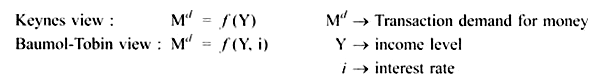

Transaction theories emphasize the role of money as a medium of exchange. According to the transaction theory, money is a dominated asset people hold money unlike other assets, to make purchases.

Money has both cost and benefit. Cost is the low rate of return and benefit is that, it makes transactions more convenient.

So people decide how much money to hold by trading off these costs and benefits. Baumol-Tobin was not satisfied with Keynes treatment of demand for money so he developed the model of cash management in 1950 in which he explained the costs and benefits of holding money.

Baumol-Tobin model shows that demand for money depends positively on the income level and negatively on the interest rate. This model is explained in terms of assets. An individual holds portfolio for monetary assets (currency and checking account) and non-monetary assets (stocks and bonds).

ADVERTISEMENTS:

The optimum amount of asset he can hold will depend on the cost considerations:

(i) Interest forgone on the cash balance held, and

(ii) Cost of acquiring bonds and converting them into cash, i.e., cost of brokerage.

ADVERTISEMENTS:

People hold money in cash for convenience. When people hold money they incur both benefit and cost. Benefit is the convenience which they get by avoiding making a trip to the bank every time they wish to buy something. But the cost of this convenience is the forgone interest which they would have earned if they had deposited the money in the saving accounts. There is, thus, a trade off between benefits and costs.

If one holds large amount of monetary assets, interest forgone will be very high but if one holds less cash, then the interest forgone will be less but the transaction cost of holding bonds, i.e., brokerage fee will be very high. To avoid these extreme situations, people will hold both monetary and non-monetary assets to minimize the cost.

For instance:

Assume:

ADVERTISEMENTS:

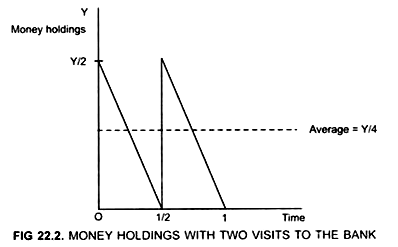

1. Price level is constant

2. Transactor has a given income. Real spending is constant over the year, that is, an individual spends uniformly over the year.

3. Transaction funds can be held either in money or in interest yielding bonds.

4. Individual X makes ‘N’ trips to the bank.

Mr. X plans to spend Rs. Y gradually over a year. There are different possibilities:

1st Possibility:

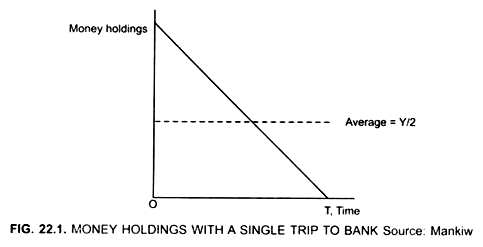

Mr. X makes a single visit to the bank (N = 1). He withdraws the entire amount Rs. Y at the beginning of the year and spend it gradually.

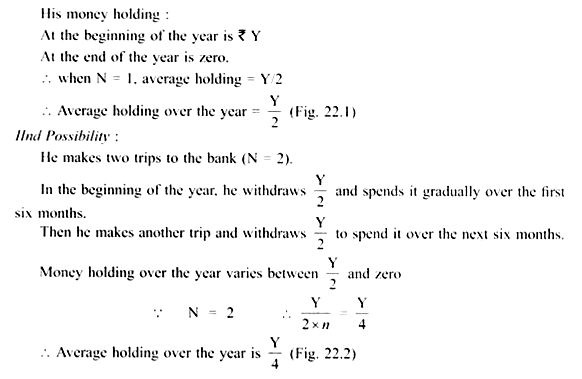

Since his average holdings are less, he forgoes less interest but the disadvantage is that he had to make two trips to the bank.

lllrd Possibility.

He makes N trips to the bank over the time period of one year. On each trip he withdraws Y/N and spends gradually that is, uniformly over the following 1/N th of the year.

Money holding varies between Y/N and zero

ADVERTISEMENTS:

Average holding over the year is Y/2N (Fig. 22.3)

Thus, we find that greater is the N, less is the money the person holds on an average and less is the interest he forgoes. But, as N increases, the inconvenience of making frequent trips to the bank increases.

Model expressed in terms of Assets:

ADVERTISEMENTS:

Let: (i) N → Number of trips made to the bank.

(ii) F → Cost of going to the bank or brokerage fee, that is, cost of transferring non-monetary assets into monetary assets.

(iii) i → Rate of interest forgone, that is, opportunity cost of holding money.

Average amount of money held for any N is Y/2N.

... Forgone interest = iY/2N

... Total cost of making trips to the bank is FN

ADVERTISEMENTS:

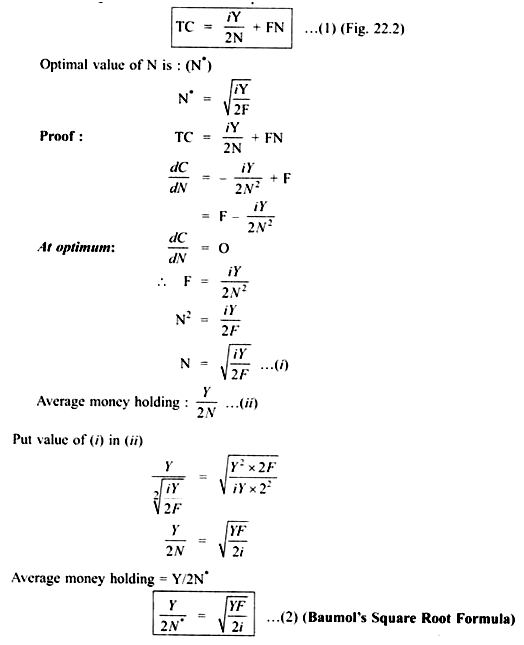

Total cost (TC) the individual bears is:

TC = Forgone interest + cost of trips

Equation (2) shows that : average cash holding is directly related to the income level (Y) and (F) but indirectly related interest rate (i) If F is greater or Y is the greater or i is lower (where Y is the expenditure), then the individual holds more money, that is, demand for money depends positively on expenditure (Y) and negatively on the interest rate.

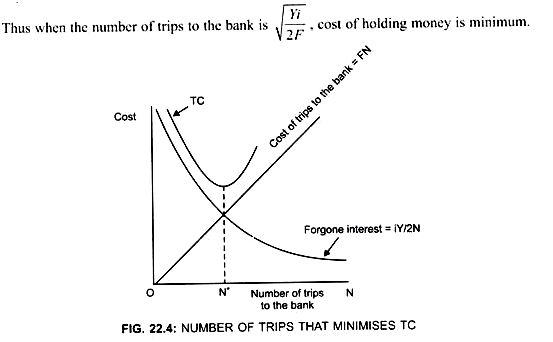

As the number of trips to the bank increases, the amount of interest forgone decreases (Fig. 22.4)

ADVERTISEMENTS:

... iY/2N curve is negatively sloped.

However, as the number of trips to the bank increases, the cost of visit increases. Therefore, the FN curve is positively sloped.

TC curve is U shaped because it incorporates the transaction costs and the interest forgone (i) Optimal number of visits is N*, because at N* the TC is minimum.

Thus, Baumol-Tobin model shows that demand for money is not only a function of income level but also the interest rate.

Implication of the Model:

If the fixed cost of going to the bank (F) changes, the money demand function changes. Thus, although the model gives us a very specific money demand function, it may not be necessarily stable over time.

ADVERTISEMENTS:

Baumol-Tobin model held that:

(a) Income elasticity of demand for money is half.

Increase in real income by 10% will lead to an increase in demand for real balance by 5%

(b) Interest elasticity demand for money is half. Increase in interest rate by 10% will lead to decrease in demand for money by 5%

Failure of the Model:

1. The Model failed because some people have less discretion over their money holdings than the model assumes.

ADVERTISEMENTS:

2. Empirical studies of money demand find that the income elasticity of money demand is greater than half and the interest elasticity of money demand is less than half.

Thus, the model is not completely correct.