In this article we will discuss about Full Employment:- 1. Meaning of Full Employment 2. Government Policies to Achieve Full Employment 3. Attainment 4. Problems.

Meaning of Full Employment:

One of the main aims of government policy is the maintenance of ‘full employment’. The precise meaning of this phrase is a matter of dispute among economists. It may apparently seem that full employment refers to a situation in which there is zero unemployment. But in practice we never come across a situation in which there is zero unemployment.

There will always be some unemployment because some workers change jobs. All the time new vacancies are created and old vacancies are filled up. Moreover, sometimes people prefer to remain unemployed for some time to be able to get a better job rather than accept any job that comes along first.

So there will always be some unemployment in every economy all the time, as people always move between jobs. An accepted minimum of unemployment has been estimated at 2 to 5% of the working population; but there is no universally agreed upon figure.

ADVERTISEMENTS:

According to Lord Beveridge full employment refers to a situation where not more than 3% of the working population are unemployed.

A situation where the percentage of people is less than 3% there is said to be a situation of over-full employment. However, such a single numerical definition can have its drawbacks because in some regions of a country the percentage of people unemployed often exceeds the national average.

The adoption of a particular percentage as an aim of national policy has certain drawbacks. In the first place, it ignores the fact than on a regional basis there may be serious unemployment in some areas while labour is scarce in others. Secondly, it obscures the difference in unemployment between industries.

They may be, for example, heavy unemployment in ship-building while in vehicles manufacture there is a labour shortage. In view of these difficulties, it is probably wiser to describe full employment simply as a situation in which the number of unemployed is no greater than the number of vacant jobs.

ADVERTISEMENTS:

Full employment does not mean that every worker will always have a job. There are, for example, always likely to be some persons unemployed because of seasonal interruptions to working, as can occur in the building trade.

If government policy has been too successful in that it has created a situation where there are more jobs than workers, then over-full employment exists. In this state of affairs a shortage of labour will exist in many industries.

This is why other definitions of full employment have been suggested by economists and policymakers from time to time. Thus, according to John Beardshaw, a situation of full employment is said to exist if the number of jobs available exceeds the number of unemployed and people have substantial choice of jobs (so that if an individual loses one he readily gets another).

Thus the following definition of Arthen Burns seems to be the most appropriate one of all. It goes like this: “Full employment may be said to mean that the number of vacant jobs at prevailing wages is as large as the number of employed and that the: labour market is so organized that everyone who is able, willing and seeking to work already has a job and can obtain one after a brief search or after undergoing some training.”

ADVERTISEMENTS:

In short, full employment is said to axis only when everyone who wants to do a job and is capable to doing it is able to find it.

Government Policies to Achieve Full Employment:

Various policy measures have been suggested for curing unemployment or, what comes to the same thing, attainment of full employment which, in almost all advanced countries, is at the centre of the stage.

Keynes and his followers emphasized that the primary objective of fiscal policy is creating jobs and incomes. Keynes suggested that for curing unemployment it is necessary to raise the level of aggregate demand and thus eliminate the deflationary gap.

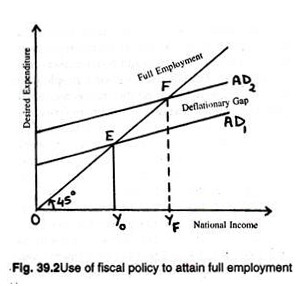

The most usual way of doing it is through deficit spending, i.e., spending more money by incurring a deficit in the budget. This point is illustrated in Fig. 39.2. Fig. 39.2 shows that unemployment occurs when the equilibrium level of national income (OY0) is below the full-employment level (OYf).

If the government increases its own expenditure or reduces taxes the aggregate demand curve or (C + I + G + X — M) schedule will shift upward and thus will enable the economy re-achieve full employment.

Thus while point E is one of under-employment equilibrium point F shows full employment. However, critics argue that fiscal policy often fights the wrong phase of the business cycle and may make the problem worse rather than better.

Secondly, there is the problem that deficits in times of full or near-full employment tend to cause inflation. No doubt one can argue for an expansionary programme of public works. This would increase the level of aggregate demand and thus reduce unemployment. The cost of such schemes would be at least partly neutralized by the increase in tax revenues.

ADVERTISEMENTS:

But modern governments remain concerned about the inflationary aspects of such schemes. It is to be noted here that both these problems are likely to occur at or near full employment.

As John Beardshaw said, “The problems associated with a finely balanced countercyclical fiscal policy can hardly be said to exist at a time of mass unemployment.” For these and other reasons fiscal policy has lost relevance in recent years and monetary policy has gained importance.

Monetary Policy:

The traditional (orthodox) monetary policy response to unemployment is to lower interest rates and expand the supply of money. Keynes and his followers argued that a fall in the rate of interest eventually causes some rise in national income by stimulating investment.

ADVERTISEMENTS:

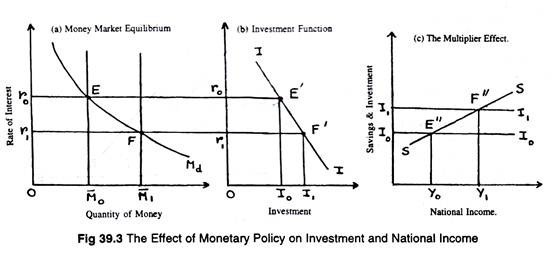

In brief, an increase in money supply [from M1 to M2 in Fig. 39.3(a)] leads to a fall in the rate of interest (from r1to r2) which in its turn, results in an increase in planned investment from I1 to I2 [(Fig. 39.3(b)].

The rise in investment, in turn, increases aggregate demand and, through the investment multiplier, raises national income [(Fig. 39.3(c)].

ADVERTISEMENTS:

However, Keynes pointed out that monetary policy fails to work during depression for two reasons:

(1) Low marginal efficiency of capital and

(2) Liquidity trap.

1. Low MEC:

If MEC (or the expected rate of return on new investment) is low, monetary policy loses its effectiveness. No one is willing to undertake fresh investment by borrowing money (whatever the rate of interest) unless there are genuine profit prospects.

Thus monetary policy is characterized by cyclical asymmetry. It is easier to restrict the demand for bank credit than to raise it. So if MEC is low and there is widespread business pessimism, monetary policy will not be effective in stimulating investment demand which is so essential for creating jobs and incomes.

ADVERTISEMENTS:

2. Liquidity Trap:

It refers to a situation where the rate of interest is so low that people prefer to hold money (liquidity preference) rather than purchase income-earning assets like bonds. At low rates of interest the demand curve for money becomes infinitely elastic.

In such a situation any attempt by the central bank to lower interest rates in order to stimulate investment will be futile, and will simply result in more money being held (demanded) for speculative purposes.

Keynes argued that in a depressed economy which is experiencing a liquidity trap the only way to stimulate investment is to increase government expenditure or reduce taxes in order to increase aggregate demand and improve business confidence about future prosperity so as to encourage business people to invest.

The Attainment of Full Employment: The Supply-Side View:

The opponents of Keynes who hold the supply- side view argued that not only’ were demand-side policies ineffective but they made matters worse. Budget deficits created more inflation, and, in the end, created more unemployment, not less.

One central idea of the supply-side schools is that there is a natural rate of unemployment which is consistent with absolute price stability (which implies the absence of inflation or deflation).

ADVERTISEMENTS:

Any attempt to reduce actual unemployment below this rate is sure to cause inflation. Only when the natural rate has been achieved can one expect the economy to be operating efficiently, and achieving economic growth which will create more jobs and incomes.

1. Reduced Welfare Payments:

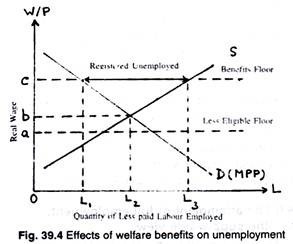

Reduced welfare payments, such as unemployment benefits, are likely to create more jobs. This point is illustrated in Fig. 39.4.

A benefit floor set at OC which is above the equilibrium wage rate results in only OL1 workers being employed instead of OL2. Some workers would prefer to remain unemployed so as to enjoy the benefit of unemployment compensation rather than accept a job at a lower wage.

ADVERTISEMENTS:

However, OL3 — OL1 claim benefits. Thus there is less employment. This means that a number of registered unemployed (L1L3) is created. But if the benefits are lowered and brought to 0a which is less than the market-clearing wage 0b, some workers would prefer to work at 0b rather than remain unemployed to recover the benefit (at the rate of 0α).

Thus lowering the benefit floor to the ‘less eligible’ level enables the economy re-achieve full employment by removing the unemployment problem from its roots.

2. Reducing Powers of Trade Unions:

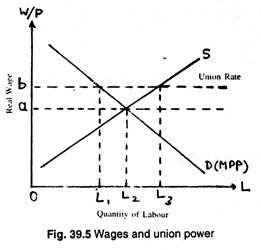

Another way of eliminating unemployment from its roots is to reduce the bargaining power of trade unions. This point is illustrated in Fig. 39.5. Suppose a strong trade union imposes a wage rate at 0b which is above the equilibrium level (0a). If through a suitable legislation it is possible to weaken trade unions, the wage rate will return to the equilibrium level and more employment will be created.

3. Raising Labour Productivity:

ADVERTISEMENTS:

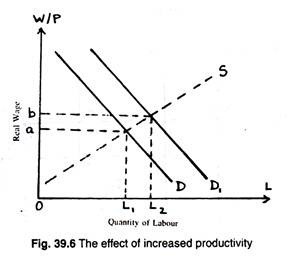

It is also possible to create more jobs by shifting to the right the derived demand curve from labour. This is possible by raising labour productivity by imparting training to workers. Productivity of labour can be improved through an act of training or education.

This point is illustrated in Fig. 39.6. Fig. 39.6 makes one point clears at least, as pointed out by John Beardshaw. In his language, “Productivity increases resulting from the reduction of restrictive practices such as demarcation, and/or improvement of the quality of the labour force through improved training, shifts the demand curve for labour to the right. This results in both higher wages and increased employment.”

Problems of Full Employment:

The adoption of a policy of full employment creates pressure within the economy which may act adversely upon certain other aims of government policy. In particular,

(a) The maintenance of stable prices and

(b) The earning of a surplus on the balance of payments may be made more difficult.

Experience has shown that the maintenance of full employment increases the danger of inflation. One reason for this is that full employment puts the trade unions in a strong bargaining position.

Claims for higher pay are usually more easily secured when unemployment is at a minimum and the extra wage costs are passed on in the form of increased prices for goods and services. In turn, higher prices give rise to fresh wage claims.

If ‘over-full’ employment exists, the problem is intensified. Shortages of labour will cause employers to offer higher wages in order to attract workers into their employ. Since in these conditions labour can only be drawn from other occupations, wage increase will be offered elsewhere in an attempt to retain labour.

In a country like the United Kingdom, which is so dependent on international trade, inflation has twin dangers. Firstly, it makes export prices rise and so renders sales abroad more difficult.

Secondly, higher earnings at home lead to an increase in demand:

(a) For imported goods, and

(b) For home-produced goods which would otherwise have been exported.

Hence the achievement of a surplus on the balance of payments is made more difficult.