The path followed by the model “resembles the path through logical time of an equilibrium model with a decelerating rate of accumulation, falling rate of profit, falling marginal efficiency of investment and rising real wage rate, approaching asymptotically to a stationary state.”

4. Trotting Platinum Age:

In trotting platinum age, growth rate of capital accumulation neither accelerates nor decelerates but it is steady. This type of platinum age is mostly suitable to the underdeveloped countries as their sole aim is to attain the growth with stability.

To conclude the concept of Golden age in the words of Prof. Joan Robinson, it is said “In Golden age, the initial conditions are appropriate to steady growth. In true and limping Golden ages, the actual realization growth rate is limited only by the desired rate. In a restrained Golden age, the realised growth rate is limited by the possible rate and kept down to it. In a Golden age, the possible rate is held down by realised rate.

In a bastard Golden age, the possible rate is limited in a different way i.e., by real wages at the tolerable minimum. Both in a limping Golden age and a bastard Golden age, the stock of capital in existence at any moment is less than sufficient to offer employment to all available labour.

In the limping Golden age, the stock of equipment is not growing faster for lack of animal spirits. In the bastard age, it is not growing faster because it is blocked by inflation barrier. In platinum ages, the initial conditions do not permit steady growth and the rate of accumulation is accelerating or decelerating as the case may be.”

Desired Rate of Accumulation:

Mrs. Robinson established a relation between the desired rate of accumulation and possible rate of accumulation.

The desired rate of accumulation which would make the firms feel satisfied with economic conjecture in which they find themselves. It is necessary to know the relation between “the rate of profit caused by the rate of accumulation and the rate of accumulation which the rate of profit will induce”. This relation is explained with the help of a diagram 2.

The curve A gives the rate of profit as a function of the rate of accumulation that gives rise to it. The curve 2 shows the rate of accumulation as a function of rate of profit that induces it. The two curves intersect at point P and Q. When the firms operate in the region lying to the right of the point P, the rate of accumulation exceeds the rate of profit.

Such a situation may rise when the ratio of basic and commodity sector S is high. In the immediate future, this ratio is likely to fall and consequently the rate of accumulation will fall. If the firms are operating in the region bounded by points P and Q, they try to step up the rate of accumulation.

This situation occurs when the ratio of machinery between the capital goods sector and consumer goods sector happens to be low with the result that it would increase the rate of accumulation. Similarly, the lower point of intersection of I and A, point Q is indeed a crucial point. This is the desired rate of accumulation.

It is desired in the sense that the firms feel contended in the situation in which they find themselves. Here, we must remember that desired rate of accumulation is analogous to Harrod’s warranted rate of growth.

Applicability to Underdeveloped Countries:

This model deals with the problem of population and its effect on rate of capital accumulation in a developing economy. There is Golden age which any country can witness through planned economic development. The main problem of an underdeveloped country is that the rate of population growth is faster than capital growth i.e. ∆N/ N ˃ ∆K/K.

This results in the under-employment. In underdeveloped country, we need a growth theory which is based on only practical ideas and techniques which could be operative in their present socio-economic environment. The process of economic growth in underdeveloped country without changing the price level would simply be a blind man’s buff. Therefore, some rise in price level is necessary.

The model of Joan Robinson is dictum against ‘Capitalist rules of the game’.

Prof. K.K. Kurihara who opines that “Joan Robinson’s discussion of capital growth has subtle effect of discrediting the whole idea of leaving so important a problem as economic growth to capitalist rules of the game for her model of Laissez faire growth demonstrates how precarious and insecure it is to entrust to private profit makers the paramount task of achieving the stable growth of economy consistent with the needs of a growing population and possibility of advancing technology.”

This model brings out cogently that the main problem to achieve steady growth depends upon population growth and capital accumulation.

The ‘potential growth ratio’ is crucial to Mrs. J. Robinson theory of economic growth. The Golden age depends upon growth ratio. The planning process becomes easier if the potential growth ratio of the economy is calculated for such period on the basis of the growth rate of labour force and of output per head.

The chief hurdle in the path of capital accumulation is population growth. When the rate of growth of population is above the rate of capital formation it leads to progressive unemployment. Thus, the plan can be made more realistic and executed more efficiently to achieve the desired goals.

Furthermore, it suggests to take initiative in controlling not the private investment but also public investment in under developed countries. In this way, Mrs. Joan Robinson hints at the adoption of the Keynesian technique of the mixed public private economy to gear the autonomous investment with the help of fiscal and monetary policies.

Relationship of Robinson’s Model to Harrod’s and Domar’s Models:

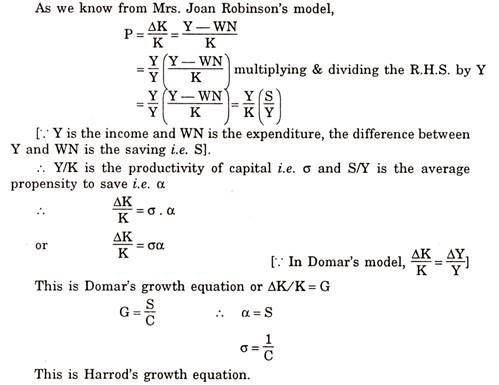

Prof. K.K. Kurihara presents relationship between the models of Harrod-Domar in mathematical symbols.

Similarities:

The above stated relationship exhibits that the two models are similar in natural and provides the same results i.e. the growth rate of the economy is determined by the saving income ratios and the productivity of capital. Moreover both models postulate the fixed capital co-efficient and technical neutrality.

Dis-Similarities:

Inspite of the fact these two models are same, yet their approaches to the problem of economic growth widely differ.

The points of differences are noted below:

1. In Harrod-Domar model, capital accumulation is determined by the saving income ratio and capital productivity. But, Robinson distinctly links capital accumulation with the profit wage relation and labour productivity

2. In Harrod-Domar, model, the prime mobile of capital accumulation is capital itself while in Mrs. Joan Robinson’s case, it is the labour. The latter is more realistic for labour is the ultimate source of capital.

3. In Harrod-Domar approach, growth is possible through trade cycle while Mrs. Joan Robinson, on the contrary neglected the explanation of trade cycle.

4. Harrod-Domar has more relevancy in the capital rich economies and Mrs. Robinson’s model has relevance in the capital-poor economies.

Critical Evaluation:

Mrs. Joan Robinson presents an interesting classification of growth process. This model seems to provide more realistic analysis of the problem of economic development in under developed countries.

In Harrod-Domar model, the capital accumulation depends upon saving ratio and capital productivity but in Robinson Model, it depends upon the profit wage relation and labour productivity bringing her theory closer to a real market economy.

The idea of Golden age lays stress on the parity between the growth rate of capital and growth rate of population. This difference between two growth rates is necessary for underdeveloped countries striving to achieve development with stability. Despite of many merits, the model is not free from flaws.

Some of these weak points are summarised below:

1. Neglects Institutional Transformation,

2. Constant Price Level,

3. Closed Economy,

4. Unrealistic Assumptions,

5. Neutrality to Policy Implications,

6. Role of Human Capital ignored,

7. Low Rate of Capital Accumulation in relation to Potential Growth,

8. No Role of State, and

9. No Technical Progress.

1. Neglects Institutional Transformation:

This model ignores institutional transformations for promoting savings.

The capital accumulation among other things implies:

(a) An increase in the volume of savings

(b) Finance and credit mechanism

(c) Act of investment

(d) Pattern of investment involving the use of capital

(e) Changing technology. But these factors find no place in the model.

The development of an economy depends upon social, cultural and institutional changes to a greater extent.

2. Constant Price Level:

This model is based on the unrealistic assumption of constant price level. The investment has to be increased continuously which tends to raise the demand for factors but their supply cannot be increased to meet the demand. This results in increase in prices which is a contradiction.

3. Closed Economy:

The model is based on the closed economy but this is unreal because underdeveloped countries are open rather than closed economies in which foreign trade and aid play creditable role in increasing the growth rate.

4. Unrealistic Assumptions:

Another weakness of the model is that it is based on certain assumptions which do not hold good in the present era. The technical neutrality does not fit in the dynamic process of growth. Growth model becomes irrelevant if factors like these are taken to be neutral.

The assumption of closed economy Laissez faire, free market system, price stability and neglect of institutional forces are all unrealistic, and this makes the economy static. Static economy and economic development cannot go side by side.

5. Neutrality to Policy Implications:

It does not suggest any fiscal or monetary policy for economic development. Prof. K.K. Kurihara is of the opinion that Mrs. Robinson’s model is not capable to introduce fiscal and monetary policy parameters. Prof. V.B. Singh has observed.

“That the critical deficiency of this model consists in its neutrality to the important policy implications in economic development.” The crux of the discussion is that this model fails to consider fiscal or monetary parameters without which theory of development remains more or less incomplete.

6. Role of Human Capital Ignored:

This model lays more emphasis on material capital but ignores the role of human capital. The essential ingredients of capital are education and technical training. Marx emphasised the role of labour productivity in the accumulation of capital. Mc Cullach included, The dexterity skill the accumulation of capital. Further, he says, the dexterity skill and intelligence of labour in his concept of capital.

The contemporary development writes subscribe to this approach by including, “investment in human capital” in their development theories. Human capital means investment in education, health, sanitation and nutrition etc. This model gives an explanation for economic development because it emphasizes the accumulation of physical capital while neglects the role of human capital.

7. Low Rate of Capital Accumulation in Relation to Potential Growth:

Generally underdeveloped countries are backward due to shortage of capital accumulation than potential growth ratio and have surplus labour force. In this regard Prof. K. Kurihara has rightly mentioned, “Joan Robinson’s discussion of capital growth has the subtle effect of discrediting the whole idea of leaving so important a problem as economic growth to the capitalist rule of the game, for her model of Laissez-faire growth demonstrates how precarious and insecure it is to entrust to provide profit makes the paramount task of achieving the stable growth of an economy consistent with the needs of a growing population and the possibility of advancing technology.”

8. No Role of State:

In Mrs. Joan Robinson’s model, the role of state has been left out of picture. In the present world, it is precarious to rely solely on the private entrepreneurs for attaining the stable growth in them with the requirements of a growing population and rapidly changing technology.

9. No Technical Progress:

According to the model, there is no technical progress. But in a dynamic setting where technical progress is inherent, technical co-efficient of production can no longer remain fixed.