Adam Smith is considered to be the father of economics. It is not so because he was first explorer in the field of economics, also not because he revolutionized economic planning by his maiden ideas, but because he abbreviated what he had received from his predecessors and handed it down as a guide to the coming generations.

He was the editor and not the author, organizer and not the originator of economic science.

“He was the man of systematic work and balanced presentation, not of great new ideas but a man who carefully investigates the given data, criticizes them cooly and sensibly, and coordinates the judgements arrived at with others which have already been established”.

Adam Smith contained all his ideas in his “Wealth of Nations”. The most important aspect of this book was a Theory of Economic Development. Physiocracy came into existence due to mercantilism. They believed in science of natural laws and emphasised the significance of agriculture and contended that it is the only industry that can make country wealthy. Adam Smith’s ‘Wealth of Nations’ was scientific not because it contained the absolute truth but because it came as a turning point, the beginning of all that came after, as it was the end of all that came before.

ADVERTISEMENTS:

The main points of the theory are as under:

Natural Law:

Adam Smith proposes natural law in economic affairs. He advocated the philosophy of free and independent action. If every individual member of society is left to peruse his economic activity, he will maximize the output to the best of his ability. Freedom of action brings out the best of an individual which increases society wealth and progress. Adam Smith opposed any government intervention in industry and commerce.

He was a staunch free trader and advocated the policy of Laissez-Faire in economic affairs. He opines that natural laws are superior to law of states. Statutory law or manmade law can never be perfect and beneficial for the society, that is why Smith respects nature’s law because nature is just and moral. Nature teaches man the lesson of morality and honesty. These exercise favourable effects on the economic progress of society.

Laissez Faire:

Adam Smith’s theory is based on the principle of ‘Laissez-Faire’ which requires that state should not impose any restriction on freedom of an individual. The theory of economic development rests on the pillars of saving, division of labour and wide extent of market. Saving or capital accumulation is the starting point of this theory. He believed that “there is a set of rules or rights of justice and perhaps even of morality in general which are, or may be known by all men by hello either or reason or of a moral sense, and which possesses an authority superior to that of such commands of human sovereigns and such customary legal and moral regulations as may contravene them”.

ADVERTISEMENTS:

The policy of laissez-faire allows the producers to produce as much they like, earn as much income as they can and save as much they like. Adam Smith believed that it is safe to leave the economy to be propelled, regulated and controlled by invisible hand i.e. the forces of competition motivated by self interest be allowed to play their part in minimizing the volume of savings for development.

Production Function:

Adam Smith recognized three factors of production namely labour, capital and land i.e.

Y = f (K, L, N)

K = Stock of Capital

ADVERTISEMENTS:

L = Labour force

N = Land

He emphasized labour as an important factor of production along with other factors and observed, “The annual labour of nation is the fund which originally supplies it with all necessaries and conveniences of life which it annually consumes and which consists always either in immediate produce from other nations”. Since the growth is a function of capital, labour, land and technology and land being passive element is least important. Prof. Adam Smith regarded labour as father and land as mother. He wrote, “To him (farmer) land is the only instrument which enables him to earn the wages of his labour and to make profits of this stock”.

The production function does not conceive the possibility of diminishing marginal productivity. It is subject to law of increasing returns to scale. Smith argued that real cost of production shall tend to diminish with the passage of time, as a result the existence of internal and external economies occurring out of the increases in market size.

Adam Smith asserted that division of labour does not depend merely on technological feasibility, it greatly depends on the extent of the market as well and the size of market depends on the available stock and the institutional restrictions placed upon both domestic and international trade. Smith observes that, “when the market is small, no person can have encouragement to dedicate himself entirely to one employment, for want of power to exchange all the surplus part of production of his own labour, which is over and above his own consumption, for such parts of the produce of other man’s labour as he has occasion for”.

Smith also recognizes the importance of technological development for improvement in productivity and which is possible only if sufficient capital is available. He wrote, “The person who employs his stock in maintaining labour, endeavors, therefore, both to make among his workmen the most proper distribution of employment and furnish them with the best machines which he can either invent or afford to purchase. His ambition in both these respects is generally in proportion to the extent of his stock or to the number of people which it can employ”.

Division of Labour:

The rate of economic growth is determined by the size of productive labour and productivity of labour. The productivity of labour depends upon technological progress of a country and which, in turn, depends upon the division of labour. This division of labour becomes the true dynamic force in Adam Smith’s theory of growth. The only remarkable feature of Smith’s account of division of labour is pointed by Prof.

Schumpeter as “nobody, either before or after Adam Smith ever thought of putting such a burden upon division of labour. With Adam Smith it is practically the only factor in economic progress”.

Division of labour increases the productivity of labour through specialization of tasks. When a work is sub-divided into various parts and the worker is asked to perform small parts of whole job, his efficiency increases as now he can focus his attention more carefully. Thus, the concept of division of labour means the transference of a complex production process into number of simpler process in order to facilitate the introduction of various methods of production.

ADVERTISEMENTS:

Adam Smith concentrated upon the social division of labour which emphasized the co-operation of all for satisfaction of the desires of each. It is the process by which different types of labour which produce goods to satisfy the individual needs of their producers are transformed into social labour which produces goods for exchanging them for other goods.

Adam Smith in his book ‘Wealth of Nations’ pointed out three benefits of division of labour:

1. Increase of dexterity of workers.

2. Saving time required to produce commodity.

ADVERTISEMENTS:

3. Invention of better machines and equipment.

The third advantage implies that invention is the result of worker’s intelligence. But Smith wrote that workers become ‘as stupid and ignorant as it is possible for human creature to become as a result of division of labour’. Division of labour necessarily leads to exchange of goods, which highlights the importance of trade. In short, division of labour leads to exchange of goods which, in turn, promotes trade and widens the extent of market. Wide extent of market is an essential pre- requisite for economic development.

Capital Accumulation:

It is the pivot around which the theory of economic development revolves. The growth is functionally related to rate of investment. According to Smith, “any increase in capital stock in a country generally leads to more than proportionate increase in output on account of continually growing division of labour”.

Capital stock consists of:

ADVERTISEMENTS:

(а) Goods for the maintenance of productive workers.

(b) Goods for helping the workers in their productive activities.

Adam Smith distinguished between non capital, circulating capital and fixed capital goods. Non capital goods refer to those which are useful directly and immediately to their owner. Fixed capital refers to those goods which are directly used in production processes, without changing hands. Fixed capital consists of all the means of production.

Capital is increased by parsimony and diminished by prodigality and misconduct. The rate of investment was determined by the rate of saving and savings were invested in full. The classical economists also believed in the existence of wage fund. The idea is that wages tend to equal to the amount necessary for the subsistence of labourers.

If the total wages at any time become higher than subsistence level, the labour force will increase, competition for employment will become keener and the wages come down to the subsistence level. Thus, Smith believed that, “under stationary conditions, wage rate falls to the subsistence level, whereas in periods of rapid capital accumulation, they rise above this level. The extent to which they rise depends upon the rate of population growth”. Thus, it can be concluded that wage fund could be raised by increasing the rate of net investment.

According to Smith, “investments are made because the capitalist want to earn profits on them. When a country develops and its capital stock expands, the rate of profit declines. The increasing competition among capitalists raises wages and tends to lower profits”. So it is a great difficulty of finding new profitable investment outlets that leads to falling profits.

ADVERTISEMENTS:

Regarding the role of interest, Smith postulated a negatively sloped supply curve of capital implying that supply of capital increased in response to decline in interest rate. Smith wrote that with the increase in prosperity, progress and population, the rate of interest falls and as a result, capital is augmented. With the fall in interest rate, the money lenders will lend more to earn more interest for the purpose of maintaining their standard of living at the previous level.

Thus, the quantity of capital for lending will increase with the fall in rate of interest. But when the rate of interest falls considerably, the money lenders are unable to lend more in order to earn more to maintain their standard of living. Under these circumstances, they will themselves start investing and become entrepreneurs. Smith believed that economic progress- involves rise in money as well as real rentals, and a rise in rental share of national income. This is because the interest of land owners is closely related to general interest of the society.

Agents of Growth:

Smith has observed that farmers, producers and businessmen are the important agents of economic growth. It was the free trade, enterprise and competition that led farmers, producers and businessmen to expand the market and which, in turn, made the economic development inter-related. The development of agriculture leads to increase in construction works and commerce. When agricultural surplus arises as a result of economic development, the demand for commercial services and manufactured articles arises.

This leads to commercial progress and establishment of manufacturing industries. On the other hand, their development leads to increase in agricultural production when farmers use advanced techniques. Thus, capital accumulation and economic development take place due to the emergence of the farmer, the producer and the businessmen.

Process of Growth:

“Taking institutional, political and natural factors for granted, Smith starts from the assumption that a social group may call it a ‘nation’ will experience a certain rate of economic growth that is accounted for by increase in numbers and by savings. This induces a widening of market which, in turn, increases division of labour and thus, increases productivity. In this theory, the economy grows like a tree. This process is no doubt exposed to disturbances by external factors that are not economic… but in itself, it proceeds continuously and steadily.

Each situation grows out of preceding one in a uniquely determined way and the individuals whose act combine to produce each situation count individually for no more than the individual cells of a tree”. The process of growth is cumulative. Division of labour made possible by accumulation of capital and expansion of market, increases national income and output, which in turn, facilitates saving and further investment and in this way, economic development rises higher and higher. Smith’s progressive state is in reality the cheerful and hearty state to all the different orders to the society. But this progressive state is not endless. It ultimately leads to stationary state.

ADVERTISEMENTS:

It is the scarcity of natural resources that stops growth. An economy in stationary state is characterized by unchanged population, constant total income, subsistence wage, elimination of profit in excess of the minimum consistent with risk and absence of net investment. In his opinion, an economy is stationary state finds itself at the highest level of prosperity consistent with its natural resources and environment.

The competition for employment reduces wages to subsistence level and competition among the businessmen brings profits as low as possible. Once profit falls, it continues to fall. Investment also starts declining and in this way, the end results of capitalist is stationary state.

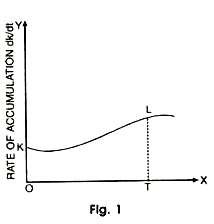

When this happens, capital accumulation stops, population becomes stationary, profits are minimum, wages are at subsistence level, there is no change in per capita income and production and the economy reaches the state of stagnation. The stationary state is dull, declining, melancholy life is hard in stationary state for different sections of the society and miserable in declining state. Smith’s theory is explained with the help of a diagram 1.

Time is taken along the X-axis and the rate of accumulation along the Y-axis. The economy grows from K to L during the time path T. After T, the economy reaches stationary state. Linked to L where further growth does not take place because wages rise so high that profits become zero and capital accumulation stops.

Conclusion:

ADVERTISEMENTS:

It can be concluded that Prof. Adam Smith did not propound any specific growth theory. His views relating to economic development are part of general economic principle propounded by him. R. Lekachaman says, “A good deal of Smith’s analysis reads as though written with todays UDC’s in mind”. In a very important aspect then this book (Wealth of Nations) was the theory of economic development.