The following points highlight the top five contributions of Robert A. Mundell to Economics. The contributions are: 1. Theory of International Trade 2. The Mundell-Fleming Model of an Open Macro Economy 3. The Optimum Currency Area Argument 4. The Monetary Approach to the Balance of Payments 5. Fiscal-Monetary Mixtures and the Assignment Rule.

Contribution # 1. Theory of International Trade:

One fundamental corollary of the celebrated Heckscher-Ohlin Theorem of international trade has been the Factor Price Equalisation Theorem, which suggests the important theoretical premise that free commodity trade across nations is a substitute for international factor mobility.

This theorem is based on a set of crucial assumptions, most of which are common with the Heckscher-Ohlin Theory of international trade. Given the set of assumptions, Mundell’s theoretical contribution has been to prove the converse of the Factor Price Equalisation Theorem.

The crucial analytical assumptions underlying the Factor Price Equalisation Theorem are:

ADVERTISEMENTS:

1. Full intersectoral mobility of the factors of production which are however, internationally immobile.

2. Constant return to scale technology for each industry, with distinct and irreversible ranking of the products of these industries by factor intensities.

3. Profit maximization by the producers under perfectly competitive commodity and factor markets.

4. Difference in factor endowment position between countries and

ADVERTISEMENTS:

5. Free trade across nations with zero tariffs and zero transport costs.

The theorem states that equality of commodity prices via the channel of free trade between nations is sufficient for complete equalisation of both relative and absolute factor prices at the past trade equilibrium scenario even though the factor prices are supposed to be different between nations, thanks to the international immobility of factors of production. There exists a one to one correspondence between commodity price ratios and factors price ratios which is crucial for proving this theorem.

Contribution # 2. The Mundell-Fleming Model of an Open Macro Economy:

The open economy version-the flexible exchange rate version of the standard IS-LM model with output demand determined and prices taken as given in the Mundell-Fleming model, was developed in the early 1960s in the contributions made by Robert Mundell (1963) and Marcus Fleming (1962).

The simplest comparative static version of the Mundell-Fleming model is a direct extension of the 1S-LM model. Mundell introduced foreign trade and capital movements into the so called IS-LM model of a closed economy, initially developed by John Hicks. This model is stated in highly simplified assumptions in terms of fixed domestic prices and static expectations about the exchange rate. Later researchers relax these assumptions and allow price adjustment when the economy deviates from full employment.

ADVERTISEMENTS:

Exchange rate expectations also enter prominently in a frame work of rational expectations. In the Mundell – Fleming macro-economic model of flexible exchange rates under conditions of perfect capital mobility, the openness of the economy is introduced with given prices at home and abroad, changes in the exchange rate, change in the terms of trade and the allocation of demand, output and employment.

Contribution # 3. The Optimum Currency Area Argument:

The credit of developing the first theory of optimum currency goes to Mundell. Mundell in 1961 developed it as branch or an extension of the fixed versus flexible exchange rate. An Optimum currency area is an area within which exchange rates should be fixed. Mundell claimed that the optimum currency area is the ‘region’ which is defined as an area within which factors of production are mobile and from which they are immobile.

Mundell argued that if currency areas are smaller than existing countries then:

i. There is considerable inconvenience in converting currencies.

ii. There is exchange rate risk in local business activity.

iii. In addition this currency markets can experience monopolistic private speculation.

Mundell therefore limited the optimum currency area to something larger than a nation. This makes the problem one of asking which countries should have fixed exchange rates.

Contribution # 4. The Monetary Approach to the Balance of Payments:

Mundell’s new ideas on the monetary approach to the balance of payments are presented in ‘International Economics’. The monetary approach explains the balance of payments in terms of difference between the supply of money and the demand for money, and also to show the effects of change in the supply of money. The monetarist approach is also used by its proponents to explain why some countries have persistent deficits.

The monetary approach shows that if too much money is created deficit will occur. It also argues that the balance of payments is essentially a monetary phenomenon and must be viewed in its entirety. It stresses that the money supply and demand are strong forces in determining a country’s external position as indicated by the change in the country’s foreign currency reserves.

ADVERTISEMENTS:

Prof. Robert A. Mundell in his seminal paper on “The Appropriate use of Fiscal and Monetary policy for Internal and External stability”, considers the problem of achieving internal stability and balance of payment equilibrium in a situation when alternations in the exchange rate are ruled out and trade controls are considered inadvisable. The external and internal balances can be respectively achieved by various combinations of fiscal and monetary policies.

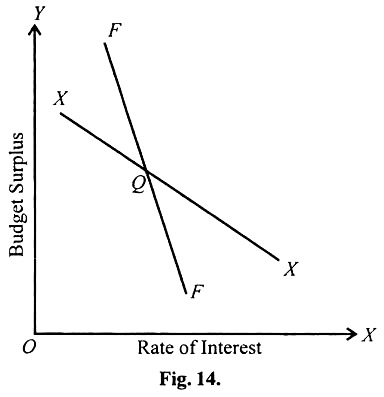

In the diagram (Fig.14) the FF line represents the ‘Foreign Balance Schedule’ which traces the locus of pairs of interest rates and budget surpluses (at the level of income compatible with full employment) along which the balance of payments is in equilibrium.

The XX line or ‘Internal Balance Schedule’ is the locus of pairs of interest rates and budget surpluses which permits continuing full employment equilibrium in the market for goods and services. Both the internal balance and the foreign balance schedules have negative slopes.

ADVERTISEMENTS:

The FF schedule has a negative slope because an increase in the interest rate, by reducing capital exports and lowering domestic expenditure and hence imports, improves the balance of payments, while a decrease in the budget surplus, by raising domestic expenditure and hence imports, worsens the balance of payments.

Any point of the FF schedule represents equilibrium. Points above and to the right of the FF schedule refer to balance of payments surpluses, while points below and to the left of the FF schedule reflects balance of payments deficits.

The internal balance line XX has a negative slope, since increase in the interest rate are associated with decreases in the budget surplus in order to maintain domestic expenditure constant. The crucial point is that the external balance FF is steeper than the internal balance locus XX. This is because of the responsiveness of capital inflows to change in interest rate.

The more mobile is capital and the lower is the marginal propensity to import the slope of FF becomes greater in absolute value than the value of XX. In the figure, the situation of overall equilibrium exists at Q. If this equilibrium is disturbed by an increase in the rate of interest, there would be deflationary pressure and a balance of payment surplus.

ADVERTISEMENTS:

In the figure, the two schedules separate four quadrants, distinguished from one another by the conditions of internal imbalance and external disequilibrium, only at the point where the FF and XX schedules intersect are the policy variables in equilibrium.

The conclusion that follows from Mundell’s diagrammatic argument is that in countries where employment and balance of payments policies are restricted to monetary and fiscal instruments, monetary policy should be reserved for attaining the desired level of the balance of payments and fiscal policy for preserving internal stability.

The opposite system would lead to a progressively worsening unemployment and balance of payments situation. That is the use of fiscal policy for external balance and monetary policy for internal balance drives the interest rate and budget surplus further away from equilibrium while the alternative system moves the instruments closer to equilibrium.

In the domain of monetary theory and macro-economic Robert Mundell’s seminal contribution has shaped the subsequent researches. Robert Mundell pointed out that whether the equilibrium rate of interest would be affected by monetary expansion or not, depends not only on the mode of monetary expansion-deficit financing versus open market operations, but also on what the government does with the interest income that accrues to it in the common stock that it purchases through the open market operations of the central bank.

If the government decides to neutralize this receipt of interest income. Mundell was perhaps amongst the first to point out the importance of this constraints and much of the discourses on modern macroeconomics since then have tried to point out this constraint as an integral part of macro-modelling.

Contribution # 5. Fiscal-Monetary Mixtures and the Assignment Rule:

Looking more closely at the basic demand policy dilemma, Robert Mundell and Fleming noticed that monetary and fiscal policy, those two main arms of demand management have different relative impacts on internal and external balance, monetary and fiscal policy can be mixed so as to achieve any combination of aggregate demand and overall payment balance.

ADVERTISEMENTS:

The pattern of policy prescriptions reveals a useful guideline for assigning policy tasks to fiscal and monetary policy. This is Robert Mundell’s assignment rule, assign to fiscal policy the task of stabilising the domestic economy only and assign to monetary policy the task of stabilising the balance of payments only.

Robert Mundell’s work is more than a bench mark. Mundell’s contributions on monetary dynamics proved to be a watershed for research in international macro-economics. He has reshaped the macro economic theory for open economics. His analysis of stabilisation policy and exchange rate systems constitutes the core of policy research. His theory of optimum currency areas has great importance.

His monetary approach to the balance of payments is a foundational work for a number of researches to build on. Mundell’s contributions at the University of Chicago serve as basic research in international macro-economics. Mundell’s analysis of monetary and fiscal policy in open economics stimulated the creative research activities. His work also initiated the necessary re-approachment between Keynesian short run analysis and classical long run analysis.

His research findings have been applied in practical economic policy making. His analysis has attracted the attention of policy makers in connection with the common European currency. Recently it has been emphasised that SAARC countries must work towards common currency on the lines of Euro so that the region became a powerful trading block.