The third significant stage of growth is the stage of take-off.

The period of this stage is 20 to 30 years during which the economy development process is automatic and the economy becomes self-reliant.

Self-reliance, means that the economy can develop without external assistance. New Industries are set up which start generating savings due to which investment level goes up, which in turn helps in raising national income.

“Take-off is an industrial revolution, tied directly to radical changes in methods of production, having their decisive consequences over a relatively short period of time”-Rostow.

Once the economy enters into self-generating growth, then economic forces accelerate the process of economic development. The self-reliant growth is also known as take off, an initial push, a big push, a critical minimum effort, a great lead forward. All the concepts mean that economic growth starts with a bang, and not with a whisper.

ADVERTISEMENTS:

According to Rostow, “Take-off is an industrial revolution, tied directly to radical changes in methods of production, having their decisive consequences over a relatively short period of time.” It is also called ‘a great watershed in the life of modern societies.’

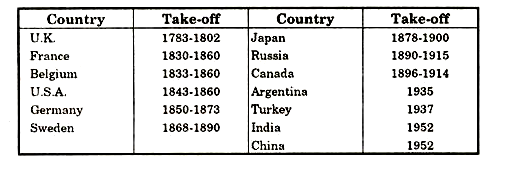

In the following table, we find tentative take off years of different countries given by Rostow:

Conditions for Take-off:

ADVERTISEMENTS:

Rostow had suggested the following three related conditions for making the growth process self-sustained:

1. A rise in the rate of productive investment from about 5 per cent or less to over 10 per cent of national income or net national product.

2. The development of the one or more substantial manufacturing sectors, with a high rate of growth.

3. The existence or quite emergence of a political, social and institutional framework which exploits the impulses to expansion in modern sector and gives growth an on-going character.

ADVERTISEMENTS:

Rate of Investment:

The self-sustained growth requires a high level of investment in an economy. Rostow has suggested that the rate of net investment should be over 10 per cent of national income, if an economy is to enter the stage of self propelling growth.

The growth in the national output should outstrip the growth of population because it is only under this condition that a growth in per capita income can be “achieved. If the capital rate is assumed to be 3. 5 : 1 and if population growth rate is 1 to 1.5 per cent per annum then at least 10.5 to 12.5 per cent of the net national product must be invested regularly in order to achieve 2 per cent growth of per capita income. On the basis of these assumptions, Prof. Rostow concludes that for take off it is necessary that the rate of investment in the economy must rise from 5 per cent of national income to 10 per cent or more.

Thus, the perpetuation of growth requires that a investment to real income during the take off period” be returned to productive investment. An adequate supply of loanable funds is essential for raising the rate of investment in the economy. These funds may come through the mobilization of domestic savings or through the import of capital.

For attaining adequate finance for take off it is necessary that:

(a) The community’s surplus over consumption does not flow into the hands of those who will utilize it by hoarding, luxury consumption or low productivity investment out-lays;

(b) Institution for providing cheap and adequate working capital be developed;

(c) One or more sectors of the economy must grow rapidly and the entrepreneurs in these sectors must plough back a substantial portion of their profits to productive investment; and

(d) Foreign capital can profitably be utilized for building up social and economic overheads.

ADVERTISEMENTS:

Development of Leading Sectors:

Another condition for take-off is the development of one or more leading sectors in the economy, Rostow regards the development of leading sector as the ‘analytical bone structure’ of the stages of economic growth. There are generally three sectors of the economy.

(a) Primary Growth Sector:

According to Rostow, “primary growth sectors are those where possibilities for innovation or the exploration of newly profitable avenues or hitherto unexplored resources yield a high growth rate and set in motion expansionary forces elsewhere in the economy.” Such sectors initiate and stimulate growth in other sectors till the growth process becomes self sustained. The development of cotton textile industries in Britain during the 18th century provided necessary momentum for the development of other sectors of the British economy.

ADVERTISEMENTS:

(b) Supplementary Growth Sector:

Rostow explains that supplementary growth sectors are those “where rapid advance occurs in direct response to or as a requirement of advance in the primary growth sectors.” These sectors develop as a consequence of the development of primary growth sectors. In this sector, those industries are included whose development supplements the growth initiated by primary sector. For example, in England, the development of cotton textile industries led to the development of coal, iron and engineering industries. These industries are regarded as supplementary growth sectors.

(c) Derived Growth Sector:

Rostow opines that “derived growth sectors are those where advance occurs in some fairly steady relation to the growth of total real income, population, industrial production or some other overall modestly increasing variable.” Growth of population and industrial workers require increase in agricultural output, development of industrial colonies, expansion of transport and other social overhead capital.

ADVERTISEMENTS:

Agriculture, industrial housing and transport etc. are included in derived growth sectors. In a growing economy, forward momentum is maintained as a result of rapid expansion in a ‘limited number of primary sectors whose expansion has significant external economy and other secondary effects’. Rapid growth on one or more manufacturing sectors is a powerful engine of economic growth.

Historically, the leading sectors have varied from cotton textiles, heavy industry complexes based on rail, road and military requirements to timber cutting, dairy products and finally a wide variety of consumer goods.

No single sector provides a key to rapid economic development but the following conditions are necessary for economic development:

(i) There must be an increase in the effective demand of their products generally brought about by discarding, reducing consumption, importing capital or by a sharp increase in real incomes.

(ii) A new production function along with an expansion of capacity with sufficient capital must be introduced in these sectors.

(iii) There must be sufficient capital and investment profits for the take off in these lending sectors.

ADVERTISEMENTS:

(iv) The leading sectors must introduce expansion of output in other sectors through technical transformations.

Cultural Frame-work that exploits Expansion:

The last condition for take-off stage is that the cultural framework should be such that it may contribute to development of modern sectors. For that, efforts should be made to increase savings to boost investment. It in turn, would raise the demand of the products of leading sectors. Besides, the people should have the will to develop.

The social and religious structure of the economy should be such which may induce Y’ development. Dogmatic ideology — should be replaced by new ideology so as to accelerate the pace of economic development.

The take-off stage can be explained with the help of a diagram:

In this diagram, on the X axis net national product and on the Y-axis savings, net investment and capital has been taken. OS is the saving schedule K0O0 and k1q1 are the capital-output ratios which are sloping downward. This has been done with a view to simplify the figure. Since the capital output ratio is being taken as constant, so K0Q0 and K1Q1 are parallel to each Other, i.e., OK0/OQ0 = OK1/OQ1– AQ0/Q0 Q1 is the marginal capital-output ratio.

ADVERTISEMENTS:

Initially, the society has a very flat curve and very steep capital output curve in the pre-take-off stage. It shows low savings and high capital-output ratio. In the zero time period Q0I0 is the net investment which raises the capital stock which becomes productive in period one to raise net national product to OQ1. In take off stage when investment is OI1 or BQ1, it will stimulate productive capital which would reduce capital-output ratio to BQ1/ Q1Q2.

This will bring change in the pattern of investment and the capital-output ratio curve would fall and it would become flatter. In this case, it is BQ2. Net national product rises to OQ2 which boosts investment to QI2 or CQ2. This way, the economy has taken-off. If the process continue, then it will become self-sustained.

Characteristics of Take-off stage:

The basic characteristics of the stage of take-off are stated below:

(i) Ploughing back of Profits:

In the economy, one or more sectors should grow at a rapid rate. The producers in such sectors should plough back their profits for productive purposes.

ADVERTISEMENTS:

(ii) Use of Savings for Investment:

The savings done by the community is invested in productive channels.

(iii) Development of Financial Institutions:

The financial institutions are be developed with a view to mobilize savings. These institutions have not only to raise facility to save but also to induce savers and then to use these resources in the most productive uses.

(iv) To raise Demand for Domestic Products:

In an economy, output would increase if there is increase in the demand for consumer goods. This would happen if income is redistributed in favour of those who do not hoard but either spend or invest.

ADVERTISEMENTS:

(v) External Resources:

No country in the world can develop in isolation, rather it develops with collaboration. Most of the advanced countries of today have developed to a greater extent through foreign capital say U.S.A., Canada, Sweden etc. The under developed countries cannot be an exception. These countries have also to depend on foreign investment to expand social overheads like roads, railway, irrigation, hydel/thermal plants etc.

(vi) Technological Advancement:

In the modern times, agriculture is not a subsistence sector rather it has become a commercial sector. This has necessitated the importance of technology. When agriculture and industry receive technical changes, there is further development of these sectors because these are complementary with each other. Thus, development techniques are widely adopted in this stage.

(vii) Foreign Trade:

Foreign trade also contributes to raise the rate of investment in take off stage. Exports of minerals and other natural resources products are increased and the revenue is spent on the import of plant and equipment.

(viii) Government Policy:

Government Policy in take off stage also becomes conducive to economic growth. The Government helps technological research and training for improved production methods. New entrepreneurs are encouraged. Investment is promoted.

(ix) Period is Short:

The period of take-off stage is generally short, lasting for about two or three decades.

(x) Economic Revolution:

It is a phase of economic evolution in which an economy holds self-sustaining and self-generating economic growth.