Read this article to learn about the interaction between multiplier and accelerator in business cycle.

We have examined the working of the Multiplier and Acceleration principles separately.

The principle of acceleration has attained more importance in cyclical theory by its alliance with the multiplier principle.

The interaction of the accelerator with the multiplier is capable, under certain circumstances, of generating continuous cyclical fluctuations.

ADVERTISEMENTS:

Economists like P.A. Samuelson, J.R. Hicks, R.F. Harrod and A. Hansen have made fairly successful attempts to integrate the two parallel concepts and have introduced certain remarkable improvements. Neither the multiplier nor the accelerator taken alone can act. In fact, the two tools combine in a series of endless possibilities, depending on the values of the accelerator and the magnitude of the multiplier. In other words, the relationship can be expressed as follows:

∆Ia → (multiplier) → ∆Y → (accelerator) → ∆Ib → (K) → ∆Y → …

where an initial increase in autonomous investment (Ia) works through the multiplier to cause an increase in income (∆Y), and this works through the accelerator to cause a greater change in induced investment (lb), which, in turn, increases income still more and so the action and the interaction continue. The process is super-cumulative because one initial increase (or decrease) will set off a snowball effect where income and investment interact to magnify the impact at each successive level.

It is, therefore, quite interesting and useful to analyze the combined effects of multiplier and accelerator on national income propagation. In order to measure the total effects of initial expenditure on national income, we must combine the acceleration and multiplier principles, popularly called the ‘leverage effects’. The combined effects of autonomous and induced investment are expressed in what Hansen calls the ‘Super-Multiplier’.

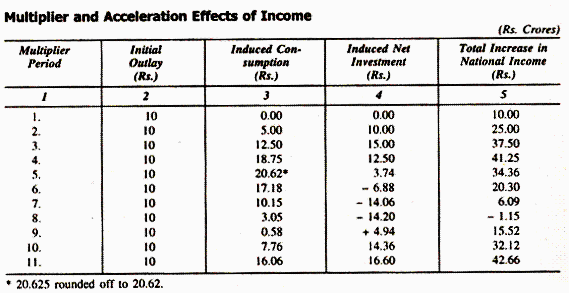

Multiplier and Acceleration Effects of Income:

Assumptions:

(i) Marginal Propensity to consume = ½=0.5

(ii) Acceleration coefficient= 2

In the table given above, we can easily see the process of income propagation via the multiplier and acceleration principles, we assume (i) MPC = ½ (ii) Acceleration coefficient = 2. In the first period there is an initial outlay of Rs. 10 crore, which does not lead to any induced investment. Hence, the total rise in national income in the first period is Rs. 10 crore (being equal to initial outlay of Rs. 10 crore).

ADVERTISEMENTS:

Since the MPC = ½, therefore, the induced consumption in the second period is Rs. 5 crore (shown in the column 3) and acceleration coefficient being 2, the induced investment in the second period is Rs. 10 crore, (shown in column 4) and the total leverage effects (total increase in national income) is Rs. 25 crore (shown in column 5). Similarly, in the third period, we get induced consumption of Rs. 12.50 crore and induced net investment of Rs. 15 crore being twice the difference between 12.50 crore and 5 crore (shown in column 3).

Thus, total income in the fourth period has reached the peak level of Rs. 41.25 crore, as a result of the combined multiplier and acceleration interaction (called Super-Multiplier). Then, in the fifth period, the total income starts falling and falls to rock bottom level of – 1.15 crore in 8th period and then again starts rising from 15.52 crore to 32.12 crore and goes upto 42.66 crore in the 11th period, thereby completing a cycle. The result is quite a moderate type recurring cycle which repeats itself indefinitely.

This shows that mpc of less than unity gives an answer to the question: Why does the cumulative process come to an end before a complete collapse or before full employment? Hansen says that the rise in income progressively slowed down on account of a large part if the increase in income in each successive period is not spent on consumption. This results in a decline in the volume of induced investment and when such a decline exceeds the increase in induced consumption, a decline in income sets in.

“Thus, it is the marginal propensity to save which calls a halt to the expansion process even when the expansion is intensified by the process of acceleration on top of the multiplier process.” However, we have assumed constant values of multiplier and acceleration coefficients but in a dynamic economy they vary cyclically. Thus, when we study the results of leverage effects or the interaction of multiplier and acceleration coefficients, we find that the level of income will be subject to various types of fluctuations depending on the values of acceleration and the multiplier.

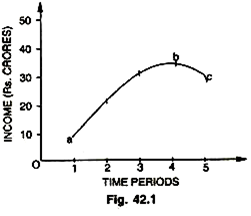

In the Fig. 42.1, we measure time periods on the horizontal axis and the increase in income on the vertical axis. The curve a to b and b to c shows the ordinary process of income propagation (total leverage effects) as a result of multiplier and accelerator interaction during 5 periods.

The income rises to its peak up to Rs. 41.25 crore (from a to b). This is because the rate of increase of induced consumption goes on g 40 – increasing from period 1 to 4, acceleration effects work g in conjunction with the multiplier to push up the level of income. However, income falls in the period 5 from b to c since the rate of increase in induced consumption 2 falls. But income and investment will not keep on going higher and higher indefinitely because two forces work to cause an eventual leveling off.

Firstly, the mps and other leakages like taxes reduce the rate of growth of consumption at each stage until the consumption finally ceases to increase at all. Secondly, the initial increase in an autonomous investment soon exhausts itself, because as the capital stock grows during expansion, the MEC is likely to fall till investment is no longer profitable. Thus, while the interaction of the multiplier and accelerators magnifies economic expansion, it also acts to set its own limits through the eventual reduction of consumption and autonomous investment.