In this article we will discuss about Adam Smith:- 1. Introduction to Adam Smith 2. Life and Antecedents of Adam Smith 3. Factors Influencing 4. Philosophy 5. Smith’s Naturalism and Optimism 6. Wealth of Nations 7. Economic Ideas 8. Theory of Value 9. Ideas on Distribution 10. Theory of Economic Growth 11. Laissez Faire or Economic Liberty 12. Critical Estimate.

Introduction to Adam Smith:

Adam Smith stands as an institution by himself in the history of economic thought. He is regarded as the founder of modern economics. It is no exaggeration to say that Economic science was born in 1776 with Adam Smith’s ‘Wealth of Nations’.

He is the first economist who dealt economic problems in a systematic manner. In other words, he is the first academic economist. He has been rightly called the “Father of Political Economy”. Alexander Gray has rightly said, “before Adam Smith there had been much economic discussions, with him we reach the stage of discussing economics”.

Life and Antecedents of Adam Smith:

Adam Smith was born in 1723 in a small town of Kirkaldy in Scotland. He studied at the Universities of Glasgow and Oxford and specialised in Mathematics, Natural Philosophy and Moral and Political sciences. At Glasgow, he worked as a Professor of Logic and later became a Professor of Moral Philosophy.

ADVERTISEMENTS:

In 1759, he published his “Theory of Moral Sentiments” which earned him great fame. In 1764, Smith accepted to become the Tutor of the Duke of Buccleuch. With the Duke, Adam Smith toured Europe. On his European tour, in France he met the famous Physiocrat Quesnay, Turgot and Voltaire.

On his return to Scotland, he settled down to write his famous book, “An Inquiry into the Nature and Causes of the Wealth of Nations” which was published in 1776. In 1778, he was appointed as Commissioner of Customs at Edinburg which position he held till his death in 1790.

Factors Influencing Adam Smith:

There are three important factors that contributed to the economic thought of Adam Smith:

(a) Predecessors,

ADVERTISEMENTS:

(b) Clubs and travels and

(c) The economic and political conditions.

(a) Predecessors:

Adam Smith’s economic thought was influenced by the views of later mercantilists like Petty, North, Child, Tucker and Cantillon. They advocated a more liberal trade, emphasised the importance of labour and believed in the advantages of large population. From Petty, Adam Smith took his ideas on Public Finance and canons of taxation.

From Physiocrats also, Adam Smith borrowed liberally. Being a personal friend of Quesnay and Turgot, he had been deeply influenced by their ideas, particularly on freedom, self-interest, circulation of wealth and natural order.

ADVERTISEMENTS:

Smith borrowed liberally from his teacher at Glasgow, Francis Hutcheson the ideas regarding division of labour, changes in the value of money, taxation etc. Smith was also grateful to David Hume for many of his ideas on foreign trade, money, labour and interest. Finally the poem, “The Fable of the Bees” written by Bernard de Mandeville influenced Smiths’ ideas regarding self- interest and public interest.

(b) Clubs and Travels:

The clubs which Adam Smith joined at Glasgow and Edinburg had also influenced his economic ideas. These clubs discussed many questions of economic importance. In addition, his travels with the Duke of Buccleuch provided him an opportunity to meet the famous physiocrats and other scholars.

(c) The Economic and Political Conditions:

The economic and political environment of the time also influenced the views and ideas of Adam Smith. During the later part of the 18th century, fundamental changes took place in England. Large agricultural estates were coming up. Population growth helped to increase agriculture and industrial production. Accumulation of capital facilitated the growth of commerce and transport.

In the political side, the historical event-declaration of the American Independence,emphasised the equality and freedom of all people. The slogans liberty, equality and fraternity began to be heard. Thus industrial capitalism, economic liberty, large scale farming, mobility of labour etc. enriched Adam Smith’s thought.

In-spite of the fact that Smith borrowed many ideas from his predecessors, the importance of his own contributions cannot be minimised. He collected the scattered ideas, gave them a shape and enhanced their significance. His work thus created a revolution in the domain of economic thinking.

The Philosophy of Adam Smith:

Adam Smith’s philosophical ideas which underlie his economic thinking are found in his master piece “Wealth of Nations.” Even though, there is no special mention about the system of philosophy and explicitly seen nowhere in his analysis, we can read between the lines, the philosophy that pervades the whole work.

Smith was guided by one universal principle, namely self-interest. Every individual has the desire to better his own lot. It was on this belief, that he regarded the entire economic world as a big workshop created by division of labour.

He believed that human conduct was governed by self-love, sympathy, the desire to be free, a sense of propriety, a habit of labour and the propensity to satisfy his wants with the help of others. Each man is the best judge of his own interest. If complete freedom is given, he would make efforts not only to better his own lot, but also would take efforts to promote the general good. Thus “An Invisible Hand” is behind all human motives.

Based on this philosophy, Smith believed that all Government interventions in human activities were injurious. So he assigned only three functions to the Government, namely, defence, administration of justice and maintenance of public works and institutions which could not be maintained by any individual or groups.

ADVERTISEMENTS:

In economic matters, Smith was a strong supporter of freedom, because he believed that the natural balance of motives proved to be effective than state interference. As a result, he supported laissez-faire doctrine.

Smith’s Naturalism and Optimism:

In addition to the concept of the economic world as a great natural community created by division of labour, we can distinguish in Smith’s works two other fundamental ideas around which his theories are framed. First is the idea of the spontaneous origin of economic institutions and secondly, their beneficent character. These two are called as “Naturalism” and “Optimism”. They are closely related and frequently mixed up in his work.

Smith proved that all economic institutions created by human beings came into existence spontaneously. For this he gave many examples like division of labour, money, capital, theory of demand and supply etc. Through a process of evolution man felt the need and established various economic institutions.

Division of labour is not the effect of human wisdom. Division of labour is the result of the common instinct among men to barter and exchange. It is spontaneously developed under the influence of self-interest which acts simultaneously. This is quite clear from his statement, “It is not from the benevolence of the butcher, the brewer or the baker that we expect our dinner but from their regard to their own interest”.

ADVERTISEMENTS:

Similarly, money is the result of the collective instinct of people, guided by personal motives. The desire to barter and exchange gave rise to money. As people realised many difficulties in the barter system of exchange, they thought of a medium of exchange and invented money. “Money is thus, the product of the simultaneous action of a great number of people, each obeying his personal inclination”. (Gide and Rist).

The same position is with capital. To Adam Smith, capital was the true source of economic life. He gave too much importance to capital and treated it as a fountain of national wealth. The accumulation of capital is mainly due to the simultaneous efforts of thousands of individuals. People, motivated by self-interest, spontaneously save something out of their income and employ these savings in productive activities.

Another example of Smith’s naturalism or spontaneous origin of economic institutions is his theory of demand and supply. Producers supply commodities according to the demand. They try to secure a balance between demand and supply. Because then only, market price will be equal to normal or natural price, which is good not only for themselves but also for all.

Smith also extends his naturalism to other spheres. For example in the case of population, he maintains that variations in the wage rate regulates the supply of labour, through changes in population. If wages are more than subsistence level, prosperity of the workers leads to an increase in population. But when wages are below the subsistence level, poverty and misery cause the death of many.

ADVERTISEMENTS:

For Adam Smith Naturalism and Optimism are inseparable. Economic institutions are not only natural but also beneficial. Smith believed that self-interest not only creates and maintains economic institutions, but ensures that the nation progresses towards greater wealth and prosperity.

Smith thus tried to prove that these spontaneous institutions were also best. Even though, this philosophy of naturalism and optimism pervades all economic theories, he never applies this concept to all. In fact optimism is intended for production and not distribution.

Wealth of Nations:

Adam Smith’s epoch making book “An Enquiry into the Nature and Causes of the Wealth of Nations” (shortly known as Wealth of Nations) was published in 1776. It is a masterly exposition of economic theories. Senior praised Smith for the extent and accuracy of his knowledge and the attractive style of his writing Edmund Burke considered Wealth of Nations as the most important book that has ever been written. The book deals comprehensively not only the domestic and international economy, but also discusses the problems of human welfare, material happiness, jurisprudence and ethics.

Wealth of Nations consists of an introduction of three pages, followed by five books, and a short appendix. The first two books deal with the theories of production, exchange and distribution. The third book deals with the economic history of European countries, agriculture and the rise of cities and towns. The fourth book contains a critical analysis of the physiocratic and mercantilist theories. The last book deals with public finance, taxation and state interference.

Adam Smith in his book, “The Wealth of Nations” defined Economics as, “The Science of Wealth”. He said that Economics is concerned with, “an enquiry into the nature and causes of wealth of Nations” Whereby “it proposes to enrich the people and the sovereign”.

According to Adam Smith all that economics deals with is wealth. It explains how people acquire mass wealth. It emphasises an earning and spending wealth as if wealth is everything for man. It also deals with the laws of production, distribution and consumption of wealth. This definition makes wealth as the subject matter of economics. It makes economics an independent subject and science. Its insistence on enriching the people and the sovereign is still appreciated.

Economic Ideas of Adam Smith:

1. Labour:

ADVERTISEMENTS:

The concepts “Labour” and “Division of labour” have attained significance through the excellent treatment of the subjects by Adam Smith in his “Wealth of Nations”. The Physiocrats considered land alone productive. They never recognised labour as productive.

But to Adam Smith, labour is the most important factor which increases the wealth of nations. It is clearly stated in the opening sentence of the book as follows. “The annual labour of every nation is the fund which originally supplies it with all the necessaries and conveniences of life which it annually consumes and which consists always either in the immediate produce of that labour, or in what is purchased with that produce from other nations”. When Smith emphasised the importance of labour, he did not underestimate the important role played by nature in production. He was aware of the fact that both physical environment and labour determined the wealth of nations.

Here Adam Smith distinguishes between productive and unproductive labour. Smith gave two definitions of productive labour:

(a) That labour is productive that produces durable (vendible) commodities. It is called Durable-Vendible-commodity criterion.

(b) That labour is productive that adds value to the product. This is known as value-added criterion.

According to the first criterion, that labour which produces durable commodities that can be accumulated is productive labour. Whereas unproductive labour produces services which are consumed at the time of production. For example, the labour of a worker in a shoe factory is productive and that of a personal servant is unproductive.

ADVERTISEMENTS:

According to the value-added criterion, productive labour not only maintains itself but also brings profits to its employers.

Adam Smith’s distinction between productive and unproductive labour is faulty. Smith tried to broaden the physiocratic idea of productive labour but did not succeed. The physiocrats regarded only agricultureal labour as productive. But Smith’s concept of productive labour includes all types of labour which produces tangible goods. But he did not include the services.

Division of labour:

The first chapter in Book-I of Wealth of Nations “Of the Division of Labour” emphasises the importance of division of labour. It occupies the central and dominant position in Smith’s theory of production. While labour is the source of wealth, division of labour will increase the productivity of labour and thereby the wealth of a nation.

The concept of division of labour was not used by Adam Smith first. Both the name and idea existed in Mandeville’s “Fables of the Bees”. The idea was also used by Harris in 1757. The only remarkable feature of Smith’s division of labour is as Schumpeter points out that, “nobody, either before or after Adam Smith, ever thought of putting such a burden upon division of labour. With Adam Smith it is practically the only factor in economic progress”.

According to Adam Smith division of labour “is a system of social co-operation” by which production is carried in particular activities. Adam Smith’s example of pin making industry which involves 18 different operations has become a classic example. Smith has shown that an individual pin maker, working alone, could not make more than 20 pins a day. But under proper division of labour, he could produce 4800 pins a day.

ADVERTISEMENTS:

Adam Smith concentrated upon the social division of labour. It emphasised the co-operation of all individuals for the satisfaction of the desires of each. Division of labour is a process by which a particular type of labour which produces goods to satisfy the individual needs are transformed into social labour which produces goods for all.

The following are the advantage of division of labour as pointed by Adam Smith:

(1) It increases the productivity of labour through specialisation.

(2) As work is sub-divided and done quickly, production also increases.

(3) Worker’s efficiency and skill increase when work is subdivided into various parts and a worker is asked to do a small part of the whole job.

(4) There is saving of time and tools.

ADVERTISEMENTS:

(5) As production increases quickly, it forms an incentive to investors.

Adam Smith also pointed out the disadvantages of division of labour:

(1) As worker is confined to one or two operations, there is no personal satisfaction of having made a full product.

(2) It leads to immobility of labour because of specialisation.

(3) As the same work is done repeatedly, the worker gets bored which leads to mental stagnation.

Adam Smith pointed out that division of labour was limited by the extent of the market. The wider the market for a commodity, the greater the division of labour. So in order to have a high degree of division of labour, large scale production is essential. Division of labour was limited by the availability of capital also.

2. Capital:

Smith regarded capital as a fountain of national wealth. It has a greater role to play in production. The wealth of a nation depends upon division of labour and division of labour itself is governed by capital.

In his book “Wealth of Nations” capital appears in three forms:

(1) As an instrument of production

(2) As a fund maintaining the workers and

(3) As a source of revenue.

Smith distinguished between two types of capital, namely, fixed capital and circulating capital.

Smith advocated that capital could be employed in four different ways:

(1) In procuring raw materials annually for the consumption of the society

(2) In the manufacture of raw materials

(3) In transporting the finished goods and

(4) In the distribution.

In other words capital is used for the cultivation of land, mines and fisheries, secondly for manufacturing, thirdly for whole sale distribution and fourthly for retail distribution. To Smith capital formation is the result of the interaction of the self-interest of individuals. Expansion of output depended on the rate of investment in a country.

The rate of investment in turn, depended on savings. “Parsimony and not industry is the immediate cause of increase of capital”. The ability to save was limited by income. The motive for saving and investment was profit. Profit depended on institutional environment.

Smith also recognised the role of interest in the supply of capital. He believed that a fall in the rate of interest would increase the supply of capital, because the entrepreneurs would enter the loanable fund market with a decline in the interest rate. But Smith’s ideas on capital gave rise to controversies among economists. At one place he regarded labour as the source of wealth and at another place he regarded capital as the source of wealth.

3. Agriculture:

Having been influenced by the physiocratic ideas, Adam Smith gave a high place to agriculture. Smith believed that investment in agriculture was the most productive form of capital investment because in agriculture, “nature labours along with men”.

4. Money:

After discussing the concept of division of labour in the first three chapters of the first book, Smith discusses about money. Regarding the origin of money, he held the view that, “Everyman…. become in some measure a merchant and therefore in effect, a currency is needed to serve as the universal instrument of commerce”. Thus money is an instrument which facilitates exchange and without it large scale production and commerce would not be possible. So it is an important factor contributing to the extension of division of labour.

According to Smith, money developed spontaneously to remove the difficulties in the barter system of exchange. He stressed the two important functions of money viz., medium of exchange and measure of value. He regarded money as the nominal price of commodities.

He rejected the bullionist policies of the mercantilists which aimed at keeping surplus money at home. He demonstrated clearly that the surplus quantity of money would be exported to other countries. He suggested that the quantity of money in circulation should be determined by the level of internal economic activity.

Theory of Value:

Adam Smith started his discussion of value by distinguishing between value in use and value in exchange. The first refers to the utility of the commodity and the second the power of purchasing other goods. This he explained with the “diamond-water paradox”. The commodities like water possessing greatest value-in-use have little value-in-exchange.

On the other hand, the commodities like diamond having little value-in-use have the greatest value-in-exchange. Even though Smith made a distinction between value in use and value in exchange, he was concerned only with the true measure of the exchangeable value.

Regarding the determination of value, Smith explained through two theories of value, namely, labour theory of value and cost of production theory of value. Smith believed that labour was the real source of value. The value of a thing depended upon the amount of labour spent for its production.

According to him, the real price of everything was “the toil and trouble of acquiring it”. This was the essence of his Labour Theory of Value. Thus the theory that labour is the cause of value was first formulated by the Father of Political Economy. It is the same theory which was used later on by Karl Marx to attack capitalism.

But in his cost of production theory of value, Smith gave a contradictory view. He said the value of a commodity was governed by its cost of production. This consisted of payments made to land, labour and capital. Smith could not make a clear choice between these two theories.

It must be noted that Smith not only discussed the different elements of the price of a commodity but also natural price and market price. He says that in an early primitive society where capital accumulation had not started and land was not appropriated, labour alone was the sole determinant and measure of value. Then he turns to the actual world where more than one factor of production exists, and the production of a commodity is the result of the co-operative efforts of labour, land and capital. In such a situation, the price of a commodity is the sum of the rewards paid to labour, land and capital.

Then Adam Smith proceeds to the treatment of natural and market prices. In each society, there exists an average rate of interest, wages, profit and rent, which Adam Smith calls, “the natural rates”, corresponding to this is the natural price. It is the price which covers the natural rates of profits, wages and rent. Thus the concept of natural price is essentially the cost of production theory of value.

Contrary to this is the market price. The market price is the actual price prevailing in the market and is determined by the forces of demand and supply. The competitive mechanism of the market ensures the tendency towards the equilibrium or natural price in the long run.

If the market price is higher than the natural price, the supply will increase and will bring the market price down to its natural price. Similarly, if the market price is less than the natural price, the supply will increase and push the market price down to the natural price.

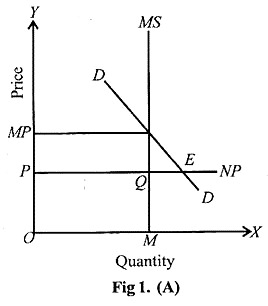

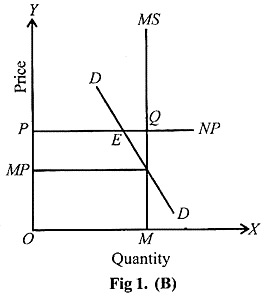

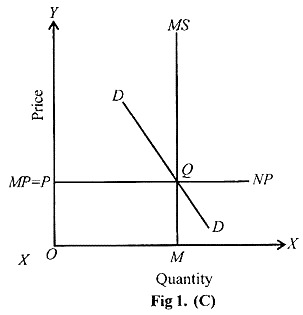

The following figures show this:

In figure 1. (A) demand is greater than the market supply (PE > PQ). So market price is above the natural price (MP > P). In part (B) demand is less than the market supply (PE < PQ) market price is less than the natural price (MP < P). In part (C) demand is equal to supply. So market price and natural price are equal NP = P.

Critical Appraisal of Smith’s Theory of Value:

Adam Smith did not formulate a satisfactory theory of value.

He himself could not choose between the two theories:

(1) It is difficult to measure labour. Even though Adam Smith used time as the measuring rod, it is not a proper scale because the less skilled labour may take long time to produce a good.

(2) Misdirected labour cannot have value. Even Karl Marx admits that “nothing can have value, without being an object of utility”. He said, “misdirected labour does not count as labour”.

(3) It fails to explain the value of rare things, such as things of art and antiques.

(4) The cost of production theory of value did not explain how the natural prices of the factors of production are determined. So it is empty and meaningless.

(5) The cost of production theory also did not explain the change in the prices of commodities.

Smith’s Ideas on Distribution:

1. Rent:

Smith’s ideas on rent were not well formed. At some places, he is surprisingly close to the modern viewpoint on rent, at others he is hopelessly embedded in Physiocratic notions. Rent is considered as a monopoly price paid to the landlord for the use of land. It varies with fertility and situation.

Improvement in transport services tend to lower and equalize rents. Haney considers that except for the mistaken notion of the landlord as a monopolist and rent as a monopoly price, this viewpoint is allied to the modern concept of rent.

Gide and Rist, however, emphasised that Adam Smith, under the Physiocratic influence, considered rent as a gift due to the special natural powers of the soil. In manufactures, man worked without the aid of nature, hence the remuneration just covered his cost of production. In agriculture, he worked in Cooperation with nature, hence the rent of land was a special surplus available to the owner of land over and above the cost of production.

Relationship of rent and prices is not clear to Smith. His point of view shifts according to the convenience of the argument. At one place he considers rent determining price of commodities, and at another, just the opposite.

2. Wages:

Smith’s theory of wages is also confused. In fact, he had thought of practically all the theories that have been emphasised by later economists.

Generally, he talks of demand and supply of labour as the factors determining wags. The supply of labour is limited by the cost of living of workers, depending on current prices of commodities. The demand for labour is determined by the quantity of stock available, the level of national capital.

In an expanding economy, higher wages will prevail due to greater demand for labour. In a stationary economy, wages will sink below the subsistence level. Adam Smith also indicates the outlines of the Wages Fund Theory, by speaking of a “fund predestined for payment of wages”. However, he does not elaborate the idea further.

3. Profit and Interest:

Adam Smith did not clearly distinguish between profit and interest. Profit was the return on the capital. Interest was a part of profit which was to be paid to the owner for the use of the capital borrowed. In brisk business conditions, competition kept the rate of profit low, because wages were increasing. In slack conditions, the opposite happened. Wages decreased and profit went up.

Criticism:

Generally, Smith’s theory of distribution is confusing. He was primarily a thinker on production, on which his thought was mature enough in his earlier years. His earlier Glasgow Lectures (1763) do not deal with distribution at all. It was under the influence of the Physiocrats that he gave any thought to problems of distribution and included them in “The Wealth of Nations.”

Naturally enough, his theory of distribution is shoddy, inconsistent and tainted with Physiocratic errors and is in mark contrast with the remarkable lucidity of his views on production. Gide and Rist consider his treatment of distribution as the “least original” of all his work.

However, we must credit the origin of many ideas on distribution to Smith. The Wags Fund Theory was to be worked up by later classical economists. The Demand and Supply Theory of wages indicated the interdependence of resources and population, which was elaborated by Malthus.

Smith also foresaw the clash of interest involved in the problems of distribution. He talked of opposing interests of labour and capital, the tendency of wages and profits to move in opposite directions. His sympathies were with the workers and he advocated the necessity of keeping the share of labour in the national produce high. Early Socialist thinkers, who came after, had drawn abundant inspiration from his views on distribution.

The dominant note in Smith’s theory of production is his optimism. He considers all productive institutions beneficent in character, but in his treatment of distribution, he was a pessimist. He was aware of the parasitism of landlords and capitalists “who love to reap where they have not sown.”

Gide and Rist, therefore, feel that Smith might well be considered as the fore-runner of Socialism, as socialist thought is primarily concerned with clash of interests in the distribution of wealth that smith clearly visualised. From the classical standpoint, however, the problems of distribution were thoroughly dealt with by Ricardo, his immediate follower, Smith having given only a sketchy outline of the same.

Adam Smith’s Theory of Economic Growth:

Adam Smith’s Theory of Economic Growth has not received as much attention as his Theory of Value and Distribution. He does provide an internally consistent dynamic Model. Irma Adelman rightly asserts,” The main strands of his Theory—the investigation of capital accumulation, population Growth, and labour productivity still underlie all current treatment of the problem and many of his policy recommendations are as controversial now as when they were first made”.

(1) Production Function:

Since he recognised the existence of three factors of production, namely labour, capital and land, his production function may be expressed as;

Y = f (K, L, N)

where, K = capital stock, L = Labour force, N = Land.

The production function is subject to increasing returns to scale because he did not assume diminishing marginal productivity. In his opinion, with the passage of time, the size of market will expand and in turn result in internal and external economies which will reduce the capital production. The greater degree of division of labour was expected to realise the economies of scale in production.

According to him, division of labour did not depend merely on technological feasibility but on the extent of the market as well; whereas the size of the market depends on the availability of capital stock. Thus accumulation of capital is a precondition to increasing division of labour.

The regulatory measures against trade have a tendency to restrict the size of the market and limit the division of labour. He recognised the importance of technological development for improvement in productivity. To understand Smith’s theory of growth we should also examine the growth of labour force, capital accumulation, and increase in the supply of land and the change in the institutional set up.

(2) Supply of Land and the Change in Institutions:

In his theory, two factors, namely supply of land and the change in institutions are comparatively less important. The rent of land therefore considered as the price paid for the use of land, is naturally a monopoly price. He nowhere explicitly stated the supply of land. Regarding institutions the change in them is determined exogenously.

Institutional variable is quite important. He asserts that free trade and laissez-faire provides a highly congenial environment for economic growth. He was thus a strong believer in ‘natural reason’ guiding human affairs. He regarded state interference not only superfluous but harmful to economic progress.

Guided by self-interest, each individual was capable of promoting his own well-being and welfare of the whole society in the process. It is wise, therefore, according to Smith to be led by the ‘Invisible Land’ that is motivation of the competitive market forces. As a matter of policy, therefore, Adam Smith advocated the removal of all restrictions on trade, choice of occupation and the use of property.

(3) The Growth of Labour Force:

The rate at which the population grows in a country largely determines the growth of the labour force. According to Adam Smith rate of population growth in the long run, depends on the fund available for human sustenance. The size of the population is determined by prevailing wage rate. If actual wages exceed the subsistence wage, population will show a tendency to increase and vice- versa.

The supply of labour is normally expected to be in equilibrium with the demand for labour. If the demand for labour records a continuous rise pushing wage rates upward, it induces working population to multiply faster, as a result of which supply also continually increases and vice-versa. Smith has explained the demand for labour in the framework of wage fund doctrine.

Since the supply of labour has a tendency to respond to the demand for it. Smith’s argument implies that in a growing economy population will be increasing, that in declining economy it will be falling, and that in a stagnant economy characterised by the constancy of National Wealth it will be stable. In his opinion, high wage rates are consistent only with the growth of the economy.

(4) Capital Accumulation:

In Smith’s theory Capital Accumulation has been assigned a strategic role in the growth process. To him, growth is functionally Related to rate of Investment with a fixed capital stock a country is bound to suffer stagnation. According to him, any increase in capital stock in a country generally leads to more than proportionate increase in the output on account of continuously growing division of labour. Adverse institutional developments nullify the gains of capital accumulation from the point of view of growth.

According to Smith, the Rate of Investment as a crucial factor in economic growth, is determined by the Rate of Savings. He did not visualize any possibility of leakages occurring (-) saving and investment although the two activities are not performed by the same set of people. Savings and Investment are determined by private profit.

However, ability to save and investment is limited by income. Due to competition among the capitalists, Overtime when a country develops and its capital stock expands, the profit rate shows a tendency to fall. In the first place, the growing stock of capital, results in larger demand for labour which pushes up the wage rate leaving a smaller surplus to the entrepreneurs, secondly a larger capital, stock required abundant opportunities for investment which may not always exist in an economy.

Therefore, when capital stock expands in a sustained maimer, entrepreneurs will be able to employ it only at a lower marginal profit Ratio, that is why he postulated a downward sloping marginal efficiency of capital curve. He postulated a negatively sloped supply curve of capital implying an indirect relation between Supply of Capital and Rate of Investment. Capital accumulation stops only when Rate of Investment falls to a rate of profit which is sufficient only to compensate for the Risk premium.

(5) Agents of Growth:

According to Smith, farmers, producers and businessmen are the agents of progress and economic growth. It was free trade, enterprise and competition that led farmers, producers, and businessman to expand the market which in turn made economic development possible.

The functions of these three are inter-related. To Smith, development of agriculture leads to increase in construction works and commerce. When agricultural surplus arise as a result of economic development the demand for commercial services and manufactured articles rises.

This leads to commercial progress and the establishment of manufactured industries. On the other hand, these developments lead to increase in agricultural production when farmers use advanced production techniques. Thus, capital accumulation decreases, economic development takes place due to the emergence of the farmer, the producer and the businessman.

(6) The Growth Process:

According to smith, the process of growth is cumulative. When there is prosperity as a result of progress in agriculture, manufacture of Industries and commerce, it leads to capital accumulation, Technical progress, increase in population expansion of markets, division of labour, and Rise in profits continuously. But this process is not endless. It is the scarcity of natural resources that finally stops growth.

According to Smith, in a development process of an economy both income level and capital stock rise. In addition, the rate of capital accumulation also shows a tendency to increase. Obviously this factor enhances the capital stock of an economy in succeeding periods by increased doses of investment.

Another factor of vital importance which contributes to the progress of an Economy is a successive decline in the incremental capital output ratio on account of the influence of capital on the productivity of labour. These factors reinforcing each other accelerate the pace of development until such time that the economy’s capital stock grows large enough to eliminate profits, not of risk. At this stage the stationary state sets in.

The stationary state in Smith’s system is distinctly different from under development economies having reached the stationary state is characterised by unchanged population, constant total income, subsistence wage, elimination of profit in excess of the minimum consistent with risk and absence of Net Investment. Adam Smith did not suggest any measures to remedy this ‘dull’ state of affairs.

In his opinion, an economy in the stationary state finds itself at the highest level of prosperity consistent with its natural resources and environment. An under- developed country in contrast, reaches stagnation before it has reached the highest degree of opulence attainable with its resources. Smith has mentioned China by way of an example of an under -developed country.

Critical Appraisal:

(1) Neglect of Middle Class:

Smith’s theory is based on the socio-economic environment prevailing in Great Britatin and certain parts of Europe. It assumes the existence of a rigid division of society (-) capitalists and labourers. But the middle class occupies and important place in Modern Society. Thus, his theory neglects the role of the middle class which provides necessary conditions to economic development.

(2) One-sided Saving Base:

According to Smith, capitalist, land lords and money lenders save.

This is, however, a one-sided base of savings because it did not occur to him that the major source of savings in an advance society was the income-receivers and not the capitalists and land lords.

(3) Unrealistic Assumption of Perfect Competition:

Smith’s whole model is based upon unrealistic assumption of perfect competition. The laissez-faire policy of perfect competition is not to be found in any economy, rather a number of restrictions are imposed on the private sector and on internal and international trade in every part of the world.

(4) Neglect of Entrepreneur:

Smith neglects the role of the entrepreneur in development. This is a serious defect in his theory. The entrepreneur is the focal point of development, as pointed out by Shumpeter. It is the entrepreneur who organises and brings about innovations, thereby leading to capital formation.

(5) Unrealistic Assumption of Stationary State:

Smith is of the view that the end result of capitalist economy is the stationary state. It implies that there is change in such an economy but around a point of equilibrium. There is progress but it is steady, uniform and regular. But this explanation of the process of development is not satisfactory because development takes place by ‘fits and starts’ and is not uniform and steady. Thus the assumption of the stationary state is unrealistic.

Smith’s Theory of Economic Development:

Adam Smith was the first to define the Wealth of Nations. It was not the stock of gold or silver but it consisted of the vendible commodities and services which are of real use to the consumers. Wealth, another very important idea of Adam Smith, could not be increased through a deliberately planned favourable balance of trade as the mercantilists thought or by following physiocratic notion of applying all energies on land; instead wealth of a nation can be increased only by increasing the productive powers of labour, for in the ultimate analysis labour is the cause of all wealth.

This brings us to two of his important factors which determine the rate of economic growth:

(i) Division of labour and the consequent improvement in “the skill, dexterity and judgment” of workers, and

(ii) The proportion of productive to unproductive labour and accumulation of capital. Smith has ascribed a crucial significance to the phenomenon of division of labour as a determinant of economic growth.

Division of labour, whether occupational or territorial, creates internal and external economies, including an improvement in technology. Technological improvement not only lowers cost of production but also increases the future productive capacity of an economy. Hence division of labour is looked upon as a major gear in the machine of economic development.

From the Theory of Division of Labour, Smith locally moves to his famous law of market. The increased productive capacity of an economy can be sustained in the long run, only if there is an adequate effective demand for products.

This effective demand itself is constituted of two parts:

(i) Domestic demand and

(ii) Foreign demand.

Smith powerfully advocates free trade as a means of intensifying foreign demand. In fact free trade leads to a ‘horizontal extension of market’ which encourages territorial division of labour. Thus the possibilities are opened upon “reap the advantages of increasing physical returns brought about by overcoming technical indivisibilities of production”.

Smith also makes a strong case for a large population and for paying high real wages to labour. High real wages, associated with an increasing population, would surely stimulate domestic effective demand and encourage occupational division of labour within the domestic economy. Thus, the process of economic growth becomes cumulative division of labour continually leads to fresh internal and external economies. Indeed Adam Smith was an essentially optimistic thinker.

Apart from division of labour, the critical proportion between productive and unproductive labour is another significant determinant of rate of economic development. Hlamyint has pointed out the extreme significance of Smithian distinction between productive and unproductive labour. In any case, Smith argues that the proportion of productive to unproductive labour is governed by the rate of capital accumulation.

“As the accumulation of stock must, in the nature of things, be previous to the division of labour, so labour can be more and more subdivided in proportion only as stock is previously more and more accumulated.” (Adam Smith) Smith argued that the annual produce of the land and labour of any nation can be increased in its value by no other means, but by increasing either the number of its productive labourers or the productive power of labour who had been employed.

The number of productive labourers cannot be much increased but in consequence of an increase of capital, or of the funds destined for maintaining them. The productive powers of the same number of labourers cannot be increased but in consequence either of some addition and improvement to those machines which facilitate and abridge labour or of a more proper distribution of employment, in either case additional capital is almost always required. Thus, to increase the produce of a nation an increase of capital is necessary.

Smith has examined in considerable detail the difficult problem of capital formation. “Capital is increased by parsimony, and diminished by prodigality and misconduct.” In effect, Smith has emphasised the importance of real savings as a factor in capital accumulation. Like other exponents of the Classical School, Smith implicitly assumed that all savings we invested.

Thus, he was led to argue that capital formation and economic development would be impossible without real savings on the part of a community. Smith’s economics is nearer to the economics of under-developed countries in which savings are less. A developed country suffers from excess savings and under-investment. Thus, he was thinking of an economy where there were unlimited sources of investment.

Adam smith correctly stated that conditioning factor in the growth of an economy ultimately is food. Surplus food production supports the rest of the population. How much ideal labour can be employed depends upon the surplus of food. He thought of food as the limiting factor for demand for labour. When a country tries to develop economically, a shortage of food is bound to occur.

Smith said that demand for food is limited by the capacity of stomach. But in underdeveloped countries people are already under-fed. Therefore, demand for food rises when development takes place, for marginal increases in income would first be spent on food. Smith did not develop this aspect fully, though he very well realised the importance of food in under-developed countries.

It has been well established now that Smith’s main concern was to increase the physical productivity. He, no doubt, elaborated a theory of distribution also in Book I of the Wealth of Nations, but that was an after-thought—the inevitable effect of Smith’s contact with the physiocrats. In the main, Smithian economics drives its ‘central unifying principle’ from its explicit emphasis on the physical problem of production, i.e., the problem of economic development.

Smith wanted economic development through liberty and free enterprise. State’s role is to break monopoly, wherever it exists and perform only routine functions. This will be a correct approach for a country where a class of entrepreneurs is available. But in a country where such a class is conspicuous by its absence, Smith’s economics will not prove to be of any practical help—particularly his philosophy of free enterprise and liberty.

Their economic development will take a very long time to materialise and the country will be subjugated to foreign rule. Underdeveloped countries suffer, apart from capital scarcity, from a chronic lack of industrial environment, overhead capital, banking, insurance, transport, external economies etc. Such a country cannot stand on its own legs in the face of competition. Thus, while most of Smith’s theoretical analysis is applicable to underdeveloped countries, his policies are not.

Laissez Faire or Economic Liberty:

Like physiocrats, Adam Smith was a great champion of the principle of economic liberty. He ardently advocated the policy of laissez faire. Toynbee has remarked that Smith’s entire economic thought is a plea for liberty. Every page of his writing is illumined by the passion for freedom. He did not have a great faith in the role of Government or in the efficiency of its officials.

Smith preferred economic liberty as it would increase national property. Really speaking he favoured free trade. He was against state interference in economic activities. For that he gave many reasons. He argued that the Government could not secure economy in expenditure. It could not make correct assessment of the needs of the economy.

Further, he believed that the agents of the state are negligent and thriftless. There are malpractices, favouritism and red tapism. He went to the extent of suggesting that payment to the Government servants should be made in proportion to the work done by them.

Functions of State:

As a part of his liberalism, Smith advocated the following minimum functions of the government:

(a) Protection against foreign countries,

(b) administration of law and justice and

(c) establishment and maintenance of public works like roads, canals,harbours and schools.

However, the state might interfere, if necessary, in matters like foreign trade, banking, education, rate of interest and labour relations.

Public Finance:

The V th book of Wealth of Nations deals with the revenue of the Government. His treatment of this subject has gained universal recognition and his treatment of canons of taxation is classical.

According to Smith public finance is needed to meet the responsibilities of the State.

The revenue of the Government is derived from two sources:

(1) Funds, land and capital of the state

(2) Taxes. In order to guide the revenue authorities, he laid down the following canons of taxation. The later economists followed these in their theories without any change.

Canon of Ability:

“The subject of every State ought to contribute towards the support of the Government and as nearly as possible, in proportion to their respective abilities”. This principle is also known as Ability to Pay or Equality Principle. It implies that people of a country should be taxed in proportion to their respective abilities. Progressive taxation is based upon this principle.

Canon of Certainty:

This implies that the tax which each individual is bound to pay should be certain and not arbitrary. The time of payment, the manner of payment, the amount to be paid etc., should be clear to the tax payer.

Canon of Convenience:

“Every tax ought to be levied at the time, or in the manner in which it is most likely to be convenient for the contributor to pay it”.

Canon of Economy:

It implies that taxes should be collected at minimum cost to the Government.

International Trade:

The IV Book of Wealth of Nations mainly criticizes the mercantilist and Physiocratic doctrines. It is here that Adam Smith has given his ideas in favour of free trade and against protection. He criticised mercantilist idea of control and protection. He is not in favour of accumulating more gold and silver by means of favourable trade.

Gold and silver, he says, are just like any other commodity and so their export or import does not affect the prosperity of a nation. Hence he disagrees with mercantilist idea that trade is advantageous because it acquires gold and silver.

According to Smith, the only advantage from foreign trade is that, it carries surplus goods to other countries and brings in commodities which are in demand. Foreign trade is like domestic trade. Foreign trade like domestic trade is equally responsible for extending division of labour, increasing specialisation and for multiplying exchanges. Smith’s entire analysis can be summed up into the dictum. “Look after trade, and the gold will look after itself”.

The arguments given by him in favour of free trade are summarised below:

(a) Free trade brings about a proper distribution of capital within the country. Protection diverts it from one channel to the other.

(b) Free trade tends to bring territorial division of labour. It extends markets and increases economic activities which in turn increase national prosperity.

(c) Protection is injurious to the development of industry and commerce because, a few industries are protected.

(d) Free trade serves the interests of the consumers. Due to the development of commerce, people get commodities produced in a distant country at competitive rates.

Although Adam Smith favoured free trade, he pointed out certain limitations also. He considered the defence of the country as more important than opulence. Hence he thought that the Navigation Act of England was the wisest step taken by the Government. He also suggested the imposition of import duties as a retaliatory measure.

Critical Estimate of Adam Smith:

Adam Smith has a strong claim as the Father of Political Economy. The Wealth of Nations has become the corner-stone of economic science. J.B. Say rightly remarked, “When we read this work, we feel that previous to Smith there was no such thing as political economy”.

Though Smith borrowed certain ideas from the mercantilists and physiocrats, he arranged those ideas, gave it a harmonious blending and presented it in an effective manner. He was superior to Quesnay and perhaps to every writer since the time of Aristotle, in the extent and accuracy of his knowledge. As Alexander Gray observes, “Adam Smith’s name is incomparably the greatest in the History of Economic Thought”.

Merits:

(1) He was the first economist who defined economics and explained the scope of the subject.

(2) Smith developed the price system or value economics which became the central point of modern economic theory.

(3) His main contribution to the science of economics is the treatment of taxation. Without any alteration, the later economists incorporated his canons of taxation in their theories.

(4) He made a lasting contribution to economic thought through his ideas of division of labour, free trade, laissez faire etc.

(5) Smith shifted the emphasis from producer to the consumer.

(6) Smith viewed the society on its economic side, working spontaneously under the influence of competition and self-interest.

Although the Wealth of Nations has been much praised as the store house of costly gems, from which later economists have freely benefited, yet it could not escape the eyes of the critics. The following are the main defects found in Adam Smith’s ideas.

Demerits:

(1) Smith was essentially a materialistic thinker. That shows an absence of idealism.

(2) While dealing with economic theories, Smith did not keep in view the moral end. He had developed excessive individualism, restricting the activities of the State. He has created an imaginary “Economic Man” with great enthusiasm and zeal.

(3) His view of wealth was too narrow.

(4) His theory of value is ambiguous, confused and inconsistent. It is a two-sided theory.

(5) His theory of distribution was pessimistic and incomplete. His treatment of distribution is inferior to production.

In-spite of the above shortcomings, the Wealth of Nation possesses a literary charm. It provides a starting point for all economists. It is a ground work for modern economics. We may conclude with the words of Alexander Gray, that “It is again a tribute to the greatness of Smith that all schools of thought may trace to him their origins or inspiration”.