The working of price mechanism can be studied under three types of economic system:

(a) Price Mechanism in a Free Economy.

(b) Price Mechanism in a Socialistic Economy.

(c) Price Mechanism in a Mixed Economy.

A. Price Mechanism in a Free or Capital Economy:

The price mechanism works through supply and demand of goods and services in competitive markets. In turn, prices are determined. Prices determine the production of innumerable goods and services. They organize production and help in the distribution of goods and services ration out the supply of goods and provide for economic growth.

ADVERTISEMENTS:

It works as under:

1. What and How Much to Produce:

The main function of prices is to resolve the problems of what to produce and in what quantities. This involves allocation of scarce resources in relation to the composition of total output in the economy. As resources are scarce, the society has to decide about the goods to be produced: wheat, cloth, roads, television, power, buildings, and so on. Once the nature of goods to be produced is decided, then their quantities are to be decided.

How many kilos of wheat, how many million metres of cloth, how many kilometers of roads, how many televisions, how many million kw of power, etc. Thus, the problem of the nature of goods and their quantities has to be decided on the basis of priorities or preferences of the society. If the society gives priority to the production of more consumer goods now, it will have less in the future. A higher priority on capital goods implies less consumer goods now and more in the future.

ADVERTISEMENTS:

This fact can be explained with the help of the production possibility curve, as shown in Figure 3. Let us suppose the economy produces capital goods and consumer goods. In deciding the total output of the economy, the society has to choose that combination of capital and consumer goods which is in keeping with its resources.

It cannot choose the combination R which is inside the production possibility curve PP because it reflects economic inefficiency of the system in the form of unemployment of resources. Nor can it choose the combination K which is outside the current production possibilities of the society; the society lacks the resources to produce this combination of capital and consumer goods.

It will have, therefore, to choose among the combinations B, C or D which provides highest level of satisfaction. If the society decides to have more capital goods, it will choose combination B; and if it wants more consumer goods, it will choose combination D.

Thus, selection depends on the following factors:

ADVERTISEMENTS:

(i) Consumers have to pick and choose from the vast variety of goods offered to them. The urgency of desire for certain goods means that the consumers are prepared to pay a large sum of money and higher prices. It implies larger profits for producers producing these commodities.

If consumers desire goods less urgently, it means their reluctance to spend more on them and they offer lower prices. Expecting a decline in profits, producers also bring smaller quantities of their products in the market.

(ii) When producers increase the supply of commodity without any regard to the wishes of the consumers, it will have a low value in their estimation and the lower will be its price. A small supply, on the other hand, increases the prestige of the commodity in ‘the minds of consumers and they pay a higher price for it. Thus, the different prices which consumers pay for various commodities and services reflect their comparative values to them.

(iii) Prices also change with consumer’s tastes and preferences. Consumers register their preferences towards commodities by paying more for them and their distaste by offering less. If consumers show preference for auto-rickshaws and taxis in place of cycle- rickshaws and tongas, they offer lower prices for the latter.

Some of the persons engaged in the latter trades will seek other occupations or may even start plying auto-rickshaws and taxis. Therefore, consumers’ tastes and preferences are also reflected in the prices of goods and services.

(iv) A change in the price of a commodity acts as a beacon light and a warning signal to the producer and the consumer. If the price of a commodity rises, it warns the consumers to buy less of it and at the same time it encourages the producer to produce more of it.

High price and prospects of larger profits attract new producers into the industry in the long run. Resource owners also shift their resources to this high priced industry. Thus when all firms in the industry produce more, supply increases more than the demand and the price may tend to fall.

On the contrary, the withdrawal of resources from the low-priced commodity brings a fall in its output. But the shifting of consumer- demand towards it tends to raise its price in the long-run. This tendency continues till both the commodities are equally priced and offer the same profits to producers in the two industries.

ADVERTISEMENTS:

(v) If the price of a commodity falls, it is a warning to the producers and consumers. Low price and low profits will induce producers to shift resources away from this industry to the high-priced industry. This long-run tendency will reduce supply and the demand will increase. As a result, price tends to rise. On the other hand, supply increases in the high-priced industry as a result of shifting of resources into it. Demand being less, price tends to fall.

(vi) As the consumer is the sovereign, he sets the price and producers manufacture those commodities which he wants more. The more the producers produce, the larger the profits they earn and so do the resource owners.

The fate of the producer is sealed if the consumer has no liking for his product and sets a low price. The producer, thus, reacts when the consumer acts and resource allocation takes place along with the production of goods.

2. How to Produce:

The next task of prices is to determine the techniques to be used for the production of articles. Prices of factor services are the rewards received by them. Wage is price for the service of labour, rent is the price for the service of land, interest for the service of capital and profit for the service of entrepreneur. Thus wages, rent, interest and profit are the prices paid by the entrepreneur for the services of the factors of production which make up the costs of production.

ADVERTISEMENTS:

Every producer aims at using the most efficient productive process. An economically efficient production process is one which produces goods with the minimum of costs. Thus, the choice of a production process will depend upon the relative prices of the factor services and the quantity of goods to be produced. A producer uses expensive factor services in smaller quantities relative to cheap resources. In order to reduce costs of production he substitutes cheaper resources for the dearer. If capital is relatively cheaper than labour, the producer will use a capital-intensive production techniques. If labour is relatively cheaper than capital, labour-intensive production processes will be used.

In less developed countries where labour is cheap, techniques involving more labour contribute to least costs; while in developing economies where labour is relatively expensive, a capital- using and labour-saving techniques combine efficiency with minimum costs. Since one price for a single commodity prevails in a free enterprise economy, only economically efficient producers can continue in the industry. Those who are incapable of paying factors their minimum rewards (prices) will either close down or shift to the manufacture of some other commodity.

3. To Determine Income Distribution:

Another function of prices is to determine the distribution of income. In a free enterprise economy product-distribution and income-distribution are interdependent. It is a system of mutual exchanges where the producers and consumers are largely the same people. The owners of factors sell their services for money and then spend that money to buy the goods produced by factor services. Producers sell goods and services to consumers for money and consumers receive income as owners of factor services. Thus income flows from owners of resources (consumers) to producers and back to consumers again.

Prices play an important role in this income flow. When the consumers buy commodities, it is their cost of living. When producers sell commodities, it is their business receipts. What consumers receive as owners of factor-services, it is their personal income and when producers pay for factor-services, it is the cost of production.

ADVERTISEMENTS:

It means that the income of an individual depends upon the amount of resources owned by him and the evaluation of his resources in the minds of consumers. People owning large quantities of resources have high incomes and/or they contribute more to the making of commodities which satisfy the consumers much.

People owning small quantities of resources have low incomes and/or they contribute little to the making of commodities which add to consumer satisfaction. Such income differentials are, however, self-correcting. No individual can afford to receive a low income for long. So workers in the low-income category will seek employment in that industry which pays higher wages.

The movement of workers from the lower-paying industry to the higher-paying industry results in the reduction of supply of the former industry and increase in the supply of the latter industry. Reduction in supply raises the price of the product, increases the profits of the producer and the incomes of the workers.

On the contrary, increase in the supply of the other commodity lowers its price, reduces profits as well as the incomes of the workers. This process will continue till income differentials disappear altogether. In this way, prices not only determine income distribution but also brings its equality.

4. To Utilize Resources Fully:

The price mechanism also helps in the full utilization of the resources of an economy. Full utilization of resources implies their full employment. This requires increase in income through large investments, and ultimately to the equality of saving and investment. In a growing economy equality between saving and investment is brought about by reductions in interest rates.

When the economy is nearing the level of full employment by an efficient use of resources, income grows at a rapid rate and so do savings. But investment lags behind which can be raised to the level of savings by interest-rate reductions. Thus the rate of interest acts as an equilibrating mechanism. Therefore, monetary and fiscal measures, and physical controls are also required to influence the decisions of consumers and producers regarding saving and investment.

5. To Provide an Incentive to Growth:

ADVERTISEMENTS:

Lastly, prices are an important factor in providing for economic growth. The impetus for improvement, innovation and development comes through the price mechanism. Higher prices and profits encourage large industrial concerns to spend huge sums on research and experimentation to improve and develop better techniques.

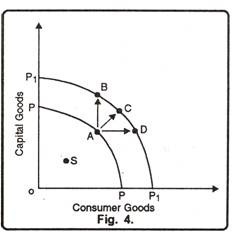

The adaptation of the economic system to change in wants, resources and technologies takes place through prices. If consumers want more of one commodity in preference to the other the price of the former rises. Resources move to that industry. Profits also increase. Larger profits lead to the adoption of superior technology which lowers costs. Larger profits and low costs attract new producers who provide new capital. All this leads to capital formation. No doubt economic growth depends upon a number of other factors, yet prices play an important role in providing for economic growth with stability. This is explained in figure 4.

In this diagram, the economy is stagnant at points inside the production possibility curve PP. For its economic growth, it has to be moved on to point A of the production possibility curve PP whereby the economy produces larger quantities of consumer and capital goods. This is possible through a higher rate of capital formation which consists of replacing existing capital goods with new and more productive ones by adopting more efficient production techniques or through innovations.

More growth leads to the outward shifting of the production possibility curve from PP to P1P1. Point C represents this situation where larger quantities of both consumer and capital goods are produced in the economy. In this way, economic growth enables the economy to have more of both the goods through higher prices, profits and incomes. Thus the price mechanism, working through supply and demand in a free enterprise economy acts as the principal organizing force. It determines what to produce and how much to produce. It determines the rewards of the factor services.

It brings about an equitable distribution of income by causing resources to be allocated in right directions. It works to ration out the existing supplies of goods and services, utilizes the economy’s resources fully and provides the means for economic growth.

Limitations:

ADVERTISEMENTS:

The price mechanism does not operate freely. It acts under certain restraints placed by the government in a free enterprise economy. Moreover, there are the “imperfections of competition” which hinders the working of the price mechanism.

Let us identify these factors as below:

1. The government issues directives to producers to manufacture goods of different types and in fixed quantities which are required to meet the social wants.

2. Even the resource owners are not allowed to act freely. If the government wants the private sector to produce more for the future, then resources will be reallocated towards the capital goods sector. People may also be asked to save more and consume less in the present.

3. The imposition of administrative controls, regulating the supplies of goods, rationing of commodities, issuing of licenses, fixation of quotas, etc. are some of the methods which tend to modify the working of an automatic price system.

4. When the government fixes prices of goods and services of say sugar, cloth, steel, etc., and wages of workers, these act as constraints on the working of the free market mechanism.

ADVERTISEMENTS:

5. Such measures as progressive income and wealth taxes, provision for social security, price support programme, giving of subsidies, credit facilities, etc., also interfere with the working of the price system.

6. Measures aimed at nationalization of social services also tend to modify the price system in favour of fixed economy.

7. The price mechanism functions under the assumptions of perfect competition. But in the real world, competition is no where perfect.

8. The imperfections of competition also lead to the emergence of monopolies which result in wrong pricing, incorrect and wasteful resource allocation and monopoly profits.

9. The price mechanism has increased income inequalities instead of reducing them. This is because supply and demand does not work properly. Production is guided by the demand of the elite and not by the needs of the poor. Resources are, therefore, directed towards producing luxury, goods for the rich. This further leads to mal-distribution of income.

B. Price Mechanism in a Socialist Economy:

The price mechanism has little relevance in a socialist economy as it is regarded as a distinguishing feature of a free market economy. In a socialist economy the various elements of the price mechanism costs, prices and profits- are all planned and calculated by the planning authority in accordance with the targets of the plan. Thus, rational economic calculation is impossible in a planned economy because unlike a free market economy the price mechanism is regulated and controlled. The various assumptions under which the price system works in a free market economy do not hold well in a socialist economy.

ADVERTISEMENTS:

In a socialist economy, it is the central planning authority that performs the functions of the market. Since all the material means of production are owned, controlled and directed by the government, the decisions about what to produce are taken within the framework of a central plan.

The decisions, as to the nature of goods to be produced and their quantities, depend upon the objectives, targets and priorities laid down by the central planning authority. The prices of the various commodities are also fixed by this authority. Prices reflect the social preferences of the common man. Consumers’ choice is limited only to the commodities that the planners decide to produce and offer.

The problem of how to produce is also decided by the central planning authority. It makes the rules for combining factors of production and choosing the scale of output of a plant, for determining the output of an industry, for the allocation of resources, and for the parametric use of prices in accounting.

The central planning authority lays down two rules for the guidance of plant managers:

(i) Each manager should combine productive goods and services in such a manner that the average cost of producing a given output is the minimum.

(ii) Each manager should choose that scale of output which equalizes marginal cost with price.

Since all resources in the economy are owned and regulated by the government, the raw materials, machines and other inputs are also sold at prices which are equal to their marginal cost of production.

If the price of a commodity is above its average cost, the plant managers will earn profits and if it is below the average cost of production, they will incur losses. In the former case, the industry would expand and in the latter case it would cut down production, and ultimately a position of equilibrium will be reached where price equals both the average cost and the marginal cost of production.

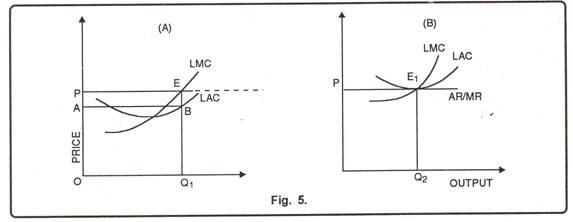

In case where costs differ with plants, the plant managers produce up to the point where marginal cost (LMC) is equal to price (P = AR = MR). In such a situation, it is only in the marginal plant that LAC = LMC = MR = AC = P at point E1 as shown in figure 5(B).

All other plants would earn extra revenue (profit) equal to PABE, as shown in figure 5(A) which would go to the government. The low cost units will subsidies the high cost units and in equilibrium total revenue and total cost would be the same for the industry as a whole.

But the problem lies how central planning authority find out the equilibrium market and accounting prices? Considering historically given prices, it can instruct the plant managers to regard them as correct prices. If they are wrong, surpluses or shortages will emerge. Prices will be readjusted. This process will continue until the equilibrium position is reached by trial and error.

The process of trial and error would proceed on the basis of historically given prices which would necessitate relatively small adjustments in prices from time to time. Thus all decisions of the managers of production and of the productive resources in public ownership and also all decisions of individuals as consumers and as suppliers of labour are made on the basis of these prices.

Consequently to these decisions the quantity demanded and supplied of each commodity is determined. If the quantity demanded of commodity is not equal to the quantity supplied, the price of that commodity has to be changed. It has to be raised if demand exceeds supply and lowered if the reverse is the case. Thus the central planning board fixes a new set of prices which serves as basis for new decisions, and which results in a new set of quantities demanded and supplied.”

The problem for whom to produce is also solved by the state in a socialist economy. The central planning authority takes this decision at the time of deciding what and how much to produce in accordance with the overall objectives of the plan. In making this decision, social preferences are given weight age.

In short, higher weight age is given to the production of those goods and services which are needed by the majority of the people over luxury items. They are based on the minimum needs of the people, and are sold at fixed prices through government stores. Since goods are produced in anticipation of demand, and increase in demand brings about shortages and this leads to rationing.

Thus, the problem of income distribution is automatically solved in a socialist economy because all resources are owned and regulated by the state. All interest, rent and profit are fixed by the state and go to the state exchequer. At regard wages, they are also fixed by the state according to the amount and quality of work done by an individual. Each individual is paid according to his ability and work. Economic surpluses are deliberately created and invested for capital formation and economic growth.

C. Price Mechanism in a Mixed Economy:

A mixed economy solves the problem of what to produce and in what quantities in two ways:

(i) The market mechanism (i.e. forces of demand and supply) helps the private sector in deciding what commodities to produce and in what quantities. In those spheres of production where the private sector competes with the public sector, the nature and quantities of commodities to be produced are also decided by the market mechanism.

(ii) The central planning authority decides the nature and quantities of goods and services to be produced where the public sector has a monopoly. In the case of consumer and capital goods, commodities are produced in anticipation of social preferences. Prices are fixed by the central planning authority on the principle of profit-price policy.

There are administered prices which are raised or lowered by the state. For public utility services like electricity, railways, water, gas, communications, etc., the state fixes their rates or prices on no-profit no- loss basis. The problem of how to produce goods and services is also solved partly by the price mechanism and partly by the state. The profit motive determines the techniques of production in the private sector. At the same time, the central planning authority intervenes and influences the working of the market mechanism.

The state guides and provides various facilities to the private sector for adopting such techniques of production which may reduce costs and maximize output. It is the state which decides where to use capital-intensive techniques and where to use labour-intensive techniques in the public sector.

The problem for whom to produce is also decided partly by the market mechanism and partly by the central planning authority. In the private sector, it is the market mechanism which determines what goods and services are to be produced on the basis of consumer preferences and incomes. Since a mixed economy aims at achieving growth with social justice, the allocation of resources is not left entirely.

The state intervenes to allocate resources and for the distribution of income. For this purpose, it adopts social security programmes and levies progressive taxes on income and wealth. In the public sector, the state decides for whom to produce in anticipation of consumer preferences.