The below mentioned article provides a close view on exports – opening the economy in India.

Subject-Matter:

The historical record indicates that countries that have followed a policy of economic openness have achieved export-led growth by it.

The experience of outward-oriented Asian economies is a case in point. Economic openness is measured by the proportion of exports to GDP. Every country engages in trade, exporting and importing goods and services to and from over partner countries.

An increasing number of countries are also linked together through trade in financial assets. One measure of a country’s economic openness, or exposure to the influences of the rest of the world, is the ratio of it exports to its GDP. Openness has increased considerably over the past decades as part of the process of globalisation. As a consequence, no country is free from influences of events that occur elsewhere, sometimes far away.

ADVERTISEMENTS:

By offering countries opportunities to trade with the outside world, openness stimulates growth through easier access to new technologies and skills and to investible resources in international capital markets, and through the promotion of market discipline.

There is a strong link between economic openness and growth. A recent study shows that between 1985 and 2001, annual economic growth was, on average, 2% higher in those Asian economies that maintained outward oriented policies than in those that had adopted inward- looking policies.

India began trade and investment liberalisation more than a decade ago. In July 1991 the Government introduced a number of liberalising measures, including reducing tariffs significantly, abolishing all quantitative restrictions on non-consumer goods, unifying the exchange rate, introducing current account convertibility, and adopting a liberal set of rules for FDI. These reforms substantially improved export performance and resulted in sizable FDI inflows. The share of trade in GDP has increased by about 50% since the inception of trade reforms, and now accounts for more than a quarter of India’s GDP.

Foreign Trade: The Centre Stage of Reforms:

The immediate cause of the 1991 crisis was the balance of payments problem when India was about to become a defaulter on foreign payments. The Government formed after May 1991 quickly negotiated with the IMF for a structural adjustment loan initiating a wide range of economic reforms.

ADVERTISEMENTS:

The external (foreign trade and investment) sector was at the centre stage of this reform package that included devaluation of the rupee in 1991, introduction of market-based exchange rate system in a phased manner, substantial reduction of tariff and non-tariff trade barriers (mainly quotas or quantitative restrictions and exchange control).

The main objective of economic reforms was to open up an almost closed economy. As a result of opening up the economy the shares of exports and imports in GDP have increased steadily. Exports rose to more than 9% of GDP in 2000-01 from a modest 6% in 1999-01 and imports to about 12% of GDP from 9% during the same period. There is no doubt that the Indian economy is increasingly becoming integrated with the rest of the world with foreign trade (exports and imports) accounting for 22% of GDP in 2000-01 (compared to 15.6% of GDP in 1990-91).

The growth of exports has fluctuated over the years. Such fluctuations reflect both short-run vulnerability and long-run potential. Agriculture accounted for 14% of India’s total export earning, textiles for 24%, gems and jewellery for 17% and chemicals and related products for 13.%

India’s visible exports (f.o.b.) increased from Rs. 44,922 crores in 1991-92 to Rs. 205,287 crores in 2000-01. During the same product imports (c.i.f.) increased from Rs. 51,417 crores to Rs. 270,663 crores. As a result the trade deficit increased from Rs. 6,495 crores to Rs. 65,376 crores.

ADVERTISEMENTS:

With the sweeping liberalisation of the foreign trade sector, the level of protection in Indian industry has declined significantly as the Government has cut down of import tariffs drastically and allowed more liberal imports of a number of goods whose import were earlier either totally banned or severely restricted. Foreign trade sector is gradually emerging as the leading sector’ of the Indian economy—a sector that is likely to change the face of the economy in the coming years giving it a strong push up in the world economy.

What is most noteworthy is that total receipt from invisibles increased much faster the total payments. In 2000-01 net receipt from invisibles amounted to Rs. 53,945 crores compared to only Rs. 4,258 crores in 1991-92. This is a visible indicator of the increasing links of the Indian economy with the global economy.

The current receipts (trade and invisibles taken together) accounted for 16.6% of GDP in 2000-01 and current payments 17.1%. This means that the current account deficit (CAD) was 0.5% of GDP. It increased from Rs. 2,237 crores in 1991- 92 to Rs. 11,431 crores in 2000-01. In the post- reform period the maximum level of CAD was 1.7% of GDP in 1995-96.

The large increase in net invisible receipts has been largely due to a rise in remittance income through the official channel following the incentives provided by the market-determined exchange rate (called managed float’) and sustained growth ‘ of software service exports. (Software service exports fall in the category of non-factor services in the account for invisibles.) These two have emerged as the largest items of invisible receipts and have helped considerably in improving India’s balance of payments position.

The EXIM Policy (1997-2002):

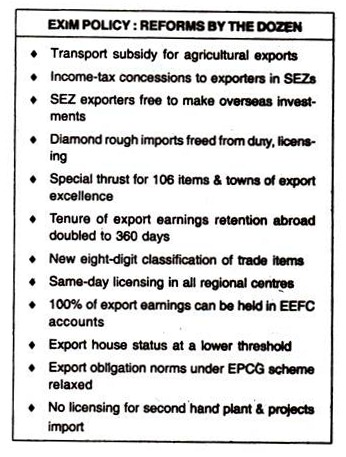

The export-import policy for five years 1997- 2002 (co-terminus with the Ninth Plan) was announced on March 31, 1997.

Four important objectives of the policy are the following:

1. The primary objective is to make India’s transitions to a globally-oriented vibrant economy faster with a view to deriving the maximum benefits from expanding global opportunities.

2. The second objective is to promote faster economic growth which can be sustained in the long run. This is possible by providing access to essential raw materials, intermediate goods, components and commodity and capital goods required for increasing domestic production.

3. The third objective is to enhance the technological strength and efficiency of Indian agriculture, industry and services with a view to improving their competitiveness in the world market as also for enabling Indian products to attain internationally accepted standards of quality.

ADVERTISEMENTS:

4. The fourth and final objective is to provide consumers with quality products at acceptable prices.

The Exim Policy of 1997-2002 was revised on April 13, 1998 and March 31, 1999. In Nov. 1997 India agreed to remove tariff restrictions on 2,714 items over a six-year period. The 1999 review of the Exim policy recognised the importance of exports of services. Moreover those who will be able to export more than 50% of their products will get various facilities.

In short, the trade policy reforms initiated in 1991 have drastically changed the foreign trade situation of the country. It has resulted in the shift from inward-oriented to an outward-oriented policy.

The EXIM Policy (2002-07):

On March 31, 2002 the GOI announced a new five-year Exim Policy- with a view to achieving 1% share of global exports. Quantitative restrictions have been lifted and various incentives offered to agricultural exports and special economic zones to achieve the $ 80 billion annual exports target by 2007.

ADVERTISEMENTS:

The policy seems to diversify markets with new export programmes to African and CIS countries and offers benefits to industrial clusters and exports of cottage and handicrafts products, gems and jewellery and electronic hardware sectors, among others.

With a view to achieving 1% share in global exports by 2007, the Government announced lifting of export restrictions, incentives to attract investments in special economic zones, continuation and simplification of existing duty neutralisation schemes, steps to reduce transaction cost and provided sops to boost agriculture, hardware and gems exports.

In the Exim Policy commerce and industry minister Murasoli Maran outlined a major policy thrust for the agriculture sector including removal of packaging restrictions and lifting of quantitative restrictions on all agricultural products except onions and jute.

ADVERTISEMENTS:

Though trading in some items would be permitted only though state trading enterprises, the Government would decanalise import of petroleum and petro goods as the administered price mechanism for the sector was being dismantled from April 1, 2002.

As part of the agriculture sector package, Maran announced transport assistance for export of fresh and processed fruits vegetables, paltry, dairy and floriculture products, in addition to wheat and rice products.

The boost electronic hardware exports units in electronic hardware technology parks can freely sell goods covered under the IT Agreement in the domestic market. The units would need to have a positive net foreign exchange as percentage of exports (NEEP) in five years instead of every year and would not face other export obligations.

For gems and jewellery exports, Maran announced waiver of customs duty on import of rough diamonds and abolished the licencing regime on these imports. The Government also provided sops for small scale and cottage industry units as also the handicrafts sector with incentives to access market access initiative (MAI) funds and export house status for units with average export performance of Rs. 5 crores instead of Rs. 15 crores.

“India needs to release itself from feelings of export pessimism and apathy and employ international trade as an engine of growth”, Maran said a year after QRs on imports were lifted.

The minister continued his love for designated areas to promote export excellence and announced sops for industrial cluster-towns which would get funds under MAI for creation of technological services, EPCG benefits and would also be eligible to avail other export schemes with further relaxed norms.

ADVERTISEMENTS:

In his last two policies, Maran had announced the establishments of SEZs and Agri Export zones (AEZs). Though no new incentives were announced for AEZs, which now number 20, for SEZs, the minister announced enhanced income tax benefits, central sales tax exemption in case of sale from domestic tariff area to SEZs and removal of restrictions on external commercial borrowings.

He also announced establishment of overseas banking units in SEZs which would be exempted from statutory liquidity ratio and cash reserved ratio to help units and their developers access funds at lower and international rates of interest.

Maran announced the continuation of export incentives schemes including the duty entitlement and passbook (DEPB) scheme, which would now have lower value caps, the advance licence scheme and also provided a relief to export obligation defaulters under the export promotion capital goods schemes.

Under the duty entitlement and passbook, which was expected to be phased out from 2002- 03, the commerce and industry minister also announced a major relaxation for exporters who would now not be subjected to post-market value verifications.

Under the advance licence scheme, the minister announced the withdrawal of annual advance licences, announced in 2001, as the exporters were encountering problems.

The minister said the scope of MAI would be enlarged and increased its allocation three-fold to Rs. 42 crores during 2002-03.

ADVERTISEMENTS:

Sops were also offered to status holders including the flexibility to retain 100% foreign exchange earnings under the Export Earners Foreign Currency account and doubling of the normal repatriation period from 180 days to 360 days.

As part of an attempt to usher in a regime with reduced transaction costs, Maran announced a reduction in the maximum fee limit on applications under various schemes, same day licencing in all regional offices of DGFT, reduction in physical examination by the customs department and permission for direct negotiation of export document to help exporters in reducing their bank charges.

Offshore Banking in Special Economic Zones:

Faced with a dwindling export growth commerce minister Murasoli Maran has put all his hopes in the Special Export Zones basket this time.

The policy has promised a slew of benefits to the SEZs including setting up of Offshore Banking Units which are expected to offer lower interest rates than their counterparts in rest of the country, allowing hedging in commodities by units in the zone and simplified external commercial borrowing norms.

The minister hopes that the momentum generated by the sops given to SEZs will push the export growth rate to a compound 11.9% in the next five years. Maran said the SEZs are the symbols of Indian endeavour to remain internationally competitive and relevant. He said “they are our best dream projects and are firmly based on success everywhere”

The measures announced for SEZs include Information Technology concessions to units and exemption from central sales tax act to supplies from rest of the country to SEZs. Besides the suppliers to SEZs will also get drawback and DEPB benefits. The commerce minister also wrested a concession from the finance ministry in regarding transactions between SEZs and other places as exports under Income Tax and Customs Act.

ADVERTISEMENTS:

The Overseas Banking Units again draws heavily from the Chinese experience.

The policy says “these units would be virtually foreign branches of Indian banks but located in India”. Exempt from almost all RBI restrictions on banks in rest of the country, the banks would be free from CRR and SLR and can therefore offer cheaper finance. The domestic banking sector is expected to respond enthusiastically to the proposals.

For the units in the 17 existing and proposed SEZs the minister has also announced ECBs of less than three-year tenures. While the detailed guidelines will be worked out by the Reserve Bank of India, the units set up there can tap the international markets more easily for short-term funds.

Since they will also be entitled to dip into the Export Earners Foreign Currency Account upto 100% for prepaying ECB loans the cumulative benefit will be substantial compared to those in domestic tariff areas. The policy has also allowed the benefits given to status holders like direct negotiations bypassing banks to SEZ units, and enhancement of normal repatriation period of foreign exchange earnings to 360 days, double the present limit of 180 days.

Justifying his putting of faith in SEZs which are not expected to be really operational till 2006, Maran said “in a world dominated by the WTO, India cannot be left behind”.