Like price elasticity of demand, price elasticity of supply is a measure of responsiveness—a measure of the market sensitivity of supply. Price elasticity of supply can be defined as the degree of responsiveness of the quantity supplied of commodity in response to a small percentage (say 1%) change in its own price.

The coefficient of price elasticity of supply of some good, say, X, is expressed as:

ES = % change in the quantity supplied of good X/% change in price of good X

This may also be expressed as:

ADVERTISEMENTS:

ES = (∆Q/Q)/(∆P/P)

while the coefficient of price elasticity of demand is always negative. Es is always positive since the supply curve usually slopes upwards from left to right.

A study of price elasticity of demand reveals that it is dangerous to infer elasticity from the slope of the curve. But it is very easy to calculate price elasticity of supply from the slope of the supply curve. Three important points may be noted in this context.

ADVERTISEMENTS:

Three points:

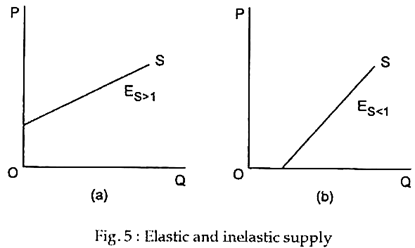

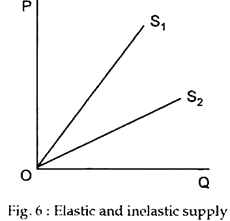

The first point is that, any straight line supply curve that intersects the vertical axis will be elastic and its value will lie between one and infinity. The second point is that a straight line supply curve that intersects the horizontal axis will be inelastic and its value will lie between zero and one. The third point is that any straight line supply curve through the origin will have unitary elasticity.

These three points are illustrated in Fig. 6:

Fig. 6 also shows that both and S2 have unitary elasticity.

ADVERTISEMENTS:

This is because:

∆Q/∆P = 1/∆P = P/Q

Thus,

ES (∆Q/∆P) = P/Q = 1/∆P = P/Q = 1

This is so because, at any point on the supply curve, P, Q and ∆P and ∆Q form similar triangles with the supply curve.

It is possible to judge the category of price elasticity of supply at any point on a supply curve by drawing a tangent to the point of the curve we wish to know about.

If the tangent intersects the vertical axis then supply is elastic at that point. If it intersects the horizontal axis, as in Fig. 6 then it is inelastic.

Two extreme situations:

ADVERTISEMENTS:

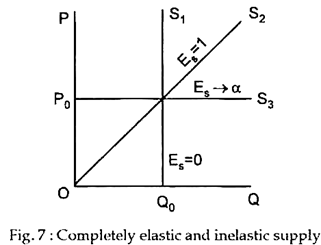

Fig. 7 shows two extreme situations of perfectly elastic and perfectly inelastic supply. The vertical supply curve shows perfectly inelastic supply. This is the case where the quantity offered for sale is fixed, as in the case of perishable goods like fish or vegetables. These are brought to a market in the morning and are sold at whatever prices they fetch. This is polar (limiting) case of perfectly inelastic supply.

The horizontal supply curve shows another extreme case, i.e., that of perfectly inelastic supply. The implication of such a supply curve is that a little price cut will cause the quantity supplied to fall to zero while a slightest increase in price will induce purchasers to offer an infinitely large quantity. In this polar case of an infinitely elastic supply the ratio of the percentage change in quantity supplied to percentage change in price is extremely large and yields a horizontal supply curve.

Between the two polar cases, supply may be elastic or inelastic depending upon whether the percentage increase in quantity is larger or smaller than the percentage increase in price. Fig. 7 also shows an intermediate case of a straight line, starting from the origin, showing the border line case of unit elasticity, where the percentage increase in quantity supplied is exactly equal to the percentage increase in price.

ADVERTISEMENTS:

Factors:

Price elasticity of supply depends on a number of factors.

The following seem to be the most important:

1. The nature of the industry:

ADVERTISEMENTS:

The most important factor affecting price elasticity of supply is the nature of the industry under consideration. This will indicate the extent to which production can be increased in response to an increase in the price of the product. If inputs (especially raw materials) can be easily found at existing market prices, as in the textiles industry, then output can be greatly increased if price rises slightly.

This means that supply is fairly elastic in the textiles industry. On the other hand, if production capacity is severely limited—as in gold mines, then even a very large increase in price of gold will lead to a very small increase in production. This means that the supply of gold is fairly inelastic.

2. Time:

The second important factor affecting price elasticity of supply is the time period under consideration. As Paul Samuelson has commented, “A given change in price tends to have a larger effect on amount supplied” as suppliers get more time to respond to price changes. Business firms may find it difficult to increase their usage of labour and output immediately after price rise.

So, supply is likely to be less elastic. However, with the passage of time, business firms can hire more labour, capital and set up new factories so as to expand production capacity. Thus supply will increase considerably. So supply will be more elastic in the long run than in the short run. The reason is simple—producers take some time to adjust their capacity to changes in demand.

Alfred Marshall referred to three time periods in this context, viz., the momentary period, the short run and the long run. In the momentary period, supply is fixed and Es is zero. In the short run, supply can be varied by using existing machines and factors more intensively. In the long run, firms can enter or leave the industry. Fig.6 shows three supply curves for the three time periods.

ADVERTISEMENTS:

A simple example will make the point clear. Suppose the demand for candles increases in Calcutta as a result of constant power failure. In the momentary period 1 we have only whatever stocks of candles already exist in stock. Thus, if price rises from P0 to P1 the same quantity will be offered for sale. In other short run, the existing candle factories can work longer hours, and hire additional workers.

So, the quantity supplied will increase from Q0 to Q1 when price rises. If power failure continues in the long run, the increase in demand for candles will also be of a permanent nature. Consequently, more candle factories are likely to be built in the long run; in which case the quantity supplied will increase from Q0 to Q2 when the price rises. Thus it seems that the supply curve rotates clockwise with the passage of time. It becomes more and more elastic.

3. Factor mobility:

The ease with which factors of production can be moved from one use to another will affect price elasticity of supply. The higher the mobility of factor services, the greater will be elasticity.

4. Natural constraints:

The natural world also places restrictions upon supply. Rubber trees, for example, take 15 years to grow. So, it is not possible to increase the supply of rubber overnight.

ADVERTISEMENTS:

5. Risk-taking:

The willingness of entrepreneurs to take risks also affects price elasticity of supply. This, in its turn, depends on the system of incentives and disincentives. If, for example, the marginal rates of tax are very high, a price rise will not evoke much response among producers.