The word, classical economists, was first used by Karl Marx to define the thoughts and perceptions of various economics experts, such as Ricardo and Adam Smith.

On the other hand, Keynes considered classical economists as the followers of David Ricardo.

According to him, these followers were John Stuart Mill, Alfred Marshall, and Pigou.

Keynes was of the opinion that classical economics refers to traditional or conventional principles of economics. He also advocated that these classical principles were accepted by several renowned economists. In fact, Keynes himself acknowledged and taught these classical principles and rejected the principles of laissez-faire.

ADVERTISEMENTS:

The classical economists did not propound any particular theory of employment. However, they have given a number of assumptions. There are two main assumptions of classical theory of employment, namely, assumption of full employment and flexibility of price and wages.Let us study these two broad features in detail.

Assumption of Full Employment:

In simpler terms, full employment refers to an economic condition in which every individual is employed. In economics terminology, full employment signifies the market condition where the demand for labor is equivalent to the supply of labor at every level of real wage. Therefore, full employment is the employment level at which every individual who desires to work at the prevalent wage rate gets employed.

Some of the definitions of full employment given by different economists are as follows:

ADVERTISEMENTS:

According to Lerner, “Full employment is a situation in which all those who are able to and want to work at the existing rate of wage get work without any due difficulty.”

According to Spencer, “Full employment is a situation in which everyone who wants to work is working except for those who fictionally and structurally unemployed.”

The classical economists had a notion that labor and other resources are utilized completely or fully employed. According to classical economists, over-production is a general condition of an economy. Therefore, the condition of unemployment does not occur in the economy.

According to them, if the condition of unemployment occurs, it is a temporary or abnormal condition in the economy. In addition, classical economists also propounded that the condition of unemployment occurs due to the interference of government or private organizations in normal mechanism of market forces.

ADVERTISEMENTS:

In addition, it can be due to wrong speculation of organizations regarding the economic condition. Therefore, classical economists considered that there would always be a condition of full employment in the economy.

According to classical economists, the lassiez-faire approach of economy helps in adjusting employment and maintaining the full employment condition. The classical economists believed that full employment is dependent on various economic factors, such as perfect competition, objective of profit maximization, and mechanism of price.

The opinion of classical economists regarding full employment is not true. The condition of unemployment can also exist in the economy in the form of unfilled vacancies. According to modern theory of employment, the market is dynamic, thus, the demand and supply of labor changes, which would result in unemployment in an economy. In the condition of unemployment, individuals who desire to work may not get employed. Therefore, there would also be a condition of unemployment in case of full employment.

As a result, in modem economics, the definition of full employment has slightly distinguished from its previous version. Now, full employment refers to the state at which the vacancies and competent individuals are at equilibrium. In addition, a certain amount of unemployment also exists in the economy. Such unemployment is termed as natural rate of unemployment.

According to Rullin and Gregory, “The natural rate of unemployment is the rate of unemployment arising from normal labor market frictions that exist when the labor market is in equilibrium.” The natural unemployment refers to frictional and structural unemployment. Therefore, we can conclude that full employment docs not refer to the condition in which the unemployment is nil; however, it is a state of natural rate of unemployment.

According to Ward, “Full employment is the level of employment associated with a normal level of unemployment.”

Flexibility of Price and Wages:

The classical economists believed that there is always a condition of full employment of resources in an economy. Besides this, they also advocated that the flexibility or adjustments in price of products and wages of individuals facilitate the condition of full employment.

ADVERTISEMENTS:

For example, in case of over-production, the prices of products decrease, which further leads to an increase in demand and rate of consumption. Consequently, employment opportunities would increase and unemployment would eliminate.

The classical economists also propounded another approach of reducing unemployment, which signifies that the condition of full employment can be achieved by cutting down wages. This would result in increase in demand for labor and lead to the condition of full employment.

According to Pigou, “With perfectly free competition, there will always be at work a strong tendency for wage rates to be so related to demand that everybody is employed.” Therefore, according to classical economists, the prices and wages adjust themselves to bring full employment in an economy.

Apart from aforementioned assumptions, which are assumption of full employment and flexibility of price and wages another important basis for classical theory of employment is Say’s Law.

ADVERTISEMENTS:

Say’s Law:

Say’s Law was given by J.B. Say, who was a French economist of early nineteenth century. With the help of this law, classical economists justified the assumption of full employment. In addition, Say’s Law also helped classical economists to believe that overproduction and unemployment are not possible in normal economic conditions.

This law was stringently followed by classical economists, such as Alfred Marshall and Pigou. According to J.B. Say, Supply creates its own demand.” He also stated, “It is production which creates market for goods; for selling is at the same time buying and more of production, more of creating demand for other goods. Every producer finds a buyer.” In simple terms, the supply of a product develops the demand for that product, which avoids the problem of over-production.

Therefore, according to Say s Law, there is very less possibility that there is no aggregate demand in the economy. He also stated that the demand for a product is originated from the income earned by the factor of production involved in the production of the product.

ADVERTISEMENTS:

When a new factor is added to the production, it increases the demand for the product, which would cause simultaneous increase in the supply of that product. Therefore, it can be concluded that production is responsible for the demand for a product.

According to David Ricardo, an important classical economist, “No man produces but with a view to consume or sell, and he never sells but with a view to consume or sell, and he never sells but with an intention to purchase some other commodity which may be useful to him or which contributes to future production.”

As per James Mill, “Consumption is co-extensive with production.”

Therefore, the supply of a product develops an equal and immediate demand of its own. The supply produces income in the form of wages, interest and profit. The purchasing power of labor results in the increase of demand and consumption of product and services. Therefore, the aggregate supply gets equal to the aggregate demand. This reduces the possibility of overproduction in the economy.

Basic Assumptions of Say’s Law:

Every law is based on certain assumptions. These assumptions are required for the effective implication of laws. In case the assumptions are not satisfied in a particular situation, then the law would not hold true. Therefore, in Say’s Law, there are certain assumptions that need to be satisfied for its proper application.

ADVERTISEMENTS:

The basic assumptions of Say’s law are as follows:

a. Requires a perfectly competitive market and free exchange economy for the application of Say’s Law

b. Assumes that all the saving is invested and income is spend immediately

c. Assumes that the flexibility in interest rate makes the saving and investment equal

d. Assumes that the government intervention is nil in the market, which implies that there is no government expenditure government revenue, taxation, and subsidies

e. Decides and limits the market size on the basis of production volume of an organization that makes aggregate demand equal to

ADVERTISEMENTS:

f. Requires a closed economy for the application of the law

Another classical theory of employment was given by Pigou.

Implications of Say’s Law:

From the discussion of Say’s law so far in the above, there can be certain implication of the law.

Some of the implications of Say’s Law are discussed in the following points:

(a) Self-adjusting economy:

ADVERTISEMENTS:

Assumes that market forces adjust themselves for the stabilization of an economy and do not require any controlling authority for this purpose. Say’s Law also assumes that in a self-adjusting economy, the condition of disequilibrium is momentary or for a shorter duration of time and the condition of equilibrium persists.

For example, if there is a condition of over-production, then prices would fall, which would automatically lead to increase in demand. Consequently, the problem of surplus of products would solve and demand and supply would remain equal. Such a condition is termed as equilibrium condition.

Similarly, in the condition of unemployment, wages would fall. In such a case, it would be beneficial for organizations to hire more labor to reduce unemployment. In this manner, an economy can adjust itself without any controlling units.

(b) Laissez-faire Approach:

States that there is no interference of the government in the economic activity. The law assumes that if government intervenes in the self-adjusting economy, then it would create the state of disequilibrium.

In the absence of government intervention, the condition of disequilibrium would be for a shorter duration and tend to be solved by he free implication of market forces. Therefore, government should not create hurdles in the normal working of an economy.

ADVERTISEMENTS:

(c) Over-production:

Assumes that the condition of over-production does riot exist in an economy in general. This is because of the reason that if there is over-production, then the prices would fall immediately and the demand would increase without any time lag.

As a result, the surplus of products would disappear from the market. According to the law, over-production may arise in an industry in specific conditions, which is also not permanent and can be resolved by market forces.

(d) Unemployment:

Concludes that the condition of unemployment cannot exist in normal economic conditions. This is because as the unemployment arises, wages would fall. In such a case, organizations would prefer to hire new employees, which would result in eliminating unemployment.

The law also assumes that there should neither be any intervention of government to regulate the rate of wages nor any role of trade unions. According to Say’s Law, the condition of unemployment exists only under some specific conditions, but this condition is momentary.

(e) Money Supply:

Assumes that whole income is spent on consumer goods and the whole amount of savings is invested immediately. Thus, money comes back to organizations only. According to Say’s Law, there is always a closed economy and there is no interference of government, such as subsidies, taxes, and tariffs.

(f) Limitless Productive Activities:

Assumes that the productive activities in an economy are limitless. In simple terms, the activities related to economic development can be performed to any extent as aggregate demand cannot be nil. This leads to unlimited economic development opportunities for under-developed countries.

Concept of Equality of Savings and Investment:

According to Say’s Law, there would always be a certain amount of total spending for keeping the available resources fully employed. The income generated by various factors of production is spent on consumer goods. In addition, some part of this income is also saved.

However, according to classical economists, the amount of saving is utilized for investment purposes. This is because of the reason that saving and investment are equal and are interchangeable concepts. It helps in maintaining the flow of income in an economy. As a result, supply of a product is able to create demand for the product.

The assumptions of classical theory of employment with respect to the concept of savings and investment are as follows:

(a) Flexibility in Interest Rate:

Assumes that rate of interest is directly affected by the supply of saving and inversely affected by the demand of investment. According to classical economists, the fluctuations in the economy can be managed by market forces themselves to bring the economy back at equilibrium position.

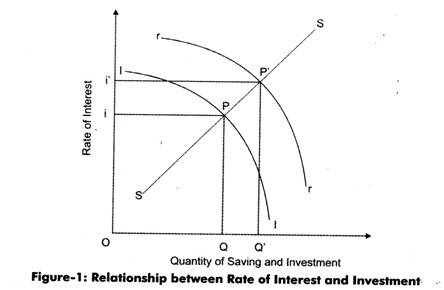

The relationship between the rate of interest (ROI) and the demand of investment (I) is shown in Figure-1:

In Figure-1, II represents the demand of investment while SS represents the supply of saving. At point P, II intersects SS, which implies that demand of investment gets equal to the supply of saving. Therefore, P is the point of equilibrium at which the interest rate is Oi with the investment and saving quantity of OQ.

When the investment increases to I’, then the rate of interest becomes Oi’ and economy reaches to new equilibrium point that is P’. Therefore, it can be concluded that economy would always be in equilibrium and there would be no situation of unemployment in the economy. In addition, the rate of interest helps in bringing back the equilibrium condition of an economy when there is a gap between savings and investment.

(b) Flexibility in Wage Rate:

Assumes that full employment condition can be achieved by cutting down the wage rate. Unemployment would be eliminated when wages are determined by the mechanism of economy itself.

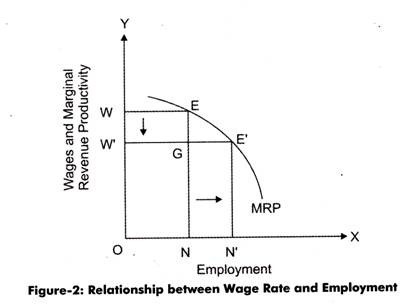

Figure-2 shows the relationship between wage rate and employment:

In Figure-2, when the wage rate is OW, then the employment is ON. As the wage rate is reduced to OW, then the employment has increased to ON’. Prof. Pigou has taken this theory as base for developing the solution of unemployment problem.

(c) Balanced Budget:

Assumes that the intervention of government in economic activities should be negligible. In addition, the government should balance its income and expenditure. The classical economists advocated that the government should follow the laissez-faire approach of economy.

Criticism of Classical Theory:

Several economists have criticized the classical theory of employment.

The main points of criticism of classical theories are as follows:

a. States that supply creates its own demand that is not possible if certain part of income is saved and aggregate revenue is not always equal to aggregate cost

b. Considers that the employment can be increased by decreasing the wage rate, which is not true in the real world

c. Assumes that rate of interest helps in maintaining equilibrium between savings and investments, which is not true in practical applications

d. Infers that the economy can be adjusted on its own and it does not require any government intervention, which is not possible

e. Considers that the wages and prices are very much flexible, which is not true in the real world economy

f. Regards money as a medium of exchange only; however, money plays an important role in the economy

g. Fails to explain the occurrence of trade cycles.