The following points highlight the ten practical uses of concept of price elasticity of demand. The uses are: 1. Wage Bargaining 2. Bumper Crops 3. Automation 4. Airline Deregulation 5. Pricing Policy 6. Excise Duty 7. Optimal Tax on Petroleum 8. Minimum Wage 9. Heroin and Street Crime 10. Devaluation.

Use # 1. Wage Bargaining:

The capacity of trade unions to raise wages depends on the elasticity of demand for the product in which labour is used as a major input. If wages are permitted to rise cost and prices will also rise.

A portion of the cost or even the whole of it may be passed of the cost or even the whole of it may be passed on to the consumer if the demand for the product is inelastic. If demand in inelastic. If demand in inelastic sales will not fall much due to price rise. Thus a wage rise is economically feasible in the food industry than in the automobile sector.

Use # 2. Bumper Crops:

Everyone knows that the demand for most agricultural commodities is highly inelastic. As a result, an increase in the output of wheat or jute due to good harvest (or productivity rise due to technological progress) may lead to a sharp fall in their prices. This will lead to a fall in the revenue of the farmers. So help the farmers the government will have to impose restriction of agricultural out-

Use # 3. Automation:

ADVERTISEMENTS:

The effect of the use of machinery or employment largely depends on the elasticity of demand for the commodity produced by the firm under consideration. Suppose a firm introduces a labour- saving machine. This may make 100 workers unemployed.

However, a part of the cost reduction due to the impact of automation (i.e., rapid technological advance) is passed on the consumers in the form of lower price of the product.

If the demand for the product is elastic, a small price cut will lead to more than proportionate increase in demand. As a result output may increase to such an extent that 100 unemployed workers or even more are reabsorbed by the firm. If demand is inelastic, few, if any, workers can be reemployed, because the in crease in the volume of firm’s business will be small.

ADVERTISEMENTS:

Use # 4. Airline Deregulation:

In the USA there was regulation of airlines in the 1970s. The basic object was to increase the profits of many carriers. The reason was simple. It was felt that deregulation increased competition among the airlines, thereby lowering air fares.

Since the demand for air travel is elastic, lower fares will surely increase total revenue. When airlines are flying with many empty seats the additional costs of carrying extra passengers is very little. So revenue increases faster than costs and profits rise.

A simple example may make the point clear. Suppose Indian Airlines is capable of carrying 10,000 passengers per month on a particular route (say, Calcutta to Bagdogra) at a fixed cost of Rs. 3 lakhs. The variable cost per passenger is Rs. 10 and the fare is Rs. 50 per trip. Suppose at present it is able to carry 8,000 passengers. In other words, 20% of its capacity is idle.

ADVERTISEMENTS:

At present its total earning is Rs. 50 x 8,000 = Rs. 4 lacs. Its total cost is Rs. 3 lakhs + Rs. 10 x 80,000 = Rs. 380,000. So its net profit is Rs. 20,000. Now suppose it reduces its fare to Rs. 45. As a result it is able to carry all the 10,000 passengers and thus fly to full capacity.

Now its total revenue will be Rs. 45 x 10,000 = Rs. 4.5 lakhs. Its total cost will be Rs. 3 lakhs + Rs. 10 x 10,000 = Rs. 4 lakhs. So its net profit will be Rs. 50,000 which is an increase of Rs. 30,000.

Use # 5. Pricing Policy:

As a corollary of 4 one can show that the concept of price elasticity has great practical relevance for business pricing policy. When a firm considers changing the prices of its product, it has to take account of the effect of the proposed price change on consumer’s spending. For example, a reduced selling price may result in a lower total revenue because demand is inelastic.

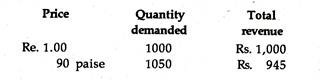

The price reduction causes a less than proportionate change in the quantity demanded, as illustrated below:

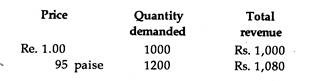

On the other hand, if demand is elastic a fall in price should result in a greater total revenue, because the price-cut causes a greater than proportionate change in the quantity demanded, as illustrated below:

Similar considerations arise when a firm contemplates an increase in its selling price. If demand is inelastic, consumers will continue to buy as must as before the price rise, and so revenue will increase. However, if demand is elastic, consumer’s demand will fall and total revenue will also fall.

Thus it is necessary for manufacturers to know something about the elasticity of demand for their products. If a manufacturer is considering increasing his output, he knows that in order to sell the increased output he must reduce the price.

ADVERTISEMENTS:

But if demand is inelastic, the quantity demanded will not rise much. So the manufacturer will find that his total revenue from the sale of the product will fall. It will be better for him to leave things as they originally are.

As Pappas has rightly put it: “a profit maximising firm would never choose to lower its price in the inelastic range of its demand curve, as such a price decrease would decrease total revenue and at the same time increase costs, since output would be rising. The result would be a dramatic decrease in profits.”

This explains why the monopolist — who is a price-maker — never operates on the inelastic part of his demand or average revenue curve.

If, on the other hand, demand is highly elastic a reduction in price may cause total revenue to inmates on the inelastic part of his demand or average revenue curve. If, on the other hand, demand is highly elastic a reduction in price may cause total revenue to increase.

ADVERTISEMENTS:

So the manufacturers may decide to increase his output. In the words of Pappas again, “Even over the range where demand is elastic, a firm would not necessarily find it profitable to cut price; but profitability of such an action depends on whether the marginal revenues generated by the price reduction exceed the marginal cost of the added production”.

In fact, the practicing manager can make use of the concept of price elasticity of demand in answering the following questions:

1. What will be the impact on sales of a 5% increase in price?

2. How large a price reduction is necessary to increase sales by 10%?

ADVERTISEMENTS:

3. Given marginal cost and price elasticity information, what is the profit maximizing price?

Use # 6. Excise Duty:

The government takes account of elasticity when selecting goods and services upon which to impose excise duty.

The main purpose of a tax on a commodity may be either:

(a) To raise its price in order to reduce consumer’s demand or

(b) To raise revenue.

The first objective is likely to be fulfilled if demand for the commodity is elastic. A simple example may make the point clear. Suppose a tax of Re. 1 is imposed on a product and 10,000 units are sold. Tax revenue is Rs. 10,000. Now suppose the tax is raised to Rs. 1.50 and sales fall to 5,000 units because demand is elastic. In this case the tax revenue will decline to Rs. 7,500.

ADVERTISEMENTS:

Thus a higher tax on a product, the demand for which is elastic, will reduce the tax revenue of the government. However, the usual objective of taxation is to raise revenue.

This objective is achieved by imposing a tax on such commodities as oil, cigarettes and liquor. The demand for those goods is inelastic and the government known that an increase in the taxes on these goods will not result in large fall in demand and consequently tax revenue.

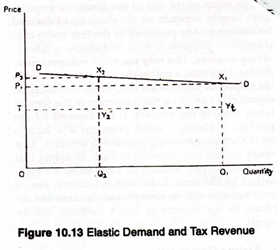

Thus two points are illustrated in the diagrams below. In Fig. 10.13 the original price of the product is OP1, of which TP1 is tax. The quantity demanded at this price is OQ1.

Where the tax is increased to TP2, the quantity demanded falls to OQ2. As a result the tax revenue of the government falls from TP1X1Y1 to TP2X2Y2.

ADVERTISEMENTS:

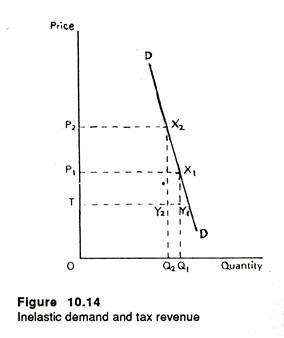

revenue has increased from TP1X1Y1 to TP2X2Y2.

(N.B. To find out the total effect of the imposition of an indirect tax like a sales tax or excise duty, supply curves should be used. So we shall again examine indirect taxes when we consider applications of price theory by using both demand and supply curves.

However, manufacturers and governments do not actually draw demand curves and work out the formula for elasticity. They, of course, make use of market research and past experience to gain an insight into the effects of various policies on the demand for different products and in this way make use of the concept of elasticity.

Use # 7. Optimal Tax on Petroleum:

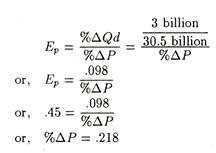

The concept of price elasticity of demand may be used to find out the optimal tax on petroleum. Suppose the government of India decides to reduce consumption of petroleum by 3 billion gallons a year by imposing an excise duty. The question here is : What should be the optimal tax on petrol which will reduce consumption by the desired amount?

Suppose the present level of consumption of petrol in the country is 30.5 billion gallons per year. Also suppose that the long run price elasticity of demand for petroleum is 0.45.

ADVERTISEMENTS:

We can now easily calculate the rate of tax necessary to have the desired effect on consumption. For simplicity let us assume that the correct price is Rs. 100 per gallon. If the Ep = .45 and if the objective is to decrease consumption by 3 billion gallons in the long run, ceteris paribus, one has to simply use the elasticity formula to determinex the tax.

Thus in order to reduce the consumption of petrol by 9.8%, it is necessary to raise its price by 21.8%. The required additional excise duty would, therefore, be Rs. 21,8 per gallon of petrol (Rs. 100 x 21.8%), making the price of petrol Rs. 122 (approx.) per gallon.

So a simple economic tool (viz. elasticity) can be used to give policy advice to the government. Government economists often use this concept in contingency planning exercises during recent oil crisis. Such examples could be multiplied. But the basic point is clear: the concept of price elasticity of demand is vitally important to business, people, farmers, labourers, and government planners and policy makers.

Use # 8. Minimum Wage:

In some countries the government has imposed minimum wage above the equilibrium level. It is felt that this will cause unemployment particularly of the child workers. This is because employers will move back to the left along this downward sloping demand curve for labour.

On the other hand those who remain employed at the minimum wage surely get higher incomes than otherwise. The amount of income lost by the unemployed and the income gained by those that remain employed depends on the elasticity of demand for child labour.

ADVERTISEMENTS:

If the demand for child labour is inelastic, minimum wage will raise workers’ welfare: the income gain associated with the minimum wage exceeds the income losses. If, on the other hand, the demand for child labour is elastic, the case against minimum wage would be stronger.

Use # 9. Heroin and Street Crime:

We know that demand for heroin by addicts is highly inelastic. This creates a problem in the area of law enforcement. The government usually seeks to solve the problem by reducing heroin addiction. This is sought to be achieved by making the drug less readily available to the addicts. If price is raised to restrict its consumption, hardly anything will happen.

Since the demand is highly inelastic, consumption will fall only slightly even if price rises very high. For those involved in drug trade this means increased revenues and profits. From the addicts’ point of view it means greater total expenditure on heroin.

In the U.S.A. and other countries a major portion of money which addicts spend on heroin is actually derived from crime (or immoral activities) such as shoplifting, smuggling, robbery, etc.

So these kinds of crime are likely to increase as addicts increase their total expenditures for heroin. And, as C. R. McConnell has rightly pointed out in this context, “the efforts of law- enforcement authorities to control the spread of from the addicts’ point of view it means greater total expenditure on heroin.

In the U.S.A. and other countries a major portion of money which addicts spend on heroin is actually derived from crime (or immoral activities) such as shoplifting, smuggling, robbery, etc.

So these kinds of crime are likely to increase as addicts increase their total expenditures for heroin. And, as C. R. McConnell has rightly pointed out in this context, “the efforts of law- enforcement authorities to control the spread of drug addiction may increase the amount of crime committed by addicts.”

Use # 10. Devaluation:

A country often devalues its currency to improve its balance of trade position. Devaluation refers to the reduction in the external value of a country’s currency in terms of another currency. However, the extent to which devaluation will succeed in improving a country’s balance of trade depends on the fulfilment of a condition which is known as the Maschall — Lerner condition.

The condition may be stated as follows:

(i) The demand for a country’s imports has to be price elastic (ex >1)

(ii) The demand for a country’s imports has also to be price-elastic > 1)

The success of devaluation thus depends largely on the reaction of import and export volumes to the changer in prices implied by the devaluation.

In such a situation an increase in import prices will result in a more than proportionate fall in import volume, reducing the total amount of foreign currency required to finance the import bill, while the decrease in export prices results in a more than proportionate increase in export volume, bringing about an increase in total foreign currency earnings on exports.

In contrast, if trade volumes are relatively inelastic to price changes, devaluation will not succeed, that is, an increase in import prices results in a less than proportionate fall in import volume, increasing the total amount of foreign currency required to finance the import bill, while the decrease in export prices results in a less than proportionate increase in export volume, bringing about a fall in total foreign currency earnings on exports.