In this essay we will discuss about the Economic Development of a Country. After reading this essay you will learn about: 1. Economic Growth and Economic Development 2. Determinants of Economic Development 3. Obstacles or Constraints 4. Pre-Requisites or Need 5. Structural Changes.

Contents:

- Essay on the Meaning of Economic Development

- Essay on the Determinants of Economic Development

- Essay on the Obstacles or Constraints on the Economic Development

- Essay on the Pre-Requisites or Need for Economic Development

- Essay on the Structural Changes During Economic Development

Essay # 1. Meaning of Economic Development:

Again Mrs. U.K. Hicks opined, “Economic Development deals with the problem of underdeveloped countries whereas ‘Economic Growth’ deals with the problem of developed countries. In underdeveloped countries the problems are that of initiating and accelerating development.”

According to Maddison, “the raising of income levels is generally called economic growth in rich countries and in poor ones, it is called economic development.”

ADVERTISEMENTS:

The processes of economic development should not only generate increased or enhanced means of production but it should also make room for equitable distribution of such resources. Thus by the term economic development we mean a process so as to raise the per capita output with a scope for equitable distribution.

Prof. Meier has rightly said, “We shall define economic development as the process whereby per capita income of a country increases over a long period of time.” Here the word “process” indicates long period changes related to changes in demand side as well as changes in factor supply.

Changes arising on the demand side are mostly related to consumers, tastes and preferences, distribution of income, size and composition of country’s population, and other organisational and institutional changes.

On the other hand, changes arising on the factor supply are also related to—capital accumulation, discovery of new resources, introduction of new and more efficient production techniques, increase in size of population and organisational changes. Cause and consequences of economic development are mostly determined by the time path and velocity of these aforesaid changes.

ADVERTISEMENTS:

Economic development, being a dynamic concept refers to the continuous increase in production over the changing time path. Secondly, attainment of economic development indicates increase in real per capita income over time. Here the real per capita income of a country simply indicates total money income adjusted to price level changes over time, i.e.

r = y/p where r = real income; y = money income and p = price level.

Thirdly, by the term economic development we mean continuous increase in the level of real national income over longer time period, covering a period, not less than 25 to 30 years.

While explaining the distinction between economic development and economic growth, C.P Kindleberger observed, “Economic growth means more output and economic development implies both more output and changes in the technical and institutional arrangements, by which it is produced.”

ADVERTISEMENTS:

As per this view, the term growth implies higher level of output as well as achievements in terms of increase in the volume of economic variables. Accordingly, Kindleberger further observed, “Growth involves focussing on height or weight, while development draws attention to the change in functional capacity.”

Although some economists have observed slight differences between economic development and economic growth but all these differences are imaginary and unreal and thus have little practical value. In this connection Prof. Arthur Lewis has rightly observed, “Most often we shall refer only to ‘Growth’ but occasionally, for the sake of variety to ‘Progress’ and ‘Development.’

Essay # 2. Determinants of Economic Development:

By economic development we mean attainment of higher level of productivity in almost all the sectors and a better level of living for the general masses. The path of economic development in an underdeveloped economy is full of hurdles or impediments.

Attaining higher level of economic development is a function of level of technology. Economic development is thus a process of raising the rate of capital formation, i.e. both physical capital and human capital.

Moreover, the task of economic development is influenced by a number of factors such as—economic, political, social, technological, natural, administrative etc. According to Prof. W.A. Lewis, there are three principal causes of economic development.

These are:

(i) Efforts to economise, either by reducing the cost of any product or by raising the yield from any given input or other resources,

(ii) Increase in knowledge and its appropriate application and

(iii) Amount of capital or other resources for land.

ADVERTISEMENTS:

While analysing the determinants of economic growth, Prof. J.J. Spengler and W.W. Rostow have made sincere attempts in this regard. Prof. Spengler has listed about nineteen determinants but Rostow mentioned six propensities having much bearing on economic growth.

These propensities are:

(1) Propensity to develop fundamental services,

(2) Propensity to apply science to economic ends,

ADVERTISEMENTS:

(3) Propensity to initiate technical innovations,

(4) Propensity to have material advance,

(5) Propensity to consume and

(6) Propensity to have children.

ADVERTISEMENTS:

All these propensities are showing a clear-cut picture of determinants of economic growth neglecting the non-economic factors totally. Regarding the determinants of economic growth, Prof. Ragnar Nurkse observed that “Economic development has much to do with human endowments, social attitude, political conditions and historical accidents.”

Again Prof. P.T. Bauer also mentioned that, “The main determinants of economic development are aptitude, abilities, qualities, capacities and facilities.” Economic development of a country thus depends on both economic and non-economic factors.

Following are some of important economic and non-economic factors determining the pace of economic development in a country:

A. Economic Factors:

1. Population and Manpower Resources:

Population is considered as an important determinant of economic growth. In this respect population is working both as a stimulant as well as hurdles to economic growth. Firstly, population provides labour and entrepreneurship as an important factor service.

Natural resources of the country can be properly exploited with manpower resources. With proper human capital formation, increasing mobility and division of labour, manpower resources can provide useful support to economic development.

ADVERTISEMENTS:

On the other hand, higher rate of growth of population increases demand for goods and services as a means of consumption leading to increasing consumption requirements, lesser balance for investment and export, lesser capital formation, adverse balance of trade, increasing demand for social and economic infrastructural facilities and higher unemployment problem.

Accordingly, higher rate of population growth can put serious hurdles on the path of economic development Moreover, growth of population at a higher rate usually eat up all the benefits of economic development leading to a slow growth of per capita income.

But it has also been argued by some modern economists that with the growing momentum of economic development, standard of living of the general masses increases which would ultimately create a better environment for the control of population growth. Moreover, Easterlin argued that population pressure may favourably affect individual motivation and this may again lead to changes in production techniques.

Thus whether growing population in a country practically retards economic growth or contributes to it that solely depends on the prevailing situation and balance of various other factors determining the growth in an economy.

2. Natural Resources and its Utilization:

Availability of natural resources and its proper utilization are considered as an important determinant of economic development. If the countries are rich in natural resources and adopted modern technology for its utilization, then they can attain higher level of development at a quicker pace. Mere possession of natural resources cannot work as a determinant of economic development.

ADVERTISEMENTS:

Inspite of having huge variety of natural resources, countries of Asia and Africa could not attain a higher level of development due to lack of its proper utilization. But countries like Britain and France have modernised their agriculture in spite of shortage of land and the country like Japan has developed a solid industrial base despite its deficiency in natural resources.

Similarly, Britain has developed its industrial sector by importing some minerals and raw materials from abroad.

However, an economy having deficiency in natural resources is forced to depend on foreign country for the supply of minerals and other raw materials in order to run its industry. Thus in conclusion it can be observed that availability of natural resources and its proper utilization is still working as an important determinant of economic growth.

3. Capital Formation and Capital Accumulation:

Capital formation and capital accumulation are playing an important role in the process of economic development of the country. Here capital means the stock of physical reproducible factors required for production. The increase in the volume of capital formation leads to capital accumulation.

Thus it is quite important to raise the rate of capital formation so as to accumulate a large stock of machines, tools and equipment by the community for gearing up production.

ADVERTISEMENTS:

Thus Prof. Ragnar Nurkse has rightly observed, “The meaning of capital formation is that society does not apply the whole of its current activity to the needs and desires of immediate consumption, but directs a part of it to the making of capital goods—tools and instruments, machines and transport facilities, plant and equipment.”

There are three stages in the process of capital formation, i.e.,

(a) Generation of saving,

(b) Mobilisation of savings and

(c) Raising the volume of investment.

Moreover, capital formation requires the suitable skill formation so as to utilise physical apparatus or equipment for raising the productivity level.

ADVERTISEMENTS:

In an economy, capital accumulation can help to attain faster economic development in the following manner:

(a) Capital plays a diversified role in raising the volume of national output through changes in the scale or technology of production;

(b) Capital accumulation is quite essential to provide necessary tools and inputs for raising the volume of production and also to increase employment opportunities for the growing number of labour force;

(c) Increase in capital accumulation at a faster rate results increased supply of tools and machinery per worker.

Various developed countries like Japan have been able to attain higher rate of capital formation to trigger rapid economic growth. Normally, the rate of capital formation in underdeveloped countries is very poor. Therefore, they must take proper steps, viz., introduction of compulsory deposit schemes, curtailing the conspicuous consumption, putting curbs on imports of consumption goods, inflow of foreign capital etc.

In order to attain a rapid economic growth, the rate of domestic savings and investment must be raised to 20 per cent.

Naturally, in the initial period, it is not possible to step up the rate of capital formation at the required rate by domestic savings alone. Initially, to step up the rate of investment in the economy, inflow of foreign capital to some extent is important. But with the gradual growth of domestic savings in the subsequent years of development, the dependence on foreign capital must gradually be diminished.

Being a technologically backward country, India has decided to permit foreign direct investment in order to imbibe advanced technology for attaining international competitiveness under the present world trade and industrial scenario.

Rate of growth of GNP = (Savings ratio/ Capital output ratio)

4. Capital-Output Ratio:

Capital-output ratio is also considered as an important determinant of economic development in a country. By capital-output ratio we mean number of units of capital required to produce per unit of output. It also refers to productivity of capital of different sectors at a definite point of time.

But the capital output ratio in a country is also determined by stage of economic development reached and the judicial mix of investment pattern. Moreover, capital-output ratio along with national savings ratio can determine the rate of growth of national income.

This is a simplified version of Harrod-Domar Model. This equation shows that rate of growth of GNP is directly related to savings ratio and inversely related to capital-outlet ratio.

Thus to achieve a higher rate of growth of national income, the country will have to take the following two steps:

(a) to raise the rate of investment and

(b) to generate necessary forces for reducing capital-output ratio.

5. Favourable Investment Pattern:

Favourable investment pattern is an important determinant of economic development in a country. This requires proper selection of industries as per investment priorities and choice of production techniques so as to realise a low capital-output ratio and also for achieving maximum productivity.

Thus in order to attain economic development at a suitable rate, the Government of the country should make a choice of suitable investment criteria for the betterment of the economy. The suitable investment criteria should maximise the social marginal productivity and also make a balance between labour intensive and capital intensive techniques.

6. Occupational Structure:

Another determinant of economic development is the occupational structure of the working population of the country. Too much dependence on agricultural sector is not an encouraging situation for economic development.

Increasing pressure of working population on agriculture and other primary occupations must be shifted gradually to the secondary and tertiary or services sector through gradual development of these sectors.

In India, as per 1991 census, about 66.0 per cent of the total working population was absorbed in agriculture. As per World Development Report, 1983, whereas about 45 to 66 per cent of the work force of developed countries was employed in the tertiary sector but India could absorb only 18 per cent of the total work force in this sector.

The rate of economic development and the level of per capita income increase as more and more work force shift from primary sector to secondary and tertiary sector.

As A.G.B. Fisher writes, “We may say that in every progressive economy there has been a steady shift of employment and investment from the essential ‘Primary activities’,……………………..to secondary activities of all kinds and to a still greater extent into tertiary production.”

Thus to attain a high rate of economic development, inter-sectoral transfer of work force is very much necessary. The extent and pace of inter-sectoral transfer of work force depend very much on the rate of increase in productivity in the primary sector in relation to other sectors.

7. Extent of the Market:

Extent of the market is also considered as an important determinant of economic development. Expansion of the scale of production and its diversification depend very much on the size of the market prevailing in the country.

Moreover, market created in the foreign country is also working as a useful stimulant for the expansion of both primary, secondary and tertiary sector of the country leading to its economic development. Japan and England are among those countries which have successfully extended market for its product to different foreign countries.

Moreover, removal of market imperfections is also an important determinant of economic development of underdeveloped countries. Accordingly, market in those countries must be free from all sorts of imperfections retarding the economic development of the country.

Removal of market imperfections will make provision for flow of resources from less productive to more productive occupations which is very much important for the development of an underdeveloped economy.

8. Technological Advancement:

Technological advancement is considered as an important determinant of economic growth. By technological advancement we mean improved technical know-how and its broad- based applications.

It includes:

(a) Use of technological progress far economic gains,

(b) Application of applied sciences resulting in innovations and inventions and

(c) Utilisation of innovations on a large scale.

With the advancement of technology, capital goods became more productive. Accordingly, Prof. Samuelson rightly observed that “High Invention Nation” normally attains growth at a quicker pace than “High Investment Nation”.

There may be three forms of technological advancement, i.e.:

(a) Capital saving

(b) Labour saving and

(c) Neutral.

The following conditions must be satisfied for attaining technological advancement in a country:

(a) making provision for large investments in research,

(b) ability to realise the possibilities of using scientific inventions and innovations for commercial purposes and expansion and diversification of the market for its product.

As underdeveloped countries have failed to fulfill these conditions thus their development process is neither self-sustaining nor cumulative. Thus in order to attain a higher rate of development, the underdeveloped countries should adapt only that type of technology which can suit their requirements.

Developing countries like Mexico, Brazil and India have been applying technologies developed by advanced countries as per their own conditions and requirements. Thus to attain a high level of economic development, the under-developed countries should try to achieve technological progress at a quicker pace.

9. Development Planning:

In recent years, economic planning has been playing an important role in accelerating the pace of economic development in different countries. Economic development is considered as an important strategy for building various social and economic overhead infrastructural facilities along with the development of both agricultural, industrial and services sectors in a balanced manner.

Planning is also essential for mobilisation of resources, capital formation and also to raise the volume of investment required for accelerating the pace of development. Countries like former U.S.S.R. and even U.S.A. and West Germany have achieved a rapid development through the adoption of economic planning.

10. External Factors:

The present situation in the world economy necessitates active support of external factors for sustaining a satisfactory rate of economic growth in underdeveloped economies. Moreover, domestic resources alone cannot meet the entire requirement of resources necessary for economic development.

Therefore, at certain levels, availability of foreign resources broadly determines the level of economic development in a country.

The external factors which are playing important role in sustaining the economic development include:

(a) Growing export earnings for financing increasing import bills required for development,

(b) Increasing flow of foreign capital in the form of direct foreign investment and participation in equity capital and

(c) international economic co-operation in the form of increasing flow of foreign aid from advanced countries like U.S.A., Japan etc. and also increased volume of concessional aid from international institutions like I.M.F., I.B.R.D. (World Bank) and other regional bodies on economic co-operation like ASEAN, OPEC, E.E.C. etc.

B. Non-Economic Factors:

Economic factors alone are not sufficient for determining the process of economic development in a country. In order to attain economic development proper social and political climate must be provided.

In this connection, united Nation Experts observed, “Economic Progress will not occur unless the atmosphere is favourable to it. The people of a country must desire progress and their social, economic, legal and political situations must be favourable to it.”

Emphasising the role of non-economic factors, Prof. Cairncross observed, “Development is not governed in any country by economic forces alone and the more backward the country is, the more this is true. The key to development lies in men’s minds, in the institution in which their thinking finds expression and in the play of opportunity on ideas and institution.”

Again Prof. Macord Wright writes, “The fundamental factors making economic growth are non-economic and non-materialistic in character. It is spirit itself that builds the body.” Prof. Ragnar Nurkse has further observed, “Economic development has much to do with human endowments, social attitudes, political conditions and historical accidents.”

Underdevelopment countries are facing various socio-political hurdles in the path of economic development. Thus in order to attain economic growth, raising the level of investment alone is not sufficient rather it is also equally important to gradually transform outdated social, religious and political institution which put hindrances in the path of economic progress.

Thus following are some of the important non-economic factors determining the pace of economic development in a country:

a. Urge for Development:

It is the mental urge for development of the people in general that is playing an important determinant for initiating and accelerating the process of economic development. In order to attain economic progress, people must be ready to bear both the sufferings and convenience. Experimental outlook, necessary for economic development must grow with the spread of education.

b. Spread of Education:

Economic progress is very much associated with the spread of education. Prof. Krause has observed that, “Education brings revolutions in ideas for economic progress.” Education provides stimulus to economic growth as it teaches honesty, patriotism and adventure. Thus education is working as an engine for economic development.

In this connection, Prof. H.W. Singer has rightly observed, “Investment in education is not only highly productive but also yields increasing returns. So, education plays pioneer role for the creation of human capital and social progress which in turn determines the progress of the country.”

c. Changes in Social and Institutional Factors:

Conservative and rigid social and institutional set up like joint family system, caste system, traditional values of life, irrational behaviour etc. put severe obstacle on the path of economic development and also retards its pace.

Thus to bring social and institutional change as per changing environment and to realise the modern values of life are very much important for accelerating the pace of economic development in a country.

Prof. Meier and Baldwin have observed that, “Not only must economic organisation be transformed but social organisation must also be modified so that basic complex of values and motivation may be more favourable for economic change and cultural change.”

d. Proper Maintenance of Law and Order:

Maintenance of law and order in a proper manner also helps the country to attain economic development at a quicker pace. Stability, peace, protection from external aggression and legal protection generally raises morality, initiative and entrepreneurship.

Formulation of proper monetary and fiscal policy by an efficient government can provide necessary climate for increased investment and also can stimulate capital formation in the country.

Thus in order to accelerate the pace of economic development the government must make necessary arrangement for the maintenance of law and order, defence, justice, security in enjoyment in property, testamentary rights, assurance to continue business covenants and contracts, provision for standard weights and measures, currency and formulation of appropriate monetary and fiscal policies of the country.

But the economy of underdeveloped countries is now facing serious threat from large scale disorder, terrorism, disturbances in the international border etc. All these have led to diversion of resources and initiatives from developmental to non-developmental ends.

Moreover, under such a chaotic situation, capital formation process, business initiatives and enterprise of private firms are seriously suffered and distorted leading to a stagnation of economy in these countries.

In this connection, Prof. Arthur Lewis has rightly stated, “No country has made progress without positive stimulus from intelligent government.” Thus to attain economic development at a quicker pace, proper maintenance of law and order and stability are very important.

e. Administrative Efficiency:

Economic development of a country also demands existence of a strong, honest, efficient and competent administrative machinery for the successful implementation of government policies and programmes for development. The existence of a weak corrupt and inefficient administrative machinery leads the country into chaos and disorder.

Prof. Lewis has rightly observed, “The behaviour of the government plays an important role in stimulating or discouraging economic activity.” Therefore, maintenance of proper administrative set up is a determinant of economic development of a country.

Essay # 3. Obstacles or Constraints on Economic Development:

The development process of an underdeveloped or developing economy is not an easy task rather it is a complicated one as these countries are not having any common characteristics. Thus the underdeveloped or developing countries are facing several constraints or obstacles to its path n economic development.

These Constraints on the path of economic development are of two types:

(a) Short-term constraints and

(b) long-term constraints.

These short-term constraints are related to over concentration and stagnation in agricultural sector, unemployment and under-employment, low productivity of capital, the growing deficit in its balance of payment position etc. Again, the long-term constraints include infrastructural bottlenecks, financial constraints etc.

The following are some of the important obstacles or constraints on the path of economic development of underdeveloped countries:

(i) Colonial Exploitation:

In the initial part of their development process, most of the underdeveloped countries were under foreign domination which had led to the huge colonial exploitation by the foreign rulers.

Foreign rulers converted these economies as primary producing countries engaged in the production of raw materials only to be supplied to the ruler country at cheaper prices and also a potent market for the sale of the manufacturing products produced by the ruler country.

Foreign capitalists mostly invested their capital on mining, oil drilling and plantation industries where they exploited the domestic workers to the maximum extent and remitted their profit to their parent country.

They have also destroyed the cottage and small industries by adopting unfair competition which has put a huge pressure on agriculture, disguised unemployment and poverty. After independence, these underdeveloped countries like India had to face serious obstacles to break this deep rooted impasse of low level equilibrium traps.

(ii) Market Imperfections:

Market imperfections in the form of immobility of factors, price rigidity, ignorance of market conditions, rigid social structure etc. have resulted serious obstacles in the path of economic development of underdeveloped countries. All these imperfections have resulted low level of output and low rate of productivity per worker.

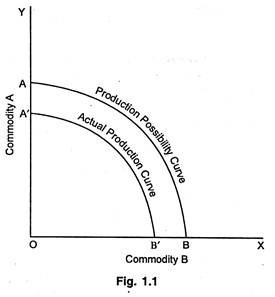

Due to these market imperfections, resources of these countries mostly remain either unutilised or underutilised leading to factor disequilibrium. This has forced the gross output of these countries for less than the potential output. Fig. 1.1 will clarify the situation.

Suppose the country is producing only two commodities A and B. The production possibility curve AB represents the production frontier which shows the various combinations of commodity A and B that may be produced by the country to its maximum extent through its fuller and best possible allocation of resources.

Thus AB represents the potential production curve. But the actual production curve of the underdeveloped country denoted by AB lies much below the potential production curve AB due to market imperfections resulting in misallocation and under-utilisation of resources in the country.

Thus due to market imperfections, the underdeveloped countries fail to reach the optimum production function due to lack of optimum allocation of resources.

(iii) Poor Rate of Savings and Investment:

Another important obstacle or constraint faced by the underdeveloped countries in their path of economic development is its poor rate of savings and investment. Inspite of their best attempt, the rate of savings of these underdeveloped countries remained very low, varying between 5 to 9 per cent only of their national income as compared to that of 15 to 22 per cent in the developed countries.

Under such a situation, the rate of investment in these countries is very low leading to low level of capital formation and low level of income.

(iv) Vicious Circle of Poverty:

Vicious circle of poverty is considered as one of the major constraints or obstacles to the path of economic development of the underdeveloped countries. Vicious circle in the underdeveloped countries represented by low productivity is resulted from capital deficiency, market imperfections, economic backwardness and poor development.

This vicious circle operates not only on demand side but also on supply side.

Low productivity results in low level of income and low rate of savings leading to low rate of investment, which is again responsible for low rate of productivity. Thus the vicious circle of poverty is resulted from various vicious circles related to demand side and supply side of capital. These vicious circles of poverty are mutually aggravating and it is really difficult to break such circles.

(v) Demonstration Effect:

Demonstration effect on consumption level works as another major obstacles or constraints on the path of economic development of underdeveloped countries as it increases propensity to consume and thereby reduces the rate of savings and investment.

Here the consumption level of individual is very much influenced by the standard of living or consumption habits of his neighbours, friends and relatives but not by its income alone.

Ragnar Nurkse has termed it ‘International Demonstration Effect’. He observed, “When people come into contact with superior goods or superior patterns of consumption, with new articles or new ways of meeting old wants, they are apt to feel after a while certain restlessness and dissatisfaction. Their knowledge is extended, their imagination is stimulated, new desires are aroused, the propensity to consume is shifted upward.”

Thus this international demonstration effect reduces the savings potential of the underdeveloped countries and thereby creates severe constraints on the path of their growth process.

(vi) Unsuitability in Adopting Modern Technology:

Underdeveloped countries are facing peculiar problem in respect of adopting modern and latest technology. Due to abundant labour supply and scarcity of capital, such technologies become unsuitable for these countries.

At the same time the existing poor technology of these underdeveloped countries fails to raise the rate of productivity and also to bring them out of the vicious circle of poverty and thereby makes it uncompetitive.

(vii) Rapidly Growing Population:

Most of the underdeveloped countries are facing the problem of rapidly growing population which hinders its path of economic development. In most of the over-populated countries of Asia and Africa, the rate of growth of population varies between 2 to 3 per cent which adversely affects their rate of economic growth and it is considered as the greatest obstacles to their path of economic development.

Jacob Viner has rightly observed, “Population increase hovers like a menacing cloud over all poor countries.”

Rapidly growing population slows down the rate and process of capital formation. Growing population increases the volume of consumption expenditure and thereby fails to increase the rate of savings and investment, so important for attaining higher level of economic growth.

Jacob Viner stated in this connection, “Population growth in a backward country does not induce capital widening investment or innovation. Instead it diminishes the rate of accumulation, raises costs in extractive industries, increases the amount of disguised unemployment and in large parts simply diverts capital to maintaining children who die before reaching a productive age. In short, resources go to the formation of population not capital.”

Moreover, rapidly rising population necessitates a higher rate of investment to maintain old standard of living and per capita income. Growing population also results food problem, unemployment problem which forced the country to divert its scarce resources to meet such crisis.

Thus, over-population results poverty, inefficiency, poor quality of population, lower productivity, low per capita income, unemployment and under-employment and finally leads the country toward under development.

(viii) Inefficient Agricultural Sector:

Another important obstacles or constraints to the path of development of underdeveloped countries are its inefficient agricultural structure. Agriculture dominates the economy of most of the underdeveloped countries like India as it is contributing the major share of their GDP.

Agricultural sector in these countries are suffering from primitive agricultural practices, lack of adequate inputs like fertilisers, HYV seeds and irrigation facilities, uneconomic holdings, defective land tenure and excessive dependence on agriculture.

Under such a poor structure, the agricultural productivity in these countries is very poor. Thus this poor performance of agricultural sector is another major obstacle in the path of economic development of these underdeveloped countries.

(ix) Inefficient Human Resources:

Inefficient and underdeveloped human resources are also considered another major obstacle towards economic development of underdeveloped countries. These countries suffer from surplus labour force but shortage of critical skills. Due to lack of adequate number of trained and skilled personnel, the production system remains thoroughly backward.

Thus this dearth of critical skills and knowledge in these countries has resulted under-utilisation and mis-utilisation of physical capital leading to lower productivity and higher cost structure of the production system. Due to lack of adoption of modern technique in agriculture, industry and trade, these underdeveloped countries fail to stand in the competition with developed countries.

(x) Shortage of Entrepreneurial Ability, Modern Enterprise and Innovation:

Underdeveloped countries are also suffering from lack of adequate number of entrepreneurial ability. Naturally there is absence of modern enterprise and proper managerial talent, Due to poor socio-cultural climate and weak environment, the managerial talent in these countries fails to reach its desirable level.

Moreover, due to the lack of spirit of experimentation and proper Research and Development (R&D) facilities, these underdeveloped countries fail to transform their production system to the desired level.

(xi) Inadequate Infrastructural Facilities:

Underdeveloped countries like India are facing serious obstacles due to inadequate infrastructural facilities. Thus the underdeveloped countries are suffering from lack of adequate transportation and communication facilities, shortage of power supply, inadequate banking and financial facilities and other social overheads which are considered very important for attaining economic development.

(xii) Adverse International Forces:

Certain adverse international forces are operating against the underdeveloped countries which are always going against the interest of the underdeveloped countries. International trade has forced the underdeveloped countries to become primary producing countries where the terms of trade as well as the gains from trade have always gone against these underdeveloped countries.

Prof. Raul Prebisch, Singer, Myrdal have formulated it “Theory of exploitation of poor countries”.

In this connection they observed, “During the last 150 years or so, the working of international forces through the media of trade and capital movement.” produced backwash effects on underdeveloped economies. There were certain disequalising forces operating in the world economy which made the gains from trade go mainly to developed countries.

(xiii) Political Instability:

Most of the underdeveloped countries are facing the problem of political instability resulting from frequent change of government, threats of external aggression and disturbed internal law and order conditions. This type of political instability creates uncertainty about its future steps and adversely affects the economic decisions of these underdeveloped countries relating to its investment.

Due to such uncertainty, flight of capital in considerable proportion takes place from these countries to advanced countries and also retards the chances of flow of foreign capital to these countries through foreign direct investment.

Moreover, weak and corrupt public administration in these countries has been resulting a huge leakage of public fund meant for investment in developmental activities.

(xiv) Inappropriate Social Structure:

Underdeveloped countries are suffering from backward social factors. Inappropriate social forces impeding the economic development of underdeveloped countries like India include prevalence of caste system, creating divergence between aptitudes, joint family system, peculiar law of inheritance, outdated religious beliefs, irrational attitudes towards number of children in a family etc.

All these social forces are obstructing the path of development of these underdeveloped countries.

Thus all these economic, political and social factors are equally responsible for the poor socio-economic set up of these underdeveloped countries and put serious obstacles for the path of economic development of these countries.

Essay # 4. Pre-Requisites or Need for Economic Development:

underdeveloped countries are very much concerned about their attainment of economic development. Attainment of economic development necessities a suitable environment for initiating, maintaining and accelerating the pace of economic development.

Prof. Lewis, in this connection, rightly observed, “The proximate causes of economic growth are: the effort to economise, the increase of knowledge or its application in production and increasing the amount of capital or other resources per head. these three causes, through clearly distinguishable conceptually are usually found together.”

Attainment of economic development in a country is very much related to social attitudes, political conditions, human resources, and also very much depending on psychological, social culture and political requirements of the country itself.

Prof. A.K. Cairncross has rightly observed that economic development “ is not just a matter of having plenty of money nor is it purely an economic phenomenon. It embraces all aspects of social behaviour, the establishment of law and order, scrupulousness in business dealing, including dealings with the revenue authorities, relationship between the family literacy, familiarity with mechanical gadgets and so on.”

Economic development of a country does not simply require removal of some of its basic obstacles like market imperfections, capital shortage, various circle of poverty etc. but it also requires a special attempt to identify some basic forces related to economic development. Following are some of the important pre-requisites for economic development of underdeveloped countries.

(i) Peoples’ Desire for Economic Progress:

Peoples’ desire for the attainment of economic progress is the most important requirement of economic development. In order to attain a self-generating growth of the economy, the people of the country must have a strong and positive willingness to attain such development. In order to arouse such peoples’ desire, people of the country must be certain and well assured about the achievement of economic development:

(ii) Economic Organisation:

If the development strategy of the country is to be efficacious then it should be preceded by a proper economic organisation promoting such development and not hindering it any way. The economic organisation of the country should be of that type which can respond well to the requirements of planning for economic development.

A proper balance between the private and public sector initiatives is considered very important for evolving such an effective economic organisation. Thus in order to achieve fast economic progress, an underdeveloped country must attempt to introduce a rational reorganisation of its entire economy.

(iii) Removing Market Imperfections:

Removal of market imperfections is considered a very important pre-requisities for economic development as such imperfections create a lot of obstacles in the path of economic development of underdeveloped countries.

Market imperfection is largely responsible for wide spread poverty in such economies. Moreover, market imperfections results factor immobility, under-utilisation of resources and thereby abstract sectoral expansion and the process of development.

Removal of market imperfections can accelerate the pace of capital formation and can also widen the scope of capital and money market in these countries. The country should arrange cheap and larger volume of credit facilities readily available for its industrialists, cultivators, businessmen, small traders and new entrepreneurs.

Knowledge of these investors about market opportunities and new techniques of production should also be enhanced to the reasonable level. A whole hearted effort should be made to utilise its available limited resources in a most efficient and dynamic manner to its maximum extent.

In this connection, Prof. Schultz has rightly observed, “To achieve economic growth of major importance in such countries, it is necessary to allocate effort and capital to do three things: increase the quantity of reproducible goods, improve the quality of the people as productive agents and raise the level of productive arts.”

Thus the removal of market imperfections leads to an efficient allocation of resources which finally leads to advancement of industrial and agricultural production and also to expansion of foreign trade resulting an successful effort to break the vicious circle of poverty.

(iv) Reasonable Equality of Income:

Another pre-requisite for economic development of an underdeveloped country is the attainment of reasonable equality of income. Because this will generate adequate enthusiasm among, the general masses toward economic development of the country as well as for the successful working of the economic plan.

Growing concentration of income and wealth in the hands of few and political influence generally protects the richer section from higher rates of taxation and thereby the tax burden ultimately falls much on the middle class and poorer sections of the society.

Underdeveloped countries like India usually face this type of problem. Therefore, it is quite necessary mat proper steps be taken to check such concentration of wealth and they should attain reasonable equality in the distribution of income and wealth.

(v) Attaining Administrative Efficiency:

Existence of a stable strong, efficient and honest government machinery is considered another pre-requisite for economic development. In order to formulate and implement economic planning along with a specific policy for economic growth, the government must be strong and efficient one, capable of maintaining internal law and order and defending the country against any external aggression.

(vi) Indigenous Base:

The development process of underdeveloped countries must have a domestic or indigenous base and it is considered another major prerequisite for economic development. Whatever initiative is to be taken for the economic development, that should come from within the economy of these underdeveloped countries but not from outside.

Plan for economic progress and social betterment cannot be initiated from outside of a country. Some developmental projects may be developed out of foreign aid but it should be maintained, with indigenous motivation.

But too much dependence on external capital and external forces may dampen the spirit and initiative for development and paves the way for exploitation of natural resources of the underdeveloped countries by foreign investors. Thus to attain indigenous base in developmental framework is considered as an important pre-requisite for economic development.

(vii) Capital Formation:

In order to attain economic development in an underdeveloped economy, capital formation is considered as an important pre-requisite for development. In these countries, the rate of savings is low due to low per capita income and higher marginal propensity to consume. Thus immediate steps be taken to raise the rate of capital formation of the country.

These require:

(a) An increase in the volume of real savings,

(b) Establishment of proper credit and financial institutions for mobilising and channelising these savings into investible fund and

(c) Utilisation of these savings for the purpose of investment in capital goods.

Prof. Lewis has rightly observed, “No nation is so poor that it could not save 12 per cent of its national income if it wanted to, poverty has never prevented nations from launching upon wars or from wasting their substance in other ways.”

(viii) Determining suitable Investment Criterion:

To determine suitable investment criteria is also another major pre-requisite for economic development of underdeveloped countries. Here the idea is not only to determine the rate of investment but also the composition of investment. In order to determine an optimum investment pattern, it is essential to consider various fruitful avenues of investment available in these countries.

As social marginal productivity of investment differs thus investment should be made in those directions where its social marginal productivity is the highest.

The attainment of such higher social marginal productivity of investment requires—minimising the capital-output ratio, promoting greater external economies, investment in labour-intensive projects, use of domestic raw materials, reducing pressure on balance of payments and improving the pattern of distribution of income and wealth so as to reduce the gap between the rich and poor.

Moreover, investment in these countries should be channelised to build adequate social and economic overheads. Again the investment should be made to attain a balanced growth of different sectors of the economy. Finally, considering the structural environment in the country, proper choice of techniques be made for various investment projects of the country.

(ix) Absorption of Capital:

Another pre-requisite for economic development is to raise the capital absorption capacity of underdeveloped countries as they mostly suffer from lack of such capacity due to non-availability of co-operant factors. Such problems of low capital absorption capacity arise due to lack of technology, shortage of skilled personnel and poor geographical mobility of labour.

Thus with the increase in capital accumulation in such countries, the supply of other co-operant factors should be increased so as to enhance the capital absorption capacity of such countries.

(x) Maintaining Stability:

Underdeveloped countries are facing a peculiar problem of instability arising due to inflationary rise in price level. Inflation in these countries is influenced by the factors like monetary expansion, deficit financing, misdirection of savings in unproductive speculative activities, market imperfection: etc.

Therefore, another requirement of economic development is to maintain stability by avoiding inflationary rise in the price level so as to check mis-allocation of resources along with its other evils.

(xi) People’s Participation and Co-Operation:

Finally, people’s participation and public co-operation in all developmental projects are considered as an important pre-requisite and a principal force behind all planned developmental schemes of the under-developed countries. In the absence of public co-operation and participation, this development strategy cannot function properly.

Prof. W.A. Lewis observed, “Popular enthusiasm is both the lubricating oil of planning and the petrol of economic development—a dynamic force that makes all things possible.”

Therefore, planners should make an endeavour to enlist public co-operation and to arouse popular enthusiasm for implementing their plan for development. Moreover, in order to implement any developmental projects to the fullest extent and also to restrict the leakages involved in it, peoples’ participation and public co-operation are considered very important, especially in these under-developed countries.

Essay # 5. Structural Changes during Economic Development:

Attaining structural changes in the economy is considered as one of the pre-conditions for economic development.in most of the developed countries, economic growth is characterised by structural transformations of the economy.

The process of growth is connected with both fuller use of existing resources and expanding resources. Here the problem has to be tackled in two ways. Firstly, the productive opportunities available within the existing resouirce and necessary known-how have to be utilised to the maximum extent through optimum allocation of the resources of the country.

Secondly, the production frontier, i.e., the various productive sectors, has to be widened through sizable changes to the maximum extent.

Again the Chances of achieving higher rate of development through better allocation of existing resources is very much limited. T.W. Schultz has aptly observed, “in most poor countries there is not much economic growth to be had by merely taking up whatever slack may exist in the way of the available resources being utilised.” Therefore, in order to provide all outward push to the production frontier, the productive has to be expanded.

Moreover, the structural transformation of the economy indicates a shift away from agriculture to non-agriculture activities and from industry to services along with a change in the scale of productive units, and necessary shift from personal enterprises to impersonal organization of economic firms along with a change in the occupational status of labour.

Following are some of the important structural changes arising out of economic development:

(i) Shift in Economic Activities:

In most of the underdeveloped agricultural countries, the structural change may be initiated through reduction in proportion of population engaged in agriculture and thereby increase in the number of persons engaged in non-agricultural occupations.

H.W. Singer observed that, “The speed or rate of economic development may then be described by the rate of which 70 : 30 ratio in economic structure is approximated to the 20 : 80 ratio which represents ultimate equilibrium at a high level of development.”

Therefore, the transfer of population from agricultural sector to non-agricultural sector must be supported by an increase in agricultural production so as to provide necessary food and raw materials to the non-agricultural sector as well as to meet the requirement of increasing population in both of these sectors.

In order to meet such requirement, there should be sufficient transformation in the agricultural sector in the form of introduction of land reform measures, raising the supply of productive inputs or factors in agriculture, promoting new credit institutions, introducing dynamic market structure, providing additional incentives, arranging changes in socio-economic relationships, introducing intensive cultivation process.

The development experience in various countries shows that the share of agricultural sector in GDP of all developing countries has declined excepting Australia. In respect of changes in the contribution of services sector, the result is not so marked or consistent among the various countries.

(ii) Changes in Sectoral Distribution of Labour Force:

Movements in structural transformations in economic growth can also be analysed in the form of changes in the distribution of labour force among three major sectors. The share of total labour force engaged in industrial sector varied between 40 to 58 per cent for almost all the countries excepting erstwhile USSR and Japan, as these countries entered lately in the field of industrialisation.

On the other hand, the share of total labour force engaged in the services sector remained almost constant and relatively poor in the countries like Australia, Great Britain, Sweden and Belgium. But the same share recorded an absolute and relative increase in the countries like USA, Canada, Italy, Japan, Switzerland and erstwhile USSR.

(iii) Changes in Sectoral Share in GDP:

Prof. Simon Kuznets has rightly observed that during the period of modern economic growth, the share of agriculture and agro-based industries in aggregate output (GDP) has recorded a sharp decline, while the shares of manufacturing industries, public utilities and certain service groups like professional, government etc. have recorded a manifold increase.

Such changes have resulted corresponding shifts in the sectoral allocation of labour force of the country. Moreover, the rapid change in the size and form of business organisations has also resulted a major structural change in the economy. Modern economic growth has resulted a fall in the domination of sole trading small farms.

Moreover, the shift away from agriculture to non-agricultural activities has also resulted a significant fall in the share of small business units. Again, the modern economic growth has also paved the way for the emergence of joint stock companies and giant corporations in modern industrial set-up.

(iv) Changes in Social Structure:

Finally, social system has much impact on the economic phenomenon of the country. Social institutions, habits and attitudes are influencing the productive activities and expenditure patterns substantially, especially in the underdeveloped countries. Savings and investment patterns are considerably influenced by cultural and social considerations.

Therefore, in order to attain structural change in the economy, there is the necessity of change in the social structure of its society. Setting a dynamic economy in a static social set up is almost impossible as they cannot pull together.

In this connection, Meir and Baldwin aptly observed, “New wants, new motivations, new ways of production, new institutions are to be created if national income is to rise more rapidly. Where there are religious obstacles to modern economic progress, the religion may have to be taken less seriously or its character altered.”

Thus necessary change in the social structure is very important for attaining economic development in a country. Prof. Gadgil also observed,

“All attitudes, habits of mind, patterns of behaviour, are born out of chiefly historical institutional modes of living. These modes of living in most under-developed countries have had in the past little direct connection with economic development. If now rapid economic development is to become the main objective of these societies, their attitudes and habits of mind must change correspondingly.”