To explain the approach and content of macroeconomics, ‘word macro is derived from the Greek word makros meaning ‘large ‘and therefore macroeconomic is concerned with the economic activity in the large.

Macroeconomic analyses the behaviour of the whole economic system in totality or entirety.

In other words, macroeconomic studies the behaviour of the large aggregates such as total employment, the national product or income, the general price level of the economy.

Macroeconomics is a Study of Aggregates:

Therefore, macroeconomics is also known as aggregative economics. Macroeconomics analyses and establishes the functional relationship between these large aggregates Thus Professor Boulding says, “Macroeconomics deals not with individual quantities as such but with the aggregates of these quantities; not with individual incomes but with the national income; not with individual prices but with the price level; not with individual output but with the national output. In his other famous book, Economic Analysis, he similarly remarks.”

ADVERTISEMENTS:

“Macroeconomics, then, is that part of the subject which deals with large aggregates and averages of the system rather than with particular items in it and attempts to define these aggregates in a useful manner and to examine their relationships. Professor Gardner Ackley makes the distinction between the two types more clear and specific when he writes, “macroeconomics concerns itself with such variables as the aggregate volume of output in an economy, with the extent to which its resources are employed, with the size of the national income, with the “general price level”.

Microeconomics, on the other hand, deals with the division of total output among industries, products and firms and the allocation of resources among competing uses. It considers problems of income distribution. Its interest is in relative prices of particular goods and services.

Neo-Classical Economists Neglected Macroeconomic Analysis:

It is worth mentioning that classical economic theory of Adam Smith, Ricardo, Malthus and J. S. Mill was mainly macro-analysis, for they discussed the determination of growth of national income and wealth, the division of national income among broad social classes (total wages, total rent and total profits), the general price level and the effects of technology and population increase on the growth of the economy.

On the other hand, neo-classical economics, in which writings of Pigou and Marshall predominate, is mainly micro-analysis. Neo-classical writers assumed that full-employment of resources prevailed in the economy and concentrated mainly upon showing how the resources were allocated to the production of various goods and how the relative prices of products and factors were determined.

ADVERTISEMENTS:

It is mainly because of their full-employment assumption and their preoccupation with the problem of determination of prices, outputs and resource employments in individual industries that they could not explain the existence of involuntary unemployment and under-utilisation of the productive capacity at times of depression in the private-enterprise capitalist countries.

They thus could not provide adequate explanation of the occurrence of the trade cycles in a private enterprise economy. What is worse, the neo: classical writers tried to apply the economic generalisations valid in the case of an individual industry to the case of the behaviour of the whole economic system and macroeconomic variables. For instance, Pigou asserted that involuntary unemployment existing at the time of depression could be eliminated and employment expanded by cutting down wages.

This is quite incorrect. While the cut in wages may expand employment in an individual industry, the reduction in wages throughout the economy will mean the fall in incomes of the working classes which will result in the decrease in the level of aggregate demand. The fall in aggregate demand will tend to lower the level of employment rather than expand it.

Macroeconomic Analysis: Keynesian Revolution:

There were no doubt pre-Keynesian theories of business cycles and the general price level which were “macro” in nature but it was late Lord J. M. Keynes who laid great stress on macroeconomic analysis and put forward a general theory of income and employment in his revolutionary book, A General Theory of Employment, Interest and Money published in 1936.

ADVERTISEMENTS:

Keynes’s theory made a genuine break from the neo-classical economics and produced such a fundamental and drastic change in economic thinking that his macroeconomic analysis has earned the names “Keynesian Revolution” and “New Economics”. Keynes in his analysis made a frontal attack on the neoclassical “Say’s Law of Markets” which was the basis of full-employment assumption of neoclassical economics and challenged the neo-classical dictum that involuntary unemployment could not prevail in a free private enterprise economy.

He showed how the equilibrium level of national income and employment was determined by aggregate demand and aggregate supply and further that this is achieved at far less than full-employment level in a free private enterprise economy and thereby causing involuntary unemployment of labour on the one hand and excess productive capacity (i.e., under-utilization of the existing capital stock) on the other. His macroeconomic model revealed how consumption function, investment function, liquidity preference function, conceived in aggregative terms, interact to determine income, employment, interest and the general price level.

Therefore, before showing how the level of income and employment is determined, we have to study the determinants of consumption function and investment function. The analysis of consumption function and investment function are the important subjects of macroeconomic theory. It is the total consumption demand and total investment demand taken together that constitutes the level of aggregate demand which is the crucial determinant of the level of income and employment in the advanced industrialised countries.

Macroeconomics and the General Level of Prices:

Besides studying how the level of income and employment is determined in the economy, macroeconomics also concerns itself with showing how the general level of prices is determined. Keynes made a significant improvement over the quantity theory of money by showing that the increase in the supply of money does not always bring about the rise in prices. Important topic in this field is to explain the causes of inflation.

Keynes, who before the Second World War showed that involuntary unemployment and depression were due to the deficiency of aggregate demand, during the Second World War period when prices rose very high he explained in a booklet entitled “How to Pay for War” that just as unemployment and depression were caused by the deficiency of aggregate demand, inflation was due to the excessive aggregate demand.

Since Keynes the theory of inflation has been further developed and many types of inflation depending upon various causes have been pointed out. The problem of inflation is a serious problem faced these days, both by the developed and developing countries of the world. Theory of inflation is an important subject of macroeconomics.

Macroeconomics and Theory of Economic Growth:

Another distinct and more important branch of macroeconomics that has been developed recently is the theory of economic growth, or what is briefly called growth economics. The problem of growth is a long-run problem and Keynes did not deal with it. In fact, Keynes is said to have once remarked that “in the long run we are all dead”. From this remark of Keynes it should not be understood that he thought long run to be quite unimportant. By this remark he simply emphasised the importance of the short-run problem of fluctuations in the level of economic activity (involuntary cyclical unemployment, depression, inflation).

It was Harrod and Domar who extended the Keynesian analysis to the long-run problem of growth with stability. They pointed out the dual role of investment; one of income generating, which Keynes considered, and the second of increasing capacity which Keynes ignored because of his pre-occupation with the short run. In view of the fact that investment adds to the productive capacity (i.e., capital stock), if growth with stability (i.e. without secular stagnation or secular inflation) is to be achieved, income or demand must be increasing at a rate sufficient enough to ensure full utilization of the increasing capacity.

ADVERTISEMENTS:

Thus, macroeconomic models of Harrod and Domar have revealed the required rate of growth of income that must take place if the steady growth of the economy is to be achieved. These days growth economics has been further developed and extended a good deal. Though a general growth theory applies to both the developed and developing economies, special theories which explain the causes of under-development and poverty in developing countries and which also suggest strategies for initiating and accelerating growth in them have been propounded. These special growth theories relating to developing countries are generally known as Economics of Development.

Macro-theory of Relative Shares in National Income:

Still another important subject of macroeconomic theory is to explain what determines the relative shares from the total national income of the various classes, especially workers and capitalists, in the society. The interest in this subject goes back to Ricardo who not only emphasised that how the produce of earth is distributed among the three social classes—landlords, workers and capitalists is the principal problem in economics but also propounded a theory explaining the determination of relative shares of rent, wages and profits in the total national income.

Like Ricardo, Marx, also showed a deep interest in this problem of determination of relative shares in a capitalist economy. But after Marx interest in this subject very much declined and the theory of distribution came to be discussed mostly in micro-terms, that is, the theory of distribution merely assumed the role of explaining the determination of factor prices rather than the relative aggregative shares of the social classes.

Thanks to the efforts of M. Kalecki and Nicholas Kaldor, the interest in this macro-theory of distribution has again been revived. Kalecki advanced the view that the relative shares of wages and profits in the national income are governed by the degree of monopoly in the economy. On the other hand, Kaldor has applied the Keynesian analysis and has shown that the relative shares of wages and profits in the national income depend upon the propensity to consume and the rate of investment in the economy.

ADVERTISEMENTS:

We have now stated, in brief, all aspects of macroeconomic theory.

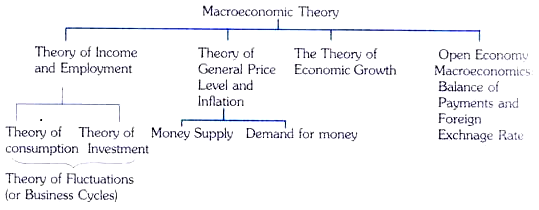

These various aspects of macroeconomic theory are shown in the following chart: